Reducing Taxes Owed With Credits

While tax deductions reduce your taxable income, tax credits come directly off what you owe the IRSdollar for dollar. The Internal Revenue Code provides for several tax credits, from the child tax credit for each of your child dependents to the earned income tax credit, which is designed to provide refunds to low-income taxpayers and families with children.

Refundable tax credits can sometimes result if any balance is left over after reducing the tax you owe to zero.

You might have owed the IRS $1,000 had you not claimed a $1,500 tax credit. The credit would erase your tax debt, and the IRS would send you a refund for the $500 balance if the credit were refundable. The IRS would keep that $500 if the credit you claimed was non-refundable, but at least it would entirely erase your tax debt.

Each credit comes with its own qualifying rules, and how you can claim it varies a little as well.

The American Rescue Plan Act of 2021 eliminates the minimum income requirement for the Child Tax Credit. It increases the maximum benefit to $3,600 for children under age six, and to $3,000 for children ages six through 17. The age-17 cap is one year older than the usual age for qualifying. This applies only to the 2021 tax year, the return you’d file in 2022.

Some tax credits, such as the Additional Child Tax Credit, require their own forms that help you calculate how much you’re entitled to and show the IRS how you arrived at that amount.

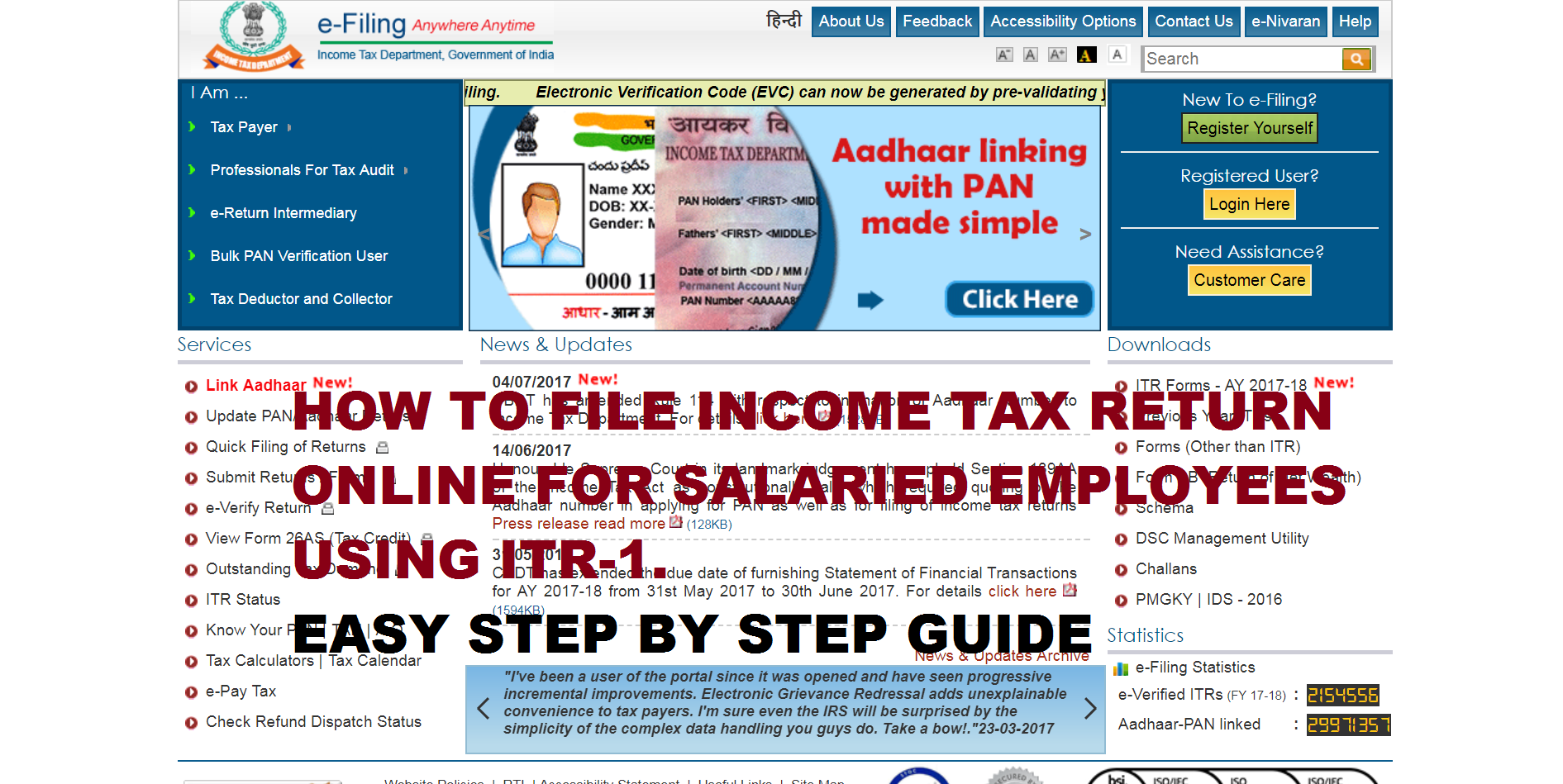

How To File Itr Online Ay 2021

The Process to file Income Tax Returns by using the internet is called E-filing. The process to e-file ITR is quick, easy, and can be completed from the comfort of an individuals home or office. E-filing ITR can also help in saving money as you would not have to hire an individual to file ITR.

Note:You can now file your taxes through the New income tax portal. The New portal comes with a plethora of features and is designed to ease the tax filing process.

Free File Is Now Closed

Check back January 2022 to prepare and file your Federal taxes for free.

IRS Free File lets you prepare and file your federal income tax online for free. File at an IRS partner site with the IRS Free File Program or use Free File Fillable Forms. It’s safe, easy and no cost to you for a federal return.

To receive a free federal tax return, you must select an IRS Free File provider from the Browse All Offers page or your Online Lookup Tool results. Once you click your desired IRS Free File provider, you will leave the IRS.gov website and land on the IRS Free File providers website. Then, you must create an account at the IRS Free File providers website accessed via Irs.gov to prepare and file your return. Please note that an account created at the same providers commercial tax preparation website does NOT work with IRS Free File: you MUST access the providers Free File site as instructed above.

You May Like: Are Raffles Tax Deductible

How To File An It Return With And Without Form

In filing IT returns, Form-16 plays a crucial role. Form-16 is an essential certificate that employers provide to employees with all the important details of tax deducted at source and proper salary break up.

That is why it is the basic form that individuals should collect. However, there are some cases where an individual can apply for IT files even without Form-16.

Therefore, to clear the fog around how to file ITR with Form-16 as well as without it, we have discussed both these processes.

The Last Date For Filing Income Tax Return Will Not Be Extended Said Union Finance Minister Nirmala Sitharaman

Union Finance Minister Nirmala Sitharaman today said that the last date for filing Income Tax Return will not be extended. Taxpayers must note that the due date for filing ITR will remain December 31, 2021.

Revenue Secretary Tarun Bajaj on Friday said that December 31 remains the official deadline for filing of income tax returns. He said returns filed so far are more than those filed in the previous year.

Bajaj said that he was expecting another at least 20-25 lakh returns to come by 12 in the night. “The figures that we were anticipating would have come…There is absolutely no proposal to extend the dates,” Bajaj said.

To a query on the glitches on the I-T portal impacting filing, Bajaj said “I’m okay if the returns were less by 1 crore. But the returns filed is more than last year’s… I’m watching the figures every hour… ITR filings are going up to 3 lakh “.

So far 5.62 crore ITRs have been filed till Friday. On Friday, 20 lakh returns were filed. Out of the total, three lakh ITRs have been filed in the last hour.

The government has already extended the deadline for filing income tax returns for 2020-21 fiscal year by five months till December 31.

Meanwhile, taxpayers who have not e-verified their ITRs for the financial year 2019-20 can complete the verification process by February 28, 2022, as the income tax department has given a one-time relaxation to assessees.

Recommended Reading: 1040paytax.com

Free Electronic Filing For Individuals

The Arizona Department of Revenue will follow the Internal Revenue Service announcement regarding the start of the 2020 electronic filing season. Because Arizona electronic income tax returns are processed and accepted through the IRS first, Arizonas electronic filing system for individual income tax returns is dependent upon the IRS’ launch date. Remember, the starting point of the Arizona individual income tax return is the Federal Adjusted Gross Income. The Arizona Department of Revenue will begin processing electronic individual income tax returns beginning mid-February.

Taxpayers can begin filing individual income tax returns through Free File partners and individual income tax returns will be sent to the IRS starting mid-February. Tax software companies also are accepting tax filings in advance of the IRS’ launch date.

Please refer to the E-File Service page for details on the e-filing process.

File Itr Without Form

If you have not received Form-16 from your employer due to some reasons, you can continue to file an IT return. Following is how to file ITR without Form-16.

- Step-1- Identify your income from all sources. It may include salary and pensions, capital gains, income from house property, income from other sources like fixed deposit interest, interest on refund, etc.

- Step-2- Get Form-26AS . You can download it from the TRACES website of the Income Tax Department.

- Step-3- Gather data related to various payments and investments and claim deduction under Section 80C and 80D of the Income Tax Act as applicable.

- Step-4- The next step in the process of how to file an income tax return without Form-16 involves claiming House Rent Allowance and other allowances.

- Step-5- After the deduction and claim are decided, the total taxable income has to be calculated. You can calculate the total taxable amount by subtracting the total deductions from the total income .

- Step-6- Next, calculate the tax liability per the applicable slab rate.

- Step-7- Determine the payable tax.

- Step-8- After you have finished doing all the above-mentioned steps, you can visit the official e-filing portal.

- Step-9- File ITR returns without Form-16.

- Step-10- Once you have completed filing ITR, you need to e-verify it.

If you complete all the procedures and do not e-verify, the submission will not start.

Also Check: How To Get A License To Do Taxes

Filing To Open An Individual Retirement Account

It might seem a little premature for your child to consider opening an individual retirement account the IRS calls it an individual retirement arrangementbut it is perfectly legal if they have earned income. By the way, earned income can come from a job as an employee or through self-employment.

If you can afford to, consider matching your child’s contributions to that IRA. The total contribution must be no more than the child’s total earnings for the year. That lets your child start saving for retirement but keep more of their own earnings. It also teaches them about the idea of matching funds, which they may encounter later if they have a 401 at work.

Filing To Earn Social Security Work Credits

Children can begin earning work credits toward future Social Security and Medicare benefits when they earn a sufficient amount of money, file the appropriate tax returns, and pay Federal Insurance Contribution Act or self-employment tax. For the tax year 2021, your child must earn $1,470 to obtain a single credit . They can earn a maximum of four credits per year.

If the earnings come from a covered job, your child’s employer will automatically take the FICA tax out of their paycheck. If the earnings come from self-employment, your child pays self-employment taxes quarterly or when filing.

Recommended Reading: How To File Uber Taxes On Taxact

Gather Tax Filing Information

Youll need to do this whether youre hiring a tax preparer or doing the tax filing yourself. The goal is to gather proof of income, expenses that might be tax-deductible or win you a tax credit, and evidence of taxes you already paid throughout the year. Our tax prep checklist has more guidance, but heres a short version of what to round up:

-

Social Security numbers for yourself, as well as for your spouse and dependents, if any.

-

W-2 form, which tells how much you earned in the past year and how much you already paid in taxes.

-

1099 forms, which are a record that some entity or person not your employer gave or paid you money.

-

Retirement account contributions.

-

State and local taxes you paid.

-

Educational expenses.

Extension To File Your Tax Return

If you cant file your federal income tax return by the due date, you may be able to get a six-month extension from the Internal Revenue Service . This does not grant you more time to pay your taxes. To avoid possible penalties, estimate and pay the taxes you owe by the tax deadline of May 17, 2021.

You May Like: Doordash Dasher Taxes

How And When To File Your Tax Return

Learn how to fill out your return using tax preparation software or on paper.

The deadline for filing personal income tax returns and paying outstanding income tax is . After April 30, penalties and interest start to apply to any outstanding balance owed.

If you are self-employed or filing for someone who has passed away, please see the CRAs website for filing deadlines.

Can I File My Taxes Online For Free If Im A Non

Yes. TurboTax makes it easy to file your Candian tax return as a non-resident. In fact, if youre a non-resident you can use any of the TurboTax Online products, including TurboTax Free. For more info, read about How Residency Status Impacts Your Tax Return

With more than 20 years experience helping Canadians file their taxes confidently and get all the money they deserve, TurboTax products, including TurboTax Free, are available at www.turbotax.ca.

Also Check: Prontotaxclass

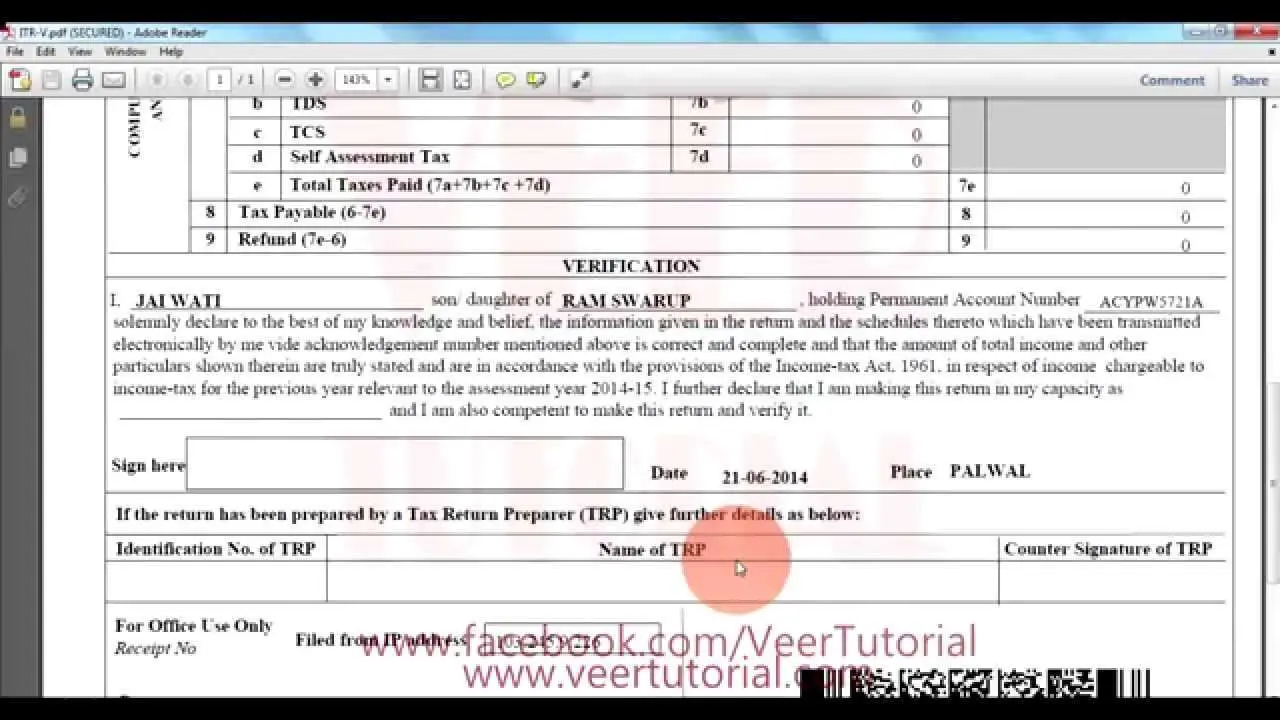

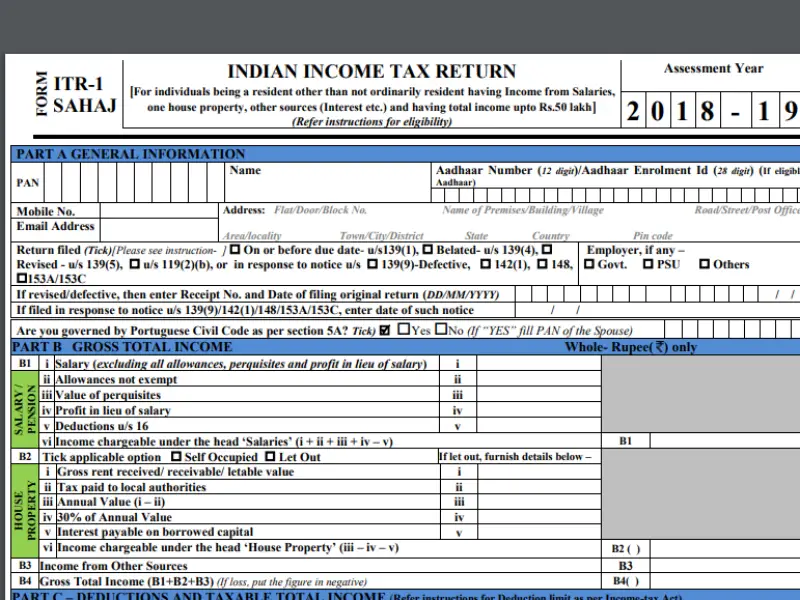

How To File Income Tax Return Itr

The income tax return is a form where taxpayers state their tax liability and deductions according to the forms category and demand. This form is available in ranges, ITR-1 to ITR-7.

When an individual fills the respective form and submits it to the IT Department, she/he has filed an income tax return. But how? Let us tell you about this process.

An income tax return can be filed both via online and offline methods. We will start with the online IT return filing method first.

Reducing Income With Tax Deductions

The amount of your income thats actually taxable can be reduced by claiming tax deductions. For example, you can subtract the amount of a gift you made to a qualifying charity or nonprofit .

This doesnt mean your total tax bill is reduced by that amount, but rather that your taxable income is reduced by this muchwhich, in turn, may lower your effective tax rate.

You cant always deduct all of what you spend. Some itemized deductions, such as for medical expenses and charitable giving, are limited to percentages of your adjusted gross income . For example, you could only claim an itemized deduction for charitable giving for up to 60% of your AGI through 2019, but the CARES Act has waived this rule for tax year 2020 and tax year 2021 in response to the coronavirus pandemic. The change in deduction amount remains in effect until December 2021, which will impact the return you file in 2022.

Tax filers can itemize their deductions, but theres also a standard deduction that often works out to more than the total of their itemized deductions for many filers. For the 2021 tax year, the standard deductions are:

- $25,100 for those who are married and file joint returns

- $12,550 for single taxpayers and those who are married but file separate returns

- $18,800 for taxpayers who qualify as heads of household

For the 2022 tax year, the standard deductions increase to:

Recommended Reading: Tsc-ind

What Is The Penalty Of Non

According to Section 234F of the Income Tax Act, a late penalty fee for filing IT returns will be levied from FY 2018-19 onwards. If you file an IT return after the due date but before the 31st December of the Assessment Year, you will have to pay a late fine of 5000. In case you pay after the 31st of December of that AY, the penalty will be 10000. However, the late fee would not exceed 1000 if your income does not exceed 5 lakhs.

The above-mentioned write-up extensively talks about how to file an IT return, the benefits of filing an IT return, the required document, the due date of filing returns, etc. Read the details thoroughly and file an IT return before the deadline to avail of significant benefits offered under it.

All Turbotax Products Include

- 100% accuracy guaranteed

Our calculations are 100% accurate so your taxes will be done right, guaranteed, or we’ll pay you any IRS penalties.

- Maximum refund guaranteed

We search over 350 deductions & credits to find every tax deduction and credit you qualify for to get you the biggest tax refund, guaranteed.

- Get the green light to file

CompleteCheck will run a comprehensive review of your return before you file so nothing gets missed.

You May Like: Internal Revenue Service Tax Returns

What Is Irs Free File

The IRS Free File Program is a public-private partnership between the IRS and many tax preparation and filing software industry leaders who provide their brand-name products for free. It provides two ways for taxpayers to prepare and file their federal income tax online for free:

- Traditional IRS Free File provides free online tax preparation and filing options on IRS partner sites. Our partners are online tax preparation companies that develop and deliver this service at no cost to qualifying taxpayers. Please note, only taxpayers whose adjusted gross income is $72,000 or less qualify for any IRS Free File partner offers.

- Free File Fillable Forms are electronic federal tax forms you can fill out and file online for free. If you choose this option, you should know how to prepare your own tax return. Please note, it is the only IRS Free File option available for taxpayers whose income is greater than $72,000.

Find what you need to get started, your protections and security, available forms and more about IRS Free File below.

About IRS Free File Partnership with Online Tax Preparation Companies

The IRS does not endorse any individual partner company.

- A copy of last year’s tax return in order to access your Adjusted Gross Income

- Valid Social Security numbers for yourself, your spouse, and any dependent, if applicable

Income and Receipts

Other income

ACA Filers

File Electronically

Contact Information

Information Safety

Prior-Year Returns

Everything You Need To File Your Taxes

Youre almost certainly paying taxes if you work for a regular paycheck. As a refresher, here’s how it works: Your employer withholds the taxes you owe from your earnings each pay period and sends them to the appropriate federal and state governments on your behalf. But that’s just the first step of the process. A great deal more is involved in filing your taxes correctly and in making sure you’re not paying more than you have to.

In this guide, learn why and how you have to file a tax return, as well as other important aspects of the filing process you need to know.

Also Check: When Does Doordash Send 1099

Filing To Recover Taxes Withheld

Some employers automatically withhold part of pay for income taxes. By filing Form W-4 in advance, children who do not expect to owe any income tax can request an exemption. If the employer already has withheld taxes, your child should file a return to receive a refund of all taxes withheld from the IRS.

To receive a refund, your child must file IRS Form 1040.

When Your Child Should File

Your child should file a federal income tax return even though it isn’t required for the reasons above, if:

- Incomes taxes were withheld from earnings

- They qualify for the earned income credit

- They owe recapture taxes

- They want to open an IRA

- You want your child to gain the educational experience of filing taxes.

In the first two cases, the main reason for filing would be to obtain a refund if one is due. The others are income-dependent or based on taking advantage of an opportunity to begin saving for retirement or to begin learning about personal finance.

Read Also: Plasma Donation Taxable Income