How To Collect Sales Tax In Illinois

It is quite simple to collect taxes in Illinois if you have a physical location within state lines. The state follows a simple origin-based sales tax system this means tax rates are established by geographical location, and the set rate is collected at the time of sale.If you are an online retailer with tax nexus obligations in Illinois, you have a few more details to sort through. Illinois charges you with the responsibility of charging the origin-based tax rate of your customers’ geographic locations. So, you must know the specific rate for the zip code to which you are shipping, and you are required to charge that particular tax rate.

The Property Tax Credit

The property tax credit is equal to 5% of Illinois property tax paid on your primary residence. You must own the residence, and you can’t claim this credit if your federal AGI exceeds $250,000, or $500,000 if you’re married and file a joint return. Complete Schedule ICR with your Illinois tax return to claim it.

Was Your Refund Less Than You Expected

Your refund may be less than you expected because you made an error on your tax return. The Department of Revenue will notify you of the changes made to your return. Review the information provided on e-file status to ensure you agree with the changes made.

Part of your refund may have been offset to pay a liability you had with the IRS, Illinois Department of Revenue, or any other state, federal or local governmental agency. That may include a school district, public institution of higher education, or circuit court clerk.

Also Check: When Can I Expect My Unemployment Tax Refund

Business Return Electronic Filing Information

Business Electronic Filing Mandate – If an income tax return preparer prepares 25 or more acceptable, original corporate/partnership income tax returns using tax preparation software in a calendar year, then for that calendar year and for each subsequent calendar year thereafter, all acceptable corporate/partnership income tax returns prepared by that income tax preparer must be filed using electronic technology.

Dying With A Will In Illinois

For a will to be valid in Illinois, the person making the will, or the testator, must be at least 18 years old. The testator must also be of sound mind, and have the mental capacity to understand the consequences of their actions. That generally means the testator has not been determined incompetent in a prior legal proceeding. The testator must sign their will in front of two witnesses and the two witnesses must sign the will in front of you, at the same time. If the testator is not able to sign their own will, the law allows them to name a different person to sign the will on his or her behalf.

Once the will is determined to be valid, the next step is the probate process. Generally, probate proceedings are only necessary if the deceased person owned any assets in their name only. Other assets, also known as non-probate property, can usually be transferred to the other owner without probate.

Also Check: How To File Federal Taxes For Free

Your Illinois Sales Tax Filing Requirements

You have two choices for filing taxes in Illinois. You can file online at https://mytax.illinois.gov/_/, or by mail using form ST-1. Form ST-1 can downloaded and printed at http://www.revenue.state.il.us/TaxForms/Sales/ST-1.htm.If you have $0 in sales, but you maintain a business license, you are still required to file a zero sales tax return, despite the fact that you have no sales.In order to determine your tax obligation, total sales and total tax collected must first be determined. A series of calculations can then be applied to these numbers based on the type of tax obligation they require. Formulas and instructions are found on the Form ST-1 Instructions page located at http://tax.illinois.gov/TaxForms/Sales/ST-1-Instr.pdf .Taxes for prior months receipts are due on the 20th of each month, and late fees will accrue as follows:* 2% up to 30 days late * 10% after 30 daysA 1.75% discount is rewarded to those retailers who pay their sales tax on time.

Filing And Payment Deadline

For 2019 state taxes, the state has extended the filing and payment deadline. Illinois residents now have until July 15, 2020 to file their state returns and pay any state tax they owe for the year. As with the federal deadline extension, Illinois wont charge interest on unpaid balances between April 15 and July 15, 2020.

You dont need to do anything to get this extension. Its automatic for all Illinois taxpayers. But keep in mind that if youre expecting a refund, you might want to go ahead and file as soon as possible. During the coronavirus crisis, the state is continuing to process tax returns and issue refunds.

Illinois state tax returns and any tax you owe are due April 15, the same day that your federal return is due. But if that day falls on a weekend or holiday, the deadline will be the next business day.

State residents can get a six-month filing extension. If you get a longer extension to file your federal return though, the state will automatically match it.

But keep in mind: If you owe tax, you must file Form IL-505-I, Automatic Extension Payment for Individuals, and pay what you owe to avoid paying penalties and interest charges.

Don’t Miss: How To Know If You Filed Taxes Last Year

Children In Illinois Inheritance Law

If you die without a will, each of your children inherits an intestate share of your property. The amount each childs share is worth depends on your marital status and how many children you have. The table below explains the details.

| Intestate Succession: Spouses and Children |

| Inheritance Situation |

Illinois Inheritance Laws: What You Should Know

Illinois levies no inheritance tax but has its own estate tax. In this article, we break down Illinois inheritance laws, including what happens if you die without a valid will and where you may stand if youre not part of the decedents immediate family. Estate planning is a complicated topic, though, and its a good idea to work with a financial professional to guide you through the process. If you dont already work with one, consider finding a financial advisor in your area.

Don’t Miss: When Is Sales Tax Due

Illinois Tax Season Update

The Illinois Office of Comptroller sends out income tax refunds after receiving the payment information from the Illinois Department of Revenue. The Illinois Department of Revenue began accepting 2020 state individual income tax returns on Friday, February 12th, the same day as the federal Internal Revenue Service. Please note that the filing and payment deadline for 2020 income tax returns originally due April 15, 2021, was extended to May 17, 2021.

After filing your state income tax with the Illinois Department of Revenue, you can check the status of your refund with the ‘Where’s My Refund’ application available on MyTax Illinois.

Once your return is processed at the Illinois Department of Revenue, the information is sent to the Illinois Office of Comptroller, at which time your refund will be issued. You can check the status of your tax refund payment at Find My Refund. We appreciate your patience during this process.

When Must I File A Nonresident Tax Return

You have to file a nonresident return in the state in which you work if theres no reciprocity, but you wont have to pay any taxes. Your home state will provide you a tax credit or some means of adjustment for the taxes youd pay to other states.

The reciprocal agreement doesnt automatically get applied. You have to fill out a form thats specific to your work state with your employer to make sure the taxes owed to your work state arent withheld from the pay you earn. If you dont fill out one of these state-specific forms then youll have to file a non-resident tax return.

You also have to file a nonresident return if you had state taxes withheld by your employer for the wrong state and need a refund from that state, or if you generated some non-employment revenue in a state other than your own.

Don’t Miss: How To Buy Tax Forfeited Land

You Can Start Filing Your Taxes In Illinois On Feb 12

SPRINGFIELD, Ill. The Illinois Department of Revenue will begin accepting 2020 state individual income tax returns on Friday, February 12, the same date that the Internal Revenue Service begins accepting federal individual income tax returns.

If a taxpayer electronically files an error-free return, they should receive a direct deposit refund in four to six weeks, if applicable.

Last year, IDOR saw a 2.7% increase in the number of electronic filers of the 6,443,623 individual income tax returns, 87% were filed electronically and 63% received refunds.

Filing tax returns electronically and requesting direct deposit is still the fastest way for taxpayers to receive a refund, said IDOR Director David Harris. As the COVID-19 pandemic continues, I also encourage taxpayers to create a MyTax Illinois account. With a MyTax Illinois account, taxpayers will be able to respond to any filing inquiries from the department electronically, resulting in faster processing and issuance of owed refunds.

The 2020 tax filing deadline is Thursday, April 15. IDOR remains highly committed to protecting taxpayers from identify theft and will continue to work with the IRS and other states to strengthen protections.

Taxpayers are encouraged to do their part by protecting their personal information and staying alert to phone scams or phishing emails. For more tips and up-to-date information, taxpayers should visit IDORs website.

Business Return General Information

Due Dates for Illinois Business Returns

Corporations – April 15, or same as IRS

S-Corporations – March 15, or same as IRS

Partnerships – March 15, or same as IRS

Fiduciary & Estate – April 15, or same as IRS

Business Extensions

Corporation – An automatic six-month extension of time to file is granted until 6 months after the original due date of the return. This automatic extension does not extend the payment of any tax due. If the C Corporation expects tax to be due, it must use Form IL-505-B to pay any tentative tax due in order to avoid interest and penalty on tax not paid by the original due date of the return. An extension of time to file the Illinois C Corporation Income Tax Return, Form IL-1120 is not an extension of time for payment of Illinois tax.

If the C Corporation will be filing the return on extension but needs to make a payment by the original due date, this payment can be made online at MyTax Illinois – Business or can be submitted by mail on Form IL-505-B Automatic Extension Payment. To access the Automatic Extension Payment Voucher, from the main menu of the Illinois Corporation return select Miscellaneous Forms and Schedules > IL Form IL-505-B-Extension Payments. Enter the amount of the payment to be made as an extension payment and mail it to the address on the form.

Amended Business Returns

Illinois Amended Business Returns cannot be e-filed.

Also Check: When Will I Get My Federal Tax Refund 2021

Sales Tax Collection Discounts In Illinois

Illinois allows merchants to keep a small percentage of the sales tax they collect as a collection discount, which serves as compensation for the work required to comply with the Illinois sales tax regulations

The collection discount is 1.75% of tax due, although there is a minimum of five dollars each calendar year.

Residency Status Information For Illinois Returns

Residents: Individuals domiciled in Illinois for the entire tax year. Domicile is the place where a person resides and the place where he or she intends to return after temporary absences. Temporary absences may include duty in the Armed Forces, residence in a foreign country, or out-of-state residence as a student or during the winter or summer. A person absent from Illinois for one year or more is presumed to be a nonresident.

Part-year resident: Individuals who move into or out of Illinois during the year. Part-year residents must file Form IL-1040 and Schedule NR, Nonresident and Part-Year Resident Computation of Illinois Tax, if they earned income from any source while they were a resident, they earned income from Illinois sources while they were not a resident, or they want a refund of any Illinois Income Tax withheld.

Nonresidents: Individuals who are domiciled outside Illinois. Nonresidents must file Form IL-1040 and Schedule NR if they earned enough taxable income from Illinois sources to have a tax liability , or they want a refund of any Illinois Income Tax withheld in error. A letter of explanation from your employer must be attached to the return. If a taxpayer is a nonresident and their only income in Illinois is from one or more partnerships, S corporations, or trusts that withheld enough Illinois Income Tax to pay their liability, they are not required to file a Form IL-1040.

Also Check: Are Donations To Churches Tax Deductible

What You Need To Fileand When

If you are a non-resident for tax purposes who received income in the U.S. during the last calendar year, you must file a tax return with the U.S. government. In addition to filing a federal tax return, you will likely need to file a return on the state level, as well.

Federal Tax Return

Federal taxes are those paid to the U.S. central government Internal Revenue Service . OIA pays for software licenses for our international population to use a special non-resident tax filing software.

State Tax Return

In addition to a federal tax return, many will also have to file a State of Illinois income tax return. If you resided and/or worked in more than one U.S. state during the past calendar year, you may have to file tax returns in all of the states in which you resided or worked. You should check the state revenue website of the other state where you lived and worked to figure out your tax filing obligations.

Spouses In Illinois Inheritance Law

If you die intestate in Illinois, the amount your spouse inherits depends on whether or not you have living descendants, including children, grandchildren and great-grandchildren. If you have no living descendants, your spouse gets all of the intestate property.

If you have living descendants, your spouse will get half of the inheritance, and your descendants will get the other half of the inheritance. However, grandchildren will only receive a share if their parents are not alive to receive their share.

Also Check: How Do You Add Sales Tax

If You Owe And Cant Pay

If you dont pay the tax that you owe by the due date, the state can assess penalties and add interest charges. Publication 103 Penalties and Interest for Illinois Taxes has the details.

You can request an installment plan by completing Form CPP-1, Payment Installment Plan Request. If the amount you need to pay off exceeds $5,000 , youll also need to file an additional form. And you can only get a payment plan if youre current on your filing obligations.

Illinois Income Tax Filing Deadline Delayed

— Gov. Pritzker announced that his administration is extending the individual income tax filing and payment deadline from April 15 to May 17.

The Illinois Department of Revenue will continue to process tax refunds for those filing ahead of the deadline.

The filing extension does not apply to estimated tax payments that are due on April 15, 2021. These payments are still due on April 15 and can be based on either 100% of estimated or 90% of actual liability for 2021, or 100% of actual liabilities for 2019 or 2020.

According to IDOR, 2.4 million taxpayers have already filed their individual income tax returns to date. Over 79% of the taxpayers that have already filed are expecting a refund this year. Last year, over 6.4 million income tax returns were filed, and 87% of people filed electronically.

Also Check: How Much Tax Should I Be Paying Per Paycheck

Need More Time About Tax Filing Extensions

You may find that you need additional time to file your taxes. This might be because you are waiting for an ITIN approval or missing some of your necessary documents. If you need additional time to file your federal return, you can file for an Automatic Extension of Time to File Your U.S. Tax Return. You should submit the extension form before the deadline listed above. More information can be found on the IRS link above.

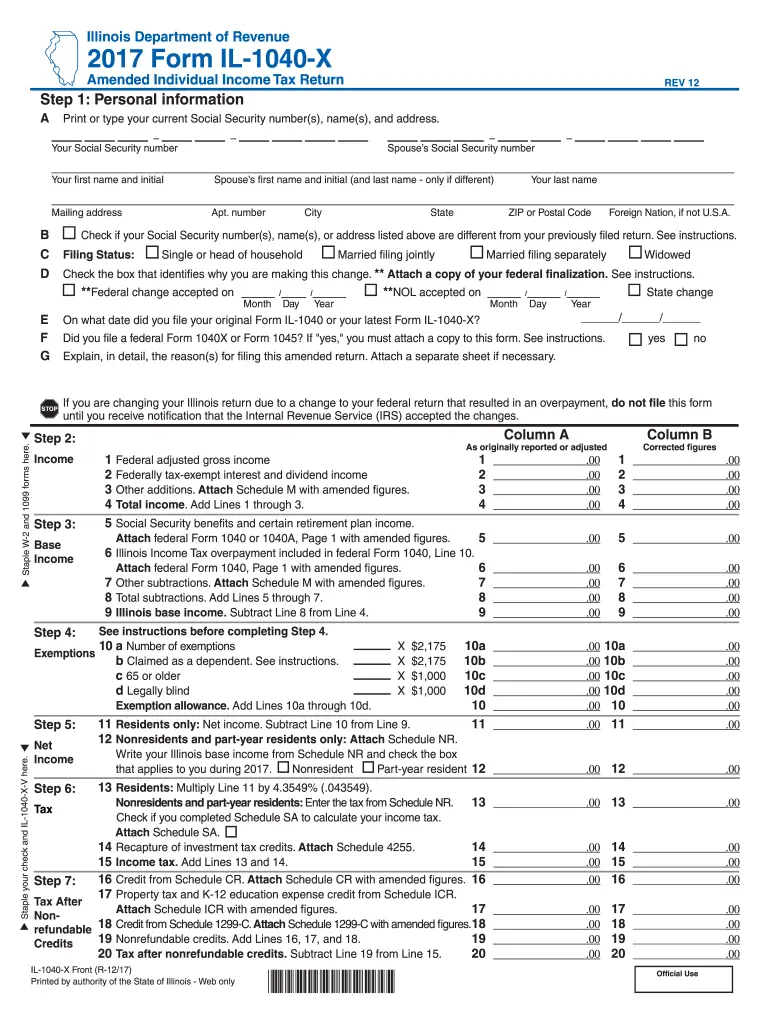

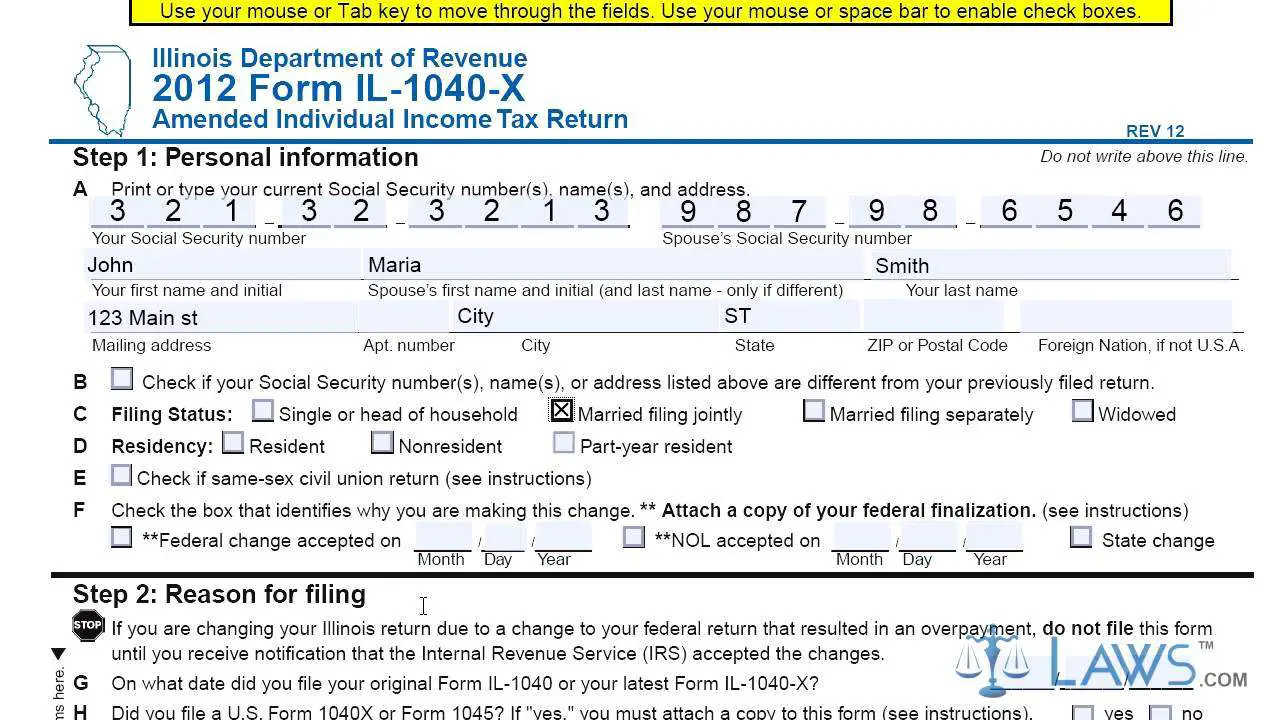

Do I Need To File Using The Same Filing Status As My Federal Return

Generally, you should use the same filing status as what is listed on your federal return. However, there are a few exceptions:

- If you file a joint federal return and you are an injured spouse , you should file separate Illinois returns using the married filing separately filing status.

- If you file a joint federal return and one spouse is a full-year Illinois resident while the other is a part-year resident or a nonresident , you may choose to file married filing separately.

If you are in a civil union, you must file your Illinois return using the same filing status as on your federal return.

For more information, see:

Also Check: How To Reduce Income Tax

What If I Live In A Reciprocal State

Ifyou lived in Iowa, Kentucky, Wisconsin, or Michigan and worked in Illinois you must file an Illinois tax return if:

- You received income from sources other than wages, salaries and tips.

- You want a refund of any Illinois tax withheld.

If you received wages, salaries, tips, and commissions from Illinois employers, you are not required to pay Illinois Income Tax on this income. This is based on reciprocal agreements between Illinois and these states. The reciprocal agreements do not apply to any other income you might have received, such as Illinois lottery winnings.