What Is A Schedule K

OVERVIEW

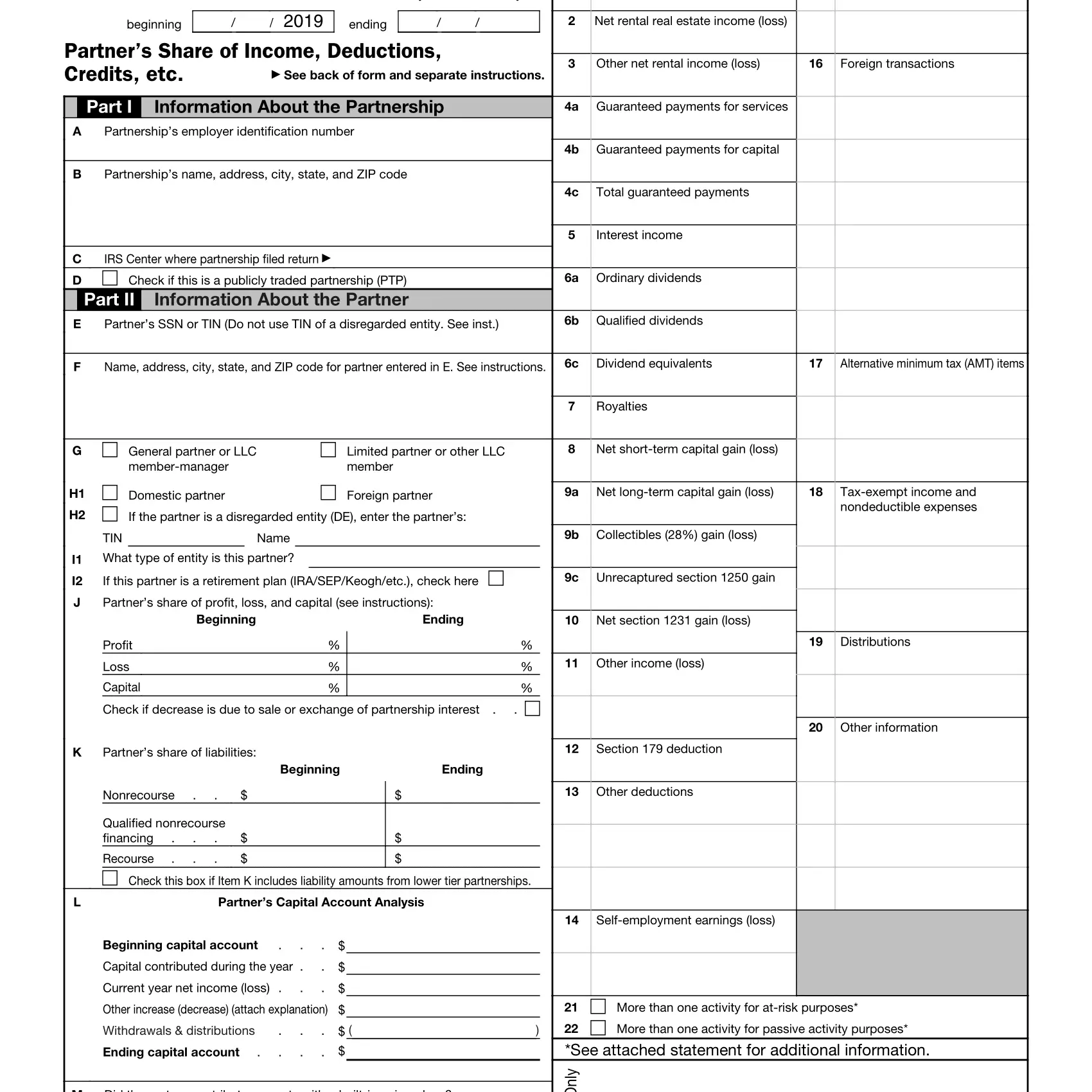

The Schedule K-1 is slightly different depending on whether it comes from a trust, partnership or S corporation. Find out how to use this tax form to accurately report your information on your tax return.

The United States tax code allows certain types of entities to utilize pass-through taxation. This effectively shifts the income tax liability from the entity earning the income to those who have a beneficial interest in it. The Schedule K-1 is the form that reports the amounts that are passed through to each party that has an interest in the entity.

Calculating How Much You’ll Owe

When youve completed your tax return and all is said and done, the income generated by your bequest will be included with all your other taxable income after you claim your own personal deductions and credits. Its therefore taxed at your marginal tax rate according to your tax bracket, just like all your other income.

But here’s a bit of a silver lining: Were the trust or estate to pay the income taxes on that $1,000, it would have been subject to a higher tax rate. More of your inheritance would have been lost to taxation. Because you personally pay a lower tax rate than what the estate or trust must pay, more of that $1,000 will stay in your pocket even though you have to report the income. There is no special K-1 tax rate.

Of course, if you inherit something like an investment account rather than cash, all income earned by it after you receive it assuming you dont immediately cash it in remains your responsibility. The estate or trust took a bow and backed out of the tax situation when it transferred the inheritance to you. Again, earnings generated would be taxed along with your other income according to your tax bracket going forward for as long as you keep the account intact.

Installment Sales To Descendants

If appreciating assets are sold to children in return for an installment note, the selling parent converts his holdings from an appreciating asset to a fixed value note. The children get the appreciating asset. This technique removes the appreciation from the parents estate. The sale is financed with the income from the property. If cash can be realized from the property to pay the note and the note interest is at least the applicable federal rate, then this technique can be viable. Note that, like many similar techniques, it only works if the property appreciates and produces enough cash to pay the parent.

The property sold may be a minority interest in something, which qualifies for a discount when its value is determined.

The parent will realize capital gain with this technique. However, a capital gain may be avoided if the sale is made to a grantor trust. .

If the sale is made to the grantor trust, no gain is realized, but on the other hand, there is no step-up in basis for the trust. Instead, it takes the grantors basis.

Disclaimer: The site is for educational purposes only, as well as to give general information. This blog is not intended to provide specific legal advice. The site should not be used as a substitute for legal advice from a licensed professional attorney in your state.

Don’t Miss: When Do We Start Filing Taxes 2021

Who Has To File A K

Each member of a partnership has to file a K-1 with the IRS. The IRS defines partnerships as “the relationship between two or more people to do trade or business.” Each member of the partnership “contributes money, property, labor or skill, and shares in the profits and losses of the business.” If youre a partner of one of the following small business structures, you must file a K-1:

- General partnership: This simplest business structure includes two or more people as partners, and personal liability is unlimited. These partners are considered self-employed, so they must pay self-employment taxes and personal taxes.

- Limited partnership : An LP has one general partner with unlimited liability, while all other partners have limited liability. These partners pay personal taxes, except for the partner with unlimited liability. They must pay self-employment taxes, too.

- Limited liability partnership : An LLP is similar to an LP except that it gives limited liability to every partner. This protects everyone from debts against the partnership.

- Limited liability company : An LLC has one person or more and files a K-1 if it has chosen to be taxed as a partnership and not as a corporation. LLCs protect partners from personal liability, keeping personal assets separate from business assets. These partners pay self-employment taxes and personal taxes.

According to the K-1 form, partners required to file include:

- Domestic partners

- LLC member-managers

- Limited partners or other LLC members

How Does Schedule K

Partnerships are categorized as pass-through entities, meaning that partners can shift the business tax liability to the individual partners themselves. Instead of paying corporate taxCorporate vs Personal Income TaxIn this article, we will discuss corporate vs personal income tax. Corporate tax is an expense of a business levied by the government on business earnings, such earnings pass through to the partners, who then pay personal income tax on their claim.

Schedule K-1 reports the division of earnings to each partner for taxation purposes and must be completed individually. Division of earnings is decided between the partners themselves and is commonly based on each partners contribution or pre-existing partnership agreements. If partners choose to reinvest their earnings back into the business, no earnings will be reported on the K-1.

If the partnership makes a loss over the tax year, partners can indicate the loss on the K-1 and carry the amount forward until a year of profit for a future tax deduction. Consecutive years of net losses can accumulate and be used to apply against future income.

You May Like: When Was Income Tax Started

Faqs On Taxation For Volatility Commodity And Currency Proshares Etfs

Partnerships are “pass-through” entities. The income and expenses of each Fund “flow through” to its shareholders. Each shareholder of Volatility, Commodity or Currency ProShares ETF is directly responsible for reporting his or her pro rata portion of income, gains, losses, deductions or other taxable events in the ETF for the calendar year.

While investors may incur trading profits or losses through buying and selling the Funds, they are also subject to tax on their portion of any income or gains passed through by the Trust. In addition to income and gains, each Fund can also pass through losses, which shareholders may use to reduce their personal taxes. The tax treatment of income, gains or losses depends on the Funds underlying positions. For example:

When Is The Estate Tax Year

Occasionally, the estate tax year will vary from the calendar year. Most often, an estate calendar year will start on the actual date of the owner’s death and typically end on December 31 of that same year.

That said, an Executor has the ability to file whats known as an election, requesting that a fiscal year be followed. In this case, the tax year would end the last day of the month before the estate owners one year anniversary of his or her death.;

Read Also: Where’s My Tax Refund Ga

When And Where To Get K

Schedule K-1 packages for ProShares ETF investors are expected to be available mid-March. Information about Schedule K-1 Tax Packages can be found at the following links:

- Copies can be obtained by calling Tax Package Support at 949-5539 for U.S. investors or 618-5164 for foreign investors.

- To access your ProShares K-1 Tax Package, or to download prior years’ Schedule K-1s, .

- View a sample ProShares K-1 Tax Package.

It’s About The Big Picture

If you get a Schedule K-1 because of a windfall such as an inheritance from an estate or as beneficiary of a trust, it’s just the way it is. But if you’re receiving them due to investments in LLCs, partnerships, or a “C” corp, you should look at the bigger picture.

Those entities are often able to pay out more of their cash flows because of their legal structures, but you’ll probably pay more tax on your end. In some cases, you’ll also get a share of the losses, deductions, and credits, as well. In other words, there are numerous potential benefits to these kinds of structures.;

There are trade-offs, too. You’ll have more complex — and potentially more costly — tax preparation each year. If you’re only getting a small amount of income because of a minimal investment in a few shares of an MLP or LLC, it may not be worth it.

But if it’s a major source of income, such as being co-owner of a business, then it’s a different situation entirely. Whether the income you get from these investments is worth the cost and headache is something you’ll have to determine based on your situation.

Don’t Miss: How To Get Stimulus Check 2021 Without Filing Taxes

Factoring In Partnership Agreements

A partnership is defined as a contract between two or more people who decide to work together as partners. The rules of this business arrangement are stated in a partnership agreement. The partnership has at least one general partner who operates the partnership.

GPs are liable for their actions as partners and for the activities of other GPs in the partnership. Limited partners, on the other hand, are liable for the debts and obligations of the partnership based only on the amount of capital they contribute. The partnership agreement dictates how the partners share profits, which impacts the information on Schedule K-1.

Special Considerations When Filing Schedule K

While not filed with an individual partner’s tax return, the Schedule K-1 is necessary for a partner to accurately determine how much income to report for the year. Unfortunately, the K-1 has a reputation for arriving late. It is required to be received by March 15 . In fact, it’s often one of the last tax documents to be received by the taxpayer.

The most common reasons are the complexity of calculating partners’ shares and the need to individually calculate every partner’s K-1.

To add insult to the injurious wait, the Schedule K-1 can be quite complex and require multiple entries on the taxpayer’s federal return, including entries on the Schedule A, Schedule B, Schedule D, and, in some cases,;Form 678.

That’s because a partner can earn several types of income on Schedule K-1, including rental income from a partnership’s real estate holdings and income from bond interest and stock dividends.

It’s also possible that K-1 income can trigger the alternative minimum tax.

Recommended Reading: Can You Refile Your Taxes

Claiming Requirements And Other Information On Your K

You can’t say much about Schedule K-1 Form 1040 requirements without getting technical about tax laws really fast. The important thing to know is that K-1s are financial reports sent out by pass-through entities. Those entities can be partnerships, S corporations, trusts or estates. With pass-throughs, the IRS doesn’t draw a line between the entity and you the financial results go directly to your personal income tax form. That can be useful because sometimes you can use those financial results to pay less in taxes overall.

There are two categories of Schedule K-1 forms. One category goes from the business, estate or trust to the IRS and reports the whole entity’s financial results. Another category of K-1 goes from the business, estate or trust to you and reports just your share of the financial results. That’s because you may own only part of the business or receive only part of the payouts or disbursements from a trust or estate.

Read More:What Is the Difference Between a Business & Personal Account

What Is Schedule K

Schedule K-1 is an Internal Revenue Service tax form issued annually for an investment in partnership interests. The purpose of Schedule K-1 is to report each partner’s share of the partnership’s earnings, losses, deductions, and credits. It serves a similar purpose for tax reporting as one of the various Forms 1099, which report dividend or interest from securities or income from the sale of securities.

The Schedule K-1 is also used by shareholders of S corporations, companies with under 100 stockholders that are taxed as partnerships. Trusts and estates that have distributed income to beneficiaries also file Schedule K-1s.

While a partnership itself is generally not subject to income tax, individual partners are liable to be taxed on their share of the partnership income, whether or not it is distributed. A K-1 is commonly issued to taxpayers who have invested in limited partnerships and some exchange traded funds , such as those that invest in commodities.

The federal income tax filing due date for individuals has been extended from April 15, 2021,to May 17, 2021. Payment of taxes owed can be delayed to the same date without penalty. Your state tax deadline may not be delayed.

Read Also: Do You Pay Income Tax On Inheritance

Who Files A K

You dont have to complete Schedule K-1 as a beneficiary, and in most cases you dont have to file the copy you receive with the IRS. This is the estates responsibility. The estate might be a probate estate, or it might be a living trust. The executor or trustee is the one who must deal with this federal tax schedule. It goes hand in hand with Form 1041, the U.S. Income Tax Return for Estates and Trusts.

Theres a major distinction between Form 1041 and Form 706, the federal return for estate taxes. Form 1041 doesnt tax the estates value but only any income it earns during the year. Estates and trusts must file income tax returns when they have gross incomes of $600 or more in the tax year. They must also do so regardless of earnings if any beneficiary is a non-resident alien.

When the estate gives some or all of that income to its beneficiaries, the trustee or executor must send those beneficiaries Schedule K-1s showing the details of the gift, as well as any deductions or credits the beneficiary might have shared in. He must also file a copy with the IRS. The beneficiary would then report this income on her personal tax return.

What Are Schedule K

Each year, business owners must file business tax documents as required by the Internal Revenue Service . Which forms you file depend on the type of business you own. Companies with a partnership business structure have to file a Schedule K-1 on an annual basis. A K-1 form is a report to the IRS about a partners business dealings over the past year. Explore our guide below to learn everything you need to know about filing a Schedule K-1 document.

Also Check: What To Do When Taxes Are Late

Why Do You Need To File Schedule K

Any time a beneficiary receives any income from Trust earnings throughout the year, a Schedule K-1 will report them to the IRS. K-1s are also used to report any deductions or credits that come from an estate or a Trust, too. In cases where there are multiple beneficiaries of a Trust, each one will have an individual Schedule K-1 filed annually to ensure proper taxes were paid.

How Can You Report Income From Schedule K

Even if youve prepared and filed your taxes on your own for years, you may want to consult with a CPA, Accountant or Financial Advisor before attempting to report income from a Schedule K-1. Or, you may also choose to use online tax software, which offers information to help you navigate the process.;

What happens if you dont file your K-1? Even if its through no fault of your own, for instance if you dont receive your Schedule K-1 on time, if you arent going to be able to file on time, you must file for an extension. Failing to do so will likely result in penalties.;

Read Also: What If I File Taxes Late

Who Files For Schedule K

The three Schedule K-1 forms for different users are:

1. Form 1065

Form 1065 encompasses all types of partnerships, including general partnerships, limited partnerships , and limited liability partnerships . Certain limited liability corporations Limited Liability Company A limited liability company is a business structure for private companies in the United States, one that combines aspects of partnerships and corp with multiple members may be taxed as a partnership using the form.

Is Irs Schedule K

It varies, depending on the individual’s participation and status. For trust and estate beneficiaries, limited partners, and passive investors, Schedule K-1 income is more akin to unearned income. For general partners and active owners in a business or pass-through business entity, the income can be considered earned income, and they may owe self-employment tax on it.

Also Check: How Much Can You Get Back In Taxes

How To Read A K

Most of the information youâll need to complete your Schedule K-1 will come from the Income and Expenses section of Form 1065.

Beyond ordinary business income , Schedule K-1 also captures things like real estate income, bond interest, royalties and dividends, capital gains, foreign transactions, and any other payments that you might have received as part of your involvement in the partnership. Youâll need that information on hand to fill out the form.