Location 11 Irs Database For Nonprofits

If you need an EIN number finder for a non-profit organization , youre in luck! You can search for tax-exempt organizations on the IRS website. People use charitable donations as a tax write-off, but the NPO only has to provide documentation under certain scenarios. If you are trying to claim the donation on tax returns, the company needs to be a 501. Make sure you check before you donate money and again when you file taxes.

How To Get A Tax Id Number For Your Business

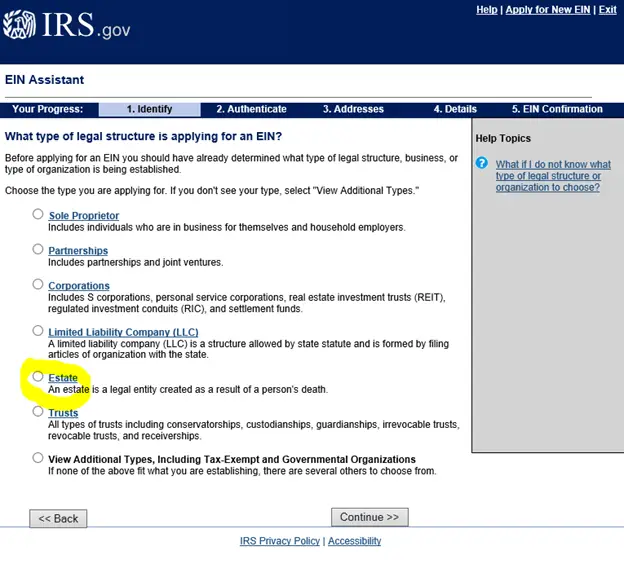

If you need to learn how to get a tax ID number, there are several options. You can apply online through the Internal Revenue Service directly or a third-party service, or fax an application using Form SS-4. International applicants can apply by phone, but if you prefer to mail in an application, that is a slower alternative.

Read Also: How Long Can You Wait To File Taxes

Employer Tax Responsibilities Explained

Publication 15PDF provides information on employer tax responsibilities related to taxable wages, employment tax withholding and which tax returns must be filed. More complex issues are discussed in Publication 15-APDF and tax treatment of many employee benefits can be found in Publication 15. We recommend employers download these publications from IRS.gov. Copies can be requested online or by calling 1-800-TAX-FORM.

Read Also: Can I File Taxes If I Receive Ssi

The Following Organizations Are Required By Law To Possess An Ein:

- Government agencies at the state and local level

You can use the EIN to research information about different businesses. It is sometimes possible to perform a federal ID tax lookup for free, but there are also paid services that can be used. Businesses will use their FTIN to correctly file documents with the federal government. Employees can find their employer’s EIN by referencing their W2 forms.

Filing For Tax Exempt Status

Its best to be sure your organization is formed legally before you apply for an EIN. Nearly all organizations are subject to automatic revocation of their tax-exempt status if they fail to file a required return or notice for three consecutive years. When you apply for an EIN, we presume youre legally formed and the clock starts running on this three-year period.

Also Check: How To Do Taxes For Cryptocurrency

Taxpayer Identification Matching Tools

There are two tools available to taxpayers that will help perfect their payee data before filing Form 1099 with the Internal Revenue Service and Form W-2 with the Social Security Administration . The Taxpayer Identification Number Matching Program is offered by the IRS, and The Social Security Number Verification Service is offered by the SSA.

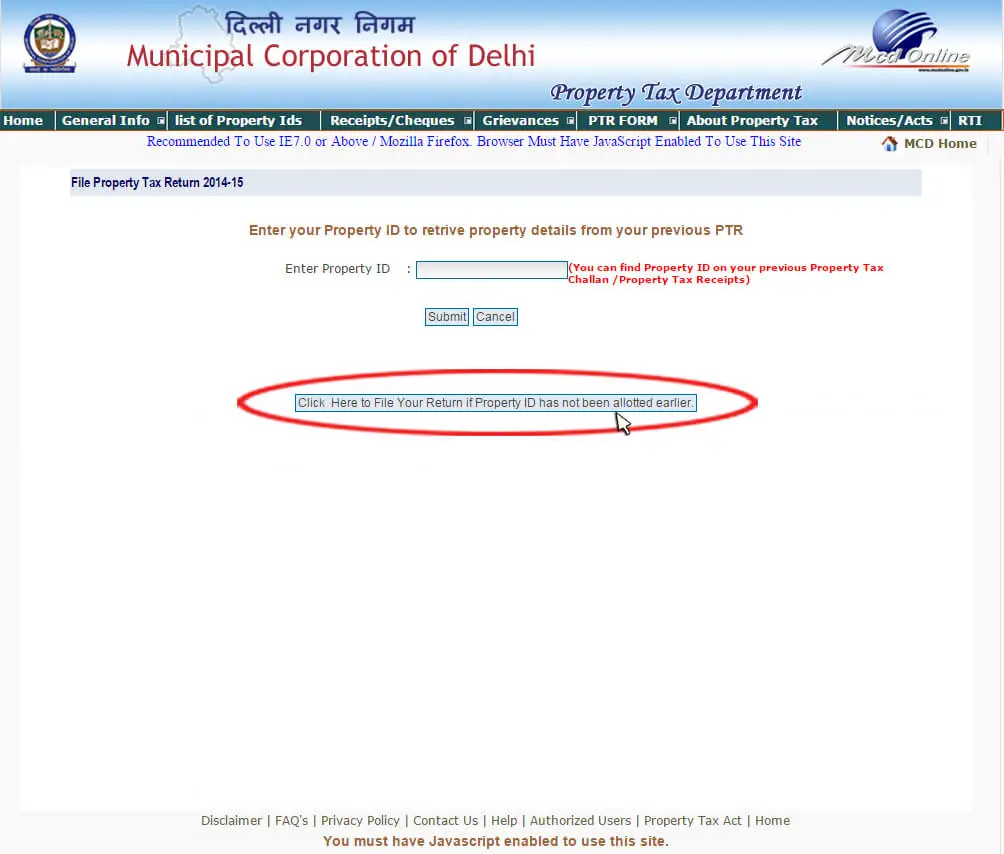

How To Check Your Tax Identification Number Online In Nigeria

One of the many responsibilities of Nigerian citizens is to pay taxes to the government. To make this process easier, the government created the Federal Inland Revenue Service to cover tax collection. Under this body, theres the Joint Tax Board which has created an online portal to check your Taxpayer Identification Number in Nigeria. This is useful to you if you have lost your TIN and want to retrieve it.

The Taxpayer Identification Number is a unique number thats given to an individual, a registered business, or an incorporated company for the purpose of tax payment. This number is generated by the Tax Authority and serves an identification purpose. Hence, 2 different individuals or corporations cannot have the same TIN.

In this post, Ill take you through how to check or retrieve your TIN from the online portal that the Joint Tax Board has provided.

Read Also: Do I Have To Pay Taxes On Bitcoin

How To Find An Ein For A Business

The nature of your business may require that you regularly look up EINs of other companies, or you may want to look up another business’s EIN to validate their information.

If the company is publicly traded and registered with the Securities and Exchange Commission , you can use the SEC’s EDGAR system to look up such a company’s EIN for free. You can do an EIN lookup for nonprofit organizations on Guidestar.

If a company is not registered with the SEC, it will be more difficult since theres no central EIN database for these companies. Here are a few strategies you can use:

- Contact the company’s accountant or financing office and ask for the EIN, though they dont have to provide it.

- Search for the company on the secretary of states website or seek out other local or federal filings that may be online.

- Hire a service or use a paid database to do the EIN search.

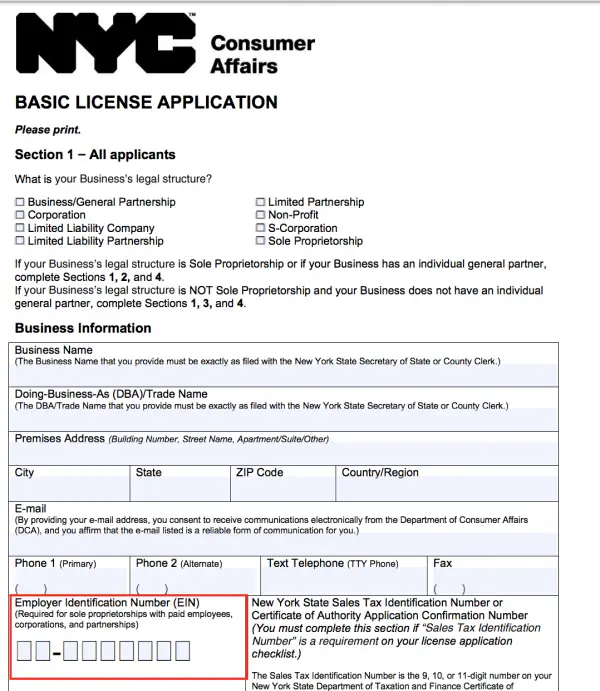

How To Apply For A Federal Tax Id Number

Once youve determined that your business needs a tax ID, youll work with the IRS to receive one. You can apply online other options include phone, mail or fax.

A federal tax ID number is free, so steer clear of any scams that try to get you to pay for an EIN. The IRS administers and grants tax ID numbers to businesses throughout the United States, so you can apply directly at IRS.gov.

Here are the three key steps:

Also Check: How Much Does It Cost To File Taxes With Turbotax

Finding The Id For Your Business

How To Get An Ein

Applying for an EIN is easy it can be done online within minutes on the IRS website or by faxing or mailing a completed Form SS-4 to the IRS.

We recommend that businesses apply for an EIN as soon as possible because its crucial for basic business functions. You don’t need an EIN if you are a sole proprietor with no employees, but if you’re looking to scale your business, having an EIN early on is beneficial.

Applying for an EIN online is fastest, but you also have these options if youre based in a U.S. state or the District of Columbia:

- Mail: Internal Revenue Service, Attn: EIN Operation, Cincinnati, OH 45999

If you’re an international applicant and don’t have a legal residence or place of business in the U.S., you can apply for an EIN by one of these methods:

- Telephone: 941-1099

- Fax: 215-1627 if within the U.S., or 707-9471 if outside the U.S.

- Mail: Send your SS-4 form to Internal Revenue Service, Attn: EIN International Operation, Cincinnati, OH 45999

If you call to request an EIN, fill out an SS-4 form ahead of time to have your answers prepared for the questions the agent will ask. If you’re filing via fax or mail, complete Form SS-4 and mail or fax it to the IRS. These methods take much longer than applying online while faxing can result in an EIN within four business days, mailed applications can take at least four weeks to process.

Also Check: What Is Child Tax Credit For 2020

Your Companys Ein And Business Identity Theft Issues

Its easy for someone to get your business EIN, and they might be able to use it to steal your business identity. The IRS recognizes that a companys EIN may be the target of hackers and identity thieves. It suggests some ways to be watchful for identity theft related to taxes. Your business may have been hacked if:

- You receive tax notices about fictitious employees

- Your business tax return is accepted, but you havent file for that year yet

- You receive bills for a line of credit or a credit card that you dont have

The best way to check for business identity theft is to get a copy of your business credit report. Check it in detail for unexplained creditors and inaccurate or out-of-date information.

How To Find An Ein For Another Business

There may come a time when you need to look up another companys EIN for verification purposes, risk assessment or other reasons. Here are a few potential ways you might be able to find a business EIN when you need it:

- Ask for the information. The companys payroll or accounting department might be a good place to submit your request, though theres no guarantee a business will be willing to share those details.

- Check the companys credit report. Unlike consumer , which have more robust privacy protections, almost anyone can check a business credit report. Some business credit reports and scores may feature a companys EIN alongside other important details, like how the business manages its credit obligations.

- Search state and federal websites. You may be able to find information about a company, including its EIN, by searching various state and federal government websites. The secretary of states website may be a good place to start. You might also consider searching the Securities and Exchange Commissions website for SEC filings if the company is publicly traded.

- Pay a third party for help. Another option to consider is an EIN database. For a fee, these third-party services may be able to provide you with useful information about various businesses.

Recommended Reading: What Is North Carolina Sales Tax

Option : Call The Irs To Locate Your Ein

You should be able to track down your EIN by accessing one or more of the documents listed above but if you’re still not having any luck, the IRS can help you with federal tax ID lookup. You can call the IRSs Business and Specialty Tax Line, and a representative will provide your EIN to you right over the phone. The Business and Specialty Tax Line is open Monday through Friday from 7 a.m. to 7 p.m. ET. This should be your last resort, however, because call wait times can sometimes be very long.

Before you call, keep in mind that the IRS needs to prove youre actually authorized to retrieve your business tax ID number. For example, youll need to prove you are a corporate officer, a sole proprietor, or a partner in a partnership. The IRS representative will ask you questions to confirm your identity.

Don’t get frustrated: This is simply a precaution to help protect your businesss sensitive data. After all you wouldn’t want the IRS to give out your social security number to anyone who called, would you? Once you’ve found your business tax ID number, we suggest putting the number in a safe placelike a locked file cabinet or secure cloud storage so you won’t have to go through these steps again.

What Is An Employer Identification Number

An employer identification number is a free tax identification number issued to a business by the Internal Revenue Service . According to the IRS, you need an EIN If youre required to report employment taxes or give tax statements to employees or annuitants. If you want a walkthrough of how to apply for an EIN, we provide it in the blog How to Register a Business.

The EIN will be on all business tax documents. An EIN is a nine-digit number that follows the pattern 00-0000000, which makes an employer identification number easily distinguishable from a social security number and other tax identification numbers.

Well cover some other uses of the EIN after discussing other federal tax identification numbers.

Don’t Miss: How To Get Tax Identification Number

Check Your Tax Documents

You can find the number on the top right corner of your business tax return. If you open the return and discover that the number has been replaced with asterisks for security purposes, contact your CPA and request the number from them.

The business EIN is listed on the top right of a business tax return. Image source: Author

If you file your own taxes with tax software, the software will save the number from year to year. Visit the softwares business section to retrieve your EIN.

How Long Does It Take To Get An Ein

The amount of time it takes your business to receive an EIN can vary. Your results will depend on how you apply for your business tax ID number in the first place.

- Online: If you apply for an EIN online, you may get an EIN number right away.

- Fax: With faxed applications, you should receive a fax back with your EIN within four business days.

- Mail: Send in your EIN application via mail and youll have to wait around four weeks for processing.

Read Also: What Is The Best Free Tax Filing Online

Federal Tax Id Number Versus Ein

In short, a federal tax ID is the same as an EIN. As is often the case in business, though, youll hear several acronyms that all reflect the same concept. These acronyms can be confusing, but here is a clear breakdown of what each refers to and how they differ.

- The federal tax ID number is also known as the TIN.

- Another acronym for the federal tax ID number is the EIN, which stands for Employer Identification Number. An EIN must come from the IRS in order to be a federal tax ID number, and it is used to identify a business entity.

- An EIN may also be called a FEIN .

How To Find The Ein For Your Business

More often than not, there will be an instance when you’re working through a business document or application, and you come upon a question asking for your EIN. What if you cant remember it? The three best places to find your business EIN are:

- Your business tax return from a previous year

- The original document of your receipt or the document you received from the IRS when you applied for your EIN

- Your states business division website, if you registered your partnership, LLC, or corporation with your state

You could also look for your EIN on other business documents or applications, including:

- A business bank account application

- An application for a business loan

- The application for a business credit card

- A copy of a state or local license or tax permit

- On a 1099-NEC form you received for your work as an independent contractor or freelancer

- On the 1099-MISC form or 1099-NEC form that you used to report payments by your business

Recommended Reading: How Much Money Will I Get Back In Taxes

Who Needs A Federal Tax Id

The IRS requires most business entities to use a federal tax ID corporations, partnerships, most LLCs, and some sole proprietorships. A federal tax ID offers other benefits, even when it isn’t required by the IRS. For instance, it can help protect against identity theft, and it’s often a prerequisite for opening a business bank account.

Understanding The Tax Identification Number

A tax identification number is a unique set of numbers that identifies individuals, corporations, and other entities such as nonprofit organizations . Each person or entity must apply for a TIN. Once approved, the assigning agency assigns the applicant a special number.

The TIN, which is also called a taxpayer identification number, is mandatory for anyone filing annual tax returns with the IRS, which the agency uses to track taxpayers. Filers must include the number of tax-related documents and when claiming benefits or services from the government.

TINs are also required for other purposes:

- For credit: Banks and other lenders require Social Security numbers on applications for credit. This information is then relayed to the to ensure the right person is filling out the application. The also use TINsnotably SSNsto report and track an individuals .

- For employment: Employers require an SSN from anyone applying for employment. This is to ensure that the individual is authorized to work in the United States. Employers verify the numbers with the issuing agency.

- For state agencies: Businesses also require state identification numbers for tax purposes in order to file with their state tax agencies. State taxing authorities issue the I.D. number directly to the filer.

Read Also: Will I Get Any Money Back From My Taxes

Also Check: Did The Irs Extend The Tax Deadline For 2021

How To Change Or Cancel An Ein

Once you obtain an EIN for your business, that tax ID remains with your business for its entire lifespan. However, there are some situations where you might need a new business tax ID number.

Here’s when you’ll need to apply for a new EIN:

-

You incorporate for the first time or change your business entity

-

You buy an existing business or inherit a business

-

Your business becomes a subsidiary of another company

-

You are a sole proprietor and are subject to a bankruptcy proceeding

-

You are a sole proprietor and establish a retirement, profit sharing, or pension plan

-

You receive a new charter from your state’s Secretary of State

-

There are changes to your ownership structure

The IRS has a detailed list of situations where you need a new EIN. A new EIN replaces your old EIN, so once you get the new tax ID, you would use that on tax returns and other business paperwork moving forward.

Note that more common changes, such as changes to your business name or address, generally don’t require a new EIN. But you should still report a business name change or location change to the IRS.