How To Pay Estimated Taxes

Ideally, the IRS would like to get your estimated taxes in four equal payments over the course of the year, but some businesses are seasonal. For example, a landscaping business makes most of its money during the warmer months of the year. Its wise to pay the tax as you get income. In this event, youd follow the annualized income installment method that enables you to pay when youre flush with cash. Instructions can be found in IRS Publication 505, Tax Withholding and Estimated Tax and Form 2210.

Once you determine the amount to pay, the IRS will accept your money in any number of ways. Instructions for payment options can be found at IRS.gov/payments. These include:

- Direct pay from your checking or savings account.

- The IRS2Go mobile app.

- Cash at a participating retail establishment.

If you pay online, which you can do any time of the year, be sure to select the tax year and tax type or form associated with your payment. If you pay by check or money order, send the payment along with a Form 1040-ES voucher to the address specified for your state or territory on that form. Make the check out to the United States Treasury, and in the notes section in the lower left corner, specify the tax year and estimated taxes.

What Is The Tax Form For Oklahoma

Form 511 is the general income tax return for Oklahoma residents. Form 511 can be eFiled, or a paper copy can be filed via mail.

How much taxes do I pay with an LLC? LLC members are responsible for paying the entire 15.3% . Members can deduct half of the self-employment tax paid from their adjusted gross income. Do Oklahoma LLCs pay franchise tax? LLCs are statutorily exempt from franchise tax. How is

Payroll Taxes Are Particularly Important

Furthermore, the type of tax involved can result in different types of responses from a taxing agency. For example, the IRS takes a dim view of businesses that dont pay and/or file their quarterly payroll taxes and are far more aggressive in that regard than with the average taxpayer who forgot to make an estimated tax payment.

The reason that the IRS is more aggressive with regard to payroll taxes is because they view that money as not belonging to the business but rather as money being held the business for the IRS because it has been withheld by the business from the employees on behalf of the IRS through payroll deductions and withholdings .

In effect, businesses are the tax collectors for the IRS, and they are simply holding those funds in trust until paid to the IRS. As a side note, the worst thing a business can do is withhold these funds and then use them for cash flow because they dont always have to be remitted to the IRS right away. They should always be withheld, set aside, and used for no other purpose than to be remitted to the IRS on time as prescribed by law.

You May Like: How Much Does H& r Block Charge To Do Taxes

Don’t Miss: Notice Of Tax Return Change Revised Balance

What Are Quarterly Taxes

There are all kinds of days we look forward to throughout the yearlike birthdays, the Friday before a three-day weekend and National Pancake Day. Then there are some days wed rather skip altogether. Were looking at you, Tax Day.

But the irony is we dont really pay our taxes on Tax Day. In fact, by the time the tax deadline rolls around, most U.S. workers will have already paid their taxes in full. Thats because their employers withhold taxes from their paycheck before it ever hits their bank accounts.

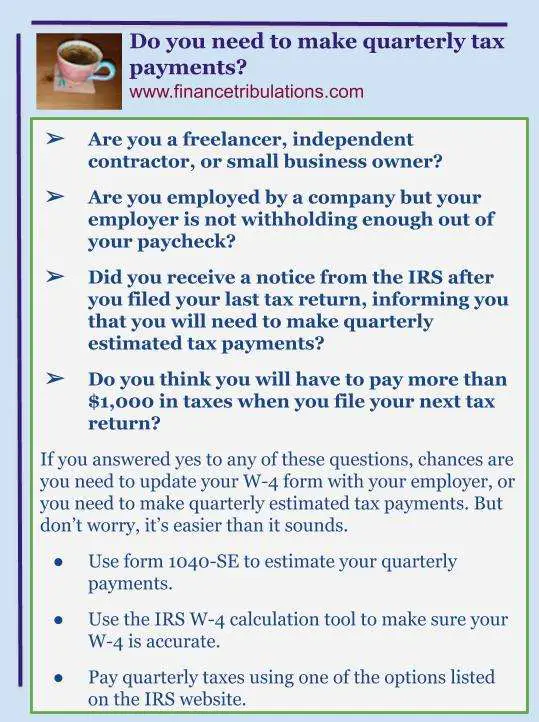

But what if youre a freelancer or a contract worker with no employer to withhold those taxes? Yes, you still have to pay taxes just like everyone else. But now its your responsibility to make sure you pay them. And that means theres a chance you might need to pay quarterly taxes to the IRS.

What all does that mean? Read on to find out.

When You Make Estimated Tax Payments

Estimated taxes are due quarterly. Due dates are normally on the 15th day of April, June, September, and January of the next year. If the 15th falls on a weekend or a legal holiday, the due date is the next business day.

You can find due dates for 2021 estimated taxes in the table below.

| Payment period |

|---|

Read Also: Mcl 206.707

Did You Remember To Pay Your Quarterly Taxes Tax Time Comes Around More Than Once A Year When You’re A Business Owner

For freelancers, tax time can be hectic. Youve got to gather all of your documents and prepare your return . Sometimes, you even have to write a big check to the IRS. This is bad enough once a year, but for freelancers, tax time happens four times a year.

The U.S. has a pay-as-you-go tax system, so taxes must be paid as you earn or receive income. For employees, those payments are handled by withholding taxes from a paycheck. Freelancers have to manage tax payments themselves though quarterly estimates.

Whether youre a new freelancer whos just trying to figure this out or an experienced pro who needs a refresher, this guide will help you decide if you need to pay and provide strategies for making quarterly estimated tax payments.

How Much Do I Have To Pay In Quarterly Taxes

When it comes to quarterly taxes, determining whether or not you have to pay them is unfortunately the easy part. Calculating the amount you owe each quarter is a little bit more challenging. When paying quarterly taxes, the easiest way to go about it is to pay 100% of the amount you paid in income tax from the previous year. Simply take the total amount you paid, and divide that by 4 to arrive at the amount you should be paying quarterly. For example, if you paid a total of $1,200 last year, divide that by 4 and you have $300. That is the amount you should pay for each quarterly payment.

When paying quarterly taxes, it is important to keep in mind that you are better off paying a little more than a little less. Nobody wants to be hit with a surprise tax bill come tax day, and if you overpay the good news is you will get a tax return! Failure to pay quarterly taxes could result in costly penalties, which only eat at your profits! In addition to paying quarterly tax payments, you may also be subject to the self-employed tax, which makes up your portion and the employer portion of social security and medicare tax. The percentage for self-employed tax is 15.3%.

You May Like: How Can I Make Payments For My Taxes

What Is A Sole Proprietor Tax

If you are a sole proprietor and do not withhold taxes from your check, you are obligated to pay income taxes on the money.

It’s very similar to Social Security taxes and Medicare deducted from employee paychecks. In the standard employee-employer relationship, the Social Security tax is split. However, when you are self-employed, you’re left to foot the bill yourself.

Before determining whether you should pay self-employment tax, you should figure out your net loss or net profit from your business. Begin by subtracting all business expenses from the income. If you have a net profit, it should be transferred to the income section on the 1040 form. Likewise, net losses should be claimed on the form as well.

These estimated taxes are due every quarter and are based on your business’s net income, dividends, interest, alimony, profits from investment sales, prizes, and awards. Simply put, you must pay taxes on any income you haven’t paid taxes on.

One great rule of thumb is if you expect to owe at least $1,000 in taxes, it’s best to file quarterly taxes.

Situation : Your Income Was Uneven

Commonly, estimated quarterly tax penalties are reduced or waived if you did not receive your income evenly throughout the tax year. In these circumstances, the IRS allows you to annualize your income and make different, unequal payments.

Check with Form 2210 to see if you fit the bill and if you can waive your taxes this way. In most cases, you have all the circumstances there to tell you whether your situation is appropriate or not .

Don’t Miss: How To Buy Tax Lien Properties In California

Do I Have To Pay State Estimated Taxes

Almost all states that impose an income tax also have estimated tax requirements. These are similar to federal requirements, but different states have different income thresholds and penalties for estimated taxes, so make sure you understand the rules where you live. Look for the state payment vouchers on last years tax return if you are unsure of how much to pay.

Our team prepares tax estimates and corresponding payment vouchers as part of the tax return preparation process. We can also refine the estimate at various points during the year with actual income information replacing assumptions made earlier in the year. If you would like us to prepare a tax estimate or have other questions, please dont hesitate to get in touch!

Changes In Income Or Exemptions

If your expected Virginia adjusted gross income changes during the year, re-compute your estimated tax to determine how much your remaining payments should increase or decrease.

A change in income, deductions or exemptions may require you to file an estimated payment later in the year. If you file your state income tax return and pay the balance of tax due in full by March 1, you are not required to make the estimated tax payment that would normally be due on Jan. 15.

If you file your return after March 1 without making the January payment, or if you have not paid the proper amount of estimated tax on any earlier due date, you may be liable for an additional charge for underpayment of estimated tax.

Read Also: How Much Does H & R Block Charge To Do Taxes

When Are Quarterly Taxes Due

If youre one of the many Americans who need to file quarterly, circle these deadlines on your calendar or set reminders on your phone so you dont forget to pay on time! If youre late on a payment, youll be hit with penalties each month that could go as high as 25% of your unpaid taxes.2 In a traditional tax year, here are the quarterly deadlines.

| When You Get Paid |

|---|

Financial Institution Excise Tax

For tax years beginning on or after January 1, 2020, the due date to file the Forms ET-1 and ET-1C has changed to correspond to the federal due dates for the income tax return. The Form ET-8 is no longer required to request an extension to file Form ET-1/ET-1C. However, if an extension has been granted for federal purposes, the extension is also granted for Alabama purposes. The federal extension form must be submitted with the Form ET-1/ET-1C. NOTE: The full amount of the tax liability is due by the ORIGINAL due date of the return.

Form FIE-V: If your payment is less than $750, you can remit your payment by check or money order. Make check or money order payable to: Alabama Department of Revenue. Include on the check: the financial institutions federal employer identification number or the Qualified Corporate Groups federal employer identification number for ET-1C filers, the form type or type of payment , and the tax year end. The check or money order must be remitted along with a complete Form FIE-V, Alabama Financial Institution Excise Tax Voucher to ensure proper posting of the payment.

Electronic Payments: For payments that are $750 or more, the payment must be made electronically. The payments can be made electronically through the following options:

Dont Miss: How Much Does H And R Block Charge To Do Your Taxes

Don’t Miss: What Does Locality Mean On Taxes

Myths About Quarterly Taxes For The 1099 Tax Form

OVERVIEW

For those Americans who pay quarterly taxesor those who don’t, but who think they shouldunderstanding the rules governing estimated taxes is vital.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

For those Americans who pay quarterly taxesor those who don’t but who think they shouldunderstanding the rules governing estimated taxes is vital.

Due Dates For Farmers And Fishermen

If you earn at least two-thirds of your gross income from farming or fishing, you do not have to make payments by the dates above. You can if youâd like, but it isnât necessary. Instead, you should do either of the following:

-

Pay all of your estimated tax for the 2020 tax year by January 15, 2021

-

File your 2020 Form 1040 by March 1, 2021, and pay the total tax due

Don’t Miss: How To File Missouri State Taxes For Free

A Guide To Paying Quarterly Taxes

OVERVIEW

Self-employed taxpayers likely need to pay quarterly tax payments and meet key IRS deadlines. Heres a closer look at how quarterly taxes work and what you need to know when filing your tax returns.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

Working for yourself presents a host of benefits, such as never having to report to a boss and setting your own hours. It also carries a few added tax requirements, such as paying your taxes quarterly instead of with each paycheck as a W-2 employee would.

Keep reading to learn answers to questions like, “Who has to pay quarterly taxes?” “When are quarterly taxes due?” and “How do I pay quarterly taxes?”

Make Payments Using Irs Direct Pay

There are many ways to make estimated tax payments but our preferred method is IRS direct pay available on the front page of www.irs.gov click the link to Make a Payment. We recommend direct pay because it is easy to make a payment online with a direct debit from your checking account. You will need some information from a prior year tax return to verify your identity prior to making the payment.

Other payment options include the governments EFTPS and mailing a check with a payment voucher.

If you are interested in more information about estimated tax for individuals you may want to visit the IRS website for form 1040-ES.

You May Like: How Much Does H& r Block Charge To Do Taxes

How To Figure Estimated Tax

Individuals, including sole proprietors, partners, and S corporation shareholders, generally use Form 1040-ES, to figure estimated tax.

To figure your estimated tax, you must figure your expected adjusted gross income, taxable income, taxes, deductions, and credits for the year.

When figuring your estimated tax for the current year, it may be helpful to use your income, deductions, and credits for the prior year as a starting point. Use your prior year’s federal tax return as a guide. You can use the worksheet in Form 1040-ES to figure your estimated tax. You need to estimate the amount of income you expect to earn for the year. If you estimated your earnings too high, simply complete another Form 1040-ES worksheet to refigure your estimated tax for the next quarter. If you estimated your earnings too low, again complete another Form 1040-ES worksheet to recalculate your estimated tax for the next quarter. You want to estimate your income as accurately as you can to avoid penalties.

You must make adjustments both for changes in your own situation and for recent changes in the tax law.

Corporations generally use Form 1120-W, to figure estimated tax.

How Can You Prove An Oral Contract

Unfortunately, without solid proof, it may be difficult to convince a court of the legality of an oral contract. Without witnesses to testify to the oral agreement taking place or other forms of evidence, oral contracts won’t stand up in court. Instead, it becomes a matter of “he-said-she-said” – which legal professionals definitely don’t have time for!

If you were to enter into a verbal contract, it’s recommended to follow up with an email or a letter confirming the offer, the terms of the agreement , and payment conditions. The more you can document the elements of a contract, the better your chances of legally enforcing a oral contract.

Another option is to make a recording of the conversation where the agreement is verbalized. This can be used to support your claims in the absence of a written agreement. However, it’s always best to gain the permission of the other involved parties before hitting record.

Also Check: How To Get A Pin To File Taxes

When Is A Verbal Agreement Legally Binding

For any contract to be binding, there are four major elements which need to be in place. The crucial elements of a contract are as follows:

Therefore, an oral agreement has legal validity if all of these elements are present. However, verbal contracts can be difficult to enforce in a court of law. In the next section, we take a look at how oral agreements hold up in court.