This Guide Can Help Your Child Learn The Process And Build Good Habits

As your child moves toward adulthood, you face several milestone decisions that involve, in part, a desire to help your child become more independent and responsible. But one milestone you may not anticipateeven though it will be part of your child’s growing-up experienceis the filing of that first income tax return in their name.

What Do I Need To File

A hefty part of doing your taxes is pulling together all the paperwork and documentation.

To prepare your taxes you will need to have your personal information , your income and receipts of other types of income . You’ll also need a copy of last year’s tax return.

Most wage-earners have what they need, income-wise, from a W-2, which you should have received from your employer. But don’t let a 1099 form for income you earned doing a side job or other gig melt your brain. It is counted as freelance income and you may have expenses to claim to offset your income.

“People need to realize that freelance income opens up a new door for deductions,” says Kohler. Look at your expenses. He says the mileage, cell phone use, home office and computer use could potentially be deductible.

“My neighbor paid zero tax on the $5,000 he earned because he could wipe it out with deductions,” Kohler said.

Keep in mind, you’ll need to have specific forms and documentation for certain circumstances, including those who receive health care through the Affordable Care Act or students who pay tuition.

Three: Put Your Tax Documentation Together

If you are expected to file a federal return or state return, you will want to have all documentation put together. The most important and helpful backup material is typically the returns filed in the prior year or any previous years returns, but if this is your first year to file your taxes, you can begin keeping excellent documentation this year and use it for future years.

You should receive all tax documentation and forms you need to file your taxes, including the following documents. Keep in mind these are just some examples of the documents you should receive by January 30 if they apply to you.

- W-2: Wage and Tax Statement

- Form 1099-MISC: Miscellaneous Income

- Form 1098-E: Student Loan Interest Statement

- Form 1098-T: The Tuition Statement

Generally, your documents will come from your places of employment and schools you attended during the tax year. If you do not receive these documents by the end of January in the new year, check with those companies or institutions to get your documents. The IRS will not have them for you.

Read Also: Tax Preparation License

So How Do You Start To Get Organized As Far As Paying Taxes Goes

Heres the general rule of thumb for getting organized: dont throw anything that could possibly have to do with your taxes away for 6 years. The Canada Revenue Agency might want them someday if they decide to audit your tax returns. This includes:

- Slips :

- T4: Employment Income

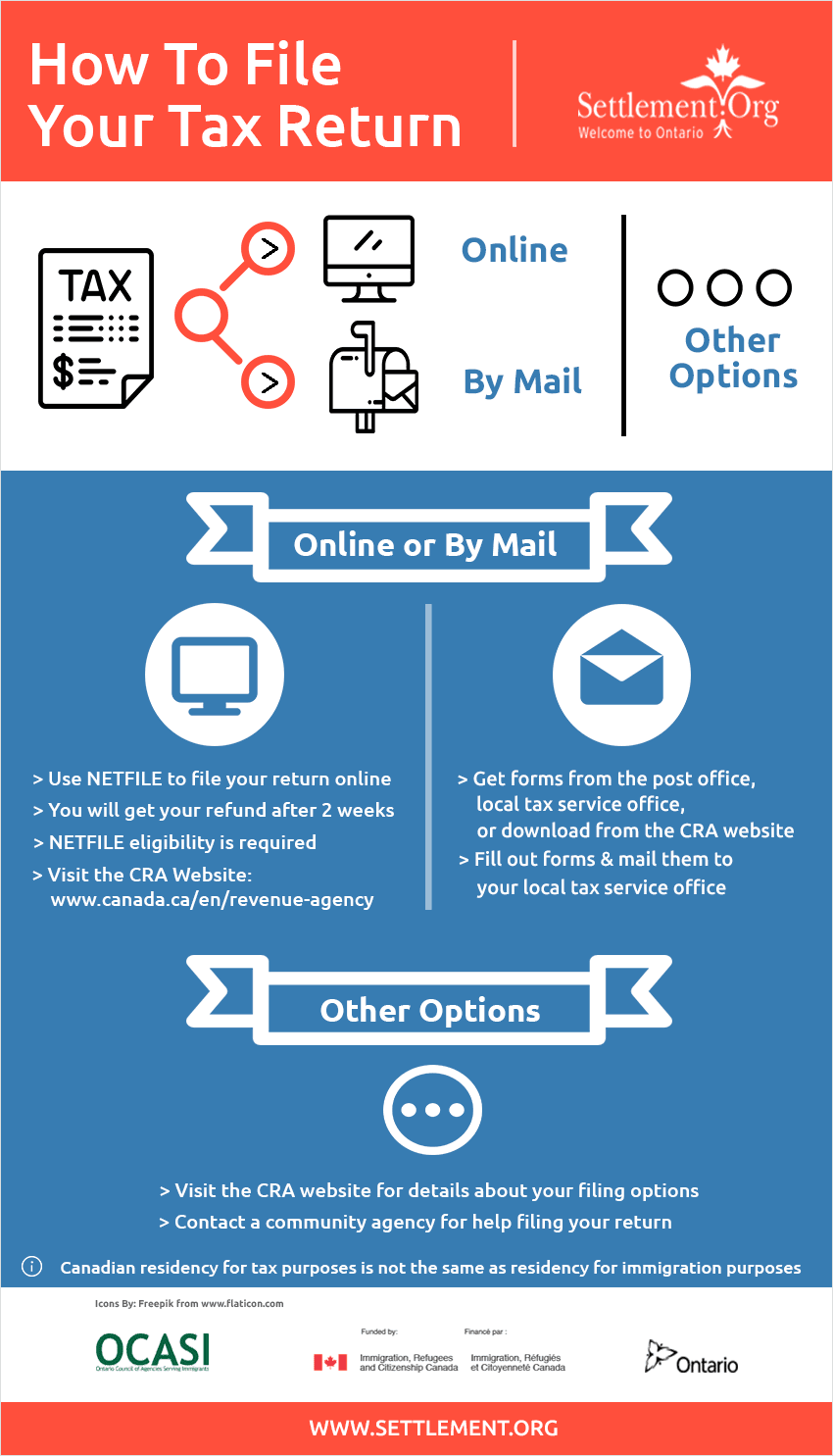

Are You A Resident Of Canada

You become a resident of Canada for income tax purposeswhen you establish significant residential tiesin Canada. You usually establish these ties on the date you arrive in Canada.

Newcomers to Canada who have established residential ties with Canada may be:

- protected persons within the meaning of theImmigration and Refugee Protection Act

- individuals who have applied for or received permanent resident status from Immigration, Refugees and Citizenship Canada

- individuals who have received “approval-in-principle” from Immigration, Refugees and Citizenship Canadato stay in Canada

If you were a resident of Canada in a previous year, and you are now a non-resident, you will be considered a resident of Canada for income tax purposes when you move back to Canada and re-establish your residential ties.

As a newcomer to Canada, you will need a social insurance number . For more information, visit Service Canada.

Don’t Miss: Appeal Cook County Property Taxes

When Is The Last Date For Filing Taxes

Last but not least, it is important to file your income tax return before the due date. The due date for AY 2019-20 is 31 July 2019. In case you miss the deadline, you can file your returns after paying a late filing fee which is Rs 5,000, if the return is filed after 31st December, late fee is Rs 10,000. However, it is restricted to Rs 1,000 for those with total income of Rs 5L.

The above process is time-consuming and tedious. There are a few online portals that help you in filling up your tax returns, offering easy to use and easy to navigate features. Lastly, do not forget to verify/e-verify your income tax return uploaded for a successful e-filing.

B Hire And Work With A Tax Preparer

While it’s never been easier to do your own taxes using software, as your financial life gets more complex you might wonder if you’re missing something and should get someone to prepare and help file your taxes. If you have a business or a healthy side gig, or you just want help understanding all of the forms, you might seek out a professional’s guidance.

» Find a local tax preparer for free:See who’s available to help with your taxes in your area

If you don’t want to meet in person with a tax preparer, theres a way to file taxes without leaving the house. A secure portal lets you share documents electronically with a tax preparer. Typically, the preparer will email you a link to the portal, youll set up a password and then you can upload pictures or PDFs of your tax documents.

Don’t Miss: Do Doordash Take Out Taxes

How To Check Itr Status Online

Once you have filed your income tax returns and verified it, the status of your tax return is ‘Verified’. After the processing is complete, the status becomes ‘ITR Processed’.

If you wish to know which stage your tax return is after filing it and want to check your ITR status online, here’s how you can do it in easy steps.

Without login credentials

You can click on the ITR status tab on the extreme left of the e-filing website.

You are then directed to a new page where you have to fill in your PAN number, ITR acknowledgement number and the captcha code.

Once this is done, the status of your filing will be displayed on the screen.

Login to the e-filing website.

From the dropdown menu, select income tax returns and assessment year

Once this is done, the status of your filing will be displayed on the screen.

Keeping the Income Tax Department informed about your income and taxability will keep you on the right side of the law and prevent any blocks in your financial competency. Now that you know whether or not you compulsorily have to file your ITR, you need to ensure that you complete the process before the deadline every year.

You May Qualify For A Homeowner Exemption

In many states, some homeowners qualify for a homeowner exemption, which can lower your property tax bill, usually by lowering the assessed value of your home.

Who qualifies? Well, that really depends on your local laws. Typically, these things are decided on the state, county, or municipal level, and requirements can vary widely. Commonly, homeowner exemptions are given to the elderly, people with disabilities, and veterans, but some jurisdictions give them out to homeowners below a certain income threshold or homeowners who make specific improvements to their property, such as planting a rain garden. Typically, you do have to use the home as your primary residence in order to qualify for the exemption.

Also Check: Efstatus.taxact.com

Types Of Taxable Income

You have to report any taxable income you earn inside and outside Canada when you file your tax return. This includes:

- any full-time or part-time work

- self-generated income

- rental income, including renting out a portion of your home

- investments

- your pension

You do not have to report certain non-taxable amounts as income, including:

- allowances

- elementary, secondary and post-secondary school scholarships

Is It Important To File Returns

You have to mandatorily file an income tax return in case your income crosses the basic exemption limit as discussed above.

However, in certain cases e.g., when you have income below threshold limit but have to claim TDS credits or declaring tax-exempt income, you would need to file an income tax return.

Additionally, filing an income tax return would also serve as a document proof while applying for a home loan, visa processing to travel abroad and obtaining a vehicle loan.

Recommended Reading: How Taxes Work With Doordash

Gather Your Tax Slips

Before a student files a tax return, they must gather all of their necessary tax slips. Students should be looking for the following slips depending on their own individual situation:

- T4 Statement of Remuneration Paid: Many students work throughout their studies or while on summer vacation. They should receive a T4 slip and remember, if they work in the hospitality industry, they need to also claim their tips and gratuities as income.

- T4A Statement of Pension, Retirement, Annuity, and Other Income: Students may receive a T4A tax slip showing income received for different reasons. Lets look at the different types of income on this slip and where they are reported.

- Educational Assistance Payments from a Registered Education Savings Plan are shown in Box 042 of the T4A slip and reported on Line 13000 Other Income of your tax return.

- Students who receive financial awards such as Scholarships, Bursaries, Fellowships, Artists Project Grants, and Prizes will receive a T4A with an amount in Box 105. Its important to note the Scholarship Exemption and ensure you enter your Box 105 amount into the correct box of your tax software in order to receive the exemption. The taxable portion of these scholarships/awards will be entered on Line 13010 Scholarships, Fellowships, Bursaries, and Artists Project Grants of the tax return.

Remember Your State Taxes

In addition to filing your federal tax return with the IRS, your state tax return is due at the same time.

Tax laws vary from state to state, which means they could offer breaks not available on your federal return, Hammer said. Some states, like Florida, impose no state income tax.

Some breaks could be related to, say, vehicle or homeownership, while others could be tied to specific jobs.

Also Check: Can You Write Off Miles For Doordash

Don’t Wait Until The Last Minute

This year’s tax-filing deadline might seem far away right now. That’s a good thing: At this point, you have time to review all your forms for accuracy.

“If something is incorrect on your W-2 or 1099, or you didn’t receive all your documents, it will be impossible to get it fixed in time if you wait until the end of tax season,” Hammer said.

Additionally, if you want to open an individual retirement account and make a tax-deductible contribution for 2017, waiting too close to the filing deadline could result in your contribution landing in the account after the deadline.

“You’d be lucky to get an account set up in five or six days,” Hammer said. “Then you have to have the contribution credited to your account in time.”

If something is incorrect on your W-2 or 1099, or you didn’t receive all your documents, it will be impossible to get it fixed in time if you wait until the end of tax season.Greg HammerCEO and president of Hammer Financial Group

Don’t Forget About Your Gig Economy Income

Millions of young people participate in the gig economy as rideshare drivers, making package or food deliveries, freelancing full or part-time or working as a project-based consultant. If you’ve earned income from freelancing, don’t forget to report your gig work income on your tax return.

- Depending on how much you earn, you may receive a 1099-MISC for your work. But even if you don’t, you still need to report the income to the IRS.

- You’ll report your gig work income on Schedule C attached to your Form 1040.

- Usually, you can deduct any expenses related to your gig work, such as miles driven, supplies and advertising costs on Schedule C as well.

Recommended Reading: Philadelphia Pa Sales Tax

Filing With A Tax Pro

For the last couple of years, my taxes have been more complicated than Id like them to be. I moved states, switched jobs, changed my filing status, didnt receive my first stimulus check and so on.

I took a stab at filing online for free but ended up with many questions and a migraine. So, I just let someone who knows what theyre doing handle it for me I made an appointment with a tax professional.

Theres nothing wrong with having a specialist do your taxes if your tax situation is a bit more complex. Of course, youll have to pay a fee, which varies by the tax preparer and complexity of your taxes. It can be a certified public accountant, attorney or enrolled agentjust make sure the person is qualified by checking their credentials. Many people also use H& R Block for filing with a tax professional.

Prices typically range between $100 and $300. If youre looking for an affordable option, look into your local credit unions which may offer low-cost tax preparation services.

If youre still a student, theres another great option for you.

Many college and university campuses will provide tax preparation services for students with the assistance of other students who may be looking to gain experience working under a qualified supervisor in a tax lab, says Jeffrey Wood, CPA and partner at Lift Financial. These labs are usually located in the business departments, may be free depending on your institution, and may be worth looking into for tax filing assistance.

Gather Tax Filing Information

Youll need to do this whether youre hiring a tax preparer or doing the tax filing yourself. The goal is to gather proof of income, expenses that might be tax-deductible or win you a tax credit, and evidence of taxes you already paid throughout the year. Our tax prep checklist has more guidance, but heres a short version of what to round up:

-

Social Security numbers for yourself, as well as for your spouse and dependents, if any.

-

W-2 form, which tells how much you earned in the past year and how much you already paid in taxes.

-

1099 forms, which are a record that some entity or person not your employer gave or paid you money.

-

Retirement account contributions.

-

State and local taxes you paid.

-

Educational expenses.

You May Like: How Much Taxes Deducted From Paycheck Mn

Extension To File Your Tax Return

If you cant file your federal income tax return by the due date, you may be able to get a six-month extension from the Internal Revenue Service . This does not grant you more time to pay your taxes. To avoid possible penalties, estimate and pay the taxes you owe by the tax deadline of May 17, 2021.

Understand How Your Taxes Are Determined

The government decides how much tax you owe by dividing your taxable income into chunks also known as tax brackets and each chunk gets taxed at the corresponding tax rate. The beauty of this is that no matter which bracket youre in, you wont pay that tax rate on your entire income.

The progressive tax system in the United States means that people with higher taxable incomes are subject to higher federal income tax rates, and people with lower taxable incomes are subject to lower federal income tax rates.

» MORE:Make sure you’re not overlooking any of these 20 popular tax breaks

You May Like: How To Appeal Property Taxes In Cook County

Use The Most Popular Tax Preparation Software Turbotax

If the thought of doing your taxes, and maximizing all of your deductions and credits, have you a little unsurewere here to help. No matter your income or complexity of your return, you have an expert in your corner with TurboTax.

Make the tax season as simple as possible with our TurboTax products. Consider TurboTax Live Assist & Review if you need further guidance, and get unlimited help and advice as you do your taxes, plus a final review before you file. Or, choose TurboTax Live Full Service* and have one of our tax experts do your return from start to finish.

*TurboTax Live Full Service is not available in Quebec.

Decide If You Want To Take The Standard Deduction Or Itemize

The standard deduction is a specific dollar amount that lowers the income youre taxed on. Like weve touched on already, for single filers, that dollar amount is $12,200. For qualifying widows or people who are married filing jointly, that dollar amount is $24,400.

So, for example, if your filing status is single, you made $30,000 in 2019, and you decided to take the standard deduction, you would only pay taxes on $17,800.

To take the standard deduction, there are no extra steps you have to dojust file your taxes like normal and the IRS will let you know when or if you get any money back. With this option, its still possible for you to get a deduction , even if you dont have any itemized deductions you can claim.

Your other option is to itemize all your deductions. People who choose this option keep receipts of qualifying expenses throughout the tax year and record them in Schedule A .

Some examples of these types of expenses would be:

- Out-of-pocket medical or dental expenses

- Charitable donations

- Large, work-related expenses that you werent payed back for

- Paid mortgage interest or real estate taxes

Depending on which tax bracket youre in, a certain amount of money will be taken off your tax bill based on the total amount of your itemized deductions.

Most people go for the standard deduction because its easier and faster, but for some people, itemizing can save a lot more money. Talking with a tax pro can help you figure out which option makes the most sense for you.

Recommended Reading: Taxes On Plasma Donation