Llc Tax Tips For Business Owners

Its easy to feel overwhelmed by all the tax responsibilities an LLC might have. Fortunately, there are a few ways to lower your tax burden and make tax filing easier.

Here are some tips for LLC tax filing:

-

Take advantage of any tax deductions and tax credits that your LLC is eligible for.

-

Review business tax deadlines in advance, and note relevant due dates.

-

Hire a certified public accountant or tax professional to assist you with tax filing.

-

Talk with your CPA or tax professional about the potential benefits of electing corporation tax status for your LLC.

-

Understand your state and localitys tax requirements.

Porter says that understanding your LLCs tax setup in the beginning is important. Common mistakes are not engaging a CPA that is familiar with the tax rules surrounding LLCs. Its much easier and cheaper in the long run to set up the LLC correctly the first time and make the valid elections for the LLC to be taxed as the business owner wishes.

What Is The Small Business Tax Rate

When you think of business taxes, you may be thinking about the federal business income tax rate. But the National Federation of Independent Business says most small businesses don’t pay income tax at a business rate.

That’s because about 75% of small businesses are not corporations. This large percentage of small businesses are considered “pass-through” entities, which means they pay tax at the personal tax rate of the owners.

Since small business tax rates are tied to the total income of the business owners, we need to look at the current individual income tax rates.

The 2021 tax tables show that the top federals income tax rate is 37% on $523,601 of taxable income for individuals and heads of households and $628,301 for married individuals filing jointly. A small business owner with income this high, whose company is a pass-through entity, would be taxed at this rate.

How Do I Calculate Alternative Minimum Tax

Calculating the AMT is complicated. Taxpayers first calculate their normal adjusted gross income, then add back in certain items. Next, they subtract the applicable AMT exemption amount, multiply that by the appropriate AMT tax rate and subtract the AMT foreign tax credit to calculate a tentative minimum tax.

Read Also: Stripe Doordash 1099

Be Careful With Loans

Steer clear of classifying any money you draw as a loan. Loans to owners must have terms like those required in traditional lending arrangements. That means there must be a signed promissory note, with stated reasonable interest rate, and a repayment schedule. There must also be consequences for non-payment. Otherwise, you risk the IRS reclassifying these loans to dividends or salary.

Do I Need To Collect Sales Taxes

If you own, or are starting, a small business, its vital that you understand your tax obligation, or it could lead to serious trouble, including fines. The tax collection and payments should be part of your business plan, and part of the homework you do when you set up your business.

If you sell online and have customers from other states, this can get tricky. It can end up costing you money if you dont know and follow the rules.

To get started on the sales tax journey, and what role your business plays, you should be able to answer these questions:

What is your sales tax nexus? Nexus is where your business has a presence, but like all other things sales-tax related, its not that simple. Its always in the state where you reside and conduct business, even if youre doing it from your kitchen table, but it extends from there. If you have more than one physical location, particularly in different communities or states, affiliates, or more, that is part of the nexus. Some states also count employees who work remotely in another state, or contractors. Warehouses and distribution centers count, too. If your business sells online to other states, it may have an economic nexus .

Does your state or local jurisdiction require you to get a license to sell or sales tax permit? Start by registering with your states taxing agency. Find out, too, if you must register in other states you do business in.

You May Like: Protest Property Taxes In Harris County

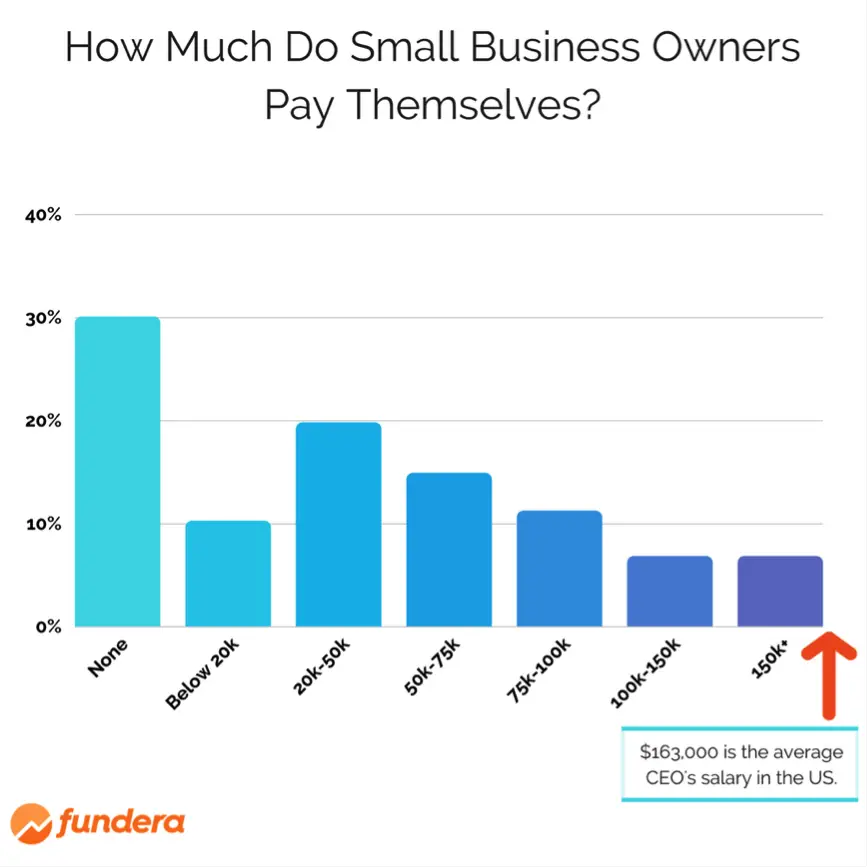

How Much To Take From Your Business

Business owners who take a draw or distribution of profits can take any amount they want from their business. Of course, you shouldn’t take money that will be needed to pay employees, pay off business loans, or pay other bills of the business.

The National Federal of Independent Business says:

If youre just starting out, the biggest determining factor for your pay is going to be your business cash flow. Wages, expenses, and all immediate obligations must be covered with cash. With limited or no cash flowa reality for many startupsyou might operate for a while without a paycheck, let alone a predictable salary.

Later in your business life, you may be able to take money from your business on a more regular basis, based on your personal financial situation.

One key point about taking money from your business: You don’t take money from “profits” because they aren’t in the bank. You take money from the business bank account. Add your personal needs to your business budget and make sure you have enough each month to meet your business obligations first.

Use The Federal Income Tax Brackets To Calculate What You Owe For The Business Income

Each year the federal government publishes the personal tax brackets which gives you everything you need to know to calculate how much tax is owed per dollar of income. You can find the tax brackets published here for 2015. As you can see in the table below, you dont pay the same percentage of tax on each dollar of income.

You May Like: Do You Have To Do Taxes For Doordash

Pros And Cons Of A Salary

Pro:

- Less admin work: Taxes are deducted from your paycheck automatically. Additionally, your compensation as the business owner is a more stable expense, which makes it easier to track your income and expenses.

Con:

- Cash flow: What happens if your business has a down month? While its possible to adjust your salary to give yourself some more wiggle room, your salary still needs to fall within the IRS definition of reasonable compensation. Plus, figuring out how much to pay yourself can be challenging.

State Sales Excise And Franchise Taxes

Sole proprietors are required to pay state sales taxes on taxable products and services sold by the business. In addition, the sole proprietor may have to pay excise taxes in the same manner as other business types.

Check with your state department of revenue for more information on sales and excise taxes. Sole proprietorships are not typically liable for franchise taxes, because these are levied by states on corporations and other types of state-registered businesses.

Don’t Miss: Donating Plasma Taxes

Remember This All Flows Through To Your Personal Tax Return

So let me do my best to explain how this works. The table above shows the percentage of tax that you will owe for each various dollar amount in income. Now remember this is a pass through entity so this is a personal income tax bracket. When you business makes net income that net income is passed through to the owners. You may also have other income that plays a role in how much you owe in taxes. For example, lets say you also have some dividend and interest income from your investments, and maybe you have some rental income from a residential rental home that you own. All of this income will be added to your business income, but right now I want to keep things simple and assume that your only income is your business income.

If this is truly your only income then you can simply follow this table and figure out exactly how much you will owe in federal income taxes.

You can find many useful templates to assist you with this on our website

Editor’s Note: Looking For Tax Debt Relief For Your Company If You Would Like Information To Help You Choose The One That’s Right For You Use The Questionnaire Below To Have Our Partner Buyerzone Provide You With Information For Free:

Types of Business TaxesThere are a variety of taxes for business. “Understand your responsibilities to help you meet them on a timely basis and avoid costly penalties for failing to act on time,” advises Barbara Weltman, a tax an business attorney and author of J.K. Lasser’s Tax Deductions for Small Business and the Big Ideas for Small Business newsletter. Here is a rundown:

- Income taxes. There are federal and, in most cases, state income taxes to contend with, whether the business pays the tax or the owner pays the tax on his or her share of business income and expenses .

- Employment taxes. If you have employees, you must withhold income taxes and the employees’ share of Social Security and Medicare taxes. You must also pay the employer share of FICA, plus state and federal unemployment tax. If your business is incorporated, you are an employee if you work for the business and you owe these taxes even if you’re the only employee. If you are self-employed, you owe self-employment taxes on your net earnings from the business.

- Sales taxes. If you sell goods and services and you are based in a state with a sales tax, you may be required to collect sales taxes on your transactions. While the customers pay the sales taxes, you can be subject to penalties for failing to collect the taxes and pay them to the state.

- Excise taxes. Depending on what type of business you operate, certain businesses may pay excise taxes on fuels, highway usage by trucks, and for other activities.

You May Like: Www.1040paytax.com Review

Use Tax Deductions To Lower Your Tax Bill

New small business owners have to stretch their financial resources.

Small businesses have business expenses that include vehicle expenses, wages, business travel, contract labor , supplies, equipment, depreciation of assets, rent on business property, utilities, insurance , and repairs.

Fortunately, as a small business owner, you are able to minimize your business taxes by writing off a lot of those operational expenses come tax season.

Tax preparation software such as the QuickBooks Self-Employed Tax Bundle with Intuit Turbotax automatically tracks your business expenses to minimize your federal tax burden, which allows you to easily claim your deductions.

Worst States For Llc Taxes

Theres generally two kinds of state-level taxes that your LLC profits may be paying: income and business taxes. The following are states that frequently find higher taxes for 1099’s or a single member LLC:

| State |

|---|

| 2 – 5.75% | – |

Please be aware that states with more progressive income rates , can make them poor choices for high business income earners. This table is designed for small business owners with ~$80,000/year in income.

Read Also: What Can I Write Off On My Taxes For Instacart

Paying Yourself As An S Corp

Payment method: Salary and distributions

If Pattys catering company were set up as an S Corp, then she would figure out a reasonable compensation for the type of work she does and pay herself a salary. To not raise any red flags with the IRS, her salary should be similar to what people in similar positions at other businesses earn. Shell also need to withhold taxes from her paychecks.

However, to avoid withholding self-employment taxes on the whole amount, Patty could also take a portion of her compensation as a distribution. Distributions are from earnings that were previously taxed at her personal rate. Keep in mind that Patty also needs to have enough equity to take distributions.

For example, if Patty wishes to be paid $75,000 from her business, she might take $50,000 as a salary and distributions of $25,000.

Should I Pay Myself A Salary

Your small business earnings are a reflection of the hard work that you had put in to bring your business to life. Its quite a fascinating experience as a business owner.

However, the challenge that you face is how to pay yourself as a business owner. There are various factors that you should consider while deciding how to pay yourself.

Recommended Reading: Irs Forgot Ein

What Is The Tax Bracket For A Small Business

Most small businesses are not taxed like corporations.

The Internal Revenue Service agency does not recognize the legality of a sole proprietorship, partnerships, limited liability companies and limited liability partnerships as taxable corporation they are instead considered pass through entities. This means that taxable income goes directly to the owners and members who report the income on their own personal income and pay taxes at the qualifying rate.

Since most small businesses are charged at an individual income tax level, here is the Federal tax brackets for 2019 for single taxpayers tax brackets:

Records & Reporting Sales Taxes

Documenting taxes collected, including in your invoices, is vital for a small business and is part of the record you must maintain to make reporting and paying taxes legal and efficient. While requirements vary from state to state, all will want records of the tax collections your business has made in some form. Be sure you know what your state and local requirements for reporting are some may drill down as deep as requiring receipts from each sale. Your state will also have a schedule for reporting the sales tax your business has collected and how the reporting must be done. This, like everything else regarding sales taxes, varies from state to state.

You May Like: Do You Have To Pay Taxes On Plasma Donations

Deduction #: Vehicle Expenses

If you use your vehicle for business, your vehicle expenses can provide a valuable deduction. Every time you go to the office supply or other store for business, meet with a client, or drive for other company business, track your business miles so you get the tax deductions you deserve.

You can usually choose one of two ways to calculate your vehicle expenses. You can take the standard mileage rate, or you can deduct your actual expenses for driving your vehicle for business.4

To claim a deduction for this, the IRS will require you to track your business, commuting, and personal miles, and the business purpose of your miles, regardless of which method you choose. If you want to deduct actual expenses, you must also track expenses for gas, oil, service, interest on a vehicle loan, lease payments, insurance, and depreciation.

An Overview Of Small Business Taxes

Tax liabilities can differ depending on business structure, location, and several other factors. Sole proprietors, for example, may face a 13% federal tax rate, while small partnerships and S-corporations pay nearly 24% and 27%, respectively.

Knowing where your small business stands with tax rates is crucial to filing the proper taxes at the right time. Not only must you be concerned with income tax but other costs such as self-employment and excise taxes. With legal implications for your business, taxes can make or break your success.

Here are several things to be aware of for your small businesss taxes, including how to file and what to pay.

You May Like: How To Get Tax Preparer License

What Taxes Do Small Businesses Pay

Though many small businesses are taxed differently from corporations, the list of taxes is similar across business structures. What changes is how the small business pays and the rate at which its taxed.

A shortlist of tax liabilities small businesses must account for include:

- Income tax: Federal, state, and local taxes on income earned during the tax year which can be passed through to personal returns depending on business structure

- Self-employment tax: Important for sole proprietors and those who work for themselves to cover government-mandated Social Security and Medicare taxes

- Employer tax: Federal taxes to cover Social Security, Medicare, federal unemployment, and income tax withholding for any employees

- Estimated tax: Federal tax on income not subject to withholding or if withheld taxes will not cover how much you will owe in the tax year

- Excise tax: Federal tax for businesses meeting requirements outlined by the IRS, such as manufacturing certain products or using special equipment.

Your small business may have a different list of taxes, depending upon your location, product or service, and holdings. Some additional taxes include property tax and dividends tax .

Learn How Small Businesses Are Taxed And What Tax Breaks Small Business Owners Can Take Advantage Of

- The type of business structure you set up for your company sole proprietorship, partnership, S corporation or C corporation governs which tax return you’ll need to use to file your taxes and how much you’ll owe.

- Small business owners often have to pay income tax and self-employment tax.

- Keep detailed expense records so you can take advantage of tax deductions.

Preparing your business tax return is a complicated, frustrating process. However, it’s important to do it right you could face steep penalties for filing an inaccurate return.

The starting point for preparing your business tax return hinges on the structure of your business. Whether you’re a sole proprietorship , a partnership, or a C or S corporation, your business entity will define which form you must use to file your business return and how much you may owe the IRS.

Read Also: Where Can I File An Amended Tax Return For Free