How To Recognize Tax Evasion And Fraud

Tax evasion or fraud occurs when taxpayers intentionally try to avoid taxes they owe. Tax evasion and fraud may look like:

- failing to file a return,

- failing to report total income,

- failing to remit monies collected, and

- selling untaxed liquor, motor fuel, and cigarettes.

Note: If you believe you are the victim of identity theft, please see Identity theft affecting your tax records.

Where Can I Report A Business For Suspected Tax Fraud

If you suspect a person or business of committing tax fraud at the state level, you should contact the states department of revenue or other taxing body to learn how to report the information. States have their own forms and rules for reporting fraud. For example, Colorado allows citizens to report suspected tax fraud online or by mail.

Reporting Fraud And Abuse Within The Irs E

All Authorized IRS e-file Providers must be on the lookout for fraud and abuse in the IRS e-file Program. Here’s what to look for and how to report it: Indicators of abusive or fraudulent returns may be unsatisfactory responses to filing status questions, multiple returns with the same address, and missing or incomplete Schedules A and C income and expense documentation. A “fraudulent return” is a return in which the individual is attempting to file using someone elses name or SSN on the return or where the taxpayer is presenting documents or information that have no basis in fact.

Note: Fraudulent returns should not be filed with the Service. A “potentially abusive return” is a return that

Don’t Miss: How Much Will A Roth Ira Reduce My Taxes

What Is Tax Evasion

Tax evasion occurs when an individual or business intentionally ignores Canadas tax laws. This includes falsifying records and claims, purposely not reporting income, or inflating expenses.

Combatting tax evasion and other financial crimes is important financially and socially. The quality of life that all Canadians enjoy is supported by the taxes we pay. Revenues collected help to fund programs and services such as health care, childcare, education, and infrastructure projects that benefit all Canadians.

Can I Get In Trouble If Im Wrong And There Is No Fraud

If you have reported a tax fraud and then realized that you were mistaken wont get you in trouble as long as you inform the government about your mistake and prove otherwise.

Its crucial to always gather enough evidence before reporting fraud to avoid wasting your time, the alleged suspects time, and the governments time and resources.

Don’t Miss: Louisiana Payroll Calculator

Providing Tax Fraud Information

With the exception of the international program, all other tips and information can be offered anonymously.

Confidentiality

- Even if you do not make anonymous tips, the CRA is obligated to keep your identity private.

- Since any action taken by the CRA against fraudulent taxpayers is also confidential, the CRA will not inform you of any investigation, assessment or other action made as a result of your information.

Can I Report State Tax Fraud

The IRS deals with federal income taxes. If you suspect a person or business of committing tax fraud at the state level, you should contact the states department of revenue or other taxing body to learn how to report the information. States have their own forms and rules for reporting fraud.

For example, Colorado allows citizens to report suspected tax fraud online or by mail. South Carolina accepts its fraud complaint forms via email or mail. And New York accepts reports of tax evasion and fraud via an online submission form, phone, fax or mail.

Also Check: Www.1040paytax.com.

How Can We Report Tax Fraud To The Irs

Method 1 of 2: Reporting Suspected Tax Fraud Gather evidence of the fraud. The more evidence you can share with the IRS, the better. Identify the correct form to use. You will report suspected fraud to the IRS by filling out a form. Read the instructions. Complete the form. Choose whether to report anonymously. Submit the form.

Most Americans Agree That Its Everyones Duty To Pay Their Fair Share Of Taxes According To A 2018 Irs Survey Yet Not Everyone Does

While nearly 84% of federal income tax gets paid on time, a gap does exist aptly dubbed the tax gap between how much tax all Americans owe in any given year and how much tax gets paid to the Internal Revenue Service. After factoring in late payments and IRS enforcement efforts, the net tax gap for tax years 2011 through 2013 was estimated at $381 billion per year, according to a September 2019 release from the IRS.

The tax gap matters. The IRS said a 1-percentage point increase in voluntary compliance would bring in about $30 billion in additional tax receipts.

As IRS Commissioner Chuck Rettig noted in a September 2019 IRS news release, Those who do not pay their fair share ultimately shift the tax burden to those people who properly meet their tax obligations.

But honest taxpayers can help the IRS narrow the tax gap. If you suspect that an individual or business has been committing tax fraud, you can report it to the IRS. Doing so can help the IRS enforce tax laws. And you may even be eligible for a cash reward in some cases.

The IRS fraud hotline is one tool to help Americans give the agency information about suspected tax cheating. Lets look at possible signs of tax fraud and some things to know about how the IRS fraud hotline works.

- Fake or altered tax returns

Don’t Miss: Www.1040paytax.com Official Site

Procurement And Tender Anonymous Fraud And Whistle Blowing Hotline

If you would like to report suspected corruption concerning SARS Procurement related matters, we have a confidential hotline. We appreciate your call and are committed to fighting crime especially if we find it in our own organisation.SARS hotline provides an anonymous reporting channel for unethical behaviour. At no time are these details divulged to the organisation / company where you are employed or to the individual whom you are reporting.

Can I Use The Irs Fraud Hotline To Report Someone

Despite what its name might imply, you cant actually file a report through the IRS fraud hotline. Instead, the hotline is an automated system that guides you toward the correct type of form to use for reporting a possible violation.

When you call the hotline, youll get a recording that tells you

- How you can submit a fraud report

- How to download a reporting form from IRS.gov, the IRS website

- How to order the form over the phone, using the hotline

- How to send a letter

Also Check: Will A Roth Ira Reduce My Taxes

Giving The Taxman A Lead

While the taxman is very open about the fact that it encourages this sort of whistleblowing, it isnt that open about the payments it makes to informants.

Ultimately, the amount paid will vary by case, depending not only on whether the information was accurate but also how much money it was able to retrieve as a result.

According to the tax experts at RPC, in years gone by these payments have often been to disgruntled employees, or former employees, who have reported suspected tax evasion from their bosses.

The firm said that another useful source of information can be the spouses or ex-spouses of fraudsters, who are aware of what their partner has been up to and is able to lead HMRC to the evidence.

Aware Of Possible Tax Fraud

If you report income tax fraud or tax evasion, you may be entitled to a whistleblower reward, as outlined in this website.Modeled on the Department of Justice program, the Internal Revenue Service income tax reward program targets tax cheats and rewards whistleblowers between 15% and 30% of the amount recovered from unpaid taxes.While much of the IRS reward program is very similar to the DOJ program, there are some significant differences, including:

Also Check: Do Nonprofits Pay Payroll Taxes

Read Also: How To Correct State Tax Return

What Is Income Tax Fraud

- St Pauls Chambers

If you or your business are being accused of income fraud, it can be a very daunting time. Income tax fraud is a criminal act, and it comes with serious repercussions and penalties.

Here, we set out to explain what income tax fraud is, the potential penalties for income tax fraud, how to report income tax fraud to HMRC and how a fraud barrister can assist income tax fraud cases.

Can I Get A Reward For Reporting A Suspected Tax Cheater

If your tip results in the IRS collecting back taxes, interest, penalties or other amounts, you may get a financial reward. You could be eligible for 15% to 30% of the amount collected, depending on the details of how much is owed and who owes it.

But to claim your whistleblower reward, youll need to give up your anonymity by providing your personal information to the IRS. Thats because the IRS needs to know who you are in order to send you the money. Youll need to provide these details and more on Form 211, the application for award for original information.

Also Check: Where’s My Tax Refund Ga

What Is Tax Evasion And How Does It Affect Canada

Tax evasion occurs when an individual or business fails to comply with tax laws to avoid paying taxes. This crime is a serious offence with harsh fines and possible jail times. More importantly, it robs society of tax dollars which are required to fund roads, hospitals, schools, and more. By evading taxes, tax evaders take advantage of the benefits of tax dollars without paying their fair share. For these reasons, its important for Canadians to report cases of tax evasion.

Canada Revenue Agency partially relies on its Leads Program and Offshore Tax Informant Program for both Canadians and non-Canadians to report individuals or businesses who may be committing tax evasion. Reporting tax evasion allows the Canada Revenue Agency to penalize those who have broken tax laws and make the system fairer for everyone.

What Would We Consider A Suspicious Activity

How SARS can be defrauded, misinformed, misled, deceived and contrived with the intention to evade tax or obtain an undue refund are too numerous to mention. It is not possible to offer even the briefest of discussions on every possible such action that may be directed against SARS. Many of these types of conduct are no more but variations of the theme. The examples offered is an attempt to better understand the application of our legislation and criminal law in dealing with instances of tax evasion and obtaining an undue refund:

Also Check: Pastyeartax Reviews

What Are The Potential Income Tax Fraud Penalties

Penalties for income tax fraud are not taken lightly. However, the extent of the penalty depends on each case of income tax fraud as some incidences may be purely accidental. The penalties for income tax fraud include:

- A fine of up to £5,000 and a six-month prison sentence

- Seven years imprisonment and an infinite fine

- You may be ordered to repay up to 200% of the amount owed if you are found guilty of tax evasion

- For knowingly submitting false documents to HMRC, the income tax fraud penalty is a £20,000 fine or six months imprisonment

- If you are found to have knowingly committed income fraud, you may be sentenced for cheating public revenue which could result in a life prison sentence and an infinite fine

The Crown Prosecution Service reported an income tax fraud case in June 2020, where a company director avoided paying £100,000 in income tax by falsely declaring the accurate turnover of his two security businesses. In this case, the penalty for income tax fraud resulted in a 28-month prison sentence and a disqualification for the following five years from becoming a company director.

How Do I Know If Im Being Investigated for Income Tax Fraud?

How to Report Income Tax Fraud to HMRC

If you suspect an individual or business of committing income tax fraud, its your duty to report them across the 2019/2020 year HMRC received 73,000 reports of tax evasion.

How Can St Pauls Chambers Assist Income Tax Fraud Cases?

Disgruntled Employees And Former Spouses Among Common Tax Informants

Reporting tax evasion to the authorities isnt just the morally right thing to do it can also boost your own finances.

A Freedom of Information request by The Telegraph has revealed that, over the last five years, the HM Revenue & Customs has paid out around £2 million to tax whistleblowers, those who have reported believed underpayment of taxes by their friends, family, colleagues, neighbours and the like.

The last financial year has been a bumper one for these payments too, with a whopping £400,000 handed out to informants, with the taxman having received 120,000 reports of apparent tax wrongdoing over the period.

So how do these reports work? And what determines how much an informant is paid?

Read Also: Do You Have To Pay Taxes On Plasma Donations

How Do I Report Possible Tax Fraud

As long as there are rules and regulations, there will probably be those who break them. Each year, a small percentage of people attempt to cheat on their taxes in an effort to owe less and/or receive a larger refund. Sometimes people do make mistakes on their tax returns, but mistakes are generally not considered fraud. Tax fraud is the intentional attempt to avoid paying the amount of taxes required, reporting income, and/or filing returns.

Some people may wonder whether they should report tax fraud, thinking it a victimless crime. However, the failure to meet tax obligations can have a harmful effect on the economy. It is considered a crime in the United States as well as in some other countries.

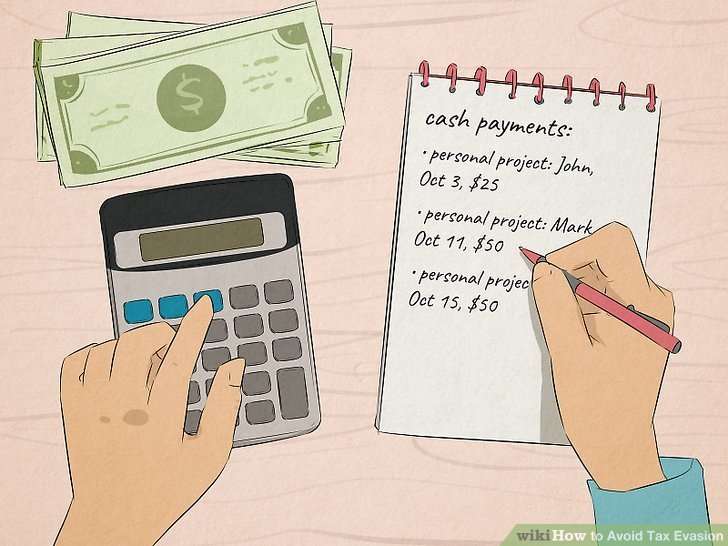

Before you can report tax fraud, it’s wise to learn the types of offenses you can report. You can report a person for claiming deductions to which he’s really not entitled, hiding or transferring assets or income, and intentionally changing the amount of income on his tax forms to an incorrect amount. Tax fraud also includes over-reporting deductions, keeping false books and records, and having two sets of bookkeeping records with differing figures in them. Even such things as claiming personal expenses as business expenses count as tax fraud.

How To Report Tax Evasion Anonymously

The IRS places strict requirements on whistleblowers seeking awards but also desiring to remain anonymous. Typically this is not allowed however, by retaining an experienced Whistleblower lawyer, you may be able to retain some form of anonymity or protection from retaliation upon bringing an IRS Whistleblower Claim. It is important to discuss your rights and options with an experienced whistleblower attorney before you blow the whistle. You may complete our free whistleblower consultation form for a case review with no cost or obligation to you.

Read Also: Appeal Property Tax Cook County

What Is Tax Evasion How To Report Tax Evasion In India

Paying taxes is a burden for many, individuals often come up with ways to escape or reduce the burden. But do you know that failing to pay taxes accurately can lead to criminal charges? Tax evasion occurs when a person or corporation unlawfully stops paying its tax or pays a partial amount of taxes. Tax evasion is a criminal activity and, as per Chapter XXII of the Income Tax Act, 1961, those who are found evading taxes are liable to face criminal charges and fines.

Tax avoidance includes hiding or fake revenue, without documentation of exaggerated deductions, without disclosing cash transactions, etc.

Activities considered as Tax Evasion according to the Income Tax Act

Say, for example, a person claims for depreciation when there is no asset in the company or claims for depreciation of properties used for residential purposes. It is simply a dishonest tax obligation avoidance process.

The following are main practices that are deemed to be tax evasion:

1. Concealing the Income6. Storing wealth outside the country7. Filing false tax returns8. Fake documents to claim exemption

How to file complaints regarding tax evasion?

The Central Board of Direct Taxes has introduced an online dedicated e-portal on the Departments e-filing website to accept and process tax evasion allegations, foreign hidden properties, as well as Benami property complaints.

Types of Penalties for different types of Tax Evasion in India:

GoodReturns.in

Irs Fraud Reporting How To Do It

Tax fraud happens when someone provides false tax information. When people and corporations dont pay what they owe, the burden falls unfairly on everyone else. Before the government can prosecute anyone for tax fraud, it has to have proof. Thats often hard to obtain. Thats why the government relies on its citizens to help by reporting any known or suspected tax fraud.

Also Check: Where Is My State Refund Ga