When Electronically Filing Amended Returns If A Field On Form 1040 Amended Return Is Blank Should The Corresponding Field On The Form 1040

For electronically filed Amended Returns: If an amount in a field on the Form 1040 or 1040-SR is blank, then the corresponding field on the Form 1040-X must also be left blank. If there is a zero in a field on the Form 1040 or 1040-SR, then the corresponding field on the Form 1040-X must also contain a zero.

How To Pay Bills While You Wait For Your Irs Refund

Waiting for a tax refund is never fun, but if you’ve weathered economic challenges during the pandemic, you may need your refund money to make ends meet. If you need help covering expenses while you’re waiting, here are a few ideas for bridging the gap:

- Look for ways tomake money fast. Also seek opportunities to earn passive income. Gig work and selling your unwanted items online are two simple ideas for generating a few dollars.

- Seek financial assistance. Private charity and government relief programs may be able to help. Also look into credit counseling or similar help with student loans or medical debt.

- Adjust your 2021 withholding or estimates. Receiving a tax refund means you’ve overpaid your taxes. If the same thing is set to happen for the 2021 tax year, you may be able to reduce your withholding or estimated tax payments for the remainder of 2021. You won’t receive a lump sum of cash, but you might increase your take-home pay. Try using the IRS Tax Withholding Estimator or check with your tax preparer before making any adjustments.

How Can I Check To See If My Individual Income Tax Return Has Been Processed And When My Refund Will Be Issued

The department has responded to increasing occurrences of tax fraud by implementing enhanced security measures to protect Louisiana taxpayers. This means it will take additional time to process refunds. The expected refund processing time for returns filed electronically is up to 45 days. For paper returns, taxpayers should expect to wait as long as 14 weeks. If you selected direct deposit for your refund, the funds should be deposited within one week of processing.

Once you have filed, you can check the status of your refund using the following methods:

- Visit Wheres My Refund? at www.revenue.louisiana.gov/refund

Recommended Reading: How Can I Make Payments For My Taxes

What Is Happening When Wheres My Refund Shows The Status Of My Tax Return Is Refund Sent

This means the IRS has sent your refund to your financial institution for direct deposit. It may take your financial institution 1 5 days to deposit the funds into your account. If you requested a paper check this means your check has been mailed. It could take several weeks for your check to arrive in the mail.

The Irs Is Really Behind On Processing Paper Returns

Tax-filers have the option to submit their returns electronically or do so on paper. But those who went the latter route this year may be in for an unpleasant surprise. Because the IRS has been so short-staffed due to the pandemic, it’s estimated that the agency has yet to look at 2.5 million hard copy tax returns for 2019, which means many filers could end up waiting a long time to receive their refunds.

Electronically filed tax returns don’t need to be manually processed, but paper returns do. As such, those who submitted an electronic tax return this year may have gotten their refund in a timely manner afterward, while those who filed on paper could be left waiting for months. Now the good news is that the IRS is prepared to pay interest on overdue refunds but that doesn’t mean Americans don’t want their money as soon as possible.

Making matters worse is the fact that the IRS extended this year’s tax-filing deadline from April 15 to July 15, thereby giving Americans an extra three months to get their returns in order. Those who filed on paper but also took advantage of that delayed deadline could really end up waiting a long time for a refund. This especially holds true if a second round of stimulus payments is approved to go out to the public, because that will no doubt divert at least some IRS resources.

Also Check: How To Get Tax Preparer License

How To Track The Progress Of Your Refund

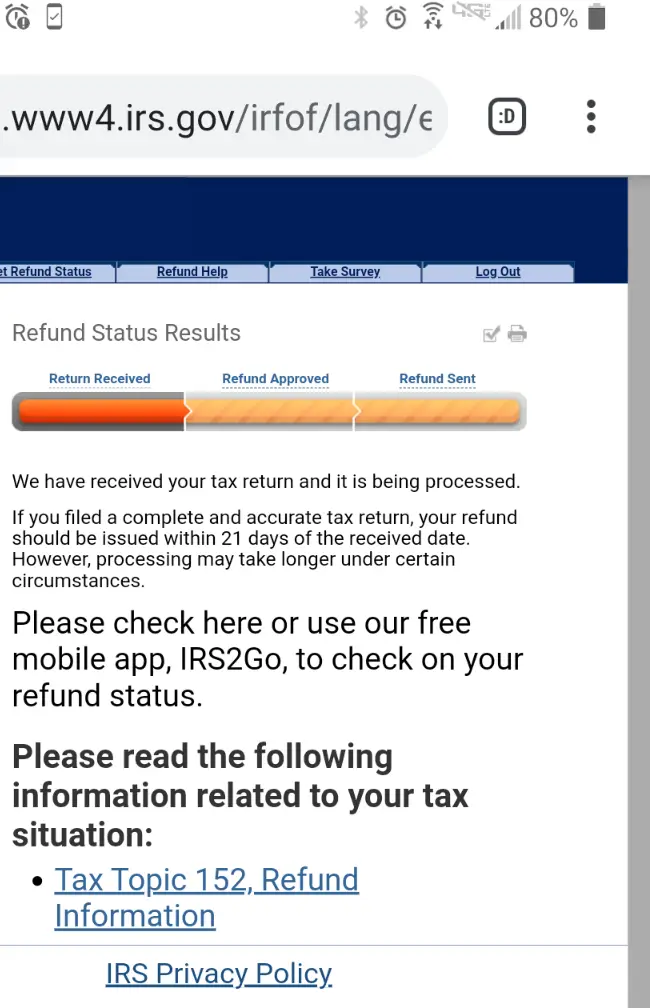

The IRS has eliminated the guesswork of waiting for your tax refund by creating IRS2Go, an app that allows you to track the status of your return. You can also check the status of your refund with the Wheres My Refund? online portal.

Both tools provide personalized daily updates for taxpayers 24 hours after a return is e-filed or four weeks after the IRS has received a paper return. After inputting some basic information , you can track your refunds progress through three stages:

Once your refund reaches the third stage, you will need to wait for your financial institution to process a direct deposit or for a paper check to reach you through the mail.

When Will I Get My Paper Check If My Direct Deposit Is Delayed Or Rejected

At times people will change their bank accounts after their return is filed or provide incorrect account numbers. In these instances the IRS will issue a paper check when they cannot send by direct deposit. This will delay your refund, but the actually IRS processing time for a paper check is only 2 extra days more than direct deposit. Usually paper checks are mailed on Fridays and you usually get within 1 week the following Friday or sooner. The US Postal usually dont deliver refund checks until Saturday morning to prevent someone watching your mail and stealing the check.

Recommended Reading: Can Home Improvement Be Tax Deductible

How To Check The Status Of Your Tax Refund

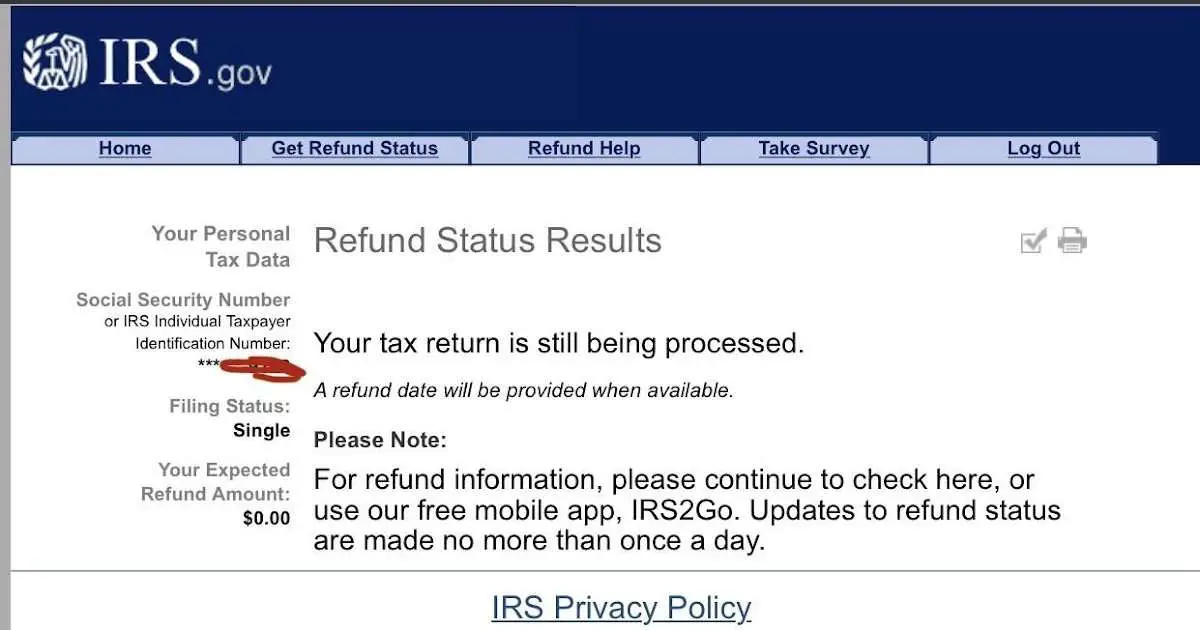

You can see where your money is 24 hours after you’ve filed your tax return by logging into the IRS Wheres My Refund tool.

To do this, youll need to enter your Social Security Number or Individual Taxpayer Identification Number , which is shown on your tax return.

Youll also need to enter your filing status and refund amount shown on your tax return – make sure its the exact amount shown to get the most accurate information.

You can also use the free IRS2GO mobile app to find out where your refund is. This is reportedly the fastest and easiest way to monitor yours.

The app is updated once every 24 hours so youll get an idea of where your cash roughly is within this time frame.

Finally, you can call the IRS to check in on your payment on 800-829-1040.

In May, the IRS also had a backlog of 335,000 paper tax returns from 2019 to process.

Irs Tax Refund Processing Schedule And Direct Deposit Cycle Chart When Will I Get My Refund

The latest tax season has been more of the same with long processing delays and delayed refund payments for many tax payers. This is due in large part to the processing and payment of two further rounds of stimulus checks by the IRS and new tax legislation under the Biden ARPA bill to provide pandemic relief.

This all meant that the the IRS has had to push out the start of processing 2020 tax returns by two to three weeks to and have delayed the end of the regular 2020-2021 tax season to May 17th, 2021. It is expected that tax returns and refund processing will stretch well into summer as the IRS clears a large back log of current and past tax year returns, in addition to making catch-up stimulus payments.

The estimated 2020-2021 refund processing schedule table below has been updated to reflect the delayed start and extension to the tax season. Note that refund deposit dates could be much longer than shown if your return is pulled for additional security or manual processing checks. To get the exact date of your refund payment check the IRS Where is My Refund tool/app.

Its also important to note that not all states have extended their tax due deadlines, so check with your states tax or treasury website for when your state or local taxes are due in 2021. Failure to pay state taxes could result in penalties.

Read Also: 1040paytax.com Safe

How Do I Use The Where’s My Refund Tool To Check The Status Of My Tax Refund

To check the status of your 2020 income tax refund using the IRS tracker tools, you’ll need to give some information: your Social Security number or Individual Taxpayer Identification Number, filing status — single, married or head of household — and your refund amount in whole dollars . Also, make sure it’s been at least 24 hours before you start tracking your refund.

Using the IRS tool Where’s My Refund, go to the Get Refund Status page, enter your SSN or ITIN, filing status and exact refund amount, then press Submit. If you entered your information correctly, you’ll be taken to a page that shows your refund status. If not, you may be asked to verify your personal tax data and try again. If all the information looks correct, you’ll need to enter the date you filed your taxes, along with whether you filed electronically or on paper.

The IRS also has a mobile app called IRS2Go that checks your tax refund status — it’s available in English and Spanish. You’ll be able to see if your return has been received, approved and sent. In order to log in, you’ll need some information — your Social Security number, filing status and expected refund amount. The IRS updates the data in this tool overnight, so if you don’t see a status change after 24 hours or more, check back the following day. Once your return and refund are approved, you’ll receive a personalized date by which to expect your money.

You can check on your refund through the IRS2Go mobile app.

How Long Will I Have To Wait For My Federal Refund Check To Arrive

The IRS usually issues tax refunds within three weeks, but some taxpayers have been waiting months to receive their payments. If there are any errors, or if you filed a claim for an earned income tax credit or the child tax credit, the wait could be lengthy. If there is an issue holding up your return, the resolution “depends on how quickly and accurately you respond, and the ability of IRS staff trained and working under social distancing requirements to complete the processing of your return,” according to its website.

The date you get your tax refund also depends on how you filed your return. For example, with refunds going into your bank account via direct deposit, it could take an additional five days for your bank to post the money to your account. This means if it took the IRS the full 21 days to issue your check and your bank five days to post it, you could be waiting a total of 26 days to get your money. If you submitted a tax return by mail, the IRS says it could take six to eight weeks for your tax refund to arrive once it’s been processed.

You May Like: What Does Agi Mean In Taxes

Your Refund Was Sent To The Wrong Bank

Filing your return electronically is the fastest way to get your refund, especially if youre using direct deposit. That assumes, however, that you plugged in the right numbers for your bank account. If you transposed a digit in the routing or account number, your money could be sent to someone else’s account.

If your refund ends up in someone else’s bank account, you’ll have to work with the bank directly to get it back. The IRS says it can’tand won’tcompel the bank to return your money to you.

If Your Dtc Application Is Approved

The notice of determination will show which year you are eligible for the DTC. You won’t need to submit a new Form T2201 every year, unless we tell you that we need one. Information about other programs that are dependent on eligibility for the DTC may also be included in the notice of determination.

When your eligibility is about to expire, we will notify you one year in advance as well as in the year it expires.

You can view your DTC information in My Account.

You should tell us if your medical condition improves to the point that you no longer meet the criteria for the DTC.

Recommended Reading: How Does H& r Block Charge

Are There Any Expected Tax Refund Delays

Yes, tax refund delays are common. The IRS is required by federal law to withhold tax refunds for taxpayers who claim Earned Income Tax Credits and Additional Child Tax Credit until at least Feb. 15, 2020. Keep in mind it can still take a week to receive your refund after the IRS releases it. So some people who file early may experience delays while awaiting their refund. Refunds should be processed normally after this date.

Note: The IRS anticipates a slower tax season for the 2020 tax year due to the backlog of tax returns that were delayed due to the pandemic. There may also be some complications for those who did not initially qualify for the the 2020 economic stimulus payment, but may qualify for the payment based on a change of income in 2020.

The IRS recommends filing your tax return electronically for faster processing and tax refund payments.

Also note that new identity theft protections and anti-fraud measures may hold up some refunds, as some federal tax returns may be held for further review.

Factors That Can Affect Timing

Taxpayers can choose how they submit their tax return and how they want to receive their refund. How you choose to file your taxes will determine how quickly your return is processed.

The IRS encourages taxpayers to file their returns electronically and elect to receive their refunds via direct deposit. By doing so, you will likely get your refund faster than someone who submits a return by mail and requests a paper check.

This is especially true for the 2021 tax season because both the IRS and the U.S. Postal Service have been experiencing delays due to the 2020 economic crisis.

In some cases, you may receive your refund as a paper check even if you requested a direct deposit. According to the IRS, this could happen if:

- You request that the refund be deposited electronically into an account owned by someone other than you or your spouse.

- Your bank rejects the transaction.

- You request that more than three electronic refunds be deposited into a single bank account.

This also happened to the filer mentioned above, who requested direct deposit. The reason, according to the IRS, was that we cant honor requests for direct deposit of refunds for prior years. Because it was a refund for 2019 taxes paid in 2021, the IRS had to send a check, even though the delay was the IRSs own and not the filers.

Your tax refund may be delayed if your return is incomplete, includes errors, was affected by fraud or identity theft, or requires further review.

You May Like: Where Is My State Tax Refund Ga

When Can I File My Tax Return

The first official day to file your 2020 tax return is February 12, 2021. However, many tax software programs will allow you to complete your return and file it before that date. They will then hold the returns until the IRS begins accepting them. Some taxpayers who submit their electronic tax return early may be able to participate in the IRS HUB Testing program. This is a controlled testing of the federal tax return system. The IRS processes a small percentage of tax returns from major software providers to test the tax return submission process and allow for fixing bugs before opening the doors to all taxpayers.

Why Would My Tax Refund Come In The Mail

There are a couple of reasons that your refund would be mailed to you. Your money can only be electronically deposited into a bank account with your name, your spouse’s name or a joint account. If that’s not the reason, you may be getting multiple refund checks, and the IRS can only direct deposit up to three refunds to one account. Additional refunds must be mailed. Also, your bank may reject the deposit and this would be the IRS’ next best way to refund your money quickly.

It’s also important to note that for refunds, direct deposit isn’t always automatic. Some are noticing that like the stimulus checks, the first few payments for the child tax credit were mailed. Just in case, parents should sign in to the IRS portal to check that the agency has their correct banking information. If not, parents can add it for the next payment.

For more information about your money, here’s the latest on federal unemployment benefits and how the child tax credit could affect your taxes in 2022.

Don’t Miss: How Much Does H And R Block Charge To Do Your Taxes

The Department Generally Processes Electronically Filed Returns Claiming A Refund Within 6 To 8 Weeks A Paper Return Received By The Department Takes 8 To 12 Weeks To Process

When inquiring about a refund, please allow sufficient time for the Department to process the refund claim.

The status of a refund is available electronically. A Social Security Number and the amount of the refund due are required to check on the status. You are not required to register to use this service.

If it is necessary to ask about a refund check, please allow enough time for the refund to be processed before calling the Department. Keep a copy of the tax return available when checking on the refund status online or by telephone.

Refer to the processing times below to determine when you should be able to view the status of your refund.

- For electronically filed returns, please wait up to 8 weeks before calling the Department. Electronically filed returns claiming a refund are processed within 6 to 8 weeks.

- For paper returns or applications for a tax refund, please wait up to 12 weeks before calling the Department. Paper returns or applications for tax refunds are processed within 8 to 12 weeks.

If sufficient time has passed for your return to be processed, and you are still not able to review the status of your refund, you may:

- Access Taxpayer Access Point for additional information, or

- Contact us at 285-2996.

For refund requests prior to the most recent tax year, please complete form RPD 41071 located at and follow the instructions.

Latest News