Contributing To A Health Savings Account Can Help You Lower Your Taxable Income

Part of your preparation for tax season should include an inventory of all deductions for which you might be eligible. A review of the costs associated with each key area of your life, including work, education, children, and health, can help clarify areas that may help reduce your taxable income. A significant deduction source is a health savings account or HSA.

What Is An Hsa

An HSA is a tax-deductible health savings account that allows you to grow your contributions tax free. Most HSAs are included with certain medical insurance plans . You can use your HSA to pay for medical expenses, eye care visits , dental bills, medicines, and more.

If you know you have an expensive medical procedure coming your way soon, it may make sense to contribute to an HSA dependent on your individual situation. Not only will you be able to contribute tax-free, youll also be able to receive tax benefits at the end of the year. But as always, theres a catch: Not everyone can open an HSA and theres yearly contribution limits . . . more on that later.

How To Claim Hsa Tax Deduction

Many of our clients ask us how to claim HSA contributions on taxes. After you calculate the eligible deduction for your HSA account, the next step is to claim the appropriate deduction on your annual federal tax return. You will need to file Form 1040 and attach IRS Schedule 1 to report your HSA contributions and take the appropriate tax deduction.

To claim the deduction, you will enter the amount you calculated using Form 8889 on Line 12 of Schedule 1. You can also use Schedule 1 to calculate other deductions, including alimony, farm income, and business losses. You will enter the total on Line 22 of Schedule 1 on Line 10a of your 1040 Form.

You May Like: How Long Can You Wait To File Taxes

Money In Your Account Can Be Invested

Account-holders who invest some of the assets in their accounts tend to have significantly higher average balances, according to the Employee Benefits Research Institute $22,496, compared with $2,296 for non-investors. Investors also had higher contribution amounts than non-investors .

A 55-year-old who contributes the maximum amount to an HSA every year until age 65 could see a balance of $60,000 from total contributions of about $42,000, assuming a 5% rate of return, the EBRI notes.

An aggressive, high-earning 45-year-old saving the maximum, including catch-up contributions when eligible, could see a balance of $150,000 at age 65. If the rate of return is 7.5%, which is feasible, the balance rises to $193,000.

Of course, an HSA is not intended primarily as a retirement savings vehicle. Its there so that you can cover out-of-pocket medical costs from year to year. But its worth considering, as each unexpected medical bill arrives, whether you should tap into your HSA or leave it for a possible greater need down the road.

You May Like: What Is Total Tax Liability

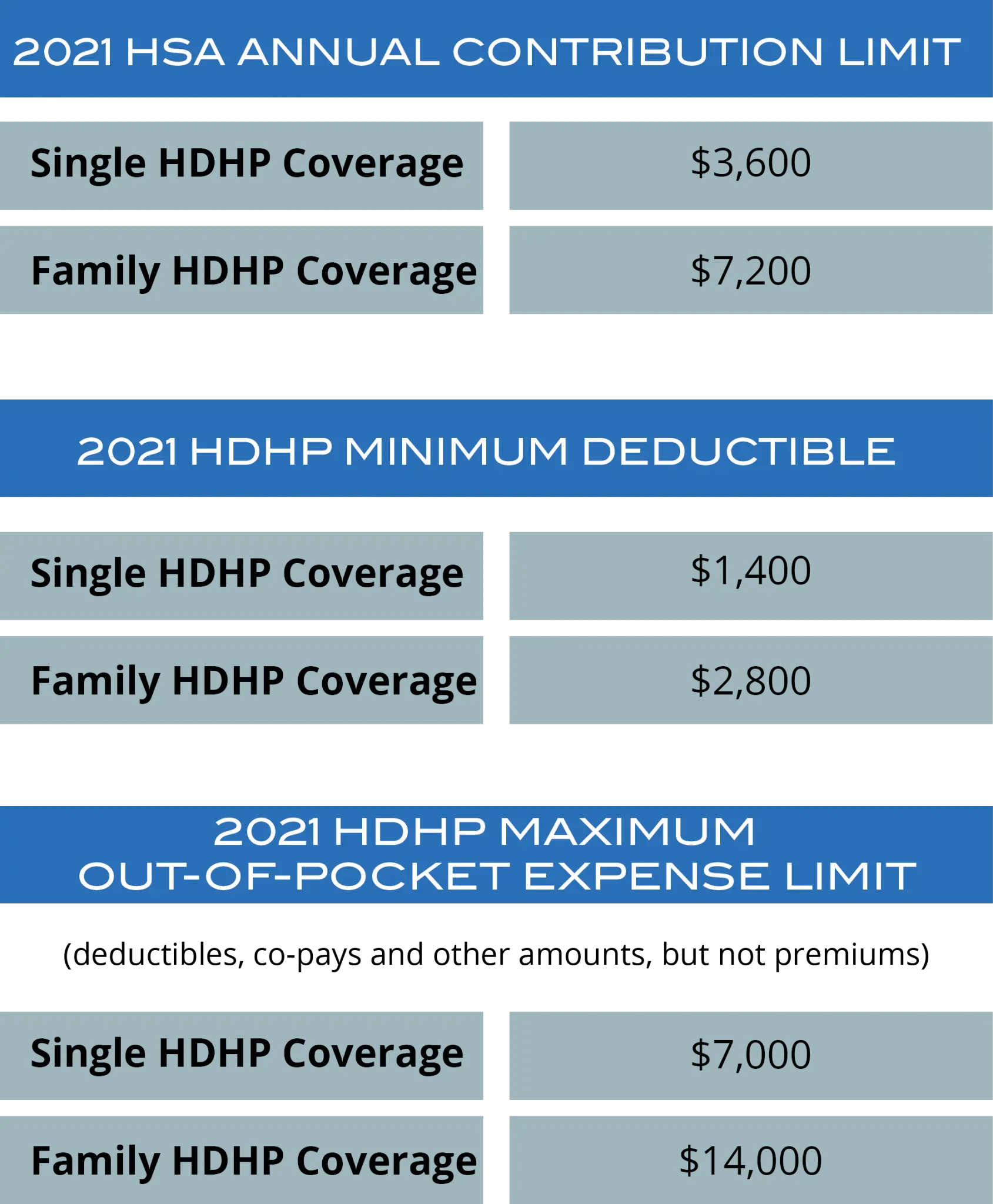

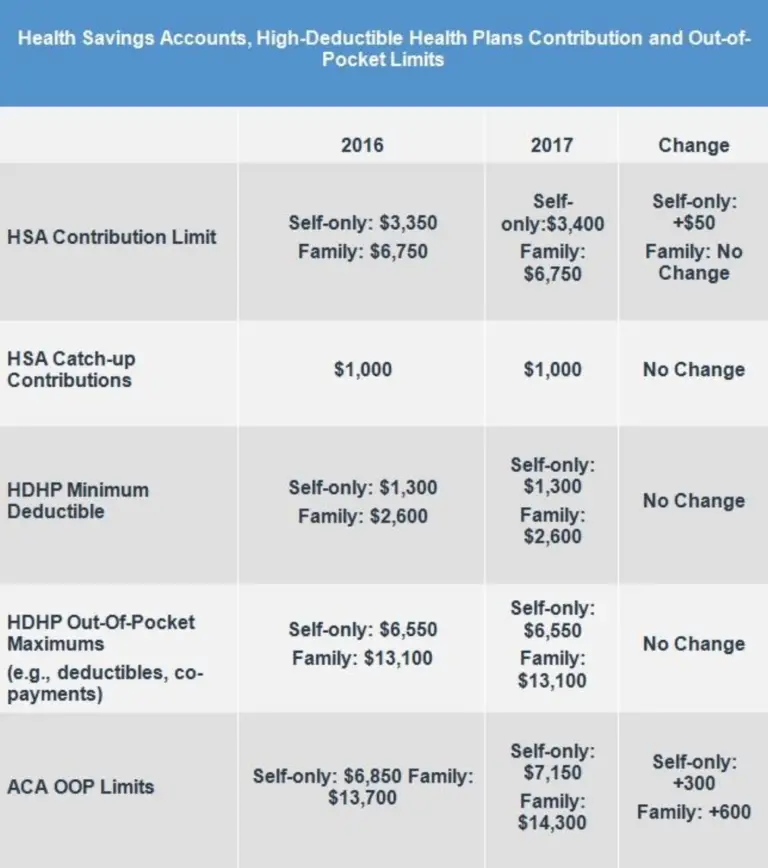

What Are The Irs Annual Contribution Limits

IRS contribution limits for individual and family plans typically increase every year. Plus, individual accountholders age 55 and older can make an additional $1,000 catch-up contribution. Eligible spouses over 55 can only make catch-up contributions to his/her account. For more information, please visit our IRS Guidelines and Eligible Expenses page.

Read Also: How To Pay Ny State Taxes

Why Are My Hsa Contributions Being Taxed

Your HSA is a workplace benefit that you contribute to through automatic payroll deductions. Your contributions are pulled from your paycheck before taxes, effectively reducing your taxable income for the year. In other words, your tax deduction is automatic.

Do HSA contributions show up on w2?

Any employer contributions made to HSAs are shown on your Form W-2 in Box 12 . This information is not reported to the IRS. The HSA Portfolio section lists the holdings in your Fidelity HSA reported as of December 31, 2020.

How is HSA taxed in California?

Because the state of California does not recognize HSAs, your HSA contributions are not tax deductible for California state income tax. As a result you dont pay federal income tax on the HSA contributions. However, the total will be included in the number on your W-2 box 16 State wages, tips, etc.

How Much Can I Contribute To A Hsa

The IRS sets limits that determine the combined amount that you, your employer, and any other person can contribute to your HSA each year:

- For 2022,the maximum contribution amounts are $3,650 for individual coverage and $7,300 for family coverage.

- For 2023, the maximum amounts are $3,850 for individuals and $7,750 for family coverage.

- You can add up to $1,000 more as a “catch-up” contribution if you are age 55 or older.

Don’t Miss: How To Do Taxes Freelance

What States Tax Hsa

State Taxation of HSAs. Most state tax laws align with federal laws in regards to HSAs, with some exceptions. As of the end of the 2018 tax year, the following states had HSA tax laws that differed with the federal HSA tax laws: California and New Jersey. California and New Jersey do not offer tax-free contributions at the state level.

Who Is Eligible For An Hsa

The IRS has set guidelines for who is eligible. At minimum, you have to have a High Deductible Health Plan. These are typically plans that have low monthly premiums, and higher deductibles for out of pocket care.

If you have a regular 9-5 job, ask your HR department if your health insurance plan makes you HSA eligible. You can always look this up on your benefits portal and when you select your health insurance plan.

HSA investing limits change slightly each year. For 2023, the limit is $3,850 for self-only coverage and $7,750 for family coverage. But if youre 55 and older you can contribute an additional $1,000 as a catch-up contribution.

As you can see, theres a fairly low annual limit for contributions , but the triple tax benefit is definitely still worth it.

Read Also: How Much Does H& r Block Charge To File Taxes

You Cant Invest Your Fsa Funds

One of the lesser-known benefits of an HSA is that you can invest those funds into good growth stock mutual funds. Because FSA funds have a 12-month lifespan, you lose the investment opportunityand the tax benefitswith an FSA. Without the investment piece, choosing an FSA means losing out on tax-free interest and earnings.

Exploring The Basics Of A Health Savings Account

Health savings accounts are commonly available to individuals who have high-deductible health plans, also referred to as HDHPs. The primary objective of a health savings account is to provide these individuals with an additional source of income to fund health costs that cannot be covered due to limitations imposed by their plan. Health savings accounts are often compared to flexible spending accounts, or FSAs. That being said, there are distinct differences between these two plans. One of the unique factors of the HSA that is not incorporated into the FSA is the ability to roll over unused funds on a yearly basis.

Whereas money contributed to an FSA can no longer be accessed after one year, funds in an HSA remain present until they are spent. Because of this, health savings accounts can act as a long-term safeguard for individuals whose current health care offerings are less than optimal. Supporters and advocates of HSAs argue that these accounts will help slow the growth of health care costs and ensure the individuals have the resources they need to access care when it is needed.

Also Check: Do You Have To Pay Taxes On Insurance Payouts

How Much Of My Hsa Is Tax Deductible

In order to itemize, deductible expenses must be more than 7.5% of your adjusted gross income . An HSA contribution deduction lowers your AGI which could make it easier for you to pass the 7.5% hurdle.

What is the HSA deduction for 2020?

$3,550Consumers can contribute up to the annual maximum amount as determined by the IRS. Maximum contribution amounts for 2020 are $3,550 for self-only and $7,100 for families.

Are HSA contributions State tax deductible?

State income taxes are also waived on HSA contributions in almost all states, with the exception of California, New Jersey, and Alabama. In addition to tax-free contributions, interest and investment earnings grow tax-free which could save you thousands more in taxes.

Keep Records Of All Hsa Distributions

If you take qualified distributions from an HSA you must keep records sufficient to show that:

- the distributions exclusively paid or reimbursed qualified expenses,

- the qualified expenses had not been previously paid or reimbursed from another source and

- the medical expenses had not been taken as an itemized deduction in any year.

Note: Do not send these records with your tax returnâkeep them with your tax records.

Don’t Miss: Can You File 2 Years Of Taxes At Once

What Is A High

It’s a health plan with a minimum deductible. For individual coverage, the annual deductible in 2023 is at least $1,500 for family coverage, it must be at least $3,000. These amounts will be adjusted for inflation and rounded to the nearest $50 in future years.

For individual coverage, the annual limit on out-of-pocket expenditures for covered benefits is $7,500 in 2023. For family policies, the limit must not exceed $15,000. These amounts will also be adjusted for inflation and rounded to the nearest $50 in future years.

How Do I Get Reimbursed From An Hsa Account

The short answer is, send in a receipt to your HSA provider and youll get reimbursed for the expense.

There are many companies offering HSA accounts, and their procedures vary. The best HSA providers make it easy for you to open an account, pay money into it, keep on top of your available balance, and get money out of it.

Don’t Miss: How Much Is Tax In Washington State

What Are Tax Deductions

Before diving into your health savings account , it helps to understand what tax deductions are and how they save you money.

The first step is adding all the income you received for the year. After that, the IRS allows you to subtract certain items to reduce how much of your income is taxable.

Next, you choose one of two options: itemize or take the standard deduction. 2017’s tax law changes nearly doubled the standard deduction. Because of this, itemizing wont necessarily offer you the biggest discount.

The good news is, your HSA deduction stays intact regardless of which option you choose. Thats because its not part of your itemized deductions and subtracted during the first step.

There are several scenarious to take into an account if you have an HSA:

When To Contribute To An Hsa

While HSAs are a great idea for folks with HDHPs, theres a right time and place when it comes to making contributions. If youre still getting out of debt and dont have a fully funded emergency fund , it is not the time to add money to an HSA. Every penny you can spare should be going toward demolishing your debt.

There are two exceptions to that rule. The first is if you are about to have a baby, major surgery or know youre going to have some large medical expenses soon. And the second is you dont have dental or vision insurance. In those cases, you can use your HSA as a sinking fund to save for those medical costs.

But once you reach Baby Step 4which means youre ready to start investing for retirementfeel free to start putting money into your HSA !

Recommended Reading: When Is Tax Filing Deadline 2021

Does California Tax Hsa Distributions

Because the state of California does not recognize HSAs, your HSA contributions are not tax deductible for California state income tax. If you are contributing through your employer, a properly configured payroll system will handle this for you. Your HSA contribution will be deducted from your gross pay for calculating the federal tax withholdings.

Which states tax HSA contributions?

HSA earnings may accrue from investing HSA funds. Alabama eliminated similar rules on Jan. 1, 2018, and is now a HSA triple-tax advantage state. Also, states without a state income tax do not provide a deduction for HSA contributions. Those states are Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming.

Is my HSA taxable?

Your HSA contributions are never taxed. An HSA is funded with pre-tax dollars, whether you make contributions or your employer does so on your behalf. If you fund the account on your own, you claim total annual contributions as a deduction on your taxes .

Questions About Your Taxes We’re Here To Help

Q. What is the HSA contribution deadline?

A. The HSA contribution deadline is the same date as the tax filing deadline for that plan year. IRS instructions state that the tax deadline is generally April 18th, 2022, for the 2021 tax year. Certain states or areas of the country may have additional time due to local holidays or natural disaster extensions. Please seek additional information from the IRS or your tax advisor.

for more information on the annual contribution limits.

Q. How do I obtain a copy of my tax forms?

A. You can get copies of your most recent tax forms by signing in to your account online and viewing the “Statements and Tax Docs” section.

Please note: tax forms are not available via the Optum Bank Mobile App.

Q. How do I save on taxes with an HSA?

A. The money you contribute to your HSA is tax-deductible up to the annual contribution limit. For example, if you are in the 28 percent tax bracket and deposit $3,000 into your HSA, you could save $840 in federal income taxes. Money you take out of your HSA to pay for qualified medical expenses is tax-free. Interest you may earn on your HSA grows income tax free.

Q. Which forms do I need to file my taxes?

A. There are three tax forms associated with health savings accounts : IRS Form 1099-SA, 5498-SA and IRS Form 8889.

Recommended Reading: How To File Back Taxes Without W2

How Does An Hsa Affect Taxes When I Contribute

Because HSA contributions can be made with pre-tax funds, you can deduct the amount you’ve contributed from your taxable income in the year you make the contribution.

The fact that HSA contributions are tax-deductible means any money you contribute reduces the income you’re taxed on, which saves you money on your IRS bill. It also means your take-home pay declines by a smaller amount than what you actually contributed.

For example, if you have $50,000 in taxable income and make a $3,600 deductible contribution to an HSA, you will be taxed on only $46,400 in income due to your contribution.

The specific amount you save due to your HSA contribution will depend both on how large your contribution is and on your tax rate. Those who are taxed at a higher rate and those who make larger contributions will realize more savings.

When Will I Get The 1099

![HSAs Are Good for Both Businesses and Employees [Infographic] HSAs Are Good for Both Businesses and Employees [Infographic]](https://www.taxestalk.net/wp-content/uploads/hsas-are-good-for-both-businesses-and-employees-infographic.png)

The 1099-SA form will be available mid-to-late January on the Member Website if you had distributions in the prior year. If you chose to get paper documents, youll get your 1099-SA in the mail in late January/early February.

IMPORTANT: You WON’T get the 1099-SA form if you DIDN’T withdraw funds from your HSA in the previous year.

The 5498-SA form is typically delivered the month after the tax filing deadline, allowing any contributions made in the current year for the prior year to be included.

Some accountholders will get their 5498-SA in January with their 1099-SA. If you get your 5498-SA at this time and then make prior-year contributions, youll get an updated 5498-SA. You wont get a 5498-SA form if you didnt have contributions and your balance was zero dollars at the end of the year.

Please note this form is informational only and doesnt need to be filed with your income tax return.

Recommended Reading: Why Appeal Property Tax Assessment

What Is A Health Savings Account

An HSA is a tax-exempt account used to pay or reimburse qualified medical expenses that generally would be eligible for the medical and dental expenses deduction. The amounts contributed to an HSA gain interest tax-free, and the account stays with you even if you change employers or leave the workforce. Unused funds carry over to the next year and there is no time limit on when the funds must be used, unlike a Flexible Spending Account in which funds are forfeited at the end of the year.

An HSA is set up by a qualified entity such as a bank, insurance company, or anyone approved by the IRS to be a trustee of Individual Retirement Arrangements . HSAs can only be established for individuals who qualify. There is no such thing as a joint HSA for married couples instead each person must qualify for, and have, their own account.

Filling Gaps In Health Plans

Remember that you can also use the account for expenses that arent covered by your health insurance plan. For example, if your medical plan doesnt cover dental or vision care, HSA funds can still be used for those bills.

There are a few things that an HSA cannot be used for. You cant use it to pay insurance premiums. Other ineligible expenses include over-the-counter items like toothpaste, toiletries, and cosmetics, as well as most cosmetic surgeries. A vacation to a healthier climate would also not qualify.

Over-the-counter costs that dont require a prescription are generally not allowed. That includes nicotine gum or patches as well as toothpaste and toiletries.

If youre 64 or younger and withdraw funds for a non-qualified expense, youll owe income taxes on the money, plus a 20% penalty. If youre 65 or over or are disabled, youll still owe taxes on the amount but will be spared the penalty.

So, frankly, after age 65, you can essentially withdraw HSA funds for anything.

Dont Miss: How To File An Amended Tax Return Turbotax

Don’t Miss: What’s The Deadline For Filing Taxes