First What Is Income Tax And What Is Taxable Income

Income tax is the tax levied by the government on an individuals income. This term individual here applies to a person, Hindu Undivided Family, company, co-operative societies and trusts. And, the tax slabs are decided based on ones income and age.

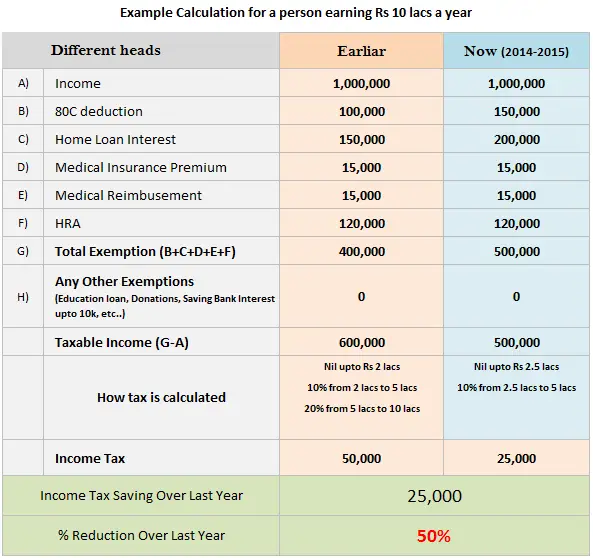

Now, taxable income is income of an individual minus the tax exemptions, deductions and rebate. These processes are laced with complicated calculations and adjustments, so we take you through them to make the math simple.

Step 1: Calculate your gross income

First, write down your annual gross salary you get. This will include all the components of your salary including House Rent Allowance , Leave Travel Allowance and special allowances, like food coupons and mobile reimbursements etc..

Next, take out the exemptions provided on the salary components. The major exemptions you get are HRA i.e. House Rent Allowance and LTA i.e. Leave Travel Allowance.

For HRA, remember you can claim HRA ONLY if you live in a rented house and can submit valid rent receipts as proof. You can easily fill out and from the ETMONEY website and submit it after affixing revenue stamp and getting it signed by your landlord or landlady to claim HRA benefit. If you have your own accommodation or live with parents, then HRA is fully taxable. Also, your tax exemption under HRA is taken as the lowest of the following amounts:

The amount you arrive at is your gross total income.

Step 2 Arrive at your net taxable income by removing deductions

The Bottom line:

Who Has To Pay Estimated Taxes

If you filled out the IRS W-4 form, which provides directions for your employer about how much to withhold from each paycheck, you might not need to pay estimated taxes. If you aren’t a W-4 salaried employee, however, you probably need to keep estimated tax payments on your radar. According to the IRS, you generally have to make estimated tax payments if you expect to owe tax of $1,000 or more when your return is filed, and if your employment type falls into one of these categories:

- Independent contractor or freelancer

- Social Security benefits, if you have other sources of income

- Prizes and awards

You may also need to pay estimated tax as a full-time employee if your employer isn’t withholding enough from your salary. To update your W-4 with the correct withholding amount, use the IRS Tax WIthholding Estimator tool, complete a new W-4, Employee’s Withholding Allowance Certificate form and submit it to your employer.

Estimated taxes are due, regardless of whether you’re paid by direct deposit, check or digital payment services like PayPal, CashApp, Zelle or Venmo. Note: While you should be paying taxes on that income already, a new rule under the American Rescue Plan requires third-party payment networks to report $600 or more payments to the IRS.

Don’t Use This Tool If:

- You have a pension but not a job. Estimate your tax withholding with the new Form W-4P.

- You have nonresident alien status. Use Notice 1392, Supplemental Form W-4 Instructions for Nonresident Aliens.

- Your tax situation is complex. This includes alternative minimum tax, long-term capital gains or qualified dividends. See Publication 505, Tax Withholding and Estimated Tax.

Also Check: When Is The Deadline To File Your Income Tax

How Your Vermont Paycheck Works

It can be a challenge to predict the size of your paycheck because money is deducted for FICA, federal and state income taxes, as well as other withholdings. But when you start a new job, you’ll have to fill out a W-4 form. Your Vermont employer uses the information you provide on this form – with regard to your marital status and any additional dollar withholdings you take – to determine how much to deduct from your paychecks for federal and state taxes. You’ll need to submit a new form during the year if you want to make changes regarding your status or dependents.

The IRS made notable changes to the Form W-4 in recent years. The new version completely removes allowances, using a five-step process asking filers to fill out personal information, list dependents and indicate any additional income instead.

A portion of your income will also go toward paying Social Security and Medicare taxes. Collectively these are known as FICA taxes, and may be referred to as such on your pay stub. For each of these taxes, a percentage of your income is withheld for the sake of sustaining these programs. Your employer will match these percentages, meaning that in the end you will have only been responsible for half of your FICA taxes.

What You Need To Calculate Your Take

Want to know what your paycheck will look like before you take a job? There is a way to figure out exactly how much youll have left after FICA, federal taxes, state taxes, and any other applicable deductions are removed. You need a few pieces of information in order to calculate your take-home pay:

- The amount of your gross pay. If you earn a fixed salary, this is easy to figure out. Just divide the annual amount by the number of periods each year. If you are paid hourly, multiply that rate by 40 hours to determine your weekly pay.

- Your number of personal exemptions. When you start a new job, you fill out a W-4 form to tell your employer how much to withhold from your check.

- Your tax filing status. There are standard federal and state tax deductions that vary depending on whether you are single, married filing jointly, married filing separately, head of household, or a surviving spouse.

- Other payroll deductions. This category could include contributions to a 401 retirement plan, health insurance, life insurance, or a flexible spending account for medical expenses. It also may include union dues or any other garnishments that are taken from your wages. It helps to categorize these according to pre-tax and after-tax contributions, to deduct them from either your gross salary or after-tax calculation.

Recommended Reading: What Do I Do If I Owe Taxes

How Your Paycheck Works: Deductions

Federal income tax and FICA tax withholding are mandatory, so theres no way around them unless your earnings are very low. However, theyre not the only factors that count when calculating your paycheck. There are also deductions to consider.

For example, if you pay any amount toward your employer-sponsored health insurance coverage, that amount is deducted from your paycheck. When you enroll in your companys health plan, you can see the amount that is deducted from each paycheck. If you elect to contribute to a Health Savings Account or Flexible Spending Account to help with medical expenses, those contributions are deducted from your paychecks too.

Also deducted from your paychecks are any pre-tax retirement contributions you make. These are contributions that you make before any taxes are withheld from your paycheck. The most common pre-tax contributions are for retirement accounts such as a 401 or 403. So if you elect to save 10% of your income in your companys 401 plan, 10% of your pay will come out of each paycheck. If you increase your contributions, your paychecks will get smaller. However, making pre-tax contributions will also decrease the amount of your pay that is subject to income tax. The money also grows tax-free so that you only pay income tax when you withdraw it, at which point it has grown substantially.

How Much Do I Take Home After Tax

| 2010 | $49,406 |

Vermonts tax rates are among the highest in the country. There are four tax brackets that vary based on income level and filing status. The states top tax rate is 8.75%, but it only applies to single filers making more than $206,950 and joint filers making more than $251,950 in taxable income. If youre a single filer with $40,950 or below in annual taxable income, youll pay the lowest state income tax rate in Vermont, at 3.35%.

Vermont has no cities that levy a local income tax. This means that whether you live in Burlington, Rutland or anywhere in between, you wont have an additional local withholding.

If youre planning on relocating to Vermont or thinking about a move within the state and youre looking to purchase a home, our Vermont mortgage guide is a great place to start learning.

You May Like: How To Tax Return Online

Should Freelancers File Tds Return

Freelancers may get their payments after tax is deducted at source. Similarly, freelancers are required to deduct tax at source before making a payment. Here is an illustration:

Roshni is a graphic designer who works as a freelancer for multiple clients. She is paid for each project she works on and not a fixed monthly salary. In each such payment, the client deducts tax at source before paying out. But, she does not know about the tax she has to deduct at the source.

Many freelancers have a name for the business and a current account meant for business purposes they are treated as small businesses from a taxation perspective. At times when Roshni has tight deadlines, she hires professionals to keep up with the deadlines. In this case, she must deduct tax at source on the amounts payable to them.

Every time a freelancer or a small business owner makes a payment to professionals which exceeds Rs.30,000 per transaction or in aggregate during a financial year, TDS applies at the rate of 10%. The deducted tax at source must be deposited with the government.

ClearTax has made it easy for freelancers to file income tax returns as well as file TDS returns.

Related Articles

How To Calculate Taxes Taken Out Of A Paycheck

Calculations, however, are just one piece of the larger paycheck picture.

Don’t Miss: How Much Is H& r Block For Taxes

Exemption On Receipts At The Time Of Voluntary Retirement

Any compensation received on voluntary retirement or separation is exempt from tax as per the Section 10. However, the following conditions must be fulfilled

a. Compensation received is towards voluntary retirement or separation

b. Maximum compensation received does not exceed Rs 5,00,000.

c. The recipient is an employee of an authority established under the Central or State Act, local authority, university, IIT, state government or central government, notified institute of management, or notified institute of importance throughout India or any state, PSU, company or a cooperative society.

d. The receipts are in compliance with Rule 2BA.

No exemption can be claimed under this section for the same AY or any other if relief under Section 89 has been taken by an employee for compensation of voluntary retirement or separation or termination of services.

Note: Exemption can only be claimed in the assessment year the compensation is received.

How Do I Pay My Estimated Taxes

When filing your estimated taxes, use the 1040-ES IRS tax form or the 1120-W form if you’re filing as a corporation. You can fill out the form manually with the help of the included worksheets, or you can rely on your favorite tax software or tax adviser to walk you through the process and get the job done. From there, you can pay your federal taxes by mail or online through the IRS website. You’ll also find a complete list of accepted payment methods and options, including installment plans.

Also Check: How To Find Out If You Owe State Taxes

Do Landlords Pay Self

Most landlords dont have to pay self-employment taxes . Thats because of how rental income is taxed: as passive income on an investment, rather than an active business.

The tax code does make a few exceptions however. If they classify you as a real estate dealer, they make you pay self-employment tax on rental income. Real estate dealers are those considered to be in the business of buying and selling real estate, such as full-time house flippers.

You must also pay self-employment taxes on rental income if you provide additional paid services to your tenants. For instance, if you own an apartment complex and provide add-on services like dog walking, laundry, dry cleaning, and maid services, you likely have to pay self-employment taxes not just on that income but also your rental income. You go from collecting passive income streams to becoming a real estate professional with active business activities.

When in doubt, talk to a CPA about how you can avoid paying self-employment taxes on rental income.

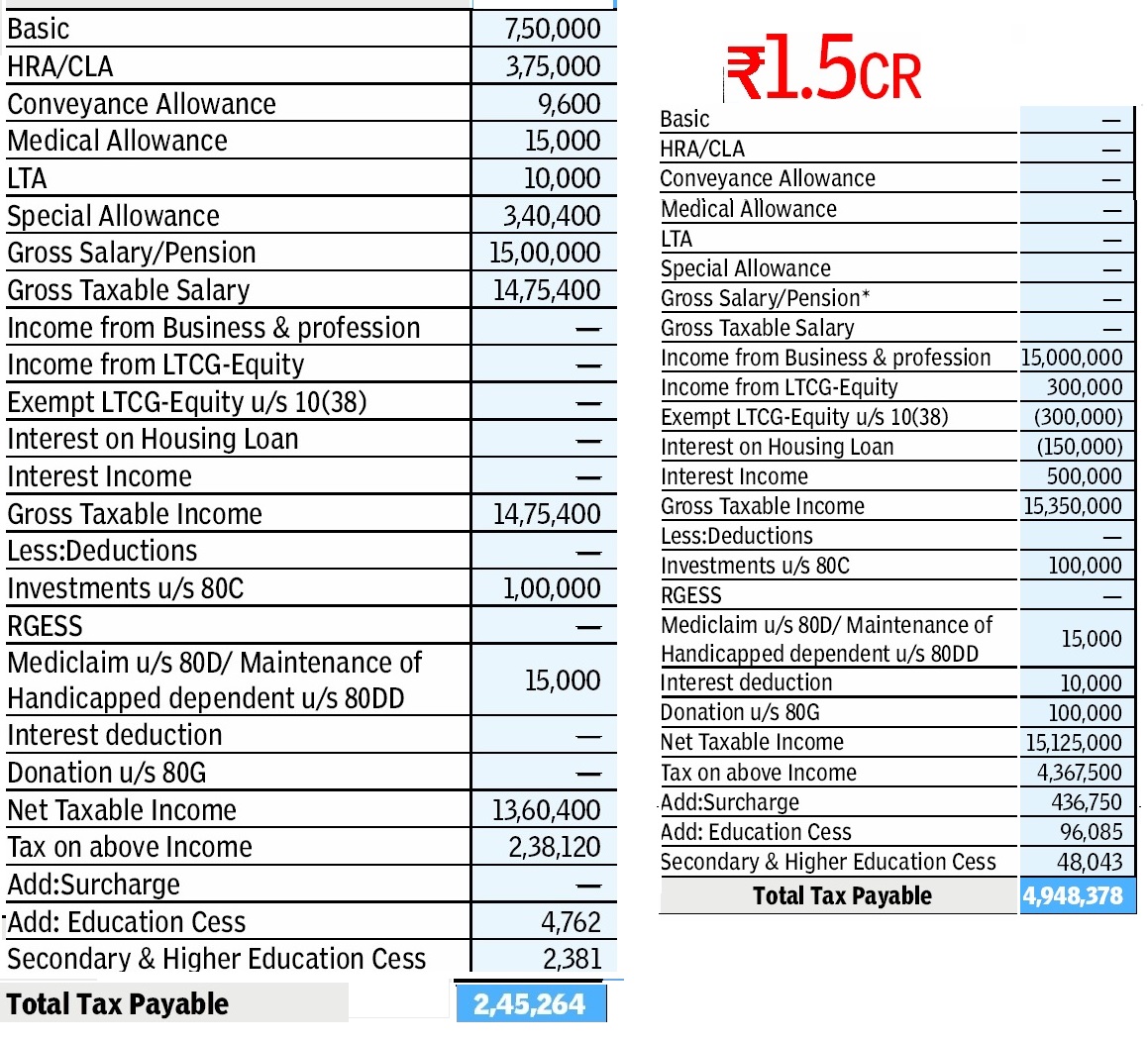

How To Calculate The Total Income Tax Liability

Individuals can determine the total tax expenses through an online income tax calculator. Such tools take into account the following pointers to reflect the actual tax liability of a resident or non-resident Indian at the end of a financial year

Entering accurate data regarding the above-mentioned pointers will demonstrate the total tax liability of individuals. Minus the taxes already paid through TDS, the remaining can be deposited directly online through the official portal Challan 280. If, in any event, the taxes paid exceed the total liability, the difference is reimbursed by the government within 30 days of filing for the same.

Taxpayers who file their return after the due date will have to pay interest under 234A and penalty under section 234F. Hence, remembering the due date of filing income tax returns is indispensable. However, keep in mind that the due date varies according to the category of taxpayers. For instance, if you are a salaried individual, usually you must file your income tax returns by the 31st of July of the assessment year.

Also Check: How To Block Someone From Claiming Your Child On Taxes

Employee Contribution To Provident Fund

Provident Fund or PF is a social security initiative by the Government of India. Both employer and employee contribute a 12% equivalent of the employees basic salary every month toward employees pension and provident fund. An interest of about 8.65% from FY 2018-19 gets accrued on it. This is a retirement benefit that companies with over 20 employees must provide as per the EPF Act, 1952.

How Much House Can I Afford With An Fha Loan

With a FHA loan, yourdebt-to-income limitsare typically based on a 31/43 rule of affordability. This means your monthly payments should be no more than 31% of your pre-tax income, and your monthly debts should be less than 43% of your pre-tax income. However, these limits can be higher under certain circumstances.

If you make $3,000 a month , your DTI with an FHA loan should be no more than $1,290 â which means you can afford a house with a monthly payment that is no more than $900 .

FHA loans typically allow for a lower down payment and credit score ifcertain requirementsare met. The lowest down payment is 3.5% for credit scores that are 580 or higher. If your credit score is between 500-579, you may still qualify for an FHA loan with a 10% down payment. Keep in mind that generally, the lower your credit score, the higher your interest rate will be, which may impact how much house you can afford.

FHA loans are restricted to a maximum loan size depending on the location of the property. Additionally, FHA loans require an upfront mortgage insurance premium to be paid as part of closing costs as well as an annual mortgage insurance premium included in your monthly mortgage payment â both of which may impact your affordability.

Don’t Miss: How To Get Stimulus Check 2021 Without Filing Taxes

Section 80c 80ccd And 80ccc

There are tax savings options wherein salaried employees can invest and claim an income tax deduction on salary up to Rs. 1.5 lacs. Some of the investments covered under the sections mentioned above include Employee Provident Fund , Life Insurance Premium, Equity Linked Savings Scheme , Pension schemes, etc. There are also many other government savings schemes included under these sections.

Compute Social Security Deductions

Use the employees gross pay with no deductions to calculate Social Security tax and Medicare tax. Multiply gross pay by 6.2 percent to find the amount of Social Security tax. If gross pay is $500, multiply $500 times 6.2 percent , which equals $31. As of 2019, Social Security tax is levied only on the first $128,400 of yearly wages.

Stop deducting this tax if the year-to-date gross pay exceeds this amount. The income cap changes periodically, so check IRS Publication 15, Circular E for the current amount.

You May Like: What Happens If The Irs Rejects Your Tax Return

Overview Of California Taxes

California has the highest top marginal income tax rate in the country. Its a high-tax state in general, which affects the paychecks Californians earn. The Golden States income tax system is progressive, which means wealthy filers pay a higher marginal tax rate on their income. Cities in California levy their own sales taxes, but do not charge their own local income taxes.

Work InfoDismiss

You can’t withhold more than your earnings. Please adjust your .

| Gross Paycheck | |

| FICA and State Insurance Taxes | –% |

| State Family Leave Insurance Tax | –% |

| State Workers Compensation Insurance Tax | –% |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |