How To Contact H& r Block

You can contact H& R Block for help at 1-800-HRBLOCK. You also have the option to connect via live chat while using the software. Screen-sharing is available as well, making it easy to get your questions answered.

If you decide you donât want to handle your filing online, you can also visit a local H& R Block office at one of more than 11,000 locations across the United States but you will have to pay a fee for in-person tax filing.

Can I Do My Taxes Online With H& r Block

H& R Block tax filing software makes it easy to complete your taxes online if you donât want to go to a local office. You can opt to use H& R Blocks software and complete your forms yourself or can get expert tax help from home with Tax Pro Go.

With Tax Pro Go, you simply upload your tax documents and youâre matched with a professional experienced with situations like yours. You can schedule a phone call to talk with your tax pro if you have any questions, and the pro will complete your taxes for you. The cost for Tax Pro Go starts at $69 and increases from there based on the complexity of your return as well as other factors.

You May Like: How Are Reit Dividends Taxed

How Much Does H& r Blocks Tax Service Cost

H& R Block offers a free online tax-filing program that includes simple federal and state tax returns. If you need to upgrade based on your tax situation, youll pay $49.99 to $109.99 to complete a federal return, and $36.99 for each state tax return.

At the time of publishing, the company is offering a temporary discount. Filing a federal return costs just $29.99 to $84.99 during the promotion, which brings the pricing more in line with TaxSlayer, the lowest-cost provider we reviewed.

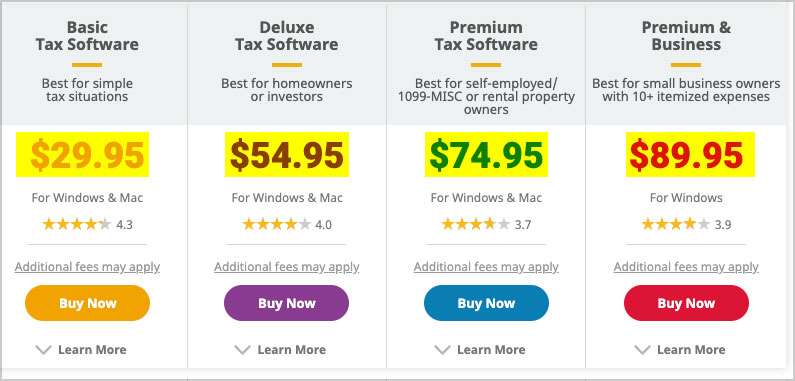

H& R Block also offers in-person tax filing starting at $69 per federal return plus an additional fee for state returns. Its desktop software, which downloads to your computer, ranges from $29.95 to $89.95 for federal returns, and $19.95 for each state return. The in-person and downloadable software options arent included in our review.

Also Check: Payable Doordash 1099

H& R Block Vs Turbotax: Cost

Cost is always a consideration when you choose a tax filing service. H& R Block and TurboTax are the two most comprehensive online services available and likewise they are also the most expensive.

As mentioned, both services offer a free option, covering simple returns. You can also file some additional schedules and forms with this option. However, H& R Block does cover more forms and schedules with its free option. It also allows you to file multiple state returns for free. By contrast, the free plan from TurboTax includes only one free state return. This all gives H& R Block a slight advantage if you qualify for the free option.

Its great if you can file your taxes for free, but the average filer will need to upgrade to another option. The Deluxe option is enough for many filers. Both Deluxe options include deduction-finding software, help with charitable donations and access to tax financial experts through online chat.

There are a couple of big differences between the options in the forms that they support. TurboTaxs Deluxe option supports Schedule SE, which allows you to file self-employment taxes. It also allows you to file Schedule C and Schedule C-EZ if you have business income to report but do not have any expenses to report.

Read Also: How Can I Make Payments For My Taxes

Is Turbotax Or H& r Block Better

Intuit makes both apps, and you can quickly transfer your financial data from QuickBooks to your tax forms. You might choose H& R Block if you want a premium experience for a lower price. H& R Blocks DIY filing options are less expensive than TurboTax across the board and edged out TurboTax in our overall ratings.

Don’t Miss: Do You Have To Claim Plasma Donation On Taxes

Premium: Best For Investors Landlords Or Those Who Sold Cryptocurrency In 2021

The Premium plan costs $50 for your federal return plus $37 for each state return.

The third tier of H& R Block tax plan options adds several layers of tax services for those with more complicated tax situations. If you earned money from a rental property or have capital gains from the sale of stock, a house or other investments, you’ll need to pay for the H& R Block Premium plan.

Likewise, if you gained or lost money from the sale of cryptocurrency, you’ll need to use the Premium plan.

The cost for virtual professional help, including screen-sharing via Online Assist, goes up to $60 for the Premium plan. The Worry-Free Audit Support and Tax Identity Shield services are still available for $20 a piece.

Is H& r Block Really Free

Yes, the service is free for both federal and state if you are filing a simple tax return. It covers unemployment income, retirement income, W-2 income, and interest and dividend income. You can also take the Earned Income Tax Credit , child tax credit, and deductions like tuition and student loan interest.

Don’t Miss: How Much Tax For Doordash

What Software Do Tax Professionals Use

Best professional tax software for tax preparers in 2021

- Drake Tax. For tax professionals. View Now at Drake Tax.

- Intuit ProSeries Professional. Maximize your savings. View Now at Intuit ProSeries Professional.

- ATX Tax. Pay-per-return system. View Now at ATX.

- TaxSlayer Pro. Only for tax professionals. View Now at TaxSlayer Pro.

You May Like: How Can I Make Payments For My Taxes

They Charge An Hourly Rate

If your tax advisor charges by the hour, make sure you find out how much they charge and how much time they expect to spend on your taxes. Usually, a tax pro will charge an hourly fee between $100200 per hour, depending on what kind of tax forms you need to file.6 If they can get your taxes done in less time, you wont get stuck with a high bill at the end.

Also Check: How To Get Out Of Paying School Taxes

Recommended Reading: How To Calculate Doordash Taxes

The H& R Block User Experience

Navigation is very simple and straightforward. You advance from screen to screen by clicking the Back and Next buttons. You do this throughout the site, though there are other navigation options, too. You can, for example, click a tab in the horizontal toolbar at the top to see its subsections . Directly below this is a list of the forms youve completed click on one to return to it. Links in the left vertical pane show you your real-time, ever-updating tax obligation or refund and take you to housekeeping pages.

The entire site functions in this way. H& R Block Deluxe makes it clear on each page what action you need to take and where you need to go next. But it lacks a comprehensive navigation tool like the one FreeTaxUSA offers. It also feels choppier than TurboTax Deluxes smooth, linear flow. Even on screens where youre just clicking Yes or No options, you still have to click the Next button to advance. That adds up to a lot of extra clicks.

H& R Block is a little more formal in its language and looks than the friendlyeven folksyTurboTax. It uses clear, understandable language, and its navigation and data entry conventions should be familiar to most taxpayers. The two sites simply have different personalities. TurboTax is the human preparer who greets you with a big smile and makes some small talk as he or she goes along. H& R Block is a bit more businesslike. Both are effective approaches.

How Can I Save Money

In a crowded market, consider other options such as TurboTax, TaxSlayer, Jackson Hewitt or even TaxAct. All software packages offer its own features and pricing tiers. FitSmallBusiness.com did a comparison of these products, showing us what its best for, the prices and what the free version supports.

If you made less than $60,000 for the year, then you can file you can file for free at MyFreeTaxes.com.

Advertising Disclosure: This content may include referral links. Please read our disclosure policy for more info.

Read Also: Best Taxes Company

The H& r Block Mobile Experience

H& R Block has an Android app and an iOS app. The H& R Block Tax Prep and File app lets you file or access a return you’ve started or completed on another device. As we found last year, the mobile app does a beautiful job of replicating the desktop experience. It offers simple navigation, an able help system, and comprehensive coverage of tax topics.

Screens look like they do on the browser-based version, with a few exceptions. For example, the mobile versions display icons at the bottom of the screen, providing another path to screens and tools. If you’re accustomed to using your phone for productivity applications, you probably wouldn’t find it difficult to complete your return on your mobile device.

What Is H& r Block

H& R Block is a tax preparation company found in the United States, Canada, and Australia. The company was founded in 1955 by the brothers Henry and Richard Bloch and continues to be based out of Kansas City, Missouri. The company now operates more than 12,000 retail offices worldwide, and is armed with a staff of 80,000 tax professionals. Its also expanded to online software options, so that customers can file their taxes from the comfort of their own home instead of going to a branch.

Don’t Miss: How Much Money Should I Save For Taxes Doordash

How Do I Contact H& r Block

One of the reasons we love H& R Block is because of the ways you can get help. You can get help online, through phone, or even have a tax preparer virtually prepare your tax return. You can also visit one of H& R Block’s network of locations as well.

To contact H& R Block by phone, you can call 1-800-472-5625. If you want to visit an office in-person, you can schedule an appointment here.

Irs Free File Program

Many Americans are eligible to file their taxes for free through the IRS Free File program, which is a public-private partnership between the agency and the Free File Alliance, a group of tax preparation companies with online software such as TurboTax, TaxAct, FreeTaxUSA and more.

In 2020, 4.2 million Americans used the Free File program for their 2019 taxes, according to the IRS. While that was a nearly 50% increase from the previous year, more could still use the program.

If your annual gross income in 2020 was less than $72,000, you can use one of the Free File software programs offered to submit federal taxes free of cost. In addition, some products will also let you file your state taxes for free. The software generally includes step-by-step instructions and help for filers.

âThis year it is especially important that people know about the Free File program because itâs a great tool for anyone that didnât get their first or second economic impact payment or didnât get the right amount,â said Christopher Miller, a spokesperson for the IRS.

To use the program, you must go through the IRS site not directly to a tax preparer, Miller said.

Free File opened on Jan. 15, meaning that people can now input and submit their tax information. When tax filing opens on Feb. 12, their forms will be automatically filed with the IRS.

Recommended Reading: Tax Form For Doordash

About H& r Block Tax Service

Founded in 1955, H& R Block has grown to become one of the largest retail tax firms in the U.S. and has completed more than 800 million tax returns in its existence. The company employs more than 60,000 tax professionals who must take at least 60 hours of training and pass a rigorous certification program. The typical H& R Block tax pro has about 10 years of experience and can help customers either online or at one of the companys retail locations in all 50 states and U.S. territories, and on U.S. military bases around the world. For no-contact help, you can drop off your tax information at one of its offices without making an appointment.

Taxpayers can also prepare returns by logging in online or downloading tax-prep software. Each of the four online-filing programs walk you through a simple interview-style interface, where you answer questions about your tax situation. The program enters your information on the appropriate tax forms accordingly.

How It Compares

Youre probably curious about how H& R Block compares to other Canadian tax software, like TurboTax or Wealthsimple Tax. Honestly, H& R Block can hold its own, but there are definitely areas where it falls a little short.

TurboTaxs pricing is a little higher, but you get a few extra features, like having seven years of taxes stored online and a handy mobile app. TurboTax also has a specific plan for those who are self-employed, something that H& R Block lacks.

Wealthsimple Tax is a little easier to use and also uses a pay what you want model, meaning you can pay $0, $20, or as much as you see fit for each return. This is a good choice if you know your tax return is going to be very straightforward.

The unique advantage of using H& R Block is the fact that you have the option of filing online or in-person. If your finances get more complex in the future, you can opt to go into an H& R Block office to consult with an expert, something that neither TurboTax or Wealthsimple Tax are set up for.

Recommended Reading: How To Look Up Employer Tax Id Number

Is It Worth It

For those who qualify for free filing, H& R Block Online deserves to be on the shortlist. It is a premium software, but the free offering is expansive. Additionally, the Premium edition of the software could offer a good value for investors and gig workers.However, users considering the Deluxe Tier should think carefully before paying the price. Deluxe users may find a better by considering TaxSlayer Classic or FreeTaxUSA. These tools may also be a good alternative for self-employed people who dont have depreciating assets in their business.Landlords and others with depreciating assets should also carefully consider whether H& R Block is the right tool to get the job done. TurboTax has a superior user experience for rental property owners which is important given the complexity of depreciation.

H& r Block: Pros And Cons

Every tax filing service has its drawbacks and benefits. Heres what stands out about H& R Block.

- Easy to use: Through step-by-step guidance and a series of questions, the tax prep program helps you find the right service, filing status and forms for your tax situation.

- Transparency: H& R Blocks commitment to transparency means you get straightforward pricing information ahead of time. With other products, you often dont get the full picture of what youll be

- Good value: H& R Block strikes a good balance of affordability and versatility, offering a wider variety of filing options than TaxAct while still feeling less overwhelming than TurboTax.

- Expert assistance: If you really need to talk to someone in person, H& R Block is one of few online tax services that also has offices around the country.

- No free advance: H& R Block offers a tax refund advance that can help you access your money early, but it comes with an annual fee and a steep interest rate.

Don’t Miss: Where Is My Federal Tax Refund Ga

More Savings Tips At H& R Block

- File with software: Starting at $19.95, you can download the tax software to easily track everything on your desktop.

- : Opt to receive your refund on an Amazon gift card and H& R Block will add a 3.5% bonus.

- Missing Stimulus Check?: If you never received your 2020 stimulus check or were underpaid based on your 2020 income, H& R Block can help you apply for Recovery Rebate Credit if youre eligible.

- Virtual Tax Prep: For $69, you can book a tax pro online, see the price, upload your documents, and have your return filed all from the comfort of your own home.

- Tax Extension Help: If you need time to file your taxes you can file for an extension with H& R Block for $10.

H& r Block Is Especially Good For

- Best for taxpayers who want desktop software: With its desktop software, you can prepare as many returns as you like and e-file five of them for no additional cost.

- Individuals and businesses who need the help of a tax professional: H& R Block offers an assisted service, where a tax professional will file for you. Free in-person audit support is also available.

- Expats seeking tax services: H& R Block offers both do-it-yourself and assisted tax services to United States citizens and green card holders who are required to file their US expat taxes every year. Its online software is designed to identify tax benefits specifically for expats.

Read Also: Is 1040paytax Com Real

H& R Block Plans Pricing And Features

H& R Block uses an interview-style tax preparation process that methodically guides you through your federal and state returns, making sure youve entered all sources of income and checked for all appropriate credits and deductions, including commonly missed deductions, along the way.

Whether you have only the barest familiarity with online tax filing or boast years of complex self-prep, you can find a plan or package that fits your needs. Thats the case even if you need to file a Schedule C for self-employment income from freelancing or solopreneurship.

H& R Block has four DIY pricing plans, one hybrid plan with expert assistance at predefined checkpoints throughout the prep process, and a customizable CPA- or EA-aided plan thats a remote version of in-office prep.

Like many tax prep software providers, H& R Block raises its fees as Tax Day approaches. The step-up date varies from year to year and generally isnt revealed well in advance. It pays to begin your return as early in the season as possible, even if you dont yet have all the documentation necessary to complete your return.

On the bright side, H& R Blocks pricing is transparent you know your final price as soon as you select a plan .