Dependent Care Tax Credit

The Oregon Employer Provided Dependent Care Tax Credit has sunset as of December 31, 2015. The Early Learning Division will no longer issue certificates starting with tax year 2016. The Early Learning Division does not give tax advice and we encourage individuals to speak to an accountant or tax consultant for more information.

Tax Credits For Families With Children

Two modest but important tax creditsthe CTC and the Child and Dependent Care Tax Credit help families meet the costs of raising children and the costs of caring for children and other dependents, respectively. These two credits are often confused in the tax policy conversation, but they serve distinct purposes. While Trumps tax plan would increase the CTCalbeit by an unspecified amountit makes no attempt to change the CDCTC, which is dedicated to families care expenses.

The Child Tax Credit

The CTC offers a modest benefit to help families cover the costs of raising a family. Families with children under age 17 are eligible for the CTC and can receive up to $1,000 per child each year.

The CTC is not fully refundable, which means that lower-income families who owe little or no federal income tax do not get its full benefit. Families who earn less than $3,000 during the tax yearsuch as when a parent loses a job or cannot workdo not benefit at all from the credit, and the refundable portion of the credit phases in slowly such that many low-income families receive only part of the . Families do not receive the credit until they file their taxes and receive their annual refund, meaning that they must cover significant child-related expenses upfront. This does not help families that are struggling to cover the cost of necessitiesincluding families with very young children, who need a daily supply of diapers and formula.

The Child and Dependent Care Tax Credit

What Should I Know If I’m Separated Or Divorced

Only the parent who has primary custody can claim the child care tax credit. The rules are similar to those governing the child tax credit and shared custody.

For more ways you’ll get money this year, here’s how you could save money with credits and benefits in 2021. Also, here’s how to opt out of the monthly child tax credit payments.

The editorial content on this page is based solely on objective, independent assessments by our writers and is not influenced by advertising or partnerships. It has not been provided or commissioned by any third party. However, we may receive compensation when you click on links to products or services offered by our partners.

Recommended Reading: How To Buy Tax Lien Properties In California

If You Have A Partner

You must include your partner in your application if you are:

- not married or in a civil partnership, but living together as though you are

Their employment and income will not affect your eligibility if they:

- are or will be absent from your household for more than 6 months

- are a prisoner

You and your partner cannot both have accounts for the same child.

What Should I Know About The 2021 Child And Dependent Care Credit

The child and dependent care credit is a tax break designed mostly to let parents claim expenses from child care. For example, if you’re working and paying for a day care provider now, that expense can be claimed when you file your taxes in 2022.

How is the credit different in 2021? In previous years — including tax year 2020 — the maximum amount you could claim for multiple children was $6,000. Under the new law, you’ll be able to claim up to $16,000 in child care expenses for multiple children and up to $8,000 for one child or dependent alone.

What does that mean? In brief, for the 2021 tax year, you could get 50% back for up to $8,000 of child care and similar expenses .

Before the American Rescue Plan, the child and dependent care credit was nonrefundable, meaning it could reduce your tax bill to zero but you would not receive a refund on anything left over. Now, the credit is fully refundable, meaning that you will receive money for it even if you don’t owe taxes.

Read Also: How Much Taxes Do You Pay On Slot Machine Winnings

What Is The Child Tax Credit Payment Schedule

The expanded child tax credit will be paid out in two distinct phases. Half your child tax credit total will come in advance, divided up in monthly checks, which started July 15 and will continue through December. The other half will be paid out on your 2021 tax return when you file in 2022. The next advance monthly payment will be disbursed on Oct. 15.

How Can Parents Of Newborns Get The Child Tax Credit

If your dependents weren’t reported to the IRS already , you have two options for receiving the child tax credit. First, you could wait until you file your 2021 tax return next spring and receive the entire child tax credit in one lump sum, just like how the former version of the credit worked. For that option, you might have to unenroll in the advance payment program, since those monthly payments are automatic for eligible families. But if you’d like to receive some advance monthly payments before next year’s tax season rolls around, there’s a second option.

The Child Tax Credit Update Portal allows taxpayers to make sure their household information is correct, check payment status and unenroll from the monthly checks. Soon, the portal will let parents report any changes in status that differ from the latest tax return the IRS has on file . The IRS announced that in late summer or early fall, eligible families will be able to use the Update Portal to add more dependents, like babies born or adopted this year.

Because the option to add a new dependent won’t be made available by the IRS until later, parents will have already missed the July, August and September advance payments. However, if they add a new 2021 dependent in time for the October check, they can receive the remaining installments: October, November, December and, of course, the 2022 payment. Let’s walk through a few examples:

Recommended Reading: Have My Taxes Been Accepted

How To Claim The Child Care Tax Credit

- Gather Care Provider Information

- Add Qualifying Care Expenses

- Complete Form 2441

Childcare is an expense that working parents often must pay out of pocket if they want to remain in the workforce. According to one poll conducted in 2019 by Child Care Aware of America, two-income households spent as much as 11 percent of their income on childcare. Compare this to other necessary and variable expenses, such as 8.6 percent of their income on food , and 2.4 percent on gas .

Childcare is expensive, and even more expensive in single-parent households, who spend, on average, around 36 percent of their income on childcare. To make matters worse, Americans of all income brackets have reported that only around 15 percent of the childcare facilities available to them are satisfactory. This puts a strain on parents when it comes to affordable child care that they feel comfortable with. The end solution for many parents is to just give up on pursuing upward career mobility.

For instance, as many as 61 percent of mothers with at least one child under the age of 6 years old said that their decision to remain out of the workforce was due to a lack of affordable and satisfactory childcare. Around 75 percent of postsecondary education dropouts said that they would have continued their educational path if not for a dearth of childcare options. Less than 28 percent of postsecondary students who are also parents complete a degree within a six year time frame.

Do You Share Custody Of A Child

You share custody of a child if the child lives part of the time with you and the rest of the time with another individual at a different address, on a more or less equal basis.

When this is the case, both individuals may be considered primarily responsible for the childs care and upbringing when the child lives with them. Each individual will get 50% of the payment they would have received if the child lived with them all of the time.

Each parent must immediately tell the CRA of their new custody situation using one of the following ways:

- use “Apply for child benefits” in My Account

- send the CRA a completed Form RC66, Canada Child Benefits Application

If you are already eligible and get full benefits for a child, you may also call 1-800-387-1193 or send a letter explaining the shared custody situation.

All payments will be calculated based on each parent’s respective adjusted family net income.

For more information, go to Canada child benefit or call 1-800-387-1193.

You May Like: Have My Taxes Been Accepted

Tax Tips: Claiming Child Care Expenses In Canada

While the pandemic has dramatically changed what child care looks like in Canada, its still a necessity for many working families. Claiming child care expenses lowers your net income and reduces the amount of taxes you need to pay. If youre wondering who can claim expenses and what payments are tax-deductible, read on. Our knowledgeable CPAs can also answer your questions and help you understand changing tax laws.

Need help looking for child care programs in Alberta? The Government of Alberta has a Child Care Lookup tool.

Child And Dependent Care Tax Credit

Unlike the child tax credit , you can use the child and dependent care credit only if you spend money for child care so that you and your spouse, if any, can work. There is no income ceiling on the child and dependent care credit . People with higher incomes get a smaller credit than those with more modest incomes. Here’s how it works.

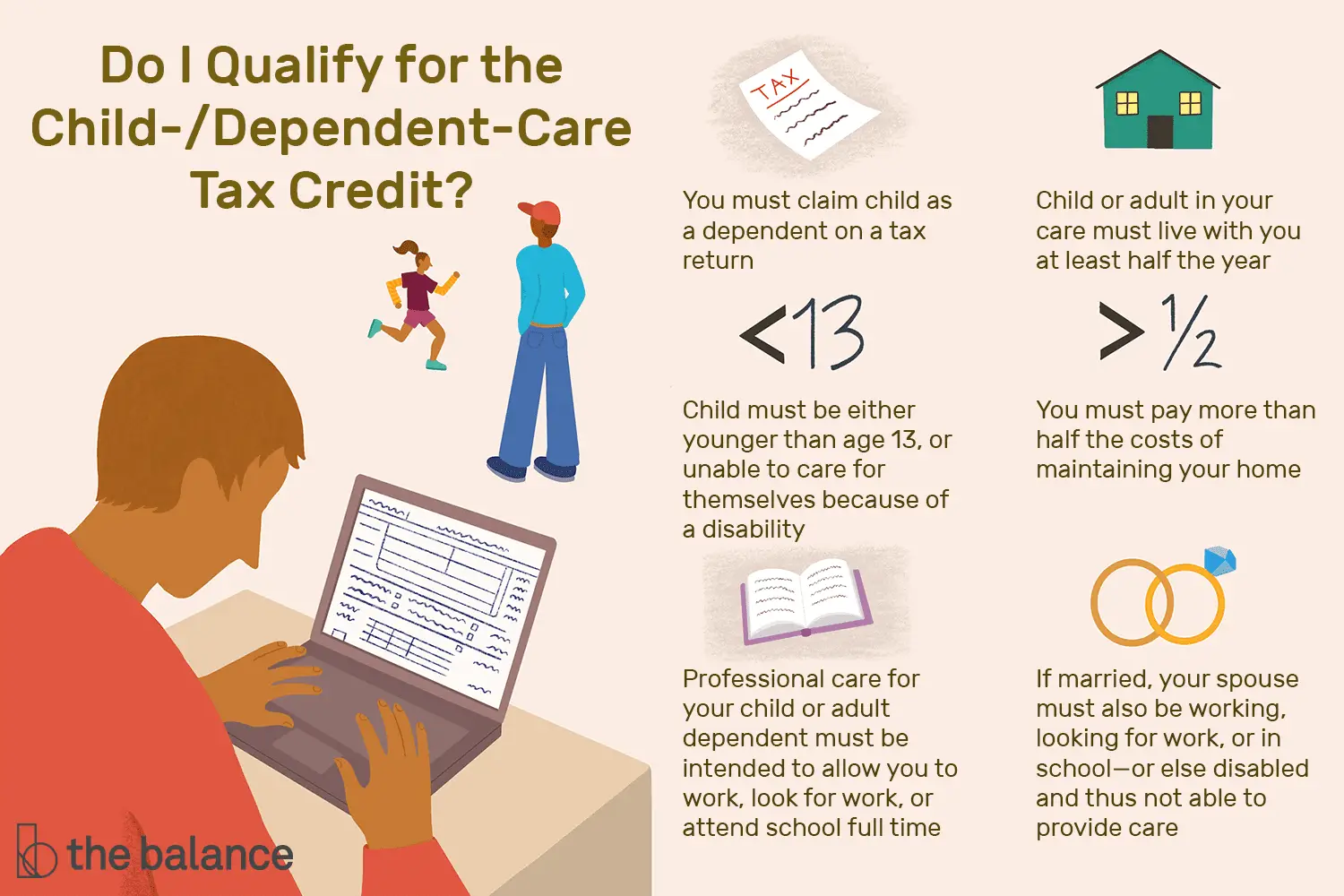

You qualify for the credit if:

- you have a qualifying child or other dependent under the age of 13, or your spouse is disabled and physically or mentally incapable of caring for him or herself, or you have any disabled dependent who has income of less than $4,000 per year

- you incur child care expenses to enable you and your spouse, if any, to earn income

- you and your spouse file a joint tax return , and

- you and your spouse, if any, both work either full or part time and have earned income for the year, unless you or your spouse is a full-time student or disabled.

The amount of the credit is based on a percentage of the child care expenses you incur on the days that you and/or your spouse work. Under the regular rules, the credit is equal to 35% of childcare expenses up to $3,000 for one child, or $6,000 for two or more. But the credit is reduced by 1% for every $2,000 in household income over $15,000, until reaching 20%. Thus, the credit is 20% of childcare expenses if your household income is $45,000 or more.

- babysitting

- nursery school, and

- day camp .

Don’t Miss: How To Buy Tax Liens In California

What If My Childcare Costs Change

The childcare element of tax credits is complicated and working out your costs can be difficult if they change frequently. That means that knowing whether there has been a change of circumstances relating to childcare is not easy.

Note: please see our coronavirus section for information about how fluctuations caused by the impacts of the coronavirus outbreak in the UK affects childcare costs for tax credits.

There is a change of circumstances for childcare costs if:

- Your average weekly childcare costs change by £10 a week or more

- Your costs reduce to nil or childcare stops

You must report changes within one month.

If you have variable childcare costs you will need to work out your expected costs for each child over the next 52 weeks and divide that total by 52 to get a new average weekly cost and compare that to the current cost used on your claim.

If you have fixed weekly childcare costs you will need to work out your weekly costs, and if the figure is different to what you have been claiming by more than £10 a week for 4 weeks in a row, then there is a change to report to HMRC.

You should use the HMRC calculator to help you work out if there has been a change of costs. Failing to report any changes could mean you are overpaid or underpaid tax credits.

The Child Care Tax Credit And Dependent Care Accounts Could Save You Thousands Of Dollars

By Stephen Fishman, J.D.

Every working parent knows that the cost of good child care is expensive and ever-increasing. Luckily, the federal government offers two tax breaks that can help defray some of these costs: the child care credit and dependent care accounts. If you pay for day care, preschool, or a nanny, it pays to learn about these two tax breaks — they could save you several thousand dollars.

Also Check: How To Buy Tax Forfeited Land

What Are Child Care Expenses

1.1 The term child care expense is defined in subsection 63. In general terms, the definition provides that a child care expense is an expense incurred for the purpose of providing child care services for an eligible child of a taxpayer, to enable the taxpayer or a supporting person to undertake specific activities. The taxpayer or supporting person must have resided with the eligible child at the time the expense was incurred in order for the expense to qualify as a child care expense. The requirements in definition are discussed below under the following headings:

- Eligible child

- Expenses to enable the undertaking of specific activities and

- Provider of child care services .

1.2 There are some expenses that might otherwise be child care expenses but that are specifically excluded from the definition of child care expense. These types of expenses are discussed at ¶1.20.

Eligible child

1.3 As noted in ¶1.1, child care expenses must be incurred in respect of an eligible child of the taxpayer. An eligible child of a taxpayer for a tax year is defined in subsection 63 to mean:

- a child of the taxpayer or of the taxpayer’s spouse or common-law partner or

- a child who is dependent on the taxpayer or on the taxpayer’s spouse or common-law partner for support and whose income for the year does not exceed the basic personal amount for the year as provided in paragraph of the description of B in subsection 118.

See the Basic personal amount in the CRAs indexation chart.

How Much Of Your Child Care Expenses Can You Claim

- Canadian taxpayers can claim up to $8,000 per child for children under the age of 7 years at the end of the year.

- $5,000 per child for children aged 7 to 16 years.

- For disabled, dependent children of any age who qualify for the disability tax credit, the amount to claim for that child is $11,000.

- You can claim $5,000 for a disabled child over the age of 16 who does not qualify for the disability tax credit but was still dependent on you and required care.

- For a boarding school or overnight camp, you may only claim up to $200 per week for a child under the age of 7 years, $275 per week for an eligible disabled child, or $125 per week for a child aged 7 to 16 years.

The CRA Form T778 Child Care Expenses Deduction lists these rates, as well as further explanations about claiming childcare expenses.

Also Check: Mcl 206.707

Mybenefits Cra Mobile App

Get your benefit information on the go! Use MyBenefits CRA mobile app throughout the year to:

- view the amounts and dates of your benefit and credit payments, including any provincial or territorial payments

- view the status of your application for child benefits

- change your address, phone number, and marital status

- view information about the children in your care

- sign up for email notifications to receive an email when there is mail to view online in My Account such as important changes made on your account

For more information, go to Mobile apps.

Check Back For Updates To This Page

For the latest updates on coronavirus tax relief related to this page, check IRS.gov/coronavirus. Were reviewing the tax provisions of the American Rescue Plan Act of 2021, signed into law on March 11, 2021.

You may be able to claim the child and dependent care credit if you paid expenses for the care of a qualifying individual to enable you to work or actively look for work. Generally, you may not take this credit if your filing status is married filing separately. However, see Whats Your Filing Status? in Publication 503, Child and Dependent Care Expenses, which describes an exception for certain taxpayers living apart from their spouse and meeting other requirements. The amount of the credit is a percentage of the amount of work-related expenses you paid to a care provider for the care of a qualifying individual. The percentage depends on your adjusted gross income.

Read Also: How To Buy Tax Lien Certificates In California

How Do I Claim The Childcare Element Of Working Tax Credit

The childcare element is part of working tax credit. This means you will need to qualify for working tax credits to get this support towards your childcare costs.

If you are already claiming working tax credit, you should contact HMRC to ask for childcare to be added to your award. You can phone the Tax Credit Helpline or contact HMRC via the tax credits online service on GOV.UK, or write to them and ask for childcare to be added to your claim. You do not need to make a brand new tax credit claim.

If you are not already claiming tax credits, it is unlikely that you will be able to get help with your childcare costs through tax credits. This is because universal credit , which is gradually replacing tax credits and some other benefits, is available across the UK. As a result, HMRC state that most people can now no longer make a brand new claim for tax credits.

When you tell HMRC that you want childcare including in your tax credits award, you will need to include the following childcare information:

- Name, address and phone number of childcare provider

- Providers registration or approval number

- How many hours the child/children attend each provider

- The name of the Local Authority or body who approved your childcare provider

- Your average weekly childcare costs

There are some changes to tax credits during the COVID-19 pandemic that may affect working hours and childcare. You can find out more in our coronavirus guidance section.