Florida Corporate Income Tax Rate Temporarily Reduced

The Florida Department of Revenue recently issued guidance that the Florida corporate income/franchise tax rate has been reduced to 3.535% from 4.458% starting January 1, 2021, but before January 1, 2022. On or after January 1, 2022, the tax rate will return to 5.5%.

For 2022 estimated tax payments, interest and penalties are not imposed on payments that meet:

- The standard requirement of 90% of the tax due in the current year, after credits or

- 100% of the tax due in the prior year in the current years tax rate

Since the 2022 corporate income tax rate reverts to 5.5%, the prior year exception for tax years beginning with the 2022 calendar year is based on the tax due from the preceding years income using the 5.5% tax rate. Therefore, FDOR advises taxpayers to recompute the prior years tax due using a 5.5% tax rate to determine the installment required for meeting the previous years exception for 2022 state corporate income tax estimated tax payments. .

Distinguishing Goods From Nontaxable Items

Since services and intangibles are typically not taxed, the distinction between a taxable sale of tangible property and a nontaxable service or intangible transfer is a major source of controversy. Many state tax administrators and courts look to the “true object” or “dominant purpose” of the transaction to determine if it is a taxable sale. Some courts have looked at the significance of the property in relation to the services provided. Where property is sold with an agreement to provide service , the service agreement is generally treated as a separate sale if it can be purchased separately. Michigan and Colorado courts have adopted a more holistic approach, looking at various factors for a particular transaction.

According To The Florida Department Of Revenue As Of 2010 Florida Has A 6 Percent State Sales Tax Which Is Applied To Most Consumer Goods Including Recreational Vehicles

Florida does not have a state income tax. Sales tax return changes the sales tax return has changed for the 2020 tax year. If the rate imposed in the purchasers home state is greater than 6%, the rate of florida tax to be collected is 6%. The latest sales tax rate for venice, fl. No discretionary sales surtax is due. Special reporting instructions for sales or leases of motor vehicles rcw 82.14.450 provides an exemption from the public safety component of the retail sales tax approved by voters in a city or county.

This means that a $20,000 vehicle in oklahoma would cost an additional $2,300. Florida collects a six percent sales tax on the purchase of all new or used vehicles. The failure to do so could result in a devastating assessment down the line. The 2018 united states supreme court decision in south dakota v. For the purposes of the motor vehicle sales and use tax collection, gross sales price includes the dealer processing fee.

What is the tax on it and what is the total price ? 33902, 33905, 33906, 33907, 33908, 33912, 33913, 33919, 33965, 33966, 33967 and 33994. Learn how to calculate sales tax by following these examples: The latest sales tax rate for venice, fl. The fort myers, florida sales tax rate of 6.5% applies to the following twelve zip codes:

Recommended Reading: Plasma Donation Taxable Income

Florida Sales Tax Exemptions For The Manufacturing Industry

Florida offers generous exemptions to manufacturers. New machinery and equipment are not subject to Florida sales tax. Repair parts and labor to that machinery and equipment are also exempt. Utilities including electricity and natural gas consumed in production are exempt from Florida sales tax. Utility usage may be apportioned based upon taxable and non-taxable usage. Material handling equipment including forklift and cranes may qualify for an exemption if theyre used in the production process. Similar to utility usage, charges for the material handling equipment may be apportioned. Labor is exempt from Florida sales tax provided that no tangible personal property is transferred during the transaction. While the sales tax exemptions offered by Florida are many, gathering supporting documentation is often the challenge particularly when usage must be apportioned. Agile Consulting Groups sales tax consultants have worked hundreds of sales tax audits for Florida manufacturers and are able to leverage that experience to maximize potential sales tax savings for our clients.

Ocala Florida Sales Tax Rate

ocala Tax jurisdiction breakdown for 2021

What does this sales tax rate breakdown mean?

Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more.

Need the exact sales tax rate for your address?

What is the sales tax rate in Ocala, Florida?

The minimum combined 2021 sales tax rate for Ocala, Florida is . This is the total of state, county and city sales tax rates. The Florida sales tax rate is currently %. The County sales tax rate is %. The Ocala sales tax rate is %.

Did South Dakota v. Wayfair, Inc affect Florida?

The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. To review the rules in Florida, visit our state-by-state guide.

Did COVID-19 impact sales tax filing due dates in Ocala?

The outbreak of COVID-19 may have impacted sales tax filing due dates in Ocala. Please consult your local tax authority for specific details. For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance.

Automating sales tax compliance can help your business keep compliant with changing sales tax laws in Florida and beyond. AvaTax delivers real-time sales tax rates and uses advanced technology to map rates to exact address locations, based on the latest jurisdiction requirements.

You May Like: How To Get Tax Preparer License

Florida Sales Tax Exemptions For The Healthcare Industry

Florida sales tax law divides hospitals in to two distinct categories. Facilities that are registered as 501 nonprofit, educational or charitable entities are free to purchase materials, supplies and most services without paying Florida sales tax. In order to qualify for this Florida sales tax exemption, a DR-5 Application for a Consumers Certificate of Exemption must be filed with the Florida Department of Revenue. If the entity meets the requirements, the Florida Department of Revenue will issue a DR-14 Consumers Certificate of Exemption which can be distributed to vendors and suppliers in lieu of paying Florida sales tax. For Florida for profit hospitals, a number of items may be purchased tax free based upon the characteristics or use of the item in question. For example, major categories of tax exempt items for Florida for profit hospitals include: hypodermic needles & syringes, medical gases and prescription drugs, chemical compounds and test kits, prosthetic and orthopedic appliances used to replace, substitute or alleviate the malfunction of any body part, items temporarily or permanently incorporated into a patient, and prescription-required single-use medical products.

Car Sales Tax For Trade

The value of your trade-in vehicle is not subject to sales tax. Imagine that you receive $7,000 for your trade-in. You then apply the $7,000 credit to a $14,000 new car purchase. The trade-in credit reduces the cost of your new car to $7,000. In this case, you then pay sales tax on the $7,000 new vehicle price.

Recommended Reading: Do I Have To File Taxes For Doordash If I Made Less Than $600

Corporate Return Filing Deadlines Extended

The Florida Department of Revenue has issued Emergency Order 20-52-DOR-003 which extends the original filing and payment due dates for corporate returns as follows:Corporate Taxpayers with a Fiscal Year Ending December 31, 2019:

- Tax return filing deadline are extended from May 1 until August 3.

- Tax payment deadline are extended from May 1 until June 1.

- The deadline to submit a request for extension to time to file and make a tentative payment is extended from May 1 until June 1.

Corporate Taxpayers with a Fiscal Year Ending January 31, 2020:

- Tax return filing deadline are extended from June 1 until August 3.

- Tax payment deadline remains June 1.

- The deadline to submit a request for extension in time to file and make a tentative payment remains June 1.

Corporate Taxpayers with a Fiscal Year Ending February 29, 2020:

- Tax return filing deadline are extended from May 1 until August 3.

- Tax payment deadline remains July 1.

- The deadline to submit a request for extension to time to file and make a tentative payment remains July 1.

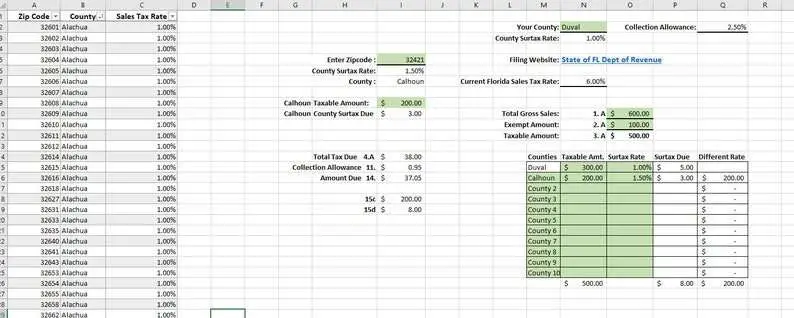

Sales Tax Reporting And Deposits

Once it has been determined that an activity will give rise to sales tax, the department will need to determine if the or sales tax rate will be used and in which Florida county the activity took place in order to collect the correct amount of sales tax from the customer. Once the taxable activity has occurred and the department has collected the payment, the department should deposit the sales tax collected at the Cashiers Office, located at SASC 101, within 48 hours. The sales tax amount should be deposited in Department Number 110401000 using Activity Number 1104120007. The department will select one of the sales tax liability general ledger accounts listed below, depending on which is the most appropriate.

Departments with sales tax related activities are responsible for ensuring the appropriate sales tax is charged at the time of sale, collected, and deposited into the correct University account. The Tax Compliance Section of the Controllers Office is responsible for remitting the sales tax monthly by the 20th of the following month.

You May Like: 1040paytax.com

Other Taxes And Fees Applicable To Florida Car Purchases

In addition to state and local sales taxes, there are a number of additional taxes and fees Florida car buyers may encounter. These fees are separate from the sales tax, and will likely be collected by the Florida Department of Motor Vehicles and not the Florida Department of Revenue.

Title Fee: Registration Fee: Plate Transfer Fee:

Average DMV fees in Florida on a new-car purchase add up to $1811, which includes the title, registration, and plate fees shown above.

Florida Remote Seller Bill Signed Into Law

Florida Governor Ron DeSantis has signed legislation requiring marketplace providers and out-of-state retailers with no physical presence in Florida to collect sales tax on sales of taxable items delivered to purchasers in Florida, if the marketplace provider or out-of-state retailer make sales exceeding $100,000 during the previous calendar year. Every person making a substantial number of remote sales is a dealer required to register to collect sales and use tax. Dealer includes a retailer who transacts a substantial number of remote sales or a marketplace provider that has a physical presence in Florida or that makes or facilitates through its marketplace a substantial number of remote sales. Retail sale for purposes of the sales and use tax is amended to include sales facilitated through a marketplace. For further details, please see S.B. 50, enacted 04/19/21.

Also Check: How To Buy Tax Liens In California

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

Florida Tax Deed Sales: Complete List Of Upcoming Sales By County

In this guide, Ill break down what you need to know about tax deed sales for every single county in Florida, as well as the important sale dates and the process for bidding within each county.

But before jumping into that..lets go over the basics.

The first thing you need to know about Florida is that it is a mixed state that has bothtax liens andtax deed auctions.

Also Check: 1099 Nec Doordash

Florida Sales Tax Registration

New businesses can register online by visiting . Alternatively, you can complete a paper version of the Florida Business Tax Application which can be . The form can be mailed to the address shown on the last page of the form, or delivered to a FL Department of Revenue taxpayer service center.

When you register for a sales tax permit in Florida, you will receive several documents. These include:

- Certificate of Registration This form authorizes you to conduct business at the address shown on the form. It should be visibly and clearly displayed at your place of business.

- Florida Annual Resale Certificate for Sales Tax This is the form you must provide when you make purchases of items that are normally taxable goods, but which when purchased for a business to resell. This form is reissued yearly.

- Sales Tax Rate Table shows the state tax plus local discretionary tax on a county-by-county basis

See the Florida Department of Revenue website to:

- using the Department of Revenues secure web application or

- using software from an approved vendor.

- If sales & use tax revenue totals less than $20,000 per year, you may report using paper Sales and Use Tax Return however electronic filing is encouraged. See instructions here.

You are required to file at the following frequency, depending on the amount of sales tax collected:

- More than $1000: Monthly

- $101-500: Semiannual

- $100 or less: Annual

Important Information For Pasco Residents

Sales tax is collected by the Florida Department of Revenue and NOT the local tax collector’s office. However, as of January 1, 2019, Hillsborough County’s overall sales tax has increased to 8.5%. Pasco County’s sales tax has not changed and remains 7%. Therefore, if you live in Pasco County, your sales tax rate remains 7%. If you are unsure of what county you live in, the Department of Revenue has an online tool to help. Please see the link below.

Sales tax has many important purchase implications based on where a person physically lives, especially with the purchase and registration of a vehicle. We at the Pasco Tax Collector’s Office want to be sure you are being charged correctly.

Read Also: Doordash Payable Account

Do I Have To Pay Sales Tax On A Used Car

Florida is one of the best states to purchase a used car because of its large inventory and quality of used cars. Purchasing a used vehicle can help you lower the cost of purchasing a new car, but it wont decrease the tax percentage you owe. You must still pay sales tax on a used car in Florida. The sales tax rate is the same for new and used vehicles. However, since used vehicles are less expensive overall, you can often expect to pay fewer dollars in taxes.

Which States Don’t Tax Retirement Distributions

Twelve states do not tax retirement distributions. Illinois, Mississippi, and Pennsylvania don’t tax distributions from 401 plans, IRAs, or pensions. The remaining nine states are those that don’t levy a state tax at all: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming. Alabama and Hawaii also don’t tax pensions, but they do tax distributions from 401 plans and IRAs.

Read Also: Www.1040paytax.com Review

How 2021 Sales Taxes Are Calculated In Miami

The Miami, Florida, general sales tax rate is 6%. Depending on the zipcode, the sales tax rate of Miami may vary from 6% to 7%Every 2021 combined rates mentioned above are the results of Florida state rate , the county rate . There is no city sale tax for Miami. There is no special rate for Miami.The Miami’s tax rate may change depending of the type of purchase.Please refer to the Florida website for more sales taxes information.

Florida Sales Tax On The Horizon For Out

Proposed Florida bill would require out-of-state sellers with $100,000 in annual taxable sales in Florida to collect and remit sales tax. Also impacted would be marketplace providers and large e-commerce platforms such as Amazon, who would similarly be required to collect and remit taxes on behalf of online retailers using their platforms.

Don’t Miss: Internal Revenue Service Tax Returns

How To Calculate Florida Sales Tax On A Car

Find the sales tax percentage for your location, as this may increase the total sales tax fee to over the base amount of 6%. Then, youll multiply the cost of the vehicle by the sales tax percentage.

Lets say in your location the sales tax is at the base of 6%. Imagine you purchased a vehicle from a trade-in. The full price was $30,000, but you received a trade-in value of $5,000, a manufacturers rebate of $500, and a dealer incentive of $1,000. You would pay $23,500 for the vehicle.

In this case, Florida collects a 6% sales tax on $24,000. $24,000 is the advertised price minus the dealer incentive and trade-in allowance. This price does not factor in the manufacturers rebate. Based on this example, you would need to pay $1,440 in sales tax.

Remember that the total amount you pay for a car not only includes sales tax, but also registration, and dealership fees.

How Income Taxes Are Calculated

When Do We Update? – We regularly check for any updates to the latest tax rates and regulations.

Customer Service – If you would like to leave any feedback, feel free to email

…read more

Jennifer Mansfield, CPATax

Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. SmartAssets tax expert has a degree in Accounting and Business/Management from the University of Wyoming, as well as both a Masters in Tax Laws and a Juris Doctorate from Georgetown University Law Center. Jennifer has mostly worked in public accounting firms, including Ernst & Young and Deloitte. She is passionate about helping provide people and businesses with valuable accounting and tax advice to allow them to prosper financially. Jennifer lives in Arizona and was recently named to the Greater Tucson Leadership Program.

…read more

Recommended Reading: How Do I Protest My Property Taxes In Harris County