When To File Your Small Business Taxes

Corporations must make estimated tax payments on the 15th day of the fourth, sixth, ninth and 12th month of its fiscal year. Owners of pass-through businesses must make estimated tax payments, which are generally due April 15, June 15, Sept. 15 and Jan. 15 of the following year. If any of those dates fall on a weekend or legal holiday, the due date moves to the following business day.

Some payroll, accounting or tax preparation software will estimate the businesss tax liability and send estimated tax payments to the IRS on their behalf. Just make sure to regularly set money aside for taxes, so its available when payments are due.

Double Taxation For Small Businesses

California imposes higher-than-average state income taxes on business and personal income. However, this is not the worst part. California is one of the few states that imposes both taxes, business and personal, on small business owners who set up their businesses as pass-through entities, such as S corporations or limited liability companies .

Businesses formed using these designations avoid federal income tax because the income they earn passes through to the business owners. The federal government considers it double taxation to tax both the business owners on the pass-through income and the business itself, so it taxes only the business owners at personal income tax rates. While most states follow the same philosophy, California stands out as one that hits these business owners from both sides.

Depending on several factors, including the net income of a pass-through entity and the amount of personal income derived from the business by its owners, this double taxation imposed by California can as much as double a small business owner’s tax burden. Considering the state also has a very high cost of living, the tax treatment of small businesses in California can make it difficult for an entrepreneur to get his venture off the ground.

Lower Corporate Tax Rate

Starting in 2018, corporations pay a flat tax of 21% on all their profits. The 21% rate is lower than the top five individual income tax rates, which range from 22% to 37%. The benefit of the lower rates is largely lost due to double taxation if corporate profits are distributed to the shareholders, who must pay individual income tax on such dividends. However, many corporations want or need to retain some profits in the business at the end of the year — for instance, to fund expansion and future growth. If it does, that money will be taxed only once, at the 21% corporate income tax rate. Thus, a corporation’s owners can save money by keeping some profits in the company.

In contrast, owners of sole proprietorships, partnerships, and LLCs must pay taxes on all business profits at their individual income tax rates, whether they take the profits out of the business or not.

The IRS will allow you to leave profits in your corporation, up to a limit: Most corporations can safely keep a total of $250,000 in the corporation without facing tax penalties .

You May Like: How Does Doordash Do Taxes

How Income Tax Works

The amount of income tax your business has to pay, depends on your taxable income. Its calculated from your assessable income less any deductions.

- Assessable income is generally income your business earns. It includes all gross income from your everyday business activities as well as other income that is not part of your everyday business activities, for example capital gains. It does not include GST payable on sales you make, or GST credits

- are amounts you can claim for expenses involved in running your business.

You must for any year you run your business. You need to lodge even when you dont expect youll owe tax.

See the Australian Taxation Office for more information on income and deductions for business owners.

How Much Income Can A Small Business Make Without Paying Taxes

Virtually all businesses have to file a tax return, but whether they actually owe taxes on that return and what kind of taxes depend on several factors.

Tax rates and at least one deduction depend on whether your business is a “pass-through” tax entity. Income and deductions trickle down from these small business structures to be reported by their owners or shareholders on their personal returns something you might want to consider if you’re starting a business for tax purposes. Technically, it’s not the business itself that pays taxes in this case, but taxes are paid all the same.

Video of the Day

Pass-through businesses include sole proprietorships, partnerships, LLCs and S corporations. C corporations are separate tax entities subject to their own tax rates.

Recommended Reading: How Does Doordash Do Taxes

Income Tax Rates For Pass

The federal small business tax rate for pass-through entities and sole proprietorships is equal to the owners personal income tax rate. For the 2019 tax year, personal income tax rates range from 10% to 37% depending on income level and filing status. For example, a single filer who reports $100,000 in net business income will pay a 24% tax rate.

Its important to note, however, as of the 2018 tax year, sole proprietors and owners of pass-through entities can deduct up to 20% of their business income before their tax rate is calculated. In the above example, the tax filer could deduct up to $20,000 from the net business income. Then, theyd only have to report $80,000 in income, reducing their tax rate to 22%.

There are limits, however, on this small business tax deduction based on income and type of business. In general, you must earn less than $157,500 or $315,000 to qualify for the full deduction. Additionally, professional service businesses, such as law firms and doctors offices, typically cant claim the full deduction either.

How Dividends Are Taxed In Canada

In the past month, Ive had countless clients ask me to explain how dividends are taxed in Canada. This has inspired me to write this article to explain to the average person how dividends are taxed in Canada. I think youll be surprised at how straight-forward it is.

To keep this simple, we will be looking at Federal taxation only. With that being said, it works the same way for Provincial taxation except that the rates are different. Also, this article is meant for general information purposes. It is not a substitute for your own research and analysis. It does not make you qualified to deal with corporate taxation matters. There is no substitute for consulting with an online accountant when it comes to tax matters.

Don’t Miss: Buying Tax Liens In California

Determining Your Small Business Taxable Income

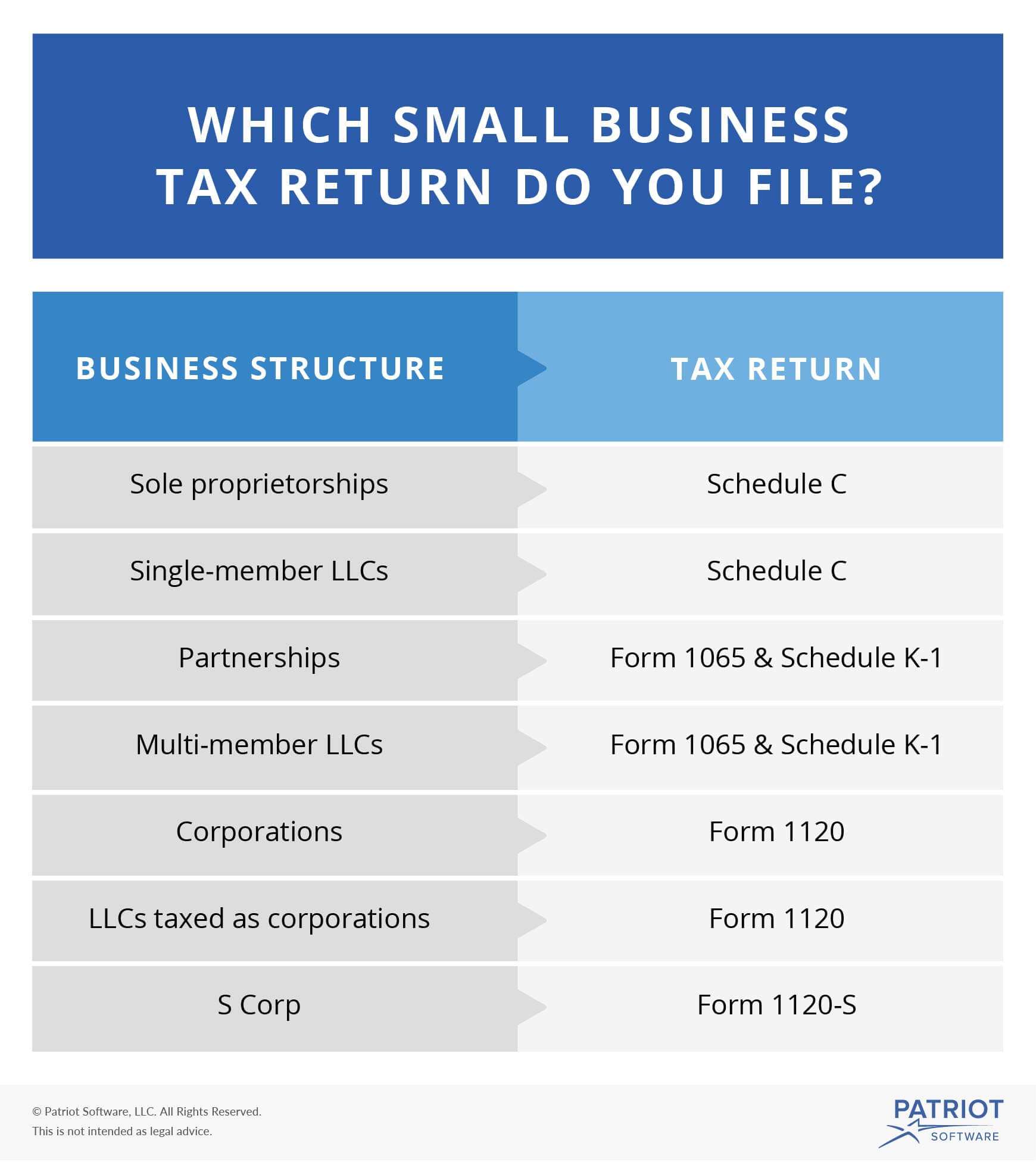

For sole proprietorships, the most basic and easy business entity to set up, determining how much tax is due starts with completing a Schedule C that will be submitted along with your personal Form 1040 tax return. This form reports your income and allowable business deductions or write-offs and results in your calculated net business income. Obviously, if you arrive at a negative number, then you have had a business loss, which might be able to be used to offset other income.

Instead of filing a Schedule C, owners of partnerships and S corporations are required to file a separate tax return to report income and expenses of the business. These returns are considered informational and no tax is calculated on them. Owners will receive a K-1 form that shows that owners individual share of the business profits.

Remember that business expenses could include a home office or workspace. This permits you to deduct a percentage of your rent or mortgage interest, utilities, property taxes, and insurance equal to the percentage of your homes square footage that you use only for business purposes. Additional write-offs can include tools, supplies, vehicle expenses, advertising costs, legal costs, and telephone and internet expenses.

The total remaining net income after these subtractions is your business income, which is transferred from your Schedule C or K-1 to your personal tax return .

How Can Small Businesses Maximize Tax Deductions

Although you may not have much control over the rate at which your business is taxed, you can save money by claiming relevant tax deductions.

In 2018, the Tax Cuts and Jobs Act went into effect, granting pass-through entities the ability to deduct 20% of their qualified business income. Scholl identified a few other ways the TCJA tax reform can help small business owners save money.

“With 100% bonus depreciation and increased Section 179 expensing in 2019, you can make significant purchases of equipment, machinery, and furniture and write off 100% of the value,” said Scholl. “More businesses can use the cash basis method of accounting the old limit was gross receipts up to $5 million and now up to $25 million average annual gross receipts.”

To qualify as a deduction, a business expense must be both ordinary and necessary. The IRS states that an ordinary expense is one that is common and accepted in the trade or business, and a necessary expense is one that is helpful and appropriate for your trade or business.

There are several deductions that many business owners overlook. Scholl listed the following deductions as possible tax breaks that business owners may be able to take advantage of:

There are rules and exceptions for all of these deductions. A financial advisor can help you determine what you qualify for.

You May Like: Can Home Improvement Be Tax Deductible

Tax Refunds For New Businesses

If you started a business during the year, you may be able to take some additional tax deductions for your startup expenses. The IRS considers start-up costs as capital expenses, which means they must be spread out over several years. But you can deduct some expenses in the first year: up to $5,000 of startup costs and up to $5,000 of organization expenses .

How Much Can A Small Business Make Before Paying Taxes

All businesses must submit an annual income tax return, according to the IRS. The exception is partnerships, which have to submit an information return instead. And if you have employees, employment taxes are mandatory.

Business owners who earn less than $400 can skip paying the self-employment tax. But thats the only tax you can avoid.

Thankfully, the IRS probably wont be interested in auditing your small business until you turn a profit. But its important to still file your taxes even if youre sustaining losses in order to take advantage of deductions and avoid legal issues down the line.

Also Check: How Does Doordash Do Taxes

Maximize Your Flexibility As A Small Business Owner

Setting up and operating a small business can come with significant initial costs.

Whether youre flying solo or working with partners, the tax system is set up to help offset those potentially high costs for self-employed professionals at tax season. Maximizing tax deductions by writing off startup and operating costs can limit your tax liability in relation to your business income.

Having quality small business tax software can guide you. As a new business owner, it also helps to work with a tax professional to avoid common pitfalls like underreporting your business expenses or ignoring an important tax form that can save you money.

This content is for information purposes only and should not be considered legal, accounting or tax advice, or a substitute for obtaining such advice specific to your business. Additional information and exceptions may apply. Applicable laws may vary by state or locality. No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customers particular situation. Intuit Inc. does not have any responsibility for updating or revising any information presented herein. Accordingly, the information provided should not be relied upon as a substitute for independent research. Intuit Inc. does not warrant that the material contained herein will continue to be accurate nor that it is completely free of errors when published. Readers should verify statements before relying on them.

Get Tax Help After Hours

As a small business owner, you’re often dealing with administrative work like taxation outside of business hours. Get help with a range of tax issues from the ATO at a time that suits you.

Small Business Assist provides online guidance and tax information. For a more personalised and secure experience, use the call-back service.

Recommended Reading: How To File Uber Taxes On Taxact

How To Count Paid Wages

Wages count toward this cash back incentive only if they apply to the FICA tax, which is the U.S. federal payroll tax, and wages paid to a business owner’s relatives are not eligible. Though money used for hiring bonuses to compete with the likes of and McDonald’s can count as eligible wages for the ERC.

The first economic relief package did not allow businesses receiving Paycheck Protection Program loans to claim the ERC, but now they can as long as they exclude any PPP loan money used to pay wages, and importantly, have not applied for PPP loan forgiveness. In effect, employers have a choice as to whether they apply for forgiveness on the PPL loan or ERC. If they apply for forgiveness and are denied, they can still apply for the ERC after. And in addition, any wages outside those paid for from PPP loan funds are still eligible for the ERC.

Fact : The Multitude Of Business Types Encourages Inefficient Tax Avoidance

Its no surprise that business owners seek to minimize the taxes they owe. The array of different business entities to choose from and the flexibility in determining whether business owners income is distributed as profits, wages, or capital gains provides considerable opportunities to structure a business to reduce tax. Because each of these sources of income may be taxed at different rates, business owners spend considerable time and cost in efforts to structure their activities to minimize taxes.

Figure 7 provides one dimension of how these distortions affect how income is distributed to owners. Owners of small C-corporations tend to take all of their income in the form of labor earnings , which is deductible to the firm, reducing their corporate income close to zero. Because wages are taxed at a top rate of about 43.4 percent, the resulting tax bill is substantially lower than the 50.5 percent rate they would face if they first payed the corporate tax and then paid individual tax on the dividends.

You May Like: Www.1040paytax

How The Tax Credit Works

The ERC started with first federal Covid economic relief package, and it is was recently expanded to give businesses the opportunity to claim more money back from wages they paid to employees in 2020 and 2021. Businesses can get money for wages paid through the end of 2021 and retroactive payments for 2020 wages.

Eligible businesses can claim up to 70% back on up to $10,000 in wages paid to employees, or a maximum amount of $7,000 per employee for each quarter of the calendar year. It adds up to a potential total of $28,000 in cash back per employee annually.

The Employee Retention Credit is geared towards small and midsize businesses because you currently need to have 500 employees or less to be eligible. On top of the employee threshold, businesses currently need to see a 20% reduction in gross receipts in one 2021 quarter compared to the same quarter in 2019, or if they didn’t see this reduction, businesses would need to have been partially or fully shut down by government during the quarters for which they are claiming the ERC. The 2020 CARES Act legislation required gross receipts in a calendar quarter below 50% of gross receipts when compared to the same calendar quarter in 2019 to qualify.

Gst/hst When You Buy A Business

For GST/HST purposes, if you buy a business or part of a business and acquire all or substantially all of the property that can reasonably be regarded as necessary to carry on the business, you and the vendor may be able to jointly elect to have no GST/HST payable on the sale by completing Form GST44, Election Concerning the Acquisition of a Business or Part of a Business. You cannot use this election if the seller is a registrant and you are not a registrant. In addition, you must buy all or substantially all of the property, not only individual assets.

For the election to apply to the sale, you have to be able to continue to operate the business with the property acquired under the sale agreement. You have to file Form GST44 on or before the day you have to file the GST/HST return for the first reporting period in which you would have otherwise had to pay GST/HST on the purchase.

Even when you use the election, GST/HST will still apply to a taxable supply of a service made by the seller a taxable supply of property made by way of lease, licence, or similar arrangement and, if the buyer is not a GST/HST registrant, a taxable sale of real property.

Recommended Reading: Efstatus.taxact.xom

Tax Advantages For Small Business

While not a total tax bargain like some of the Sun Belt states, such as Texas and Florida, Oregon confers several tax advantages to small business owners that paint it in a favorable light, especially compared to California. Business owners in California are frequently assessed hefty taxes on business income and personal income derived from the business. In Oregon, by contrast, business owners pay one or the other. Moreover, personal income taxes in Oregon tend to be lower than in California, especially for high earners.

Until 2020 , Oregon had only one type of tax on businesses, and for the most part, it is only imposed on corporations and limited liability companies that elect to be treated as corporations. Most small businesses are set up as S corporations, LLCs not treated as corporations, partnerships, and sole proprietorships, meaning their business taxes in Oregon, if applicable at all, are minimal.