New Jersey State Tax Calculation

| Take Home Pay for 2022 |

|---|

| $487,054.85 |

We hope you found this salary example useful and now feel your can work out taxes on $830k salary, if you did it would be great if you could share it and let others know about iCalculator. We depend on word of mouth to help us grow and keep the US Tax Calculator free to use.

How To Stay In A Lower Tax Bracket

You can reduce your tax bill with tax deductions and tax credits. Another way to reduce your taxable income, and thus stay in a lower tax bracket, is with pre-tax deductions.

A pre-tax deduction is money your employer deducts from your wages before withholding money for income and payroll taxes. Some common deductions are:

- Contributions to a 401 plan

- Contributions to a Flexible Spending Account

Returning to the example above, lets say you decide to participate in your employers 401 plan and contribute $1,500 per year to your account. Now, your taxable income is $39,000 contribution + $1,700 in other income $12,500 standard deduction). You remain in the 12% tax bracket while saving for retirement. Its a win-win.

For 2020, you can contribute up to $19,500 to a 401 plan. If youre age 50 or above, you can contribute an additional $6,500 in catch-up contributions, for a total of $26,000. In 2021, the contribution limit will remain at $19,500, or $26,000 if youre age 50 or older.

If youre self-employed or dont have access to a 401 plan at work, you can still reduce your taxable income while saving for retirement by contributing to a Traditional IRA or through a broker or robo-advisor like SoFi Invest. These contributions reduce your AGI because they are above-the-line deductions .

For 2020, you can contribute up to $6,000 to a Traditional IRA . The contribution limits are the same for 2021.

What Is The Income Tax Rate For 2020

The federal income tax has seven tax rates for 2020: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37 percent. The amount of federal income tax an employee owes depends on their income level and filing status, for example, whether theyre single or married, or the head of a household. You can find your 2019 and 2020 federal income tax rate based on your filing status by using the IRS income tax rates and brackets.

RELATED ARTICLES

Also Check: Do You Report Roth Ira Contributions Your Tax Return

Other Notable Taxes In Texas

Texas has an oyster sales fee. Shellfish dealers in Texas are required to pay a tax of $1 per 300 pounds of oysters taken from Texas waters.

- Cameron County, Texas is located at 26.15° North, and contains the most southern point along the US-Mexico border.

- Three of the ten most populous cities in the country are in Texas.

- In 2014, Texas produced more oil than any country in the world except Saudi Arabia.

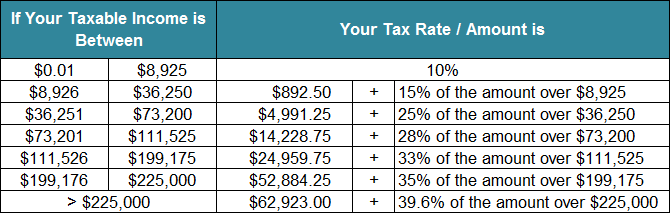

Tax Rates And Brackets

| Tax rate |

|---|

| $311,026 and more |

Federal income tax is progressive, so your taxable income can fall into more than one tax bracket. The highest tax bracket that applies to your income determines your marginal tax rate. For each tax bracket and filing status, calculating federal tax means applying the tax rate for that bracket to the portion of your taxable income that falls within the bracket thresholds, plus any additional amount of tax associated with that bracket.

Heres an example of how federal income tax calculation works.

If youre a single filer with taxable income of $9,000, your marginal tax rate is the lowest 10% because your total taxable income falls within the threshold for the lowest tax bracket.

But what if youre a single filer earning taxable income of more than $518,401? Your marginal tax rate is the highest , because $518,401 is the lowest threshold amount for that tax bracket, which is the final one your income falls into. But only the portion of your income that exceeds $518,400 will be taxed at 37%. All the lower tax brackets also apply to the portions of your income that fall within those brackets – the 10% rate applies to the first $9,875 of your taxable income, 12% to the next $30,249 and so on.

Don’t Miss: Do Roth Ira Contributions Need To Be Reported On Taxes

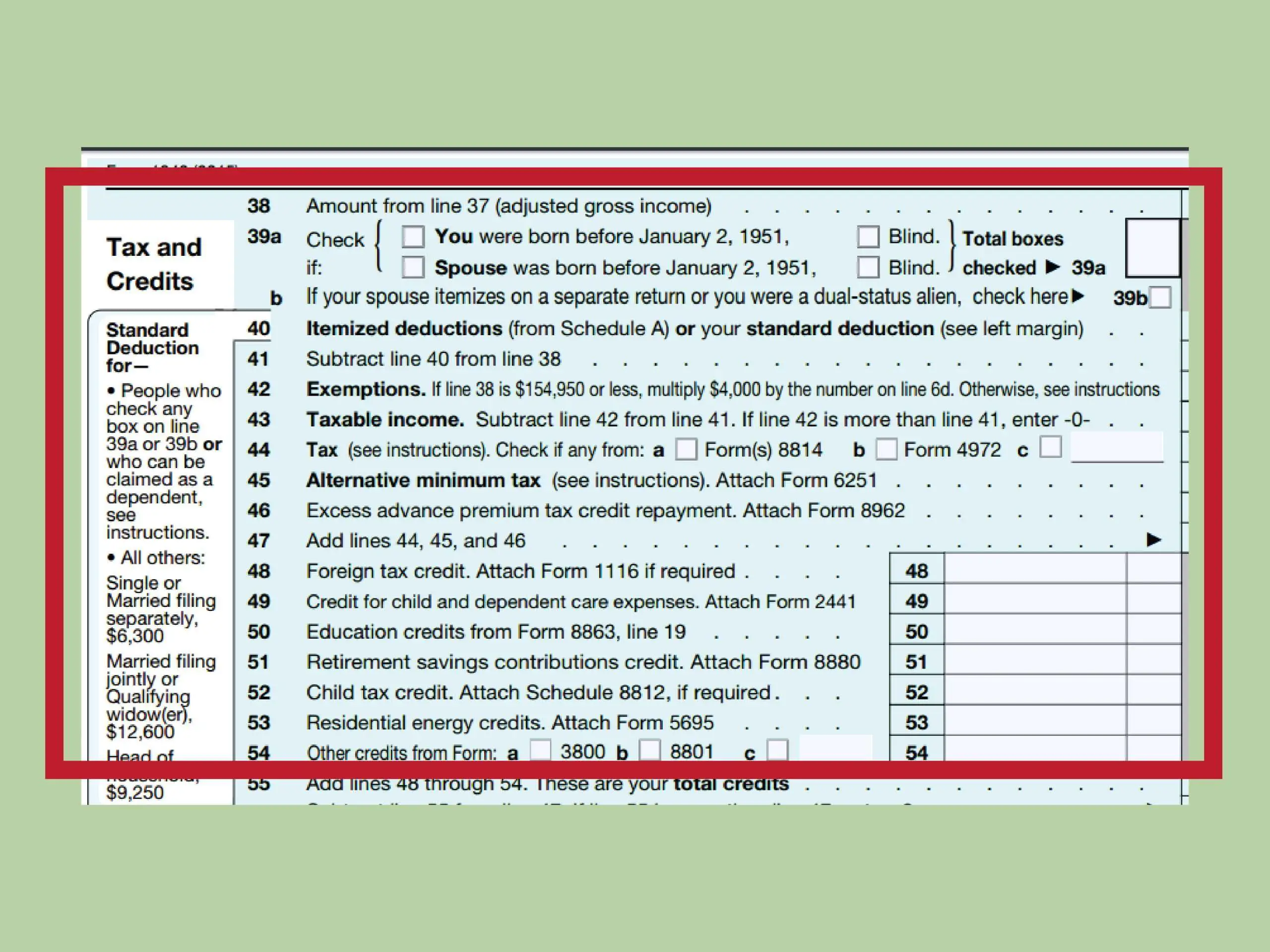

How To Calculate Taxable Income

Arriving at your taxable income requires a bit of arithmetic. Begin with your gross income, which is all the money you earned during the tax year: income from jobs, from owning a business, retirement withdrawals, Social Security), rents, and/or investment earnings.

Next up: determining your adjusted gross income . These are adjustments taken before any deductions are applied. These may include student loan interest, moving expenses, alimony you paid, tuition and fees, as well as contributions to a traditional IRA, among others. Subtract these expenses from your gross income to arrive at your AGI.

Finally, apply deductions.

Again, you may itemize your deductions by listing eligible expenses, or you may take the standard deduction. Everyone qualifies for the standard deduction, but if you think your allowable deductions exceed the standard deduction youre paying a lot in home mortgage interest your property or state income taxes are high medical expenses take a big bite out of your budget it would be make sense to take the time to itemize your deductions and see if it exceeds the allowable standard deduction.

The standard deduction for the 2020 tax year, due May 17, 2021

- Single filers: $12,400

- $12,400

- Heads of households: $18,650

Once of all that is calculated and subtracted from your AGI, youve arrived at your taxable income. But calculating how much you will pay in taxes isnt as simple as taking that number and multiplying it by your tax rate.

Canadian Income Tax Brackets

Tax Brackets are ranges of income that determine how much tax you will have to pay on the income in that bracket. Each bracket has a lower and upper limit as well as a tax rate.

If you earn more than the lower limit, you will have to pay that tax rate on any additional income up to the upper limit. Any amount beyond the upper limit will be taxed based on the next tax bracket. Each province has their own set of tax brackets, which can differ from the federal tax brackets.

For example, if you earn $80,000, you will be in the $49,020 to $98,040 tax bracket with a tax rate of 20.5%. This means that you are taxed at 20.5% from your income above $49,020 . Any additional income up to $98,040 will be taxed at the same rate. Any income beyond the upper limit will be taxed at the next tax bracket rate of 26%.

At $80,000, you will also have income in the lower two tax brackets: $0 to $13,229 and $13,230 – $49,020. Your income within those brackets will be taxed at their respective tax rates of 0% and 15%.

The basic personal amount of $13,229 has a tax rate of 0%. This means that if you make $13,229 or less, you will not have to pay any federal income tax. Different provinces have different basic personal amounts. The basic personal amount will gradually increase to $15,000 by 2023.

Read Also: Www Michigan Gov Collectionseservice

Making Estimated Tax Payments

Many business owners think that the income tax payment deadline is on âtax day,â which falls in mid-April. However, federal income taxes must be paid as they are incurred. This means that most small businesses must make estimated tax payments throughout the year based on an estimate of their total taxable income at the end of the year.

How To Calculate Your Tax Refund

Every year when you file your income taxes, three things can happen. You can learn that you owe the IRS money that the IRS owes you money or that youre about even, having paid the right amount in taxes throughout the year. If the IRS owes you money it will come in the form of a tax refund, while if you owe the IRS money, youll have a bill to pay. Our tax return estimator can help you figure out how much money could be coming your way, or how much youre likely to owe.

Why would the IRS owe you a tax refund? There are several possible scenarios. You might have overpaid your estimated taxes or had too much withheld from your paycheck at work. You might also qualify for so many tax deductions and tax credits that you eliminate your tax liability and are eligible for a refund. A tax return calculator takes all this into account to show you whether you can expect a refund or not, and give you an estimate of how much to expect.

Don’t Miss: Michigan.gov/collectionseservice

Putting It All Together: Calculating Your Tax Bill

To calculate how much you owe in taxes, start with the lowest bracket. Multiply the rate by the maximum amount of income for that bracket. Repeat that step for the next bracket, and continue until you reach your bracket. Add the taxes from each bracket together to get your total tax bill.

For example, the single filer with $80,000 in taxable income would pay the lowest rate on the first $9,875 he makes then 12% on anything earned from $9,786 to $40,125 then 22% on the rest, up to $80,000 for a total tax bill of $13,774.

Effectively, this filer is paying a tax rate of 17.2% , which is less that the 22% tax bracket our taxpayer actually is in.

But, wait. Effective tax rates dont factor in any deductions, so if you wanted get closer to what percentage of your salary goes to Uncle Sam, try using your adjusted gross income. Assuming the single filer with $80,000 in taxable income opted for the standard deduction , the amount of his AGI that went to the IRS was 14.9% a far cry from 22%.

For a final figure, take your gross income before adjustments. Add back in your allowable above the line deductions for example, retirement and health savings account contributions certain business-related expenses alimony paid and divide your tax bill by that number. The overall rate for our single filer with $80,000 in taxable income might be closer to 12% or even lower.

What Are Sales Tax Rates Like In My State

Forty-five states and the District of Columbia collect statewide retail sales taxes, one of the more transparent ways to collect tax revenue: consumers can see their tax burden printed directly on their receipts.

In addition to state-level sales taxes consumers also face local sales taxes in 38 states. These rates can be substantial, so a state with a moderate statewide sales tax rate could, in fact, have a very high combined state and local rate compared to other states.

The map below provides a population-weighted average of local sales taxes, to give a sense of the average local rate for each state.

Read Also: Efstatus Taxact Com Return

How Does The Tax Foundations Tax

If youre familiar with our work, you may know that we produce estimates for how different U.S. federal tax policies could impact factors like GDP, wages, jobs, federal revenue, and the distribution of the tax system .

We produce these estimates using an in-house tool we call the Taxes and Growth dynamic model.

In economic jargon, the Tax Foundations tax model is considered a general equilibrium model and consists of three main parts: a tax simulator, a neoclassical production function, and an allocation or demand function. Together, these three components work together to produce revenue and economic estimates.

The Tax Foundation model can produce two types of estimates: comparative statics , and year-by-year estimates over the 10-year budget window.

Using the comparative statics framework, the model estimates the long-run impact of tax policy by comparing a baseline tax policy and economy to an economy with an alternate tax policy. It essentially tries to answer the question: what would todays economy look like if an alternative tax policy had always been in place?

In addition to long-run estimates, the Tax Foundation model can create estimates of federal revenues, GDP, wages, investment, capital stock, employment, consumption, and other measures of economic output for each year over a 10-year period.

Total Estimated 2020 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

Also Check: How To Buy Tax Lien Properties In California

How To Calculate Estimated Taxes

To calculate your estimated taxes, you will add up your total tax liability for the yearâincluding self-employment tax, income tax, and any other taxesâand divide that number by four.

You can calculate your estimated taxes on the IRSâ Estimated Tax Worksheet found in Form 1040-ES for individuals or Form 1120-W for corporations, will guide you through these calculations in detail.

You can also use our free estimated tax calculator.

Keep reading for a more in-depth explanation of how to calculate your estimated taxes.

Further reading: What is Self Employment Tax?

How To Calculate Your Adjusted Gross Income

Your adjusted gross income is an important part of your tax calculation. To get your AGI, you can subtract certain deductions from your income to reduce the amount of income that will be taxed.

Some examples of deductions that help determine your AGI:

- Deductible IRA contributions

- Contributions to a Keogh retirement plan

- Penalty on early withdrawal of savings

- Teacher’s education expenses up to $250

Read Also: Www.1040paytax

How To Determine Your Tax Bracket

As mentioned above, determining your tax bracket hinges on two things: filing status and taxable income. Here are some useful details:

The IRS recognizes five different filing statuses:

- Single Filing Unmarried, legally separated and divorced individuals all qualify all single.

- A married couple agrees to combine income and deduct the allowable expenses.

- A married couple files separate tax returns to keep an individual income lower. This is beneficial in certain situations like repaying student loans under an income-driven repayment plan.

- Head of Household Unmarried individuals who paid more than half the cost of keeping up a home for the year and have a qualifying person living with them in their home for more than half the year.

- Qualifying Widow A widow can file jointly in the year of their spouses death. A qualifying widow has a dependent child and can use the joint tax rates and the highest deduction amount for the next two years after their spouses death.

Are Tariffs Taxes

Yes! Tariffs are taxes. Tariffs are a type of excise tax that is levied on goods produced abroad at the time of import. They are intended to increase consumption of goods manufactured at home by increasing the price of foreign-produced goods but have a negative economic impact on all involved.

Though tariffs may shield domestic industries from foreign competition in the short term, they do so at the expense of others in the economy, including domestic consumers and other industries, resulting in reduced economic output, employment, and wages.

Ultimately, tariffs increase the tax burden on domestic consumers in the form of higher prices, landing hardest on lower and middle-income households.

Recommended Reading: How Do I Get My Pin For My Taxes

How We Make Money

Bankrate.com is an independent, advertising-supported publisher and comparison service. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products.

Bankrate, LLC NMLS ID# 1427381 |NMLS Consumer AccessBR Tech Services, Inc. NMLS ID #1743443 |NMLS Consumer Access

Overview: What Is The Federal Unemployment Tax Act

The Federal Unemployment Tax Act came into law after the worst recession the U.S. had ever seen, where unemployment spiked to unprecedented levels. FUTA funded a program that compensates those who lose their jobs due to layoffs, and sometimes firings.

FUTA joined the Social Security Act of 1935 to create a suite of economic security programs that buoy individuals and the U.S. economy during hard times. The Social Security Act of 1935 had administered unemployment benefits until FUTA was enacted in 1939.

Since then, the government has added several national programs, including Medicare and Medicaid, and business taxes partially fund many of them.

If youve ever applied for unemployment benefits, you know its managed at the state and territory level. Though the federal government collects tax for unemployment, the money gets distributed to each state and participating territory, which is then disbursed to residents in need.

Employers fund federal unemployment through a FUTA payroll tax. The amount owed, or liability, depends on the number of employees and their wages. Businesses dont pay FUTA tax on contractors since theyre not considered employees.

FUTA is an employer tax, so employees do not pay into it.

Recommended Reading: Where’s My Tax Refund Ga

Add It All Together And Divide By Four

Now, the final step. To calculate her estimated quarterly tax payments for each quarter, Stephanie simply adds together her income tax and her self-employment tax for the year and divides this number by four. Voila.

$8,130.24 + $12,716.59 = $20,846.83 .

$20,846.83/4 = $5,211.71 .

If you filed your previous yearâs taxes with the help of a CPA, they should also be able to send you estimates for this yearâs payments. And if youâre paying estimated quarterly taxes for the first time, it canât hurt to run your numbers by a CPA before submitting.