When You Owe Income Tax On A Withdrawal

Once you reach age 59½, you can withdraw money without a 10% penalty from any type of IRA.

If it is a Roth IRA and you’ve had a Roth for five years or more, you won’t owe any income tax on the withdrawal. If it’s not, you will.

Money deposited in a traditional IRA is treated differently from money in a Roth.

If it’s a traditional IRA, SEP IRA, Simple IRA, or SARSEP IRA, you will owe taxes at your current tax rate on the amount you withdraw. For example, if you are in the 22% tax bracket, your withdrawal will be taxed at 22%.

You won’t owe any income tax as long as you leave your money in a traditional IRA until you reach another key age milestone. Once you reach age 72, you will be required to take a distribution from a traditional IRA. ;Act in December 2019).

The IRS has specific rules about how much you must withdraw each year, the required minimum distribution . If you fail to withdraw the required amount, you could be charged a hefty 50% tax on the amount not distributed as required.

There are no RMD requirements for your Roth IRA, but if money remains after your death, your beneficiaries may have to pay taxes. There are several different ways your beneficiaries can withdraw the funds, and they should seek advice from a financial advisor or the Roth trustee.

Who Pays Corporatie Income Tax

Public and private companies usually have to pay corporate income tax;on their profits. In certain circumstances, foundations and associations must also file corporate income tax returns.

Some legal entities, such as fiscal investment institutions, do not pay corporate income;tax. Some legal entities that collectively invest, may also be exempt;from corporate income tax.

Natural persons pay tax on their profits through their personal income tax returns.

Dealing With Capital Loss

You can use any capital losses to offset or reduce capital gains. And if you have more capital losses than you need to reduce your capital gain to zero, or if you only have capital losses, you are allowed to carry forward that capital loss into future years, OR, you can carry it back up to three previous years to amend a capital gain you declared.

Recommended Reading: How To File Federal Taxes For Free

What Is The Percentage Of Federal Income Tax Withheld

As an employer, you withhold income tax on behalf of your employees and then remit those taxes quarterly to federal, state, and local tax authorities.

To calculate how much of your employeeâs federal income tax to withhold, youâll need a copy of their Form W-4, as well as your employeeâs gross pay.

Your next step is to determine the method you want to use to calculate withholding. Most employers have two options, the wage bracket method and the percentage method. While not exactly simple, the wage bracket method is the more straightforward way to calculate payroll tax.

The Federal Income Tax Brackets

The U.S. currently has seven federal income tax brackets, with rates of 10%, 12%, 22%, 24%, 32%, 35% and 37%. If youre one of the lucky few to earn enough to fall into the 37% bracket, that doesnt mean that the entirety of your taxable income will be subject to a 37% tax. Instead, 37% is your top marginal tax rate. You should note, however, that President Joe Biden has proposed raising the top bracket up to 39.6%.

With a marginal tax rate, you pay that rate only on the amount of your income that falls into a certain range.;To understand how marginal rates work, consider the bottom tax rate of 10%. For single filers, all income between $0 and $9,950 is subject to a 10% tax rate. If you have $10,150 in taxable income, the first;$9,950 is subject to the 10% rate and the remaining $200 is subject to the tax rate of the next bracket . Check out the charts below to see what your top marginal tax rate is.

Don’t Miss: Where To Mail Federal Tax Return 2021

Penalty Tax On Early Pension Distributions

The official retirement age according to the IRS for distribution of retirement funds is 59 1/2. If you retire early before reaching 59 1/2, you might have to pay a 10 percent penalty on your pension distributions in addition to the regular income tax.

The 10 percent early retirement penalty doesn’t apply if:

- You retired early due to total and permanent disability.

- You’re collecting the pension because you were the beneficiary of a plan participant who passed away.

- You retired during or after the year you reached the age of 55.

- You elected to receive your pension payments in a Substantially Equal Periodic Payments plan. A SEPP plan allows you to elect to take your periodic payments in equal amounts every period based upon specific IRS calculations.

- You left your job after your 55th birthday.

Taxation Of Pensions Fully Funded By An Employer

Regular pensions that are entirely funded by your employer are fully taxable, and you pay the ordinary income tax rates. If you didn’t pay any money into the pension during your lifetime, your full pension benefits are taxable income. This means that if you didn’t specifically make contributions or your employer didn’t take any money out of your paycheck for your pension, everything you receive at retirement is taxable. If your monthly pension check is $1,000 per month, you’ll pay ordinary income taxes on $1,000 per month.

Recommended Reading: How To Pay Federal And State Taxes Quarterly

How Federal Tax Brackets Work

Tax brackets are not as intuitive as they seem because most taxpayers have to look at more than one bracket to know their effective tax rate.

Instead of looking at what tax bracket you fall in based on your income, determine how many individual tax brackets you overlap based on your gross income.

Figuring that out is easier in practice:

- Example one: Say youre a single individual who earned $40,000 in the year. Technically, youd be aligned in the 12 percent tax bracket, but your income wouldnt be levied a 12 percent rate across the board. Instead, you would follow the tax bracket up on the scale, paying 10 percent on the first $9,875 of your income and then 12 percent on the next chunk of your income between $9,876 and $40,125. Because you dont make above $40,125, none of your income would be hit at the 22 percent rate.

That often amounts into Americans being charged a rate thats smaller than their individual federal income tax bracket, known as their effective tax rate.

- Example two: Say youre a single individual in 2020 who earned $70,000. You would pay 10 percent on the first $9,875 of your earnings ; then 12 percent on the chunk of earnings from $9,876 to $40,125 , then 22 percent on the remaining income

- Your total tax bill would be $11,905.50. Divide that by your earnings of $70,000 and you get an effective tax rate of 17 percent, which is lower than the 22 percent bracket youre in.

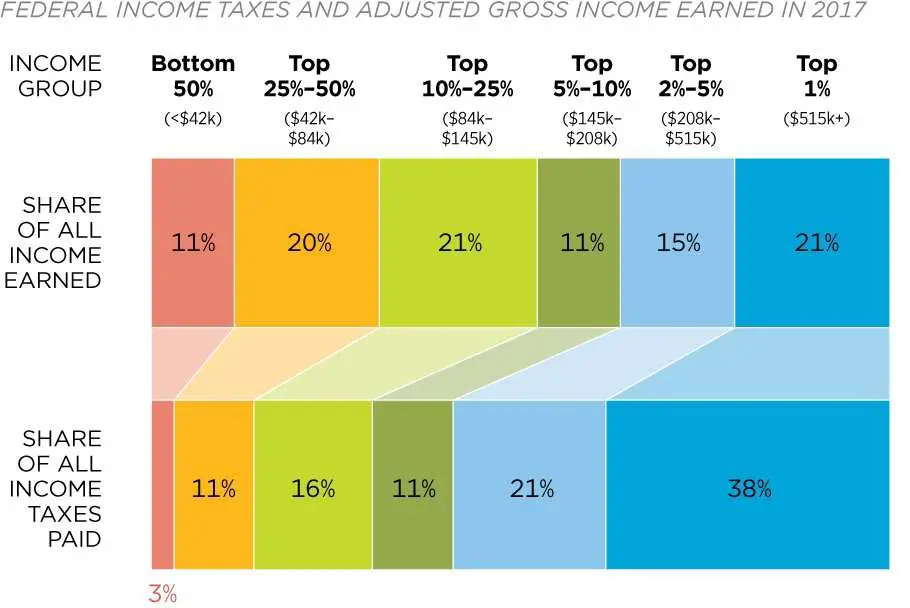

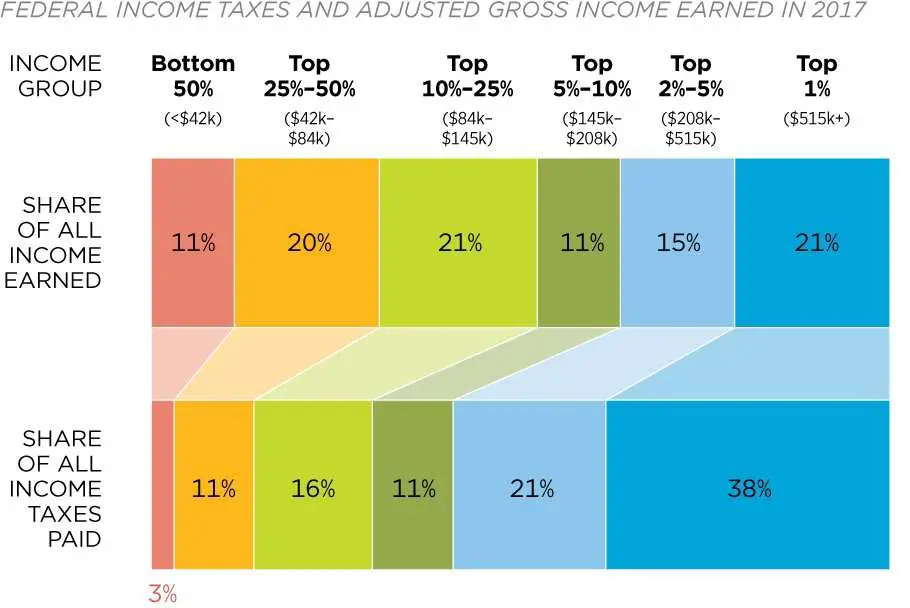

Reported Income Increased And Taxes Paid Increased In 2017

Taxpayers reported $10.9 trillion in adjusted gross income on 143.3 million tax returns in 2017, the last tax year before the Tax Cuts and Jobs Act took effect. Total AGI grew $780 billion from 2016 levels, significantly more than the $14 billion increase from 2015 to 2016. There were 2.4 million more tax returns filed in 2017 than in 2016, and average AGI rose by $4,232 per return, or 5.8 percent.

Taxes paid rose to $1.6 trillion for all taxpayers in 2017, an 11 percent increase from the previous year. The average individual income tax rate for all taxpayers rose from 14.2 percent to 14.6 percent.

The share of income earned by the top 1 percent rose from 19.7 percent in 2016 to 21.0 percent in 2017, and the share of the income tax burden for the top 1 percent rose as well, from 37.3 percent in 2016 to 38.5 percent in 2017.

|

Note: Table does not include dependent filers. Income split point is the minimum AGI for tax returns to fall into each percentile. ;Source: IRS, Statistics of Income, Individual Income Rates and Tax Shares . |

|

| ; | |

|---|---|

| 21.0% | |

| 38.5% | |

| 14.6% |

Don’t Miss: Does Contributing To Roth Ira Reduce Taxes

What Is Sales Tax

A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Usually, the vendor collects the sales tax from the consumer as the consumer makes a purchase. In most countries, the sales tax is called value-added tax or goods and services tax , which is a different form of consumption tax. In some countries, the listed prices for goods and services are the before-tax value, and a sales tax is only applied during the purchase. In other countries, the listed prices are the final after-tax values, which include the sales tax.

What Is Social Security

Social Security is a system created by the federal government to alleviate the strain of the Great Depression. The Social Security Act was signed into law in 1935 as a way of providing the elderly with income when they were no longer able to work.

Social Security is funded by contributions from workers. When you earn wages, a percentage of those wages is paid to the Social Security fund. When you retire, you then receive a monthly distribution based on how much you contributed in your lifetime.

Social Security also provides benefits for people who are disabled and cannot work or are limited in how much they can work.

You May Like: How To File Taxes At H&r Block

Income Tax In The Netherlands

If you are a or a partner in a , and the Tax and Customs Administration considers you to be in business , you’ll have to pay on your business profits. The Tax and Customs Administration applies various criteria to determine your exact status, e.g. anticipated profitability, business practices, autonomy, personal risk, etc.

Tax Groups With Subsidiary Companies

In principle, every company pays its own corporate income tax. However, if a parent company forms a tax group with one or more of its subsidiaries, the Tax and Customs Administration will on request treat the companies as a single taxpayer.The main benefit of a tax group is that a loss incurred by one company can be deducted from the profits earned by other companies in the group.

The formation of a tax group is subject to certain conditions. The main condition is that the parent company holds at least 95% of the shares in the subsidiary. In addition, the parent company and subsidiary must:

- have the same financial year;

- apply the same accounting policies;

- be established in the Netherlands.

You May Like: How To Calculate Tax In California

How To Calculate Federal Income Tax Withholding Using The Wage Bracket Method

In IRS Publication 15-A, find the tables marked âWage Bracket Percentage Method Tables.â Use the table corresponding to your employeeâs pay period.

Check form W-4 to determine whether the employee files income tax as married or single and the number of allowances they claim.

Find the employeeâs gross wage for the pay period in columns A and B. The wage should be over the amount found in column A but under the amount found in column B.

Subtract the amount found in Column C.

Multiply the result by the percentage found in Column D.

Check form W-4 to determine if the employee requests additional tax withheld from each paycheck. If they do, add that amount to the final number.

The end result is the amount you should withhold from the employeeâs paycheck for that pay period.

The Percentage Method is much more complicatedânot recommended if youâre doing this alone. If you want to learn more about the Percentage Method, you can read all about both methods in IRS Publication 15-A.

Once youâve figured out how much income tax to withhold from your employeesâ paychecks, your next step is to figure out how much FICA to withhold , and how much youâll be required to pay on their behalf.

How Much Do People Pay In Taxes

Andrew Lundeen

Tax day is a day away and this time of year there are always questions about who pays how much in taxes.

A recent poll by Pew Research Center found that the feeling that some wealthy people dont pay their fair share, bothered 79 percent of respondents some or a lot. Recent analysis by the Joint Committee on Taxation shows that these respondents can rest easy.

When it comes to individual income taxation in the United States, the average tax rate paid increases as we move up the income scale . As a group, taxpayers who make over $1,000,000 pay an average tax rate of 27.4 percent. At the bottom of the income scale, taxpayers who earn less than $10,000 pay an average tax rate of -7.1 percent, which means they receive money back from the government, in the form of refundable tax credits. The next income group up has an even lower negative tax rate at 11 percent.

These results are as expected. The U.S. income tax system is progressive, with marginal tax rates increasing as incomes increase and a large number of tax credits that limit the tax burden for lower incomes.

Many would argue, however, that people pay more federal taxes that just individual income taxes. They are correct. People also pay social insurance taxes , business taxes, and excise taxes.

Whether this level of progressivity is the correct amount requires a larger discussion, but its important to note that progressive taxes come with an economic cost.

Was this page helpful to you?

Recommended Reading: Are Taxes Due By Midnight May 17

How Do I Pay Vat

If youre buying goods and services, VAT is usually added into the price before you pay so you dont have to do anything extra. It may be possible to claim back the VAT youve spent if the goods or services youre buying are for your work or business.

If youre self-employed and are selling the goods or services, you add the VAT yourself. You must register for;VAT with HMRC if your business VAT taxable turnover is more than £85,000.

- Find out more:self-employed VAT return

If You Work More Than One Job

Keep the;wage base in mind if you work for more than one employer. If you’ve earned $69,000 from one job and $69,000 from the other, you’ve crossed over the wage base threshold. Neither employer should withhold any further Social Security tax from your payor pay half the 12.4% on your behalfuntil year’s end.

It doesn’t matter that individually, neither job has reached the wage base threshold. The wage base threshold applies to all your earned income. But separate employers might not be aware you’ve collectively reached this limit, so you’ll have to notify both employers they should stop withholding for the time being. However, you can always receive reimbursement of any overpayment when you file your taxes.

These are annual figures, so the Social Security tax starts right back up again on Jan. 1 until you hit the next year’s Social Security wage base.;

Read Also: How To See My Past Tax Returns

How To Determine Your Tax Bracket

As mentioned above, determining your tax bracket hinges on two things: filing status and taxable income. Here are some useful details:

The IRS recognizes five different filing statuses:

- Single Filing Unmarried, legally separated and divorced individuals all qualify all single.

- A married couple agrees to combine income and deduct the allowable expenses.

- A married couple files separate tax returns to keep an individual income lower. This is beneficial in certain situations like repaying student loans under an income-driven repayment plan.

- Head of Household Unmarried individuals who paid more than half the cost of keeping up a home for the year and have a qualifying person living with them in their home for more than half the year.

- Qualifying Widow A widow can file jointly in the year of their spouses death. A qualifying widow has a dependent child and can use the joint tax rates and the highest deduction amount for the next two years after their spouses death.

Current Fica Tax Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

Combined, the FICA tax rate is 15.3% of the employees wages.

Do any of your employees make over $137,700? If so, the rules are a little different. Read more at the IRS website.

Also Check: What Do I Do If I Owe Taxes

Turnover Tax / Value Added Tax

is a form of turnover tax that you add to most but not all goods and services your business sells in the Netherlands . You can usually reclaim the VAT that your business pays on the goods and services it purchases. Turnover tax returns can be filed either monthly, quarterly, or annually. .

If your business is established outside the Netherlands, but trades in the Netherlands? You will still have to deal with Dutch VAT rules. The rules that apply to differ from the rules applicable to businesses in the Netherlands.

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents you’ll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

You May Like: How To Apply For Irs Tax Forgiveness