How Can I Find Out If Someone Claimed Me As A Dependant

;;Did your return; efile reject because someone claimed you ?; If you qualify as their dependent then you need to check that box on your return.; Go to My Info, click Edit by your name and scrolls down to #3 and change it.

Or if you don’t know who claimed you or if they are not qualified to claim you then you will need to print and mail your return and let the IRS determine who is able to claim you.

What Are Property Taxes

Before we explain how to find tax delinquent properties in your area, we need to cover the mechanics of how property taxes work. If this is too elementary for you, skip to the next section.

If youre new to this, keep reading, as this is good information to know. Long story short, every home and land owner must pay annual property taxes to the city, county, or township in which the property is located.

This money pays for roads, parks, emergency services, and anything else that the municipality offers to the public. In some cases, there are bonds added onto specific parcels to pay for schools or other public amenities.

The municipality must be able to track the amount of taxes owed, the property owner, and a little information on the property itself. All this information is compiled by the tax assessor and made available to the public.

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents you’ll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Read Also: When Is Sales Tax Due

How To Report Tax Id Theft

Its important to take action if you receive a 5071C letter from the IRS. You can also take these steps if you become the victim of a tax ID theft or if you receive a letter from the IRS about a problem.

Respond immediately to any IRS notice by calling the number provided on the letter. If instructed, go to the IRS Identity Verification Service.

Complete IRS Form 14039, Identity Theft Affidavit. Print it, then mail or fax according to instructions.

Continue to pay your taxes and file your tax return, even if you must do so by paper.

If you are a victim of state tax ID theft, contact your state’s taxation department or comptroller’s office about the next steps you need to take.

If youve already contacted the IRS, but still need more tax ID theft assistance, you can call 1-800-908-4490.You should also take these steps to report the scam and protect your bank accounts:

File a report with the Federal Trade Commission at IdentityTheft.gov. You can also call the FTC Identity Theft Hotline at 1-877-438-4338 or TTY 1-866-653-4261.

Contact one of the three major credit bureaus to place a fraud alert on your credit records:

TransUnion: 1-800-680-7289

Contact your financial institutions to close any accounts opened without your permission or that show unusual activity.

What An Irs Treas 310 Transaction Means

If you receive your tax refund by direct deposit, you may see;IRS TREAS 310;listed for the transaction. The 310 code simply;identifies the transaction;as a refund from a filed tax return in the form of an electronic payment . This would also apply to those receiving an automatic adjustment on their tax return or a refund due to March legislation on tax-free unemployment benefits. You may also see;TAX REF;in the description field for a refund.

If you received;IRS TREAS 310;combined with a;CHILD CTC;description, that means the money is for a monthly advance payment for the enhanced;child tax credit.;

If you see a;449;instead of;310, it means your refund has been offset for delinquent debt.

Also Check: How To Pay Llc Taxes

Learn About Tax Id Theft And How To Avoid It

Tax ID theft occurs when someone uses your Social Security number to file taxes and claim a tax refund. You may not know that your tax ID has been stolen until you:

-

E-file your tax return and find that another return has already been filed using your Social Security number, or;

-

The Internal Revenue Service sends a 5071C letter to the address on the federal tax return indicating that tax ID theft has occurred.

Find out what steps you can take after receiving a 5071C letter and how you can avoid or report tax ID scams.

Education Property Tax Credit

Whether you own or rent your home, you could be eligible to save up to $525 with the Manitoba governmentâs Education Property Tax Credit . The credit is provided by the province of Manitoba to help cover the school taxes you pay, or a portion of your rent either directly on your municipal property tax statement or through your income tax return.

Seniors may be eligible for additional savings. See below to learn more.;

Home owners:

If you own your home and pay property taxes, you can save up to $525 off your property taxes with the EPTC. The process that allows new or first time homeowners who are eligible to apply the basic $525 Education Property Tax Credit on the property tax statement for their principal residence is being streamlined, reducing costs for Manitobans and the province. Instead of applying to Manitoba Finance during a limited period of the year, homeowners will be able to self-assess and notify their municipal office at any time throughout the year.;

- Homeowners who notify their municipality before the printing of the municipal property tax statement for the year will have the credit applied starting in that year.

- Homeowners who notify their municipality after the printing of the municipal property tax statement for the year may claim the credit on their personal income tax return for that year and will receive the credit on their property tax statement in subsequent years.

Renters:

Seniors:

Recommended Reading: How To Buy Tax Lien Properties In California

What Taxes May Be Claimed

Only taxes levied in the year of the claim may be used for credit no matter when they are paid. You may also include the administrative collection fees up to 1 percent.

Do not include:

- Delinquent water or sewer bills

- Property taxes on cottages or second homes

- Association dues on your property

- Most special assessments (including but not limited to solid waste fees

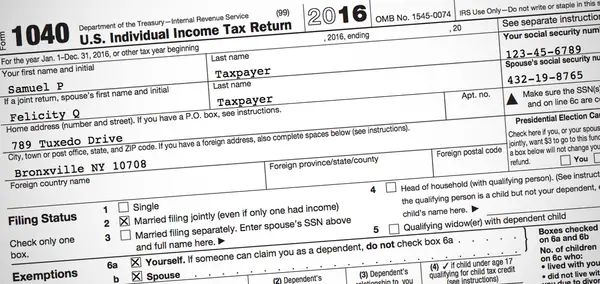

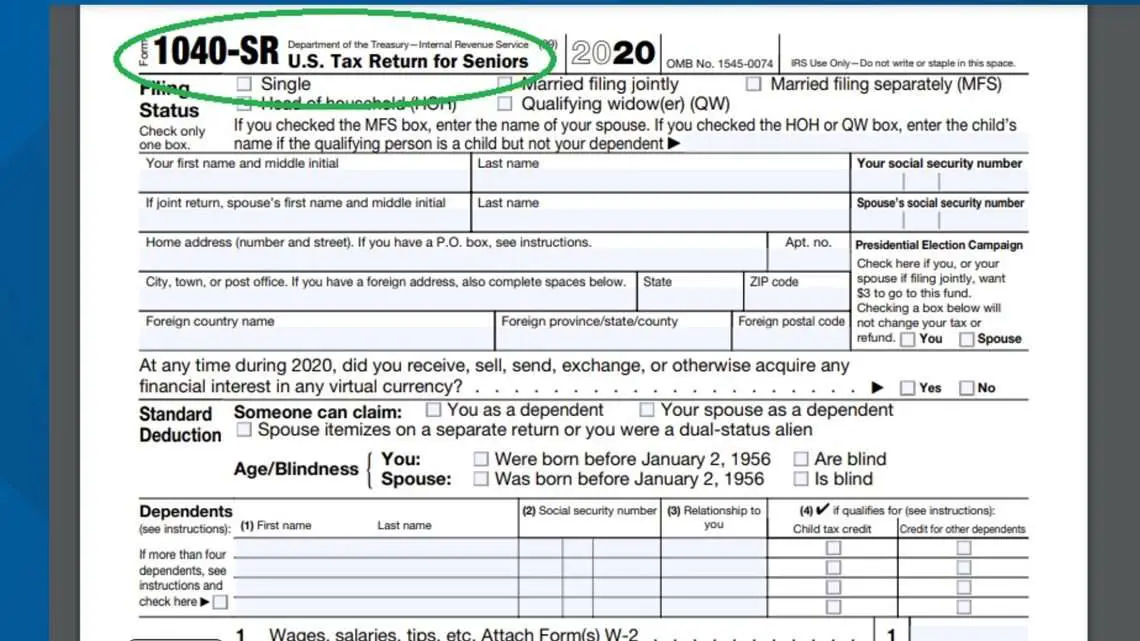

Which Form Should Be Used

In addition to completing the federal TD1:

- Employees who claim more than the basic personal amount have to complete the TD1 that corresponds to their province or territory of employment. To determine which is the province or territory of employment, go to Which provincial or territorial tax tables should you use?;

- Pensioners who claim more than the basic personal amount have to complete the TD1 that corresponds to their province or territory of residence.;

- Individuals paid by commissions and who claim expenses can elect to use Form TD1X, Statement of Commission Income and Expenses for Payroll Tax Deductions, to take into consideration the expenses in the calculation of their income tax.

Note

Recommended Reading: Do You Have To Pay Taxes On Plasma Donations

I Pay Or Receive Child Support Money Do I Qualify

Typically, the custodial parent is the one who claims the child on their taxes, while the noncustodial parent pays child support. There are some cases where your stimulus check may have been garnished to help pay your child support. If you owe more than $150 in overdue child support , your state may reserve the right to garnish some or all of your first and third stimulus checks, based on how much you owe .;

If you’re owed child support, you may receive money garnished from your child’s other parent, though it may take a while to get to you after it is processed by the state.;

For parents who have joint custody, it’s possible that both could get an extra $500 per child dependent as part of their check. It may be the case again with the $600 per-child payment. We’re still inquiring about the $1,400 for the third payment. Find out;everything you need to know about stimulus checks and child support here.;

Stimulus check money can be elusive at times, and the rules can differ based on your age and personal circumstances.

Eliminating Dependents During Audits

If you choose not to amend your tax return, you run the risk of the IRS discovering that the same child is being claimed as a dependent on two returns. The IRS has three years from the time you file the original return to perform an examination and make additional assessments. In the event you are chosen for an audit, the agency is likely to require proof that your child either lives with you or that you have the other parent’s consent.

There is the possibility that the IRS will not discover the error within the three-year period. However, if you claim a dependent with full knowledge that you do not qualify, the IRS may argue that it has an unlimited amount of time to examine your return since you made a willful attempt to evade income tax.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. Whether you have a simple or complex tax situation, we’ve got you covered. Feel confident doing your own taxes.

Read Also: Are Property Taxes Paid In Advance

Claiming A Qualifying Relative As A Dependent

Qualifying dependent relatives include anyone who satisfies a separate set of guidelines from the IRS.

Note that the key difference between this type of dependent and the qualifying child dependent is that this dependent may not have to have lived with you most of the year. For example, a child can be a qualifying relative to you, even if theyâre not a qualifying child, if he or she lives apart from you.

The IRSâs guidelines for qualification are as follows:

-

Relationship: Neither you nor anyone else is claiming him or her as a qualifying child dependent.

-

Income: They earned a gross income of less than $4,300, for tax year 2020, which you’ll report on your 2021 tax returns. For tax year 2021, the income limit to qualify will remain 4,300. There are some exceptions for dependents who have a disability.

-

Support: You must have provided more than half of their support during the year, unless you have a multiple-support agreement for the dependent with another person, or the dependent is a child of divorced or separated parents, or is a victim of kidnapping.

-

Filing status: If he or she is married and files jointly, you canât claim him or her as a dependent.

-

Legality: Your relationship to the dependent doesnât violate local law.

Additionally, the dependent must have lived with you for the entire year unless he or she falls into one of the following categories, which are considered ârelatives who donât have to live with youâ while receiving your support:

Your Refund Could Be Coming By Snail Mail

There are a couple of reasons that your refund would be mailed to you. Your money can only be electronically deposited into a bank account with your name, your spouse’s name or a joint account. If that’s not the reason, you may be getting multiple refund checks, and the IRS can only direct-deposit up to three refunds to one account. Additional refunds must be mailed. Also, your bank may reject the deposit and this would be the IRS’ next best way to refund your money quickly.;

It’s also important to note that for refunds, direct deposit isn’t always automatic. Some are noticing that like the stimulus checks, the first two payments for the child tax credit were mailed. Just in case, parents should sign in to the IRS portal;to check that the agency has their correct banking information. If not, parents can add it for the next payment in September.

For more information about your money, here’s;the latest on federal unemployment benefits;and how the child tax credit could impact your taxes in 2022.

Recommended Reading: What Is The Tax In Georgia

Are You Old Enough To Receive A Stimulus Check What It Takes To Qualify As An Adult

Are you eligible to get your own stimulus check, contribute to your family’s overall amount or get no money at all? We’ll tell you how the eligibility rules for the third stimulus payment apply to you.

Find out if you’re eligible to get a stimulus check on your own or if you’ll be claimed as a dependent.

The IRS pushed out another wave of third stimulus check payments last week as;direct deposits; and by mail as paper checks and EIP cards. Under the new bill, eligible adults qualify for a $1,400 check and their dependents qualify for the same amount to add to the family’s overall total .

This time, the third payment differs in its;definition of an eligible dependent: People of any age are eligible now. So, if you’re between the ages of 17 and 24 — those left out of the first two payments — what does that mean for you? Do;older adults;qualify for their own check, or will it go toward a family total? Could;you be left out entirely?

We’ll help you figure out where you stand — whether you’re a student, living on your own and are employed, if you’re in the military, if you receive;SSI, SSDI or veteran benefits, if you’re married or a parent, or if you’re;in a child-support situation. Since it’s still tax season, we’ll help explain how some young adults could;get the $1,200 stimulus payment;or;$600 check. Here’s why you may suspect a stimulus check holdup and how to solve the problem. This story was recently updated.

How To Claim The Disability Amount Once The Dtc Application Is Approved

You can claim the disability amount on your tax return once the person with the disability is eligible for the DTC.

- To claim the disability amount for yourself, see line 31600

- To claim the disability amount for your dependant, see line 31800

- To claim the disability amount for your spouse or common-law partner, see line 32600

If a person was eligible for the DTC for previous years but did not claim the disability amount when they sent their;tax return, they can request adjustments for up to 10 years under the CRA’sTaxpayer Relief Provision.

To claim the disability amount for those prior years, you can ask for a reassessment. For more information, go to How to change my return.

See the following chart to know the maximum federal disability amounts and the maximum supplement for children with disabilities for prior years.

Maximum disability amountsYou May Like: How To Appeal Property Taxes Cook County

Who Does The Irs Consider An Adult Or A Dependent For Stimulus Payments

To qualify for your own third stimulus check, you need to have filed your 2019 or 2020;taxes independently, which means no one else claimed you on their taxes as a dependent. You also had to have an adjusted gross income, or AGI, of under $75,000 to receive the full amount.

There are two different sets of rules for who counts as an adult or a dependent under current tax law, according to , a senior fellow at the Urban-Brookings Tax Policy Center.;

One is the support test. If you’re unmarried, you don’t claim children as your own dependents, your parents provide you with financial support equal to or greater than half of your annual income and you made less than $4,200 in 2019 or less than $4,300 in 2020, then your parents can still claim you as their dependent. Another is the residency test: If you’re a full-time student under the age of 24 who resides with an adult taxpayer more than half of the year , you can be claimed as a dependent, no matter how much money you make.;

The IRS will use;your 2019 tax return;to determine your eligibility for a third stimulus check. However, filing your 2020 tax returns could help you get your payment based on that income if the IRS processes your payment after you file. We recommend filing your taxes as soon as possible so the agency has your most recent information on file — especially if 2020 was the first year that you were financially independent, and no longer counted as a dependent.

Or You Can Use Independent Computer Software Products

You can file both your Maryland and federal tax returns online using approved software on your personal computer. To use this method, you’ll need to know the correct county abbreviation for the Maryland county in which you live. You may need to enter the correct subdivision code for the city in Maryland in which you live.

Recommended Reading: Do You Need To Claim Unemployment On Taxes

What To Do If My Parents Claimed Me On Their Taxes

There are thousands of financial products and services out there, and we believe in helping you understand which is best for you, how it works, and will it actually help you achieve your financial goals. We’re proud of our content and guidance, and the information we provide is objective, independent, and free.

But we do have to make money to pay our team and keep this website running! Our partners compensate us. TheCollegeInvestor.com has an advertising relationship with some or all of the offers included on this page, which may impact how, where, and in what order products and services may appear. The College Investor does not include all companies or offers available in the marketplace. And our partners can never pay us to guarantee favorable reviews .

For more information and a complete list of our advertising partners, please check out our full Advertising Disclosure. TheCollegeInvestor.com strives to keep its information accurate and up to date. The information in our reviews could be different from what you find when visiting a financial institution, service provider or a specific product’s website. All products and services are presented without warranty.

As you start working and making money, you are supporting yourself through your life and education. It’s inevitable, and everyone goes through it. But it does look different for everyone.

This little box on your tax return raises so many questions: