Box : Medicare Wages And Tips

The wages subject to Medicare tax are the same as those subject to social security tax in Box 3, except there is no wage base limit for Medicare tax.

Medicare wages are reduced for health insurance premiums, Commuter Benefits, DeCAP, and HCFSA contributions.

Medicare wages are not affected by deferred compensation or pension contributions.

How To Get Your W2 Online

Companies like H& R Block and TurboTax offer a service where you can search a database of 90 million entries to find your W2 online. All that you need is your employers name and their FEIN Federal Employer Identification Number. You can find this on a previous W-2 or ask your employer directly.

Once the correct details appear, you will be given directions for importing your W2.

The online tax software will securely hold the document until you need it for filing with the IRS. Just remember that they require identification to release the documents to you for security reasons.

Find Your Gross Income

The first step of calculating your W2 wages from a paystub is finding your gross income. This is the total amount of money you’ve earned without deductions or tax withholdings. For many people, this will be an hourly rate multiplied by a certain number of hours a week. Your paystub will show you this amount. It will also include extra overtime hours, bonuses, or commissions.

Also Check: When Do You Do Tax Returns

What Is A Paystub

A paystub is a paycheck you receive from your employer every time you get paid. This paystub includes details about your pay, including how much money you’ve earned for that pay period and the year-to-date payroll. It will also show what deductions and taxes have been taken out of your total earnings.After these things have been taken out, the paystub will list your net earnings, or the amount of money you actually get from the paycheck.

What To Do If Your W

If your employer leaves out a decimal point, gets your name or a dollar amount wrong, or checks the wrong box it happens point out the mistake and ask for a corrected W-2. Pointing out the mistake and waiting for a new W-2 will cost you time, but heres something that could make you feel better: The IRS might fine your employer if the error involves a dollar amount or a significant item in your address.

Don’t Miss: How To File Uber Taxes On Taxact

Getting Prior Years W2s

If you file a prior-year tax return, there may be complications such as missing W-2s and other forms. However, you can still get a copy of that form. To get a copy of a prior year W-2, there are a couple of possibilities.

Contacting the issuer is the easiest way to find that particular W2. Employer payroll departments save such essential documents that contain tax information. You can contact them and ask for the form to be sent to your address. This is usually the best way.

You can also contact the IRS directly. If you cant get in touch with that employer, then you will need form 4506. Although it may take longer and cost you some money, this allows you to obtain a copy of that years W-2 rather than do nothing.

Its important to note the IRS holds past W-2s and other tax documents for 7-10 years. After that, theyre filed under each taxpayers social security number. So you can ask for a W-2, but not until a year after it was filed, and form 4506 will be required to get a copy after that. Also note:

- The IRS charges a $57 service fee checks are paid to The United States Treasury.

- Check the second page of form 4506 for the address to send it to.

- It takes the IRS up to two months to process the request and send the W-2.

Remember, with a few clicks of the mouse, you can use the TurboTax W2 finder or the H& R Block W2 finder and get the data from your current online W2, and your tax returns are ready to start in moments.

Sign Up For Electronic W2

Its safe and convenient. Your W-2 cant get lost, stolen, or misplaced and you can download/print at any time. The deadline for requesting an electronic W-2 for the 2021 tax information is .

- Go to UCPath online and click on Employee Actions > Income and Taxes > Enroll to Receive Online W-2. If the current status says CONSENT RECEIVED, no action is required you are already signed up for the electronic statement.

- Once signed up, all notifications pertaining to your W-2/W-2c will be sent to your preferred email address on file in the UCPath system make sure it is correct.

- UC does not send actual W-2 statements to employees by email or text. You SHOULD NOT open any attachments or click on any email links that claim to give access to your W-2! If you receive an email or text that has a link or an attachment for viewing your W-2, it is a phishing scam designed to gain access to your private information. All employees must sign in to UCPath to view/print their electronic W-2.

- Find more information on UCnet.

If you chose paper delivery of your W-2 it will be mailed on or before January 31. It will be identical to the version available online. Your W-2 is available online whether you opt-in or opt-out of electronic delivery

Recommended Reading: Plasma Donation Taxable

Deductions And Adjustments Worksheet

If you have substantial deductions and credits you’re going to claim, you may be eligible to claim more allowances than you qualify for based on the personal allowances worksheet. For example, if you have a substantial mortgage interest deduction, charitable donations or education tax credits, you can use the deductions and adjustments worksheet to see if you can claim extra. This worksheet estimates how much lower your income tax liability will be because of the deductions and converts that amount to the number of allowances you should claim to approximate your tax withholding. To complete the form, you need to estimate all of your deductions and credits.

Use A Substitute Form

If you have not received your W-2 form by Feb. 16, you should call the IRS at 800-829-1040. You will need to provide your name, address, phone and Social Security Number. You will need to provide your employer’s information as well. You must file your return even if you never receive your W-2. To obtain a replacement form from the IRS, file a form 4852, Substitute for Form W-2, Wage and Tax statement. Estimate your income and withholding using the method outlined in Step 2. You may experience a delay in getting any refund due while the IRS verifies the information.

Don’t Miss: How To Look Up Ein Numbers For Tax Purposes

Account For Other Deductions

Many people are eligible for pretax deductions that lower the amount of their taxable income. These deductions might include things like employer benefits, health insurance, retirement accounts, life insurance, transportation programs, and more. You can find the total of these deductions on your paystub.Once you have this number, subtract it from the number you got in step two. If you already have your form W2, the number you’re left with should match the amount in Box 1 on your W2 form. This is your total taxable income for the year.

Request A State Copy Of Your W

If your employer withheld state taxes from your wages, you might be able to get a duplicate W-2 from your state revenue agency. The cost of a duplicate W-2 from the state might be less than ordering a copy of your entire tax return from the IRS. There may be drawbacks, however. For instance, duplicate W-2s from the California State Controllers Office are available for only up to the last four years.

References

You May Like: 1040paytax Customer Service

First Time Signing In This Year

Box : Social Security Tax Withheld

This is the total social security tax withheld from your pay during the year.

Most employees pay 6.2% of covered wages, up to the maximum social security wage base which is adjusted each year. If more than 6.2% of that amount was withheld, OPA will issue you a refund in February. If you do not receive a refund that is owed to you, contact your agency’s Payroll Office.

Also Check: Do You Pay Taxes On Donating Plasma

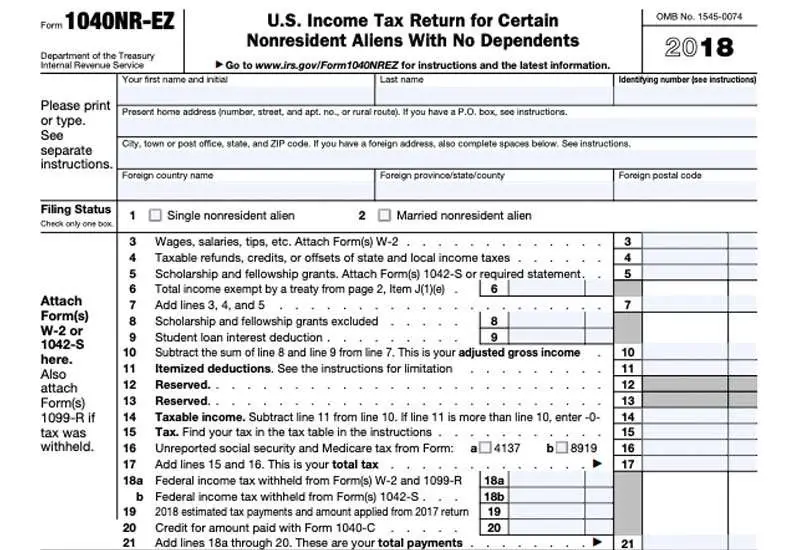

Where Is The Agi On My Tax Return

To find the value of adjusted gross income by using your tax return, you will have to look in the upper left-hand corner of your income tax return. There you will see the name of your tax form which could be any form including: 1040, 1040-SR.

In the United States, form 1040 is used for federal income tax returns. This form has various versions. You can determine the value of your adjusted gross income from different lines on various forms.

- For the tax year 2020, check the line 8b on the form 1040.

- For the tax year 2020, check the line 8b on form 1040-SR.

How Do I Calculate Agi

There is no rocket science involved in the AGI calculation. The simple steps involved in calculating your AGI from the information given on W-2 are:

Read Also: Home Improvement Cost Basis

The Simple Way To Calculate W

To find your earned employment income from 2020’s W-2, you can usually just add Box 2 to Box 1 to see what you earned before federal taxes were withheld. Be sure to combine your results from both W-2 forms if your status is married filing jointly. Keep in mind that taxable income is based on adjusted gross income instead of your gross earned income. That means that using this simple equation before factoring in all of your specific deductions for the year will only give you a rough estimate.

Read More:Are Tax Brackets Based on Gross Income or Adjusted Gross Income?

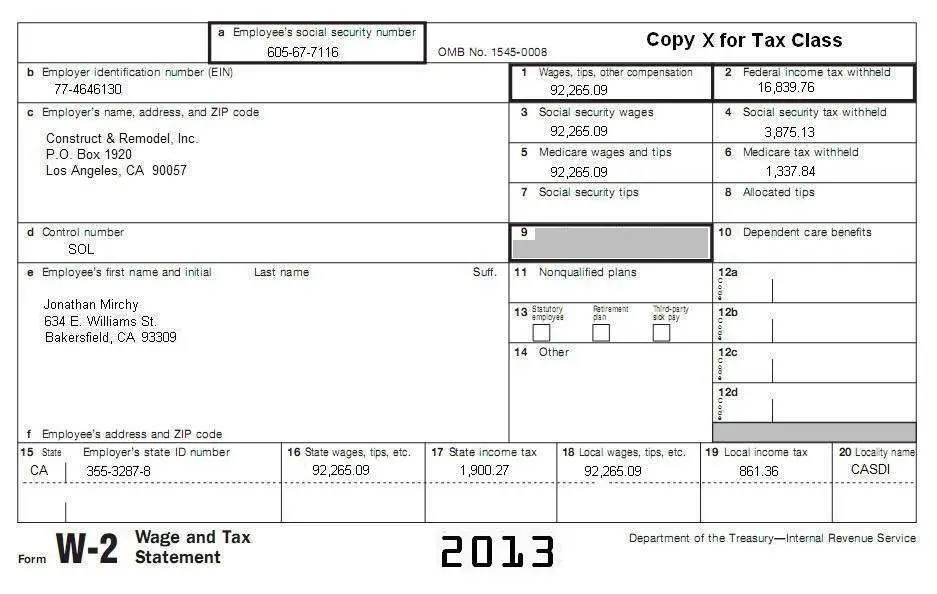

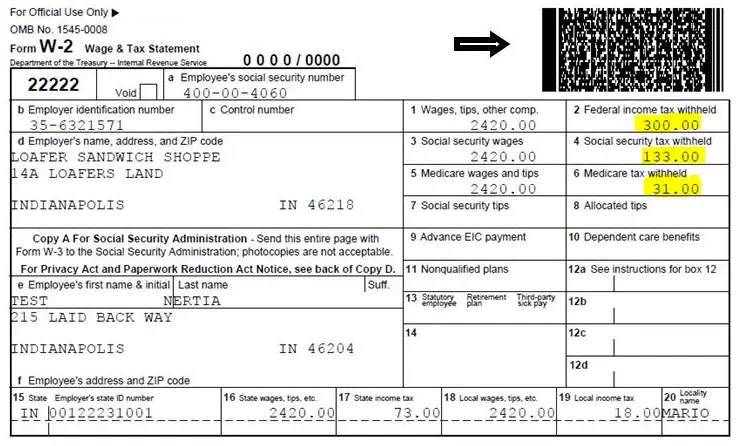

It’s important to know what all of the boxes on your W-2 form represent when sitting down to figure out your 2020 taxes. You should also know that not every box will apply to your tax situation. For instance, boxes for tips and dependent care benefits may not be applicable. Here’s the breakdown of the core boxes that nearly all taxpayers will use:

1. Box 1 of your W-2 form accounts for wages, bonuses, gifts, taxable benefits and all other forms of compensation. The number in this box represents your total federal gross income.

2. Box 2 represents your total amount withheld from your paycheck by your employer for federal income taxes.

3. Box 3 shows how much of your salary was subject to Social Security for the year.

4. Box 4 shows the amount of Social Security withheld.

5. Box 5 shows how much of your salary was subject to Medicare for the year.

6. Box 6 shows the Medicare amount withheld.

Tips For Calculating Adjusted Gross Income

If you want to calculate your adjusted gross income then these handy tips may be useful to you.

File with Ease from Home Today!

Recommended Reading: Wheres My Refund Ga State

So What Is The H& r Block W2 Finder

H& R Blocks W-2 Finder s is one of the tools you can use to get your W2 form online and file your taxes fast. And that ultimately means receiving your refund faster as well.

You dont need to wait for your W-2 to come by mail when using the H& R Block W-2 Finder. Once you pull your W-2 in electronically, it is safely stored and ready to start filing with H& R Block. Best of all, you will receive it for free.

Understanding Your Tax Refund Results

Our tax return calculator will estimate your refund and account for which credits are refundable and which are nonrefundable. Because tax rules change from year to year, your tax refund might change even if your salary and deductions dont change. In other words, you might get different results for the 2021 tax year than you did for 2020. If your income changes or you change something about the way you do your taxes, its a good idea to take another look at our tax return calculator. For example, you might’ve decided to itemize your deductions rather than taking the standard deduction, or you could’ve adjusted the tax withholding for your paychecks at some point during the year. You can also use our free income tax calculator to figure out your total tax liability.

Using these calculators should provide a close estimate of your expected refund or liability, but it may vary a bit from what you ultimately pay or receive. Doing your taxes through a tax software or an accountant will ultimately be the only way to see your true tax refund and liability.

Don’t Miss: Tax Write Off For Doordash

What Is A W2

You will receive a W2 Form from all of your employers at the beginning of the new year prior to tax return deadlines.

This form will list all the wages you earned during the tax year. It will also show what taxes federal, state, local, and social security were withheld from your earnings.

It is imperative that you keep your W2 Forms safe as you will need them as a reference for filing your return.

How To Track Your Tax Refund

Many taxpayers prefer to get their tax refund via direct deposit. When you fill out your income tax return youll be prompted to give your bank account details. That way, the IRS can put your refund money right in your account, and you wont have to wait for a check to arrive in the mail.

If you file your taxes early, you dont have to wait until after the tax deadline to get your tax refund. Depending on the complexity of your tax return, you could get your tax refund in just a couple of weeks. To get a timeline for when your refund will arrive, you can go to www.irs.gov/refunds. You can check the status of your refund within 24 hours after the IRS notifies you that it has received your e-filed tax return .

In a given tax year, you may want to know how big your refund will be so you can plan what to do with it. You may want to use it to boost your emergency fund, save for retirement or make an extra student loan or mortgage payment.

Recommended Reading: Amend Tax Return Online For Free

Why Do I Need A W

All employers must file a W-2 for each employee. This document reports the amount of income you earned at that job, as well as your federal, state, Social Security, and Medicare taxes withheld. In addition, your W-2 offers details on other contributions you made during the year, such as those related to your retirement fund and healthcare.

If you have switched jobs, you will need to get a W-2 from your former employer as well as your current employer before you file your tax return. This can be a little confusing at the best of times and can be even trickier if a former employer doesnt cooperate.

How To Get Your W2 Form Online

Online tax filing helps users to get their W2 form online quickly. They have a free W2 finder that you can use to search for yours.

After you get your W-2, you can start filing your taxes online, or you can download a copy so you can print it out and attach it to your tax return.

Its a much faster process than waiting for your W2 to come out in the mail. With over 100 million W2s available online, theres a good chance youll be able to find yours.

You May Like: Doordash Tax Deductions

File An Amended Return

If you receive your W-2 after you file your return, you can easily amend your return with the more up-to-date information by filing a Form 1040X, Amended U.S. Individual Income Tax Return. If you underpaid taxes, there may be a small penalty. However, you will not be penalized for filing a late return if you use Form 4852 and file your return by the deadline.

Is There Any Way To Download My W

TurboTax does not have a copy of the W-2 or Form 1099. It would have W-2 and Form 1099 worksheets that included the tax data from the forms that were entered. The worksheets would be included in the PDF of the tax return in the tax year the return was completed.

Copies of a Form 1099 would have to obtained from the issuer of the form.

If you cannot obtain the W-2 from your employer, then for a fee you can get a complete copy of a W-2 from the Social Security Administration –

You can get a free Wage and Income transcript from the IRS –

For a fee of $50 you can get a complete federal tax return to include copies of W-2’s, if you mailed the tax return and included a paper W-2, from the IRS by completing Form 4506 –

See this IRS Tax Topic –

To access your current or prior year online tax returns sign onto the TurboTax website with the userID you used to create the account –

Scroll down to the bottom of the screen and Click on Add a state

Click on Tax Tools on the left side of the online program screen. Then click on Print Center. Then click on Print, save or preview this year’s return. Choose the option Include government and TurboTax worksheets

You May Like: Tax Preparation License