Can You Look Up An Ein Number Of Another Business

It is not a common situation, but sometimes small business owners may want to find out the EIN of another company, sometimes called a reverse EIN lookup. For example, some vendors require an EIN from companies theyre doing business with. In certain industries, like insurance and law, you may need another companys EIN as a part of your day-to-day business. Another possibility is that you want to look up another businesss EIN to make sure their information is valid.

The bad news is that theres no convenient, searchable database in which you can just type in the name of the company and get its EIN if its a private company. If the company is publicly traded and registered with the Securities and Exchange Commission , then the business is required to have its EIN on all documents. You can use the;SECs EDGAR system;to conduct an EIN lookup of a publicly-traded company for free.

When finding the EIN of a private company, things get a bit more difficult. Here are some basic steps you can take to track down another businesss EIN:

- Contact the companys payroll or accounting department and ask for the EIN.

- Get the companys business credit report through a credit bureau like Experian, Equifax or Dun & Bradstreet. You can purchase or view another companys credit report, which contains their EIN.

- Hire a service to look up the EIN for you.

- Check to see if the company filed any local or federal registration forms, which can sometimes be found online.

Do I Need To Apply For A New Ein For New Business

If you are planning to start a new business in any U.S state then obtaining an IRS issued Employer Identification Number is mandatory. An EIN is not only required by new businesses but also by those existing entities that have or will be witnessing a change in business ownership or structure. Sole proprietors will require an EIN only if they are hiring employees, changing the business structure to an LLC, corp., or have signed in partners to operate as a partnership.

The different types of businesses that will have to apply for and obtain an EIN include Corporations, Limited Liability Companies, Partnerships, Estates, Sole Proprietors, and Trusts. The Internal Revenue Service has also provided specific scenarios where-in the above mentioned business entities may not be required to apply for a new Employer Identification Number e.g., if a corporation opts to be taxed as an S Corporation then it will not be required to apply for a new EIN.

Contact The Irs To Find Your Ein

If you can’t find your EIN on any of your documents, you can contact the IRS, but you’ll need to call them Monday through Friday between 7 a.m. and 7 p.m. local time.

If your EIN has changed recently, and your EIN is probably different on older documents, this should be your first option. Be sure that the person contacting the IRS is authorized to do so, such as a sole proprietor, partner in a partnership or corporate officer.

Read Also: What Is The Tax In Georgia

How To Do An Ein Lookup

There may come a time when you need to search for another businessâs EIN, for your own tax purposes or to validate some information.

Hereâs how:

- If youâre an employee and need your employerâs EIN, itâs on the back of your W-2 form

- If the company is publicly traded, use the Security and Exchange Commissionâs EDGAR tool to look it up for free

- If the company is privately held, you may need to track down its accountant to ask or use a lookup service

When Is An Employer Id Number Required

Before you establish or register your business, you should know if you need an EIN in the first place. If you own a business that fits any of the following, youll need to apply for an EIN.

If you:

- Are part of a multi-member LLC

- Have a 401k or Keogh plan

- Inherited or purchased a business

If you are still not 100% clear on whether or not your particular entity is required to have an EIN, the IRS has a helpful questionnaire to further assist you.

If you are a required entity, its important to understand the financial planning and budgeting needed to ensure the longevity of your company. While applying for an EIN is free, additional corporate licenses and permits are not. Your accountant will review and analyze all these expenses for tax purposes.

Don’t Miss: How Much Money Is Taken Out Of Paycheck For Taxes

How To Get An Ein

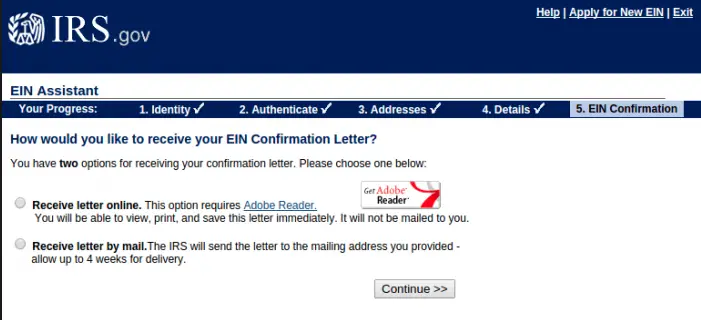

You can apply to the IRS for an EIN in several ways: by phone, fax, or mail, or online. Filing online using the IRS EIN Assistant online application is the easiest way. You can get your number immediately using the online or phone option.

Its a good idea to print out a copy of the application form before you begin the application process. Work through the application questions so you have all the answers youll need.

Beware of Fake EIN application sites. They look like the IRS site, but they’ll charge you to file the form. The IRS never charges for this application. Here are some ways to tell whether the site is the “real” IRS:

- Look at the URL. It should be irs.gov, NOT irs.com.

- Most IRS pages have the letters “IRS” and a special symbol with a scale of justice.

- Look at the fine print on the bottom of the page. Non-IRS sites are required to state that they’re not affiliated with the U.S. Treasury Department or the IRS.

What Is An Ein And How Can I Get One

An EIN serves as a unique identifier for your company and is largely used for tax purposes. The IRS requires any registered business that has employees or is a corporation or partnership to have one. Your EIN serves as the primary ID of a business to the government. It’s also commonly referred to as a “tax identification number ,” “95 number” or “federal tax ID.” It is often used for the following reasons:

- Business taxes

- Obtaining a business license

- Various business legal documents

Applying for an EIN is easy; it can be done online within minutes on the IRS website through form SS-4.

We recommend that businesses apply for an EIN as soon as possible because its crucial for basic business functions. You don’t need an EIN if you are the only employee, but if you’re looking to quickly scale your business, having an EIN early on is only beneficial.

Completing on online SS-4 is fastest, but you also have these options if youre based in a U.S. state or D.C.:

- Fax: 641-6935

- Mail: Internal Revenue Service, Attn: EIN Operation, Cincinnati, OH 45999

If you’re an international applicant and don’t have a legal residence in the U.S., you can apply for an EIN via one of these methods:

- Telephone: 941-1099

- Fax: 215-1627 if within the U.S., or 707-9471 if outside the U.S.

- Mail: Send your SS-4 form to: Internal Revenue Service, Attn: EIN International Operation, Cincinnati, OH 45999

Read Also: How To Get Tax Exempt Status

Is Employee Identification Number Needed

In most cases, small businesses are not required to have an Employee Identification Number. If, for example, somebody is running their business as a sole proprietorship and they have no other employees, they’re most likely not going to need an EIN. If, however, the business in question has more than one employee or they have chosen to structure themselves as either a corporation or a partnership, they’re going to need to apply for an Employee Identification Number.

Some other things that might trigger the need for an Employee Identification Number might include:

- Filing a tobacco tax return

- Filing a firearms tax return

- Setting a Keogh plan up through the business in question

If you’re a business owner and you’re not sure if you need to file for an EIN, it is probably in your best interest to contact an attorney with knowledge and experience in this area to examine your specific situation and help you determine if this is something you’ll need to do. It’s not a good idea to proceed without knowing for sure whether or not you’re going to need an EIN.

How To Find Your Employers Ein

Due to the coronavirus, a massive surge in unemployment has swept the nation. And in many states, you may need your employers EIN in order to file for unemployment. If you need to locate a current or former employers EIN for that or another reason, you can do so in two ways:

- Locate Your W-2:;Your employers EIN will appear on your W-2 form in Box b. If you have past tax records, this is the easiest way to find your employers identification number. If you cannot find your physical copy of your W-2, check your tax filing software such as TurboTax or any online payroll records you may have through companies such as ADP.

- Contact Your Employer:;If you cannot locate your personal tax forms or dont have sufficient forms due to being an independent contractor, the next step is to contact your employer. Reach out to the accounting, payroll and/or HR departments. They should be able to help you out right away.; If your employer is a publicly traded company, you should be able to find it online on the companys 10-K, which is public record. If your employer went bankrupt, look online for public court records which may include its EIN.

Also Check: How Can I Make Payments For My Taxes

Minnesota Taxpayer Identification Number

A business needs to obtain a Minnesota tax identification number if it is required to file information returns for income tax purposes, has employees, makes taxable sales, or owes use tax on its purchases. Most businesses need a Minnesota tax identification number. However, a sole proprietorship or single member limited liability company which does not have any of these tax obligations does not need a Minnesota tax identification number. See the Minnesota Department of Revenue Minnesota Sales and Use Tax Business Guide.

You may apply for a Minnesota Tax ID number with the Minnesota Department of Revenue online at Business Registration, by phone at 651-282-5225 or 800-657-3605, or by filing a paper form Application for Business Registration .

To apply online, youll need your federal employer ID number , if applicable; business name or if applicable, Certificate of Assumed Name; business owner’s Social Security Number; contact phone number and email address; the North American Industry Classification Code ; and business begin date. You will need your federal employer ID number , if applicable; the legal name or sole proprietor name and business address; the business name if applicable; NAICS ; names and social security numbers of the sole proprietor, officers, partners or representatives; and address and name of a contact person. If you do not have Internet access, call 651-282-5225 or 800-657-3605 to speak to a business registration representative.

Introduction To Federal Tax Id Lookup

Do you own your business in the competitive business world of the US? If so, then you know with whom you are dealing? No matter how efficient you are at doing what you do, there are probably quite a few administrative and regulatory obligations on your business checklist such as registering your company in any state, arranging finances, getting a permit, and a lot more.

One of the pertinent requirements for the newest startups is to obtain an EIN or Federal Employer Identification Number , from the IRS.

Whether you are planning to have a partnership with another company or willing to donate to charity or switch suppliers, you need to check their Federal Tax ID lookup. This unique identification number will provide you the valuable insights into the business you are interested in.

A Federal Tax ID lookup is all it takes to figure out this nine-digit number so that you can check the tax status and the identity of the organization with whom you are planning to do business.

Read Also: How To Register For Tax Id

Why Does A Business Need An Ein Number

The EIN is the businesss identifier and tax ID number. You use it to file taxes, apply for loans or permits, and build business credit. If you ever get a request for your TIN, or tax identification number , its the same as the EIN.

If youre a sole proprietor working for yourself, you wont need the number until you start to hire employees and contractors. Then, you will use it to register a tax withholding account.

What Are The Methods And Resources To Look Up For A Tax Id For A Business

Once you understand the importance of obtaining an EIN for your business entity, the next step is to make one aware of the methods and resources for Federal Tax ID Lookup. There are several ways by which you can search for specific Federal Tax IDs that businesses are operating with. Typically, all professional entrepreneurs and business owners have the tax identification number assigned by the IRS.

Whether you are a vendor who is seeking the tax identification number for your payments reports, or a business owner who has lost his FEIN; you will require specific and detailed information pertaining to the company in order to locate it. Here are some methods, which will help you with federal tax ID lookup for different business entities.

Also Check: How To Pay Back Taxes Online

Option : Check Other Places Your Ein Could Be Recorded

If you’ve misplaced your EIN confirmation letter, then you’ll need to get a little more creative to find your business tax ID number. Fortunately, once you get an EIN, your tax ID typically won’t change for the entire lifespan of your business. That makes locating the EIN easier.

These are some additional places where you can locate your EIN:

1. Old federal tax returns

2. Official tax notices from the IRS

3. Business licenses and permits and relevant applications

4. Business bank account statements or online account profile

5. Old business loan applications

6. Your;business credit report

7. Payroll paperwork

Note that your EIN generally will not appear on business formation paperwork, such as articles of incorporation, articles of organization, or a fictitious business name document. These documents establish your business’s legal setup but don’t contain your business’s tax ID number.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: Can I File Old Taxes Online

Can I Look Up My Ein

Here are a few ways to find your EIN if you misplaced or forgot it:

EIN Confirmation LetterWhen you received your EIN, the IRS should have sent you a confirmation letter with your EIN enclosed. Depending on how you applied, they would have sent either an email or mailed letter.

Other Personal DocumentsIf you can’t locate your confirmation letter, look through your business’ paperwork. Here are some documents that would have needed your business’ EIN:

- Federal tax returns

- Payroll documents

Ask the IRSAs a last resort to finding your EIN, you can contact the IRS. Call the IRS’ Business and Specialty Tax Line at 800-829-4933 MondayFriday, 7 a.m. to 7 p.m. local time.

A representative will provide your EIN over the phone. The representative will need to verify your identity before providing your EIN, so have your Social Security number, identification card, or other form of identification available.

Once you have found your EIN, keep the number in a safe spot so you can find it quickly and easily next time.

How To Change Or Cancel An Ein

Once you obtain an EIN for your business, that tax ID remains with your business for its entire lifespan. However, there are some situations where you might need a new business tax ID number.

Here’s when you’ll need to apply for a new EIN:

-

You incorporate for the first time or change your business entity

-

You buy an existing business or inherit a business

-

Your business becomes a subsidiary of another company

-

You are a sole proprietor and are subject to a bankruptcy proceeding

-

You are a sole proprietor and establish a retirement, profit sharing, or pension plan

-

You receive a new charter from your state’s Secretary of State

-

There are changes to your ownership structure

The IRS has a detailed list of situations where you need a new EIN. A new EIN replaces your old EIN, so once you get the new tax ID, you would use that on tax returns and other business paperwork moving forward.

Note that more common changes, such as changes to your business name or address, generally don’t require a new EIN. But you should still report a business name change or location change to the IRS.

Also Check: Is Past Year Tax Legit

Request A Reference Librarian

With the advancement of technology and network opportunities, the business owners underestimate the importance of their local libraries. If you have to look up an organizations Federal Tax ID number, then local library references can be a valuable asset. Most of the public and college libraries have a desk of reference, managed by the reference librarians.

You can easily access Federal tax ID lookup for specific business entities. More importantly, reference librarians are specialized professionals who can help you in finding out the specific information, such as a companys EIN and FTIN details.