Forms That Have Always Been Around

Forms you may need to submit with your return include the following:

- W-2s: These are forms your employer provides detailing wages and taxable benefits earned and taxes withheld during the year. Employers must send a W-2 by January 31 if you earned more than $600 in wages during the year.

- W-2G: This details gambling winnings and federal tax withheld from winnings.

- 1099-MISC: If you have income from freelance or gig work, the company that paid you should send you a 1099 detailing the payment.

These forms typically show earned income. Of course, there are other forms you may need to include, but these are some of the most common.

If you submit a return via mail, you can attach copies of these forms. If you e-file using an online tax program, youll need to upload your forms to the program.

Tangible Personal Property Taxes

Tangible personal property is property that can be moved or touched, such as business equipment, machinery, inventory, furniture, and automobiles.

Taxes on TPP make up a small share of total state and local tax collections, but are complex, creating high compliance costs; are nonneutral, favoring some industries over others; and distort investment decisions.

TPP taxes place a burden on many of the assets businesses use to grow and become more productive, such as machinery and equipment. By making ownership of these assets more expensive, TPP taxes discourage new investment and have a negative impact on economic growth overall. As of 2019, 43 states taxed tangible personal property.

New Forms You May Need To Submit

Unsurprisingly, the postcard-size 1040 form doesnt really provide the IRS with all the information necessary to determine how much tax you owe. You might also need to include schedules that provide the IRS with information about credits, deductions and income sources.

These include but arent limited to

Your head may be swimming with all of these add-ons to the basic 1040 form especially since each schedule lists its own additional forms to include. ® can help you determine which additional forms you need to complete based on the deductions and credits you claim, as well as on your income sources.

Also Check: How To Buy Tax Lien Properties In California

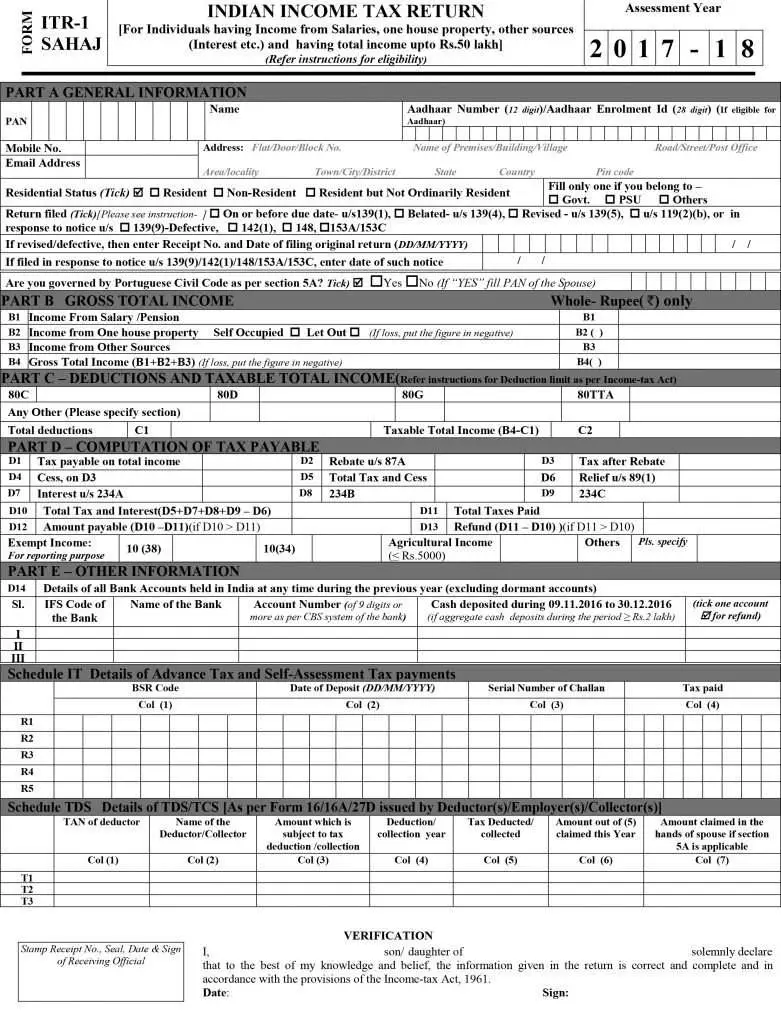

Form 1040 Us Individual Income Tax Return

If you’ve ever wondered how the IRS calculates your income taxes, this is your one-stop form to unravel all the hidden gems. Form 1040 is where you declare your filing status, take your standard deductions, claim lucrative credits, and determine how much you owe the IRS. This is your starting point to understanding the basics of the tax return.;

Types Of 1099 Tax Forms

There are more than a dozen different kinds of 1099 forms, which cover some common and pretty uncommon sources of income. Here’s a breakdown of some of the reasons you might receive one of these documents:

Work

- Form 1099-MISC. You should receive this document for any miscellaneous income you got during the year, of at least $600. Examples include: work you did for someone that’s not your employer, prizes, and awards.

- Form 1099-G. You may get this document if you received money from the government, including for unemployment compensation and tax refunds or credits.

- Starting this year, the IRS is transitioning to Form 1099-NEC for money you earned as a nonemployee, like if you are a freelancer or independent contractor. You’ll first receive these 1099 forms to file with your taxes in 2021.

Video by Euralis Weekes

Investments

- Form 1099-B. This document will detail any income you earned from the sale of securities, like stocks, bonds, exchange-traded funds , and mutual funds.

- Form 1099-DIV. Financial institutions issue this form to report dividends and other distributions they made to taxpayers.

- Form 1099-INT. If you earned more than $10 in interest from a financial institution, you’ll receive one of these forms.

- Form 1099-OID. You might receive this form, short for “original issue discount,” if you bought bonds or other financial securities at a discount to the face value or whatever the redemption value will be at maturity.

Real estate

Don’t Miss: When Are Delaware State Taxes Due

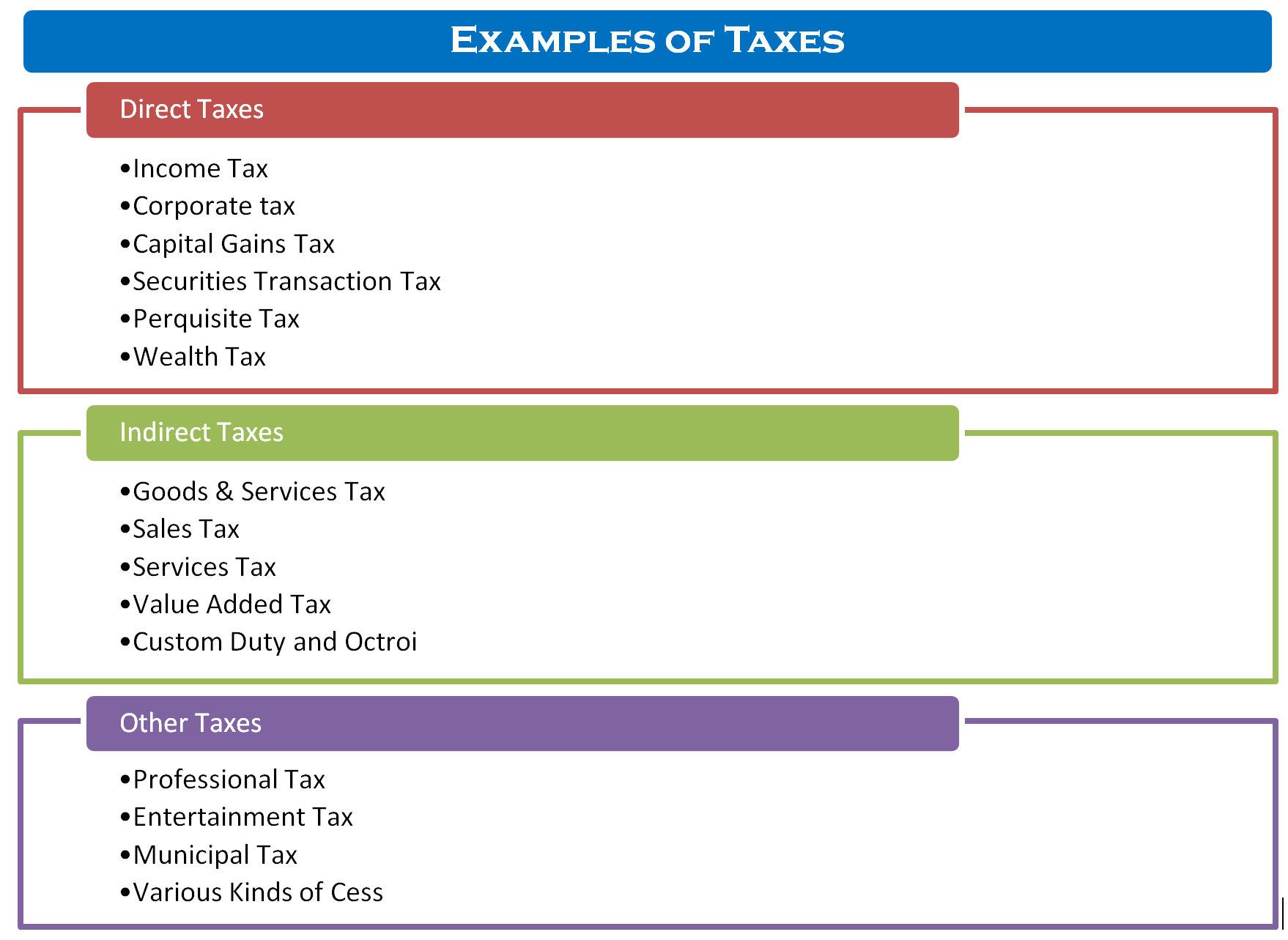

Taxes On Goods And Services

When you purchase certain goods or services, you may have to pay a consumption tax. Consumption taxes are often indirect taxes because even though the government is collecting from a retailer, the person who buys the good is the one who ultimately pays the tax.

Below are four common types of consumption taxes:

-

Sales taxes

-

Tariffs

What Is Form : Us Individual Tax Return

Form 1040 is the standard Internal Revenue Service form that individual taxpayers use to file their annual income tax returns. The form contains sections that require taxpayers to disclose their taxable income for the year to determine whether additional taxes are owed or whether the filer will receive a tax refund.

You May Like: What Tax Bracket Are You In

What Is The Difference Between Tax Forms 1040 1040a And 1040ez

Tax time can be stressful, and for many, the headaches start with trying to figure out which forms to use. Everyone required to file an individual federal income tax return must use Internal Revenue Service tax Form 1040, or one of its shorter versions, such as Form 1040EZ or Form 1040A.

Various income levels require you use different tax forms. So you can better choose the right one for your situation, understand the most commonly used tax forms.

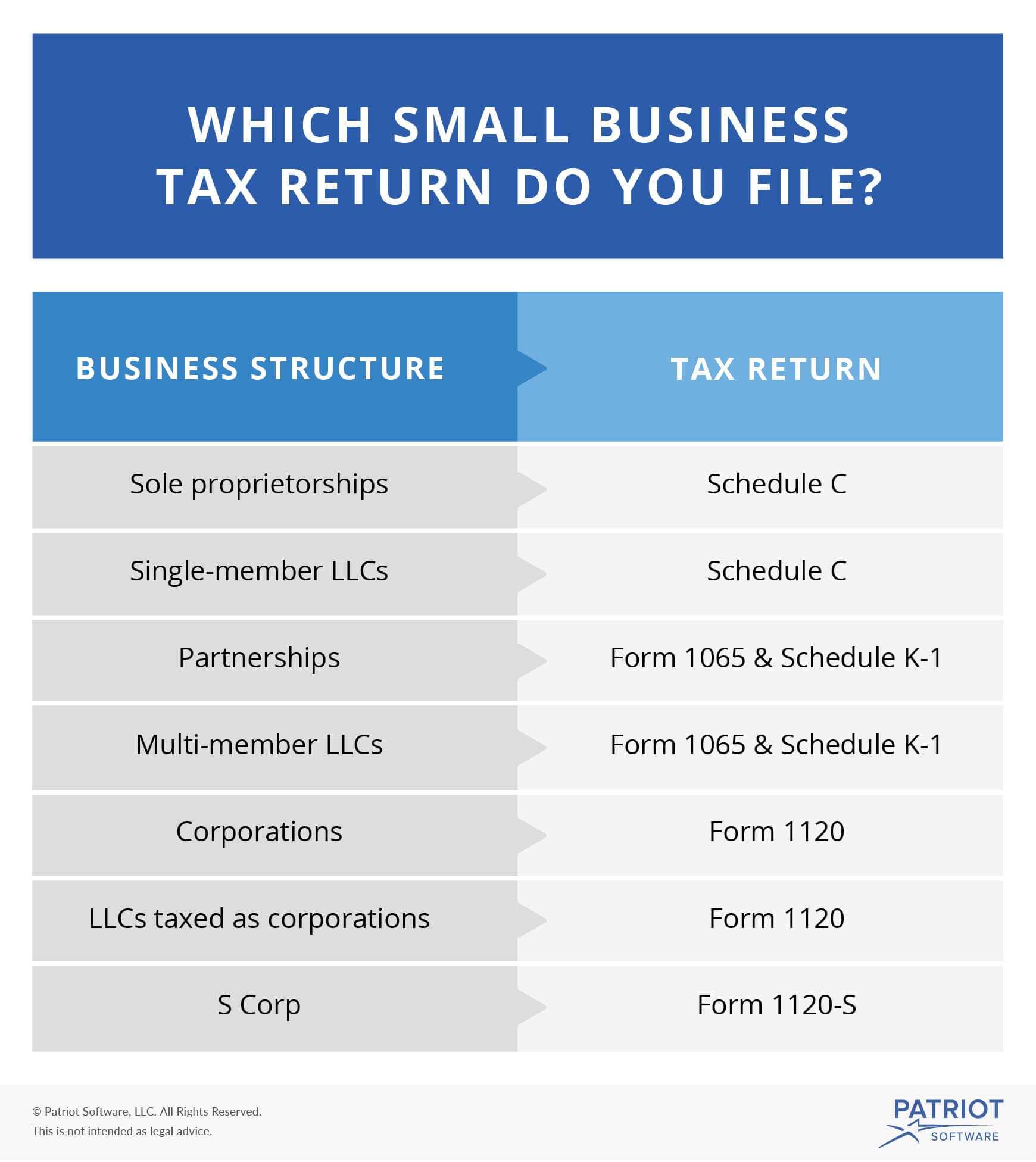

Tax Considerations By Business Type: Sole Proprietorship

In a sole proprietorship, both the owner and the business are the same. In regards to taxes, the government does not see the business in a sole proprietorship as a separate taxable entity. Any business liabilities or assets are included in the owner’s personal liabilities and assets. A sole proprietor would file either of the following tax forms:

- Schedule C

- Schedule C-EZ, Form 1040

Individuals can have multiple businesses under a sole proprietorship. In this case, they would just list each business and its activity on a new Schedule C form. A Schedule F would be used if the sole proprietorship is in the farming industry.

Sole proprietorships are generally simple to file. It includes any employees that are considered to be self-employed or an independent contractor. The paid tax rate is the same as the business owner’s personal tax rate.

You May Like: How To Review My Tax Return Online

Common Tax Form Attachments

Depending on your situation, you may be required to file attachments to your return. According to the IRS the following attachments are the most common:

- Schedule A is for itemizing deductions, such as mortgage interest, property taxes, medical or dental expenses, and charitable contributions.

- Schedule B is the place to report taxable interest or ordinary dividends exceeding $1,500 . This is also where you report income from a seller-financed mortgage.

- Schedule C reports the profit or loss and any deductible expenses from a business you own.

- Schedule D is where you report capital gains and losses from stock sales or other transactions.

- Schedule SE calculates the self-employment tax.

Tax Considerations By Business Type: S Corporation

An S corporation is also classified as a separate tax entity. An S corporation has special permission from the IRS for treatment as a partnership. They are not liable for corporate taxes and are instead taxed on a pass-through basis. The biggest advantage of this tax setup is that S corporations are not double taxed. An S corporation will file the following documents:

- Form 1120S

- Form 1040

- Schedule K-1

S corporations do not usually have as many partners, or shareholders, as C corporations do. Each of the S corporation owners reports their liabilities and assets on their personal income statements.

It is important to understand the different types of business tax returns and what documents are required of each. If you need help with different types of business tax returns, you can post your legal need on UpCounsel’s marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

You May Like: What Is Deduction In Income Tax

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

RATE SEARCH: Shopping for a mortgage? Compare mortgage rates today at Bankrate.com.

Tax Forms: Everything You Need To Know For Filing

As you get ready to file your tax return for income you earned in 2016, youll have to pick from among three forms: the;1040, the 1040EZ or the 1040A.

Anyone can decide to fill out Form;1040; the others have more-specific requirements.

Heres a quick breakdown:

;;Form 1040EZ:;With this one, you cant claim any , with the exception of the Earned Income Tax Credit. Its by far the briefest version of the 1040, and you can easily file your return;for free with many;online tax preparation services.

;Form 1040A: If you dont plan to itemize your deductions, like for mortgage interest, then take a look at the 1040A. You might not be able to claim deductions, but you can claim tax credits, like for educational expenses.

;Form 1040: You can claim all the deductions and credits in the world, and anyone can use it, regardless of filing status. Its just much longer than the other forms.

The longer the form, the more opportunities for tax breaks, both deductions and credits. Both are good, ultimately reducing how much the federal government takes from you.;The table;below;shows you which deductions and credits are available with each 1040 tax form.

More help on filing your taxes:

You May Like: How Fast Can You Get Your Tax Refund

You Should File Form 1040 If:

- Your income, or combined incomes for joint filers, is more than $100,000.

- You itemize deductions.

- You have self-employment income.

- You received income from the sale of property.

Keep in mind that just because you got a particular income tax form in the past, that doesnt mean you have to use it. If your situation has changed say, you now have enough deductions to make itemizing worthwhile then file a different form.

It could be tax money in your pocket.

RATE SEARCH: Stretch your retirement income with a CD ladder. Compare CD rates today.

Related Links:

Which Tax Forms To Use

The documents to start with are the 1040 and 1040-SR. For tax years prior to 2018, Forms 1040EZ and 1040A were available but have been phased out beginning with the 2018 tax year by a redesigned Form 1040 and a new 1040-SR for those 65 and older. The 1040 family of forms serves as the center of your tax return.

- Form 1040EZ; is the simplest version of this essential tax form. You generally can file it if you:

- Have no dependents

- Earned less than $100,000

- Dont plan to itemize your deductions

- Form 1040A is more comprehensive than 1040EZ, but simpler than the regular 1040. It lets you make certain adjustments to your taxable income, such as child tax credits or the deduction for student-loan interest, but doesnt let you itemize deductions. You typically can use this form if you earn less than $100,000 and dont have self-employment income.

- Form 1040;for tax years prior to tax year 2018 applies if the other two tax forms dont: for example, if you make $100,000 or more, have self-employment income or plan to itemize deductions. Beginning with the 2018 tax year, the redesigned Form 1040 will be used by most taxpayers. The 1040-SR is available as of the 2019 tax year.

Don’t Miss: When Do You Get The Child Tax Credit

How Do I Get A 1040 Form

If you’re filing your return using tax software, you answer questions and provide information that is translated into entries on your form 1040 or form 1040-SR. You should be able to electronically file your form 1040 or 1040-SR with the IRS and print or download a copy for your records.

If you prefer to fill out your return yourself, you can download a form 1040 or form 1040-SR from the IRS website.

If you are looking for your tax returns from past years, you can request a transcript from the IRS.

» MORE:;Really get to know your money how much you have and how youre spending it.

What Tax Forms Are Required

QUICK TIP:; ;To keep it simple,;upload your entire U.S. income tax return to IDOC.; We need the entire return as you submitted it to the IRS including your personal return, your corporate and/or partnership return , including all schedules and pages.; You may simply upload a single PDF of your tax return to IDOC, and IDOC will separate and organize your submission for you – it’s very easy!

This page explores;some of the more common tax forms;that are required when domestic students;complete the CSS Profile and FAFSA. Most families have submitted these forms to the IRS already for last year’s federal income tax return, so the;forms should be available to you or your parent/guardian. Our Financial Aid Office uses these forms to verify the information that you/your parents reported on your CSS Profile and/or FAFSA forms. You will submit electronic copies of the tax forms to Swarthmore;using IDOC .;

This list of;the more commonly-required forms does not apply to everyone, and is not an exhaustive list. You;may not possess or have to submit every one of the forms/documents listed on this page. In addition, you may need to submit;less common forms that are not listed here.;

Also Check: Is Past Year Tax Legit

Tax Considerations By Business Type: General Partnership

A business partnership is also not considered to be a taxable entity. In a general partnership, each partner claims their own liabilities and assets and includes it with their personal tax return. All income that comes through the business is listed and then included on the individual tax return. A general partnership will utilize the following tax documents:

- Form 1065

- Form 1040

In a general partnership, each partner can expect to receive a Schedule K-1, which shares each partner’s income. You will use this form when filling out your own income documents. Each partner can expect to pay taxes on their portion of the income received.

State And Local Income Taxes

Like the federal government, most states have their own income tax for residents of the state and potentially people who work in the state even if they donât live there. Most states also all have a progressive tax with marginal tax brackets, though the number of brackets and the income ranges differ. For example, Alabama has tax rates of 2%, 4%, and 5% depending on your income.

Only seven states do not have an income tax:

-

Alaska

-

Pennsylvania

-

Utah

Some cities, counties, and local governments also collect income taxes. As examples, in Missouri, both Kansas City and St. Louis collect an income tax. In Maryland, each county collects its own income tax. In Oregon, cities in the Portland area pay an income tax to support public transit.

Also Check: What Is The Date To Pay Taxes

Form 1098 Mortgage Interest Statement

Don’t forget to claim your deduction for your mortgage interest. If you paid $600 or more in mortgage interest, you should receive this form as a reminder of how much you paid. But it’s on you to keep track of your mortgage interest if it’s less than $600, because your lender won’t be required to send you a form.;

New Form 1040 Instructions

Here are the new 1040 form instructions as of 2019 from the IRS:

You will use the redesigned Form 1040, which now has three new numbered schedules in addition to the existing schedules such as Schedule A. Many people will only need to use Form 1040 and none of the new numbered schedules. However, if your return is more complicated , you will need to complete one or more of the new numbered schedules. Below is a general guide to which schedule you will need to use based on your circumstances. See the 1040 instructions for the schedules for more information. If you e-file your return, you generally wont notice much of a change and the software will generally determine which schedules you need.

Also Check: How To Find Tax Amount