Wheres My State Tax Refund Colorado

Taxpayers can check the status of their tax refund by visiting the Colorado Department of Revenues Revenue Online page. You do not need to log in. Click on Wheres My Refund/Rebate? from the Quick Links section. Then you will need to enter your SSN and the amount of your refund.

Colorado has increased its fraud prevention measures in recent years and and warns that it may need take up to 60 days to process returns. Returns will take longest as the April filing deadline approaches. This is when the state receives the largest volume of returns. The state also recommends filing electronically to improve processing time.

Where Is My Arkansas State Tax Refund Check

How do you check the status of Your Arkansas state tax refund?

- To check the status of your staterefund online, visit the Wheres My Refund? page on the Arkansas Department of Finance and Administrations website. Enter the primary filers Social Security number or IRS Taxpayer Identification Number as listed on your statetax return and the expected refund amount as noted on your return.

Your State Tax Refund

Firstly Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming dont have income tax. If you received income such as wages, scholarship or any other earnings and/or income, you would not have been required to file a State tax return and you will therefore have no entitlement to a State tax refund.

In addition, New Hampshire and Tennessee only tax interest and dividend income, not wages, scholarship, earnings, or other type of income.

For all other States, you can check the status of your State tax refund by using the useful links listed below.

Also Check: How To Pay Doordash Taxes

Wheres My State Tax Refund Utah

You can check the status of your refund by going to the states Taxpayer Access Point website. On that page you can find the Wheres My Refund? link on the right side.

Due to identity protection measures, the Utah State Tax Commission advises that taxpayers should allow 120 days for a refund to get processed. The earliest you can hope for a refund is March 1.

Arkansas Refund Status State Tax Refund

Arkansas Department of Finance is responsible for handling all Arkansas State Tax Refund Payments.

The Individual Income Tax Section is responsible for technical assistance to the tax community in the interpretation of Individual, Partnership, Fiduciary and Limited Liability Company tax codes and regulations prepares and distributes tax forms and instructions to individuals and businesses necessary to complete Individual, Partnership, Fiduciary, Limited liability and Employer tax returns collects and maintains a records of employer payments into accounts setup for employee withholding and individual accounts setup for estimated tax payments Assess individual taxpayers for failure to file tax returns and adjust tax return for math errors and tax law errors maintain a record of tax, penalty and interest owed on individual and withholding accounts. Notifies taxpayers of any delinquent on deficient tax amounts transfer accounts to Legal and Collection Sections for additional activity provides administrative procedure and revenue estimate impact statements for all proposed legislation provides administrative support for purchasing, personnel action, budgeting and inventory control of section personnel and equipment

Wheres My Arkansas State Refund? Find my AR Refund. E-File Department of Finance. Track my AR State Tax Refund. Arkansas Tax Resources list here.

Arkansas Refund Status State Tax Refund

Recommended Reading: How To Calculate Doordash Miles

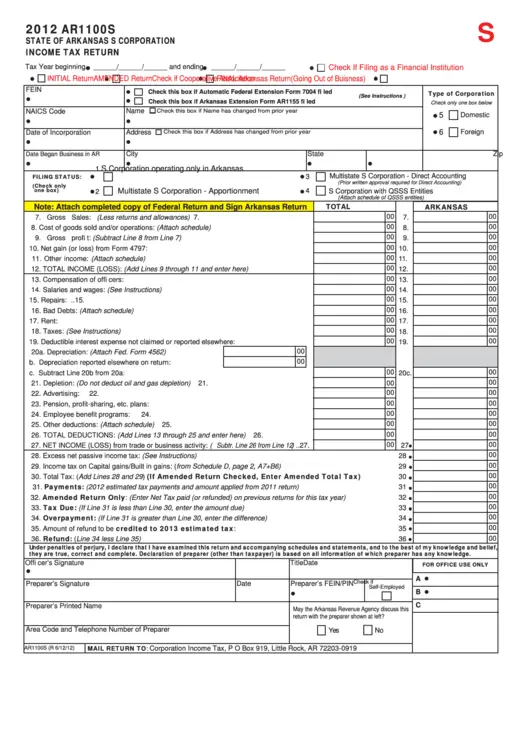

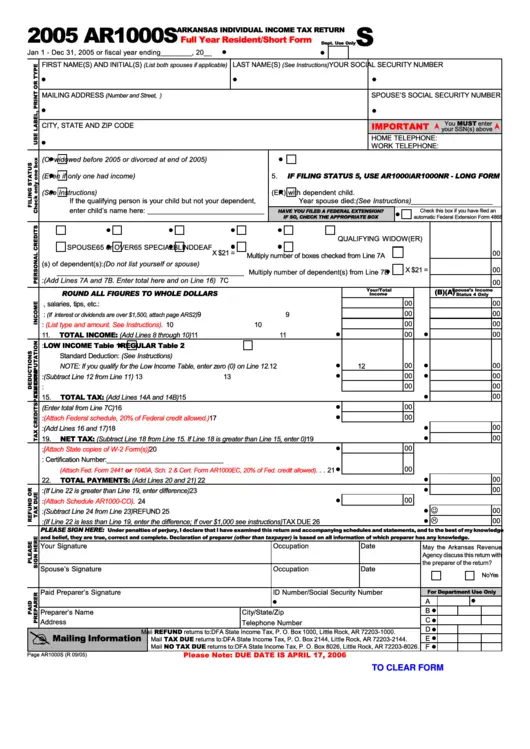

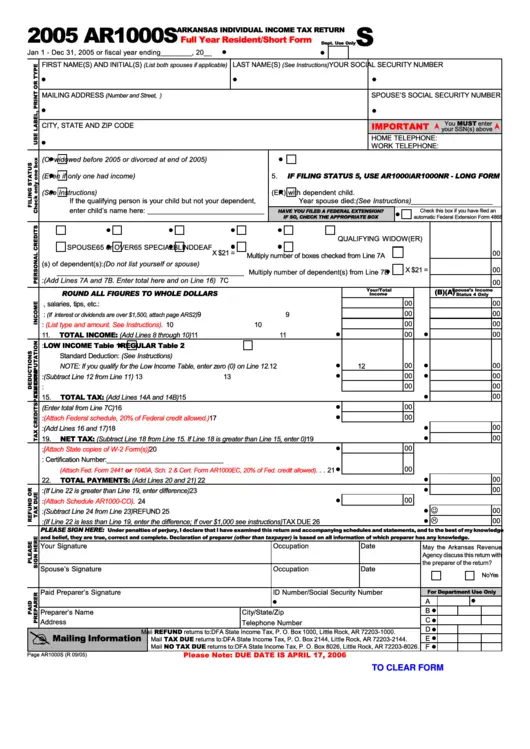

How Can Arkansans File Their Returns

There are two main ways to file Arkansas state tax returns: by mail or online.

To file by mail, full-year resident Arkansans can fill out this form. Nonresidents or part-year can fill out this form.

For people expecting a refund, they can mail the return to Arkansas State Income Tax P.O. Box 1000 Little Rock, AR 72201-1000. For those paying taxes or who do not expect a refund nor need to pay taxes, they can mail their return to Arkansas State Income Tax P.O. Box 2144 Little Rock, AR 72201-2144.

If an individual owes taxes, they can include a check with the return but not cash, according to the Department of Finance and Administration.

To file online, visit this site to see programs that partner with the state. Some are available for free, depending on a filers income and other factors.

Wheres My State Tax Refund Tennessee

Tennessee residents do not pay income tax on their income and wages. The tax only applied to interest and dividend income, and only if it exceeded $1,250 . Taxpayers who made under $37,000 annually were also exempt from paying income tax on investment earnings. The state levied a flat 4% tax rate for 2017 and was phased entirely by January 1, 2021. A refund is unlikely for this income tax.

Don’t Miss: Does Doordash Take Out Taxes

How Can I File An Arkansas State Tax Return

Arkansas doesnt provide an option to e-file your individual state tax return through the DFA website. But if you meet income, age and other requirements, you may be able to file your Arkansas state tax return for free through an online provider. Or you can file your federal income tax return and your single-state tax return for free with , which is always free regardless of your income level or age.

You also can file paper forms. You can download them from the DFA site and mail your tax forms and any payment to one of these addresses.

|

If you owe tax |

Wheres My State Tax Refund Vermont

Visit Vermonts Refund Status page and click on Check the Status of Your Return. You will find it toward the bottom left. That link will take you to form that requires your ID number, last name, zip code and the exact amount of your refund. The Vermont Department of Taxation may withhold some refunds until it receives W-2 withholding reports from employers.

Also Check: 1099 From Doordash

How To Contact The Arkansas State Department Of Revenue

Or, you can also call the Arkansas State Department of Revenues refund line at +1 682-1100 or their toll free line at + 882-9275.

If you have filed for your tax refund electronically, it should be issued within 21 business days after they acknowledge the receipt of the return. However, if you have submitted a paper tax return, it may take up to ten weeks from the day you mailed it.

Wheres My State Tax Refund Illinois

The State of Illinois has a web page called Wheres My Refund, where you can see if the state has already processed your tax return and initiated your refund. The only information you need to enter is your SSN, first name and last name. If the state has not processed your return yet, you can set up an email or text notification to let you know when it does.

Recommended Reading: How Do Taxes Work With Doordash

Wheres My State Tax Refund

You can check the status of your state refund online through your states website.

When you file with TaxSlayer, your federal and state return statuses are easily accessible in your account. When you log in, you can clearly see when your returns have been accepted. Once your state accepts your return, your refund is processed and distributed.

How Do I Send My Tax Return By Mail

Use the U.S. Postal Service® to mail your tax return, get proof that you mailed it, and track its arrival at the IRS.Mailing Tips Send to the Correct Address. Check the IRS website for where to mail your tax return. Use Correct Postage. Weigh your envelope and apply the right amount of postage. Meet the Postmark Deadline.

You May Like: How Much Taxes Do I Have To Pay For Doordash

Arkansas Tax Deductions And Taxable Income

Arkansas taxpayers can itemize their deductions or claim the standard deduction on their state returns. The standard deduction for most filers is $2,200. Married couples filing jointly can claim a standard deduction of $4,400.

Additionally, different types of income are not considered taxable in the state of Arkansas.

For example, all Social Security benefits are not taxed. The service pay or allowance received by an active duty member of the armed forces is 100 percent exempt from Arkansas income tax. That covers all members of the armed services, including the National Guard and Reserve Units.

Tax filers can claim a $26 personal tax credit that reduces their tax liability for each filer and dependent. A political contribution credit of up to $50 can also be claimed on the Arkansas state return for contributions made to a number of areas.

The Child Care Credit ranges between 20 percent to 35 percent of some or all of the dependent care expenses a taxpayer pays throughout the year. The percentage available depends on their income level.

Where Is My State Tax Refund

So, you received your federal tax return for the year, but youre still waiting on your state refund.

It can take anywhere from a day to more than 15 weeks to get a state refund, depending on what state you live in. Please refer to the table below to find your states refund timeframe.

You May Like: How Do You Do Taxes With Doordash

How Long Will It Take To Get My State Tax Refund

While there are a few exceptions, most states have state income taxes. If you are looking for information about your state income tax refund, use the chart below. It gives the average time it takes to get your refund processed in each state.

Also, if you click on the states name, youll find more detailed information about the states tax refund policies and timeframes. Youll also find links to your states department of revenue web page and automated phone number. Those will be the best options to check the status of your refund.

For most states, youll need your social security number, the tax year and your expected refund amount to check your state refund status.

Tips For Managing Your Taxes

- Working with a financial advisor could help you invest your tax refund and optimize a tax strategy for your financial needs and goals. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Each state will process tax returns at a different pace. On the other hand, the IRS generally processes federal returns at the same pace, no matter where you live. Heres a federal refund schedule to give you an idea of when to expect your refund.

Read Also: Is Doordash 1099

Am I Required To File A State Tax Return

Typically, it depends on where you live and if your income is over a certain threshold. Every state has its own tax laws and requirements. Check your states department of revenue or taxation website to find out if you should file a state return this year.

If you live or work in one of these states, you do not have to file a state tax return or pay income taxes to that state:

- Alaska

- Washington

- Wyoming

Tennessee used to tax investment income and interest, but that was fully repealed on Jan. 1, 2021. Similarly, New Hampshire only taxes investment income and interest, but is set to phase that out in 2023. In the meantime, you may still have to file a New Hampshire state return if you have those types of income.

Remember even if you are not required to file a state return, you may still be subject to federal income taxes.

If your state owes you a tax refund, you must file a return to claim it even if youre not required to file a state return.

Wheres My State Tax Refund Massachusetts

The Massachusetts Department of Revenue allows you to check the status of your refund on the MassTax Connect page. Simply click on the Wheres my refund? link. When the state approves your refund, you will be able to see the date when it direct deposited or mailed your refund.

The turn around time for refunds, according to the state, is four to six weeks if you filed electronically and elect for direct deposit. You can expect a turnaround time of eight to 10 weeks if you filed a paper return and chose direct deposit. If you opted to get your refund as a paper check, you can expect to wait about one week longer than the times mentioned above.

Also Check: How Do I File Taxes With Doordash

Who Has To File An Income Tax Return

According to the Department of Finance and Administration, full-year residents of Arkansas for 2020 must file a tax return if they are:

Single with a gross income of at least $12,675

Head of household with one or no dependents and a gross income of at least $18,021 or with at least two dependents and a gross income of at least $21,482

Married filing a joint return with one or no dependents and a gross income of at least $21,375 or at least two dependents with a gross income was at least $25,726

Widowed in 2018 or 2019 and not remarried in 2020 with one dependent and a gross income of at least $18,021 or at least two dependents and a gross income of at least $21,482

Nonresidents or part-year residents who moved into or out of Arkansas during 2020 must file a return regardless of income.

Before Entering Into Ral Or Rac Agreement:

- Check out the free or low-cost options listed below.

- Consider that electronically filed returns can be deposited in your account in as few as eight days.

- If you do not have a bank account, the Internal Revenue Service can provide your refund by check or prepaid debit card.

- Always get a written list of fees before entering into any agreement or having any tax preparation services performed.

Read Also: How To Get 1099 From Doordash

Where Do I Send My Arkansas State Tax Return

The proper mailing address for your Arkansas state tax return will vary, depending on whether or not you are expecting a tax refund.

The exact mailing addresses for filing your personal tax return are published on Page 2 of the Arkansas state instructions booklet for all filers . A courtesy link to that document is found below.

General Tax Return Information

Due Date – Individual Returns – April 15, or same as IRS

Extensions – Taxpayers that have requested an extension of time to file their federal income tax return are entitled to receive the same extension on their Arkansas income tax return. The federal automatic extension extends the deadline to file until October 15th.

Taxpayers who do not file a federal extension, can file an Arkansas extension using Form AR1055 before the filing due date of April 15th. Inability to pay is not a valid reason to request an Arkansas extension. The Arkansas Extension of Time to File can be accessed from the main menu of the Arkansas return by selecting Arkansas Extension of Time to File.

Drivers License/Government Issued Photo Identification: Arkansas does not require this information to file the tax return. Providing the information will help identify the taxpayer’s identity and can help process the tax return quicker. To enter Identification Information, from the main menu of the Arkansas return select Personal Information > Driver’s License Information.

Unemployment Compensation and PPP Loan Forgiveness

Update: On March 1, 2021, the Governor signed 2021 AR SB 236 into law. The following changes affect the 2020 tax year.

Unemployment compensation. This law exempts unemployment compensation benefits from tax for:

Unemployment compensation benefits paid from federal unemployment funds for calendar years 2020 and 2021, and

Read Also: Pastyeartax Reviews

Checking The Status Of My Federal Tax Return

I met with my accountant a couple weeks ago and have recently received a copy of my taxes back. Since I am expecting a sizeable tax refund so I am obviously excited and anxious. A few years ago I discovered the IRS website, Wheres My Refund?

Despite it being from the IRS, the website is actually really easy to use and all you need is:

- Your Social Security Number

- Filing Status

- Refund Amount

Where Do I Mail My Arkansas Tax Return 2019

For people expecting a refund, they can mail the return to Arkansas State Income Tax P.O. Box 1000 Little Rock, AR 72201-1000. For those paying taxes or who do not expect a refund nor need to pay taxes, they can mail their return to Arkansas State Income Tax P.O. Box 2144 Little Rock, AR 72201-2144.

You May Like: Freetaxusa Legit

Using The Irs Where’s My Refund Tool:

The IRS has instituted a simple method for checking the status of an individual’s tax refund. “Where’s My Refund” is what the IRS calls its tool which allows filers to check the status of their Federal Refund. In order to check this, you must have first filed your return and it must have been received by the IRS. Status updates are typically only made every 24hrs, so you may also need to wait at least one day after receipt of the return prior to using the IRS Where’s My Refund tool.

You can check the status of your refund by clicking the “Check My Refund Status” button below. Please note, in order to retrieve the information on your refund you will need to enter your SSN, filing status and the amount of your expected tax refund.

Twenty-one days or less is the “stated” turn-around time in which a filer should receive their refund. However, in practice many refunds are processed much more quickly than this some in as little as 8 days. For this reason, you may want to consider waiting until the 8th day before checking your tax refund’s status. Keep in mind that federal return timeframes are based on the receipt date and those who file by mail should add time to this estimate.

If you would like to check your status these are the items you will first need: