What Happens If You Dont File Taxes For 5 Years

If you fail to file your tax returns on time you could be charged with a crime. The IRS recognizes several crimes related to evading the assessment and payment of taxes. Penalties can be as high as five years in prison and $250,000 in fines. However, the government has a time limit to file criminal charges against you.

Go Online And Use The Wheres My Refund Irs Tool It Works

Although the IRS Wheres My Refund tool is available to check the progress of your return, it only applies to the tax return you filed for the mostcurrent tax year.

For example, lets say you file your 2013 tax return and soon after remember to file your late 2012 return. Although you filed your 2013 taxes before your 2012, 2013 is going to be the one that the IRS site shows the status for since it is the most recent tax year in their database for you.

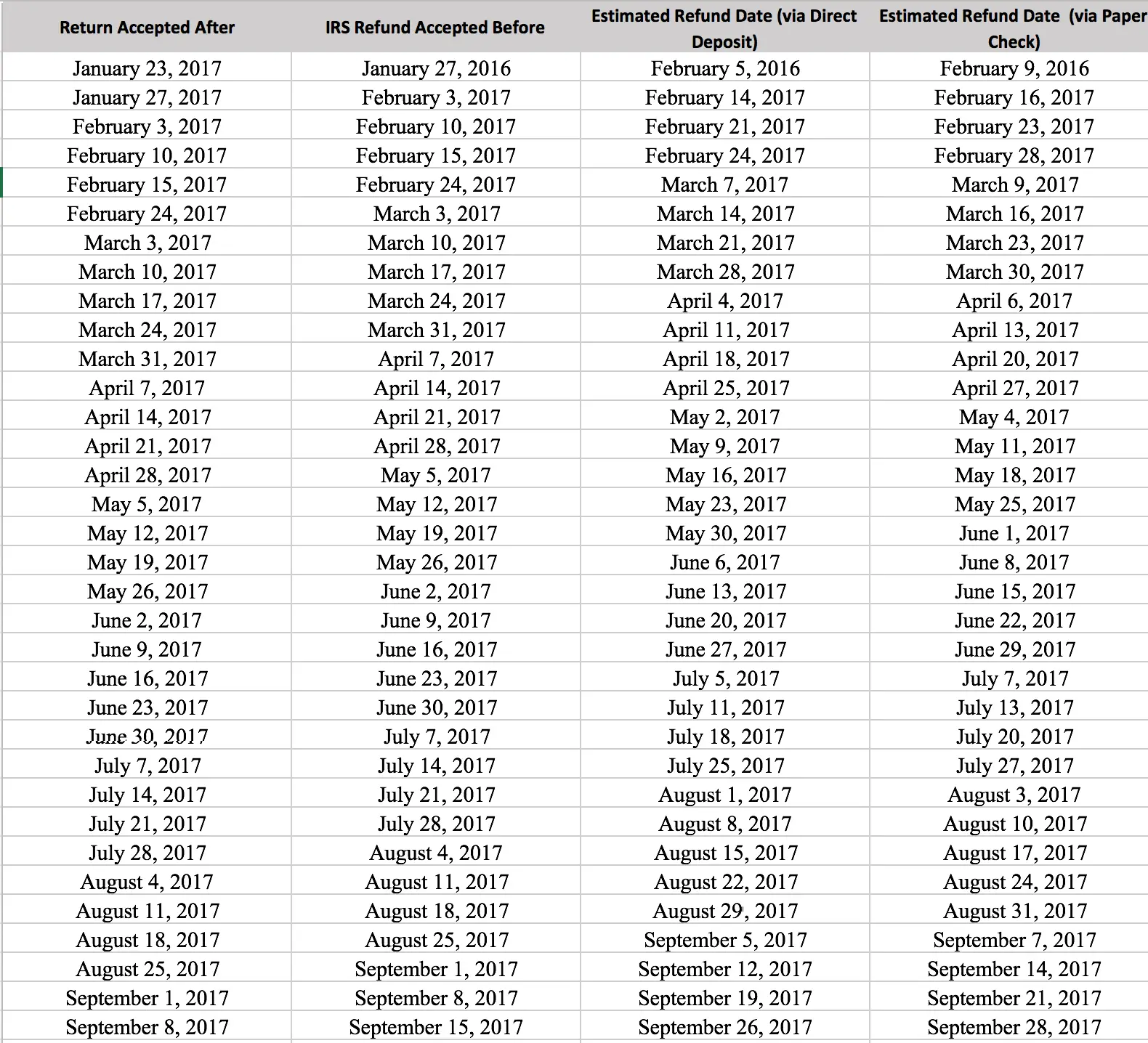

The 2017 Tax Refund Schedule

If every cloud has a silver lining, the silver lining for the onerous task of tax-return preparation is the tax refund that often follows it. Once you send your return to the Internal Revenue Service , you’re probably itching to get your payment. Here’s a look at the 2017 tax refund schedule, and when you can expect your money.

First off, if you’re a longtime follower of the IRS and its practices, you probably have a hazy memory of a tax refund schedule that it would publish each year. Well, you might want to sit down, because I have some bad news for you: It has been discontinued. You’re not totally out of luck, though. We have enough information with which to make some educated guesses.

Image source: Getty Images.

Don’t Miss: Can I Check My Property Taxes Online

Can You Get Irs Refund After 3 Years

In most cases, an original return claiming a refund must be filed within three years of its due date for the IRS to issue a refund. Generally, after the three-year window closes, the IRS can neither send a refund for the specific tax year.

If You Choose Direct Deposit

Your tax refund will be sent to your bank the same day the IRS sends your tax refund. It will typically take 3-5 days for your bank to process, depending on your bank.

*Faster access compared to standard tax refund electronic deposit and subject to IRS submitting refund information to the bank before release date. IRS may not submit refund information early.

*Faster access compared to standard tax refund electronic deposit and subject to IRS submitting refund information to the bank before release date. IRS may not submit refund information early.

All timing is based on IRS estimates.

Don’t Miss: How To Track Gas Mileage For Taxes

Using The Wheres My Refund Tool

The IRS offers a quick way to check the status of your tax refund on its website at IRS.gov. Refunds can be traced by using the Wheres My Refund? tool. Youll need your Social Security number, filing status, and the amount of your tax refund.

Depending on how you filed and which tax year you filed, you can see an updated status in as little as one day. Those who filed online can see their status one day after they are received by the IRS for the current tax year, and three to four days after filing online for previous tax return years. Those who mailed their tax returns can check their status four weeks after submitting them in the mail, although there may not be an update for up to six months.

How You File Affects When You Get Your Refund

The Canada Revenue Agency’s goal is to send your refund within:

- 2 weeks, when you file online

- 8 weeks when you file a paper return

These timelines are only valid for returns that we received on or before their due dates.

Returns may take up to 16 weeks if you live outside Canada and file a non-resident personal income tax return.

The CRA may take longer to process your return if it is selected for a more detailed review. See Review of your tax return by the CRA for more information.

If you use direct deposit, you could get your refund faster.

Recommended Reading: How To Know Tax Id Number

Where’s My 2017 Tax Refund

How long ago did you file your 2017 tax return? Did you use online TurboTax desktop software? If you used online, then what does it say when you check your account? Does it say “accepted”.”rejected” or “ready to mail?” If it says anything other than accepted, it was not filed at all unless you put it in a envelope and mailed it yourself.

If it was not filed then it has to be printed, signed and mailed now. E-filing has been closed for 2017 returns since October of 2018.

If it was accepted and your refund never arrived, check with the IRS:

To call the IRS:IRS: 800-829-1040 hours 7 AM – 7 PM local time Mon-Fri

Listen to each menu before making the selection.

First choose your language. Press 1 for English.

Then do NOT choose the first choice re: “Refund”, or it will send you to an automated phone line.

Instead, press 2 for “personal income tax”.

Then press 1 for “form, tax history, or payment”.

Then press 3 “for all other questions.”

Then press 2 “for all other questions.” It should then transfer you to an agent.

Your tax refund was not sent to TurboTax. TurboTax does not handle your refund at all.

Santa Barbara Tax Products Group, LLC is the bank that handles the Refund Processing Service when you choose to have your TurboTax fees deducted from your refund. This option also has an additional charge from the bank that processes the transaction.

You can contact them SBTPG, toll-free, at 1-877-908-7228 or go to their secure website www.sbtpg.com

Find Out If Your Tax Return Was Submitted

You can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer. Whether you owe taxes or youre expecting a refund, you can find out your tax returns status by:

-

at 1-800-829-1040

-

Looking for emails or status updates from your e-filing website or software

If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. To do so, use USPS Certified Mail or another mail service that has tracking or delivery confirmation services.

Also Check: How Are Revocable Trusts Taxed

How The Treasury Offset Program Works

Here’s how the Treasury Offset Program works:

If you owe more money than the payment you were going to receive, then TOP will send the entire amount to the other government agency. If you owe less, TOP will send the agency the amount you owed, and then send you the remaining balance.

Here’s an example: you were going to receive a $1,500 federal tax refund. But you are delinquent on a student loan and have $1,000 outstanding. TOP will deduct $1,000 from your tax refund and send it to the correct government agency. It will also send you a notice of its action, along with the remaining $500 that was due to you as a tax refund.

The Internal Revenue Service can help you understand more about tax refund offsets.

We Have Received Your Return And It Is Being Processed No Further Information Is Available At This Time

This is a general processing status. Unless your return is selected for additional review, or we request additional information, this will be your status throughout processing until we schedule an issue date and update your status at that time. While your return is in this stage, our Call Center representatives have no further information available to assist you. As your refund status changes, this message will automatically update in our automated phone system, our online Check your refund status application, and in the account information available to our representatives.

Read Also: How Much Is Sales Tax In Arkansas

Contact The Irs And Research Your Irs Account

After you understand more about why the IRS delayed your tax refund, and how to respond to the IRS, do so right away to avoid further problems.

Your H& R Block tax professional can also help you investigate the cause of a refund delay and communicate with the IRS for you. Learn more about H& R Blocks Tax Audit & Tax Notice Services.

Related Tax Terms

Related IRS Notices

Where Is My Refund

If youve already filed your tax return in the last month or so, but havent gotten your refund yet, you may be wondering: Where is my refund?

The IRS, in general, processes refunds in approximately 21 days, if you filed electronically, and six weeks if you filed a paper tax return. However, there are several things that could delay or stop you from receiving the refund, in full or in part. Below are some of the main reasons you may not have received your refund yet, and tools to help you find out the status of it, along with self-help information to assist you should you need it.

Also Check: How Do Donations Help With Taxes

Handling A Refund Delay Do Your Research And Respond Right Away

If the IRS is delaying your refund, youll need to understand why, and navigate the IRS to issue your refund as quickly as possible. This can be a daunting task because refund holds can feel like audits. But, be patient, and dont worry. If your tax return is correct, its just a matter of explaining everything to the IRS.

Best course: If you get a notice from the IRS about your refund hold, immediately investigate the cause. Heres where to start.

Let’s Track Your Tax Refund

Within 2 days of e-filing, the IRS may accept your return and begin processing it.

Within approximately 2 days of acceptance, the IRS will process your tax refund.

Refund sent or deposited by IRS

You should receive your tax refund from the IRS within 19 days* after acceptance. If you have not received it by this time, contact the IRS for assistance.

You can also check your refund status directly with the IRS’ Where’s My Refund Tool.

Still waiting on your refund?

Read Also: How Much Tax Do You Pay On $15000

How Long Does It Take To Receive A Prior Year Tax Refund

We issue most refunds in less than 21 calendar days. It is taking the IRS more than 21 days to issue refunds for some 2020 tax returns that require review including incorrect Recovery Rebate Credit amounts, or that used 2019 income to figure the Earned Income Tax Credit and Additional Child Tax Credit .

Refund Checks Which Are No Longer Negotiable

Under Nebraska law, tax refund checks can not be cashed after one year because they are considered to be expired. At that point, the Nebraska Department of Revenue can no longer reissue the refund. If you have a refund warrant that cannot be cashed, contact DOR to obtain the necessary forms which must be filed with the Nebraska State Claims Board. Once the State Claims Board has received and reviewed your completed and notarized form along with your expired refund warrant, notification will be sent to you regarding approval or denial of the expired refund warrant.

You May Like: Do You Have To Pay Taxes On Pandemic Unemployment

What If My Refund Was Lost Stolen Or Destroyed

Generally, you can file an online claim for a replacement check if it’s been more than 28 days from the date we mailed your refund. Where’s My Refund? will give you detailed information about filing a claim if this situation applies to you.

For more information, check our Tax Season Refund Frequently Asked Questions.

Reasons You May Not Have Your Refund Yet

Earned Income Tax Credit and Additional Child Tax Credit : If you claimed the EITC or the ACTC, and there are no errors, you should receive your refund, if you selected Direct Deposit around the first week of March. However, if there are problems with any of the information related to the claim, your refund will be held, and you will be asked to supply more information. If you receive an IRS letter or notice about your claim, reply immediately following the steps outlined and using the contact information provided.

Identity Theft: Tax-related identity theft happens when someone steals your personal information to commit tax fraud. The IRS has specific programming to review tax returns to identify instances of possible identity theft, which can also cause a delay in issuing a refund.

- If this is the case, you should receive IRS letter 5071c requesting you to contact the IRS Identity Verification telephone number provided in the letter or take other steps. The right ones for you are based on whats happening with your tax account, so follow the instructions in the correspondence.

- You can also see our Identity Theft page or for more information. See our Tax tip for keeping safe on social media at tax time too.

Options for tracking your refund

Also Check: Are Tax Relief Companies Worth It

Can You Get Prior Year Tax Information From The Irs

There are a few times where you may run into a situation where you need to provide a copy of your prior year tax return. For instance, you could be applying for a home mortgage loan and need proof of income or maybe you misplaced it and would just sleep better at night knowing you have a copy in your filing cabinet. Either way, in most circumstances, a paper transcript of this information will do. Before venturing to the IRS website, be sure to have the following information ready:

- social security number

- street address currently on file with the IRS

- zip code currently on file with the IRS

- type of transcript needed

Happy hunting!

Tags: amended tax return, contact the IRS, progress of tax return, tax refund, where’s my refund tool

This entry was postedon Thursday, October 20th, 2016 at 3:22 pmand is filed under Taxes for Prior Years.You can follow any responses to this entry through the RSS 2.0 feed.You can leave a response, or trackback from your own site.

How To Deal With Refund Problems

The benefit of using the IRS tools to check on your refund is that they can anticipate and help you deal with possible problems. For example, if you don’t receive your refund on schedule even though the Where’s My Refund tool says that you should have gotten it, then the IRS can help you be able to start a refund trace. That should help you get to the bottom of any issues that may have come up, such as a mismatch on the banking information you provided through direct deposit or an address problem that could have led to your refund getting lost in the mail.

Read Also: When Are Us Taxes Due This Year

Check The Status Of Your Refund

If youre expecting a refund, there are two ways to check where its at:

- go online, using My Account or the MyCRA mobile web app

If you file online and are registered for online mail, you could get your notice of assessment shortly after you file your tax return using the Express NOAservice.

If you file online and sign up for direct deposit, you could get your refund in as little as eight business days. Direct deposit is fast, convenient and secure. New enrolment options are available for TD Canada Trust customers and Desjardins members.

How Much Will Your Refund Be

You won’t know exactly how much the IRS owes you until you complete your return. However, you can get a good estimate of how big your tax refund should be by using simple tax calculators like the one below:

* Calculator is for estimation purposes only, and is not financial planning or advice. As with any tool, it is only as accurate as the assumptions it makes and the data it has, and should not be relied on as a substitute for a financial advisor or a tax professional.

To use this calculator, you’ll need your W-2 forms to know your total annual income and amount of tax withheld from your paychecks during the year. With additional basic information like the size of your family and how much in itemized deductions you qualify to receive, you’ll get a solid ballpark estimate of what you’ll have coming back to you from the IRS.

Don’t Miss: Can You File Llc Taxes Online

How To Use The Irs2go Mobile App

The IRS2Go mobile app can also be used to track your refund, among other things. To use the app, download it from the App Store, Google Play, or Amazon. You can track the status within the same time frame, about a day after filing online or up to four weeks after submitting the return in the mail.

Other features on the app include the ability to make tax payments and free access to software that can help you to file your taxes. These features can be used in both English and Spanish.

Tax Refund Status Faq

Will I see a date right away when I check the status in Wheres My Refund?

The IRS Wheres My Refund? tool will not give you a date until your tax return is received, processed, and your tax refund is approved by the IRS.

Its been longer than 21 days since the IRS has received my tax return, and I have not received my tax refund. Whats happening?

Some tax returns take longer than others to process depending on your tax situation. Some of the reasons it may take longer include incomplete information, an error, or the IRS may need to review it further.

I requested my money be automatically deposited into my bank account, but I was mailed a check. What happened?

The IRS is limiting the number of direct deposits that go into a single bank account or prepaid debit card to three tax refunds per year. Your limit may have been exceeded. In addition, for a small number of returns, the IRS decides there may be indications that the bank account on the return is suspicious and they may decide to issue a check instead.

Read Also: Are Charitable Contributions Made From An Ira Tax Deductible