How Did The Tax Cuts And Jobs Act Of 2017 Impact My Taxes

As with any major tax reform, the Tax Cuts and Jobs Act of 2017 affected taxpayers in different ways depending on a number of factors, including income level, marital status, whether they had children, whether they owned a business, and more.

That said, chances are the TCJA lowered your taxes. On net, about 80 percent of taxpayers saw their taxes go down, 15 percent saw no material change in their taxes, and 5 percent saw their taxes go up.

To get a better sense of how the TCJA impacted you, we encourage you to explore our Tax Plan Calculator to model a scenario similar to your own and our interactive map to see the average tax change by income group and income range across the country. Both are linked below.

What Is Your Small Business Tax Liability

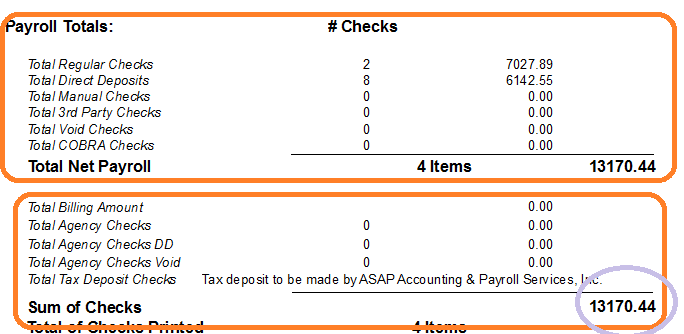

Your business can incur tax liabilities from many taxable events. A taxable event is a transaction that results in tax liability, such as earning taxable income, making sales, and issuing payroll.

The government decides which events are taxable. When a taxable event occurs at your business, you must pay the appropriate tax authority. The amount of your tax liability depends on the event. Generally, you can calculate tax liability as a percentage of the total taxable event.

You may have additional tax liabilities other than the ones listed here, such as franchise or excise tax. But, here are some of the most common tax liabilities many small business owners come across.

What Is Tax Liability And Do I Have It

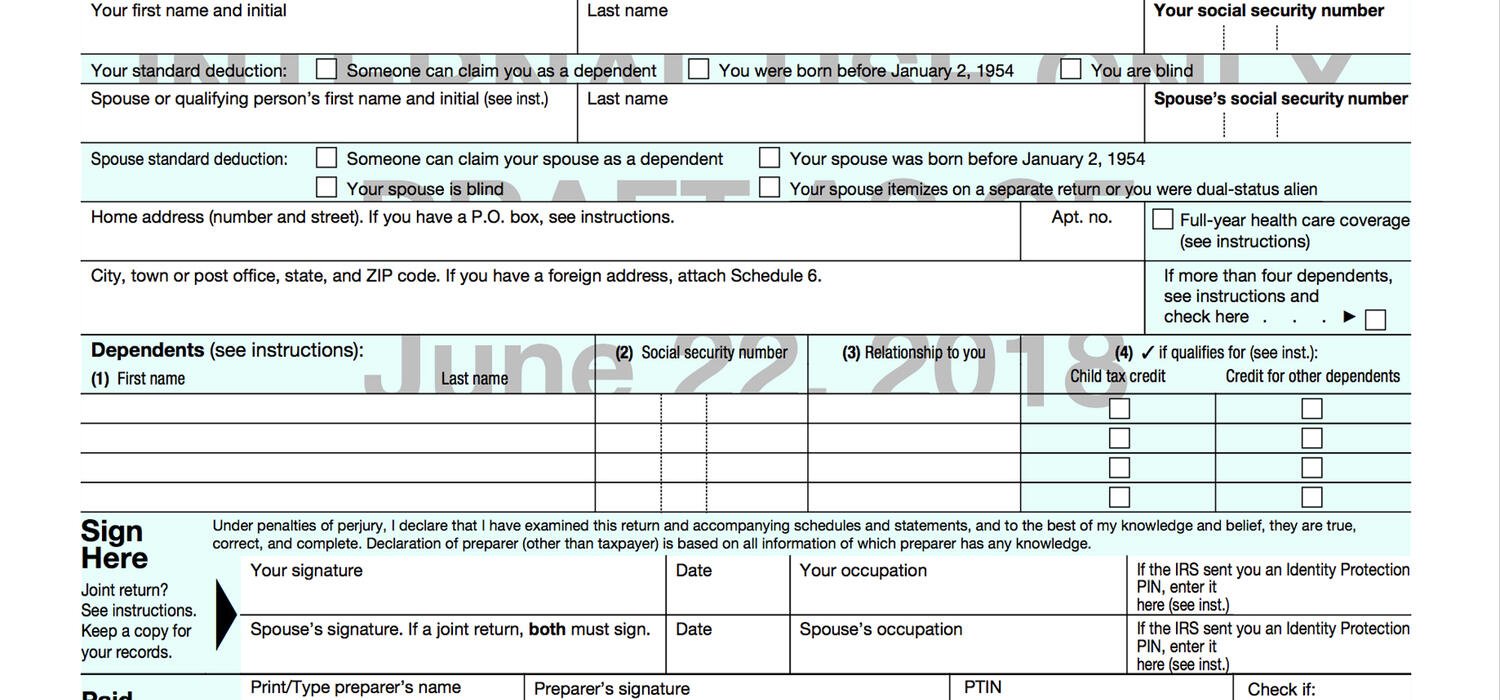

A tax liability is what you owe to the IRS or other taxing authority when you finish preparing your tax return. Your tax liability isnt based on your overall earnings but on your taxable income after you take deductions and claim tax credits. Your current years tax liability appears on line 37 of the 2020 Form 1040.

Also Check: Where Can I Amend My Taxes For Free

What Are The 5 Sources Of Income For Tax Liability

- Income from salary : It includes individuals earning a steady source of income either through salary or pension.

- Income from other heads : It includes an interest in FDs and savings accounts.

- Residential property income : It is primarily for rental income however, it also includes income from the sale of a property.

- Income from capital gain : This head includes income from the sale of capital assets like shares, mutual funds, etc.

- Income from business or self employment : It includes income earned from the business, freelancing, contracting, doctors, lawyers, Chartered Accountants, etc.

What Are Sales Tax Rates Like In My State

Forty-five states and the District of Columbia collect statewide retail sales taxes, one of the more transparent ways to collect tax revenue: consumers can see their tax burden printed directly on their receipts.

In addition to state-level sales taxes consumers also face local sales taxes in 38 states. These rates can be substantial, so a state with a moderate statewide sales tax rate could, in fact, have a very high combined state and local rate compared to other states.

The map below provides a population-weighted average of local sales taxes, to give a sense of the average local rate for each state.

Recommended Reading: Ein Free Lookup

How Capital Gains Can Increase Tax Liability

Selling an asset like a piece of art, an investment or a parcel of real estate for more than it was purchased for creates what the IRS calls a taxable capital gain. For example, if a real estate investor buys a tract of land for $100,000 and sells it eight years later for $150,000, theyve made a profit of $50,000, which would generally be taxable and thus add to their overall tax liability.

Capital gains tax rates differ depending on the amount of time the underlying property is held and the individuals taxable income. Because capital gains can be quite large, they need to be anticipated and accounted for when thinking about future tax liability.

Read: 15 Commonly Missed Tax Deductions

Calculating Federal Income Tax Liability

First, find your gross taxable income for the tax year in question. This amount must include salaried wages, bonuses, tips, alimony payments, commissions, income from a hobby or side business, capital gains income, interest, retirement fund distributions, unemployment payments, and state and local tax refunds.

Some types of income are not taxed, including federal tax refunds, inheritances, gifts, welfare payments, child support payments, proceeds from life insurance policies, and tax-exempt bond interest.

Then, find your adjusted gross income by making common adjustments such as IRA contributions, alimony payments, student loan interest, moving expenses, tuition payments, and medical insurance premiums.

If you need help determining your federal income tax liability, you can post your legal need on UpCounsel’s marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

Content Approved

Don’t Miss: Efstatus Taxact 2016

What Is Total Tax Liability Mean

A tax liability is a tax debt you owe to a taxing authorityaka the IRS, state government or local government. Your total tax liability is the total amount of tax you owe from liabilities like income tax, capital gains tax, self-employment tax, and any penalties or interest.

What is total tax liability mean?

- A tax liability is the total amount of tax debt owed by an individual, corporation or other entity to a taxing authority like the Internal Revenue Service .

How To Reduce Tax Liability In India

One can reduce their tax liability through a host of legitimate under the Income Tax Act, 1961. These include Section 80C, National Pension Scheme, health insurance, rent deductions, contribution to charity and political parties.

Section 80C

This is the most popular section under the Income Tax Act, 1961 for tax deductions. Section 80C has various investment policies for the taxpayer that can serve the dual purpose of tax saving and capital appreciation. The investment opportunities in this section, together, offer a deduction of INR 1,50,000 per annum. Following are the different types of investment opportunities under this section are:

- ELSS funds Tax saver funds

- Employee Provident Fund

- Tuition fees

Contribution to the National Pension Scheme

Contribution to NPS under Section 80CCD will help investors save an additional of INR 50,000 per annum on the taxable income. This scheme also aids investors during their retirement.

Health Insurance Premiums

Under Section 80Df the Income Tax Act, 1961 allows a deduction of INR 25,000 per annum for health insurance premiums. For senior citizens, the limit is INR 50,000 per annum. Also, a person who is paying for self and senior citizens, then the deduction allowed is INR 75,000 per annum.

Deduction on Rent

One can claim a deduction on their HRA amount, in case they live in rented premises and get an HRA. In case one doesnt HRA, then they can claim rent expense sup to INR 60,000 per annum under Section 80GG.

Donation to Charity

You May Like: Doordash Taxes How Much

Calculate Deductions And Credits You Qualify For

Deductions refer to the specified amounts of money that you can subtract from the total personal and business taxable earnings before applying the set taxation rates. On the other hand, credits will be subtracted from the total taxes you owe and reduce the final amount the IRS ends up with.

You can take your deductions either as standard deductions or itemized deductions. These deductions usually depend on your filing status and apply to most taxpayers. For the tax year 2021, the standard deduction is $12,550 for singles or married filing single taxpayers, $18,800 for heads of households and $25,100 for couples filing joint returns.

Read More: Tax Credits: What Are They & How Do You Qualify?

Examples Of Tax Liability

The most common type of tax liability for Americans is the tax on earned income. Assume, for example, that Anne earns $60,000 in gross income, which is reported on an IRS W-2 form at the end of the year. With a federal tax rate of 22% for that level of income, Anne’s tax liability would be $8,949 based on 2020 tax brackets.

In particular, Anne would owe 10% on the first $9,950 of income, 12% on the next $30,575, and 22% on the last $19,475.

Assume that Anne’s W-4 resulted in her employer withholding $6,500 in federal taxes and that she made a $1,000 tax payment during the year. When Anne files Form 1040, her individual tax return, the remaining tax payment due is the $8,949 tax liability less the $6,500 in withholdings and $1,000 payments, or $1,449.

Residents and business owners in Louisiana and parts of Mississippi, New York, and New Jersey were granted extensions on their deadlines for filings and payments to the IRS due to Hurricane Ida. Due to the tornado in December 2021, taxpayers in parts of Kentucky were also granted extensions. You can consult IRS disaster relief announcements to determine your eligibility.

You May Like: How Do I Get My Pin For My Taxes

Supply Of Goods And Services

Meaning of supply ss 123

48. For purposes of the GST/HST, the term “supply” generally means the provision of property or a service in any manner, including sale, transfer, barter, exchange, licence, rental, lease, gift or disposition.

Agreement as supply s 133

49. The entering into of any agreement to supply any property or any service is deemed to be a supply of the property or service made at the time the agreement is entered into. The provision of the property or service under the agreement is treated as being a part of the same supply and not as a separate supply. As a result, the tax applies to any prepayment or part payment of the consideration for a supply even if, at the time payment is made, property has not in fact been transferred or the service has not yet been rendered.

Transfer of security interest s 134

50. Where there is an agreement relating to any indebtedness or other obligation, the transfer of property or an interest in property pursuant to a security arrangement to secure payment of the debt or performance of the obligation is not treated as a supply. Furthermore, where, upon payment or forgiveness of the debt or performance of the obligation, the property, or interest in it, is restored to the original owner such transfer is also not considered to be a supply.

What Are Income Tax Rates Like In My State

Individual income taxes are among the most significant sources of state tax revenue, accounting for 37 percent of all collections. Theyre also one of the most visible tax types to most individuals. Thats because taxpayers are actively responsible for filing their income taxes, in contrast to the indirect payment of sales and excise taxes.

Forty-three states levy individual income taxes. Forty-one tax wage and salary income, while two statesNew Hampshire and Tennesseeexclusively tax dividend and interest income. Seven states levy no income tax at all.

Recommended Reading: Buying Tax Liens In California

Related To Total Tax Liability

What Is Income Tax Payable

Income tax payable is a term given to a business organizations tax liability to the government where it operates. The amount of liability will be based on its profitability during a given period and the applicable tax rates. Tax payable is not considered a long-term liability, but rather a current liability,Current LiabilitiesCurrent liabilities are financial obligations of a business entity that are due and payable within a year. A company shows these on the since it is a debt that needs to be settled within the next 12 months.

The calculation of the taxes payable is not solely based on the reported income of a business. The government typically allows certain adjustments that can reduce the total tax liability.

Recommended Reading: Does Doordash Send 1099

Examples Of Income Tax Liability

Anytime there is a taxable eventthink earning income, making sales or issuing payrollyou rack up tax liabilities.

Like we mentioned above, the most common type of tax liability is earned income. So, for example, lets say you earn $50,000 in gross income in a year and youre a single filer. If you take the standard deduction of $12,400, that leaves you with $37,600 in taxable incomeputting you in the 12% tax bracket. Wondering where we got that percentage? Lets break it down a bit more.

Your taxable incomeyour gross income after deductions and creditsgets divided into tiers that are each taxed at a certain rate.

Below are the federal income tax rates for the 2020 tax year.1

|

Tax rate |

|

$518,401 or more |

So, to continue with our example above, the first $9,875 is taxed at 10% . The second portion of your taxable incomeanything between $9,876 and $40,125is taxed at 12%. Since you earn less than $40,125, youll subtract the $9,876 from your total taxable income number to see how much of your income falls into that range. That would look like this: $37,600 minus $9,876 equals $27,724. This is the amount that gets taxed at 12% .

Now we know that your tax liability on that income would be $4,314.50found by adding the first bracket at 10% to the second bracket at 12% .

On top of that, lets say you also had a tax bill of $3,000 from the year before that you didnt pay . Your total tax liability would be $7,314.50 .

Examples Of Total Tax Liability In A Sentence

Final court disposition means the date the courtenters a disposition for the subject referral.

Total Tax Liability for the YearYour total tax liability for the year must equal line 12.

If the Total Tax Liability is $500 or more, the tax- payer must make installment payments.

If the Total Tax Liability is less than $500, install- ment payments may be made as shown in above or, in lieu of making installment payments, the tax- payer may make a payment of 50% of the Total Tax Liability.

An Bord Pleanála are therefore requested to overturn the decision of the Planning Authority and grant planning permission for the proposed development.

The SNI Combined Groups share of each Combined State Total Tax Liability will be based on the apportionment percentage of all members of the SNI Combined Group, determined with reference only to those companies that are subject to such states taxing jurisdiction, as if such members of the SNI Combined Group had filed a separate Combined Return.

Any Combined State Total Tax Liability in excess of the SNI Group State Tax Liability shall be the responsibility of EWS and EWS shall indemnify SNI and SNI Affiliates from and against the EWS Group State Tax Liability for all taxable years ending on or before December 31, 2007.

The VAT gap is defined as the difference between the VAT revenue expected and the VAT actually collected by national authorities.

Also Check: How Do I Get A Pin To File My Taxes

The Definition Of Tax Liability

The definition of tax liability is the money you are obliged to pay as taxes to the government. If your income is low enough, you will not be taxed at all. And there are many Americans who don’t pay any taxes as many pay federal income tax or payroll tax through their work. There are also state and local taxes, excise taxes, and other taxes that generate income for very low-income people.

How To Calculate Liabilities: A Step

The total liabilities are the combined debts that a business must pay to any outside parties. This can include debts like loans, future buyouts, salaries to your employees, and more

You need to understand what total liabilities are and how they affect your balance sheet if youre an accountant or business owner. Total liabilities can be thought of as the broad economic obligations of an organization.

The higher the total liabilities, the more money the company needs to make to pay off its debts and make a profit.

Accountants and business owners can calculate their total liabilities quite simply. To do this, you must list all your liabilities and add them together.

Accounting software makes this easy. Software like FreshBooks produces a financial statement called a balance sheet. This lists and adds up all liabilities for you.

That said, you should still check your work by using the basic accounting formula.

In this guide, we’ll guide you through each step required to calculate liabilities. Calculating liabilities helps a small business figure out its total debt. You can also plug it into the basic accounting formula to make sure your books are correct.

Still confused about what a liability is? This article has a simple definition and examples relevant to small businesses.

In this article, well cover:

- Accrued liabilities

Liabilities can further be classified into several distinct types.

Don’t Miss: 1099 Form Doordash

Check The Basic Accounting Formula

In double-entry bookkeeping, there is an accounting formula used to check if your books are correct. The formula is:

Liabilities + Equity = Assets

Equity is the value of a companys assets minus any debts owing. An asset is an item of financial value, like cash or real estate.

In a nutshell, your total liabilities plus total equity must be the same number as total assets. If both sides of the equation are the same, then your book’s “balance” is correct.

A small business can use this formula to check whether they accurately calculated their liabilities.

That said, if the equation doesn’t work, you’ll need to double-check your equity and assets as well to figure out what account is wrong.

If you already know your total equity and assets, you can also use this information to calculate liabilities:

Assets – Equity = Liabilities

A balance sheet generated by accounting software makes it easy to see if everything balances.

In the below example, the assets equal $18,724.26. Assets plus liabilities also equal $18,724.26. Total liabilities must be correct because the equation balances.

If youre using Excel, plug in your assets and equity and make sure the equation works.

For more information on balance sheets and how to read and use them, read this article.

People also ask:

- Pension expenses

- And more