Can I File Taxes If I Didnt Work

If you didnt earn any income in the last tax year, youre not obligated to file a tax return. If you had very low or no income last year and are not required to file, you may wish to file anyway to claim certain refundable tax credits. Refundable tax credits can provide you with a tax refund even when you do not work.

How To File Taxes Without A W

Its that time of year again.

The deadline for employers to provide W-2 forms to their employees is February 1, 2021. . But sometimes, for various reasons, employers do not provide W-2s. In some cases, a business has had to close its doors and has chosen not to pay for its former employees to receive W-2s. So, whats a taxpayer to do?

What Happens If You Lost Your W

Contact Your Employer

Whatever the cause of a lost W-2, the first place to look is with your employer. If documents are lost, the taxpayer would simply reach out to the issuer of the document and request a replacement, Collins says. The business should be able to supply a copy of the original W-2 on request.

Don’t Miss: Doordash Tax Deductions

Need A Loan Get One In 3 Simple Steps

If you are considering applying for a personal loan, just follow these 3 simple steps.

Apply

Apply online for the loan amount you need. Submit the required documentation and provide your best possible application. Stronger applications get better loan offers.

Accept

If your application meets the eligibility criteria, the lender will contact you with regard to your application. Provide any additional information if required. Soon youll have your loan offer. Some lenders send a promissory note with your loan offer. Sign and return that note if you wish to accept the loan offer.

Repay

The loan then gets disbursed into your U.S. bank account within a reasonable number of days . Now you need to set up your repayment method. You can choose an autopay method online to help you pay on time every month.

About Stilt

Stilt provides loans to international students and working professionals in the U.S. at rates lower than any other lender. Stilt is committed to helping immigrants build a better financial future.

We take a holistic underwriting approach to determine your interest rates and make sure you get the lowest rate possible.

Learn what others are saying about us on , Yelp, and or visit us at . If you have any questions, send us an email at

To Get Current Tax Year Information

Your current tax year wage and withholding information is the information you need to report to New York State on the return you file this year. Your employer provides this information to us by filing a quarterly report with all the employees wage and withholding totals. These returns contain New York State information only.

Beginning May 18, if you’ve contacted your employer and were not able to obtain a copy of your W-2, we can provide you with a state wage and tax transcript that includes any information your employer has reported to us.

Don’t Miss: How To Protest Property Taxes Harris County

Can I File My Taxes With Just My Last Pay Stub I Got This Year

According to the Internal Revenue Service, you should wait to get your W-2 tax form from your employer before filing your income tax return. But if the form doesn’t come and you’ve reached out to your employer and the IRS, you’re still required to file your taxes with your best estimate of what you were paid and what was withheld from your paychecks. One way to do this is by using the information on your last pay stub of the tax year.

Tips

-

In the event that you did not receive a W-2 form from your employer, you can use your last pay stub of the year to provide the IRS with evidence of your income when you are filing your taxes.

File Your Taxes With A Missing Or Incorrect W

As the tax deadline approaches we will discuss two problems preventing you from filing your tax return missing or inaccurate tax documents, especially W-2s and K-1s. Some small employers forget to send W-2s or go out of business other businesses may send incorrect forms. K-1s are the worse. With a K-1 you may not even know what the numbers should be and they always come just before the extension deadline.

There is a process in finalizing your tax return when information reported to you is wrong. The IRS knows some tax reporting documents have errors. Unfortunately, the IRS computer only believes what it sees.

Once information is reported to the IRS you need to make sure you tell the IRS computer what it wants to hear or you will end up in IRS hell getting letter after letter while the IRS employee working your case is never available. The best course of action is to avoid the IRS letter or audit in the first place. There is a process to fix wrong information.

Don’t Miss: Do You Pay Taxes On Donating Plasma

What If Im An Independent Contractor

If you are an independent contractor, then you should not be expecting any W-2s. Instead, any company from which you earned more than $600 for the year should send you a form 1099 instead. This form serves a similar purpose to the W-2, except it will not show any withholdings, since as an independent contractor, you are responsible for taxes on your own.

If you fail to receive a 1099 from a company, all of the same instructions above apply. Namely, you can contact the company if you failed to receive it, and file a form 4852 and report the situation to the IRS if that proves fruitless. If you’re a freelancer, on how to file taxes without a W-2.

Tracking Down A Missing W

The W-2 tax form spells out how much you made from your job and how much was withheld for federal income tax, Social Security and Medicare taxes and any state and local taxes. Your employer is required to send it to you each year, and you must file it with your taxes or include the information in your return if you file digitally. If you’re an independent contractor, you will likely receive Form 1099-MISC instead.

If you don’t receive a W-2 from your employer early in the new year, contact your employer to inquire. You may be able to get a second copy printed at work or mailed to you at home. If you have an online human resources or payroll portal, log in to it to see if your W-2 is available to download or print out. Some tax software can also automatically import W-2 forms from certain payroll processors, so this may be an option as well.

If none of this works, you can contact the IRS for help. The IRS will reach out to your employer on your behalf and remind the company of its obligation to send you the form.

Read Also: Reverse Ein Lookup Irs

What If I Am Unable To Get A W

If your W-2 never arrives and your employer refuses to resolve the situation, you can contact the IRS at 800-829-1040 or locate an IRS Taxpayer Assistance Center and let them know. They will contact your employer and try to resolve the situation. The IRS, being a government authority, tends to be good at motivating negligent employers who want to avoid legal consequences.

If a W-2 form is truly unobtainable, you can fill out form 4852 with your best estimates for your earnings and withholdings. Again, the best place to find these numbers is on your end-of-the-year paystub.

Can I Find Out How Much I Will Get Back On My Taxes Without My W

If you didn’t get a W-2 tax form from an employer, contact your employer to get a copy or check your online workplace portal if you have one. If you still can’t get a copy, contact the IRS for help. You’re still obligated to file taxes using your own records if you don’t get a copy of the form, and you must amend your tax return later if your information turns out to be wrong.

TL DR

If you can’t get a copy of your W-2 form, you still must file taxes. Use IRS Form 4852 and your own records to indicate your employer, how much you made and how much was withheld for taxes.

You May Like: Plasma Donation Income

When To Call In Extra Help

Some people are simply old pros when it comes to filing their taxes. But, if you just dont have the time to figure everything out, theres no harm in calling in reinforcements.

Online NETFILE-certified programs can make filing your return quick and easy. Or, if your taxes are complicated, you can hire an accountant. An accountant may be able to suggest other expenses you can claim on your return, which is why its crucial to save all your receipts.

If an accountant isnt in your budget and you dont want to file online, many communities offer no-charge tax return consulting sessions. Some schools and community centres may even offer simple tax help.

If you make a modest income, you may be eligible for one of the CRAs free tax clinics theyre virtual this year.

Although tax filing was extended last year due to the COVID-19 pandemic, the deadline remains on schedule this tax season. Still, the CRA understands the extraordinary circumstance stemming from 2020, including emergency and recovery benefits, work from home credits, and other financial challenges that will make filing a return difficult this year. Visit the CRA website to learn more about the tax accommodations and assistance available.

Dont forget, the deadline to file your taxes is April 30, 2021!

What Copies Of W

The form consists of six copies:

- Copy A Submitted by the employer to the Social Security Administration.

- Copy B To be sent to the employee and filed by the employee with the employees federal income tax returns.

- Copy C To be sent to the employee, to be retained by the employee for the employees records.

Don’t Miss: Efilemytaxes

How To Obtain A W

If its easy to lose a W-2 for the current tax year, its even easier for past years. If you need to file an amended return for a prior year and dont have the relevant W-2, you can request a transcript of your missing W-2 form from the IRS. Sometimes this can work for the current year as well.

The IRS online tool to request wage and income transcripts also lets you get the information that was reported on your W-2, 1099 and other forms for previous years. You can request a lost W-2 for any one of the last 10 tax years.

Pay Nothing Out Of Pocket Use Your Federal Refund To Pay For Turbotax Learn More

TurboTax CD/download also available

- Earned Income Tax Credit

- Child tax credits

- Student Loan Interest deduction

Don’t Miss: Efstatus Taxactcom

The Case Of Multiple W2 Forms

If you work more than one job or switch employers during the year, you will have multiple W2 forms. This also applies to couples filing jointly for their taxes. As a general rule of thumb, it’s a good idea to keep track of any job changes when tax season rolls around. Account for all possible W2 forms and paperwork before filing.

Check With Your Employer

First things first. Before you start work on a replacement W2, check with your employer. Make sure the payroll administrator has the correct information on file to get you your paperwork. If all information is correct, it could be the form was a little late in mailing. Give it a few days to arrive in your mailbox.

Better yet. If a W2 hasnt been mailed out yet, check if the company can electronically deliver it to you on a secure portal. I dont suggest emailing it since it does have important financial data and email isnt secure. Electronic availability is quite common these days.

If, however, the days pass by and the form is lost or your employer is inordinately slow in issuing a replacement, or you worked for a company that went out of business and theres no one to ask about getting a W2, now what?

No need to panic. When missing a W2, you can recreate one using an IRS form and file that instead with your return.

You May Like: Is Money From Plasma Donation Taxable

How To Get A Copy Of A Lost W

Freelance Writer, Self-employed

Summary

Lost your W-2 or have a missing 1099 MISC form? Read on to find out the best approach to help get it back.

A W-2 is a statement of wages that shows how much an employer has paid an employee during the previous year, as well as how much tax has been withheld. A 1099-MISC form serves a similar purpose for independent contractors. Its essential for employees and independent contractors to have information on these forms to accurately complete their federal income tax returns.

These forms come from employers. By every January 31, employers have to send employees copies of W-2 and 1099 forms. But sometimes those forms arent sent, get lost in the mail or are lost by the taxpayer by the filing deadline of April 15. If that happens, the taxpayer could be unable file a return on time, potentially incurring penalties and interest for failure to file.

If youre not sure where your forms are and are wondering, “How can I get a copy of my W-2 online?” or What if I lost my W-2? dont feel bad and dont worry. Often, a W-2 isnt missing because the taxpayer lost it.

It is common for business owners to misplace important tax documents, according to Rhonda Collins, director of tax content and government relations for the National Association of Tax Professionals, a trade group based in Appleton, Wisconsin. To avoid lost W-2s, Collins recommends that both businesses and individual taxpayers keep careful records.

How To Get Your W2 Form Online

Online tax filing helps users to get their W2 form online quickly. They have a free W2 finder that you can use to search for yours.

After you get your W-2, you can start filing your taxes online, or you can download a copy so you can print it out and attach it to your tax return.

Its a much faster process than waiting for your W2 to come out in the mail. With over 100 million W2s available online, theres a good chance youll be able to find yours.

Also Check: How Do You File Taxes For Doordash

What To Do If You Cant Find Your W 2 Form

The W 2 form is usually mailed to you or made accessible online by the company you work for. If the form is lost, missing, or you cant find it online, contact your employer immediately. In addition, its a good idea to call the IRS if you dont receive the W2 by mid-February.

In the worst-case scenario, you can fill out Form 4852 and attach it to your tax return. The substitute wage and tax statement allows you to input the same details. A tax extension is another possibility and buys you more time.

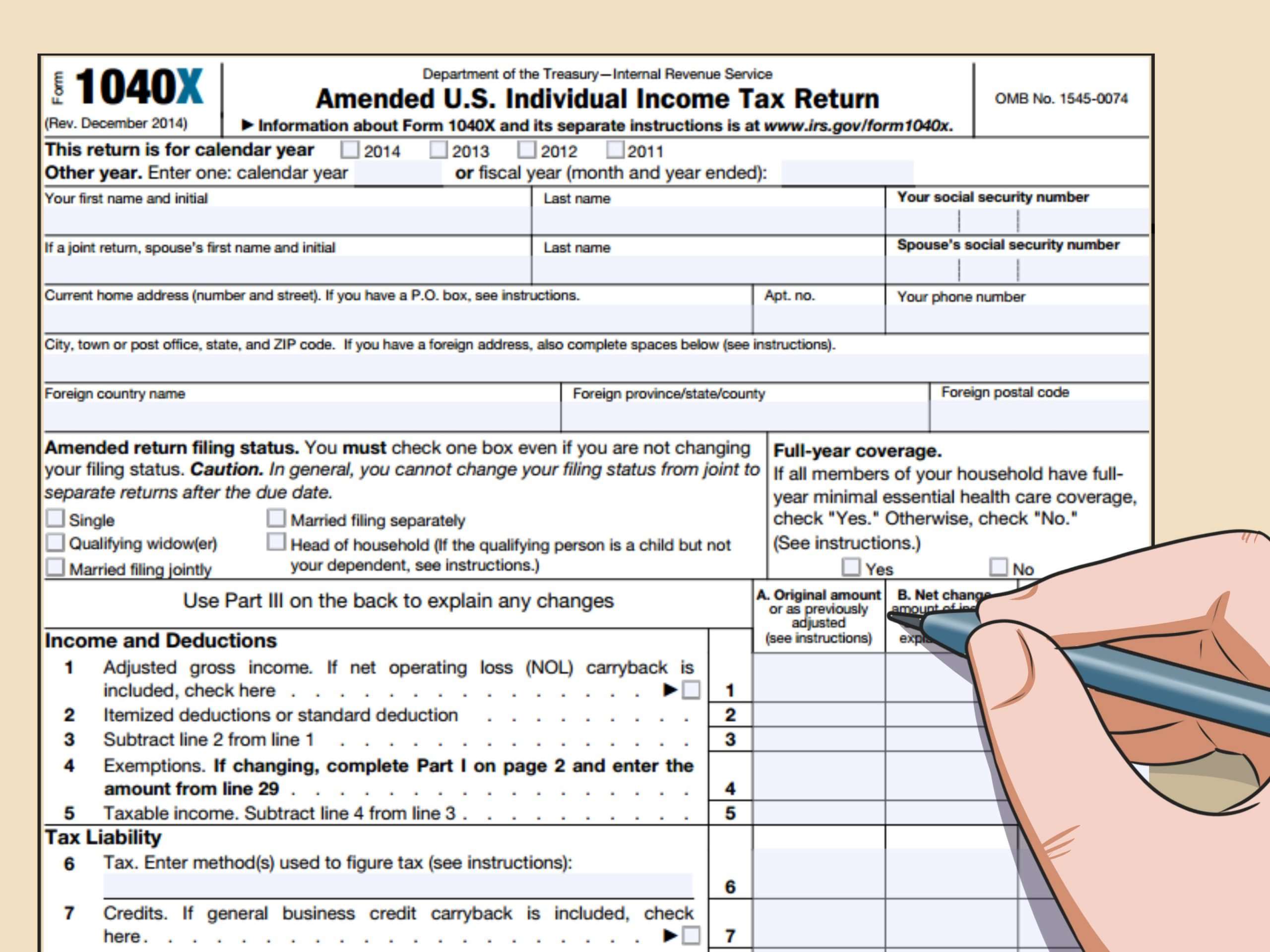

Your best bet is to file on time. If the W 2 arrives later, and the information is different from your estimates provided, Form 1040X can be filled out to correct any discrepancies and amend the previous years tax return.