S To Get A Tax Id Number

1. Decide if you really need an Employer Identification Number.

- Any business that withholds taxes on employees’ payroll needs an EIN to ensure that payments to the IRS are properly credited.

- New businesses need an EIN to pay taxes or open business accounts or lines of credit with vendors.

- Corporations and business partnerships must get an EIN per IRS regulations.

- Estates, trusts, and nonprofit organizations also need an EIN.

- Sole proprietorships don’t have to get an EIN, but they can if they prefer to do business that way instead of using the owner’s Social Security number. That helps keep personal and business matters separate.

2. Once you know you need an EIN, you can apply for one with the Internal Revenue Service in one of four ways: online, by fax, in the mail, or by phone . The application form is Form SS-4 if you’re looking for it on the IRS website.

3. The next step is choosing the right kind of EIN for the type of business you operate. Some possibilities are sole proprietorship, corporation, LLC, partnership, nonprofit, or estate.

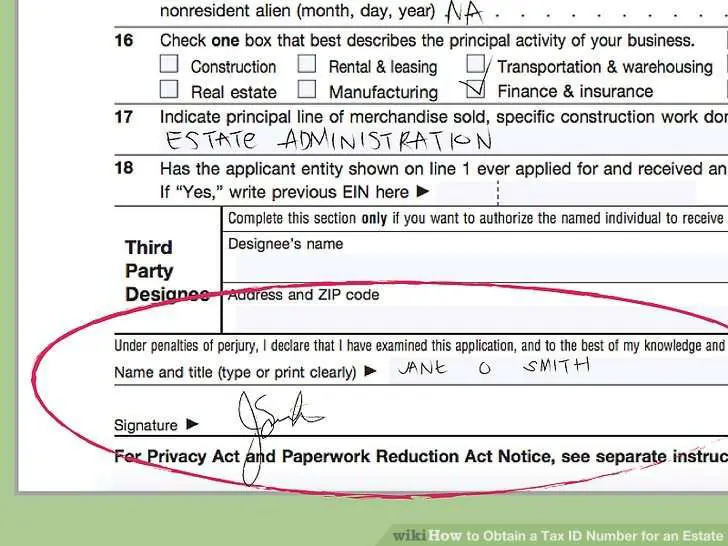

4. You also need to state why you are applying at this time. This could be a new business, or maybe you’ve been operating under your personal Social Security Number and want to set up an EIN to move away from that. Your request might also be related to hiring new employees or setting up a pension plan. Finally, you need to fill in what field you’re in and what products or services you offer and give your name and SSN to complete the form.

How Do You Get A Business Tax Id Number

OVERVIEW

Does your business employ workers, withhold taxes, or operate as a corporation or partnership? If so, you need an Employee Identification Number. Follow these 4 steps to obtain one.

If you operate a business the IRS may require you to obtain an Employee Identification Number , which is also referred to as your business tax ID number. Each EIN is unique in the same way that your Social Security number is. The number allows the IRS to identify your business and requires you to provide it on all of your tax documents and forms. Fortunately, the IRS makes it very simple to obtain a new EIN.

Save The Document With Your Ein

Once you complete all sections of the application, the system will generate a new EIN that you can begin using immediately. An official IRS document will load onto your computer, which confirms that your application was successful and provides your EIN. Its a good idea to save a copy on your computer and to print one for your records in case you forget the EIN.

Recommended Reading: Do I Have To Pay Taxes On Plasma Donation

Finding Your Tax Id Is Easy As Ein Zwei Drei

Whether youre working on filing your small business taxes or applying for a PPP loan, youll need to know your EIN. Now that you know how to find it, make sure to keep the files in a safe place, and consider pulling your business credit periodically.

The Motley Fool has a Disclosure Policy. The Author and/or The Motley Fool may have an interest in companies mentioned.

Why Do I Have To Identify And Validate Myself Using My Personal Information

The CRA is responsible for protecting confidential taxpayer information by preventing unauthorized access. The CRA can only disclose information about a taxpayer to the taxpayer or the taxpayers authorized representative. We need to identify you and make sure you are the person who has been authorized to access the taxpayer’s information.

Don’t Miss: How Do You Do Taxes With Doordash

Receive Your Federal Tax Id Number

After you submit your online application with all the required information, you should receive your federal tax ID number. You can view, download, save and print the confirmation notice which includes your number directly from the IRS website. You can start using your EIN as soon as you receive this notice.

Once you have your EIN, meet with a your local business banker to learn how a business bank account can help get you started on the right foot and what financing options may be available for you.

For Informational/Educational Purposes Only: The views expressed in this article may differ from other employees and departments of JPMorgan Chase & Co. Views and strategies described may not be appropriate for everyone, and are not intended as specific advice/recommendation for any individual. You should carefully consider your needs and objectives before making any decisions, and consult the appropriate professional. Outlooks and past performance are not guarantees of future results. J.P. Morgan and its affiliates and employees do not provide tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors.

Will You Ever Need To Change Your Ein

If you change entity type, you will need to change the EIN for the business. This usually happens when you go from a sole proprietor to a general partnership or S corporation.

When establishing a business, its a good idea to pick a business entity you can stick with to avoid having to change your EIN.

Read Also: Do You Have To Pay Back Taxes For Doordash

Option : Check Your Ein Confirmation Letter

The easiest way to find your EIN is to dig up your EIN confirmation letter. This is the original document the IRS issued when you first applied for your EIN. The letter will show your business tax ID and other identifying information for your business.

-

If you applied online for your EIN, the IRS would have issued your confirmation letter right away, accessible online. You would have also had the opportunity to choose receipt by traditional mail.

-

If you applied by fax, you would have received your confirmation letter by return fax.

-

If you applied by mail, you would have received your confirmation letter by return mail.

Your EIN confirmation letter is an important tax and business document, so ideally you stored it away with other key paperwork, such as your business bank account information and incorporation documents.

In this sample EIN confirmation letter, you can find your EIN at the top of the page, as well as in the first paragraph.

What Do I Need A Tin For

Once you know what your TIN is, you may be wondering when and why youll need it. You as a taxpayer will need to provide your TIN on all tax returns and other documents sent to the IRS. Even if you do not have a number issued to you by the IRS, your SSN must be on forms submitted to it. You have to provide your taxpayer identification number to others who use the identification number on any returns or documents that are sent to the IRS this is especially the case for business transactions that may be subject to Reverse-Charge procedures. This may also be the case when you are interacting with a bank as an entity.

Aside from using your EIN for tax returns and business to business transactions also known as B2B youll need to keep your SSN in mind for other purposes too. As well as for personal tax returns, your Social Security number is vital in daily life, because without it you wont be able to get a job or collect Social Security benefits if necessary. It is also a confidential piece of identity information, so avoid just telling anyone what it is. Keep it safe with other important documents.

Click here for important legal disclaimers.

- 06.12.19

Don’t Miss: How Can I Make Payments For My Taxes

Whats My Tax Identification Number

A tax identification number, or TIN, is a unique nine-digit number that identifies you to the IRS. Its required on your tax return and requested in other IRS interactions. Social Security numbers are the most popular tax ID numbers, but four other kinds are popular too: the ITIN, EIN, ATIN and PTIN.

Why Does A Business Need An Ein Number

The EIN is the businesss identifier and tax ID number. You use it to file taxes, apply for loans or permits, and build business credit. If you ever get a request for your TIN, or tax identification number , its the same as the EIN.

If youre a sole proprietor working for yourself, you wont need the number until you start to hire employees and contractors. Then, you will use it to register a tax withholding account.

You May Like: How Much Taxes Do I Have To Pay For Doordash

Types Of Tax Id Numbers

- Social Security Number : In addition to its use for government services and identification, this nine-digit number keeps track of your earnings over the course of your lifetime as well as how many years you have worked. This number is issued to US residents, permanent residents, and temporary residents.

- Employer Identification Number : Also known as a Federal Tax Identification Number, or a Business Tax ID. The IRS assigns this nine-digit number to businesses operating in the US. Additionally, EINs go to estates and trusts with income to report.

- Individual Taxpayer Number : This number allows foreign nationals and those who may be ineligible for a social security number to pay taxes. The applicants information does not affect their immigration status or involve immigration enforcement. The nine-digit number is for tax purposes only.

- Adoption Taxpayer Identification Number for Pending U.S. Adoptions : This number is for children involved in domestic adoptions. Its a temporary number given to the adopting parents/taxpayers when they dont have the childs social security number.

- Preparer Taxpayer Identification Number : This number corresponds to those who prepare taxes such as your accountant. All paid tax preparers must obtain a PTIN. This number goes on all prepared tax forms and is an essential component of starting a tax preparation business if you work in this field.

Option : Call The Irs To Locate Your Ein

You should be able to track down your EIN by accessing one or more of the documents listed above but if you’re still not having any luck, the IRS can help you with federal tax ID lookup. You can call the IRSs Business and Specialty Tax Line, and a representative will provide your EIN to you right over the phone. The Business and Specialty Tax Line is open Monday through Friday from 7 a.m. to 7 p.m. ET. This should be your last resort, however, because call wait times can sometimes be very long.

Before you call, keep in mind that the IRS needs to prove youre actually authorized to retrieve your business tax ID number. For example, youll need to prove you are a corporate officer, a sole proprietor, or a partner in a partnership. The IRS representative will ask you questions to confirm your identity.

Don’t get frustrated: This is simply a precaution to help protect your businesss sensitive data. After all you wouldn’t want the IRS to give out your social security number to anyone who called, would you? Once you’ve found your business tax ID number, we suggest putting the number in a safe placelike a locked file cabinet or secure cloud storage so you won’t have to go through these steps again.

Don’t Miss: Power To Levy Taxes

Federal Tax Id Number Versus Ein

In short, a federal tax ID is the same as an EIN. As is often the case in business, though, youll hear several acronyms that all reflect the same concept. These acronyms can be confusing, but here is a clear breakdown of what each refers to and how they differ.

- The federal tax ID number is also known as the TIN.

- Another acronym for the federal tax ID number is the EIN, which stands for Employer Identification Number. An EIN must come from the IRS in order to be a federal tax ID number, and it is used to identify a business entity.

- An EIN may also be called a FEIN .

How Do I Register Myself With Represent A Client

First, you will need to validate your identity and create a CRA user ID and password or login with a Sign-in Partner. Second, you will need to register with the service and get a representative identifier . Go to the Represent a Client Web page to get started.

If you are a non-resident representative living in the United States, you can register with Represent a Client. For more information see, Represent a Client Non-resident representative.

Don’t Miss: How To Get Doordash Tax Form

Check Your Tax Documents

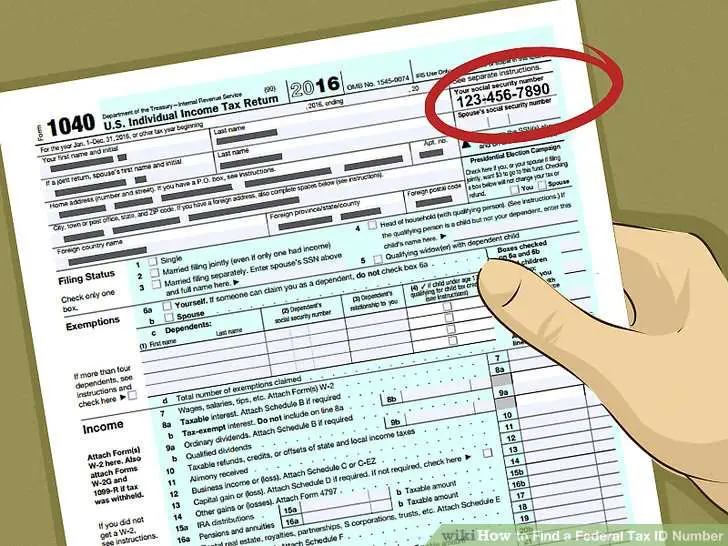

You can find the number on the top right corner of your business tax return. If you open the return and discover that the number has been replaced with asterisks for security purposes, contact your CPA and request the number from them.

The business EIN is listed on the top right of a business tax return.

If you file your own taxes with tax software, the software will save the number from year to year. Visit the softwares business section to retrieve your EIN.

Can I Cancel A Tin

In terms of a business, an EIN cannot be canceled. Once the IRS assigns a business their business tax ID, it is non-transferable. What a business owner can do is close a business. To close a business, you must simply send a letter to the IRS stating your information and your reason for terminating the business. They will then follow up with your request and confirm when the closure has taken place.

A Social Security Number is also a unique number that stays with you forever. In this case, the IRS does not allow cancellation or transfers.

Read Also: Doordash Taxes Percentage

Do I Need A Tax Id Number

If you operate a sole proprietorship without any employees, or a single person LLC, you donât need a tax ID number to file your taxes.

All other business structures, including any businesses with employees, need tax ID numbers to file their taxes.

And, as mentioned, youâll need a tax ID number for business banking.

Why You Should Get A Tax Id Number Now

Even if youâre donât need a tax ID number to file your taxes now , itâs in your best interest to get one as soon as you go into business. Your best bet is to apply for an EIN.

Why the rush? Getting an EIN is free, and doesnât take much time or effort. It gives you the freedom to grow your business in the future. When you eventually decide itâs time to open a business bank account, hire employees, or restructure your business, youâre all set. Getting a tax ID number now will save you a step later on, when your hands are full helping your business grow.

Need help setting up a TIN? Let BenchTax take care of the crucial stuff. A tax expert will handle the heavy lifting, so you can focus on your business. Learn More.

Recommended Reading: How Does Doordash Taxes Work

What Is A Tax Identification Number

A tax identification number is a unique identifier for a person or a business. Some examples are the Social Security number for an individual , Individual Tax Identification Numbers , and Employer Identification Numbers . People, businesses, nonprofit organizations, and other entities need a number to file taxes and other documents. To keep things consistent, all these numbers have nine digits. A TIN comes from the federal government through either the Internal Revenue Service or the Social Security Administration .

The IRS mandates that businesses get an EIN, also called a business tax ID number. It allows the IRS to classify businesses according to the kind of goods and/or services they provide. It also gives the entity a unique piece of identifying information to use on official records.

When you’re starting a new business, there are four ways to get assigned an EIN by the IRS. Two of them give you your number on the spot, so you are ready to start using it right away. Of the other two, one is only available from outside the United States, and the other takes about four weeks.

If you lose your EIN, you can call the Business & Specialty division of the IRS at 800-829-4933. You will need to give identifying information for security reasons so that your personal information stays safe.

Where Else Can I Find My Employer’s Ein While I’m Waiting For My W

- Try asking your employer .

- Get it from last year’s W-2, if you’re still working for the same company. This is assuming your employer kept the same EIN .

- If you work for a publicly-traded company , try an online search for their 10-K.

- On the 10-K, look for IRS Employer Identification No. or similar. It’s usually on the first page.

We don’t maintain, nor are we able to retrieve, your employer’s EIN .

Related Information:

Don’t Miss: How To Buy Tax Lien Certificates In California

How To Cancel Your Business Account With The Irs

That said, you can contact the IRS to cancel your business account. You can do that by sending a letter to the IRS that includes:

- Complete legal name of your business entity

- EIN of the business

- The reason you wish to close the account

- Copy of EIN Assignment Notice

Then mail the above information to:

Internal Revenue Service

Cincinatti, Ohio 45999