When To Contact The Irs

1. IRS Audit

One of the most common reasons why tax filers contact the IRS is due to receiving a dreaded IRS audit letter. If you receive one, try not to panic as most tax issues are simple to fix. Before you contact the IRS, start by finding out what section of your tax return the government wants to audit. Once you know what the auditor is questioning, you can start gathering the requested information. An audit doesn’t always indicate a problem. You may be getting audited for one of the following reasons:

Random selection and computer screening

This type of IRS audit is selected based solely on a statistical formula. The IRS compares your tax return against “norms” for similar returns. The IRS develops these “norms” from audits of a statistically valid random sample of returns.

Related examinations

The IRS may select your returns when they involve issues or transactions with other taxpayers, such as business partners or investors, whose returns were selected for an audit.

2. Missing W-2

Missing tax forms such as a W-2 is another popular reason why filers contact the IRS. However, if you haven’t received your form by mid-February, there are a few options available to you, including contacting the IRS.

Contact your Employer. Ask your employer for a copy. Be sure they have your correct address.

How To Send Notice Using An Irs Form 8822

Fill out Form 8822, available here. For a change in your business address, you can use Form 8822-b, here. Download and print the forms here, or order them by calling the phone number 800-TAX-FORM . You can mail these to the address listed on the forms.

If you don’t change your address and the IRS sends you notices to your previous address, you are considered notified and the clock starts to run on any taxes, penalties or interest you may owe. Make sure you notify IRS of your change of address.

Submit Irs Forms By Fax

The IRS put an end to faxing and mailing tax transcripts in June 2019. Receiving forms and instructions by fax isn’t the best way to transmit sensitive information, but you can still fax some documentation.

Fax to the number listed on your CP06 audit notice if you have to transmit required supporting documentation during an audit of your tax return.

Don’t Miss: Doordash Tax Deduction

Connect With The Irs Online

One of the best ways to get the information you need is directly from the IRS website at IRS.gov. You can download almost any form or publication here. You’ll find a lot of information right at your fingertips, including answers to frequently asked questions, tax law changes, and even planning calculators. It’s not a substitute for talking directly with a tax expert, but the site can point you in the right direction when you need answers to basic tax questions.

As for that tax refund you’re expecting, there’s a special tool available to track its status, too. Just go to “Where’s My Refund?” and click on “Check My Refund Status.”

Use A Secure Method To Mail Your Return

Always use a secure method, such as certified mail, return receipt requested, when you’re sending returns and other documents to the IRS. It will provide confirmation that the IRS has actually received your documents or payment.

In addition to addressing it correctly and using sufficient postage, be sure the envelope is postmarked no later than the date your return is due. If you use registered mail, the date of the registration is the postmark date if you use certified mail, the date stamped on the receipt is the postmark date. If you use an IRS-approved private carrier , make sure the return is sent out no later than the date due.

Also Check: Does Doordash Tax Your Earnings

How Do I Enter A Street Address With The Irs

entering your street address IN ALL CAPS. Typing your address in all caps is the key to getting into the Get My Payment tool and allowing you to enter your bank information on the IRS website instead of waiting for a check in the mail. If you would rather wait for a check to come in the mail, no action is needed.

Which Address Should I Put On My Return

Your W-2 information must match exactly, because that’s what the issuer of those W-2’s sent to the IRS. If you’re talking about the “mailing address” you enter under the Personal Info tab, you should use the address of where you live “right now”, as that is the address the IRS will send any correspondence to concerning your tax return. If for some reason the IRS can not direct deposit your refund to whatever account you specify, then the IRS will cut a check and mail it to the address you enter in that “mailing address” section under the Personal Info tab. Use your current address. If the BF is only concerned about what “he” can claim, well….. I’ll leave that alone.

Read Also: Www Michigan Gov Collectionseservice

Irs Is Sending Out Important Stimulus Check Envelopes Make Sure To Watch Out For These Details To Get Yours

- 11:13 ET, Jan 10 2022

THE Internal Revenue Service has warned Americans not to dispose of a letter being sent out residents later this month.

Millions of taxpayers are set to automatically receive the envelopes in the coming days.

They will be marked as “important tax document” or “third economic payment”, according to reports.

The 6475 letter is for those who received a third stimulus check last year.

It will also help those who may not have yet received money they are owed.

What Are These Irs Tax Refund Statuses

Both IRS tools will show you one of three messages to explain your tax return status.

- Received: The IRS now has your tax return and is working to process it.

- Approved: The IRS has processed your return and confirmed the amount of your refund, if you’re owed one.

- Sent: Your refund is now on its way to your bank via direct deposit or as a paper check sent to your mailbox.

Read Also: Www.1040paytax.com Review

How Do I Use The Where’s My Refund Tool

To check the status of your 2021 income tax refund using the IRS tracker tools, you’ll need to give some information: your Social Security number or Individual Taxpayer Identification Number, your filing status and your refund amount in whole dollars, which you can find on your tax return. Also, make sure it’s been at least 24 hours before you start tracking your refund.

Using the IRS tool Where’s My Refund, go to the Get Refund Status page, enter your SSN or ITIN, filing status and exact refund amount, then press Submit. If you entered your information correctly, you’ll be taken to a page that shows your refund status. If not, you may be asked to verify your personal tax data and try again. If all the information looks correct, you’ll need to enter the date you filed your taxes, along with whether you filed electronically or on paper.

The IRS also has a mobile app called IRS2Go that checks your tax refund status. It’s available in English and Spanish. You’ll be able to see if your return has been received, approved and sent. In order to log in, you’ll need your Social Security number, filing status and expected refund amount. The IRS updates the data in this tool overnight, so if you don’t see a status change after 24 hours or more, check back the following day. Once your return and refund are approved, you’ll receive a personalized date by which to expect your money.

You can check on your refund using the IRS2Go mobile app.

How To Contact The Irs

Individual telephone assistance can be obtained by dialing 1-800-829-1040 Monday through Friday from 7 AM to 7 PM.

You can find a on the IRS website which allows you to select your home state and determine the appropriate mailing address for each filing.

The IRS offers the Interactive Tax Assistant to find and submit general tax questions. However, it’s best not to use it for more complex questions that require individualized information.

In-Person

Referred to as the Taxpayer Assistance Centers , in-person IRS offices are open from Monday through Friday from 7 AM to 7 PM.

You May Like: Doordash Accounting Method

When Preparing To Contact The Irs Be Sure To Have The Following Information Available

When Calling About Your Own Account

- Social Security cards and birth dates for those who were on the return you are calling about

- An Individual Taxpayer Identification Number letter if you don’t have a Social Security number

- Filing status Single, Head of Household, Married Filing Joint or Married Filing Separate

- Your prior-year tax return

- A copy of the tax return you’re calling about

- Any letters or notices sent to you by the IRS

When Calling About Someone Else’s Account

- Verbal or written authorization to discuss the account

- The ability to verify the taxpayer’s name, SSN/ITIN, tax period, form

- IRS PTIN or PIN if you are a third-party designee

- A current, completed, and signed Form 8821, Tax Information Authorization or a completed and signed Form 2848, Power of Attorney and Declaration of Representative

What Does the IRS Help With?

The IRS can assist with concerns such as

Filing requirements/ status/ dependents/ exemptions

|

Department of the Treasury Internal Revenue Service Fresno, CA 93888-0045 |

How Do I Request An Irs Tax Return Transcript

As part of the federal verification process, you may be required to provide a copy of an IRS Tax Return Transcript to confirm the information filed on your federal tax return.

An IRS Tax Return Transcript can be obtained:

- ONLINE: Visit www.irs.gov. Click on Get Your Tax Record, and then click on Get Transcript Online or Get Transcript by Mail.

- Online requests require the Social Security number, filing status and mailing address from the latest tax returns, an email account, a mobile phone with your name on the account, and your personal account number from a credit card, mortgage, home equity loan, home equity line of credit or a car loan.

- If you do not have all of the above, you will need to use an IRS Form 4506-T to request a copy of your tax return transcript.

Step-by-step instructions for completing the paper form:

You May Like: Doordash Mileage Calculator

Needed For Tax Returns

The letter can also be used to work out if you are entitled to claim the Recovery Rebate Credit on your 2021 tax return.

This credit will be the difference between the amount of the third stimulus check you were eligible for and how much you actually received.

Stimulus checks first went out to eligible recipients in March last year and can be worth up to $1,400 per qualifying taxpayer and each of their dependents.

People maybe in line for more money if they never received their stimulus check, or if their circumstances have changed.

Anyone having another baby or taking on another dependent child would qualify for extra money.

Families may have already received, or about to receive, Letter 6419, which concerns the 2021 child tax credit payments.

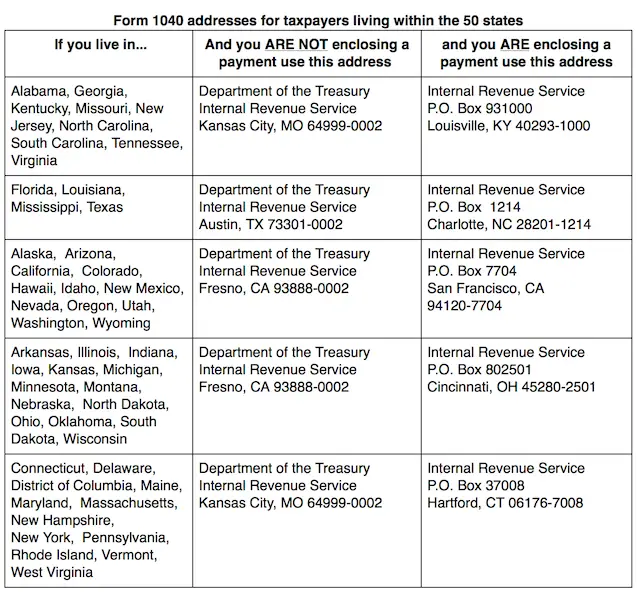

Mailing Address For Individual Tax Payment

For people who owe money on their tax balance, one way of making the payment is by mailing a money order or check to the IRS. The IRS may send you a notice stating your balance and where to send the payment, or you can use the payment voucher, which is Form 1040-V to pay the amount that is due on your Form 1040, 1040A, or 1040EZ. The following table summarizes the mailing addresses of any Form 1040-V payments according to people who live in the areas.

| Louisiana, Florida, Texas, and Mississippi | Internal Revenue Service P.O. Box 1214 Charlotte NC 28201-1214 |

|---|---|

| Arizona, Alaska, Colorado, California, Idaho, Hawaii, New Mexico, Nevada, Utah, Oregon, Wyoming or Washington | Internal Revenue Service P.O. Box 7704 San Francisco, CA 94120-7704 |

| Illinois, Arkansas, Iowa, Indiana, Michigan, Kansas, Montana, Minnesota, North Dakota, Nebraska, Oklahoma, Ohio, Wisconsin or South Dakota. | Internal Revenue Service P.O. Box 802501 Cincinnati, OH 45280-2501 |

| Georgia, Alabama, New Jersey, Kentucky, South Carolina, North Carolina, Virginia, or Tennessee | Internal Revenue Service P.O. Box 931000 Louisville, KY 40293-1000 |

| Delaware, Connecticut, Maine, District of Columbia, Massachusetts, Maryland, New Hampshire, Missouri, Pennsylvania, New York, Vermont, Rhode Island or West Virginia | Internal Revenue Service P.O. Box 37008 Hartford, CT 06176-7008 |

The following group of people should mail their forms to the Internal Revenue Service, P.O. Box 1303, Charlotte, NC 28201- 1303.

Also Check: How To Protest Property Taxes Harris County

Where Is The Stumphouse Tunnel In South Carolina

Stumphouse Tunnel Located within Stumphouse Park. The Stumphouse Mountain Tunnel was part of the Blue Ridge Railroad project, an 1850s attempt to link the port of Charleston to the cities of the Midwest by rail. The Civil War and subsequent collapse of the states economy brought construction to an end and the tunnel was never completed.

Get In Touch If You Can’t Pay

Reach out to the IRS immediately if you owe a tax bill and you aren’t able to pay it in full. You should file your return promptly by the filing deadline and pay as much as you can at that time. The IRS might then help you work out an installment agreement to pay the balance over time.

You can easily apply for an installment agreement online. This quick communication can help minimize penalties and interest on what you owe.

Also Check: Does Doordash Give 1099

Where To Send Returns Payments And Extensions

Eric is a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a solid base supporting his current book of business.

The Balance / Lara Antal

It’s usually best to go the extra mile when you’re dealing with the Internal Revenue Service , even if it feels like a nuisance or a waste of time. That’s even more applicable if you’re one of the few people who still files a paper or snail-mail tax return rather than filing electronically.

Following a few guidelines will ensure that your tax return goes to the proper address, that it gets there on time, and that you have proof of delivery.

All You Need To Know Is Yourself

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

You May Like: How Do You Pay Taxes On Doordash

Note Forms 1040 And 1040

For example if delivering a Form 1040 in 2021 with payment from California the correct address with the four-digit zip code extension is. The one you use depends on where youre filing from and whether your return includes a payment. The IRS mailing addresses listed below can also be stored printed by clicking the link.

For state return mailing addresses find the respective Address es via the link. For state return mailing addresses find the respective Address es via the link. So if you filed your tax return on.

And you ARE enclosing a payment use this address. People who use an FPO or APO address. In short a certificate of mailing does not constitute valid proof of timely mailing.

Alabama Georgia Kentucky New Jersey North Carolina South Carolina Tennessee Virginia. People who are dual-status alien or non-permanent resident of Guam or the US. 9 rijen The mailing address for Form 1040 in 2021 hasnt changed.

Box 1303 Charlotte NC 28201-. If this day falls between April 01 2020 and July 14 2020 you have time until July 15 2020 to mail in the forms. Department of the Treasury Internal Revenue Service Kansas City MO 64999-0014.

People who file form 2555 2555 EZ 4563. Individual corporation partnership and many others. If you are a taxpayer or tax professional filing an individual federal tax return for International use the return type below for the appropriate filing addresses.

Fillable Form 1040 2018 Income Tax Return Irs Tax Forms Irs Taxes

Pin On Eztaxreturn