Stating The Sit Facts

State Income Tax is something that affects the majority of U.S. citizens. However, it is not always a complicated tax, and it is also deductible in some cases. Moreover, living in a state that withholds income tax might save you from a high sales tax rate. Either way, it is the employers responsibility to know how to calculate State Income Tax. Additionally, the employer needs to know which employees owe tax to more than one state. So, I recommend staying on top of information regarding State Income Tax. When in doubt, rest assured your dedicated payroll provider will update you with the most current SIT information.

How Does This Fit In With The Personal Savings Allowance

The personal savings allowance means every basic-rate taxpayer is able to earn £1,000/year in savings interest before paying any tax on it .

The PSA adds to these tax-free savings rules. You’re still able to earn £5,000 savings interest without paying tax, if you’re on a low income, but you’ll also pay no tax on the next £1,000 of savings interest as you use up your personal savings allowance .

Total Estimated 2021 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

You May Like: Tax Write Off For Doordash

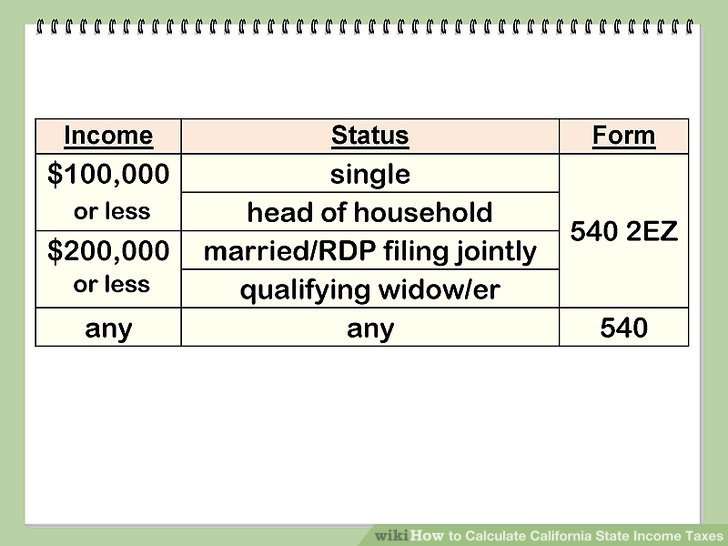

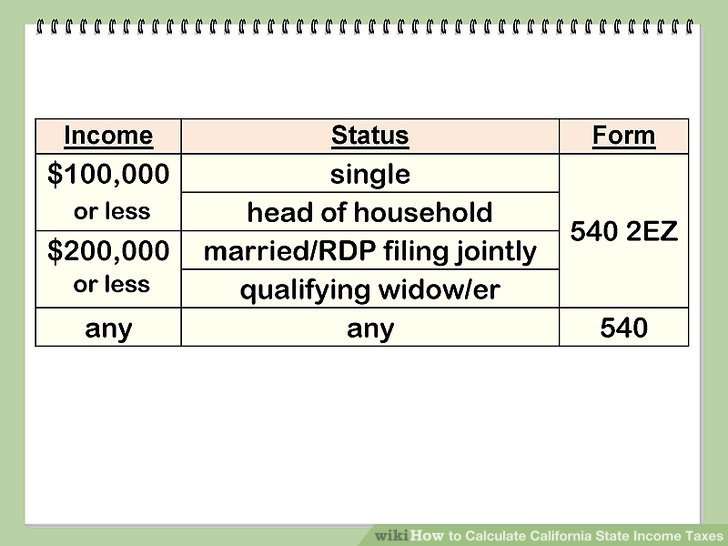

California State Income Tax

Do I have to pay California State Income Tax? The FTB requires California residents to pay state taxes regardless of where they earn a living. This tax liability also applies if you live in California part-time. Nonresidents living in California but living in another state must also file a California tax return.

You’ll Need To Earn At Least 142 A Week But Less Than 100000/year

To qualify, you need to be working and:

Your partner doesn’t have to be the other parent – it’s all based on who you live with so if you are a single parent but then your new partner decides to move in, if they don’t meet the criteria above you would then no longer be able to claim Tax-Free Childcare.

What if I am self-employed?

- If you’re self-employed as long as on average in the next three months or across the whole current tax year you meet the £142 a week minimum, you will qualify.

- If you’ve been self-employed for less than 12 months, the minimum income requirement doesn’t apply to you.

Read Also: Doordash Tax Deduction

Overview Of Illinois Taxes

Illinois has a flat income tax that features a 4.95% rate. This means that no matter how much money you make, you pay that same rate. Sales and property taxes in Illinois are among the highest in the nation.

| Household Income |

| Number of State Personal ExemptionsDismiss |

* These are the taxes owed for the 2021 – 2022 filing season.

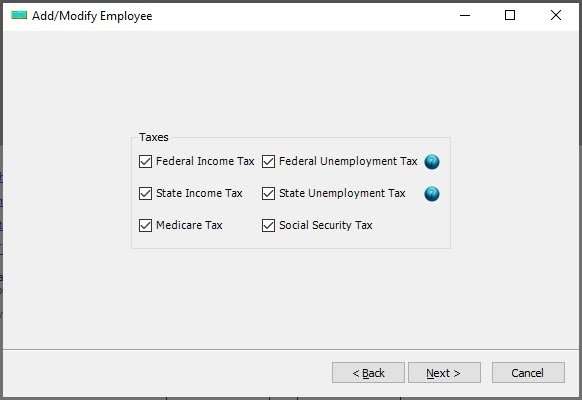

State Income Tax Withholding

If you live in a state with a state income tax requirement, the employer will withhold the same from your paycheck. Again, Form W-4 will determine the amount. If you owe income tax to more than one state, you must request your employer to withhold taxes for the other states as well. Alternatively, you can also ask the employer to withhold more taxes or make estimated payments to cover the difference.

These are the likely state tax scenarios you can face depending on where you live:

-

No state withholding at all

-

Several state withholdings for your home state and other states where you work

Also Check: Reverse Ein Lookup Irs

There’ll Be A Loss If One Of You Is A Non

This is the scenario where applying for marriage tax allowance may actually leave you out of pocket. This happens when the loss incurred by the non-taxpayer outweighs the gain made by the taxpayer. Let’s use another example to explain this:

Peter earns £11,970 and is a non-taxpayer . His wife Fiona earns £12,870 and is a basic-rate taxpayer . If Peter decides to transfer some of his personal allowance to Fiona, he’ll have no choice but to transfer the full £1,260. That leaves him with a personal allowance of £11,310 and bumps Fiona’s personal allowance up to £13,830 .

Peter now earns £660 more than his personal allowance , meaning he’ll pay basic-rate tax for the year of £132 . Meanwhile, the £1,260 personal allowance increase Fiona gets means she’ll get to keep an extra £60 .

The net loss to Peter and Fiona is £72 showing that in this circumstance, couples could lose out.

So if you’re earning near the £12,570 basic-rate income tax threshold, look carefully at the tax gain and loss each of you would have before you commit to transferring the allowance to your partner.

States With Local Income Taxes In Addition To State

The following states have local income taxes. These are generally imposed at a flat rate and tend to apply to a limited set of income items.

Alabama:

- Some counties, including Macon County, and municipalities, including Birmingham

California:

Colorado:

Delaware:

Indiana :

- All counties

- Many school districts and Appanoose County

Kansas:

- Some counties and municipalities

Kentucky:

- Most counties, including Kenton County, Kentucky, and municipalities, including Louisville and Lexington

- All counties, and the independent city of Baltimore

Michigan:

Missouri :

New Jersey:

New York :

Ohio:

- Some school districts .

- RITA .

- Most cities and villages on earned income and rental income. Some municipalities require all residents over a certain age to file, while others require residents to file only if municipal income tax is not withheld by employer. Income is reported on a tax form issued by the municipal income tax collector, currently Cleveland‘s Central Collection Agency or the Regional Income Tax Authority , or a collecting municipality. Municipalities such as Columbus and Cincinnati sometimes also collect for neighboring towns and villages.

Oregon:

Pennsylvania:

West Virginia:

- Some municipalities, including Charleston and Huntington

Also Check: Home Improvement Cost Basis

How Do I Determine Which Percentage To Elect

Every employee must consider the facts of their own situation and adjust their election accordingly.

If you want to keep your withholding approximately the same as last year, use last year’s federal Form W-2, or your last pay stub, to calculate which withholding percentage to elect. For example, if box 1 of federal Form W-2 shows $40,000 in wages and box 17 shows $1,000 in state income tax withheld, divide box 17 by box 1 to determine your percentage . To keep your withholding the same as last year, choose a withholding percentage of 1.8% and withhold an additional $10.77 per biweekly pay period . Be sure to take into account any amount already withheld for this year.

If you want to withhold more, choose one of the higher percentages or choose to have an additional amount withheld.

Note: Underwithholding can result you owing tax and/or underpayment penalties when you le your Arizona return at the end of the year.

Local Income Tax Withholding

Cities and local communities may also have an income tax, and your employer will withhold these taxes as well. The rules and rates vary from one local community to another. Knowing if your paycheck includes withheld local taxes is crucial to avoid unpleasant surprises when the time for filing your taxes come.

Local income tax is taxed per jurisdiction. If you work or live in a city or community that levies the tax, then your wages will be taxed.

Read Also: Is Donating Plasma Taxable Income

What Is State Tax Apportionment And How Do You Calculate It

State income tax is a direct tax on business income youve earned in a state. It sounds straightforward, but this is a complex topic: States have various ways of calculating how much of your corporations business income is attributable to its presence and activity there. Each state gets to decide what matters most your payroll, property, or sales and in what ratio to account for them. This can make calculating state income tax complex, particularly if you do business in multiple states.

Tax teams that are equipped with a knowledge of state requirements, and that have the technology to help track their many facets and frequent changes, are best positioned to stay in compliance.

How To Calculate A State Tax Refund

All income made in a particular state is subject to that state’s income-tax regulations. Most individuals pay income tax throughout the year by instructing their employer to deduct a specified percentage of their paycheck each period and submit it to the state. Occasionally, an employee will over-pay during the course of the year or pay taxes to the wrong state. In such instances, a refund should be requested by your state for the amount of overpayment.

Also Check: When Do You Do Tax Returns

Do I Have To Pay California State Taxes As A Nonresident

If you are a resident for part of the year, you will pay California tax on income earned during the portion of the tax year in which you resided. California, plus state income tax on income from California sources only if you were a foreign citizen. Non-residents can still pay California taxes on income from California sources.

Dealing With An Onshore Bond Tax Credit

Tax law for taxing insurance bond gains is contained in Part 4, Chapter 9 of the Income Tax Act 2005. Although, where the policyholder is a company, then the loan relationship rules apply instead as discussed here.

Chapter 9 comprises Sections 461 to 546 and from outset, S461 makes it clear that gains are charged to income tax. Only in certain specific circumstances will a charge to capital gains tax arise.

Chargeable event gains on UK bonds are not liable to basic rate tax. The individual who is liable for tax under the chargeable event regime is treated as having paid tax at the basic rate on the amount of the gain. This reflects the fact that the funds underlying a UK policy are subject to UK life fund taxation.

It is a longstanding principle that the notional tax is not repayable ITTOIA 2005

HMRC manuals therefore state that basic rate tax is still treated as paid even if some or all of the gain is subject to the 0% starting rate for savings.

Finance Act 2008 created a new 10% starting rate for savings. A consequence of this was that S530 was repealed. That particular subsection had been in place to ensure that gains taxed under the previous 10% starting rate band would be taxed at 20% rather than 10%. With S530 being omitted, this consequence was that gains with a notional 20% credit became chargeable at 10% leaving a balance of tax credit.

Example of bond gain partially taxable at 0% savings rate –

Recommended Reading: H& r Block Early Access W2

Do Non Residents Have To File Taxes In California

California uses its own method to calculate its share of the annual tax for residents and non-residents. For more information. Non-residents or residents with annual accounts should provide: for more information. A non-resident application is required when a resident spouse and a non-resident spouse wish to file a application.

How Do These Allowances Affect The Amount Of Tax I Pay

This can be quite a complex subject as the amount you earn as income – eg from a job – can affect your allowances for savings interest and whether it’s paid tax-free. Let’s take the three main scenarios for non-savings income earnings…

Recommended Reading: Harris County Property Tax Protest Services

Overview Of Florida Taxes

Florida is known for having low taxes. Delving into the numbers, the state mostly lives up to the reputation. Despite having no income tax, though, there are some taxes that Florida residents still have to pay.

| Household Income |

| Number of State Personal ExemptionsDismiss |

* These are the taxes owed for the 2021 – 2022 filing season.

How And When Will I Get The Money

It depends on which year you’re claiming for:

- For the current tax year, the higher earner will simply pay slightly less tax on their take-home pay. This is done by adjusting the recipient partner’s personal tax code. The partner who transferred their personal allowance will also receive a new tax code, if employed.– How long will it take until you see a change to your take-home pay? It usually takes two days to get a new tax code. But when you’ll see a difference to your pay depends on whether your employer gets it in time to meet the cut-off date for their payroll, eg, if you get paid on the 25th each month and your employer gets your new tax code on the 10th, it’s likely to be applied that month, but if they only receive it on the 23rd you’ll probably have to wait for another month.– Self-employed? If you’re self-employed, your self-assessment tax bill will be reduced as HMRC will take into account that you’ve now got a bigger allowance.

- If you’re backdating for previous years, you will get a payout. You can either get it via a bank transfer or receive a cheque.– How long will it take until you get the money? If you’ve submitted your claim online, it will take around two weeks for HMRC to process and for you to see the money in your account. If you’ve submitted a form by post, HMRC says it will take between 24 and 29 working days after receipt to get the money.

Recommended Reading: Is Plasma Money Taxable

How The Marriage Tax Allowance Is Calculated

The partner who has an unused amount of personal allowance can transfer £1,260 of their allowance to the other . They can only transfer £1,260 no more, no less.

This is how it works:

Part-time Peter works just enough and earns £5,000 at his local fish and chip shop. His full personal allowance for the year is £12,570, so he has plenty of spare allowance to transfer £1,260 to his wife.

Peter’s wife, full-time Fiona, is a software developer. She earns £35,000 and is a basic-rate taxpayer . Her personal allowance increases by £1,260 to £13,830 when Peter chooses to make his transfer.

So she has an extra £1,260 which she would’ve paid tax on at 20%, but is now tax-free, so she’s £252 up .

Overview Of Pennsylvania Taxes

Pennsylvania has a flat income tax rate of 3.07%, the lowest of all the states with a flat tax. The statewide sales tax rate is 6%, though two counties charge an additional sales tax above this rate.

| Household Income |

| Number of State Personal ExemptionsDismiss |

* These are the taxes owed for the 2021 – 2022 filing season.

Also Check: How To Find Employers Ein

Calculating Your Tax Refund

Whether or not you get a tax refund depends on the amount of taxes you paid during the year. This is because they were withheld from your paycheck. However, it also depends on your tax liability and whether or not you received any refundable tax credits.

When you file your tax return, if the amount of taxes you owe is less than the amount that was withheld from your paycheck during the course of the year, you will receive a refund for the difference. This is the most common reason people receive a tax refund.

If you paid no taxes during the year and owe no taxes, but are eligible for one or more refundable tax credits, you will also receive a refund equal to the refundable amount of the credits.

How To Pay Taxes Owed To The State Of California

- Use Your Personal Estimated Tax Receipts 12 to Pay Estimated Tax by Mail

- Write a check or money order to the IRS for the franchise.

- Write your BSN or ITIN in it and form 2021 540ES

California 529Are there any tax advantages with California 529 plans? Like other state-sponsored 529 plans, the California-sponsored 529 can offer an increase in non-deductible savings as well as the ability to potentially decrease your taxable assets.Which state has the best 529 plan?Utah The first state outside the Midwest, Utah, consistently ranks among the top states with 529 records. This is partly because the

Don’t Miss: How Do I Get My Doordash 1099