Taxes On Employee Tips

Taxes will also have to be collected on tip income too.

As an employer you must collect income tax,employee Social Security tax, employee Medicare tax,and additional Medicare tax if applicable on tip income.

You can collect these taxes from wages or from other fundsyour employee makes available.

If the employee receives regular wages and reports tips,calculate income tax as if the tips were supplementalwages or part of regular wages.

If you have not withheld income taxfrom the regular wages because the wages were too low,add the tips to the regular wagesand withhold income tax based on the total.

But if you withhold income tax from the regular wages,then you have two options available.

You can withhold a flat 22 percentfor tax year after 2017,or you can add the tips and the regular wagesfor the most recent payroll period and calculatethe income tax withholding as if the totalwere a single payment.

Then subtract the tax already withheldfrom the regular wages and withhold the remainingtax from the tips.

As the employer youre responsiblefor the employer’s Social Security tax on wagesand tips until the wages including tips reach the limit.

You are responsible for the employerMedicare tax for the whole year on all wages and tips.

If the employee’s income is below the 22percent income tax bracket,calculating their tax using the 22 percent flat rate maymean that you’re withholding a lot more taxthan is necessary.

This could cause a hardship for the employee.

Choose Your Calculation Method

Once youve gathered all the W-4 and payroll information you need to calculate withholding tax, you need to choose a calculation method. There are two methods you can choose from:

- The Wage Bracket Method: The wage bracket method of calculating withholding tax is the simpler of the two methods. Youll use the IRS income tax withholding tables to find each employees wage range. The instructions and tables can be found in IRS Publication 15-T.

- The Percentage Method: The percentage method is more complex and instructions are also included in IRS Publication 15-T. The instructions are different based on whether you use an automated payroll system or a manual payroll system. The worksheet walks you through the calculation, including determining the employees wage amount, accounting for tax credits, and calculating the final amount to withhold.

Recommended Reading: Does Doordash Tax Tips

Federal Income Tax Withholding

Employers withhold federal income tax from their workers pay based on current tax rates and Form W-4, Employee Withholding Certificates. When completing this form, employees typically need to provide their filing status and note if they are claiming any dependents, work multiple jobs or have a spouse who also works , or have any other necessary adjustments.

You May Like: Can You File Missouri State Taxes Online

California Median Household Income

| 2011 | $57,287 |

So what makes Californias payroll system different from the systems you might have encountered in other states? For one thing, taxes here are considerably higher. The state has ten income tax brackets and the system is progressive. So if your income is on the low side, you’ll pay a lower tax rate than you likely would in a flat tax state. Californias notoriously high top marginal tax rate of 13.3%, which is the highest in the country, only applies to income above $1 million for single filers and $2 million for joint filers.

While the income taxes in California are high, the property tax rates are fortunately below the national average. If you are thinking about using a mortgage to buy a home in California, check out our guide to California mortgage rates.

California also does not have any cities that charge their own income taxes. However, sales tax in California does vary by city and county. This wont affect your paycheck, but it might affect your overall budget.

California is one of the few states to require deductions for disability insurance. This may seem like a drag, but having disability insurance is a good idea to protect yourself and your family from any loss of earnings you might suffer in the event of a short- or long-term disability.

Employment & Training Investment Assessment

The fifth component of your tax rate is the Employment and Training Investment Assessment . The assessment is imposed on each employer paying contributions under the Texas Unemployment Compensation Act as a separate assessment of 0.10 percent of wages paid by an employer. Money from the assessment is deposited to the credit of the employment and training investment holding fund. By law, the Replenishment Tax Rate is reduced by the same amount, so there is no increase in your tax rate due to this assessment.

Also Check: How Are Roth Iras Taxed

Vermont Median Household Income

| 2010 | $49,406 |

Vermonts tax rates are among the highest in the country. There are four tax brackets that vary based on income level and filing status. The states top tax rate is 8.75%, but it only applies to single filers making more than $206,950 and joint filers making more than $251,950 in taxable income. If you’re a single filer with $40,950 or below in annual taxable income, you’ll pay the lowest state income tax rate in Vermont, at 3.35%.

Vermont has no cities that levy a local income tax. This means that whether you live in Burlington, Rutland or anywhere in between, you wont have an additional local withholding.

If you’re planning on relocating to Vermont or thinking about a move within the state and you’re looking to purchase a home, our Vermont mortgage guide is a great place to start learning.

Income From Capital Gains

The nature and number of transactions usually determine the computation of income from capital gains. It can be attained in the following manner:

- Calculate your long-term capital gains from your total sales of assets.

- Calculate your short-term capital gains from the total sales of capital assets.

- Deductions are to be claimed after this.

Read Also: How Long It Take To Get Taxes Back

Lets Review Our Example Using The 2020 W

- Our employee earns $50,000 a year, or $2,083.33 of gross pay per semi-monthly pay period.

- Our employees federal income tax withholding is $12.29 using the new W-4.

- Social Security tax is $129.17, and Medicare tax is $30.21. The total combined FICA tax is $159.38.

- Since our employee lives in Florida, there is no state income tax withholding.

- There were no deductions or expense reimbursements.

- Thus, our employees net pay is $1,911.66.

From time to time, there may be other things youll need to add or deduct from your employees paychecks. When these items are added and subtracted, the rest of the basic math outlined above stays the same.

How To Increase A Take Home Paycheck

Salary Increase

The easiest way to achieve a salary increase may be to simply ask for a raise, promotion, or bonus. However, this is assuming that a salary increase is deserved. For instance, an employee is in a legitimate position to ask for a raise or bonus if their performance exceeded original expectations, or if the companys performance has noticeably improved, due in part to the employees input. If internal salary increases are not possible, which is common, try searching for another job. In the current job climate, the highest pay increases during a career generally happen while transitioning from one company to another. For more information about or to do calculations involving salary, please visit the Salary Calculator.

Reevaluate Payroll Deductions

Sometimes, it is possible to find avenues to lower the costs of certain expenses such as life, medical, dental, or long-term disability insurance. For instance, someone who is healthy with no major diseases or injuries can reconsider whether the most expensive top-of-the-line health insurance is necessary. In addition, each spouses company may have health insurance coverage for the entire family it would be wise to compare the offerings of each health insurance plan and choose the preferred plan.

Open a Flexible Spending Account

Work Overtime

Temporarily Pause 401 Contributions

Recommended Reading: How To Do Taxes For Doordash

How Your California Paycheck Works

Your job probably pays you either an hourly wage or an annual salary. But unless youre getting paid under the table, your actual take-home pay will be lower than the hourly or annual wage listed on your job contract. The reason for this discrepancy between your salary and your take-home pay has to do with the tax withholdings from your wages that happen before your employer pays you. There may also be contributions toward insurance coverage, retirement funds, and other optional contributions, all of which can lower your final paycheck.

When calculating your take-home pay, the first thing to come out of your earnings are FICA taxes for Social Security and Medicare. Your employer withholds a 6.2% Social Security tax and a 1.45% Medicare tax from your earnings after each pay period. If you earn over $200,000, youll also pay a 0.9% Medicare surtax. Your employer matches the 6.2% Social Security tax and the 1.45% Medicare tax in order to make up the full FICA taxes requirements. If you work for yourself, youll have to pay the self-employment tax, which is equal to the employee and employer portions of FICA taxes for a total of 15.3% of your pay.

Reporting And Depositing Payroll Taxes

Employers can either directly report and deposit payroll taxes with federal, state, and local governments, or they can contract with a payroll company to handle this task.

Generally, filings are handled electronically. The employer designates how much of each tax is to be withheld each pay period by each employee, and those funds are withheld from paychecks and electronically deposited on a periodic basis with the relevant federal, state, and local agencies.

Also Check: How Is Capital Gains Tax Calculated On Sale Of Property

You May Like: What Is My Capital Gains Tax Rate

How Your Paycheck Works: Income Tax Withholding

When you start a new job or get a raise, youll agree to either an hourly wage or an annual salary. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week, or dividing your annual salary by 52. Thats because your employer withholds taxes from each paycheck, lowering your overall pay. Because of the numerous taxes withheld and the differing rates, it can be tough to figure out how much youll take home. Thats where our paycheck calculator comes in.

Tax withholding is the money that comes out of your paycheck in order to pay taxes, with the biggest one being income taxes. The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks. It’s your employer’s responsibility to withhold this money based on the information you provide in your Form W-4. You have to fill out this form and submit it to your employer whenever you start a new job, but you may also need to re-submit it after a major life change, like a marriage.

If you do make any changes, your employer has to update your paychecks to reflect those changes. Most people working for a U.S. employer have federal income taxes withheld from their paychecks, but some people are exempt. To be exempt, you must meet both of the following criteria:

What Is The Percentage Of Federal Income Tax Withheld

As an employer, you withhold income tax on behalf of your employees and then remit those taxes quarterly to federal, state, and local tax authorities.

To calculate how much of your employeeâs federal income tax to withhold, youâll need a copy of their Form W-4, as well as your employeeâs gross pay.

Your next step is to determine the method you want to use to calculate withholding. Most employers have two options: the Wage Bracket Method or the Percentage Method. While not exactly simple, the wage bracket method is the more straightforward approach to calculating payroll tax.

You May Like: How To Report Forex Income On Tax Return

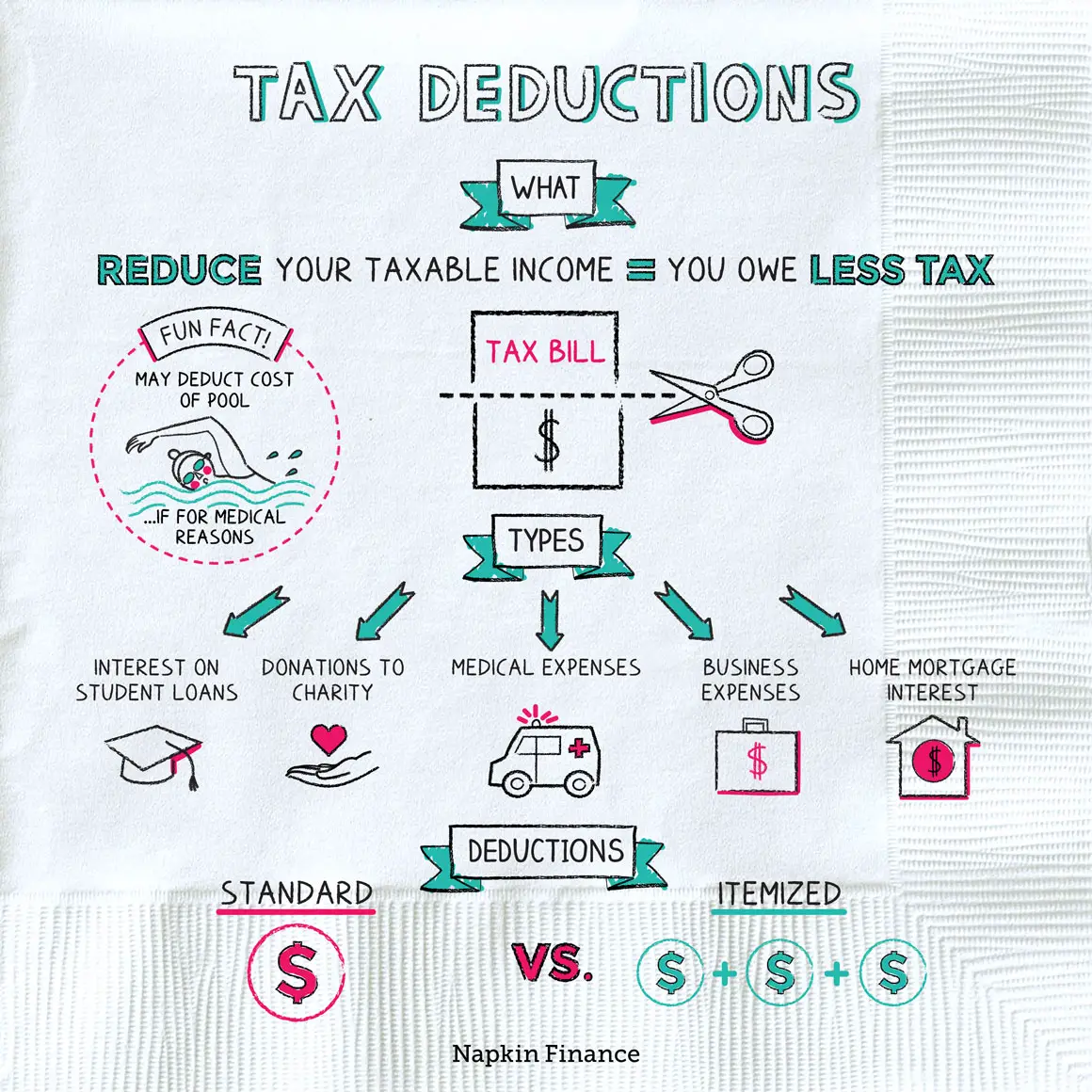

How To Calculate Federal Tax Credits

Unlike adjustments and deductions, which apply to your income, tax credits apply to your tax liability, which means the amount of tax that you owe.

For example, if you calculate that you have tax liability of $1,000 based on your taxable income and your tax bracket, and you are eligible for a tax credit of $200, that would reduce your liability to $800. In other words, you would only owe $800 to the federal government.

Tax credits are only awarded in certain circumstances, however. Some credits are refundable, which means you can receive payment for them even if you dont owe any income tax. By contrast, nonrefundable tax credits can reduce your liability no lower than zero. The list below describes the most common federal income tax credits.

- The Earned Income Tax Credit is a refundable credit for taxpayers with income below a certain level. The 2021 credit can be up to $6,728 for taxpayers with three or more children, or lower amounts for taxpayers with two, one or no children.

- The Child and Dependent Care Credit is a nonrefundable credit of up to $4,000 or $8,000 related to childcare expenses incurred while working or looking for work.

- The Adoption Credit is a nonrefundable credit equal to certain expenses related to the adoption of a child.

- The American Opportunity Tax Credit is a partially refundable credit of up to $2,500 per year for enrollment fees, tuition, course materials and other qualified expenses for your first four years of post-secondary education.

Employee And Employer Taxes

If you pay employees, there are some slightly different tax implications. Speak to your accountant to get clear guidance for your unique situation.

Employer Payroll Tax Withholding

All employers are required to withhold federal taxes from their employees wages. Youll withhold 7.65 percent of their taxable wages, and your employees will also be responsible for 7.65 percent, adding up to the current federal tax rate of 15.3 percent. Speak to your accountant for more information.

Recommended Reading: Will A Roth Ira Reduce My Taxes

You May Like: What Is The Penalty For Filing Income Tax Late

State And Local Payroll Tax

Employers are also responsible for paying state and local payroll tax on behalf of employees. As with federal payroll tax, part of this tax is employer paid and part is employee paid. Keep in mind that âemployee paidâ just means that you, the employer, withhold a certain amount from your employeeâs paycheck and then remit it as part of your payroll taxes.

In addition to state payroll tax , employers are also responsible for remitting state income tax on behalf of their employees. Have all your SUTA questions answered in just a 3 minute read.

State and local payroll taxes are governed at the state and local level, and every stateâs payroll tax rules are different. The Federation of Tax Administrators published a list of each stateâs taxing authority. You can find out more about payroll tax in your state and local area there.

How Your Paycheck Works: Deductions

Federal income tax and FICA tax withholding are mandatory, so theres no way around them unless your earnings are very low. However, theyre not the only factors that count when calculating your paycheck. There are also deductions to consider.

For example, if you pay any amount toward your employer-sponsored health insurance coverage, that amount is deducted from your paycheck. When you enroll in your companys health plan, you can see the amount that is deducted from each paycheck. If you elect to contribute to a Health Savings Account or Flexible Spending Account to help with medical expenses, those contributions are deducted from your paychecks too.

Also deducted from your paychecks are any pre-tax retirement contributions you make. These are contributions that you make before any taxes are withheld from your paycheck. The most common pre-tax contributions are for retirement accounts such as a 401 or 403. So if you elect to save 10% of your income in your companys 401 plan, 10% of your pay will come out of each paycheck. If you increase your contributions, your paychecks will get smaller. However, making pre-tax contributions will also decrease the amount of your pay that is subject to income tax. The money also grows tax-free so that you only pay income tax when you withdraw it, at which point it has grown substantially.

Dont Miss: How To Calculate Net Income After Taxes

Also Check: When Do I Pay Taxes As An Independent Contractor

How To Calculate Tax In Excel

In this condition, you can easily calculate the sales tax by multiplying the price and tax rate. Select the cell you will place the calculated result, enter the formula =B1*B2 , and press the Enter key.

What is the formula to add taxes in Excel?

- Enter the formula by referencing the cells that have the price and the sales tax respectively. The necessary formula is Cell with Price + . For example, if the price is in cell A3 and the tax rate is in cell B3, then the corresponding formula is +A3+.

Futa Tax Household Workers

For household workers you are subject to FUTA taxonly if you paid total cash wages of a $1,000or more for all household employees in any calendarquarter in the current or prior year.

A household worker is an employee who performshousehold work in a private home,local college club, or local fraternity,or sorority chapter.

Read Also: When Will The Irs Start Processing 2021 Tax Returns

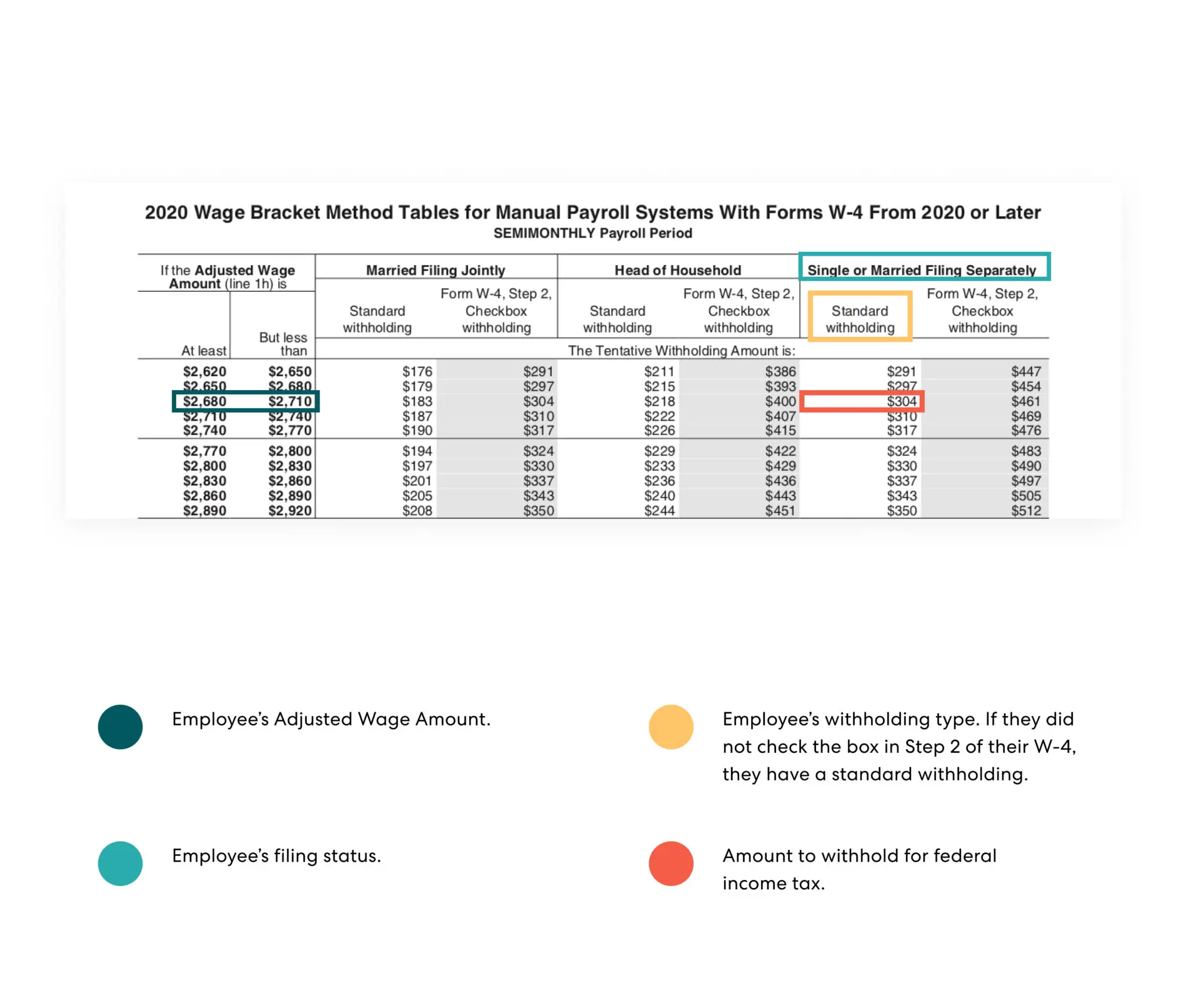

Calculating Withholding: Wage Bracket Method

Under the wage bracket method,you simply locate an IRS Publication 15-Tthe proper table for your payroll periodand the employee’s marital status as shownon the employee’s Form W-4.

Then look at the employee’s Form W-4 for the numberof withholding allowances claimed.

Using the number of allowances claimed on the Form W-4,and the amount of taxable wages paid,follow the column and row to find the amountof tax to withhold.

For withholding computations for employees claiming morethan 10 withholding allowances,you will need to refer to the special wagebracket instructions in IRS Publication 15-T.