Best Tax Software Programs For 2021

- Price: $90 + $50 per state

- Support: Phone, chat, video, full tax preparation

- Accuracy Guarantee: Money-back

We picked TurboTax as best overall because it is easy to use, offers different pricing tiers for different needs, and offers the option to upgrade for live support.

-

DIY and live assist plans

-

Limited tax support unless you pay

-

Expensive state filing fees

-

Most expensive plan overall

TurboTax makes it easy for first-time or inexperienced tax filers to get started. Users are first asked to choose their situation, like I want to maximize deductions and credits, I have a job , etc. This helps TurboTax determine which pricing plan is right for the user. The software then uses plain-language questions to walk users through every part of the tax filing process and includes quick explanations of confusing terms or processes.

TurboTax also offers many other conveniences, including importing a PDF of a previous return to start a new return, importing W-2 and 1099 forms by snapping a picture of them, and the ability to file taxes using the TurboTax mobile app. Users also have the option to get their return reviewed by a CPA or agent before they file as well as unlimited live tax advice for an extra fee.

TurboTax offers a variety of pricing plans. Users can choose from one of four DIY TurboTax plans or four TurboTax Live plans. Fees for all plans are only due at the time of filing.

Read our full TurboTax review

How We Chose The Best Tax Software For Small Business

This review was based on information gathered on 10 different tax software options for small businesses. The winning software programs offered a good user experience including important features to prepare an accurate tax return in a timely fashion. Additional factors reviewed include cost, customer reviews, software popularity, and available options for both technical and tax support.

What To Do If You Have Tax Owing

2020 was a financially rough year for many Canadians, and the federal government stepped in where they could and offered benefits to those who were struggling to make ends meet during the COVID-19 pandemic. What many Canadians failed to realize, is that those benefits were taxable. As a result, you may find yourself not getting money back at tax time, but instead, youll owe a portion of your benefits back to the government. Heres what to do if you suspect you may owe money at tax time.

- Prepare your return promptly if you think you might owe money at tax time, prepare your return as soon as possible. Preparing early will show you exactly how much you owe, and give you time to plan to pay it back

- File on time if you owe a tax balance, dont delay filing because of it. Filing after the deadline results in a late filing penalty and wont affect your taxes owing youll need to pay those anyway.

- Make a plan to pay your taxes if you dont have the cash on hand to pay your tax bill, consider tapping your cash resources. Emergency funds are there for a reason and paying an outstanding tax bill is one of them.

- Consider paying in installments If you dont have the cash on hand to pay your tax bill, consider making payments in installments. The Canada Revenue Agency will charge interest on your outstanding balance, but the interest rate is low.

You May Like: Where’s My Tax Refund Ga

Turbotax Vs Human: Best Way To Save On Your Tax Return

This article was updated on February 23, 2011.

Everything we do, we do online. We meet and chat and date. We plan and play and pay bills. Kids text, celebrities tweet and boomers post snapshots on Facebook. Our pay stubs are PDFs, our health care comes via HR portal, and our photos have migrated from shoebox to hard drive to remote server. You may have communicated with your college roommate yesterday, but when was the last time you actually spoke?

So given all the supremely personal acts that we have happily relinquished to software, why do 60 percent of Americans use a real live tax pro to do their taxes? TurboTax costs less than $100 for most people, and its probably a breeze compared with open enrollment. Yet only 21 percent of Americans use tax software. Nearly as many, 17 percent, use a pencil.

To find out what some guy with a green eyeshade can do for you that software and circuits cant, we put em all to the test. In a competition the likes of which hasnt been seen since John Henry took on the steam engine, we pitted New York City CPA Howard Samuels against three tax programs to see who could get the biggest refund from Uncle Sam. May the best number-cruncher win.

About my family: Im a self-employed journalist and my husband works as a commercial real estate broker. We are new parents and rent a New York City apartment.

Heres how the contest played out.

You Should Use Taxact If

TaxAct has always been the cheapest option of the three, and its functionality has improved significantly over the years. Now, its nearly on par with TurboTax and H& R Block.

That said, my TaxAct return has consistently taken longer than my TurboTax and H& R Block returns. The support infrastructure is unimpressive, though the tax audit defense no longer costs an arm and a leg just $10 when you upgrade to the premium plan.

But TaxAct is no longer the best game in town for ultra-frugal filers.

In general, TaxAct is ideal for somewhat more experienced filers who dont mind exchanging time for money. Though its interface has gotten more user-friendly over the years, its still not the best software for first-timers.

TaxAct is a solid choice if:

See our full TaxAct review for a complete analysis.

Don’t Miss: Have My Taxes Been Accepted

Best Overall: H& r Block

H& R Block

We chose H& R Block as best overall because it is a trusted name in tax preparation, and its tax software for small businesses and business owners offers an excellent user experience and covers a wide range of tax situations. It offers a straightforward user interface that makes it easy to do your taxes accurately the first time.

-

Online version includes self-employment and small business income on your personal tax returns

-

Option to upgrade for on-demand assistance from a tax expert

-

Mobile app allows you to upload tax documents and track filing status

-

Business editions are priced higher than competitors

-

Some functionality may not be available on mobile

H& R Block is a well-known brand in personal and business tax preparation. It was founded in 1955 and has prepared more than 800 million tax returns. If you want to do your own taxes, you can choose between online and downloadable versions of H& R Blocks tax software. For the 2019 tax year, H& R Block prepared 23 million tax returns and 8 million people used H& R Block Online to do their taxes.

The software program does a good job of walking you through complex tax situations. If you think youll need extra help, you can upgrade to Online Assist, which allows you to do your taxes on any device with unlimited, on-demand help from a tax pro. It costs $159.99 for Premium or $194.99 for Self-Employed, plus $49.99 per state.

Do It Right Avoid Fines

There are so many ways to file an incorrect income tax return. Forgetting to report income is one of the most serious errors, but you can also make other mistakes that may result in a higher tax bill, or even a fine. Tax sites help you avoid both by providing simple and clear written guidancenot in the complex language of the IRS.

These applications help you put the right numbers and other information in the right places. But what if you don’t understand a topic or are not sure if it applies to your situation? For example, you might want to know whether you are eligible for a certain deduction without risking a penalty if you’re not. Tax preparation services provide multiple types of help. For example, they might:

-

explain a question in more depth

-

hyperlink a word or phrase and open a window containing a definition

-

display FAQs and other context-sensitive information

-

include voluminous files that you can search for answers to specific questions

-

offer chat, phone, or email help

The better you understand what information your return requires, the more likely you are to knock some money off of your tax bill and stay off the IRS’s radar.

Read Also: Protesting Harris County Property Tax

American Opportunity Tax Credit

What it is: A per-student refundable tax credit for qualified education expenses during the first four years of higher education.

To qualify: You, your spouse or dependent must be pursuing a degree or other recognized education credential be enrolled at least half time for at least one academic period that begins during the tax year be in the first four years of education not have a felony drug conviction and have modified adjusted gross income of less than $90,000 or less or $180,000 or less if youre married filing jointly.

How much the credit is worth: Up to $2,500 per eligible student, depending on income and expenses. The credit can give you 100% of the first $2,000 of qualified education expenses, plus 25% of the next $2,000. If the credit reduces the tax you owe to zero, you can get 40% of the credit balance back as a refund, making the AOTC a partially refundable credit.

What Is Tax Software For Small Business

Tax software for small business is an online, desktop, or mobile option to complete your taxes on your own without paying a professional preparer. Depending on the software you choose, you may be able to file self-employed taxes with a Schedule C or more complex taxes for a partnership or corporation. While personal tax preparation software focuses only on Form 1040 in most cases, small business tax software has the ability to complete taxes for businesses of all sorts.

Read Also: Property Tax Protest Harris County

How To Pick The Right Online Tax Software For You

Most online tax software options allow you to start your taxes for free. If you make under $72,000, for example, the IRS offers its own filing system free of charge. A hefty majority of taxpayers around 70 percent qualify for this service, according to the IRS.

- If youre on a budget or have a fairly simple tax situation, you may be better off selecting the free or standard option.

- If your situation is more complex for instance, you own multiple properties, run a small business, sold stocks this year or are a freelancer you should seek more premium option.

- Most free online tax services have income limits, so higher earners may be forced to go premium regardless of how simple their financial situation is.

Feeling overwhelmed with options? Your best bet is to purchase tax software that does most of the heavy lifting for you, said Brown. This would include paid versions of TurboTax, H& R Block and Tax Slayer. While you may wind up paying more, its better than filing your taxes with mistakes, he said.

Trying to get the biggest return possible? Dont be afraid to try multiple options. Most tax software allows you to begin a return for free and pay only when youre ready to submit the return. You should be able to see your tax refund account and cancel any filing that doesnt offer the biggest refund.

Invest In Tax Planning

Tax planning is one of the best ways to take advantage of all these deductions and get the maximum tax refund possible. Tax planning often starts at the very beginning of the year and takes into account how much money you’ll earn and how different expenses affect the total tax amount that you’ll owe. Planning also helps you evaluate different ways of using your money to buy needed, yet tax-deductible items or make other tax-reducing investments.

A tax-planning professional can play with the numbers in computer software to evaluate what changes you can make to lower the tax bill, therefore upping the refund.

For more tax tips, check out the links on the next page.

Recommended Reading: How To Get Tax Preparer License

It All Comes Down To Dollars And Cents

Unless you have a low enough income to qualify for the IRS Free File program, you can count on paying to do your taxes. For 2019, I’m using TaxAct for my business taxes and TurboTax for my personal taxes. This is exactly what I did last year too, and I’m happy with the setup.

The combined experience gets me the lowest cost on my taxes and tax preparation combined. Don’t pay more for services you don’t need and don’t overlook important deductions and credits. That’s what savvy tax preparation is all about.

What Can A Small Business Write Off

Small businesses can write off most expenses directly related to running the business. That can include equipment, labor, office supplies, and any services your business needs to operate. In some cases, it may even include a deduction for use of a home office or vehicle for business purposes.

If you have serious doubts or questions about what your small business can write off, it may be worthwhile to pay for an upgrade to a version of a tax program where you can access expert advice.

Recommended Reading: Do You Have To Do Taxes For Doordash

Why Do People Need Tax Software Programs

For those who dont want to pay a professional to prepare their tax returns, tax software has two distinct benefits over trying to go it alone. The first is to ensure that every required expense and form are recorded and filed properly.

The second thing tax software can do is maximize tax returns. Because tax laws are changing all of the time, individuals and businesses cant keep track of every available new deduction. Since tax software gets updated constantly, users are guaranteed to find the latest opportunities to get more money back on their returns.

What’s New And What To Consider When You File In 2022

Reconcile advance Child Tax Credit payments

If you received advance payments, when you file your 2021 tax return, you will need to compare the advance Child Tax Credit payments that you received during 2021 with the amount of the Child Tax Credit that you can properly claim on your 2021 tax return. The fastest way for you to get your tax refund that will include your Child Tax Credit is by filing electronically and choosing direct deposit.

If you received less than the amount that you’re eligible for, you’ll claim a credit for the remaining amount of Child Tax Credit on your 2021 tax return. If you received more than the amount that you’re eligible for, you may need to repay some or all of that excess payment when you file.

In January 2022, the IRS will send you Letter 6419 to provide the total amount of advance Child Tax Credit payments that you received in 2021. You need to keep this and any other IRS letters you received about advance CTC payments you received with your tax records and refer to them when you file.

Claim Recovery Rebate Credit

Individuals who didn’t qualify for third Economic Impact Payments or did not receive the full amount may be eligible for the Recovery Rebate Credit based on their 2021 tax situation. The fastest way for you to get your tax refund that will include your Recovery Rebate Credit is by filing electronically and choosing direct deposit.

See IRS.gov/rrc for more information.

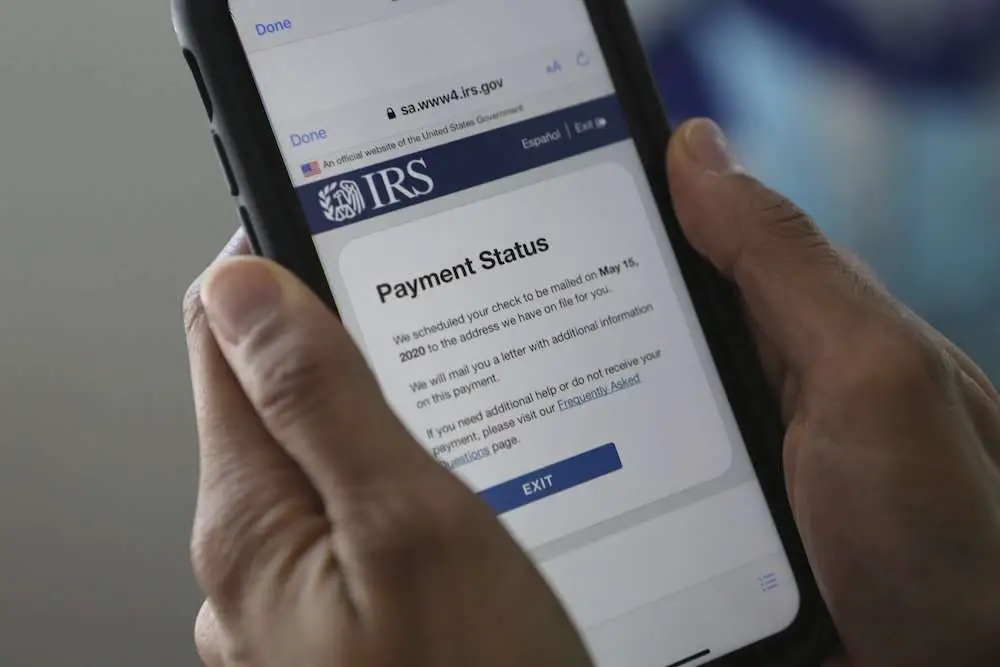

Get Your Refund Status

Don’t Miss: Pastyeartax.com Reviews

Online Vs Cd/download Vs In

All tax preparation platforms discussed in this article are online. H& R Block and TurboTax also have CDs as well as downloadable software. Only Jackson Hewitt and H& R Block offer in-person filing, though TurboTax has added a new feature, TurboTax Live Full Service, that allows you to meet one-on-one with a tax expert via a live video call. Generally speaking, CD/download versions are the least expensive and in-person filing is the most expensive. As features and services offered vary, direct comparison is difficult.

What To Claim To Get A Bigger Refund

It is not uncommon for taxpayers to knowingly overpay the IRS by claiming zero allowances. This is often done in anticipation of a larger lump sum refund that can then be used to pay off large bills, take a family vacation or pay an extra mortgage payment. Not everyone is good at saving, and some filers claim zero allowances to help squirrel away some extra money every pay period to spend as they please, or to assist in paying off debt. Theres nothing wrong with this approach, and it works well for many taxpayers. Whether or not you should claim zero allowances is a personal one, but there are online calculators available that help you calculate payroll deductions so you know how much you’ll be taking home every paycheck.

Bear in mind, if you were due a tax refund but owe back taxes or past-due child support payments, then you may have all or a portion of your tax refund intercepted to settle any arrears.

Also Check: Pastyeartax Reviews