Registration In Other States

If you will be doing business in states other than Ohio, you may need to register your LLC in some or all of those states. Whether you’re required to register will depend on the specific states involved: each state has its own rules for what constitutes doing business and whether registration is necessary. Often activities such as having a physical presence in a state, hiring employees in a state, or soliciting business in a state will be considered doing business for registration purposes. Registration usually involves obtaining a certificate of authority or similar document.

For more information on the requirements for forming and operating an LLC in Ohio, see Nolo’s article, 50-State Guide to Forming an LLC, and other articles on LLCs in the LLC section of the Nolo website.

Penalties And Fees For Paying Ohio Income Tax Late

mail_outline

The tax deadline passed this year, and you have not filed your Ohio State Tax Return. You are not alone. Many taxpayers procrastinate. It is easy to get busy and put your taxes to the side, while you wait to receive all the necessary forms. Before you know it, the deadline has rolled past. Now, that you have missed the deadline, it can feel easy just to forget about filing. They are already late, right? If you are filing your taxes past the deadline, it is important you file as quickly as possible to reduce the penalties and fees for paying your Ohio Income Tax late. Luckily, an experienced tax preparer can hep prevent missed deadlines in the future, saving you money. You can also use our tax planning documents for free to ensure you are ready on time for the next tax season.

What Federal Tax Forms Should Be Filed

Most international students and J-1 scholars should file a special tax form along with Form 8843. If a tax treaty exemption is being claimed, form 8233 must also be submitted. These are the tax forms for non-residents.

International students who have been in the U.S. in F-1 or J-1 status for more than five years should review IRS publications to determine if they should instead file form 1040 or 1040-EZ. J-1 scholars who have been in the U.S. in J-1 status for more than two years should review IRS publications to determine if they should instead file form 1040 or 1040 EZ.

H-1B, TN or 0-1 status holders who have been in the United States for more than 183 days also should review IRS publications to see if they should file resident rather than non-resident tax forms.

Recommended Reading: How Can I Make Payments For My Taxes

Ohio May Stand Out As The Home Of The Rock & Roll Hall Of Fame But When It Comes To State Tax Burden Its Solidly In The Middle Of The Pack

The Buckeye State ranks 19th in the country for state and local tax burden, according to the Tax Foundation. The state uses its revenue, including money from tax collection, to fund schools, colleges, government operations, and programs to stimulate businesses and health and human services.

How To Get Help Filing An Ohio Sales Tax Return

Lastly, here is the contact information for the state if case you end up needing help:

Gateway Help Desk: Available at 866-OHIO-GOV for help with filing a return, answering general questions, or assistance with logging in to the website.

The Help Desk is available Monday through Friday 8 a.m. 5 p.m., excluding state holidays.

Instead, if you are looking for a team of experts to handle your sales tax returns for you each month, you should check out our Done-for-You Sales Tax Service. Feel free to contact us if youre interested in becoming a client!

Read Also: Otter Tail County Tax Forfeited Land

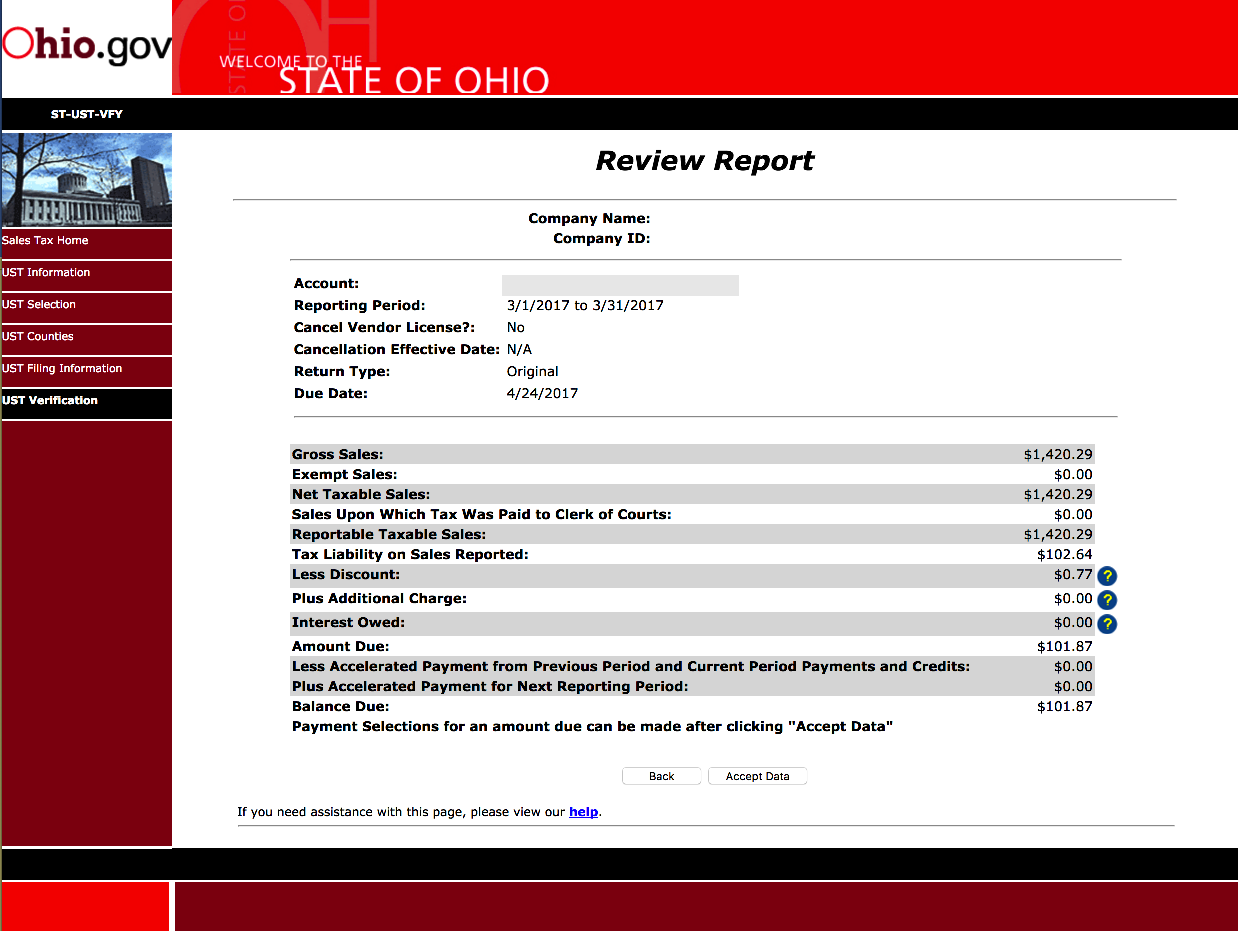

S For Filling Out Ohios Sales Tax Return

The first step to file and pay your Ohio sales tax return is to log on to the Ohio Gateway here.

If you do not have a username and password you need to click on Never used the Gateway? Create an Account and then follow the instructions for signing up.

Step 1: After logging on, you should now be on the dashboard. Click on Sales Tax .

Step 2: Read and acknowledge any new updates in order to proceed. Then click Next.

Step 3: Select your filing period. The return type will auto-populate for you if this is an original return. Click Next.

The file upload functionality allows you to upload a txt or csv file that includes your county sales data so you do not have to manually enter it on this screen. For detailed file format instructions, click on this link that provides county data file format specifications.

Step 4: Either upload or enter manually your taxable sales and tax liability in each county that you have. Note, there are MANY counties. You can add counties by clicking the Add Counties button at the top. You can toggle between pages of counties using these buttons:

Once you are finished adding all the counties, click Next.

Step 5: Enter your gross sales, exempt sales, and sales upon which tax was paid to the Clerk of Courts. Then, click Next.

Note: If you have marketplace sales you would include those sales in your gross sales numbers then enter the marketplace sales in the exempt line.

Who Needs To File Tax Forms

Anyone receiving payments from a U.S. source, whether they are U.S. residents or internationals are subject to U.S. taxation. There are specific regulations and processes required for determining the tax withholdings for international persons. In certain situations, there could be a tax treaty that may exist to exempt an international person from taxes or there may be regulations that allow a reduction in taxes. Visit the Office of Business and Finance’s page on Nonresident Alien Taxation to learn more.

The Ohio State University uses a secure online international tax compliance software called GLACIER. Glacier captures the information required to determine the actual tax status of an international person. All international persons who are not U.S. Residents and who are receiving payments from The Ohio State University are required to have a GLACIER record. Therefore, a GLACIER record is required even if an international employee, student, scholar or visitor meets the definition of a Resident Alien for Tax Purposes. Once the university determines that you are a nonresident alien, you will receive an email to your Ohio State email address directing you to the GLACIER website with a username and password for entry.

For questions related to filing taxes, contact .

Also Check: Do You Have To Report Roth Ira On Taxes

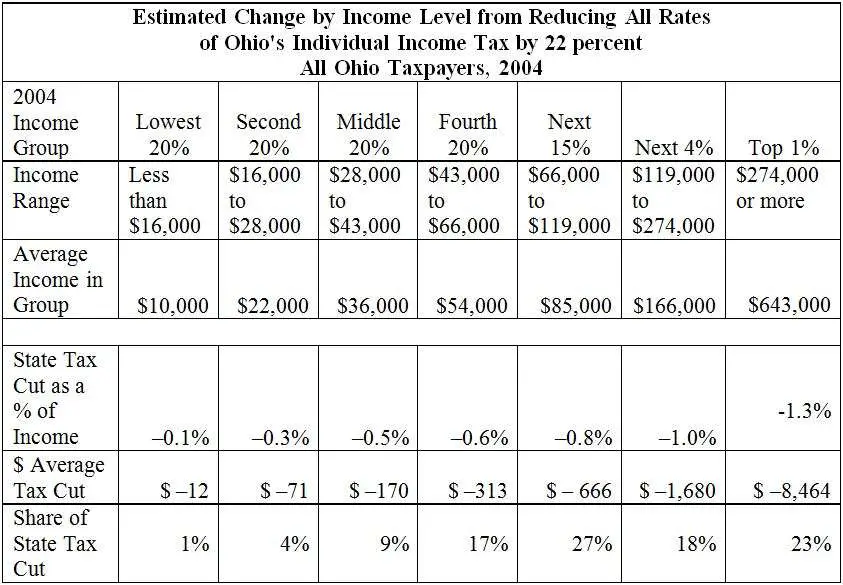

A Plan To Improve Ohios Tax System

Policy choices to build strong communities for all Ohioans and mitigate the pain for those who struggle start with strengthening the income tax to prevent further cuts of essential services and prevent layoffs among public sector workers, whose wages stabilize families and communities when the private sector economy falters. This is particularly critical for communities of color, as significant numbers of Black and Latinx people are employed in public sector jobs. Ohios lawmakers can start with eliminating tax breaks and implement some of the changes approved in last years House budget bill. In July of 2020, Policy Matters Ohio recommended closing or narrowing unproductive tax loopholes to raise $600 million – in addition to reducing the LLC loophole, addressed in this paper. In the plan outlined here, we propose raising another $1.94 billion by rebalancing and strengthening the state income tax. Together, these plans would raise $2.5 billion more than the projected budget shortfall for the state. If they enacted our plan, Ohio policymakers could prevent cuts and make the investments needed so Ohio emerges from the pandemic recession stronger, more equitable and better prepared for the next shock.

Capping and reducing the LLC loophole

Cap the LLC loophole

This change would raise hundreds of millions in new tax revenues and help to rebalance the income tax.

Restoring the top tax bracket and adding a new tax bracket on the top 1% of income

Boost the state EITC

How Do I Pay My Ohio State Taxes

payPaymentspaymentpayment

Ohio law does not authorize the Department of Taxation to set up a payment plan. We will apply partial payments to the outstanding balance. However, partial payments will not stop the imposition of additional interest or the referral of the account to the Attorney General’s Office.

Beside above, how do I pay my state taxes? If you owe state taxes, you’ll need to make your payment directly to the state’s tax authority. For many states, you can pay online through Credit Karma Tax by providing your bank account information for a direct debit.

Likewise, people ask, where do I send my Ohio State tax payment?

If you are filing the IT 1040 Ohio individual income tax return and your return shows tax due, please mail your return and payment to the Ohio Department of Taxation, P.O. Box 2057, Columbus, Ohio 43270-2057.

How do I pay my Ohio State taxes online?

You can pay using a debit or credit card online by visiting Official Payments or calling 1-800-272-9829. This payment method charges your credit card . Note: When using this method to make a payment, you will be provided a confirmation number.

Also Check: How Much Does H& r Block Cost To File Taxes

Ohio Municipal Income Taxes

Many municipalities in Ohio collect income taxes of their own, with rates as high as 3% in some areas. Below are the municipal tax rates for Ohios largest cities, as well as the rates for every school district that collects an income tax. These are all assessed at a flat rate, based on the taxable income used for Ohio state taxes.

Ohio Extends Tax Filing Deadline To Align With Federal Date Of May 17

The Ohio Department of Taxation announced Wednesday that the state is pushing back the tax filing deadline to May 17 to match the federal government and IRS date.

The new deadline to file and pay Ohio individual income and school district income taxes for 2020 is approximately one month from the original date of April 15.

Ohio Tax Commissioner Jeff McClain said the extension is intended to provide some relief for Ohioans affected by the public safety measures to help the spread of COVID-19.

As with the IRS extension, Ohio will be waiving penalty on tax due payments made during the extension and there will be no interest charges on payments.

The department said that the first quarter estimated income tax payment for 2021 is not impacted by the extension and must still be made by April 15.

Recommended Reading: Where’s My Tax Refund Ga

Things To Consider After Filing A Sales Tax Return In Ohio

You should make a copy of your return for your records. To do this go back to the Dashboard/Homepage. Click on the Recent tab.

You should then see a listing with the return you just filed. Click on the eyeball. This will bring up your payment receipt. At the bottom of your receipt will be a link to a pdf of your UST-1 Summary. Click on this to print your return.

Do Ohio Seed Employees Pay Taxes

must paystate free time taxes Back to your status employees we live. If you want to live in more states, you must pay free time taxes It belongs to the federal state. If your business is in Kentucky, but you have employee He who comes and goes Ohio must payunemploymenttaxes come Ohio so employee Salary

Don’t Miss: How Do I Get My Pin For My Taxes

What Fees Should I Expect When Buying A Used Car

These include insurance, registration and fuel. Also be sure to factor in the costs of tax, title, registration and insurance for the used car youre buying. As a broad rule and depending on where you live, tax, license, assorted fees and other costs will add roughly 10 percent to the purchase price.

Tax Day Extended To May 17 2021

The Cincinnati Income Tax Commissioner will extend the date to file annual income tax returns until May 17, 2021. This extension follows the Ohio Department of Taxations decision to extend Ohios tax return deadline to the federal governments May 17, 2021 due date. Both penalty and interest will be waived during the time of the extension.

Unlike the extension in 2020, this extension does not apply to individuals or businesses required to remit quarterly net profit estimated taxes by April 15, 2021. Also, this extension does not extend the due dates for remitting employers withholding tax.

Please feel free to contact the Cincinnati Income Tax Division Customer Service Team at 352-2546 if you have any questions.

Please to view an outline and example on how to calculate Net Operating Loss for tax year 2020.

The Cincinnati Income Tax Division is located at:

805 Central Avenue Suite 600 Cincinnati OH 45202

Office hours are M-F 8:00 AM to 4:30 PM

Questions? Call Customer Service at 352-2546 Individual Accounts

352-3847 Business and Payroll Withholding Accounts

Cincinnati Income Tax Division representatives are available to assist taxpayers during business hours. No appointment is necessary.

Also Check: Do Roth Ira Contributions Need To Be Reported On Taxes

Do Florida Workers Pay Sewn Taxes

Employer Responsibilities: Florida Joints employers must pay the tax if their salary is higher than or equal to the Joints tax. number $1,500 during a calendar quarter Or hire at least one worker a day for 20 different weeks in a calendar year. Farmers employers who pay workers a total of $20,000 in wages during the calendar quarter are also required to pay Joints tax.

Do You Need To File An Ohio Sales Tax Return

Once you have an active sales tax permit in Ohio, you will need to begin to file and pay sales tax returns. Not sure if you need a permit in Ohio? No problem. Check out our blog, Do You Need to Get a Sales Tax Permit in Ohio?

Also, If you would rather ask someone else to handle your Ohio filings, our team at TaxValet can handle that for you with ourDone-for-You Sales Tax Service. We specialize in eliminating the stress and hassle of sales tax.

You May Like: How Can I Make Payments For My Taxes

Local Income Tax Brackets

| City |

|---|

| 1.50% | 7.25% |

While those taxes apply to nearly every product that can be bought, there are some exceptions. For example, there is no sales tax on newspapers, prescription drugs, property used for agricultural production or utilities such as gas, water and electricity. Food is also exempt from sales tax, so long as it is not prepared for on-site consumption .

What If You Cant Pay Off Your Tax Balance In 1 Year

If the taxpayer is unable to afford to pay off the tax amount in 12 monthly payments, you can look to qualify for other forms of tax relief. If you do not qualify for other options, the AG may accept a lesser monthly payment figure if the taxpayer can establish financial hardship. A taxpayer establishes a financial hardship by providing financial information. The financial information should show the taxpayer is unable to pay the standard 12-month payment amount. Each special counsel will determine financial hardship differently. However, generally, they seek the same or similar financial information discussed in an Offer in Compromise Application.

Recommended Reading: How Much Does H& r Block Charge To Do Taxes

How To Apply For A Payment Plan

In Ohio, and unlike with the IRS, there is not a specific form for an Installment Agreement or payment plan. Consequently, you or your representative must negotiate with the AG or the private collection firm that has your file. Once you reach an agreement, the collection firm will draw up an installment agreement for you. Taxpayers, or their representatives, should be mindful to include a hold or stay on enforced collections as part of the written payment agreement to protect the taxpayer from later being subject to enforced collection. It is highly recommended you work with a licensed tax professional that has experience resolving Ohio state tax problems, click the link or start your search below.

Disclaimer: This article is not legal or tax advice. This article should not be used as a substitute for the advice of a competent attorney or tax professional admitted or authorized to practice in your jurisdiction.

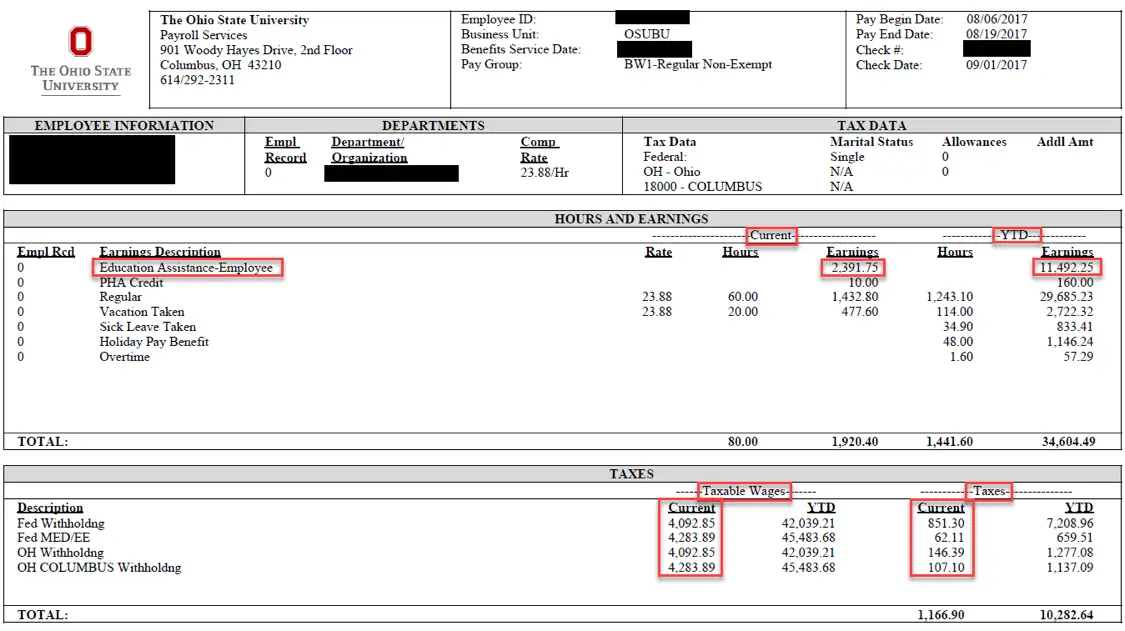

Fica Tax And Exemptions

General Student FICA exemption:

FICA taxes do not apply to payments received by students employed by a school, college, or university where the student is enrolled full time and pursuing a course of study.

International Student and Scholar FICA exemption:

International students, scholars, professors, teachers, trainees, researchers, physicians and other nonresident aliens for tax purposes present in the United States in F-1, J-1, M-1 or Q-1/Q-2 non-immigrant statuses are exempt from FICA taxes on wages.

Limitations on FICA exemption for International Persons:

Also Check: How Much Does H& r Block Charge To Do Taxes

What Taxes Employers In New York Pay

Social security and medical insurance taxes are much greater. The employer is responding to a fixed percentage of the original $132,900 worker’s salary up to a maximum of $8, and Medicare has no higher wages. The employer pays a percentage of the wages to all employees. Taxes must be paid by the chief contractor in New York.

Ohio Penalty For Failure To File

To avoid this penalty, even if you cannot pay your Ohio Income Tax balance, it is important you either file your Ohio Income Tax Return or a federal extension by the tax deadline.

If you fail to file your Ohio Income Tax Return or federal extension by the tax deadline, a failure to file penalty of the greater of $50 per month up to a maximum of $500, or 5% per month up to a maximum of 50% of the tax, may be charged. To avoid this penalty, even if you cannot pay your Ohio Income Tax balance, it is important you either file your Ohio Income Tax Return or a federal extension by the tax deadline.

Recommended Reading: How To Buy Tax Lien Properties In California