How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

How Often Do 3 Year Old Snakes Eat

Smaller or younger snakes usually eat twice each week, while larger, more mature snakes typically eat once every week or two. Female snakes approaching breeding season can be fed more frequently. Your veterinarian can give you more specific advice about feeding based on your snakes individual requirements.

How Long Should Businesses Keep Tax Returns And Other Business Tax Records

Fortunately, the IRS cannot assess additional tax once a certain periodcalled the statute of limitationshas passed. The federal income tax statute of limitations equals:

- three years from the filing dateor the due date, if laterfor most tax returns

- four years after the tax becomes dueor gets paid, if laterfor employment tax returns

- six years from the filing dateor the due date, if laterfor tax returns that underreport gross income by more than 25%

- seven years from the filing dateor the due date, if laterof the related tax returns for losses from worthless securities or bad debt

- Forever for unfiled or fraudulent tax returns

Some state taxing authorities follow IRS rules, while others use different periods. Creditors and investors may have their own requirements.

Creating different retention policies for each possible scenario may prove impractical. Retaining tax returns and other records for seven yearsstarting from the later of the filing date and due date of the related tax returnoffers a convenient rule of thumb. This covers almost all documents for businesses that file all required tax returns without fraud.

You May Like: How To Submit Payroll Taxes

What Can Trigger An Irs Audit

Common IRS Audit Triggers

- Cryptocurrency or Other Digital Currency Transactions. …

- Net Operating Losses …

- Receiving Advance Child Tax Credit Payments. …

- Taking Early Withdrawals from Retirement Accounts. …

- Earning Substantial Income. …

- Being Self-Employed and/or Working as An Independent Contractor.

Who Can Help Me With Canadian Tax

If you need help with filing your Canadian tax return or have more questions about Canadian taxes and tax records, Taxback.com is here to help.

Did you know that if you have spent time working in Canada, you could be due a tax refund? We can apply for your Canadian tax refund on your behalf The average Canadian tax refund is $998.

Every year, thousands of employees including working holidaymakers overpay taxes and leave their money at the Canadian tax office. Its your hard-earned cash why leave it behind?

Taxback.com will take care of all the paperwork and complicated forms and ensure you get your maximum legal refund!

Recommended Reading: How Are Crypto Gains Taxed

Is Now The Right Time To Get Rid Of Old Paperwork

How long do you really need to keep your business records? In fact, you can be downright inundated with records from tax returns and expense receipts to invoices, cancelled checks, payroll records, bank statements, meeting minutesthe list goes on.

Whether you have everything methodically stored in a filing cabinet or stashed out of sight in a desk drawer, youve probably asked yourself, do I really need to keep all this?

Record keeping isnt fun. And outside of the tax world, there are few rules and little guidance on exactly what should be kept and for how long. Conventional wisdom when it comes to documentation is better safe than sorry.

However, instead of stockpiling everything, its smarter to have an overall plan for keeping your records to make sure you keep the important stuff.

So Ive got some advice for you about record-keeping.

Keep in mind that what follows is just general guidance, and not necessarily the final word. Your accountant or tax advisor may have different recommendations for your situation.

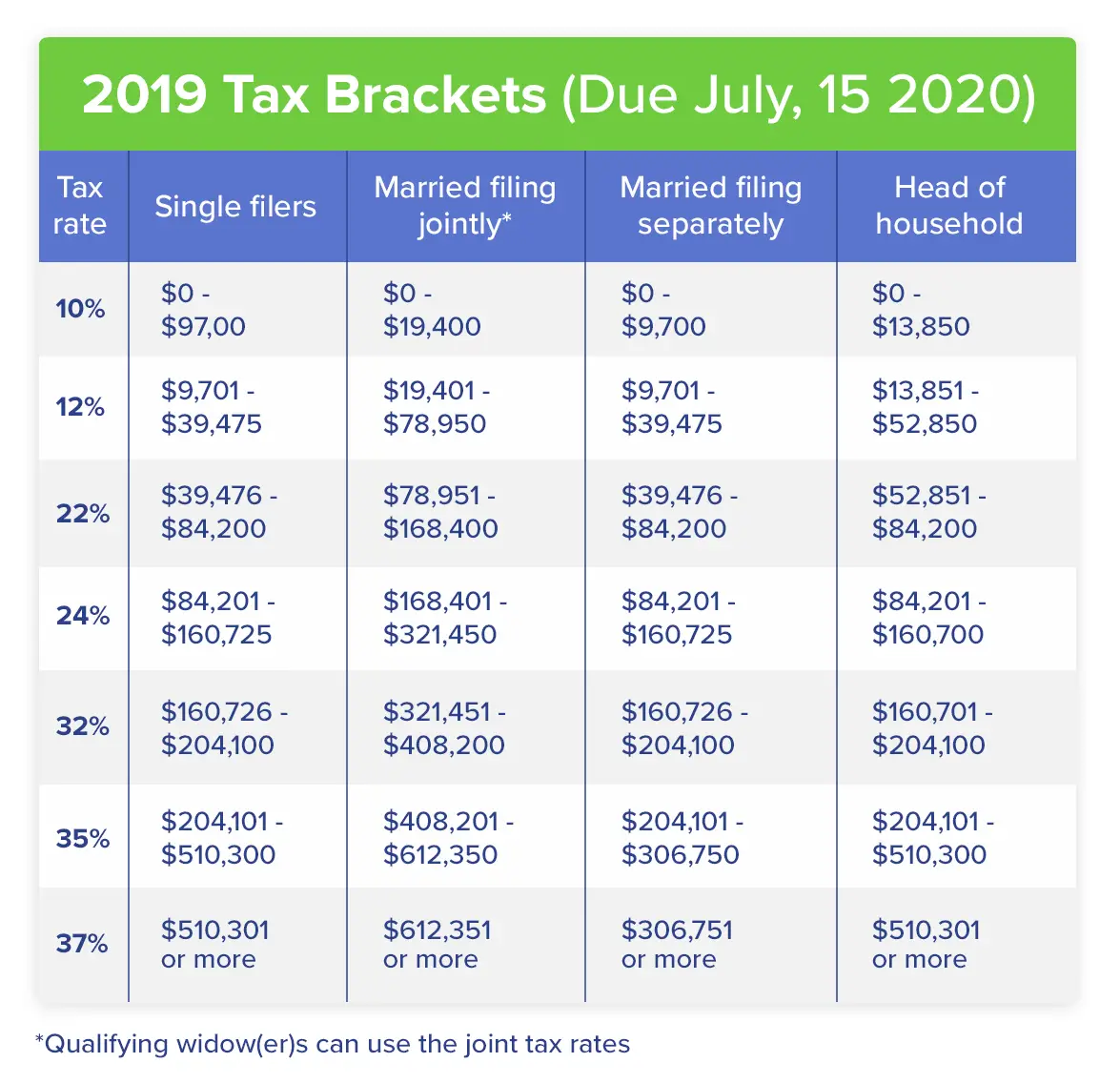

According To The Irs What Is The Period Of Limitations

The period of time when you are still able to amend your tax returns to claim a tax credit, or refund, is called the period of limitations, according to the IRS. During this time, the IRS may still assess you with additional tax liabilities. Specific examples of this are listed later in the article. Unless stated otherwise, a time period of limitations refers to years after the taxes were filed. Tax returns that were filed early are considered filed on the tax deadline, usually around April 15th. For 2020, this will be July 15th. However, the time period of limitations for returns filed on extension will be years from the actual date the taxes were filed.

Keep copies of your filed tax returns indefinitely. Having access to copies of your older tax returns may help in preparing future tax returns and making computations if you need to file an amended return. With the help of scanning and cloud storage, I dont see many reasons to delete older tax returns. I think we could all save a lifetime of tax returns on our computers without putting a dent in our storage limits.

Period of Limitations that apply to income tax returns via the IRS website

1. Keep records for three years if situations , , and below do not apply to you.

2. Keep records for three years from the date you filed your original return or two years from the date you paid the tax, whichever is later if you file a claim for credit, or refund, after you file your return.

You May Like: How To File Last Years Taxes Turbotax

How Many Years Of Tax Documents Should You Keep

How long does the IRS keep your tax records?

- The IRS recommends that tax records be kept at least three to four years after the filing date. Some people feel that a person should always keep all of their tax paperwork. The IRS suggests keeping tax records and paperwork for three to four years after filing.

It’s Not Just About Taxes

While youre focused on your tax papers, its good idea to organize all your financial documents, says Barbara Weltman, an attorney who runs Big Ideas for Small Business and is the author of J.K. Lassers 1001 Deductions & Tax Breaks 2022 .

There are many occasions when you may need to retrieve your papers at short notice, she says.

For instance, you may need taxes and brokerage financial statements from previous years if youre meeting with a financial adviser. If your home is hit by a fire or flood, or a thief pays a visit, you may need quick access to your insurance papers. If you become ill, your loved ones may need to find papers that prove they can look after you, such as your healthcare proxy or durable power of attorney.

While the process may be daunting, getting your papers organized now means you can purge unneeded documents and simplify your life, McBride says.

Don’t Miss: Can I Use Bank Statements As Receipts For Taxes

No You Can’t Just Throw Them In The Garbage The Second You Get Your Refund Check

Tax season eventually comes to a close, but you’ll always have your tax return and other paperwork to serve as a reminder of that time — at least until you throw it out. Hopefully, you’re not doing that the second you’ve gotten your refund or paid your tax bill for the year, though, because that could cause huge problems if the IRS decides to pay you a special visit.

That’s not to say you can never throw out your old tax paperwork. You just need to know when it’s safe to do so and how to get rid of those documents the right way. There are three things you should know before you decide to dump your old tax returns in the trash.

Image source: Getty Images.

If You Lose Tax Returns

The IRS’s recommended periods for saving tax returns are really just minimums. Tax records include a wealth of information about your finances, so you may want to keep all of them indefinitely. The IRS keeps returns it receives for seven years, after which it is required by law to destroy the information. If you’ve thrown out a return from the past seven years and now need it, you can request a copy from the IRS by filing Form 4056. It’ll cost you $50. Or you can file Form 4506-T and get a transcript of your return a printout of all the data from the return, but not an actual copy of the return. Transcripts are free. If you worked with a paid preparer or used online tax prep software, you may be able to get a copy from the preparer or software provider.

References

Don’t Miss: How Much Money To Do Taxes

How Long Should I Keep My Federal Tax Returns

We are often asked, How long should I keep copies of my federal Form 1040 tax return?

Well, it depends.

In our opinion, you should keep records of your tax returns indefinitely. But, the IRS does provide some guidance on the time frame to keep the returns.

Statute of Limitations for Audits

As a general rule, the IRS can audit your tax returns going back three years, so you should keep tax returns and other records for at least three years from the date the returns were filed.

However, you should keep the returns longer if one of the following applies:

The third point is the important one to highlight. If the IRS considers a return to be fraudulent, the statute of limitations never expires for the IRS to audit your tax return.

The fraudulent tag is a high burden for the IRS to meet, but it is still on the table. For these reasons, we recommend keeping the tax returns forever because you dont want the IRS to audit a year that you thought was closed, have the IRS allege fraud, and then not have the supporting documents defend yourself.

In the digital age, it is much easier to keep copies of tax returns. Just scan the old returns into a PDF format and save them on a thumb drive.

The Takeaway

Shred Old Paper Returns So Identity Thieves Can’t Access Them

Deleting digital copies of old tax returns is easy, but if you have old paper returns, you can’t just put them in the trash. They contain a lot of personal information about you that identity thieves would love to have, such as your birth date, Social Security Number, employment information, and address. With this information, it’s easy to open up new credit accounts in your name, and that can create a major headache for you later.

When you’ve verified that it’s time, always shred old paper returns, or dispose of them in some other way that will ensure no one else can recover information from these documents.

You might decide to get rid of your old paper returns but retain digital copies just in case you’d need them for some reason in the future. If you decide to do this, make sure you have a password on your computer so that unauthorized users cannot access your important financial documents.

Your old tax returns don’t become irrelevant the second you’ve paid your tax debt or gotten your refund for the year. Keep in mind the three points listed above before throwing yours out so you don’t run into any problems later.

The Motley Fool has a disclosure policy.

You May Like: How Can I Find My Previous Tax Returns

How Far Back Can The Irs Audit You

The six-year rule allows for payment of living expenses that exceed the Collection Financial Standards, and allows for other expenses, such as minimum payments on student loans or credit cards, as long as the tax liability, including penalty and interest, can be full paid in six years.

What Is The Deal With Keeping My Canadian Tax Documents For Six Years

The Canada Revenue Agency might audit your tax return at any point within the six years after you file it, so you need to keep all your documents related to filing taxes in Canada.

Having your tax records in order will allow you to substantiate any claims you make to the CRA, so it’s in your best interest to keep track of everything.

However, your Canadian tax records may need to be kept for a longer or shorter period, depending on the specifics of your situation.

You will get written or oral notification from the CRA if they ask you to preserve your tax records for a longer time than six years.

You May Like: What Is The Limit For Donations On Taxes

Should You Shred Old Tax Returns

With that timeframe, California residents should keep their state tax records for at least four years. What Should I Do with My Old Tax Returns? Once you have scanned your tax documents, make sure to dispose of them in a secure manner. At the very least, shred them before throwing them in the trash.

Documents That You Must Keep For 3 Years:

You May Like: What Is The Self Employment Tax Rate In Texas

Is There Any Reason To Keep Old Tax Returns

You probably learned that you should keep a tax return for at least three years after filing it. The reason for the three-year answer is that the IRS has up to three years to audit you and assess additional taxes. The IRS can go back six years when more than 25% of income was omitted from the tax return.

How Long Should You Keep Business Tax Records

Keep business income tax returns and supporting documents for at least seven years from the tax year of the return. The IRS can audit your return and you can amend your return to claim additional credits for a period that varies from three to seven years from the date you first filed. But its a good idea to use seven years as your guide for keeping these documents.

If you dont file a return at all, the IRS can come after your business at any time.

Examples of supporting documents include:

- profit and loss statements

Also Check: How To Read My Tax Return

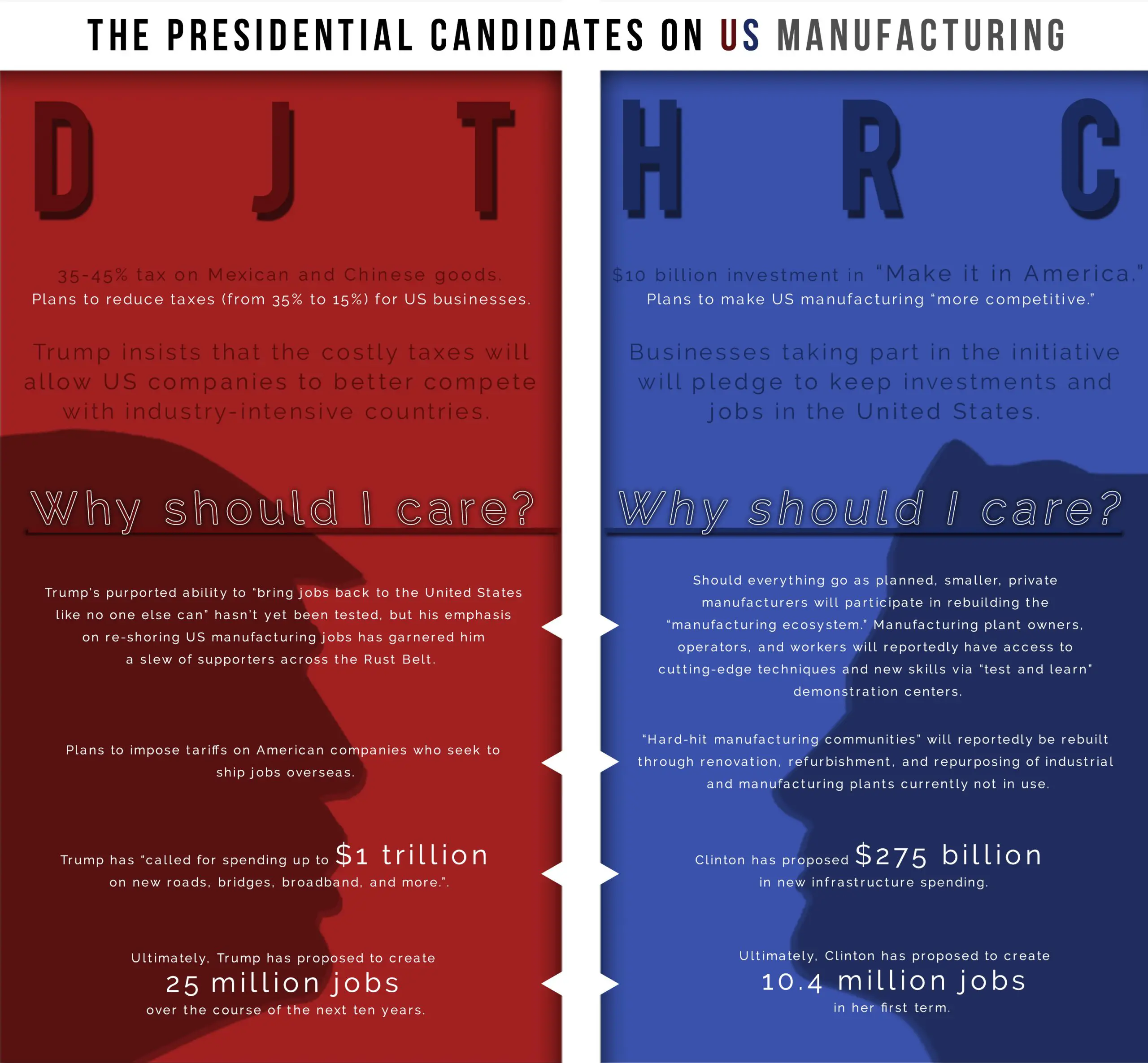

What Do The Key Players Think

Let’s first look at what the real people in charge, the tax authorities, think about this. When we say tax documents, we mean things like a copy of your tax return, slips, statements, invoices, receipts, schedules or cheques.

In short, everything that was required to file your tax return and everything you got as a result of filing it.

So, the Canada Revenue Agency, as well as Revenu Québec, strongly advise you to keep all documents concerning your tax return for a period of six years. The ARC has even prepared a two-minute video on the subject… showing that they take the subject seriously!

Video :

How Long Do I Have To Keep My Tax Records For

HomeNewsHow long do I have to keep my tax records for?

Tax Record Keeping! What do I have to keep and what can I shred?

You may have recently finalised your tax return for another financial year and are wondering how long you should keep your tax records for before they can be shredded. This is a common and important question we are often asked by our clients. Another question we often hear is whether such records need to be originals or if a digital or photocopy would suffice.

Usually individual taxpayers should keep records for five years from the date of lodging their tax return, however there are circumstances which call for records to be kept for longer, examples of these include:

Often individual taxpayers will purchase assets for use in their employment and want to claim a tax deduction for these items. Such assets may include office equipment, furniture or a motor vehicle if they are required to travel for work. These items are generally not fully tax deductible in the year they are purchased, instead requiring the taxpayer to depreciate them over several years. For record-keeping purposes, details about the purchase of these assets must be kept for five years from the date of making the final claim for decline in value.

Capital gains tax assets

Ways to keep records

Read Also: How Much Tax Do I Need To Pay