Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Can I See Someones Tax Return

While public tax return filings are not available in the US, taxpayers are able to obtain them on their behalf by signing a written authorization. A copy of that return will be your only option. You may also obtain a complete copy of a tax filing by completing Form 4460 from the Internal Revenue Service.

Blocking Search Engines From Indexing Its Free File Program Page

Citizens of the US that make up to $72,000 per year are eligible for free preparation and filing of tax forms through the IRS Free File program. However, TurboTaxs free file program page contains specific HTML tags which block search engines from indexing it. TurboTax has been deceiving customers which were eligible for the free submission into signing up for their commercial product. Starting December 30, 2019, under a new agreement from the IRS, TurboTax can no longer hide their free version services from search results.

Dont Miss: How Much Does Tax Take

Read Also: Do Beneficiaries Pay Taxes On Life Insurance Policies

Heres How To Get Prior

IRS Tax Tip 2018-43, March 21, 2018

As people are filing their taxes, the IRS reminds taxpayers to hang onto their tax records. Generally, the IRS recommends keeping copies of tax returns and supporting documents at least three years. Taxpayers should keep some documents such as those related to real estate sales for three years after filing the return on which they reported the transaction.

How Can I Get My Old Tax Returns

To get a transcript, taxpayers can:

Transcript of Return from the IRSYou can request an IRS transcript of your tax return from the IRS website. Visit the IRS website for instant online access to your transcript. Call 1-800-908-9946. Use Form 4506-T.

Also Know, how do I get my old tax returns from TurboTax? How to Open Previous Tax Returns in TurboTax

Similarly, it is asked, do you need previous tax returns?

You must always file your back tax returns on the original forms for each tax year you are filing. You can always search through the IRS website for the forms, but for quicker access, you should use sophisticated tax preparation software, such as TurboTax.

How do I get my w2 from previous years?

If you cant get your Form W-2 from your employer and you previously attached it to your paper tax return, you can order a copy of the entire return from the IRS for a fee. Complete and mail Form 4506, Request for Copy of Tax Return along with the required fee. Allow 75 calendar days for us to process your request.

You May Like: Do I Qualify For Child Tax Credit 2021

How Can I Get A Copy Of My Income Tax Return Online

It is summed up in the following steps.

Get A Free Copy Of A Prior Year Return

Print your completed tax returns for free! If you prepared a tax return from 2012-2020 using FreeTaxUSA, here’s how to print a copy of your return:

- Returning users:

- Step 2) Click on Prior Years at the top of the screen

- Step 3) Choose the year in the Prior Year Returns section

- Step 4) View or download the return you want to print

You May Like: How To File Old Taxes On H& r Block

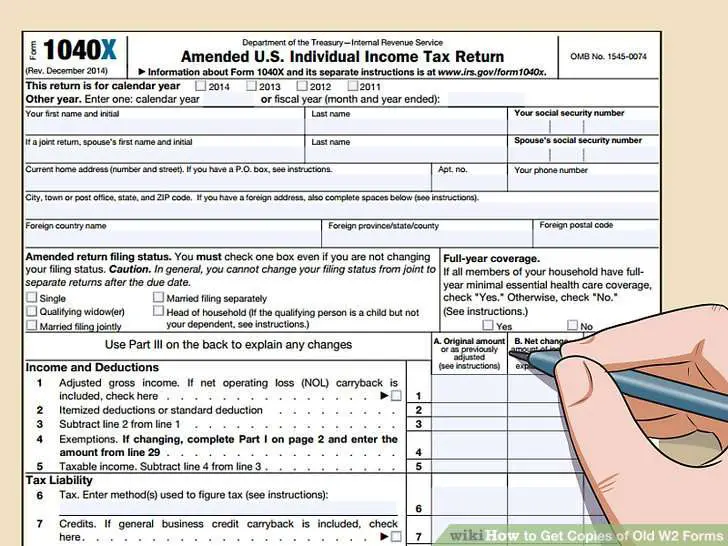

How About Checking The Status Of An Amended Tax Return

You can use the Wheres My Amended Return IRS tool. This tool shows updates for amended returns for current years and up to three prior years. However, it is recommended that you wait three weeks after mailing your return to retrieve the most accurate status update. Before opening the tool, youll want to make sure you have a few bits of information on hand:

- tax year

- zip code

Use A Tax Return To Validate Identity

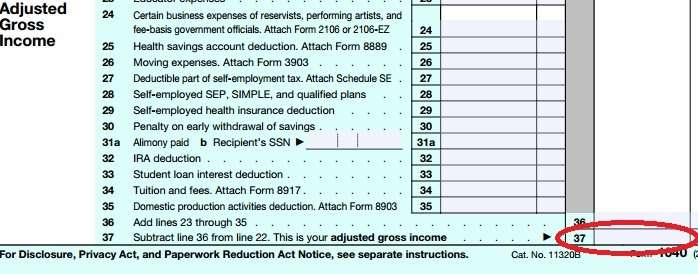

Taxpayers using a tax filing software product for the first time may need their adjusted gross income amount from their prior years tax return to verify their identity. Taxpayers can learn more about how to verify their identity and electronically sign tax returns at Validating Your Electronically Filed Tax Return.

Those who need a copy of their tax return should check with their software provider or tax preparer first, as prior-year tax returns are available from the IRS for a fee.

Recommended Reading: Who Needs To File Taxes

Import A Pdf For A Prior Year:

If last year you used other tax software, an accountant, or tax service, youll get the option to import a PDF when youre starting in TurboTax. A PDF imports your personal info and your AGI so you can e-file.

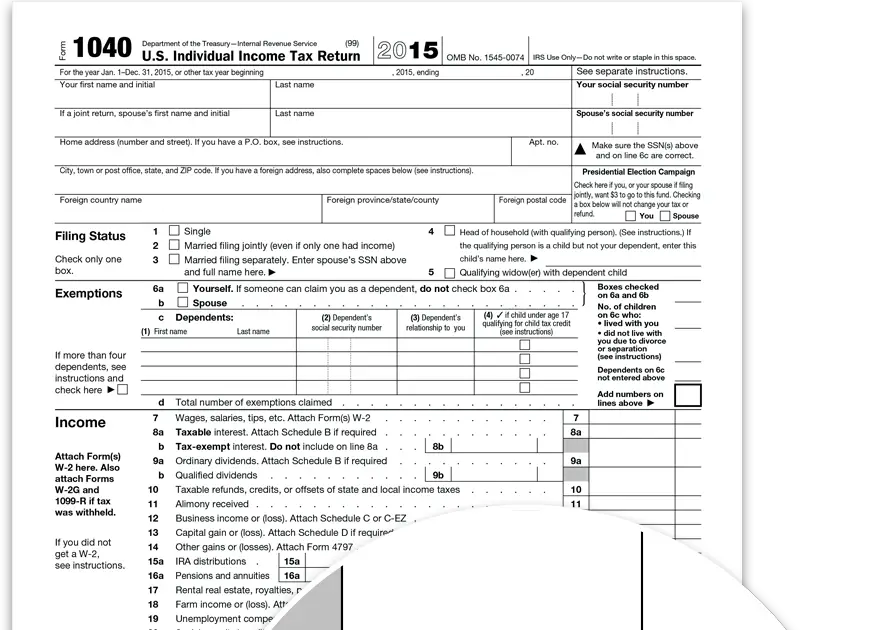

Select the method you used to file last year and follow the screens. The PDF needs to be your 1040, 1040A, or 1040EZ, and the program accepts PDFs from a range of providers.

But, if the PDF is password protected or a scan of a hard copy, you wont be able to import. If this happens, dont worry, well guide you through typing in your info.

*Tip: While you can import a 1040EZ return to a paid version of TurboTax, you cant import prior years to their Free Edition , so you may have to pony up for another edition

Q5 How Do I Request A Transcript For An Older Tax Year When It’s Not Available Online

Tax return and record of account transcripts are only available for the current tax year and three prior tax years when using Get Transcript Online. Note: There is a “show all +” expand button below the online tax account transcript type that may provide additional tax years you need. Otherwise, you must submit Form 4506-T to request a transcript for a tax year not available.

Tax return and tax account transcripts are also limited to the current and prior three tax years when using Get Transcript by Mail. To get older tax account transcripts, submit Form 4506-T.

You May Like: Do I Pay Taxes On Stimulus Check

Create And File Prior Year Tax Returns

Go to our Access Prior Year Tax Returns webpage for a list of available Online and Desktop programs for previous years.

Note. TaxAct does not provide archived copies of returns filed through the TaxAct Desktop or TaxAct Professional Editions. If you no longer have access to your saved return file, you can receive a copy of a successfully-filed return from the IRS by calling 800-829-1040. For more information, go to the IRS Topic No. 156 Copy or Transcript of Your Tax Return How to Get One webpage.

If you were a prior year TaxAct Online user and did not finish your prior year return, or if you need to start a new return for a previous tax year, you can still prepare and print your return using our TaxAct Online service.

To access an existing return, you need to know the tax year, username, and password that you set up for your account at the time of registration. Go to the Prior Year Returns webpage and select the year you wish to access to start a new return or sign-in to an existing return.

Prior year returns may be electronically filed by those using the TaxAct Professional program or by those using the TaxAct Business Consumer program.

While the IRS now allows year-round electronic filing with the new MeF system, they do shut down for a short period for maintenance each year from later in November to some time around the end of January.

Was this helpful to you?

How Far Back Can You Get Copies Of Tax Returns

You can only get a tax transcript going back three tax years. If you need something older than that, youll have to order a copy of your actual filed tax return. You can get one for the current tax year and as far back as six years. To do so, you must complete and mail in IRS Form 4506, Request for Copy of Tax Return.

Also Check: How Do 1099 File Taxes

Q3 What If I Can’t Verify My Identity And Use Get Transcript Online

Refer to Transcript Types and Ways to Order Them for alternatives to Get Transcript Online. You may use Get Transcript by Mail or you may call our automated phone transcript service at to order a tax return or tax account transcript be sent by mail. Please allow 5 to 10 calendar days from the time we receive your request for your transcript to arrive. The time frame for delivery is the same for all available tax years.

Did Turbotax Rip You Off

Tweet This

I know, its July, the sun is shining, and the last thing you want to think about for the next eight or nine months is taxes. Well, Intuit, the maker of TurboTax, would love for you to forget too. It most certainly hopes you glossed over the revelations by intrepid reporters from ProPublica who discovered its egregious conduct.

Did TurboTax Rip You Off?

Deposit Photos

TurboTaxs recent machinations are like the digital version of Volkswagens emissions scandal. But instead of manipulating software to hide higher levels of pollutants coming out of a car, TurboTax manipulated software and the metadata on its own site so certain results wouldnt show up in Google searches. The tactic likely prevented millions of Americans from filing their taxes for free. Instead, these individuals were nudged to TurboTaxs premium products and charged for a service they should have gotten without paying.

While ProPublicas article received attention and even led some regulators to open investigations, it deserves amplification as many consumers who may have been short-changed are not aware of what happened, how they were deceived, or what recourse they should take. Furthermore, Turbo Tax has neither shown remorse nor taken real corrective action .

Deposit Photos

Also Check: How Much Do Taxes Cost At H& r Block

Read Also: Can Irs Take 401k For Back Taxes

Q4 Can I Use Get Transcript If I’m A Victim Of Identity Theft

Yes, you can still access Get Transcript Online or by Mail. If we’re unable to process your request due to identity theft, you’ll receive an online message, or a letter if using the Mail option, that provides specific instructions to request a transcript. You may also want to visit our Identity Protection page for more information.

Access Tax Records In Online Account

You can view your tax records now in your Online Account. This is the fastest, easiest way to:

- Find out how much you owe

- Look at your payment history

- See your prior year adjusted gross income

- View other tax records

Visit or create your Online Account.The method you used to file your tax return and whether you had a balance due affects your current year transcript availability.

Request your transcript online for the fastest result.

Don’t Miss: Where Do You Pay Taxes

If You Used The Cd Or Downloadedversion

Your tax return is stored on your computer if you purchased the TurboTax CD or downloaded the program from the internet. Its a tax data or .tax file, so you can only open it in the TurboTax software. Hopefully, thats still installed on your computer, and you can print a copy of the return out from there.

View Your Annual Tax Summary

- English

View your Annual Tax Summary and find out how the government calculates and spends your Income Tax and National Insurance contributions.

- From:

- 5 February 2021 See all updates

Use this service to view your Annual Tax Summary. The summary shows:

- your taxable income from all sources that HMRC knew about at the time that it was prepared

- the rates used to calculate your Income Tax and National Insurance contributions

- a breakdown of how the UK government spends your taxes – this makes government spending more transparent

The summary might be different from other HMRC tax calculations. This could be because:

- your circumstances have changed

- some sources of income are not included

The summary is for information only. You do not need to contact HMRC or your employer.

Sign in using your Government Gateway user ID and password, if you do not have one, you can create one when you view your summary.

Also Check: Where To Mail Tax Return In Texas

How To Obtain A Copy Of Your Tax Return

OVERVIEW

You can request copies of your IRS tax returns from the most recent seven tax years.

The Internal Revenue Service can provide you with copies of your tax return from the most recent seven tax years. You can request copies by preparing Form 4506 and attaching payment of $43 for each one. Once the IRS receives your request, it can take up to 60 days for the agency to process it. If you filed your taxes with a TurboTax CD/download product, your tax return should be stored on your computer, so you can print a copy at any time. If you used TurboTax Online, you can log in and print copies of your tax return for free.

How To Filean Amended Tax Return With The Irs

turbotax.intuit.comtaxreturn

Beginning with the 2019 tax year, you can e-file amended tax returns. If you used TurboTax to prepare Form 1040-X, follow the softwares instructions to e-file the

www.PastYearTax.com/_Tax2019Ad

Do Your 2019, 2018, 2017, 2016 Taxes in Mins, Past Tax Free to Try! Easy Fast & Secure

Read Also: What Refinance Costs Are Tax Deductible

Where Do I Find My Pdf Tax Return

If you want to see your tax return before you file it, you can view your PDF tax return summary on the Tax summary page under the SUMMARY icon on the WRAP-UP tab. This document provides you with an overview of the amounts that were used to calculate your refund or tax owing.

To see your PDF tax summary:

You can open the downloaded PDF by clicking the icon that appears at the bottom of your screen or by searching the folder of your computer. The downloaded file will be named similarly to one of the following examples:

Milo_CRA_2021_summary.pdf

Milo_RQ_2021_summary.pdf

Note: Remember, you can always go back and make changes to your return by clicking the Back button on the Tax summary page or by using the tabs at the top of the page to navigate to a previous section.

Can I Still File My 2015 Taxes And Get A Refund

Luckily, the answer for you is yes, but the time is limited. Since the original tax deadline date for 2015 was April 18, 2016, you have until this tax deadline to claim your 2015 refund. April 15, 2019 is the last day to claim your 2015 refund. Otherwise, your refund will expire and go back to the U.S. Treasury.

Recommended Reading: How Do You Get Tax Returns

First Time Signing In This Year

+ How Do I Speak To A Live Person At Turbotax 2021 Images

We have various wallpapers about How do i speak to a live person at turbotax 2021 available in this site. You can get any images about How do i speak to a live person at turbotax 2021 here. We hope you enjoy explore our website.

Currently you are searching a post about how do i speak to a live person at turbotax 2021 images. We give some images and information connected to how do i speak to a live person at turbotax 2021. We always try our best to present a post with quality images and informative articles. If you did not find any articles or photos you are looking for, you can use our search feature to browse our other post.

How Do I Speak To A Live Person At Turbotax 2021. You can speak to a person, you just have to go through the procedure to do that. Read faqs, ask a question in our answerxchange community, or give us a call. Or you can phone turbotax support during business hours and they can question you. How do i speak to a real person at turbo tax , need a number you can check your refund method that you selected upon filing by following these steps.

Recommended Reading: Where Do I Mail My Irs Tax Return