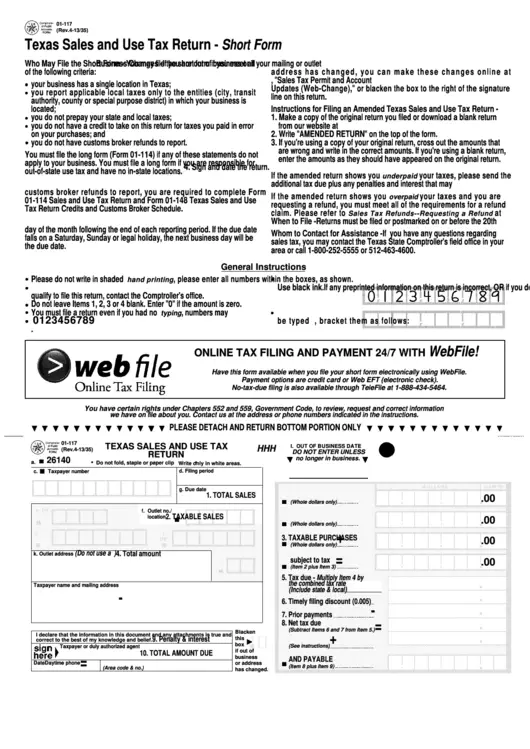

Filing Your Texas Sales Tax Returns Online

Texas supports electronic filing of sales tax returns, which is often much faster than filing via mail.

Texas allows businesses to make sales tax payments electronically via the internet.

You can process your required sales tax filings and payments online using the official Texas WebFile website, which can be found here

Please note that if you file your Texas sales taxes by mail, it may take significantly longer to process your returns and payments.

Simplify Texas sales tax compliance! We provide sales tax rate databases for businesses who manage their own sales taxes, and can also connect you with firms that can completely automate the sales tax calculation and filing process.

Do I Have To File Maine State Taxes

Anyone who is a resident of Maine for any part of the tax year, and has taxable Maine-source income, must file a Maine return. Anyone who is not a resident of Maine, but performs personal services in Maine for more than 12 days and earns more than $3,000 of income from all Maine sources, must file a Maine return.

Where Do I Mail My Federal Income Tax Return

Answer : The federal income tax return form 1040 can be filed at the state wise addresses provided by International Revenue Service.People of Florida and Georgia can mail at Department of the Treasury Internal Revenue Service Atlanta, Georgia 39901-0002. People who are residing in Alabama, Kentucky, Louisiana, Mississippi, Tennessee, and Texas can mail their federal income tax returns …

Don’t Miss: Door Dash Taxes

Where Do I Send Back Taxes

If the IRS mailed you a notice about your late taxes, you should mail your return to the address listed in that notice. Otherwise, where you mail your old tax returns depends on where you live and whether or not youâre including a payment with your return. The IRS instructions for Form 1040 of the year youâre filing for should also include the proper mailing addresses.

Victims In Fema Disaster Areas: Mail Your Request For An Extension Of Time To File

Find out where to mail your form.

Need more time to prepare your federal tax return? This page provides information on how to apply for an extension of time to file. Please be aware that:

- An extension of time to file your return does not grant you any extension of time to pay your taxes.

- You should estimate and pay any owed taxes by your regular deadline to help avoid possible penalties.

- You must file your extension request no later than the regular due date of your return.

You May Like: Doordash 1099

Filing Back Taxes With Tax

Using an online tax-filing service will cost money, but it will offer more guidance and information about which forms you need and how to complete them. However, some online products only allow you to access a few years of prior-year tax forms. Select services do allow you to e-file back taxes for certain tax years, but itâs likely that you will need to print your tax return after filling it out and then mail it to the IRS.

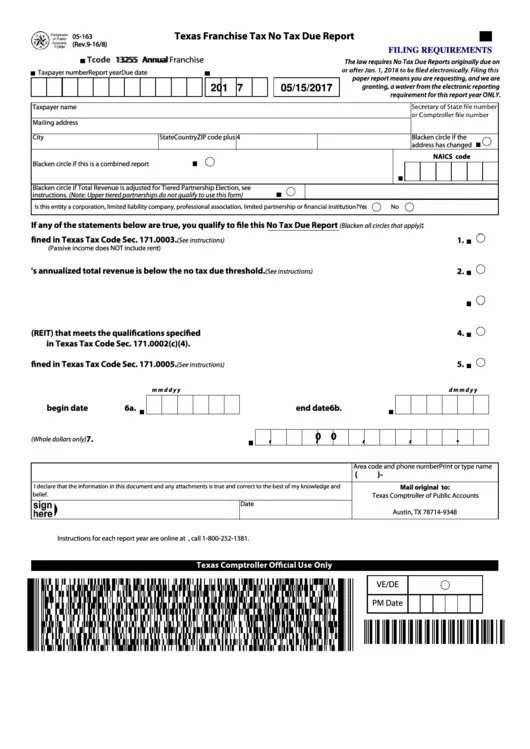

Do Mail Taxes Where My Texas I In

Where do I mail my tax return to in the state of Texas ? The mailing address to file your federal income tax return from Texas will depend on whether you are enclosing a payment or not . From Texas, use this IRS mailing address if you are not enclosing a payment: Texas State Sales Tax 2017 Between 2017 and 2018, state sales tax collections in …

You May Like: Michigan Gov Collectionseservice

Mailing Address For Back Taxes

| Your residence |

|---|

Kansas City, MO 64999-0002 | Internal Revenue Service

P.O. Box 1214

Charlotte, NC 28201-1214 || Alaska, California, Hawaii, Washington | Department of the Treasury

Internal Revenue Service

Fresno, CA 93888-0002 | Internal Revenue Service

P.O. Box 7704

San Francisco, CA 94120-7704 || Arizona, Colorado, Idaho, Kansas, Montana, Nebraska, Nevada, New Mexico, Oregon, North Dakota, South Dakota, Utah, Wyoming | Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002 | Internal Revenue Service

P.O. Box 802501

Cincinnati, OH 45280-2501 || Connecticut, District of Columbia, Maryland, Rhode Island, West Virginia | Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002 | Internal Revenue Service

P.O. Box 931000

Louisville, KY 40293-1000 || Delaware, Maine, Massachusetts, New Hampshire, New York, Vermont | Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999-0002 | Internal Revenue Service

P.O. Box 37008

Hartford, CT 06176-7008 || Florida, Louisiana, Mississippi, Texas | Department of the Treasury

Internal Revenue Service

Austin, TX 73301-0002 | Internal Revenue Service

P.O. Box 1214

Charlotte, NC 28201-1214 || Illinois, Michigan, Minnesota, Ohio, Wisconsin | Department of the Treasury

Internal Revenue Service

Fresno, CA 93888-0002 | Internal Revenue Service

P.O. Box 802501

Cincinnati, OH 45280-2501 || Pennsylvania | Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002 | Internal Revenue Service

What If I Cant Afford To Pay My Back Taxes

Even if you canât afford to pay taxes you owe in full, always file your return as soon as you can. Then you can request an additional 60 to 120 days to pay. Make this request either online through the IRSâ Online Payment Agreement application or by calling the IRS at 800-829-1040. There is no fee for requesting extra time to make payments.

If you need more than 120 days to pay off your full debt, you can request an installment agreement from the IRS where you make monthly payments until your balance is fully paid. If monthly payments are still unaffordable, you may qualify for an offer in compromise, which is when the IRS cancels your debt for a lesser amount than what you owe.

Recommended Reading: Doordash State Id Number For Unemployment California

Post Civil War Reconstruction And Popular Tax Reform

After the Civil War, Reconstruction, railroads, and transforming the North and South war machines towards peacetime required public funding. However, in 1872, seven years after the war, lawmakers allowed the temporary Civil War income tax to expire.

Income taxes evolved, but in 1894 the Supreme Court declared the Income Tax of 1894 unconstitutional in Pollock v. Farmers’ Loan & Trust Co., a decision that contradicted Hylton v. United States. The federal government scrambled to raise money.

In 1906, with the election of President Theodore Roosevelt, and later his successor William Howard Taft, the United States saw a populist movement for tax reform. This movement culminated during then-candidate Woodrow Wilson‘s election of 1912 and in February 1913, the ratification of the Sixteenth Amendment to the United States Constitution:

The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration.

This granted Congress the specific power to impose an income tax without regard to apportionment among the states by population. By February 1913, 36 states had ratified the change to the Constitution. It was further ratified by six more states by March. Of the 48 states at the time, 42 ratified it. Connecticut, Rhode Island, and Utah rejected the amendment Pennsylvania, Virginia, and Florida did not take up the issue.

Tax Forms & Instructions

Use the forms below to register or update your unemployment tax account: Employer’s Registration – Status Report – enables TWC to establish a new account for a non-farm employer. Print this form and mail it in or register online. Farm & Ranch Employment Registration – Status Report – enables TWC to establish a new account for a Farm or Ranch employer.

Recommended Reading: 1099 Doordash

Related Question For Why Would I Get A Letter From The Irs In Austin Texas

Are all letters from the IRS bad?

Not All Letters from the IRS Are Bad

To start, it is important to point out that not all letters and notices that you receive from the IRS are necessarily bad. For instance, the IRS may seek additional information about a limited aspect of your tax return.

Can I walk into the IRS without an appointment?

Before visiting an IRS Taxpayer Assistance Center for in-person help with their tax issues, a taxpayer needs to call 844-545-5640 to schedule an appointment. All TACs provide service by appointment. Taxpayers should consider the self-service options on IRS.gov before calling for an appointment.

Is the IRS open to the public?

We’re open and processing mail, tax returns, payments, refunds and correspondence. However, COVID-19 continues to cause delays in some of our services.

How do I contact the IRS about my stimulus check?

tool at the IRS.gov site. You can request a payment trace if the IRS portal shows your payment was issued but you haven’t received it. You can call the IRS with Economic Impact Payment questions at 919-9835, but IRS live phone assistance is extremely limited.

Was this helpful?

Filing A Resident Tax Return

There are three methods of filing a US tax return as a resident alien:

If you are married to a U.S. Citizen or resident alien for tax purposes, you may choose to be treated as a resident alien for tax purposes and file a joint resident tax return with your spouse.

The advantages of this include:

- You can use the filing status “married filing jointly,” which usually results in lower taxation

- You can claim tax credits normally not available to nonresident tax filers

- You can claim the standard deduction

The disadvantages are:

- You may be subject to Social Security and Medicare withholding on your wages

- You may not be able to claim tax treaty benefits

- You will be taxed on your worldwide income

Don’t Miss: Best Taxes Company

Filing Your Tax Return

What you need to know about filing your personal income tax and benefit return.

Get help this tax season with the Ontario Child Care Tax Credit and the Low-Income Workers Tax Credit.

Save your receipts for the new Seniorsâ Home Safety Tax Credit in 2021, which you can apply for during the 2022 tax season.

You may be eligible for tax credits and benefits to help you with living costs.

Paper Returns Have Vulnerabilities Too

Its also important to consider how safe it is to submit your tax return by mail. Paper returns can be lost or stolen. Theyre also more susceptible to error. Unfortunately, your private information is vulnerable no matter how you submit your return.

Certain forms cant be e-filed no matter how you complete them. However, most people wont need to file these forms. The most common circumstance when you might have to submit a paper return is if you need to file an amended return.

Besides the possible security riskswhich may be outweighed by features such as convenience and receiving your refund fasterare there any other cons of filing your tax forms electronically?

Don’t Miss: Does Doordash Give 1099

What Happens If You Dont File Taxes While Living Abroad

Just like every US resident, if youre living abroad and fail to file your US or state taxes, you can receive a penalty for not filing taxes, even if you do not owe taxes. The failure to file penalty could be thousands of dollars, being disqualified from benefits that will reduce your tax obligation, or worse.

Read Also: Reverse Ein Lookup Irs

How To File Your Federal Taxes

Tax Filing Deadline. The deadline for filing federal income taxes was extended by the IRS from April 15 to May 17, 2021.This deadline does not apply to state and local tax returns. To make sure you file those on time, find out the tax filing due dates in your state.If you owe money and do not file and pay your taxes on time, you will be charged interest and a late payment penalty.

Read Also: Employer Tax Identification Number Lookup

Paying Other Business Taxes

Making your tax payments online is the best and easiest way to pay. LLC owners, sole proprietors, or partners in partnerships can use one of several IRS e-pay options, including direct debit from a bank account, credit card, or debit card.

Corporation and partnership returns should use the IRS Electronic Federal Tax Payment System .

How Do I Send My Tax Return By Mail

Use the U.S. Postal Service® to mail your tax return, get proof that you mailed it, and track its arrival at the IRS. Mailing Tips

Recommended Reading: How Does Doordash Taxes Work

Ways To File Back Taxes

If you miss Tax Day and need to file your taxes late for the current year, you can still e-file your return until November. The IRS announces in October when exactly it will stop accepting e-filed returns for that tax year. So if youâre filing 2020 taxes but miss filing by May 17, 2021, you had until November 2021 to e-file.

If youâre filing a federal tax return from a previous year, you may need to mail a physical copy of your tax return to the IRS. You may be able to e-file your back taxes, but this is only available for certain tax years and through certain online tax-filing services.

There are three ways you can complete your back taxes.

How To Check The Status Of Your Coronavirus Stimulus Check

If you’re trying to find out the status of your coronavirus stimulus payment, go to the IRS’s Get My Payment page. You can learn whether your payment has been issued, and if it’s coming by direct deposit or mailed check.

Learn more about the stimulus payments, including whether you qualify for one and what, if anything, you may have to do to get yours.

Recommended Reading: How To Protest Property Taxes Harris County

Protect Yourself From Tax

Tax ID theft occurs when someone steals your personal information to file a tax return using your personal data. Usually, the fraudulent tax filer will use your Social Security number to file your return in order to collect a refund. To protect yourself from tax ID theft, you can obtain a six-digit Identity Protection PIN from the IRS. IP PINs are known only to you and the IRS so the IRS is able to confirm your identity when you file your return. Learn more about how the IP PIN works and how to apply.

Where Do I Mail My Tax Return In Texas

4.4/5

| and you are filing a Form | and you ARE NOT ENCLOSING A PAYMENT, then use this address |

|---|---|

| 1040-ES | |

| Department of the Treasury Internal Revenue Service Austin, TX 73301-0052 | |

| 4868 |

Herein, where do I mail my tax return?

| Form | |

|---|---|

| Department of the Treasury Internal Revenue Service Fresno, CA 93888-0002 | |

| 1040NR | Department of the Treasury Internal Revenue Service Austin, TX 73301-0215 USA |

| Form | |

| Department of the Treasury Internal Revenue Service Ogden, UT 84201-0002 |

Beside above, where do I mail my amended Texas tax return?

| If you are filing Form 1040X: | THEN mail Form 1040X and attachments to: |

|---|---|

| Florida, Louisiana, Mississippi, Texas | Department of the Treasury Internal Revenue Service Austin, TX 73301-0052 |

Beside above, what kind of envelope should I mail my tax return in?

For small returns, a standard business-class envelope is usually acceptable. Fold the return in thirds. You can also use a large, flat envelope large enough to hold the return unfolded, but be aware that the Postal Service charges more in postage for such envelopes. Larger returns may have to be mailed in a box.

Can I fold my tax return?

Yes, you can fold your return to put it in an envelope. When you mail a tax return, you need to attach any documents showing tax withheld, such as your W-2’s or any 1099’s. Use a mailing service that will track it, such as UPS or certified mail so you will know the IRS received the return.

You May Like: How Much Do I Pay In Taxes For Doordash

Registration In Other States

If you will be doing business in states other than Texas, you may need to register your LLC in some or all of those states. Whether you’re required to register will depend on the specific states involved: each state has its own rules for what constitutes doing business and whether registration is necessary. Often activities such as having a physical presence in a state, hiring employees in a state, or soliciting business in a state will be considered doing business for registration purposes. Registration usually involves obtaining a certificate of authority or similar document.

For more information on the requirements for forming and operating an LLC in Texas, see Nolo’s article, 50-State Guide to Forming an LLC, and other articles on LLCs in the LLC section of the Nolo website.

Independent Office Of Appeals

The Independent Office of Appeals is an independent organization within the IRS that helps taxpayers resolve their tax disputes through an informal, administrative process. Its mission is to resolve tax controversies fairly and impartially, without litigation. Resolution of a case in Appeals “could take anywhere from 90 days to a year”. The current chief is Donna C. Hansberry.

Also Check: How To Get Your 1099 From Doordash