Die With Appreciated Stock

The standard calculation for capital gains in your retail brokerage account , IRA, or other tax-qualified retirement plan) after commissions and fees is:

capital gains = sale proceeds cost basis

Should you sell the stock during your lifetime, the net proceeds in this equation are your capital gains . Should you gift the stock, the cost basis carries over to the new owner.

Yet when you die before selling or gifting, this cost basis in most situations is stepped up to the fair market value on the date of death. The stock escapes the capital gains tax on the price increase during your lifetime, regardless of the size of your estate. Thus, no taxable gain is recognized when the inherited shares get sold at no higher than the death-date price.

All the 2020 Democratic presidential candidates seem to be calling for the elimination of this provision. This tax rule, which was not changed when the estate tax income exemption amount increased, is viewed as a tax loophole for super-wealthy people who create sophisticated trusts and estate-planning strategies. However, this tax treatment at death to step up the basis is available for everyone and does eliminate the taxes your heirs and beneficiaries pay.

What Is A Tax Bracket

A tax bracket refers to a range of incomes subject to a certain income tax rate. Tax brackets result in a progressive tax system, in which taxation progressively increases as an individuals income grows. Low incomes fall into tax brackets with relatively low income tax rates, while higher earnings fall into brackets with higher rates.

Give Away Appreciated Assets

If you dont need to liquidate all of your assets to cover daily living expenses, giving highly appreciated securities to charity or to heirs can lessen your capital gains tax liability.

When donating an appreciated security directly to charity instead of giving cash, you can bypass paying taxes on the capital gain, providing an additional perk on top of the tax deduction for charitable contributions.

If you leave your appreciated securities to heirs, they will receive a step up in cost basis upon your death. This means that the price of the security on the date of your death will become the new cost basis for your heirs.

Read Also: Where Can I Find My Agi On My Tax Return

What Happens If You Don’t Report Stocks On Taxes

You typically dont have to report that you own shares of a stock on your taxes. You do have to report any income earned from those shares whether from capital gains due to the sale of the shares or from dividends earned while holding the shares.

Failure to report this income and pay the appropriate taxes could be a crime. Brokerage firms will directly report the proceeds from the sale of stock to the IRS. The company issuing the dividend will also report this income to the IRS. If these amounts are not reflected on your tax return, this could be a red flag for the IRS.

Time Gains Around Retirement

As you approach retirement, consider waiting until you actually stop working to sell profitable assets. The capital gains tax bill might be reduced if your retirement income is low enough. You may even be able to avoid having to pay capital gains tax at all.

In short, be mindful of the impact of taking the tax hit when working rather than after you’re retired. Realizing the gain earlier might serve to bump you out of a low- or no-pay bracket and cause you to incur a tax bill on the gains.

Don’t Miss: When Is The Deadline To File Your Income Tax

What Are The Exceptions To The Capital Gains Tax Rate For Long

One major exception to a reduced long-term capital gains rate applies to collectible assets, such as antiques, fine art, coins, or even valuable vintages of wine. Typically, any profits from the sale of these collectibles will be taxed at 28% regardless of how long you have held the item.

Another major exception comes from the Net Investment Income Tax , which adds a 3.8% surtax to certain net investments of individuals, estates, and trusts above a set threshold. Typically, this surtax applies to those with high incomes who also have a significant amount of capital gains from investment, interest, and dividend income.

How To Get Into A Lower Tax Bracket And Pay A Lower Federal Income Tax Rate

Two common ways of reducing your tax bill are credits and deductions.

-

Tax credits directly reduce the amount of tax you owe they don’t affect what bracket you’re in.

-

Tax deductions, on the other hand, reduce how much of your income is subject to taxes. Generally, deductions lower your taxable income by the percentage of your highest federal income tax bracket. So if you fall into the 22% tax bracket, a $1,000 deduction could save you $220.

In other words: Take all the tax deductions you can claim they can reduce your taxable income and could kick you to a lower bracket, which means you pay a lower tax rate.

Also Check: What Is California State Tax Rate

Adjusted Cost Base For Real Estate

For real estate properties, the adjusted cost base includes the purchase price of the property, closing costs, and capital expenditures on the property.

Closing costsare the fees that a buyer pays to acquire the real estate property and include one-time fees such as theland transfer taxes, lawyer and legal fees, home inspection fee, and property survey fee. It is important to differentiate between capital expenditures and current expenses on your property.

Current expenses cannot be included in the adjusted cost base while capital expenditures should be included in the ACB, irrespective of when the capital expenditures were made during the entire duration of your ownership of the home.

Some examples of capital additions and improvements to your home include installing a new HVAC system, waterproofing your basement, installing a hot tub, etc. Meanwhile, current expenses are monthly costs incurred by the homeowner or a tenant, such as electricity bills, hydro bills, restorations, and short term repairs such as painting the wall or replacing broken light bulbs.

TheCanada Revenue Agency guidelines on current expenses and capitalexpenses indicate that capital expenditures are improvements that provide a long term benefit, significantly increase the value of the home, and contribute to extending the useful life of your property.

What Is A Flow

You are a member of, or investor in, a flow-through entity if you own shares or units of, or an interest in, one of the following:

You May Like: How To Report Self Employment Income On Taxes

Bonds Debentures Promissory Notes And Other Similar Properties

Use this section to report capital gains or capital losses from the disposition of bonds, debentures, Treasury bills, promissory notes, and other properties. Other properties include bad debts, foreign currencies, and options, as well as discounts, premiums, and bonuses on debt obligations. Report these dispositions on lines 15199 and 15300 of Schedule 3.

Capital gains arising from donations made to a qualified donee of a debt obligation or right listed on a designated stock exchange, or a prescribed debt obligation, are treated differently. If you made such a donation, use Form T1170, Capital Gains on Gifts of Certain Capital Property. If you have a capital gain, report on Schedule 3 the amount calculated on Form T1170.

For more information on these donations, see Pamphlet P113, Gifts and Income Tax.

If you sold any of the types of properties listed above in 2020, you will receive a T5008 slip, Statement of Securities Transactions, or an account statement.

If you have bought and sold the same type of property over a period of time, a special rule may affect your capital gain calculation.

For more information, see Identical properties.

Treasury bills and stripped bonds

Before you calculate your capital gain or loss, you have to determine the amount of interest accumulated to the date of disposition. Subtract the interest from the proceeds of disposition and calculate the capital gain or loss in the usual way.

Example

Jesse calculates interest on the T-bill as follows:

Note

Learn How Capital Gains Are Taxed

Capital gains are 50% taxable. The amount of tax you pay on a capital gain depends on your annual income. That means 50% of the amount you made from selling your investment is added to your income, and then your personal tax rate is applied to the total. The higher your tax bracket, the more tax youll pay on your capital gains.

For example, lets say you bought a building for $400,000 and sold it for $500,000. Youll need to add half of your profit to your income for the year. Because your profit was $100,000, youll report $50,000 as a taxable capital gain. Your personal tax rate is then applied to the total amount of income you reported to determine how much tax you owe.

Also Check: How Is Capital Gains Tax Calculated On Sale Of Property

How Can I Legally Reduce My Capital Gains Taxes

There are a number of perfectly legal ways to minimize your capital gains taxes:

- Hang onto your investment for more than one year. Otherwise, the profit is not treated as a capital gain, it’s treated as regular income, meaning you’ll probably pay more.

- Also, keep in mind that your investment losses can be deducted from your investment profits, at a rate of up to $3,000 a year. Some investors use that fact to good effect. For example, they’ll sell a loser at the end of the year in order to have losses to offset their gains.

- If you’re saving for retirement, consider a Roth IRA or a Roth 401. You won’t owe capital gains taxes on the profits after retiring.

- Keep track of any qualifying expenses that you incur in making or maintaining your investment. They can increase the cost basis of the investment and thereby reduce its taxable profit.

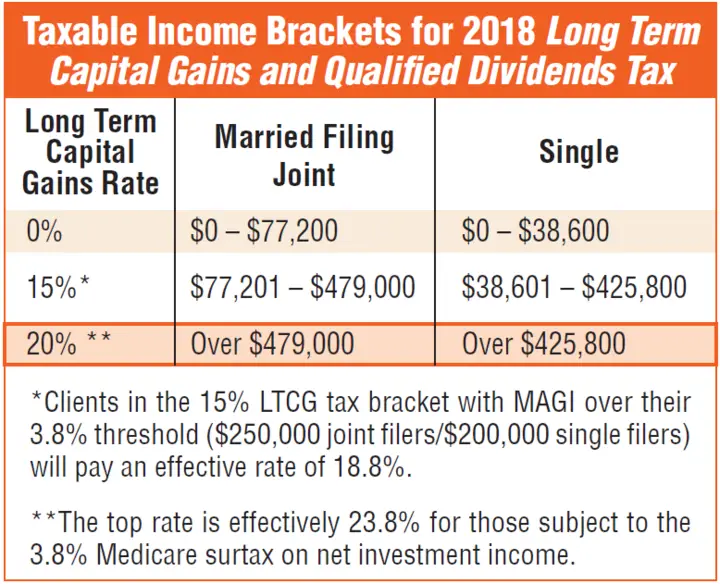

Long Term Capital Gain Brackets For 2020

Lets take a look at how long-term gains are actually taxed. In many cases, long-term capital gains will have favorable tax treatments. That means you will likely pay less taxes on long-term capital gains than you would other types of earned income, like your salary. Long-term capital gains are taxed at the rate of 0%, 15% or 20% depending on your taxable income and marital status.

For single folks, you can benefit from the zero percent capital gains rate if you have an income below $40,000 in 2020. Most single people will fall into the 15% capital gains rate, which applies to incomes between $40,001 and $441,500. Single filers, with incomes more than $441,500, will get hit with a 20% long-term capital gains rate.

The brackets are a little bigger for married couples, filing jointly, but most will get hit with the marriage tax penalty here. Married couples with incomes of $80,000, or less, remain in the 0% tax bracket, which is great news. However, married couples who earn between $80,001 and $496,600 will have a capital gains rate of 15%. For those with incomes above $496,600 will find themselves getting hit with a 20% long-term capital gains rate.

Short-Term Capital Gains

Related: How Your Company Stock Options Will Be Taxed

Tax-Loss Harvesting

Taxation doesn’t end when you leave the workforce. You will owe taxes on your retirement accounts … once you start making withdrawals.

Getty

Taxes on Investments in Retirement Accounts

Also Check: What Is Tax Resolution Services

The 10%12% Tax Bracket

For people in the 10% or 12% income tax bracket, the long-term capital gains rate is 0%. Under the Tax Cuts & Jobs Act, which took effect in 2018, eligibility for the 0% capital gains rate is not a perfect match with the income ceiling for the 12% income tax rate. The income thresholds for the 0% rate are indexed for inflation:

- in 2019, $39,375 and $78,750

- in 2020, $40,000 and $80,000

Before you believe you quality for this special 0% capital gains rates, or think you can shuffle your stock to someone else in a lower tax bracket who can sell to get the 0% rate, you want to be sure you dont trip over the tax rules. For example, the net gains from your stock sale count against the income limit. Should you decide this is a good year to convert a traditional IRA to a Roth IRA, that income counts, too. The kiddie tax is triggered should the gifted stock be sold by a child under the age of 19 .

What Are Capital Gains On Stock

A capital gain is the increase in the value of a capital asset. That asset could be just about anything, but most typically relate to either real estate or financial assets such as stocks, bonds, and mutual funds.

As I mentioned above investments typically produce returns either through fixed-income payments, such as interest and dividends or through capital gains. And just like interest and dividends, capital gains usually trigger a taxable event.

Let’s say you purchase 100 shares of stock at $50 per share, for a total investment of $5,000. Six months later, the price of the stock rises to $65 per share. You sell your entire position for $6,500, producing a $1,500 gain on sale.

The $5,000 purchase price of the stock represents your cost basis. The $1,500 gain represents a capital gain. You can use tax software to get your gains and losses. Here are the leading ones:

| Recommended Service |

|---|

| All Needed Tax Breaks for Investments |

You May Like: How To Get Out Of Paying School Taxes

Use Capital Losses To Offset Gains

If you experience an investment loss, you can take advantage of it by decreasing the tax on your gains on other investments. Say you own two stocks, one of which is worth 10% more than you paid for it, while the other is worth 5% less. If you sold both stocks, the loss on the one would reduce the capital gains tax you’d owe on the other. Obviously, in an ideal situation, all of your investments would appreciate, but losses do happen, and this is one way to get some benefit from them.

If you have a capital loss that’s greater than your capital gain, you can use up to $3,000 of it to offset ordinary income for the year. After that, you can carry over the loss to future tax years until it is exhausted.

A Guide To The Capital Gains Tax Rate: Short

OVERVIEW

This guide can help you better understand the different rules that apply to various types of capital gains, which are typically profits made from taxpayers sale of assets and investments.

The Internal Revenue Service taxes different kinds of income at different rates. Some types of capital gains, such as profits from the sale of a stock that you have held for a long time, are generally taxed at a more favorable rate than your salary or interest income. However, not all capital gains are treated equally. The tax rate can vary dramatically between short-term and long-term gains. Understanding the capital gains tax rate is an important step for most investors.

Don’t Miss: How To Efile Just State Taxes

Selling Or Donating Certified Canadian Cultural Property

You do not have to report a capital gain when you sell or donate certified Canadian cultural property to an institution or public authority designated by the Minister of Canadian Heritage. The Canadian Cultural Property Export Review Board certifies this property as cultural property and will give you a certificate for tax purposes. Cultural property can include paintings, sculptures, books, manuscripts, or other objects.

Donations of cultural property made on or after March 19, 2019, no longer require that property be of national importance to claim the exemption from income tax for any capital gains arising on the disposition of the property.

If you sell or donate certified cultural property to a designated institution, you may have a capital loss. The tax treatment of the loss will depend on what type of property you sold or donated. For example, the certified cultural property may be listed personal property. If this is the case, the rules for listed personal property losses will apply. For information on how to apply capital losses, see Chapter 5.

For more information, see Interpretation Bulletin IT-407R4-CONSOLID ARCHIVED – Dispositions of Cultural Property to Designated Canadian Institutions, or Pamphlet P113, Gifts and Income Tax.

Federal Capital Gains Tax Rates

The tables below show marginal tax rates. This means that different portions of your taxable income may be taxed at different rates.

For example, a single filer who made $10,000 would pay 10% income tax on their first $9,950 and 12% on the remaining $50. That’s a total of $1,001 in tax and an overall tax rate of 10.01%.

Recommended Reading: How Do You Add Sales Tax