How Much Money Do You Have To Make To Not Pay Taxes

The amount that you have to make to not pay federal income tax depends on your age, filing status, your dependency on other taxpayers and your gross income. For example, in the year 2018, the maximum earning before paying taxes for a single person under the age of 65 was $12,000.

If your income is below the threshold limit specified by IRS, you may not need to file taxes, though its still a good idea to do so.

What this article covers:

NOTE: FreshBooks Support team members are not certified income tax or accounting professionals and cannot provide advice in these areas, outside of supporting questions about FreshBooks. If you need income tax advice please contact an accountant in your area.

When You May Want To Submit A Tax Return To Claim A Tax Refund

With all the above being said, there are years when you might not be required to file a tax return but may want to. If you have federal taxes withheld from your paycheck, the only way you can receive a tax refund when too much was withheld is if you file a tax return.

- For example, if you are a single taxpayer who earns $2,500 during the year, with $300 withheld for federal tax, then you are entitled to a refund for the entire $300 since you earned less than the standard deduction.

- The IRS doesn’t automatically issue refunds without a tax return, so if you want to claim any tax refund due to you, then you should file one.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. Whether you have a simple or complex tax situation, we’ve got you covered. Feel confident doing your own taxes.

Make Tax Returns Easier With A Simple App

You can view real-time insights into your business finances, such as cash flow and profit and loss statements. The app provides running tax estimates so that you always know how much to set aside for your tax return. Find out more here.

Multi-award-winning Counting Ltd, backed by Sage and ING Bank, designs and operates the Countingup websites and app, offering an electronic money business current account with innovative built-in accounting software.Prepay Technologies Ltd trading as PPS is the e-money issuer of your business current account and Counting Ltd is a registered Agent of PPS. PPS is authorised and regulated by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuance of electronic money and protects customers against its insolvency by safeguarding an amount equivalent to the money held in Countingups e-money business current accounts. The Countingup card is an electronic money product issued by PPS pursuant to license by Mastercard International Incorporated.

Recommended Reading: How To Track Your Taxes

What Happens If You Don’t File A Return

What happens if you fail to report income this year? You won’t get arrested. The IRS doesn’t have any tax police out looking for non-filers. But, eventually, bad things will likely happen and get worse over time. Sooner or later, the IRS will probably discover you should have filed a return. This usually happens because third parties reported to the IRS payments they made to you. This could be any of the following:

- Salary an employer reports on Form W-2,

- Income you earned as an independent contractor reported by your clients on Form 1099-MISC, or

- Interest income reported by a bank or other financial institution on Form 1099-INT

IRS computers will check and see if you reported this income on your timely filed tax return. If there is no return on file, the IRS will send you a notice called Notice CP 59, First Notice Request for Your Tax Return. This form demands that you file a tax return and pay any tax due. In addition to the taxes you should have paid, you’ll owe interest and penalties. These can be severe. As much as 25 percent of your unpaid taxes.

Choosing A Professional Tax Preparer

Many taxpayers choose to work with professional tax preparers. Neither the IRS nor the Vermont Department of Taxes endorses tax preparers, so you should conduct your own due diligence to find a reputable professional who will meet your tax preparation needs. The IRS provides the following online searchable databases that can help you find a tax preparer in Vermont:

Recommended Reading: What Is The Sales Tax In Arkansas

Taxslayer Terms Of Service

Please read the Terms of Service below. They cover the terms and conditions that apply to your use of this website . TaxSlayer, LLC. may change the Terms of Service from time to time. By continuing to use the Site following such modifications, you agree to be bound by such modifications to the Terms of Service.

General Terms and Conditions. In consideration of use of the Site, you agree to: provide true, accurate, current and complete information about yourself as prompted by the registration page and to maintain and update this information to keep it true, accurate, current and complete. If any information provided by you is untrue, inaccurate, not current or incomplete, TaxSlayer has the right to terminate your account and refuse any and all current or future use of the Site. You agree not to resell or transfer the Site or use of or access to the Site.

You acknowledge and agree that you must: provide for your own access to the World Wide Web and pay any service fees associated with such access, and provide all equipment necessary for you to make such connection to the World Wide Web, including a computer and modem or other access device.

User Conduct On the Site.

While using the Site, you may not:

IRS Circular 230 Notice. Nothing in our communications with you relating to any federal tax transaction or matter are considered to be “covered opinions” as described in Circular 230.

- PreSDDSpare, E-file, and Print

- Prepare, E-file, and Print

- Prepare, E-file, and Print

You Have Other Options

You can save considerably by purchasing tax preparation software instead if your tax situation isn’t very complicated. These programs have evolved considerably over the years and are set up to ask you specific questions, then prepare your return based on your answers and the data you input.

Prices start as low as $29.95 for the H&R Block basic tax software and $49.99 for a basic TurboTax programs for 2020 returns, and there could be steeper discounts during tax season. There might be an extra cost for preparing state returns, however.

You can have your return prepared and filed for free through IRS Free File if your tax situation is;very;simple and basic, subject to some income limits. You can’t have more than $69,000 income, and some of the participating providers’ limits are even less than this. The Free File website can guide you to what’s available.

The IRS Volunteer Income Tax Assistance Program also provides free tax preparation for low-income taxpayers, as well as for the elderly, disabled, Native Americans, rural citizens, and those for whom English is a second language. There are more than 9,600 volunteer program sites across the U.S. as of 2020.

Read Also: How Are Property Taxes Calculated In Texas

To Itemize Or Not To Itemize

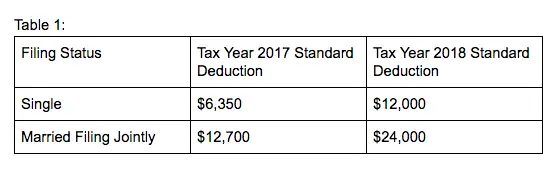

You might not have to torture yourself over the decision between itemizing and claiming the standard deduction. The Tax Cuts and Jobs Act effectively doubled the standard deduction for all filing statuses when it went into effect in 2018.

As of the 2020 tax yearthe return you would file in 2021you’d need more than $24,800 in itemized deductions to make itemizing worthwhile if you’re married and you file a joint tax return. You’d be taxed on $4,800 more in income if you itemized and have only $20,000 in itemized deductions. That’s not even to mention the additional tax prep fee.

The standard deductions for other filing statuses are $12,400 if you’re single or if you’re married and filing separately, and $18,650 if you qualify as head of household.

How To Know If Youre Self

There are a ton of different terms for being self-employed, so I want to start with clearing some things up. If youre a freelancer, if youre a small business owner, or even if you have a side hustle, all of those would fall under the umbrella of self-employed. Self-employed simply means you are earning income by yourself, outside of an employer.

That being said, there are a few exceptions in which you arent self-employed but still need to set aside money for income taxes. For instance, if you earn cash tips from your job, that is considered taxable income. Not only do you need to claim that cash as income when filing your taxes, but you also need to pay tax on it. The same goes for if you do any cash gigs. For instance, if youre a musician and get paid for your performance in cash, that cash is considered taxable income that you need to claim and pay taxes on. If you do not claim any cash you earn as income on your taxes, that is considered tax evasion and is illegal.

Another example would be if you are a hired contract worker for a company. In some instances, the company will pay you regularly as if you are a normal employee, but they wont take any tax or CPP off your paycheque. In this case, you may not be self-employed in the traditional sense, but you would be in the sense that you have to save a percentage of your pay for tax time.

For more info, check out this article on the governments website about tax obligations for self-employed individuals.

You May Like: Is Past Year Tax Legit

How Complicated Are Your Taxes

Lets be honest for a second: If you want a plain vanilla tax filing, you could probably get away with paying a fee close to the minimum range. But the more complicated your tax situation is, the more time itll take to prepare your return. And we all know time is money.;

For example, lets say you have a side business. Youll want to itemize deductions and file a Schedule C form in addition to your basic 1040. In that case, the average cost is around $515.4;

More Tax Filing Requirements

Optional filing. Even if you are not required to file a tax return, you can choose to file one. You may want to file an optional tax return if you had any federal withholding or are entitled to tax credits, like the earned income tax credit or the Health Insurance Premium Tax Credit and want to get a refund.

Other filing requirements. In addition to the income requirements, there are other circumstances when you must file a tax return. One example is if you sold your home. For all the requirements, see Publication 17.

When to file. If you earn enough money to file a tax return, you must file your tax return by the tax deadline.

After you file. Once you file, you can see How Long Does it Take to Get Your Tax Refund Back?

Don’t Miss: How To Get Stimulus Check 2021 Without Filing Taxes

General Information About Individual Income Tax Electronic Filing

Filing electronically is a fast growing alternative to mailing paper returns. The Missouri Department of Revenue received more than 2.7 million electronically filed returns in 2019. Convenience, accuracy, and the ability to direct deposit your refund are just a few of the reasons why electronic filing is becoming one of the Department’s most popular filing methods.

Income Thresholds For Taxpayers 65 And Older Are Higher

If you are at least 65 years old, you get an increase in your standard deduction. You also get an increased standard deduction if:

- You are blind

- Or your spouse is also at least 65

- Or if your spouse is blind

The largest standard deduction would be for a married couple that are both blind and both over 65 years old.

Having a larger standard deduction can allow you to have more income than someone under age 65 and still not have to file a return.; ;TurboTax;can help you estimate if you’ll need to file a tax return and what income will be taxable.

Read Also: How Much Taxes To Pay On Stocks

Tax Attorney Or Lawyer

After completing their education and passing a state exam, attorneys may choose to specialize in different areas, including tax preparation and filing. A tax attorney may be especially helpful when there are complicated cases or you suspect you may need to legally defend yourself against the IRS or state tax department.

How To Report Kiddie Tax On Your Tax Return

There are two ways to report kiddie tax on a federal tax return:

-

A child can file their own tax return and complete IRS Form 8615, which has three parts that walk through how to calculate your kiddie tax. If the child is a minor, a parent or guardian should complete the necessary tax forms on behalf of the child.

-

A childâs parent can elect to include the childâs income on their tax return by completing IRS Form 8814. This option isnât available if the childâs unearned income is more than $11,000.

Also Check: How To Buy Tax Lien Properties In California

Minimum Gross Income Thresholds For Taxes

The IRS defines “gross income” as anything you receive in the form of payment that’s not tax-exempt. Gross income can include money, services, property, or goods. The thresholds cited here apply to income earned in 2020, which you must report when you file your 2020 tax return in 2021.

In a practical sense, the limits are equal to the years standard deduction, because you can deduct this amount from your gross income and only pay income tax on the difference. You would owe no tax and would not be required to file a return if youre single and earned $12,400 in 2020, because the $12,400 deduction would reduce your taxable income to $0. But you would have to file a tax return if you earned $12,401, because youd have to pay income tax on that additional dollar of income unless you had applicable tax credits you could use.

As of the 2020 tax year, these figures are:

| Single under age 65 | |

| Qualifying widow age 65 or older | $26,100 |

Dependents May Have To File

If you are a dependent of another taxpayer, then you follow a different set of rules.

The rules determining whether a dependent needs to file a tax return are somewhat complicated, but Ill try my best to keep it simple. Dependents who are under 65 and have unearned income over $1,100, or earned income over the standard deduction of $12,200, must file a tax return.;

That parts pretty easy. Heres where it gets more complex: If you received both earned and unearned income in 2019, you must file a return if your combined income adds up to more than the larger of $1,100 or total earned income plus $350.

For example, 18-year-old Danielle is claimed as a dependent by her parents. In 2019, she received $200 in unearned income from taxable interest from an investment and also earned $4,050 from her part-time job at the library. Danielles unearned income and earned income each fall below the individual thresholds. Her total income of $4,250 is also less than her earned income plus $350 . Since all three of these factors apply, Danielle does not have to file a 2019 tax return.;

Still confused? Understandable. Basically, if you are a dependent and have both earned and unearned income you have to file a tax return if your total income was more than $1,100 and your unearned income was more than $350.;

Related:Where to Get Your Taxes Done

Also Check: What Cars Qualify For Federal Tax Credit

Pricing Methods Used By Tax Preparers

You can ask up front how the firm determines its prices if you’re comparing tax professionals or accountants. Ask for an estimate of what their services might cost you, although you probably won’t get an answerat least not a firm, definitive oneuntil you’ve met with the professional and they have a firm grasp of your tax issues.

Some accountants offer free consultations, so you might get an answer at the end of this initial meeting.

Otherwise, the firm would have to base its number on your personal summary of your situation, and this might or might not provide an accurate picture of your tax situation. After all, you probably wouldn’t be seeking a professional’s services if you were exceptionally savvy about tax matters.

Some of the methods used by tax professionals to set prices include:

- A set fee for each tax form or schedule

- A fee based on last year’s fee plus an additional fee for any changes in a client’s tax situation

- A minimum tax return fee, plus an additional fee based on the complexity of the client’s situation

- A value-based fee based on the subjective value of the tax preparation service

- An hourly rate for time spent preparing the tax return and accompanying forms and schedules

- A set fee for each item of data entry

Is It Worth Paying Someone To Do Your Taxes

Yes, in some cases it is worth it to hire a professional to do your taxes. This is especially true if you have a complicated tax situation, you own a business, you have numerous investments or you need to file several state returns. But, if your taxes are fairly simple, you may be able to file taxes by yourself.;

The bottom line: Getting your taxes done right is important and can save you money in the long run. If youre not confident you wont make any mistakes, consider hiring a qualified preparer near you.

You May Like: Where Can I Get 1040 Tax Forms