Wheres My State Tax Refund Oregon

You can check on your state income tax refund by visiting the Oregon Department of Revenue and clicking on the Wheres My Refund? button. This will take you to an online form that requires your ID number and the amount of your refund.

This online system only allows you to see current year refunds. You cannot search for;previous years tax returns or amended returns.

Video: What To Do If Your Tax Return Is Rejected By The Irs

OVERVIEW

It’s always disappointing when your tax return is rejected, but it doesn’t have to be scary. This video address some of the common mistakes that cause rejections and what you can do about it.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

Fill Out The Correct Form For Your Business

Amended return forms, by business type| Business type | |

|---|---|

|

|

|

|

| Limited Liability Company : |

|

Read Also: Do You Have To Claim Social Security On Taxes

Find Out If Your Tax Return Was Submitted

You can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer. Whether you owe taxes or youre expecting a refund, you can find out your tax returns status by:

-

Looking for emails or status updates from your e-filing website or software

If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. To do so, use USPS Certified Mail or another mail service that has tracking or delivery confirmation services.;

When Not To Amend A Tax Return That You Filed

In some cases, you dont need to amend your tax return.

The IRS usually corrects math errors when processing your original return without the need for you to file further paperwork.

If you didnt include a required form with your return, the IRS will write to you to request the missing item so that they can finish processing your tax return. When you receive a notice about errors, there will usually be other ways to correct errors besides an amended tax return.

Usually, these misunderstandings can be quickly rectified by providing the correct information to the IRS. The notice that you receive will explain clearly what the issue is and how to respond.

You May Like: What Is Tax Liabilities On W2

How To Complete An Amended Return

You can file your amended return;electronically, or on paper.;If you file electronically, follow the instructions for your software provider.

In either case, make sure to indicate that its an amended return before filling it out.;

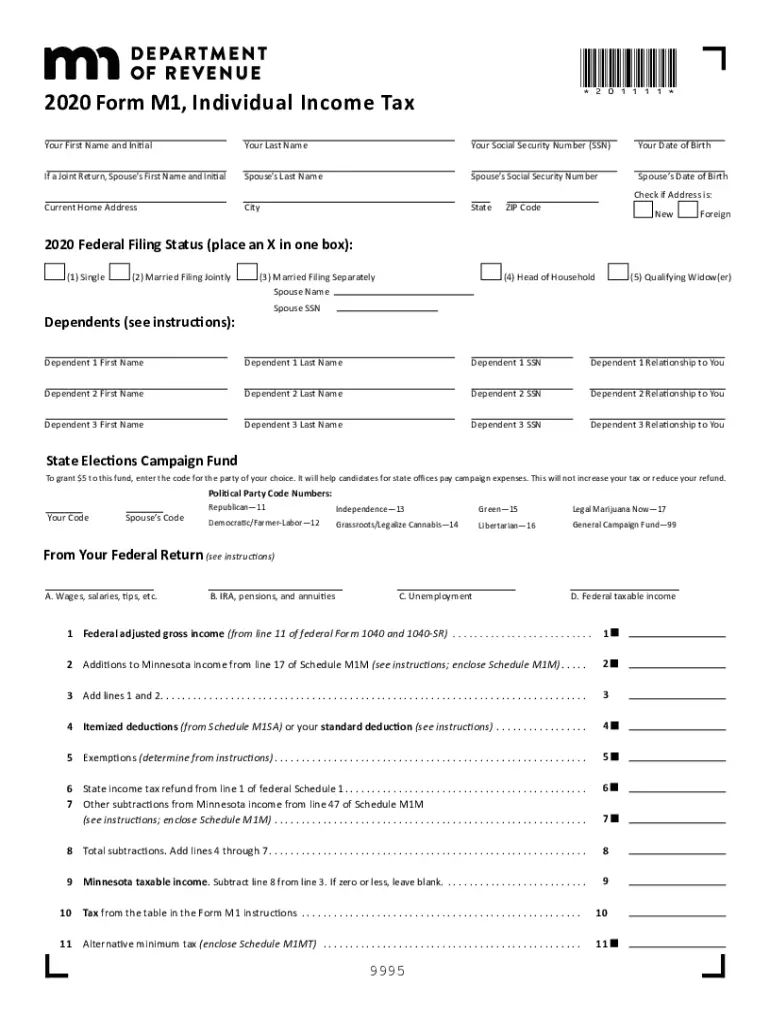

For paper returns, mark the oval labeled Amended Return. Complete the new return using the corrected information, as if it were the original return. Do not make any adjustments to your amended return to show that you received a refund or paid a balance due with your original return. Attach a complete copy of your federal amended return, if applicable.

If your amended return results in additional tax due, interest must be paid on the tax you owe from the due date on the original return to the date filed or postmarked.

If You Must Amend Your Return

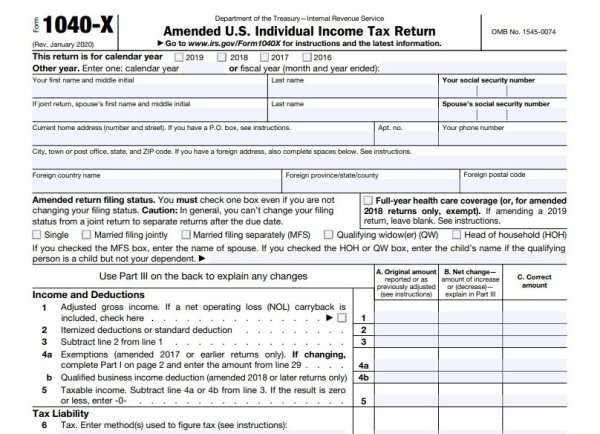

If you need to make a change or adjustment on a return already filed, you can file an amended return. Use Form 1040-X, Amended U.S. Individual Income Tax Return, and follow the instructions.;

You should amend your return if you reported certain items incorrectly on the original return, such as filing status, dependents, total income, deductions or credits.

However, you dont have to amend a return because of math errors you made; the IRS will correct those. You also usually wont have to file an amended return because you forgot to include forms, such as W-2s or schedules, when you filed the IRS will normally request those forms from you.

You May Like: How Can I Make Payments For My Taxes

You May Face A Penalty

If you forgot to report income, such as that from a side hustle, Kazenoff says you’ll likely need to file an amended return, and pay.

You should plan to pay the taxes on that unreported income before the April 15 due date. If you don’t, you’re going to owe interest on the outstanding balance. You may also face a late filing penalty.

You can file an extension, but keep in mind that doesn’t extend the time to pay, Kazenoff says. You’ll need to estimate what you owe and send it into the IRS before your filing deadline. And it’s important that your estimate be as accurate as possible, she adds. This year, the IRS says you need to pay 80 percent of what you owe for the 2018 tax year to avoid a penalty.

Once you file an amended return, you can track its progress. Three weeks after mailing in your return, you can use the “Where’s My Amended Return?” page on the IRS website. Processing can take up to 16 weeks.

Identify The Error Or Amendment You Wish To Make

If you are correcting an error on your original tax return, you will need a blank copy of that particular form from the same year. This will allow you to recalculate your tax and to see which numbers on the original tax return will change as a result of the amendment. You can find IRS forms from prior years using TurboTax’s prior-year returns function, or you can search through the IRS website for it.

You May Like: What Is California State Tax Rate

Reasons You Need To File An Amended Virginia Income Tax Return

Changes to Your Federal Return

If you or the IRS changes your federal return, youre required to fix or correct your Virginia return to reflect the changes on your federal return within one year of the final determination date of the federal change.

IRS CP2000 Notices & Federal Tax Adjustments;

The IRS reports changes to federal returns to Virginia Tax. However, this can happen years after you receive your IRS notice, and interest will continue to accrue on any additional balance due starting from the original due date. To avoid additional interest on any tax due, file your amended Virginia return as soon as you are notified of a change to your federal income tax return by the IRS – dont wait for us to notify you.

You have one year from the resolution of your federal audit to file an amended Virginia return. If you dont file an amended return, or notify us in writing of IRS audit results, we can adjust your return based on the IRS audit findings at any time in the future, which may result in additional tax and interest.;

If youre not sure if you need to file an amended Virginia tax return, give us a call.;

Changes to Another States Return Affecting Your Virginia Return

If you file an amended return with any other state that affects your Virginia income tax, you must file an amended Virginia return within one year.;

Correcting an Error

How The Treasury Offset Program Works

Here’s how the Treasury Offset Program works:

If you owe more money than the payment you were going to receive, then BFS will send the entire amount to the other government agency. If you owe less, BFS will send the agency the amount you owed, and then send you the remaining balance.

Here’s an example: you were going to receive a $1,500 federal tax refund.;But you are delinquent on a student loan and have $1,000 outstanding. BFS will deduct $1,000 from your tax refund and send it to the correct government agency. It will also send you a notice of its action, along with the remaining $500 that was due to you as a tax refund.

The Internal Revenue Service can help you understand more about tax refund offsets.

Also Check: Did The Tax Deadline Get Extended

Can An Amended Tax Return Be Filed Electronically

No, you cant e-file your amended tax return.;Amended returns are only filed on paper.

Once you complete the form, youll have to mail it to the IRS along with all the required supporting documents.; The normal processing time for form 1040X is between 8 and 12 weeks from the time the IRS receives your tax return.

If you are amending for more than one tax year, you will need to file Form 1040X for each tax year separately.

Many people find the prospect of dealing with the IRS and amending their tax return to be quite daunting.

Remember That The Irs Will Catch Many Errors Itself

For example, if the mistake you realize you’ve made has to do with math, it’s no big deal: The IRS will catch and automatically fix simple addition or subtraction errors.

And if you forgot to send in a document, the IRS will usually reach out in writing to request it.

If the issue is a small one, the best thing you can do is wait until the IRS has fully processed your initial tax return. At that point, you will be able to see if the IRS simply corrected the error or has asked you to submit more information.

And Kazenoff says it’s OK to cash the refund check from the original return before receiving any additional refund that may be due to you.

“You really should wait until that first return is processed because you want it to go through the system,” says Kazenoff, who previously worked as a senior tax attorney with the Office of Chief Counsel at the IRS. “Better to wait for it to get processed.” The IRS says that most returns are processed within 21 days.

If your error means you actually owe more to the IRS, the process can be a little more complicated. But for most people, it’s still manageable. Read on for what to do if you have a bigger tax mistake to solve.

Recommended Reading: Where Can I Find My Real Estate Taxes

Wheres My State Tax Refund North Dakota

North Dakotas;Income Tax Refund Status page is the place to go to check on your tax refund. Click the link in the center of the page and then enter your SSN, filing status and exact tax refund. The refund status page also has;information on how the state handles refunds.

The state advises not to call unless you check your refund status and it says to call.

How Can I Correct A Wrong Social Security Number On My Tax Return

According to the Internal Revenue Service, one of the most common errors on tax returns is writing down the wrong Social Security number or forgetting to include the number on the return. Mistakenly writing down the wrong Social Security number on your tax return can prevent the IRS from giving you credit for the return you filed, tax breaks for the dependents you claimed and the payments you submitted. To fix the problem, you need to file an amended tax return.

You May Like: How To File 2 Different State Taxes

When You Do Need To File An Amended Return:

- You had a change in filing status.

- You recorded an incorrect income amount.

- Deductions or credits claimed are not correct.

Both state and federal forms may need to be filed including:

- state form;IT-40 or IT-40 PNR should be filed.

| Tax Years; 2021 and prior |

|

| Tax Years;;2022 and forward |

|

When there are changes to your income, exemptions, or credits, filing an amended return may result in a refund or tax due.

To ensure an amended return is complete DOR recommends:

Download And Prepare New Schedules And Attachments

When you prepare an amended return, the IRS only wants you to update figures that change. It doesn’t require you to complete an entire tax return. However, if any of the original schedules you filed will change because of your amendment, then those schedules must be prepared again and attached to your Form 1040X.

Don’t Miss: Where Can I Find My Property Tax Bill

Wheres My State Tax Refund New Mexico

The Tax & Revenue department of New Mexico provides information on their website about tax returns and refunds. To the check the status of your return, go to the Taxpayer Access Point page and click on Wheres My Refund? on the right of the page.

Taxpayers who filed electronically can expect a a refund to take six to eight weeks to process. The state asks that you wait at least eight weeks before calling with inquiries about your return. Paper returns will likely take eight to 12 weeks;to process. The state advises waiting 12 weeks before calling with refund status questions.

I Filed Taxes In The Wrong State How Can I Correct This

I just found out I’ve been filing taxes in the wrong state. I’m military and I’ve move a few times which has caused me some confusion. I thought I was supposed to file taxes based on the state I was in. Recently I found documentation stating my state of residency is South Carolina. How do I correct the returns I’ve submitted in the past to make them reflect SC? How can I fix this?

You May Like: What Is The Tax In Georgia

Wheres My State Tax Refund West Virginia

Check on your state tax return by vising the West Virginia State Tax Departments website. On the right side of the page, you will see a link called Wheres My Refund? This link will take you to the;refund status page. Enter your SSN, the tax year and the amount of your refund in order to check your status.

The state is implementing new security measures for the 2017 tax year, which may slow down the turnaround time for your refund. It advises only calling to ask about your refund if more than eight weeks have passed since you filed.

Wheres My State Tax Refund Maryland

Visit the Comptrollers website to check the status of your Maryland tax refund. All you need to do is enter your SSN and your refund amount. Joint filers can check their status by using the first SSN on their return.

According to the state, it usually processes e-filed returns the same day that it receives them. That means you can expect your refund to arrive not too long after you file your taxes. On the other hand, paper returns typically take 30 days to process. For security reasons, it is not possible to verify any of your tax return information over the phone.

Also Check: How To Buy Tax Lien Properties In California

Tips For Managing Your Taxes

- Your taxes should be accounted for in your long-term financial plan. If you need professional guidance on how to build a financial plan, consider working with a financial advisor.;SmartAssets free matching tool can pair you with up to three advisors in your area. Get started now.

- Each state will process tax returns at a different pace. On the other hand, the IRS generally processes federal returns at the same pace, no matter where you live. Heres a federal refund schedule;to give you an idea of when to expect your refund.

You Can File An Amended Tax Return On Your Own

People with simple tax situations and small changes might be able file an amended tax return on their own.;Many major tax software packages;include modules that will file an amended tax return. Many tax preparers are happy to file amended returns as well.

And note: Amending your federal tax return could mean having to amend your state tax return too.

Also Check: How Much Tax Do You Have To Pay On Stocks

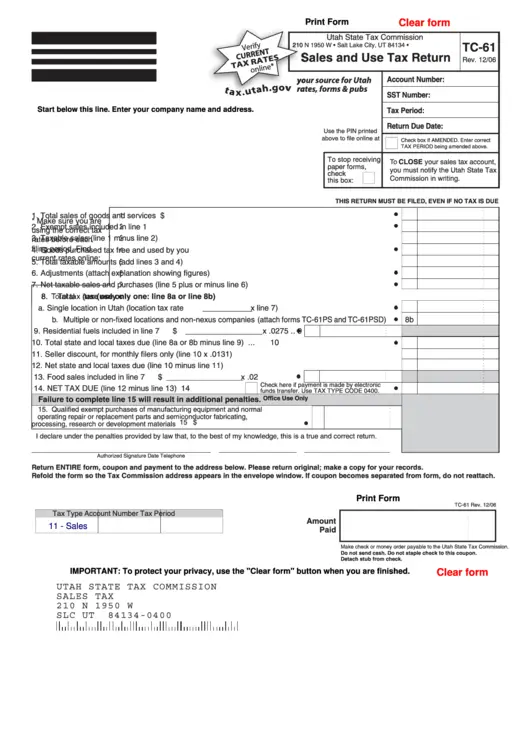

How To Amend A State Tax Return

Situations occur when you need to amend your state tax return. Failure to report income, unclaimed deductions and incorrect filing status are common reasons why tax returns are amended. You can not just amend your state tax return, you must also amend your federal tax return. Amending a state return may alter your tax liability, causing you to owe additional taxes to the government. If you have a tax preparer, this person can assist you in amending your state and federal tax returns. Otherwise, the Internal Revenue Service can help you begin the process.

How Can I Amend My Tax Return

Fortunately, if youve made an error on your tax return and need to amend it, dont worry, there are a few ways to do so that youll find quite simple.

First and foremost, if you need to amend your tax return,;do not file another return for that year.

You must wait to receive your Notice of Assessment before making any changes to your tax return. Amendments can be made for 10 previous years, so if you are filing this years , you can only amend back to 2010.

There are three ways to make amendments to your tax return: through CRA My Account, ReFile using your tax solution, or . There are rules and limitations for each one, and well take you through them so you have a better understanding of which one to choose.

For Quebec residents; If you need to amend your provincial return, please click;here;for instructions directly from Revenu Quebec.

Requesting an Amendment Online through CRA My Account

Requesting an amendment to your tax return online simply requires you to log in to your CRA;My Account;and click;Change my return.; You select the line that needs to be corrected and input the corrected value.

Do keep in mind that you cannot request an amendment to change any of the following:

Requesting an Amendment using ReFILE and your tax software

- Making or amending an election

- Applying for certain benefits

- Applying for the disability tax credit

- Have a current reassessment in progress

- Have not yet received the original return assessment

- If you have to change personal information

Recommended Reading: Where Can I Get Taxes Done For Free