How To Get One Of These Tax Refunds

Here’s the story behind the surprise refunds: Millions who lost their jobs last year because of the pandemic were forced to file for unemployment as businesses closed or cut back operations.

Normally, jobless benefits are taxed like any other income. But the COVID-19 rescue package Biden signed in March has made up to $10,200 in 2020 unemployment compensation tax-free for individual taxpayers. Couples filing jointly get a $20,400 exclusion.

If you collected unemployment last year and filed taxes ahead of Biden’s relief law, you may have overpaid based on what you thought you owed. So, you may have a refund coming, though only if your adjusted gross income was under $150,000.

Some 40 million Americans received unemployment payments in 2020, according to the Century Foundation, and the average beneficiary got $14,000. Of that, $10,200 is now tax-free leaving only $3,800 that’s taxable.

In early June, the IRS said it had identified 13 million taxpayers who were potentially eligible for the adjustment. If you’ve been hoping for a fourth stimulus check, one of these refunds might be the next best thing, for now.

How To Check The Status Of Your Tax Return

You should be able to check IRS tax refund status roughly 24 hours after you receive confirmation from the IRS that they have received your tax refund via e-File. You will need to wait at least four weeks if you mailed in your tax return.

The best way to check the status of your federal tax refund is to visit the Wheres My Refund page at the IRS website.

What you will need:

- Exact refund amount

You can also call the IRS at 1-800-829-1954 or 1-800-829-4477 or 1-800-829-1040 and inquire about your tax return status with an IRS customer service representative. Note that the IRS only updates tax return statuses once a day during the week, usually between midnight and 6 a.m. They do not update the status more than once a day, so checking throughout the day will not give you a different result.

Should I call the IRS to check my federal tax refund status?

The IRS has stated you should only call them if it has been:

- 21 days or more since you e-filed

- Six weeks or more since you mailed your return, or when

- Wheres My Refund tells you to contact the IRS

Why The Irs Might Send You An Extra Refund What We Can Tell You

For most people still without the refunds, the IRS says the best course of action is to wait patientlyas it has already confirmed that it will automatically adjust tax returns if they qualify for the unemployment refund.

Heres What You Need to Remember: Be aware that the IRS has already sent out more than eight million of the so-called plus-up or supplemental checks. These top-off funds, according to the agency, are for taxpayers who earlier in March received payments based on their 2019 tax returns but are eligible for a new or larger payment based on their recently processed 2020 tax returns.

Much like the frustrations some Americans had to endure in getting their hands on the coronavirusstimulus checks under President Joe Bidens American Rescue Plan, those who are still waiting for their refunds from 2020 unemployment benefits are also voicing their complaints.

But after weeks of making their unfortunate situation known in interviews and on social media platforms like , the Internal Revenue Service finally came through in a big way recently by disbursing nearly three million refunds to eligible Americans.

Because the occurred after some people filed their taxes, the IRS will take steps in the spring and summer to make the appropriate change to their return, which may result in a refund, the IRS stated.

The IRS plans to issue the next set of refunds in mid-June, the agency said.

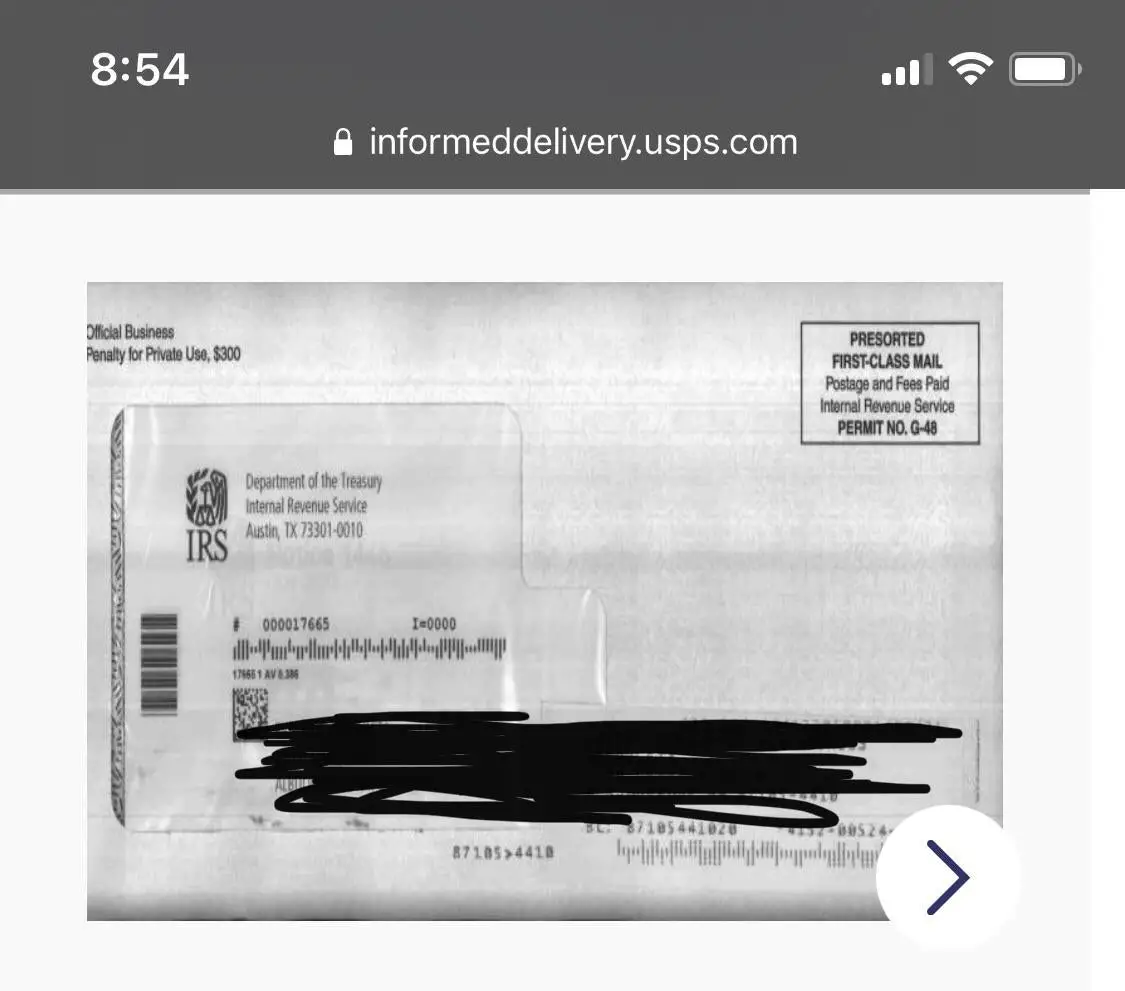

Image: Reuters.

Read Also: How Do Small Business Taxes Work

Avoid Promises That Sound Too Good To Be True

If any of the above delays apply to you, then there isnt much you can do except wait. No tax preparer or accountant will be able to push your tax refund through more quickly. Anyone who promises they can is most likely pushing a Tax Refund Anticipation Loan, which is an advance on your tax return.

In most cases, you receive your tax refund upfront and sign over the return to the company usually in exchange for a hefty fee. In almost every case you will be much better off waiting for your return instead of taking an advance and paying the excessive fees.

Your Tax Refund Has Been Sent

If you get this status then that means your refund has been sent to you either via mail or directly deposited into your bank account.

But weve seen people get this status and they still dont have their refund. So what exactly is going on?

Two big things that we see when you have this status and you dont have your refund.

a. If You Chose to Get Your Refund Via Mail

If the IRS says your tax refund for 2021 has been sent and you filed by mail, then try to give it about 7 to 10 days to actually come to your mailing address.

Again, there have been some major mail delays that have been going on.

Now after 10 days, you still dont have it then go back to your tax return and make sure you gave the IRS the correct address.

Weve seen before with our clients that sometimes they gave the IRS an old address or a secondary address like a family members house.

If this is the case then you will want to go to the IRS website, log into your account and update your address.

If these two things dont help you then keep reading to see if it could be something else.

b. If You Chose to Get Your Refund Via Direct Deposit

If you chose to get your refund direct deposited and you dont see it in your account and your status is refund sent, heres what you need to look at.

First, and just hasnt cleared yet.

That will help a lot of the time. If it doesnt, then go back to your tax return and make sure you gave the IRS the correct bank account number.

Recommended Reading: How Much To Withhold For Self Employment Taxes

Tax Filing Season Begins Jan 24 Irs Outlines Refund Timing And What To Expect In Advance Of April 18 Tax Deadline

IR-2022-08, January 10, 2022

WASHINGTON The Internal Revenue Service announced that the nation’s tax season will start on Monday, January 24, 2022, when the tax agency will begin accepting and processing 2021 tax year returns.

The January 24 start date for individual tax return filers allows the IRS time to perform programming and testing that is critical to ensuring IRS systems run smoothly. Updated programming helps ensure that eligible people can claim the proper amount of the Child Tax Credit after comparing their 2021 advance credits and claim any remaining stimulus money as a Recovery Rebate Credit when they file their 2021 tax return.

“Planning for the nation’s filing season process is a massive undertaking, and IRS teams have been working non-stop these past several months to prepare,” said IRS Commissioner Chuck Rettig. “The pandemic continues to create challenges, but the IRS reminds people there are important steps they can take to help ensure their tax return and refund don’t face processing delays. Filing electronically with direct deposit and avoiding a paper tax return is more important than ever this year. And we urge extra attention to those who received an Economic Impact Payment or an advance Child Tax Credit last year. People should make sure they report the correct amount on their tax return to avoid delays.”

Things To Consider If Your Refund Status Has Been Sent But Still Havent Received It

Now if the account number is correct and the status is that your refund has been sent, then we still need to look a little bit deeper.

Here are 4 more things to consider.

1. You owe taxes from a previous year.

Because If you owe taxes then it is very possible that the IRS will see that and use any tax refunds to apply against your tax liability.

This is pretty clear, but we see it all the time when clients just simply forget about the tax liabilities that they still need to pay off when thinking about their tax refund.

2. You owe someone money.

For example, if you owe child support, then it is very possible that your tax refund in 2021 can be garnished and used to support your other government liabilities.

Now you will likely know if the first two happen to you because the IRS will usually send a letter confirming how your tax refund was used to pay your liabilities.

3. Your tax accountant took your tax refund to pay themselves.

If you did not pay your accountant an upfront fee to do your taxes then some systems are set up to take a cut out of your tax refund for their tax fees.

So for example, if you were supposed to get back an $800 refund and your tax accountant charges $800 then you would end up not getting any additional money.

Most accountants will tell you this upfront, so you know what to expect. But there are some sketchy tax people who will overlook this information.

4. You owed the IRS.

The IRS even put some of these delay notices on their website.

Recommended Reading: Should I Charge Tax On Shopify

How The Treasury Offset Program Works

Here’s how the Treasury Offset Program works:

If you owe more money than the payment you were going to receive, then TOP will send the entire amount to the other government agency. If you owe less, TOP will send the agency the amount you owed, and then send you the remaining balance.

Here’s an example: you were going to receive a $1,500 federal tax refund. But you are delinquent on a student loan and have $1,000 outstanding. TOP will deduct $1,000 from your tax refund and send it to the correct government agency. It will also send you a notice of its action, along with the remaining $500 that was due to you as a tax refund.

The Internal Revenue Service can help you understand more about tax refund offsets.

The Average Tax Refund Last Filing Season

The average tax return for the 2020 tax year was $2,827, a 13.24 percent increase from the previous year. Nearly 240.2 million returns were filed in 2021, amounting to $736.2 billion.

There have been 125.3 million refunds issued totaling $317.7 billion. Of the refunds, more than 102 million were direct-deposited.

Don’t Miss: How To Pay Fica Taxes

Millions In State Tax Refunds Heading To Unclaimed Property If Taxpayers Dont Claim Themcontinue Reading

BATON ROUGE Louisiana taxpayers have until Oct. 6, 2022, to claim millions of dollars in state income tax refunds before they become unclaimed property.

The Louisiana Department of Revenue sent letters to 20,400 individual and business taxpayers advising them to claim their refunds before they are transferred by law to the Unclaimed Property Division of the state treasurers office. More than $36 million in unclaimed refunds is due for transfer if not claimed from LDR.

To claim a refund, complete and return to LDR the voucher in the Notice of Unclaimed Property letter dated Aug. 18, 2022. The department will issue paper checks to all taxpayers submitting completed vouchers by the Oct. 6 deadline.

Any refund not claimed by the deadline remains the property of the taxpayer, and can be retrieved from the Unclaimed Property Division.

A New Round Of Surprise Tax Refunds Is Coming This Week Will You Get One

If you’re still in financial pain from the COVID crisis, or if you could just use a few extra dollars, you’re in luck: An unexpected windfall may come your way this week.

The IRS will send out another cluster of surprise tax refunds, courtesy of the pandemic relief bill President Joe Biden signed earlier this year. A previous wave went out at the beginning of June.

At that time the tax agency distributed over 2.8 million refunds to taxpayers as automatic payments meaning it wasn’t necessary for recipients to fill out any forms or sit on hold for an hour to get their money.

An out-of-the-blue refund might provide welcome relief if you’re needing more money to help with expenses or pay down debt. Here’s a look at whether the week ahead might bring you cash back from the IRS.

You May Like: Do Churches Pay Payroll Taxes

We Have Received Your Return And It Is Being Processed No Further Information Is Available At This Time

This is a general processing status. Unless your return is selected for additional review, or we request additional information, this will be your status throughout processing until we schedule an issue date and update your status at that time. While your return is in this stage, our Call Center representatives have no further information available to assist you. As your refund status changes, this message will automatically update in our automated phone system, our online Check your refund status application, and in the account information available to our representatives.

Irs Is Holding Millions Of Tax Returns Delaying Refunds

May 6, 2021 / 6:49 AM / MoneyWatch

The IRS is holding 29 million tax returns for manual processing, delaying tax refunds for many Americans, according to the National Taxpayer Advocate, an independent arm of the tax agency that looks out for consumers’ interest. The delays are prompting some taxpayers to fret over social media about spending weeks waiting in limbo for their money.

Typically, the IRS sends most refunds within three weeks of taxpayers filing their return. But this year is complicated by several issues, including a backlog of 2019 paper tax returns that the IRS was unable to process after shuttering its offices during the coronavirus pandemic.

A recent notice from the IRS said that some people may experience a longer than average wait for their payments. That may especially impact tax returns that need a correction due to changes made by the Recovery Rebate Credit a tax credit adjustment for people who were owed more stimulus money or to verify income for the Earned Income Tax Credit and Additional Child Tax Credit , according to the agency.

“This work does not require us to correspond with taxpayers but does require special handling by an IRS employee, so in these instances, it is taking the IRS more than 21 days to issue any related refund,” the IRS said in a March 18 post.

Don’t Miss: How To Avoid Federal Taxes

Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you aren’t required to file a return, it might benefit you to file if:

- Federal taxes were withheld from your pay

and/or

- You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

Tips For Maximizing Your Tax Savings

- Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- When youre filing your taxes, a tax filing service can make things easier. They can take a lot of the confusion out of the process for you and help you file a more accurate tax return. They can also help you find deductions or exemptions that you wouldnt have known about on your own. Popular software choices include TurboTax and H& R Block.

- If you find that youre regularly receiving large tax refunds, this may mean that youre paying too much in taxes in the first place. In that case, you may want to adjust the withholding amounts on your W-4 so you can keep more money throughout the course of the year. Big refunds are exciting, but why give the IRS a free loan?

Don’t Miss: How To Avoid Capital Gains Tax On Land Sale

I Received A Validation Key Letter Will That Delay My Refund

In the best interest of all our taxpayers, the Colorado Department of Revenue implements measures to detect and prevent identity theft-related refund fraud. The Department has a “Validation Key” process where information will be requested to be entered on Revenue Online to validate their Colorado refund. Please be aware that if you do not respond to the validation key letter in a timely manner your refund will be delayed. Visit the Identity Verification web page for more information.

Estimated Irs Refund Tax Schedule For 2021 Tax Returns

In prior years, the IRS issued its refund tax schedule to provide a timeline of when you can expect to receive your tax refund. While the IRS no longer publishes a refund tax schedule, we put together an estimate of when you might expect to receive your tax refund based on previous years.

|

Date the IRS received your return |

Estimated direct deposit refund date |

Estimated check refund date |

|

May 13 |

Read Also: How Can I Make Payments For My Taxes