Employment Tax Mistakes / These 8 Payroll Errors Cost You Money How To Fix Them : How To Collect And Pay Employment Taxes Including Federal And State Income Tax Withholding Fica Tax Unemployment Taxes

Ten major tax mistakes to avoid and how you can avoid them. Many of the offers appearing on this site are from advert. How to write and calculate the circumference of a circle, that the mitochondria is the powerhouse of the cell. You’ll simply need to file an amended return either electronically or by mail. In some cases, the irs will catch your error and update the o.

Who Doesn’t Have To Pay Into Fica Taxes

Just about everyone contributes to FICA and withholdings. The major exemptions from FICA include:

- Civilian federal government employees hired before 1984.

- Around 25% of state and local government employees with certain pension plans.

- Some on-campus college student employees.

- Some workers in the country with certain types of non-immigrant visa status.

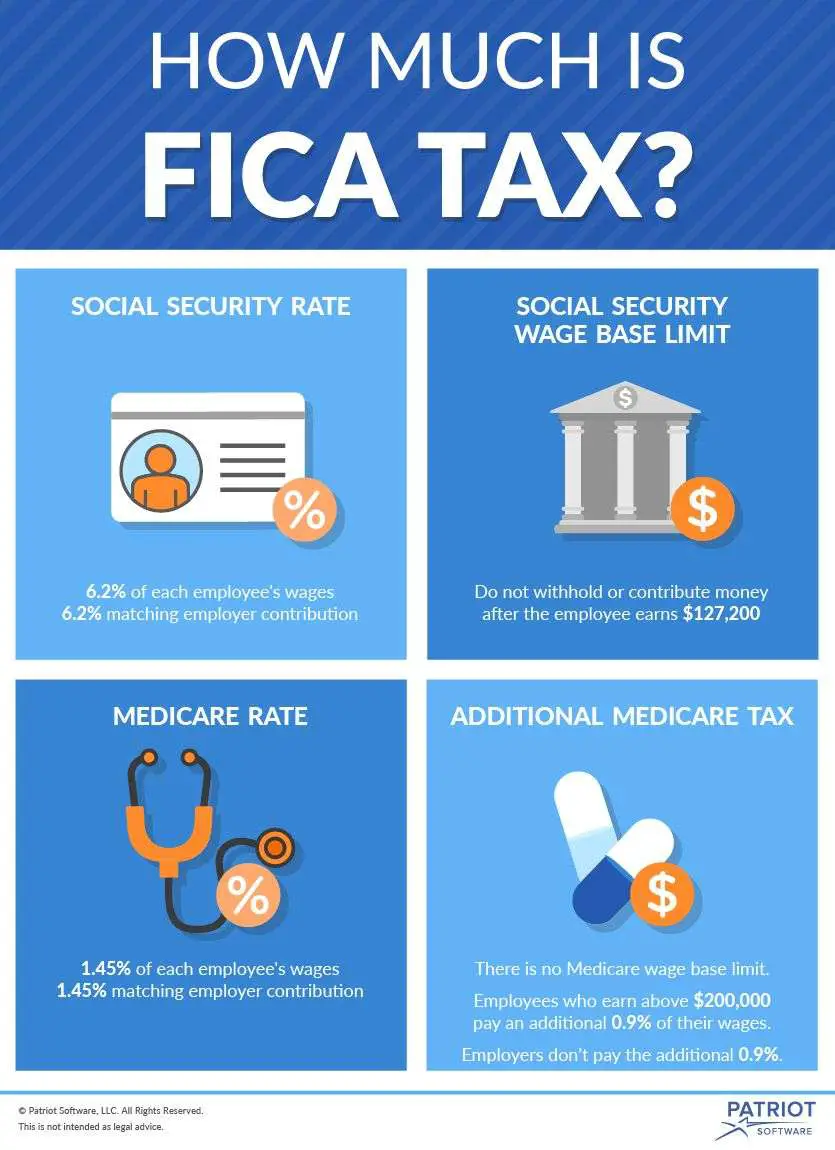

Fica Tax Withholding Rates

There are actually two different rate components, broken out as follows:

- The Social Security withholding rate is gross pay times 6.2% up to the maximum pay level for that year. This is the employee’s portion of the Social Security payment. You as the employer must pay 6.2% with no limit.

- The Medicare withholding rate is gross pay times 1.45 %, with a possible additional 0.9% for highly-paid employees. Your portion as an employer is also 1.45% with no limit, but you don’t have to pay the additional 0.9%

- For a total of 7.65% withheld, based on the employee’s gross pay.

Recommended Reading: Do You Have To Report Roth Ira On Taxes

What Is The Fica Withholding Process

Employers must withhold both the employees’ share of FICA taxes as well as the employer’s portion. These taxes first go through the IRS, followed by the Social Security Administration to fund retirement and disability payments. The remainder then goes to the federal government’s Medicare trust, which covers medical expenses for individuals aged 65 and older, or for those who qualify for disability benefits.

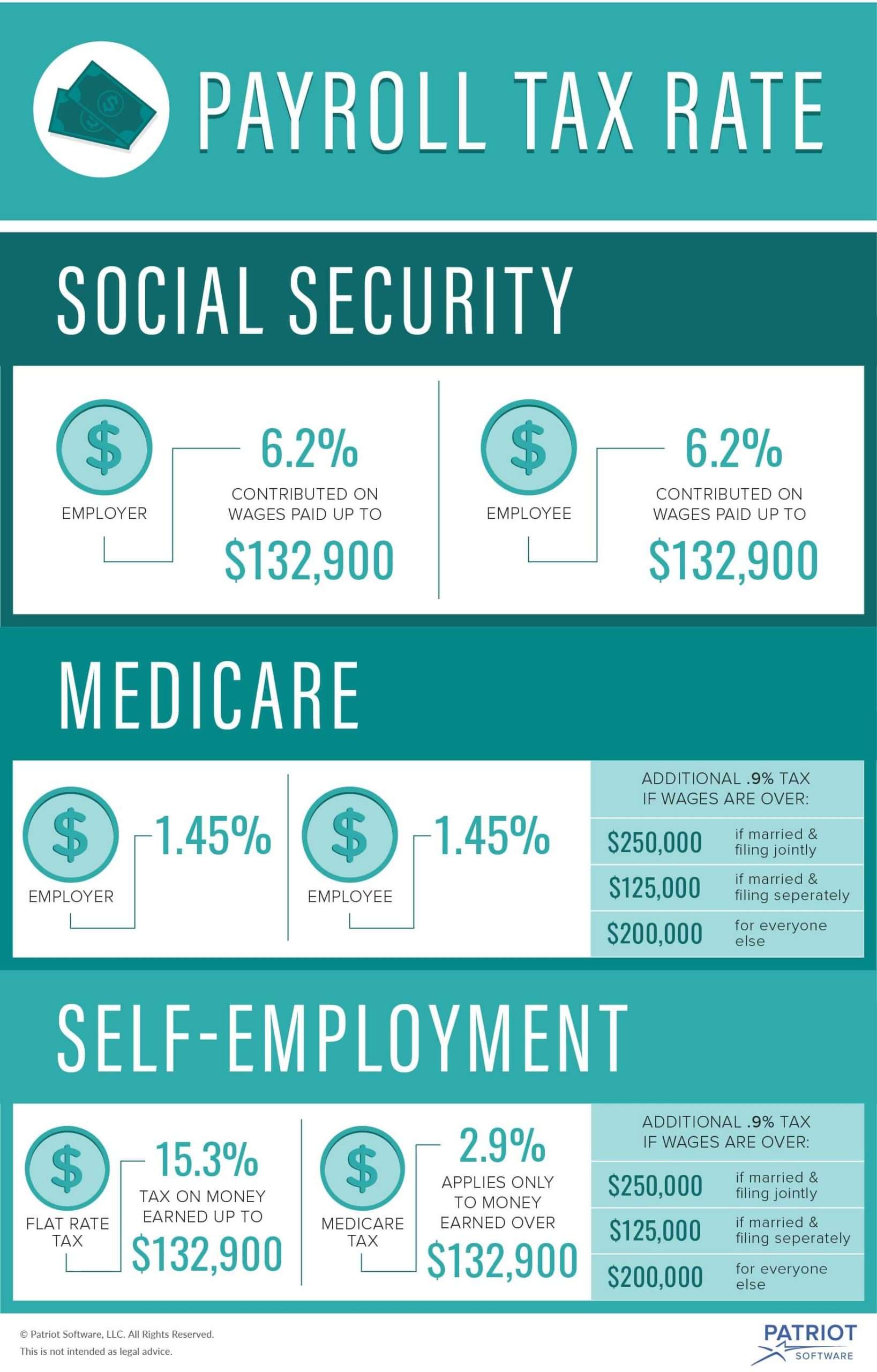

How Does Fica Work For Those Who Are Self

Self-employed workers and independent contractors pay both the employer and employee contributions for FICA. This is mandated by the Self-Employment Contributions Act . You can use Schedule SE to figure out how much tax is due on your self-employment net earnings.

The total contribution amounts taken from net earnings are:

- 12.4% Social Security tax: This amount is withheld from the first $142,800 an employee makes in 2021.

- 2.9% Medicare tax.

- 0.9% Medicare surtax: For single filers earning more than $200,000 per calendar year or joint filers earning more than $250,000 per calendar year.

Self-employed workers will pay self-employment tax based on the net income from their business, which is calculated using form Schedule SE. The Social Security Administration uses your historical Social Security earnings record to determine your benefits under the social security program.

Also Check: How Much Does H& r Block Charge To Do Taxes

Who Pays Fica Tax

If you work a typical job , your employer will automatically deduct your share of the FICA taxes from your paycheck. It will send that share directly to the IRS for you. Additionally, your employer will pay its half of the tax directly to the IRS.

Self-employed people must pay both the employer side and the employee side of the FICA tax.

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents you’ll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Also Check: Do You Have To Report Roth Ira On Taxes

How To Pay Social Security And Medicare Taxes

This article was co-authored by Darron Kendrick, CPA, MA. Darron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984. This article has been viewed 28,185 times.

Most people working in the United States are required to pay Social Security and Medicare taxes. If you earn wages from an employer, these are called Federal Insurance Contributions Act taxes, and they are split 50/50 between the two of you. If you are self-employed, according to the Self-Employment Contributions Act , you must pay the full amount of these taxes yourself. When completing your yearly income taxes, you will need to complete additional forms in order to calculate the amount of tax you owe and to pay the IRS.

What Is The Fica Tax Rate For The Self

If youre wondering, what is the FICA tax rate as a self-employed person? its the same tax rate as a small business owner who employs full-time W-2 employees.

FICA tax is akin to self-employment taxes so youre taxed at a rate of 15.3% for both FICA tax or self-employment tax. Self-employment tax is calculated in the same fashion as FICA tax for employees 12.4% for Social Security, 2.9% for Medicare taxes. Self-employed taxpayers must figure and file quarterly tax payments since they dont have an employer.

While this seems like a lot of extra tax to pay, theres good news: as a self-employed individual, you can deduct half of your self-employment tax on your tax returns, giving you an opportunity to reduce your overall taxable business income.

Looking for other ways to lower your taxable income? Check out these self-employment tax deductions.

Recommended Reading: Otter Tail County Tax Forfeited Land

How Fica Tax And Tax Withholding Work In 2021

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Payroll taxes, including FICA tax or withholding tax, are what your employer deducts from your pay and sends to the IRS, state or other tax authority on your behalf. Here are the key factors, and why your tax withholding is important to monitor.

Fica Tax For The Self

The self-employed dont have an employer to collect and pay FICA taxes. Instead, you must pay both the employer and worker amounts , and deduct one-half of the self-employment taxes on your personal tax return.

To explain the steps involved, lets assume that Mary works as a freelance graphic designer.

Don’t Miss: Do I Have To Report Roth Ira Contributions On My Taxes

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual’s Medicare wages that exceed a threshold amount based on the taxpayer’s filing status. Employers are responsible for withholding the 0.9% Additional Medicare Tax on an individual’s wages paid in excess of $200,000 in a calendar year, without regard to filing status. An employer is required to begin withholding Additional Medicare Tax in the pay period in which it pays wages in excess of $200,000 to an employee and continue to withhold it each pay period until the end of the calendar year. There’s no employer match for Additional Medicare Tax. For more information, see the Instructions for Form 8959 and Questions and Answers for the Additional Medicare Tax.

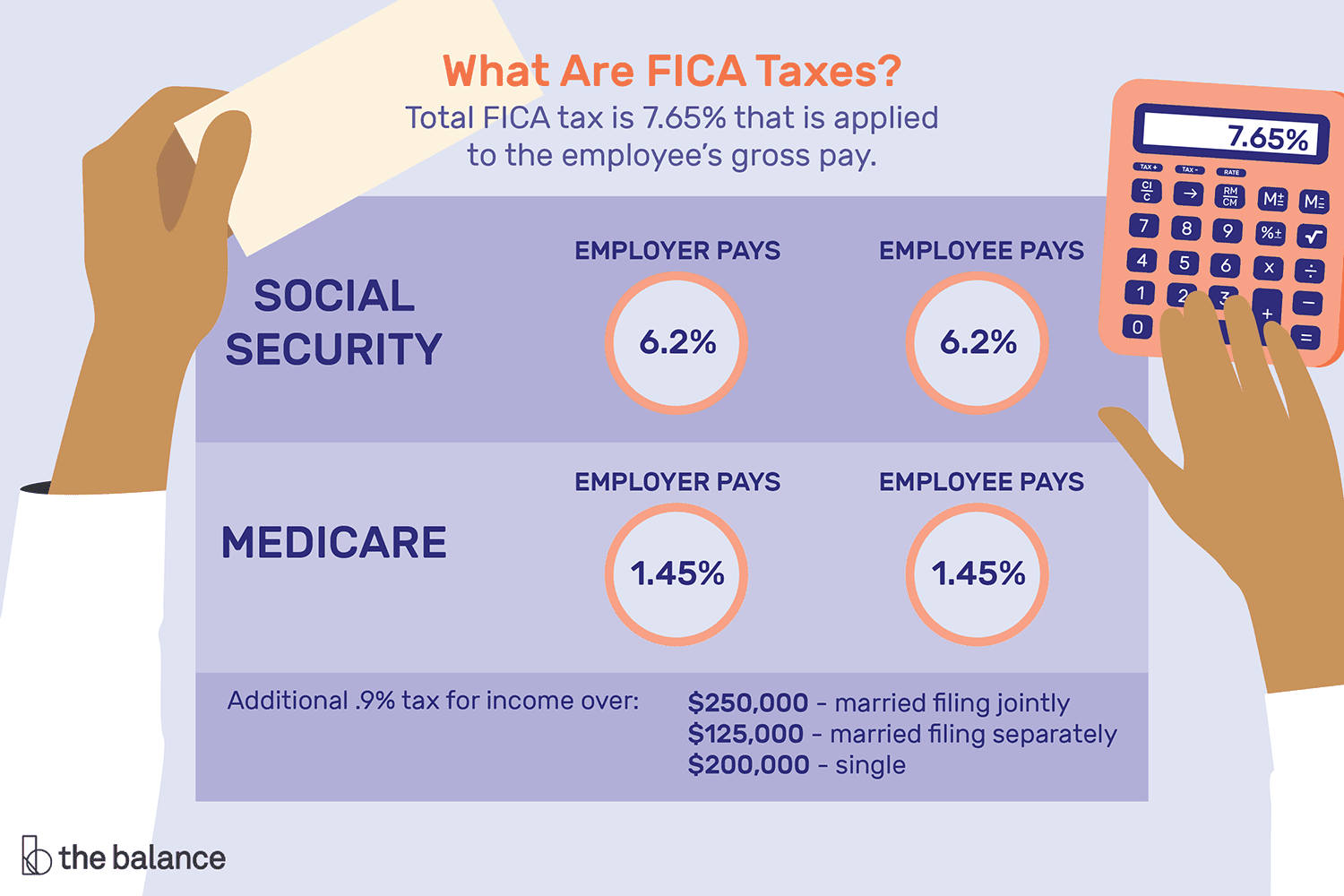

How Much Is Fica Tax

Employers and employees each pay the FICA tax rate of 7.65%, which goes toward Social Security and Medicare taxes. Again, this rate is applied to each employees taxable wages. All in all, the IRS receives 15.3% on each employees wages for FICA tax.

You withhold 7.65% of each employees wages each pay period. And, you contribute a matching 7.65% for the employer portion.

Of this FICA tax amount of 7.65%, 6.2% goes toward Social Security tax and 1.45% goes toward Medicare tax.

Take a look at the breakdown of FICA tax:

- Employee: 6.2% Social Security / 1.45% Medicare

- Employer: 6.2% Social Security / 1.45% Medicare

Recommended Reading: How Can I Make Payments For My Taxes

Exemption From Social Security Or Medicare Taxes

Under certain circumstances, New York City employees may be exempt from Social Security and/or Medicare taxes. If you fall into one of the following categories, you may be exempt from Social Security or Medicare taxes:

- Not a pension member and contribute at least 7.5% or more to a single defined contribution plan, such as the Deferred Compensation 401 or 457 plans, or a 403 Tax Deferred Annuity . Get more information about Social Security & Medicare Tax Exemptions for Non-Members of Pension Plans.

- City pension plan member in 1957 electing not to have Social Security

- Half time CUNY student working at CUNY

- Non-resident student or teacher admitted to the US under certain visas

- Foster Grandparent working for the Department of Aging

- Election Inspector/Worker earning less than $2,000 from the Board of Elections in 2021

- Beneficiary of a deceased employee receiving payment after the calendar year of the employee’s death

- Temporary emergency relief employee.

Learn more about Social Security & Medicare Tax Exemptions for Other NYC Employees.

The Social Security Protection Act of 2004 requires newly hired public employees to sign a “Statement Concerning Your Employment in a Job Not Covered by Social Security”. Form SSA-1495 explains the potential effects of two provisions in the Social Security law on workers whose earnings are not covered under Social Security.

Fica Tax Income Limits

Social Security tax only applies to your first $142,800 of income . You donât have to pay any Social Security taxes on income you earn above $142,800. When your income from a single employer is above the limit, your employer should stop removing Social Security taxes on the applicable income. If you overpay Social Security taxes, you can get the overpayment refunded to you on your federal income tax return.

Medicare tax applies to all of your income. There is also an additional Medicare tax of 0.9%, sometimes called the Medicare surtax, that could bring your total Medicare tax up to 2.35%. The Medicare surtax applies to any income you have above $200,000 if your filing status is single or head of household. Joint filers pay the surtax on income above $250,000. Married individuals who choose to file separate tax returns must pay the additional Medicare tax on income above $125,000.

Don’t Miss: Www.1040paytax.com

What Is The Tax Rate

Right now, the FICA tax is set at 6.2% for Social Security and 1.45% for Medicare. Both the employee and the employer must pay the 6.2% Social Security tax and the 1.45% Medicare tax. Together the FICA tax is 15.3% of all wages that you earn.

The social security tax is paid only on the first $142,800 of your income. That means if you earn $150,000, you wont pay the 6.2% tax on the last $7,200 of your income. Your employer doesnt have to pay its half of the Social Security tax on the last $7,200 of your income either. Thats a great tax break for high income earners.

However, the tax break doesnt extend to the 1.45% Medicare portion of the tax. High income earners have to pay an additional 0.9% Medicare tax if their income exceeds certain thresholds.

In 2021, the thresholds were:

- $200,000 for a Single Filer

- $125,000 for married filing separately

- $250,000 for married filing jointly

Find Experts Who Can Help

Use QuickBooks®Self-Employed and take charge of your taxes.

QuickBooks can track the income and expenses on Schedule C, and calculate the estimated tax payments for income taxes. The software has a great app to track business mileage automatically using a mobile device.

The experts at QuickBooks can generate your tax filings and manage self-employment taxes. You can also speak with a CPA.

Use QuickBooks to reduce the time and hassle of tax filings, and get back to managing your business.

Also Check: How Much Does H& r Block Charge To Do Taxes

Is Fica Taxation Applicable To All Income

The FICA tax is applicable to all earned income. This includes salary, tips, bonuses, commissions, and anything else that counts as wages. Rent, some forms of royalties, capital gains, and dividends are exempt from FICA taxes.

A5. Taking time away from work can impact your overall earnings and your day-to-day finances. It can also impact your ability to save and invest in your retirement, contribute to your social security benefits and more. #CreditChat

Understanding Social Security Taxes

If you work for someone else, Social Security taxes are deducted from your paycheck. The Social Security tax rate for 2021 is 6.2%, plus 1.45% for the Medicare tax. So, if your annual salary is $50,000, the amount that will go to Social Security over the course of the year is $3,100, plus $725, for a total of $3,825.

Your employer will match an additional $3,825 over the course of the year, and it will also report your Social Security wages to the government. When you retire or if you become disabled, the government uses your history of Social Security wages and tax credits to calculate the benefit payments youll receive.

Don’t Miss: Have My Taxes Been Accepted

How Does Fica Impact Your Social Security And Medicare Benefits In Retirement

The amount of money you’ll receive in monthly Social Security benefits when you retire is based on a formula that looks at the average you earned during the 35 years in which you earned the most money. You can use the Social Security Administration’s calculator to estimate your benefits.

- Several things will affect your benefits like how much your spouse earned, if your spouse has passed away, and if you got divorced.

- The money you contribute to FICA won’t directly impact how much you receive in Social Security benefits nor how much you’ll pay for Medicare coverage.

FICA and withholding taxes are important to understand so you know where your money is going. Although the amount you contribute to FICA is determined by the government, you do have some control over other withholdings based on your W-4 Form answers. You can also keep your hard-earned money in your pocket by making sure you don’t miss any tax deductions.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. Whether you have a simple or complex tax situation, we’ve got you covered. Feel confident doing your own taxes.

Why Do I Have To Pay Fica Tax

Employers have to withhold taxes from employee paychecks because taxes are a pay-as-you-go arrangement in the United States. When you earn money, the IRS wants its cut as soon as possible.

Some people are exempt workers, which means they elect not to have federal income tax withheld from their paychecks. Social Security and Medicare taxes will still come out of their checks, though.

Typically, you become exempt from withholding only if two things are true:

-

You got a refund of all your federal income tax withheld last year because you had no tax liability.

-

You expect the same thing to happen this year.

Read Also: 1040paytax.com Safe

Payments Not Subject To Fica Taxes

FICA doesnât apply to all types of pay. Here are a few of the more common types of payments to employees that arenât subject to FICA tax withholding:

- Wages paid after the workerâs death

- Wages paid to a disabled worker after becoming eligible for Social Security disability insurance benefits

- Employee expense reimbursements within the specific government rate for per diems or standard mileage

- Children under 18 employed by a parent

- Employer contributions to a qualified retirement or pension plan

- Tip income if less then $20 in a month

- Workers compensation payments

For a complete list of special rules for various types of payments, see the table in IRS Publication 15.

Are There Additional Employer Responsibilities For Fica Taxes

Withholding FICA and depositing it with the government is only part of employer responsibilities for this tax. Additional responsibilities include:

- Filing employer tax returns to report FICA.

- Reporting Social Security and Medicare tax payments on employees’ Form W-2.

Employers have no FICA responsibilities with respect to independent contractors or workers who are employees of another company .

Also Check: How Much Taxes Do You Pay On Slot Machine Winnings

What If An Employer Withholds Too Much Fica Tax From An Employee’s Pay

If you over-withhold FICA from an employee’s pay, you should take steps to correct the problem. Here are the options:

- Refund the excess withholding to the employee. This can be done by taking out less from the employee’s paycheck to offset the excess withholding. This is usually a good option.

- File a claim with the IRS to recoup the excess payment. This may be necessary if the employee is no longer on your payroll and there are no other options to adjust future withholding.

Use Form 941-X, Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund, or Form 944-X, Adjusted Employer’s Annual Federal Tax Return or Claim for Refund to make the make an adjustment in withholding or a claim for refund. If you do nothing, the employee can claim the excess payment as a tax credit on an income tax return.

Medicare Surtax For Highly Paid Employees

After the passage of the Affordable Care Act in 2010, employees who make over a certain amount of money each year must pay an additional Medicare surtax. Once an employees wages reach $200,000, you must start withholding 0.9% on any wages exceeding that threshold. There is no employer matching in this case only employees pay the Medicare surtax.

Also Check: Do You Report Roth Ira Contributions On Taxes