Planning Related To The Ordering The Use Of Current Year Contributions And Contribution Carryovers

In light of the above, there are significant questions to be considered in choosing which deductions will yield the most favorable results. An individual computes their charitable contribution deduction by applying the AGI limits first to current year charitable contributions that do not qualify for the 100% of AGI deduction and then to carryover contributions within each category: 60%, 50%, 30% other than capital gain property, 30% capital gain property, and 20%. In other words, current year contributions of 30% capital gain property will be followed by the contribution carryover of 30% capital gain property and both will precede 20% current year contributions and 20% contribution carryover. Page 14 of IRS Publication 526 provides a more detailed explanation. The carryover period for charitable contributions is five years.

The impact on charitable contribution carryovers, and the five year carryover period, should be considered when making the qualified contribution deduction election. The election may help use prior year contribution carryovers since current contribution carryovers are used before qualified contribution deductions when applying AGI limits.

State And Local Tax Treatment Of Charitable Contributions

In addition to the federal income tax deduction for qualified gifts to charity available to individual taxpayers, a number of states and local jurisdictions that tax individual income also permit resident taxpayers to deduct or receive a tax credit for qualified gifts to charity.

Please refer to the notes below for important disclosures. Potential Donors should consult their own tax advisors before contributing.

| Residence | Maximum State/Local Charitable Tax Benefit |

|---|---|

| Alabama |

| Maximum State/Local Charitable Tax Benefit | |

|---|---|

| Missouri | |

| N/A | 0.00% |

* Charitable tax benefit is reduced at higher contributor income levels or subject to a cap. See below for additional information. Maximum state/local tax benefits indicated above are based on the treatment of qualified charitable contributions and tax rates in effect as of March 2021. State and local income tax rates and the treatment of charitable contributions for state and local tax purposes are subject to change.

* In the following jurisdictions, the state and local tax benefits to individual resident taxpayers of charitable contributions are subject to additional limitations:

Procedure To Avail The Deductions Under 80ggc

The procedure to avail the said tax deduction under Section 80GGC is fairly easy and convenient. The taxpayer can file their tax returns by including the given amount of contribution in the space provided under Section 80GGC in the Income Tax Return form. The Section appears under Chapter VI-A of the Income Tax Return Form. The deduction can be availed by contributing in any cashless form including online banking, cheques, debit cards, credit cards, demand drafts etc.

The details of the donations are to be submitted to the employer for incorporating it in form 16. Otherwise, the details are to be mentioned in the specified column while submitting tax returns. The political party shall issue a receipt containing the name and address of the party, amount donated, along with the PAN and TAN of the party. This donation is deducted directly from the salary, and the donation receipt is in the name of the employer. The employee can claim a deduction if he has this certificate from the employer, which confirms that the contribution was made from the employee’s salary account.

Recommended Reading: How Do Tax Liens Work

How A Gift Is Used Affects Donor Value

If you’re donating tangible personal property, what the charity does with the item affects how much you can deduct.

- If you donate land so the local homeless shelter can build a new facility to house more people, you can write off the full market value.

- If you donate a work of art to the shelter for its fundraising auction, you only get a deduction for the price you paid for the artwork.

- What if you donated the piece of art to a museum that will display it as part of its collection? In that case, you get to deduct the full market value.

For property worth more than $5,000 , you’ll need to get a formal appraisal. You’ll also have to make sure the appraiser is a member of a recognized professional group or meets minimum education and experience guidelines. If you don’t, the IRS can disallow your deduction.

Limits For Charitable Tax Deductions

There are no limits on the amount of charitable contributions you can deduct in 2020 or 2021, because the limits were lifted during the coronavirus pandemic. In previous years, you could only claim deductions in a given year for charitable gifts worth up to 50% of your adjusted gross income . If you have any deductions you canât claim because in a year, you can carry over excess donations for up to five years.

For example, letâs say your AGI for the year is $50,000 and you donated $70,000 of eligible donations. Normally, you can only claim $25,000 in deductions for the first year since thatâs 50% of your AGI, but you could claim another $25,000 next year and then the final $10,000 the year after.

Read Also: When Does Income Tax Have To Be Filed

Itemizing Charitable Deductions Under The Cares Act

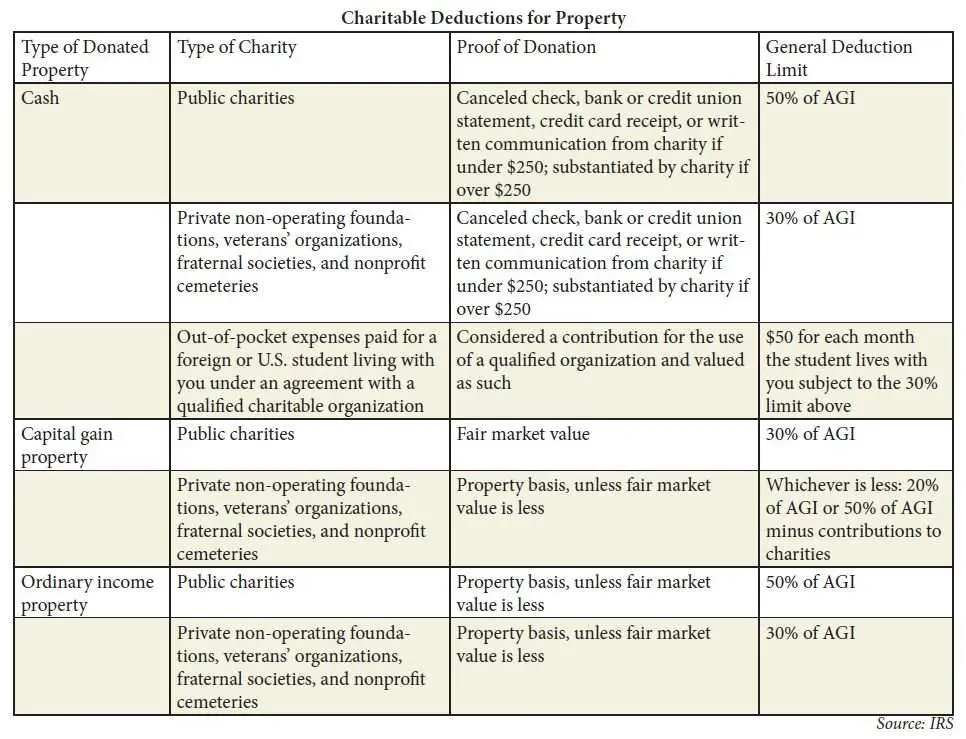

As a general rule, treatment is more favorable for public charities than for private foundations, and for cash donations than for donations of other types of property.

For those who itemize, the charitable deduction limit may be restricted based on the type of property donated, the taxpayers circumstances, and how the IRS classifies the charity receiving the donation. As a general rule, treatment is more favorable for public charities than for private foundations, and for cash donations than for donations of other types of property.

If a taxpayer is donating to a public charity, donor-advised fund, or supporting organization, in tax years other than 2020 they may deduct a cash gift of up to 60% of their contribution base. The contribution base is generally equivalent to the donors adjusted gross income . For gifts of long-term capital gain property, donors may deduct the fair market value of the donation up to 30% of the donors contribution base, in addition to avoiding any capital gains tax that would otherwise have been due on the appreciated assets. For gifts of short-term capital gain property, taxpayers may deduct up to 50% of the contribution base . The difference between long-term and short-term capital gain is whether the asset was held for more than a year or one year or less .

Under the CARES Act, the only change to the rules above is that for tax year 2020, cash donations to a public charity may be deducted up to 100% of the donors contribution base.

Reliance On Tax Exempt Organization Search

Revenue Procedure 2011-33, 2011-25 I.R.B. 887 describes the extent to which grantors and contributors may rely on the listing of an organization in electronic Publication 78 and the IRS Business Master File extract) in determining the deductibility of contributions to such organization. Grantors and contributors may continue to rely on the Pub.78 data contained in Tax Exempt Organization Search to the same extent provided for in Revenue Procedure 2011-33.

Similar reliance provisions apply to an organization’s foundation classification as it appears in the list. See also Revenue Procedure 89-23.

You May Like: How Can I Check My Income Tax Refund Status

Can You Deduct Charitable Contributions If You Dont Itemize Your Taxes

Other than the temporary $300 exception for 2020 and 2021, in order to deduct a charitable contribution, you must itemize your taxes. THIS. IS. HUGE.

With increased standard deductions, very few American taxpayers will itemize their taxes, and opt for the standard deduction instead. If you take the standard deduction, you cant deduct charitable contributions.

$300 Deduction If You Claim The Standard Deduction

For the 2021 tax year, people who take the standard deduction can deduction up to $300 of cash donations to charity. Note the emphasis on the word “cash” this deduction isn’t available if you donate a car, clothing, food, furniture, or any other property. Donations to donor advised funds and certain organizations that support charities are not deductible, either. Contributions carried forward from prior years and most cash contributions to charitable remainder trusts are excluded, too.

The $300 amount is per person. So, if you’re married and filing a joint return, you can deduct a total of $600 on your 2021 tax return . The deduction won’t reduce your 2021 adjusted gross income, though.

This new deduction was originally allowed for 2020 returns only. However, the recent COVID-relief and government spending bill extended the $300 charitable deduction for non-itemizers for another year. There are some differences between the 2020 and 2021 deduction, though. For instance, the maximum deduction for joint filers is $300 for 2020 returns. The 2020 deduction also reduces your AGI.

Don’t Miss: How To Pay My Federal Taxes Online

What Kind Of Gifts And Donations Is Tax Deductible

Donations of $2 or more made to an organisation that is defined by the Australian Tax Office as a Deductible Gift Recipient can be considered tax deductible donations. Cancer Council NSW is a DGR. Click here for more information.

If you receive something in exchange for the donation then it doesnt qualify as a tax deduction. The Tax Office defines this as a transaction where you receive a good or service in return for the money donated. However receiving tokens, like lapel badges and stickers that promote the organisation, are acceptable and still qualify as a tax deduction.

Are All Donations Tax Deductible

No. The IRS only allows you to deduct donations from your taxable income if the donation was made to a qualified tax-exempt organization. 501 organizations are included, but other types of orgs are as well. Make sure you do your research to determine if the organization is tax exempt. The big exceptions are that contributions made to political campaigns or organizations or for-profit organizations are not qualified charitable contributions, and are not tax deductible.

Also Check: How To Calculate Payroll Tax Expense

Cash Donations Less Than $250

You must prove the donation amount if you want to deduct it with one of these:

- Receipt

- Bank or credit union statements

- Canceled checks

- Date

- Donation amount

For donations you made by payroll deduction, you can prove your donations if you have both of these:

- Document showing the amount withheld, like a pay stub or W-2 from your employer

- Pledge card or other document from the organization. It must state that they dont provide goods or services for donations made by payroll deduction.

Can I Take A Fair Market Value Deduction For Donating Private S

Yes, it’s possible to deduct the full fair market value of the contribution if the recipient organization is a public charity. But tactically, the answer depends on whether the charity is able to accept private stock as a gift. Most charitable organizations simply dont have the resources, expertise or appetite to efficiently accept and liquidate these types of assets, particularly in a time crunch at the end of the year.

However, Fidelity Charitable has a team of in-house specialists who work with donors and their advisors to facilitate charitable donations of S-corp and private C-corp stock every day . Once you make a donation to Fidelity Charitable and the asset is sold, youre able to recommend grants to your favorite charities, quickly and easily.

And by donating private stock, you generally do not pay capital gains taxes on Fidelity Charitable’s subsequent sale of the stock. There’s a second tax benefit as well: you’ll generally be able to deduct the full FMV as determined by a qualified appraisal.

Read Also: Is Past Year Tax Legit

How To Claim A Charitable Deduction On Your Taxes

If youâre claiming the above-the-line charitable deduction, all you need to do is write the amount of your charitable contributions on the correct line of Form 1040. The deduction was on line 10b for 2020 taxes. Hereâs how to fill out your Form 1040 if you need more help.

If youâre itemizing to claim the charitable deduction, just fill out the “Gifts to Charity” section of Schedule A by entering the amount of money or the value of items that you donated. There are some extra steps if you made individual donations worth at least $250, plus an extra form to fill out if you had donations of $500 or more. There are also income limits for charitable donations, which we discuss in a later section.

Always keep a record of your donations in case you ever have to go through an IRS audit. If the organization doesnât give you a receipt, ask for one. A copy of your credit card statement or bank statement may also be enough if itâs clear who received the payment.

Keeping Records Of Your Donation

Your written records must indicate the name of the charitable organization, the date of your contribution, and the amount that you gave. Canceled checks work well because the name of the charity, the date, and the amount of the gift all appear there. Bank statements are good, too, when they show a gift paid by debit card, and credit card statements work when they show this same information.

Charitable organizations will often provide donors with written letters of acknowledgment or receipts. The IRS can disallow charitable donations of $250 or more if you don’t have a written acknowledgment from the charity to document your gift, in addition to your other records.

You might need a separate acknowledgment for each gift if you make more than one contribution over this amount. Otherwise, the single acknowledgment must list each tax-deductible donation in detail with the date you made it.

Don’t Miss: How To Determine Taxes On Paycheck

Federal Tax Deductions For Charitable Donations

You may be able to claim a deduction on your federal taxes if you donated to a 5013 organization. To deduct donations, you must file a Schedule A with your tax form. With proper documentation, you can claim vehicle or cash donations. Or, if you want to deduct a non-cash donation, you’ll also have to fill out Form 8283.

Not All Donations Qualify For Deductions

The tax law imposes requirements designed to ensure that deductions are allowed only for contributions that serve a charitable purpose. Therefore, a recipient must qualify for tax-exempt status as required by the tax code and determined by the Internal Revenue Service .

The list of eligible entities includes organizations operated exclusively for religious, charitable, scientific, literary, or educational purposes the prevention of cruelty to animals or children or the development of amateur sports. Nonprofit veterans organizations, fraternal lodge groups, cemetery and burial companies, and certain legal corporations can also qualify if donations are designated for eligible purposes.

To determine whether an organization qualifies to receive deductible contributions, the IRS Tax Exempt Organization Search tool can help verify an organizations tax-exempt status and determine its eligibility for deductible contributions. A donation to a federal, state, or local government may be eligible if the gift is earmarked for public purposes . Gifts to benefit a particular individual, a for-profit business, or a private interest do not qualify as deductible charitable contributions.

To get the potential tax benefits, individual taxpayers must file IRS Form 1040. Except for a special benefit available only in 2020, charitable contributions must be claimed as itemized deductions on Schedule A.

Recommended Reading: Where’s My Tax Refund Ga

Details About Cares Act

The inclusion of an expanded charitable giving incentive is a critical acknowledgement by Congress that the work of nonprofits like Make-A-Wish are essential services. Indeed, now more than ever children facing critical illnesses need the hope of their wish coming true. It is the first time Congress has passed this type of giving incentive in response to disaster or national emergency.

Leverage Deduction Rules Or A Bunching Strategy

Donors who bunched two or more years of contributions into 2020 and subsequently will take the standard deduction for 2021 may also consider taking the special $300 or $600 deduction for cash donations made to operating charities in 2021.1

You May Like: How To Grieve Property Taxes

What Is The Eligibility Criteria U/s 80ggc

- Section 80GGC can be claimed by any person except any local authority or artificial juridical persons who are wholly or partly funded by the government. The following groups are specified under the Section 80GGC to make the political contribution- an individual, a Hindu Undivided Family , a firm, an AOP or BOI and an Artificial Juridical Person. The last candidate in the list should not be funded by the government.

- The tax deduction benefits can also be availed by making donations to multiple political parties rather than only one.

- Deduction limit- While the entire contribution is eligible for the deduction, it should be made sure that the mode for the donation should never be in cash.