When Can I Check The Status Of My Refund

The IRS says that you should wait at least 24 hours after you e-file your federal tax return before you check. If you filed by paper, expect to wait at least four weeks before you check Wheres My Refund. The information is updated nightly so you dont need to check more than once a day.

The information about the status of your refund will be available for at least a few months. If you file before July 1, the refund information will be available online at Wheres My Refund? until the second or third week in December. If you file after July 1, the information will be available until you file a tax return for a more current tax year.

Im A Nonresident Alien I Dont Have To Pay Us Federal Income Tax How Do I Claim A Refund For Federal Taxes Withheld On Income From A Us Source When Can I Expect To Receive My Refund

To claim a refund of federal taxes withheld on income from a U.S. source, a nonresident alien must report the appropriate income and withholding amounts on Form 1040-NR, U.S. Nonresident Alien Income Tax Return. You must include the documents substantiating any income and withholding amounts when you file your Form 1040NR. We need more than 21 days to process a 1040NR return. Please allow up to 6 months from the date you filed the 1040NR for your refund.

Wheres My State Tax Refund Minnesota

Through the Wheres My Refund? System, you can check the status of your Minnesota tax refund. You will need to enter your SSN, your date of birth, your return type , the tax year and the refund amount shown on your return. Its important to be aware that if your tax return does not have your date of birth on it, you cannot check its status.

The refund system is updated overnight, Monday through Friday. If you call, the representatives will have the same information that is available to you in this system.

You May Like: How Can I Make Payments For My Taxes

Can You Transfer Your Refund To Another Person

No, you;cannot;ask;the CRA;to transfer your refund to pay another persons amount owing. This includes your spouse or common-law partner.

Residents of Quebec can transfer their Revenu Quebec refunds to their spouse. For more detailed information on how to proceed, please review the following link from Revenu Quebec: REFUND TRANSFERRED TO YOUR SPOUSE

Some Tax Returns Take Longer To Process Than Others For Many Reasons Including When A Return:

- Includes errors such as an incorrect Recovery Rebate Credit amount

- Is incomplete

- Is affected by identity theft or fraud

- Includes a claim filed for an Earned Income Tax Credit or an Additional Child Tax Credit using 2019 income.;

- Includes a Form 8379, Injured Spouse Allocation, which could take up to 14 weeks to process

- Needs further review in general

For the latest information on IRS refund processing during the COVID-19 pandemic, see the IRS Operations Status page.

We will contact you by mail when we need more information to process your return.

You May Like: What Does Agi Mean For Taxes

Why Is My Refund Different Than The Amount On The Tax Return I Filed

All or part of your refund may have been used to pay off past-due federal tax, state income tax, state unemployment compensation debts, child support, spousal support, or other federal nontax debts, such as student loans. To find out if you may have an offset or if you have questions about an offset, contact the agency to which you owe the debt.

We also may have changed your refund amount because we made changes to your tax return. This may include corrections to any incorrect Recovery Rebate Credit amount. Youll get a notice explaining the changes. Wheres My Refund? will reflect the reasons for the refund offset when it relates to a change in your tax return.

Tax Topic 203, Refund Offsets for Unpaid Child Support, Certain Federal and State Debts, and Unemployment Compensation Debts has more information about refund offsets.

Income Tax Refund On Appeal

When the taxpayer is eligible for a refund due to any order passed in response to an appeal, then there is no requirement of making a claim for such refund amount as the ITR department will itself credit the amount of refund. In short, there is no requirement for the taxpayer to place any additional request for refund cases related to appeal.

Please note that if the assessment of taxpayers return of income was cancelled with a decision to make a fresh assessment, the refund shall become due only after making the fresh assessment.

Also Check: How Much Do I Need To Make To File Taxes

We Received Your Return And May Require Further Review This May Result In Your New York State Return Taking Longer To Process Than Your Federal Return No Further Information Is Available At This Time

Once we receive your return and begin to process it, our automated processing system scans it for any errors or signs of fraud. Depending on the result of that scan, we may need to manually review it. This status may update to processing again, or you may receive a request for additional information. Your return may remain in this stage for an extended period of time to allow us to review. Once you return to the processing stage, your return may be selected for additional review before completing processing.

Will Ordering A Transcript Help Me Find Out When Ill Get My Refund

A tax transcript will not help you find out when youll get your refund. The information transcripts have about your account does not necessarily reflect the amount or timing of your refund. They are best used to validate past income and tax filing status for mortgage, student and small business loan applications, and to help with tax preparation.

You May Like: What Is The Pink Tax

Undelivered Federal Tax Refund Checks

Refund checks are mailed to your last known address. If you move without notifying the IRS or the U.S. Postal Service , your refund check may be returned to the IRS.

If you were expecting a federal tax refund and did not receive it, check the IRS’Wheres My Refund page. You’ll need to enter your Social Security number, filing status, and the exact whole dollar amount of your refund. You may be prompted to change your address online.;

You can also to check on the status of your refund. Wait times to speak with a representative can be long. But, you can avoid waiting by using the automated phone system. Follow the message prompts when you call.

If you move, submit a Change of Address – Form 8822 to the IRS; you should also submit a Change of Address to the USPS.

How To Check The Status Of Your Income Tax Refund

Waiting for your tax refund from the Canada Revenue Agency can seem like an eternity.; Instead of checking your mailbox daily, or looking at your bank account online every day, the CRA has other options you might want to consider.; Before going through them, however, we must look at the NETFILE process to ensure you have successfully filed your tax return the first time around.

No filed return means no tax refund! You can usually expect your refund within two weeks after you successfully NETFILE, but may take longer if your return is selected for a review. For more information on your refund status, please see this CRA link: Tax Refunds: When to expect your refund.

Recommended Reading: Where To Find Real Estate Taxes Paid

Wheres My State Tax Refund Colorado

Taxpayers can check the status of their tax refund by visiting the Colorado Department of Revenues Revenue Online page. You do not need to log in. Click on Wheres My Refund/Rebate? from the Quick Links section. Then you will need to enter your SSN and the amount of your refund.

Colorado has increased its fraud prevention measures in recent years and and warns that it may need take up to 60 days to process returns. Returns will take longest as the April filing deadline approaches. This is when the state receives the largest volume of returns. The state also;recommends filing electronically to improve processing time.

How Do I Check My Tax Refund Status

There are several ways you can find the tax refund status for federal income tax returns filed with the IRS in the United States. Determining the status of a tax refund may depend on what forms were used to file the return and the method by which the return was filed.

According to the IRS, it takes approximately seven days to process a tax return filed electronically, and four to six weeks to process a return filed through the mail. As a result, the tax refund status of a return will not be available until that return is processed.

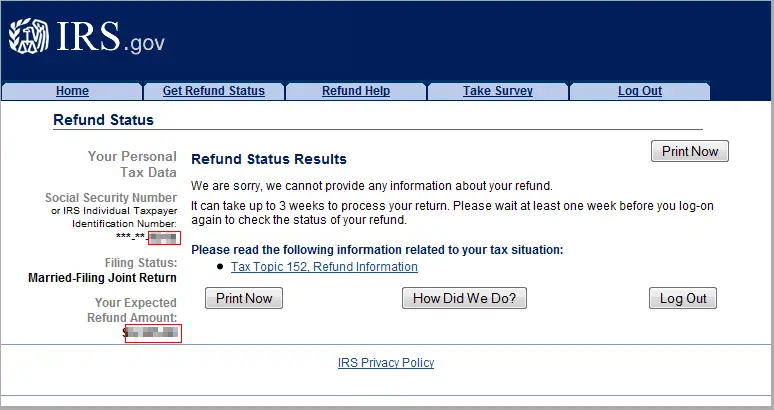

If the return was filed with the IRS before April 15, the annual tax deadline, the tax refund status may be available online at the IRS’s website. The IRS provides an online service called “Where’s My Refund?” that can provide the status of a refund whether the tax return was filed electronically using tax preparation software, electronically using fillable forms, or mailed in paper form. The online form requires the social security number of the taxpayer, the filing status, and the exact refund amount. Information on the tax refund status for some returns, including the Amended US Individual Income Tax Return, is not available online.

Recommended Reading: What Is The Sales Tax In Arkansas

Wheres My State Tax Refund Oregon

You can check on your state income tax refund by visiting the Oregon Department of Revenue and clicking on the Wheres My Refund? button. This will take you to an online form that requires your ID number and the amount of your refund.

This online system only allows you to see current year refunds. You cannot search for;previous years tax returns or amended returns.

Find Out If Your Tax Return Was Submitted

You can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer. Whether you owe taxes or youre expecting a refund, you can find out your tax returns status by:

-

Looking for emails or status updates from your e-filing website or software

If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. To do so, use USPS Certified Mail or another mail service that has tracking or delivery confirmation services.;

Don’t Miss: How Much Is California State Tax

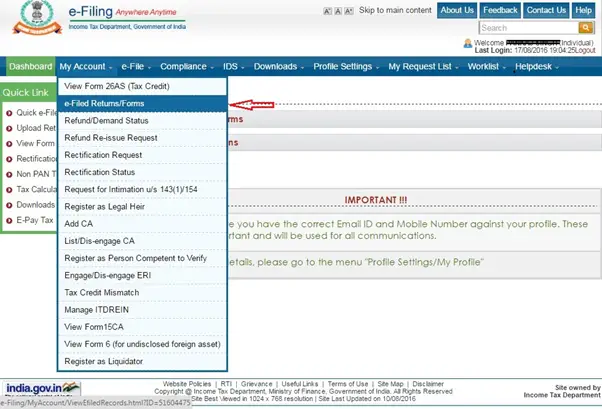

My Refund Failed To Reach Me As My Address Has Changed I Want To Raise A Request For Refund Re

You can only raise a request of refund re-issue if your refund failed to reach you and was returned to the Income Tax Department. In that case, login in the Income Tax e-Filing website and go to My Account â Refund re-issue request. Select the mode through which you wish to receive the refund- ECS or Cheque. Provide the new Bank Account Number and provide the new Address. Submit the request.

Once the request is submitted, your new Address is updated with the Income Tax Department.

Check The Status Of Your Refund

The best way to check the status your refund is through Where’s My Refund? on IRS.gov. All you need is internet access and this information:

- Your Social Security numbers

- Your filing status

- Your exact whole dollar refund amount

You can start checking on the status of you return within 24 hours after the IRS received your e-filed return, or four weeks after mailing a paper return.

Generally, the IRS issues most refunds in less than 21 days, but some may take longer.

On the go? Track your refund status using the free IRS2Go app. Those who file an amended return should check Wheres My Amended Return?

Also Check: What Age Do You Have To File Taxes

Income Tax Refund Status Faqs

Yes, if your income tax refund has been delayed, then you will get 0.5% per month/ part of the month interest on your amount which was due. This interest will be calculated from 1 April of the assessment year right to the date on which your refund has been granted.

You will be eligible for an income tax refund if you have paid a tax amount over and above the actual tax payable. The refund amount will be calculated during the time of filing the ITR.

The income tax refund will correspond to the excess amount of tax that you have paid. This is not an income and is not taxable. However, your interest earned on the income tax refund will be taxable .

Yes, if you wish to claim your income tax refund for any excess amount of tax you had paid during a financial year, you will have to file an income tax return for the assessment year.

The returns can be filed multiple times within the one-year expiry limit.

How Quickly Will I Get My Refund

We issue most refunds in less than 21 calendar days.

It is taking the IRS more than 21 days to issue refunds for some 2020 tax returns that require review including incorrect Recovery Rebate Credit amounts, or that used 2019 income to figure the Earned Income Tax Credit and Additional Child Tax Credit .

Also Check: What Is Form 8995 For Taxes

Wheres My State Tax Refund Illinois

The State of Illinois has a web page called Wheres My Refund, where you can see if the state has already processed your tax return and initiated your refund. The only information you need to enter is your SSN, first name and last name. If the state has not processed your return yet, you can set up an email or text notification to let you know when it does.

How To Check The Status Of Your Refund

What you’ll need:

Two ways to check the status:

The Indiana Department of Revenue screens every return in order to protect taxpayer IDs and refunds. For more information about your refund, you may call 317- 232-2240, Monday through Friday, from 8 a.m. to 4:30 p.m., EST.;A DOR representative will be happy to assist you.

Refund amounts can be accessed from 2017 to the current tax season.

Also Check: How To File Taxes With No Income

Understanding Your Refund Status

As you track;the status of your return, you’ll see some or all of the steps highlighted below. For more information about your status and for troubleshooting tips, see Understanding your refund status.

Want more information about refunds? See these resources:

Respond to a letter;Your refund was adjusted

Wheres My State Tax Refund Oklahoma

In order to check the status of your state tax refund, visit;Oklahoma Tax Commission page and click on the Check on a Refund link. From there you can get to the Oklahoma Taxpayer Access Point. You will need to log in with the last seven digits of your SSN or ITIN, the amount of your refund and your;zip code.

If you e-filed, you can generally start to see a status four days after the;Oklahoma Tax Commission receives your return. Paper filings will take longer an you should wait about three weeks before you start checking the status of a refund. Once a refund has been processed, allow five business days for your bank to receive the refund. If you elect to get a debit card refund, allow five to seven business days for delivery.

Recommended Reading: How To Report Self Employment Income On Taxes

How Is The Payment Of Income Tax Refund Done

The payment for your income tax refund can be done in two ways:

Income tax refunds can be paid to your via NECS/RTGS. You should ensure that you mention all required details of your bank account in order for the tax refund amount to be credit promptly. These details include IFSC code of your bank branch, bank account number, and communication address. This will facilitate easy and efficient income tax refunds transfer.

If by any chance the bank account details provided by you are improper or unclear, then this refund will be paid to you via a cheque to your bank account

The’where’s My Refund’ Online Tool

The IRS indicates that it issues most refunds within three weeks if you choose direct deposit and you’ve e-filed;your tax return. Refunds can take six to eight weeks if you file a paper return.

The IRS urges taxpayers to file electronically with direct deposit as soon as they have the information they need. This will help speed refunds during the ongoing public health and economic crisis in 2021.

Go to Where’s My Refund? on the IRS website to check the status of your refund. The tool is updated every 24 hours. You’ll need some information at your fingertips:

- Your Social Security number or Employer Identification Number as it appears on your tax return

- The filing status you claimed on your return: single, head of household, married filing jointly, married filing separately, or qualifying widow

- The exact refund amount as shown on your tax return

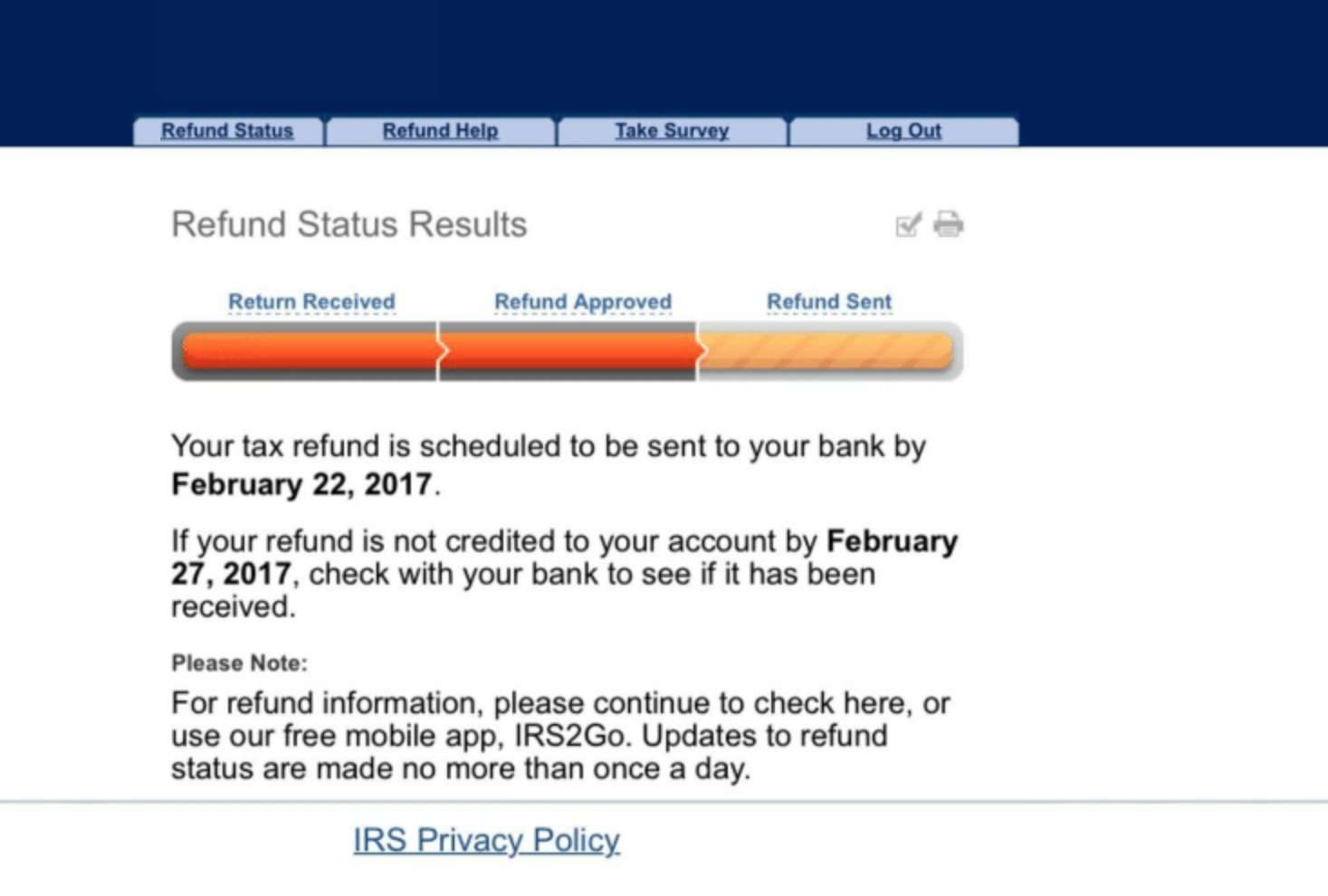

You’ll be redirected to a Refund Status Results screen when you plug in this information. This screen should say one of three things:

- Return received

- Refund approved

- Refund sent

You should see an estimated date for deposit into your bank account if your refund has been approved. There should also be a separate date for when you should contact your bank if you haven’t received your refund by then.

You can’t use the Where’s My Refund? tool to get information about your 2020-21 stimulus checks, also referred to as “economic impact payments.” Use the Get My Payment tool instead if you’re still expecting one of those checks.

Don’t Miss: How Is Capital Gains Tax Calculated On Sale Of Property