Tax Treatment Of An Llc

The IRS assumes that LLCs with more than one member are partnerships for tax purposes. That means the LLC itself pays no tax, but taxable profits and deductible losses are passed through to the members,who are treated as partners under the tax rules.

So at tax time to keep the IRS happy an LLC files Form 1065: Partnership Return of Income. The annual Form 1065 must also include a Schedule K-1 for each member. Schedule K-1 reports the members share of LLC income, deduction, and tax credit items. These amounts are then included on the members personal tax return.

If you choose to have your LLC file taxes as a corporation, you must tell the IRS by filing Form 8832: Entity Classification Election. At tax time you’ll use Form 1120: Corporation Income Tax Return, or the short form, 1120-A.

If you have a single-member LLC, you’ll file as a sole proprietorship using Schedule C .

A rather sticky issue for LLC members is whether they owe self-employment tax on their share of the company’s earnings. In general, members who are actively engaged in the business must pay this tax.

There is a special rule for LLC members who are the equivalent of Limited Partners and don’t take an active role in the business: They don’t pay self-employment tax on profits the company passes through to them, only on compensation they receive for any services they provide to the LLC.

Filing State Income Taxes

LLC members must also file state income tax returns. Like the federal government, most states allow LLC members to pay taxes on profits through personal tax returns. A few states also require members to pay an additional tax on the income made by the LLC.

For instance, in some states a member may have to pay a tax on LLC income that exceeds a certain amount. Other states may require the LLC to pay an annual fee, sometimes called a “franchise tax” or a “renewal fee.”

Who Can Use Form D

You can use this simpler version of the D-40 if you meet all of the following:

- You dont claim any dependents

- Your filing status is single, married/registered domestic partners filing jointly, or a dependent claimed by someone else

- You dont claim an exemption for being 65 years or older

- You dont claim an exemption for being legally blind

- You dont claim Injured Spouse Protection

- You didnt make any estimated income tax payments

- You dont itemize deductions

- You dont have federal adjustments to income

- You do not file DC Schedules S, H, U, I or N

- You were a DC resident from January 1st through December 31st

- You dont claim a deduction for a payment to the DC college savings plan

- Your taxable income is $100,000 or less, consisting only of wages, salaries and tips; taxable scholarships or fellowship grants; unemployment compensation; and/or interest and dividends

Recommended Reading: How To Figure Out Tax Percentage

Filing Requirements For An Llc Partnership

An LLC that is taxed as a partnership is subject to the same federal income tax return filing requirements as any other partnership. The LLC must file an informational partnership tax return on tax form 1065 unless it did not receive any income during the year AND did not have any expenses that it will claim as deductions or credits.

Thus, an LLC with no business activity that is taxed as a partnership is not required to file a partnership tax return unless there are expenses or credits that the LLC wants to claim.

Differences Between The Old And New Taxes

![Small Business LLC Taxes & LLC Tax Returns [+ Free Checklist] Small Business LLC Taxes & LLC Tax Returns [+ Free Checklist]](https://www.taxestalk.net/wp-content/uploads/small-business-llc-taxes-llc-tax-returns-free-checklist.png)

The new Oklahoma franchise tax, which was instituted in 2014, is very similar to the old pre-moratorium franchise tax. For example, both the old and new franchise tax included a maximum annual payment of $200,000.

Because the two taxes were so similar, business entities formed before the moratorium was put in place will likely understand how to correctly file the new tax. On the other hand, businesses formed after the moratorium may have been taken by surprise by the reinstatement of the franchise tax and should be very careful about filing and paying this tax.

Don’t Miss: How To Correct State Tax Return

Single Member Limited Liability Companies

A Limited Liability Company is an entity created by state statute. Depending on elections made by the LLC and the number of members, the IRS will treat an LLC either as a corporation, partnership, or as part of the owner’s tax return . A domestic LLC with at least two members is classified as a partnership for federal income tax purposes unless it files Form 8832 and elects to be treated as a corporation. For income tax purposes, an LLC with only one member is treated as an entity disregarded as separate from its owner, unless it files Form 8832 and affirmatively elects to be treated as a corporation. However, for purposes of employment tax and certain excise taxes, an LLC with only one member is still considered a separate entity.

Tips To Maximize Your Business Potential

- Enlist the help of a professional if you need help managing the finances of your small business. SmartAssets free tool;can quickly match you with up to three suitable advisors in your area based on your needs. Get started now.

- Where you bank with your business is often overlooked, but paying attention to this detail can boost your finances significantly. Check out our list of the;best banks for small business;to take advantage of these opportunities.

Also Check: How To Appeal Property Taxes Cook County

Llc Tax Filing For Corporations

If you own an LLC and are classified as either a partnership or disregarded entity, you can elect to be classified as a C corporation or S corporation.

To be classified as a C Corp, you must file Form 8832, Entity Classification Election. You will need to attach a copy of Form 8832 to your next federal income tax return.

Generally, you can only elect to become an S Corp if you are already a C Corp. This is not the case with LLCs. If you want to be classified as an S Corp, you just need to file Form 2553, Election by a Small Business Corporation.

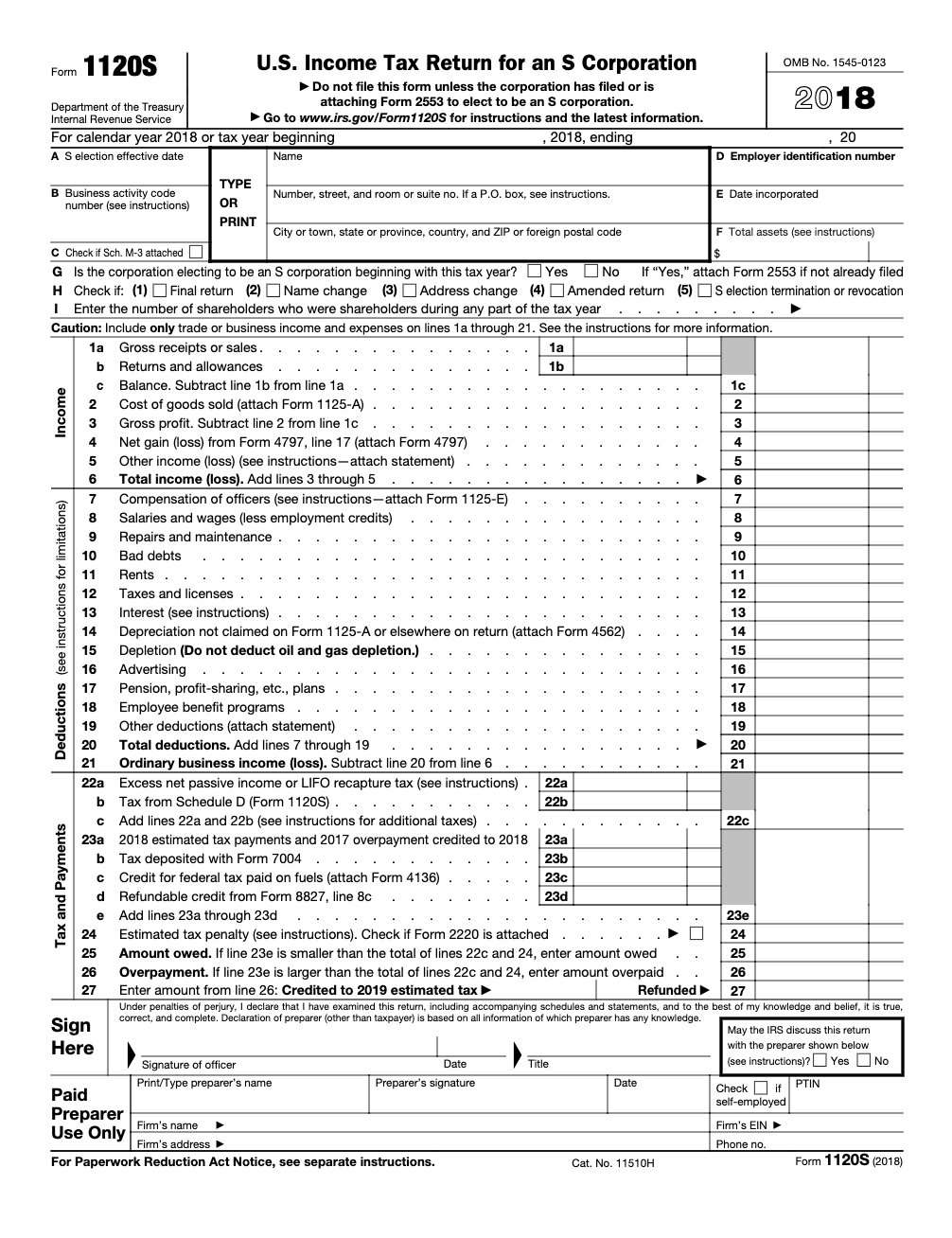

LLCs classified as corporations file one of the following:

- Form 1120, U.S. Corporation Income Tax Return

- Form 1120S, U.S. Income Tax Return for an S Corporation

You need an EIN to file taxes if you are an LLC classified as a corporation.

To file tax forms for an LLC, you need to keep track of your businesss income and expenses. Patriots online accounting software makes it easy to track your money. And, we offer free, U.S.-based support. Get your free trial today!

This article has been updated from its original publish date of 09/15/2015.

This is not intended as legal advice; for more information, please

Requirements For Llcs Treated As Partnerships

You dont have to file a federal business return when theres no business activity in your inactive LLC taxed as a partnership.

LLCs treated as partnerships report their business activity on Form 1065. As a pass-through entity, partnerships pay taxes through each owners personal return, not at the company level.

Still, an LLC taxed as a partnership files information return Form 1065 to relay earnings, deductible business expenses, and credits to the IRS. Since partnerships file information returns, theyre not considered disregarded entities like businesses taxed as sole proprietorships.

Recommended Reading: Do You Need To Claim Unemployment On Taxes

Choosing Corporate Tax Status For Your Llc

So far, weve discussed the default income tax rules for LLCs, but things can get more complicated. The members of an LLC can choose for the business to be classified as a C-corporation or S-corporation for tax purposes. The voting procedure and consent required to make this change will be reflected in the LLC operating agreement.

Your LLC can opt to be taxed as a C-corporation by filing Form 8832 with the IRS . If you make this change, your LLC will be subject to the 21% federal corporate tax rate. Youll need to file taxes using Form 1120, U.S. Corporation Income Tax Return. Youll also pay state and local corporate taxes as applicable where your business is located.

To opt for S-corporation tax status, file Form 2553 with the IRS. An S-corp is taxed like a pass-through entity, similar to an LLC, with some differences in how salary and distributions from the business are taxed. To file taxes for an S-corp, submit Form 1120S, U.S. Income Tax Return for an S-corporation, to the IRS.

Note that choosing corporate tax status wont affect your LLC from a legal standpoint. Legally, your business will continue to operate as an LLC. You should consult with a tax professional to see if youd benefit from corporate tax status. Income in a corporation is taxed differently than an LLC, and a corporation is eligible for more deductions and credits.

Do I Need To File A Tax Return For An Llc With No Activity

Even if your LLC didnt do any business last year, you may still have to file a federal tax return.

Sometimes a limited liability company has a year with no business activity. For example, a newly formed LLC might not have started doing business yet, or an older LLC might have become inactive without being formally dissolved.

But even though an inactive LLC has no income or expenses for a year, it might still be required to file a federal income tax return.

LLC tax filing requirements depend on the way the LLC is taxed. An LLC may be disregarded as an entity for tax purposes, or it may be taxed as a partnership or a corporation.

Recommended Reading: Can You File Missouri State Taxes Online

S To Complete Arizona’s Llc Tax Filing Requirements

1. Register your LLC with the State of Arizona and pay applicable fees.

- Only registered LLCs are required to pay taxes.;

2. Understand what ongoing tax and legal business requirements your LLC is subjected to.;

- Not all LLCs are subjected to the same tax filing requirements. For instance, LLCs with employees need to file payroll taxes. LLCs without employees do not have this requirement. By understanding which tax filing requirements impact your business, you will be better prepared to complete what is required.

3. If your LLC files taxes as a limited liabilitypartnership, you need to file Form 1065 U.S. Return of Partnership Income.;

- You must also show the distribution of the business in terms of profits, losses, and credits on an IRS Schedule K-1.

4. If your LLC files taxes as a C corporation, you need to file Form 8832 Entity Classification Election so the IRS will know how your LLC is being taxed.;

- If you do not file this election with the IRS, you will be taxed as a pass-through entity by default.;

- You must then file the Form 1120 U.S. Corporation Income Tax Return.

- Arizona also has a state corporate tax that is a flat rate. You will need to file this with Form 120.;

5. If your LLC files taxes as an S corporation, you will need to file Form 1120S U.S. Corporation Income Tax Return with the IRS.

- You must include an owner’s report about how the profits, losses, and credits were distributed.;

8. Register to pay Arizona state unemployment insurance taxes.;

How Do Llc Taxes Work

An LLC is typically treated as a pass-through entity for federal income tax purposes. This means that the LLC itself doesnt pay taxes on business income. The members of the LLC pay taxes on their share of the LLCs profits. State or local governments might levy additional LLC taxes. Members can choose for the LLC to be taxed as a corporation instead of a pass-through entity.

There are several types of LLC taxes. The federal government, as well as state and local governments, levy these taxes. All LLC members are responsible for paying income tax on any income they earn from the LLC as well as self-employment taxes. Depending on what you sell and whether you employ anyone, you might also be responsible for paying payroll taxes and sales taxes. To complicate things even more, an LLC can opt to be taxed as a different business entity.

In this guide, well cover the entire range of LLC taxes, what youll be responsible for, and options for reducing your tax bill. Understanding your tax burden in advance can help you make smarter financial decisions.

Recommended Reading: Can I Pay Quarterly Taxes Online

C Corporation Income Tax Rate

Taxable IncomeTax Rate All over $0 21%

The 21% rate is lower than individual rates at certain income levels. However, this doesnât necessarily mean youâll save any tax with C corporation taxation on account of double taxation.

With C corporation taxation, any direct payment of your LLCâs profits to you is a dividend for tax purposes and taxed twice. First, the LLC pays corporate income tax on the profit at the 21% corporate rate on its corporate return.

Then you pay personal income tax on what you receive from the LLC at capital gains rates. These can be as high as 20% .

When you add the personal tax on dividends to the 21% C corporation income tax, the combined tax is often higher than the income tax a single-member LLC owner taxed as a sole proprietor would pay at his or her individual rate on a like amount of income.

Llc Tax Form For A Disregarded Entity

A disregarded entity is a single-member LLC, combining both aspects of a corporation and a sole proprietorship. If you are a single-member LLC, the IRS automatically classifies you as a disregarded entity.

Under a disregarded entity classification, the business is with the business owner for income taxes. Report your LLCs income, gains, and losses on your federal income tax return if you are the owner of a disregarded entity.

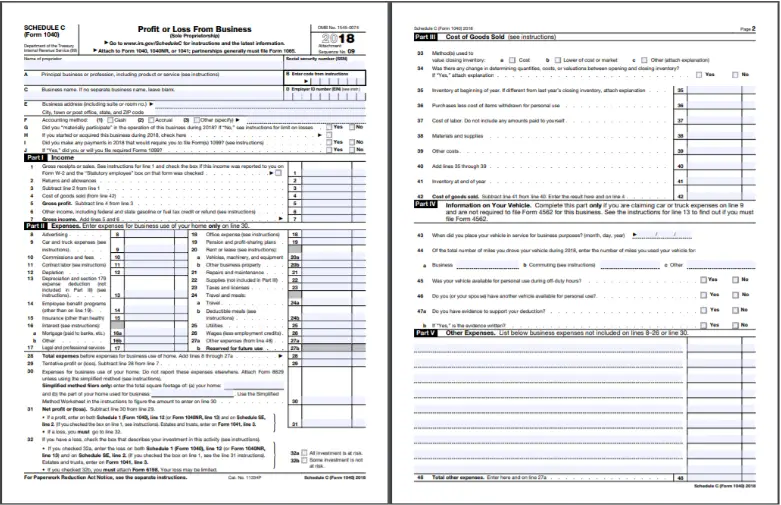

To report your business taxes as a disregarded entity, attach a single-member LLC tax form to your Form 1040:

- Schedule C, Profit or Loss From Business

- Schedule C-EZ, Net Profit From Business

- Schedule E, Supplemental Income and Loss

- Schedule F, Profit or Loss From Farming

Unless you have employees or must file excise tax forms, you are not required to have an Employer Identification Number . You can use your Social Security number to file small business taxes.

If you do have an EIN, you can use either your SSN or EIN on your LLC tax form.

If you add owners to your LLC, your classification will default from a disregarded entity to partnership.

Recommended Reading: How To Register For Tax Id

When Do Franchise Tax Returns Become Delinquent

Franchise tax returns and payment filed after September 1st are considered delinquent unless the elected filing date of a corporation coincides with a fiscal-year schedule. In this case, payments are considered delinquent if no payment is received by the 15th day of the third month following the close of the corporate year.

Corporate Taxation For Llcs

The vast majority of LLCs stick with default taxation. That is, they get taxed like sole proprietorships or partnerships.

However, you can choose to have your LLC taxed like a corporation. This option is easily accomplished by filing a document called an election with the IRS. You can submit this form at any time.

When it comes to taxes, there are two types of corporations:

- C corporations, sometimes called regular corporations, and

- S corporations, also called small business corporations.

There are significant differences between these types of corporate taxation. You can elect to have your LLC taxed either way.

Read Also: Do I Have To File Taxes If I Receive Unemployment

Llcs Classified As Partnerships

The FTB sets forth the following requirements for LLCs that are classified as partnerships. Note that this is not an exhaustive list. LLCs that are classified as partnerships in California must generally:

- File Form 568

- Pay a yearly minimum franchise tax

- Pay an LLC fee, depending on the circumstances

- Provide members with California Schedule K-1

Filing Taxes As A Single

If you run an LLC by yourself and havenât opted to file your taxes as a corporation, youâll file your taxes as a sole proprietor would, by reporting your income and expenses on your personal tax return .

To do this, youâll first have to calculate and report your businessâ profits using an IRS form called Schedule C. To fill that out, youâll need an income statement, and financial records and receipts for all the deductions you plan on making.

Youâll also have to report and pay Social Security and Medicare tax using Schedule SE.

You May Like: Can Home Improvement Be Tax Deductible

Dividing Up The Profit Between Members

Upon formation, LLCs draft an operating agreement which clarifies members ownership shares. This comes into play when distributing profits between members. If profit sharing differs from ownership shares, members can draft a special allocation.The LLCs profits are reported as income on members individual tax returns based on these profit sharing agreements. Members must pay taxes on this amount even if the LLC does not distribute all their money.;

Liability For Filing Return

In order for a business to be registered in Oklahoma, it must report its income to the state’s tax commission and the IRS. Corporations and other for-profit businesses organized in the state are subject to the rules of taxation. While the type of business structure elected makes a difference in reporting and filing requirements at the federal level, all business entities are subject to a single franchise tax rule in the state.

If a business has filed its articles of incorporation or articles of organization and has been registered with the Secretary of State, it is subject to taxation. Sole proprietorships are the exception to this rule, as they are subject to the same rules of individual tax filers with a home business. The Oklahoma Secretary of State website offers information about business registration and licensing.

Business entities, like joint-stock companies, trusts, and associations, that are registered in another state, district, territory, or foreign country are responsible for filing state franchise tax if operating in Oklahoma unless they are exempt by statute. Visit the Oklahoma State Legislature website for more information about the state’s tax laws.

Also Check: How Much Money Is Taken Out Of Paycheck For Taxes