Line 9949 Total For Personal Portion

If you rent part of the building where you live, you can claim the amount of your expenses that relate to the rented part of the building. You have to divide the expenses that relate to the whole property between your personal part and the rented part.

You can split the expenses using square metres or the number of rooms you are renting in the building, as long as the split is reasonable.

For example, if you rent 4 rooms of your 10-room house, you can deduct both:

- 100% of the expenses that relate only to the rented rooms, such as repairs and maintenance of the rooms, plus

- 40% of the expenses that relate to the whole building, such as taxes and insurance

If you rent rooms in your home to a lodger or roommate, you can claim all of the expenses for the part you are renting.

You can also claim an amount for the rooms in your home that you are not renting and that both you and your lodger or roommate use. You can use;actors such as availability for use or the number of persons sharing the room to calculate the allowable expenses. You can also calculate these amounts by estimating the percentage of time the lodger or roommate spends in these rooms .

If you are a co-owner or partner of a partnership, enter the personal portion of the expenses for all co-owners or partners on this line.

Line 8299 Total Gross Rental Income

Your gross rental income is your total “Gross rents” on Form T776. Enter this amount at line 12599Footnote 1 of your income tax and benefit return.

If you are a co-owner of the rental property or a partner in a partnership that does not need to provide you with a Slip T5013, Statement of Partnership Income, enter the gross rental income for the entire property at line 12599Footnote 1;of your income tax return. Do not split the gross income according to your ownership share.

Exemptions For People With Disabilities And/or Veterans With Disabilities

If you qualify for this exemption, you may pay reduced rates or nothing at all depending on the law in your area. In some cases, this particular exemption may be tied to specific qualifications. For example, your level of tax exemption as a disabled veteran may be tied to your disability rating from the VA.

You May Like: How To Calculate Net Income After Taxes

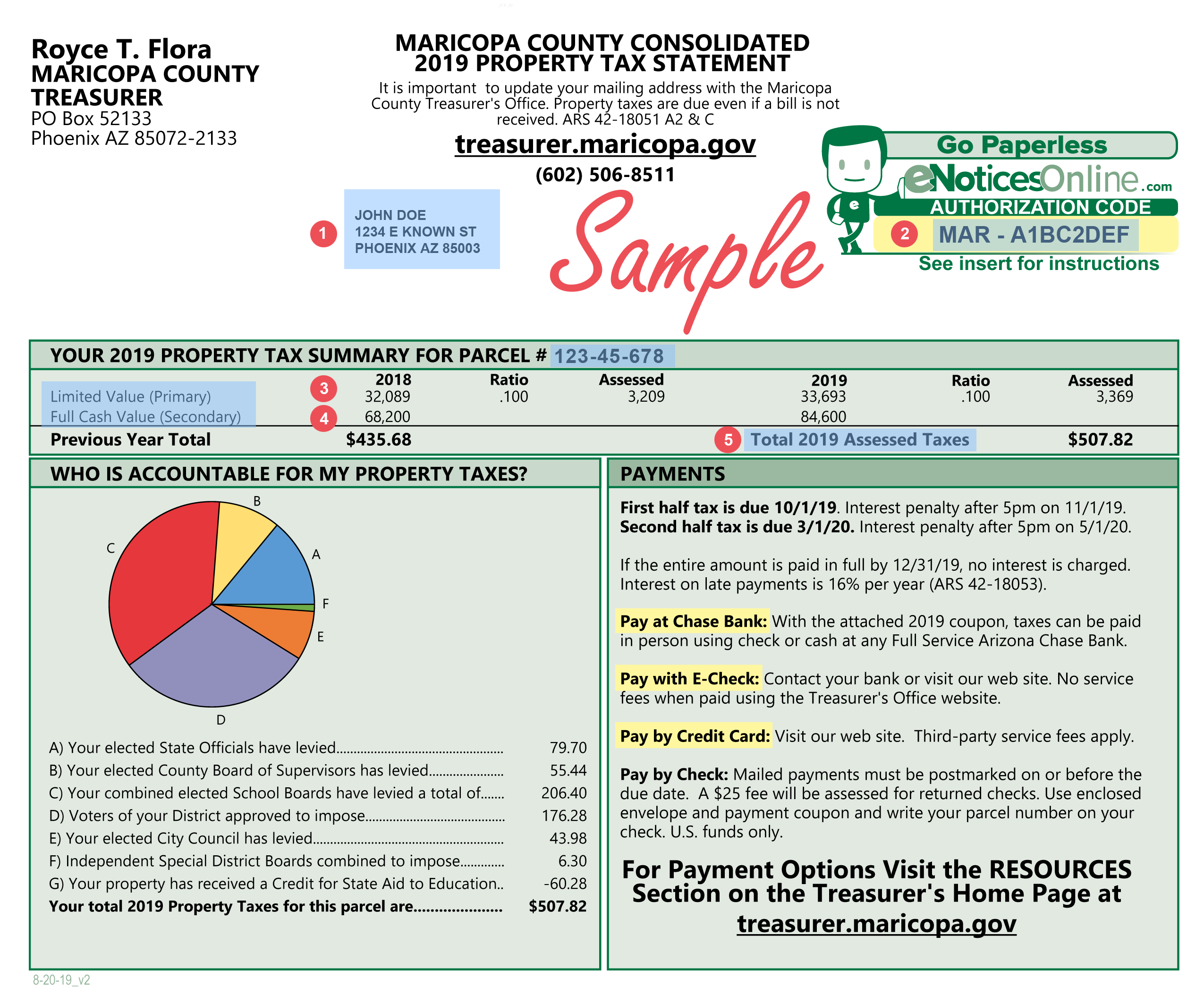

How Do Property Tax Assessments Work

Property tax assessments are done at varying frequencies. Some states do property assessments every year, while others do it every number of years. Still others, like California, usually only assess property values when a property is sold or under other special circumstances.

Low rates were a big story in 2020. It was a great year to refinance!

still

Completing Form T776 Statement Of Real Estate Rentals

If you received income from renting real estate or other real property, you have to file a statement of income and expenses. On your statement of income and expenses, report the rental income you earned in the calendar year .

Form;T776 will help you calculate your rental income and expenses for income tax purposes. Even though we accept other types of financial statements, we encourage you to use Form;T776.

To calculate your rental income or loss, complete the areas of the form that apply to you.

For more information on how to fill out Form;T776, go to Guide;T4036, Rental Income.

Write down your name and your social insurance number .

Read Also: How To Track Your Taxes

What Is Property Tax

Property tax is real estate tax paid by the owner of a property. It is based on the value of the property. Your property is assessed by local government to determine how much your property is worth and how it should be taxed.

Property taxes are a major source of income for city, county, and state governments.

Ask For Your Property Tax Card

Few homeowners realize they can go down to the town hall and request a copy of their property tax cards from the local assessor’s office. The tax card provides the homeowner with information the town has gathered about their property;over time.

This card includes information about the size of the lot, the precise dimensions of the rooms, and the number and type of fixtures located within the home. Other information may include a section on special features or notations about any improvements made to the existing structure.

As you review this card, note any discrepancies, and raise these issues with the tax assessor. The assessor will either make the correction and/or conduct a re-evaluation. This tip sounds laughably simple, but mistakes are common. If you can find them, the township has an obligation to correct them.

Don’t Miss: What Is The Tax In Georgia

Tracks Your Mortgage Interest

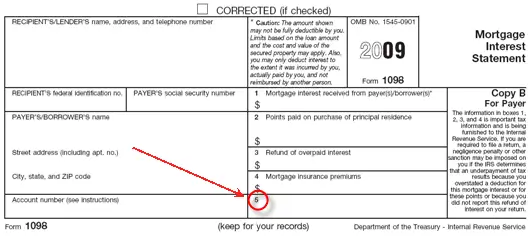

The primary purpose of your 1098 is to track your mortgage interest. One box on the form reports the total of your monthly interest payments. Another reports if you paid any deductible points, or prepaid interest. If you paid more than $600 in mortgage insurance premiums you claim them as part of your mortgage interest write-off you’ll see that total in a separate box. Your lender can report property taxes paid, using Box 5 of the form, but this isn’t mandatory.

County Tax Collector’s Office

Most county tax collectors have an online portal where you can enter the property address and see when property taxes were paid and for how much. If you are looking to buy a home or invest in a property, you can see the history of the assessed value of the property for both land and improvements. This should also show taxes and any special assessments and bonds paid by the property owner; these are additional to the property tax. Improvements are the structures on the property. This is important information in due diligence on any real estate purchase. Knowing the costs you need to budget for and understanding improvements on the land is helpful in establishing fair market value estimates.

You May Like: How To Pay Llc Taxes

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents you’ll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

What Happens To Foreclosed Properties

Before a home is foreclosed upon, owners can pay their back taxes or tax bill in full at any time before the property is seized.

However, this doesnt happen as often as youd think. Many properties end up being foreclosed on and sold at the city, township, or countys yearly Tax Lien Sale.

The town holds these sales in hopes of making back the cost of the unpaid property and real estate taxes, so the properties are usually auctioned at a fraction of their worth.

Thats tempting for a real estate investor, but it isnt the key to unlocking the potential of finding tax-delinquent properties. Catching the property owners before the county forecloses and sells the property is the key.

You May Like: When Is Sales Tax Due

Line 9936 Total Capital Cost Allowance Claim For The Year

Enter the amount of your total capital cost allowance ;calculated in Area A;of form T776.

If you are a partner in;a partnership, how you claim CCA will depend on whether your partnership is required to file a slip T5013SUM, Summary of Partnership Income, and issue you a slip T5013, Statement of Partnership Income. If the partnership issues you a slip T5013, your CCA amount is already included in box 110 of your slip T5013. If your partnership does not issue you a slip T5013, enter the total CCA allocated on the financial statements the partnership gave you.

Mortgage Tax Statement: Form 1098

Mortgage companies commonly handle property tax payments on behalf of homeowners. That’s because it’s in the lender’s interest to make sure that the property taxes get paid, because if a government places a lien on a home for unpaid taxes, it makes it harder for the lender to recover its money in the event of a sale or foreclosure.

Usually, homeowners’ monthly mortgage payments include a portion designated for property taxes. The lender sets aside this amount in a special account, called “escrow,” and pays the tax bill when it’s due. At the end of each tax year, lenders must provide homeowners with a copy of IRS Form 1098, the “Mortgage Interest Statement.” If taxes have been paid out of escrow, Box 5 of this form usually lists the amount paid for the year.

Read Also: How To Buy Tax Lien Properties In California

Property Taxes Not Included

It’s a common condition for taking out a mortgage for you to include 1/12 of your annual property tax bill along with your monthly mortgage check. The money goes into an escrow account your lender uses to pay the tax bill. That guarantees your house the bank’s collateral won’t be taken for unpaid property taxes. Your lender should send you an annual statement detailing the amount of taxes paid, but it doesn’t have to be part of the 1098.

Why Do I Have To Pay Property Taxes

In all 50 U.S. states, the majority of property owners are required to pay real estate taxes. These taxes are vital to making sure local governments can provide the infrastructure and public services their communities need. Most citizens in the community rely on the government to provide at least one important public service.

Additionally, in many areas of the country, local property taxes make up the lions share of funding for public schools.

Don’t Miss: Did The Tax Deadline Get Extended

What Is A Homes Fair Market Value

The market value of a home is basically the amount a knowledgeable buyer would pay a knowledgeable seller for a property, assuming an arms-length transaction and no pressure on either party to buy or sell. When a property sells to an unrelated party, the sales price is generally assumed to be the fair value of the property.

Line 9369 Net Income Before Adjustments

Enter on this line the gross income minus the deductible expenses on Form T776.

This amount is the net rental income of all co-owners or;partners before claiming capital cost allowance for rental property.

If you are a co-owner, enter your share of the amount from line 9369 on amount 5;of Form T776. This amount is based on your share of ownership of the rental property.

If you are a co-owner or partner, also fill in Part 2 Details of;other;co-owners;and;partners, on Form T776.

Also Check: Where To Find Real Estate Taxes Paid

Taxes Paid Through Escrow Accounts

If you pay your real property taxes by depositing money into an escrow account every month as part of your mortgage payment, make sure you don’t treat the entire payment as a property tax deduction.

Generally, only the amount that the bank or lender reports to the Internal Revenue Service , often noted on Form 1098, qualifies for the deduction. Thats because, the amount you must pay to an escrow account is adjusted yearly to be as close as possible to the precise amount due, but its rarely exactly the same amount.

Whether you have stock, bonds, ETFs, cryptocurrency, rental property income or other investments, TurboTax Premier is designed for you. Increase your tax knowledge and understanding all while doing your taxes.

How Can I Find Out What My Property Taxes Arei Lost The Receipt

Online Access

Visit the website of the county assessor to which you pay property taxes.

Locate the property search link. Each countys website varies, but common link titles to look for include Search Property Records, Property Search or Real Property Tax Records. Some websites may list this type of search in the online services menu; others display a link on the home page.

Select a search method. In most cases, you can choose to search by your name or the address of your home. Enter appropriate data into the search field based on your selection.

View property tax payment history. You can view real estate tax assessments and payments for the current year. Some websites may also provide historical payment information.

Form 1098 Tax Document

Obtain Form 1098 from your mortgage lender. This tax document lists the mortgage interest you pay during the year and also lists any real estate taxes your lender paid on your behalf through an escrow account. Your lender is authorized to pay only the actual amount of your property tax assessment through an escrow account, so in general, tax amounts shown are correct.

Examine Box 4 on Form 1098. Your lender uses this general information box to report information other than your mortgage interest to you. Any amounts shown should include a description, such as “Taxes” or “Property Tax.”

Recommended Reading: How To Pay My Federal Taxes Online

How To Find Tax Delinquent Properties In Your Area

When property taxes go unpaid, or are delinquent for a period of time, this is recorded by the tax assessor or tax collector. Its public record, too. Thats the key to this real estate investment strategy.

Every tax delinquent property is compiled together in a ledger that can be called by many names:

- Tax Delinquent List

Project Type:

Real Property Tax In The Philippines: Important Faqs

Clueless how to pay your real property tax in the Philippines? Here’s a quick FAQ!

Being a property owner entails a series of never-ending responsibilities. For one, it is your civic duty to know about the fees and taxes we need to pay. One of which is called the real property tax.;What is the meaning of real estate tax? It can be defined as a tax that is based on the value of buildings or land.;

Below are the frequently asked questions on real property tax in the Philippines.

Q: What is Real Property Tax?

A: Real property tax is a kind of tax levied by the local government on properties and should be paid by property owners.; Properties that are taxable include land, building, improvements on the land and/or the building, and machinery.;

Q: Why are properties being taxed?

A: In 1991, Republic Act 7160, also known as the Local Government Code was passed. Under this law, local governments are given the authority to create and collect their own source of revenue to fund public expenditure. These sources of income include real property taxes among others.;

Q: Who should pay for real property tax?

A: People who own or whose names are on titles and certificates of ownership are required to pay for land taxes in the Philippines, whether the real estate property is for residential or commercial use.;

Q: What are the real property tax rates in the Philippines?

Q: Are there other taxes levied by the government that I should know of?

Q: How do I compute the real property tax?

- TAGS

Recommended Reading: Should I Charge Tax On Shopify

Claiming Property Taxes On Your Tax Return

OVERVIEW

If you pay taxes on your personal property and owned real estate, they may be deductible from your federal income tax bill. Most state and local tax authorities calculate property taxes based on the value of the homes located within their areas, and some agencies also tax personal property. If you pay either type of property tax, claiming the tax deduction is a simple matter of itemizing your personal deductions on Schedule A of Form 1040.

Apple Podcasts | Spotify | iHeartRadio

How Property Tax Is Calculated

Your property tax is calculated by first determining the taxable value. The taxable value is your assessed value less any exemptions. The taxable value is then multiplied by your local millage rate to determine your ad valorem taxes. Ad valorem taxes are added to the non-ad valorem assessments. The total of these two taxes equals your annual property tax amount.

Your propertys assessed value is determined by the Palm Beach County Property Appraiser. The millage rate is set by each ad valorem taxing authority for properties within their boundaries.

Non-ad valorem assessments are determined by the levying authority using a unit measure to calculate the cost of services. For example, Solid Waste Authority fees are based on the type of property producing the waste.

Don’t Miss: Do You Have To Claim Social Security On Taxes

Who Pays The Tax

Anyone who owns a taxable property in Philadelphia is responsible for paying Real Estate Tax. Typically, the owner of a property must pay the real estate taxes. However, anyone who has an interest in a property, such as someone living in the property, should make sure the real estate taxes are being paid.

Form 1098 Tax Document

Obtain Form 1098 from your mortgage lender. This tax document lists the mortgage interest you pay during the year and also lists any real estate taxes your lender paid on your behalf through an escrow account. Your lender is authorized to pay only the actual amount of your property tax assessment through an escrow account, so in general, tax amounts shown are correct.

Examine Box 4 on Form 1098. Your lender uses this general information box to report information other than your mortgage interest to you. Any amounts shown should include a description, such as “Taxes” or “Property Tax.”

Compare Box 4 amounts with other sources. Your end-of-the-year mortgage statement may itemize taxes and other items paid through your escrow account. Compare any tax payments shown on this statement with the amount in Box 4. You may also contact your county assessor for confirmation of Box 4 amounts.

References

At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since 1986 it has nearly tripled the S&P 500 with an average gain of +26% per year. These returns cover a period from 1986-2011 and were examined and attested by Baker Tilly, an independent accounting firm.

Visit performance for information about the performance numbers displayed above.

You May Like: What Is California State Tax Rate