Federal Income Tax Withholding

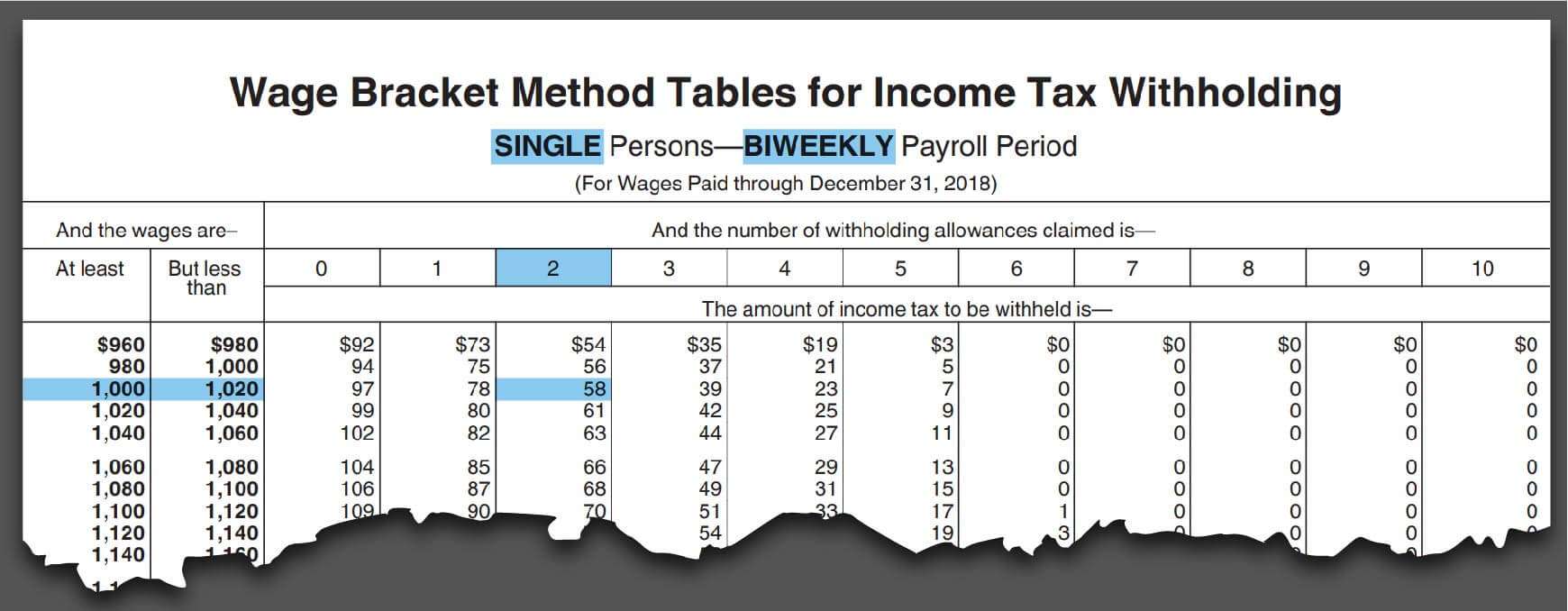

To figure federal income tax, use your Form W-4 and IRS Circular E, which can be found online. Federal income tax withholding is based on your filing status, taxable wages and number of allowances. You can find your filing status on line 3 of the withholding allowance certificate section of your W-4 your number of allowances is on line 5. Look for the Circular E withholding tax table that matches your filing status, taxable wages and number of allowances. For example, your taxable wages for the biweekly pay period are $900 and you claimed “Single” filing status with three allowances on your W-4. According to Page 52 of the 2015 Circular E, your withholding would be $36. If you meet the criteria for being exempt, as stated on line 7 of the W-4, no federal income tax should be withheld.

How To Calculate Withholding Tax: A Simple Payroll Guide For Small Business

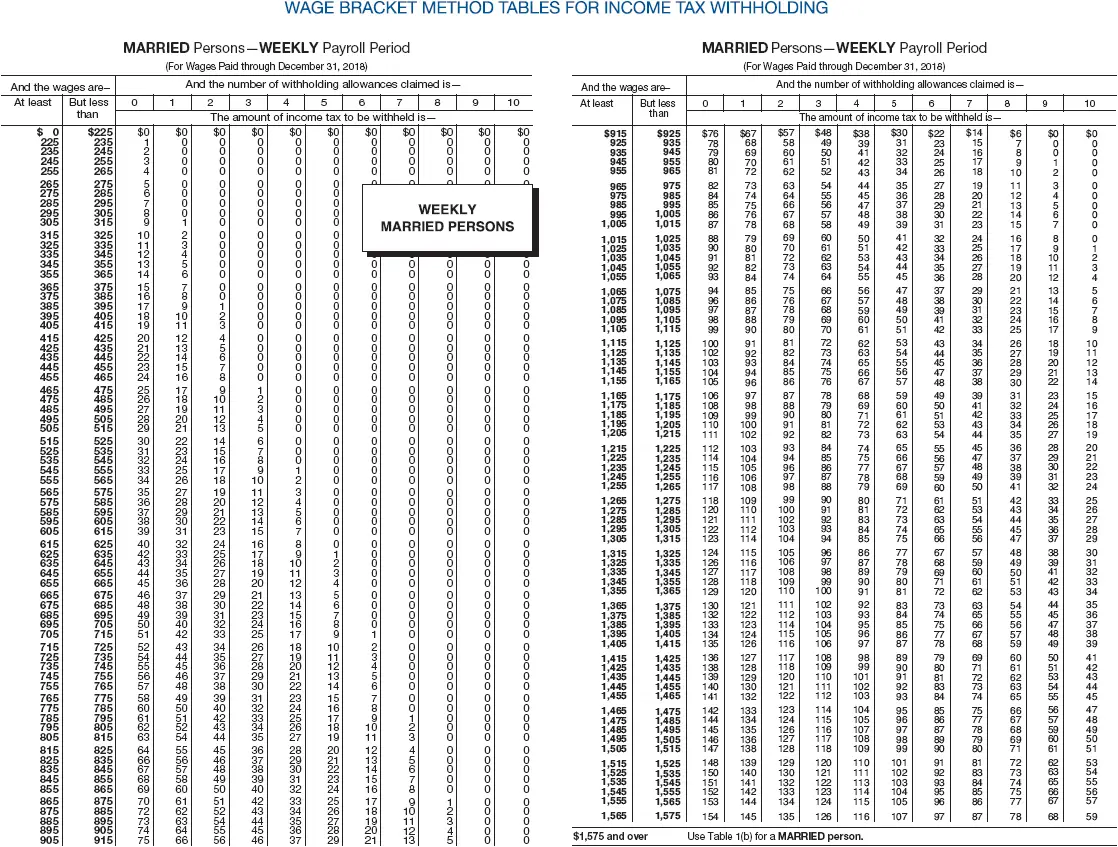

Small businesses need to calculate withholding tax to know how much money they should take from employee paychecks to send to the Internal Revenue Service to cover tax payments. Employers calculate withholding tax by referring to an employees Form W-4 and the IRSs income tax withholding table to determine how much federal income tax they should withhold from the employees salary or wages. There are two main methods small businesses can use to calculate withholding tax: the wage bracket method and the percentage method. To calculate withholding tax, youll need the following information:

- Your employees W-4 forms

- The IRS income tax withholding tables and tax calculator for the current year

Small business owners should learn how to calculate withholding taxes to make sure employees are being taxed at the correct rate.

These topics take you through how to calculate withholding tax:

NOTE: FreshBooks Support team members are not certified income tax or accounting professionals and cannot provide advice in these areas, outside of supporting questions about FreshBooks. If you need income tax advice please contact an accountant in your area.

How To Use A Withholding Tax Table: Example

Lets say you have a single employee who earns $2,020 biweekly. They filled out the new 2020 Form W-4.

The employee has a relatively simple tax situation. When they filled out Form W-4, they wrote that they did not have another job or a working spouse. And, they did not claim dependents. They did not request any extra withholding.

Use the wage bracket method tables for manual payroll systems with Forms W-4 from 2020 or later to find out how much to withhold for federal income tax. This is Worksheet 2 in IRS Publication 15-T.

The worksheet is broken down into four steps:

Recommended Reading: How Much To File Taxes

The Federal Income Tax

The federal personal income tax that is administered by the Internal Revenue Service is the largest source of revenue for the U.S. federal government. Nearly all working Americans are required to file a tax return with the IRS each year. In addition to this, most people pay taxes throughout the year in the form of payroll taxes that are withheld from their paychecks.

Income taxes in the U.S. are calculated based on tax rates that range from 10% to 37%. Taxpayers can lower their tax burden and the amount of taxes they owe by claiming deductions and credits.

A financial advisor can help you understand how taxes fit into your overall financial goals. Financial advisors can also help with investing and financial plans, including retirement, homeownership, insurance and more, to make sure you are preparing for the future.

How Do I Determine Which Percentage To Elect

Every employee must consider the facts of their own situation and adjust their election accordingly.

If you want to keep your withholding approximately the same as last year, use last year’s federal Form W-2, or your last pay stub, to calculate which withholding percentage to elect. For example, if box 1 of federal Form W-2 shows $40,000 in wages and box 17 shows $1,000 in state income tax withheld, divide box 17 by box 1 to determine your percentage . To keep your withholding the same as last year, choose a withholding percentage of 1.8% and withhold an additional $10.77 per biweekly pay period . Be sure to take into account any amount already withheld for this year.

If you want to withhold more, choose one of the higher percentages or choose to have an additional amount withheld.

Note: Underwithholding can result you owing tax and/or underpayment penalties when you le your Arizona return at the end of the year.

You May Like: How To Pay Oklahoma State Taxes

Do You Pay Taxes On Social Security

You have to pay federal income taxes if you meet certain combined income thresholds based on your filing status. Combined income includes your adjusted gross income, nontaxable interest, and half of your Social Security benefits. For example, if you file as an individual and your combined income is between $25,000 and $34,000, you may have to pay income tax on up to 50% of your benefits. If your income is more than $34,000, you may have to pay taxes on up to 85% of your benefits. Taxes are limited to 85% of your Social Security benefits.

Tax Withholding: How To Get It Right

Note: August 2019 this Fact Sheet has been updated to reflect changes to the Withholding Tool.

FS-2019-4, March 2019

The federal income tax is a pay-as-you-go tax. Taxpayers pay the tax as they earn or receive income during the year. Taxpayers can avoid a surprise at tax time by checking their withholding amount. The IRS urges everyone to do a Paycheck Checkup in 2019, even if they did one in 2018. This includes anyone who receives a pension or annuity. Heres what to know about withholding and why checking it is important.

Recommended Reading: Do You Need To Report Unemployment On Your Taxes

Income And Withholding Page

Depending on your situation, there are a few inputs for this question.

- For a past job, we will ask for federal income tax withheld year-to-date.

- For current jobs, we will ask for federal income tax withheld per pay period and year-to-date. The per pay period input refers to federal income tax withheld per paycheck.

- If youre filling this out in January and your most recent pay period ended in December of the previous year, then please input the federal income tax withheld per pay period in the last paycheck input.

How do I input a bonus that I have not yet received?

The application is designed to handle withholding on a bonus. For a bonus not yet received, enter the amount in the any bonuses you expect to receive later this year field. Then, you may select a checkbox right under that field if you know that your employer will withhold tax on the bonus for you.

What date shall I select for the pay period end date question?

The pay period end date should be on your pay statement when the employer processes your pay for that period. For example, the pay period end date could be Friday, January 17, but the paycheck for that period might not be received until the Monday of January 27. In this case, you would use Friday, January 17 as your input to that question.

The Estimator does not currently accommodate RMDs.

How To Check Your Withholding

Use the IRS Withholding Estimator to estimate your income tax and compare it with your current withholding. Youll need your most recent pay stubs and income tax return.

The results from the calculator can help you figure out if you need to fill out a new Form W-4 for your employer. Or, the results may point out that you need to make an estimated tax payment to the IRS before the end of the year.

If you adjusted your withholding part way through 2020, the IRS recommends that you check your withholding amounts again. Do so in early 2021, before filing your federal tax return, to ensure the right amount is being withheld.

Also Check: Where Do I Pay My Federal Taxes

You Dont Make Enough Income

The amount of federal income tax you owe largely depends on what your income is. The more you earn, the more you are required to pay.

The percentage of tax withheld from your paycheck depends on what bracket your income falls in.

For example, for 2021, if youre single and making between $40,126 and $85,525, then you are responsible for paying 22 percent of your income in taxes to the federal government.

However, if you make less than $9,000, you might not have to have taxes withheld.

Do I Have To File Taxes If I Made Less Than $10000

If your gross income was less than $10,000, you may not have to file a federal income tax return. But you may still want to file if you worked during 2020 and your employer withheld tax from your paycheck. Filing a tax return even if youre not required to do so is the only way to get any tax youre owed refunded to you.

Don’t Miss: Where Can I Find My Property Tax Bill

What You Should Know About Tax Withholding

To understand how allowances worked, it helps first to understand how tax withholding works. Whenever you get paid, your employer removes, or withholds, a certain amount of money from your paycheck. This withholding covers your taxes, so that instead of paying your taxes with one lump sum during tax season, you pay them gradually throughout the year. Employers in every state must withhold money for federal income taxes. Some states, cities and other municipal governments also require tax withholding.

Withholding is also necessary for pensioners and individuals with other earnings, such as from gambling, bonuses or commissions. If youre a business owner, independent contractor or otherwise self-employed, you will need to make sure you withhold taxes yourself. You can do this by paying estimated taxes.

Exactly how much your employer withholds will depend largely on how much money you make and how you fill out your W-4. While you used to be able to claim allowances, your withholding is now affected by your claimed dependents, if your spouse works or if you have multiple jobs. You can also list other adjustments, such as deductions and other withholdings.

When you fill out your W-4, you are telling your employer how much to withhold from your pay. Thats why you need to fill out a new W-4 anytime you start a new job or experience a big life change like a marriage or the adoption of a child.

How Do I Affect Withholding Now

Since the 2020 W-4 is far simpler than it has been in the past, it might seem harder to change your total withholding. The loss of allowances on the form might seem especially irksome, but not to worry. There are still plenty of ways to affect your withholding.

First, its important to fill out the multiple jobs or working spouse section using the worksheet on the third page of the W-4 so that the IRS has a proper record of how much money total you bring in.

Second, the total number of dependents you claim also has a significant effect on your total withholding, so make sure you claim the correct number of dependents in Step 3.

Finally, Section 4 of the W-4 is a bit more open ended. Here youll be able to state other income and list your deductions, which can be used to reduce your withholding. Use the worksheet on page 3 of the W-4 to figure out your deductions. Finally, you can also use the extra withholding section to make your total withholding as precise as possible.

If you have a complex tax situation, it may be wise to work with a financial advisor who specializes in tax issues.

Don’t Miss: How Does Doordash Do Taxes

Putting It All Together: Calculating Your Tax Bill

To calculate how much you owe in taxes, start with the lowest bracket. Multiply the rate by the maximum amount of income for that bracket. Repeat that step for the next bracket, and continue until you reach your bracket. Add the taxes from each bracket together to get your total tax bill.

For example, the single filer with $80,000 in taxable income would pay the lowest rate on the first $9,875 he makes then 12% on anything earned from $9,786 to $40,125 then 22% on the rest, up to $80,000 for a total tax bill of $13,774.

Effectively, this filer is paying a tax rate of 17.2% , which is less that the 22% tax bracket our taxpayer actually is in.

But, wait. Effective tax rates dont factor in any deductions, so if you wanted get closer to what percentage of your salary goes to Uncle Sam, try using your adjusted gross income. Assuming the single filer with $80,000 in taxable income opted for the standard deduction , the amount of his AGI that went to the IRS was 14.9% a far cry from 22%.

For a final figure, take your gross income before adjustments. Add back in your allowable above the line deductions for example, retirement and health savings account contributions certain business-related expenses alimony paid and divide your tax bill by that number. The overall rate for our single filer with $80,000 in taxable income might be closer to 12% or even lower.

When To Check Your Withholding:

- Early in the year

- When the tax law changes

- When you have life changes:

- Lifestyle – Marriage, divorce, birth or adoption of a child, home purchase, retirement, filing chapter 11 bankruptcy

- Wage income – You or your spouse start or stop working or start or stop a second job

- Taxable income not subject to withholding – Interest income, dividends, capital gains, self employment income, IRA distributions

- Adjustments to income – IRA deduction, student loan interest deduction, alimony expense

- Itemized deductions or tax credits – Medical expenses, taxes, interest expense, gifts to charity, dependent care expenses, education credit, child tax credit, earned income credit

Also Check: How To Track E File Tax Return

What About Tax Credits

You might also qualify for tax credits. While they dont reduce your taxable income or change your tax bracket, theyre even better they reduce your income tax liability. In other words, whatever amount of tax you are deemed to owe, you can deduct the entire amount of the tax credit on a dollar-for-dollar basis.

You may qualify for federal or state tax credits, and they vary by income, so be sure to talk with a tax professional. Common tax credits include:

- Child tax credit

- Residential energy tax credit

- Renters tax credit

While paying taxes is no ones idea of a good time, understanding federal tax brackets and other nuances of the tax system can at least make it a little less confusing and help you feel more comfortable and confident when it comes time to file.

Please remember that, while this article does provide some tax information, this is not tax advice. Please consult a financial advisor for tax assistance.

Income Taxes: What You Need To Know

- Read in app

When it comes to income taxes, there are different types of people.

There are individuals who find pleasure in tackling the 1040 all on their own. At the other end of the spectrum, there are people who make a mad dash for the nearest H& R Block about 9 p.m. on April 15.

But no matter where you fall on that scale, its important to master the basics. Most of lifes milestones carry some sort of tax implication, whether its having a child, purchasing a home, changing jobs or, yes, even dying. And as you travel through life and your situation evolves, your approach to income taxes needs to be adjusted accordingly.

To complicate matters, the rule book is constantly changing. So taxpayers must sort through a befuddling mix of new rules, deductions and credits each year. For some people, all of the noise is justification enough to pay an accountant.

Even if you do, there is still a variety of issues you should be aware of that will help you maximize your tax savings. This guide will explain how income taxes work and how to trim your bill, and offer a few approaches to tax preparation.

Income Taxes

The amount you owe for federal, state and local taxes is determined by how much you earn each year. The United States uses a progressive tax system, which means the more money you earn, the higher your tax rate. The chart above lays out the different tax brackets and rates, which depends on your filing status .

Cutting Your Tax Bill

Alternative Minimum Tax

Filing Taxes

You May Like: What’s The Sales Tax In Florida

Everyone Should Check Withholding

The IRS recommends that everyone do a Paycheck Checkup in 2019. Though especially important for anyone with a 2018 tax bill, its also important for anyone whose refund is larger or smaller than expected. By changing withholding now, taxpayers can get the refund they want next year. For those who owe, boosting tax withholding in 2019 is the best way to head off a tax bill next year. In addition, taxpayers should always check their withholding when a major life event occurs or when their income changes.

Estimate What You’ll Owe

If you are a salaried employee with a steady job, it’s relatively easy to calculate your tax liability for the year. You can predict what your total income will be.

Millions of Americans don’t fall into the above category. They work freelance, have multiple jobs, work for an hourly rate, or depend on commissions, bonuses, or tips. If you’re one of them, you’ll need to make an educated guess based on your earnings history and how your year has gone so far.

From there, there are several ways to get a good estimate of your tax liability.

Don’t Miss: Where Can I Find My Tax Return From Last Year