If You Used The Cd Or Downloadedversion

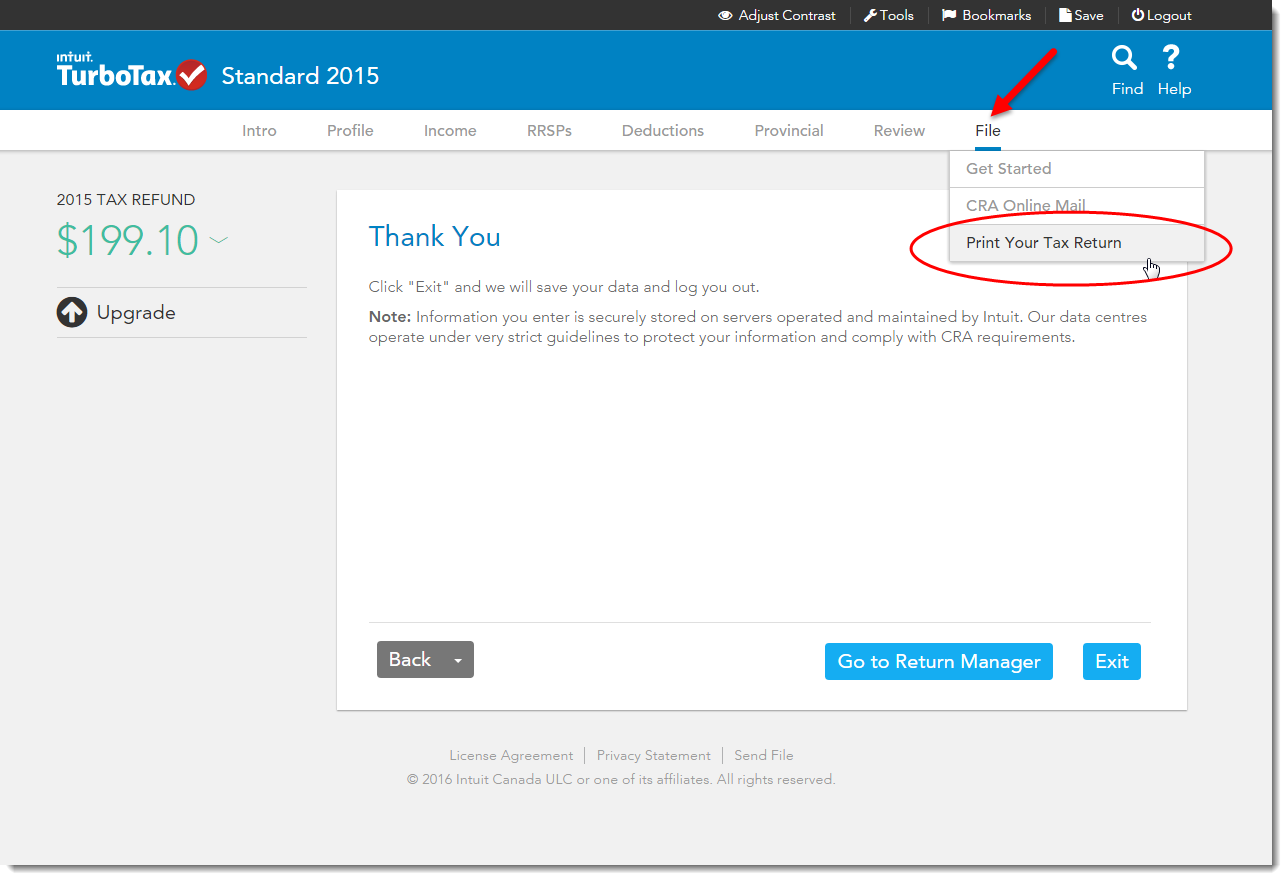

Your tax return is stored on your computer if you purchased the TurboTax CD or downloaded the program from the internet. It’s a tax data or .tax file, so you can only open it in the TurboTax software. Hopefully, that’s still installed on your computer, and you can print a copy of the return out from there.

Income $72000 And Below:

- Free federal tax filing on an IRS partner site

- State tax filing

- Guided preparation simply answer questions

- Online service does all the math

- Free electronic forms you fill out and file yourself

- No state tax filing

- You should know how to prepare paper forms

- Basic calculations with limited guidance

Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you aren’t required to file a return, it might benefit you to file if:

-

Federal taxes were withheld from your pay

and/or

-

You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

Also Check: What Happens If You File Your Taxes One Day Late

How Do You Get A Lost Tax Return

Visit the IRS Online If you visit IRS.gov/transcripts, youll find an automated Get Transcript option with two choices for recovering your lost tax return online or by mail. Each choice requires you to register and create a free account for which you provide certain information to verify your identity.

Last Years Tax Info Transferred

Now that youve transferred last years info, you can continue through TurboTax to review and complete your return.

*If you havent yet completed this years tax return with TurboTax, check out our TurboTax coupon page with an exclusive 10-20% discount for all editions of TurboTax including: Basic, Deluxe, Premier, and Self-Employed.

Read Also: What Is The Penalty For Filing Your Taxes Late

How To Filean Amended Tax Return With The Irs

turbotax.intuit.comtaxreturn

Beginning with the 2019 tax year, you can e-file amended tax returns. If you used TurboTax to prepare Form 1040-X, follow the software’s instructions to e-file the…

www.PastYearTax.com/_Tax2019Ad

Do Your 2019, 2018, 2017, 2016 Taxes in Mins, Past Tax Free to Try! Easy Fast & Secure

Did Turbotax Rip You Off

Tweet This

I know, its July, the sun is shining, and the last thing you want to think about for the next eight or nine months is taxes. Well, Intuit, the maker of TurboTax, would love for you to forget too. It most certainly hopes you glossed over the revelations by intrepid reporters from ProPublica who discovered its egregious conduct.

Did TurboTax Rip You Off?

Deposit Photos

TurboTaxs recent machinations are like the digital version of Volkswagens emissions scandal. But instead of manipulating software to hide higher levels of pollutants coming out of a car, TurboTax manipulated software and the metadata on its own site so certain results wouldnt show up in Google searches. The tactic likely prevented millions of Americans from filing their taxes for free. Instead, these individuals were nudged to TurboTaxs premium products and charged for a service they should have gotten without paying.

While ProPublicas article received attention and even led some regulators to open investigations, it deserves amplification as many consumers who may have been short-changed are not aware of what happened, how they were deceived, or what recourse they should take. Furthermore, Turbo Tax has neither shown remorse nor taken real corrective action .

Deposit Photos

What TurboTax Did

IRS Free File website

Goodarzi didnt do this.

Also Check: How Much Do Taxes Cost At H& r Block

How Do I Open My Tax Filesjuly 17 200: 09 Am Subscribe

hector horaceComputers & Internetspakto10:35 AMunixrat10:46 AMmajick10:53 AMMeTainterrobang11:05 AMluriete11:09 AMthilmony11:09 AMa site like thisXQUZYPHYR11:18 AMprevious years’jamaro11:18 AMmendel11:41 AMISA*03*076mendel11:51 AMhector horace12:20 PMview old tax returnswebsite service areamendel12:40 PMmisha12:51 PMmendel1:11 PMAnd absolutely print up hard copieshector horace2:03 PMAnd absolutely print up hard copiesmisterbrandt2:05 PMhector horace2:24 PMmeehawl2:37 PMnyxie5:33 PMhector horace6:37 PM« OlderNewer »

How To Get Copies Of Past Years Tax Returns

Here’s how to obtain copies of a prior year return you filed in TurboTax Online:

If you don’t see your tax year listed, you may have multiple accounts.

Hope this was helpful!

Read Also: What Do Tax Accountants Do

Forgot Your Turbotax Account Password Or User Id

If you have forgotten your TurboTax online user ID or password, follow these simple steps to recover your account in a few minutes.

During your account recovery process, you will either receive a one-time code to help you recover your TurboTax account or receive a list of all accounts associated with the information that you provide.

If you follow the on-screen instructions properly and you are still unable to recover your account successfully, be sure to select the “Try Something Else” on the Account Recovery Page. The system will ask you a wide range of questions to verify your identity. If you answer all the questions correctly, you will automatically gain access to your account.

Once you regain access to your account make sure that you include or update your phone number to boost your account security and also make the process of account recover quite easy.

Blocking Search Engines From Indexing Its Free File Program Page

Citizens of the US that make up to $72,000 per year are eligible for free preparation and filing of tax forms through the IRS Free File program. However, TurboTax’s “free file program” page contains specific HTML tags which block search engines from indexing it. TurboTax has been deceiving customers which were eligible for the free submission into signing up for their commercial product. Starting December 30, 2019, under a new agreement from the IRS, TurboTax can no longer hide their free version services from search results.

Don’t Miss: How Much Does Tax Take

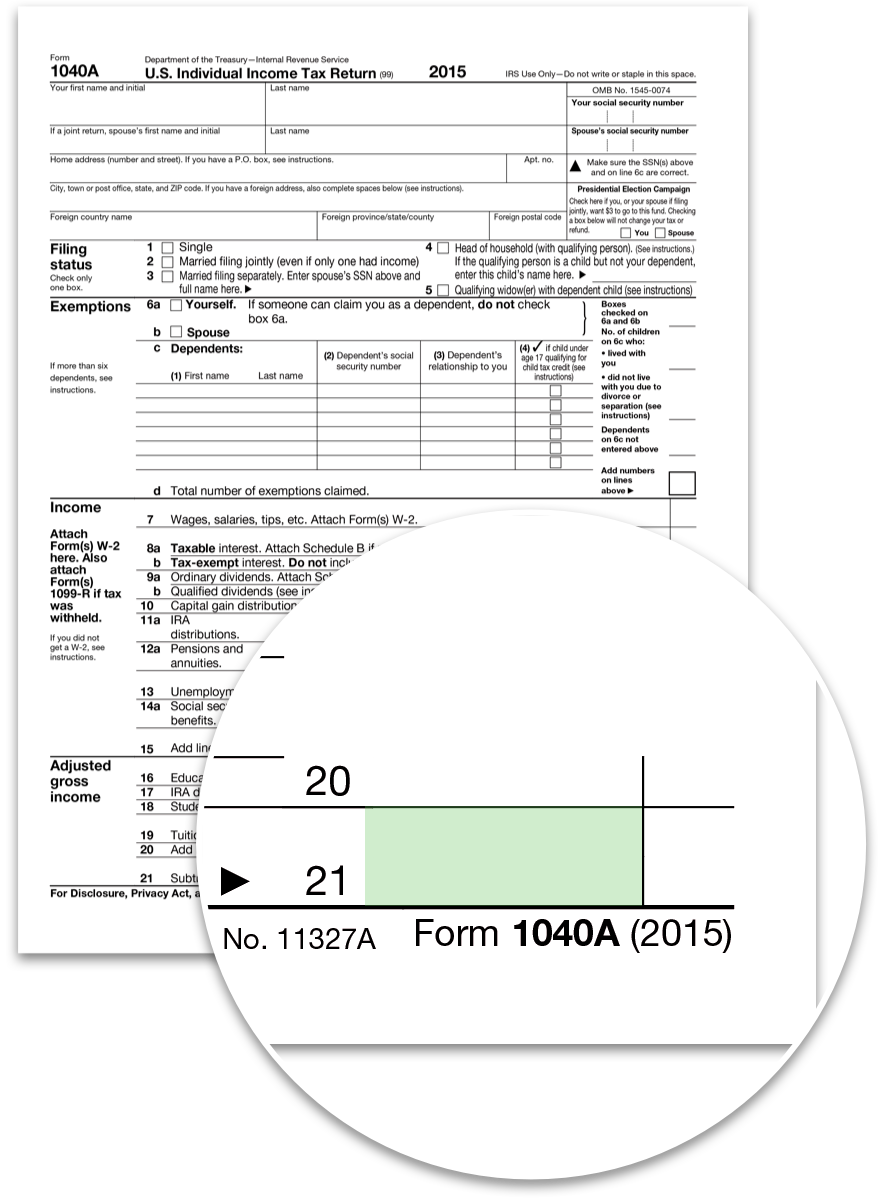

Import A Pdf For A Prior Year:

If last year you used other tax software, an accountant, or tax service, youll get the option to import a PDF when youre starting in TurboTax. A PDF imports your personal info and your AGI so you can e-file.

Select the method you used to file last year and follow the screens. The PDF needs to be your 1040, 1040A, or 1040EZ, and the program accepts PDFs from a range of providers.

But, if the PDF is password protected or a scan of a hard copy, you wont be able to import. If this happens, dont worry, well guide you through typing in your info.

*Tip: While you can import a 1040EZ return to a paid version of TurboTax, you cant import prior years to their Free Edition , so you may have to pony up for another edition

Pay Social Security Taxes To Qualify For Benefits

Self-employed individuals have to pay Social Security taxes through their estimated tax payments and individual income tax returns. By filing a return and paying the associated taxes, you report your income so that you may qualify for Social Security retirement and disability benefits when you need them.

Read Also: How Much Do I Get Back In Taxes

How Can I Get My Old Tax Returns

To get a transcript, taxpayers can:

Transcript of Return from the IRSYou can request an IRS transcript of your tax return from the IRS website. Visit the IRS website for instant online access to your transcript. Call 1-800-908-9946. Use Form 4506-T.

Also Know, how do I get my old tax returns from TurboTax? How to Open Previous Tax Returns in TurboTax

Similarly, it is asked, do you need previous tax returns?

You must always file your back tax returns on the original forms for each tax year you are filing. You can always search through the IRS website for the forms, but for quicker access, you should use sophisticated tax preparation software, such as TurboTax.

How do I get my w2 from previous years?

If you can’t get your Form W-2 from your employer and you previously attached it to your paper tax return, you can order a copy of the entire return from the IRS for a fee. Complete and mail Form 4506, Request for Copy of Tax Return along with the required fee. Allow 75 calendar days for us to process your request.

How Do You Get A Copy Of Your W2 If You Lost It

If you lost or havent received your W-2 for the current tax year, you can:

Also Check: How Much Taxes Do You Pay On Slot Machine Winnings

Not Free No Help When The Irs Sends A Letter And Still Waiting For Refund Four Months Later

I used the TurboTax app to file my refund in early February. The app was relatively easy to use, but it did get old going in circles sometimes. Unfortunately, the free option really is not usable. If you have to file state taxes like just about everyone, then you will have to pay $40 per state. If youre a college student in another state like me, that means two states so $80. Of course, no student discount. Honestly, that was not too bad since I was supposed to get a lot back.Unfortunately, that was not what happened. I did get some from one the state returns, but that was it. The IRS sent a letter for a health insurance form that didnt even apply to me. If you want help with that, guess what? It will cost you even more money! At that point, I wasnt paying TurboTax any more so I went off on my own. Eventually I got it figured out, but not without massive disruption to my school work. None of that help was thanks to TurboTax which sends you to FAQs that dont really apply.They have online discussions which appear to have many people with the same problem. This program is made to look easy- and it is at first- but the headache it causes later is not worth it. Never had trouble like this with H& R Block so I think Ill go back to them next year. Whatever you do, dont use TurboTax. It is seriously not worth it. Still waiting for that federal tax refund BTW.

Free Electronic Filing For Individuals

The Arizona Department of Revenue will follow the Internal Revenue Service announcement regarding the start of the 2020 electronic filing season. Because Arizona electronic income tax returns are processed and accepted through the IRS first, Arizonas electronic filing system for individual income tax returns is dependent upon the IRS’ launch date. Remember, the starting point of the Arizona individual income tax return is the Federal Adjusted Gross Income. The Arizona Department of Revenue will begin processing electronic individual income tax returns beginning mid-February.

Taxpayers can begin filing individual income tax returns through Free File partners and individual income tax returns will be sent to the IRS starting mid-February. Tax software companies also are accepting tax filings in advance of the IRS’ launch date.

Please refer to the E-File Service page for details on the e-filing process.

Also Check: Do Nonprofits Pay Payroll Taxes

Can I Still File My 2015 Taxes And Get A Refund

Luckily, the answer for you is yes, but the time is limited. Since the original tax deadline date for 2015 was April 18, 2016, you have until this tax deadline to claim your 2015 refund. April 15, 2019 is the last day to claim your 2015 refund. Otherwise, your refund will expire and go back to the U.S. Treasury.

Can I File My 2017 Taxes In 2021

Time matters with tax refunds

April 15, 2021 is the last day to file your original 2017 tax return to claim a refund. If you received an extension for the 2017 return then your deadline is October 15, 2021. For the 2018 tax year, with a filing deadline in April of 2019, the three-year grace period ends April 15, 2022.

Recommended Reading: How Do You Find Property Taxes By Address

Turbotax For Previous Years

If you filed tax returns with Turbotax, those returns are stored in your account. You must use the same account that you used during the filing process, according to the Turbotax community. It’s not uncommon to create a new account in the new tax year, and this practice separates your returns across multiple accounts. Search through your email to find your Turbotax account setup and reset your password if necessary to log in.

Once you access the account used to file previous returns, Turbotax recommends selecting the “Documents” option on the left menu. The selection is located immediately below the “Tax Home” label. Next, access the drop-down menu to select the desired tax year for the return you want to retrieve. This menu only shows the years you filed returns through Turbotax.

At this point, you can open the file to view it in PDF form, or you can download or print it directly from the screen.

If All Else Fails Contact The Irs

Of course, the IRS has copies of your tax returns as well, so you can reach out to the agency if your computer or tablet has since crashed or you can’t retrieve your return from TurboTax online for some reason. Unfortunately, you’ll have to pay for it, and you’ll have to wait a while to get your hands on it.

You can make your request by snail-mailing Form 4506 to the IRS along with your payment. You can download the form from the IRS website. You must include your spouse’s name and Social Security number on the form if you filed a joint married return, but your spouse doesn’t also have to sign the form.

The fee is $50 for each return as of 2020. The IRS indicates that you’ll have to wait about 75 days for processing. It keeps returns for seven years.

Don’t Miss: Where To File Quarterly Taxes

Find Out If Your Tax Return Was Submitted

You can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer. Whether you owe taxes or youre expecting a refund, you can find out your tax returns status by:

-

Looking for emails or status updates from your e-filing website or software

If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. To do so, use USPS Certified Mail or another mail service that has tracking or delivery confirmation services.

+ How Do I Speak To A Live Person At Turbotax 2021 Images

We have various wallpapers about How do i speak to a live person at turbotax 2021 available in this site. You can get any images about How do i speak to a live person at turbotax 2021 here. We hope you enjoy explore our website.

Currently you are searching a post about how do i speak to a live person at turbotax 2021 images. We give some images and information connected to how do i speak to a live person at turbotax 2021. We always try our best to present a post with quality images and informative articles. If you did not find any articles or photos you are looking for, you can use our search feature to browse our other post.

How Do I Speak To A Live Person At Turbotax 2021. You can speak to a person, you just have to go through the procedure to do that. Read faqs, ask a question in our answerxchange community, or give us a call. Or you can phone turbotax support during business hours and they can question you. How do i speak to a real person at turbo tax , need a number you can check your refund method that you selected upon filing by following these steps.

Recommended Reading: What States Are Tax Free