What Are Some Other Inflation Adjustments I Should Look Out For

We mentioned earlier that the IRSâs tax brackets apply to your taxable income, which is what you get when you apply certain adjustments and deductions to your revenue.

One other way that the IRS helps guard against bracket creep is by adjusting the values of deductions to keep up with inflation. Here are the main ones you should look out for:

How Long Does It Take To Get My Tax Return Done At Etax

You can finish your tax return easily online in just minutes at Etax.com.au. With no appointments or waiting, you can join tens of thousands of Australians by using our number one online tax return service anywhere, any time. And, youll have year-round access to qualified Etax accountant advice online using Live Chat, My Messages, or friendly help by phone.

They Charge A Set Fee For Each Tax Form Or Schedule

No ifs, ands or buts about it! They have one flat fee per form or schedule. If youre wondering what the average costs for filing common forms are, heres the breakdown:;

- $323 for a Form 1040 with a Schedule A and state return

- $220 for a Form 1040 and state return

- $192 for Schedule C

- $118 for Schedule D

- $145 for Schedule E

- $200 for Schedule F 5

Don’t Miss: How Much Tax Do You Have To Pay On Stocks

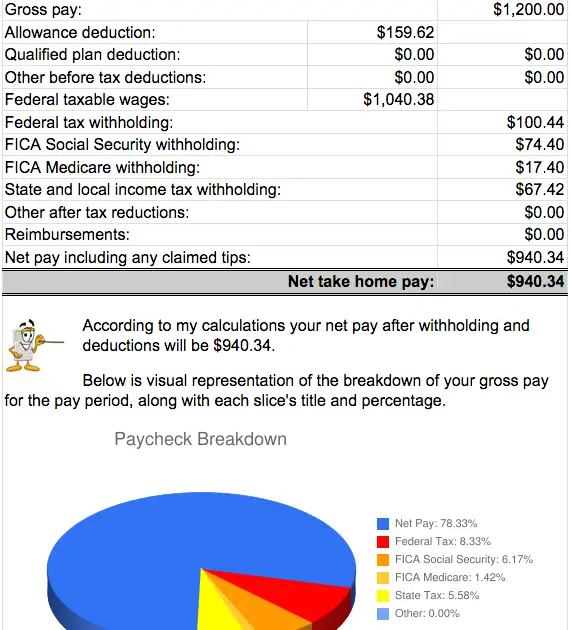

How To Change Your Take

If you’re wondering what percentage of your paycheck is withheld for federal income tax and how you can adjust it it all comes down to Form W-4. To calculate how much you should take out of each paycheck, use aW-4 Withholding Calculator and try a few different tax scenarios to find what works best for you.

Thenew format for the W-4 form introduced in 2020 allows you to indicate how much money you earn from additional jobs or how much your spouse makes to set accurate withholding levels.;

- Additionally, you can adjust forchild tax credits, credits for other dependents, and any other relevant tax deductions you plan to take in excess of the standard deduction.

You may be able to simply ask for an additional specific dollar amount to be withheld. The W-4 comes with a worksheet to help you calculate the amount you want to have taken out.

- If you enjoy the thrill ofa large refund, don’t claim any extra deductions or make adjustments for other credits.;

- Conversely, the more credits and deductions that you specify, the larger your regular paycheck will be and the lower your refund will be.;

Most tax experts advise you not to go for a large refund because that, in effect, means you’re giving the government an interest-free loan. Financial advisors typically recommend that you should maximize your paychecks andinvest the extra money throughout the year.

Previous Years Tax Brackets

Taxes were originally due April 15, but as with a lot of things, it changed in 2020. The tax deadline was extended to July 15 in order to let Americans get their finances together without the burden of a due date right around the corner.

Here is a look at what the brackets and tax rates were for 2019:

2019 Tax Brackets| Tax rate |

|---|

Read Also: What Can I Write Off On My Taxes For Instacart

How Much Tax Is Deducted From A Paycheck In Ny

Unlike the rest of the countries federal minimum wage, New York State introduced a statewide $15 per hour minimum wage plan. The state had plans to increase the minimum wage ever since 2016, making it so that the minimum wage would be increasing every year until it is $15 per hour statewide. The Commissioner of Labor will publish the annual wage increase before or on October 1st every year.

However, this plan only included general workers. Meanwhile, service workers and other tipped employees are still under the threshold outlined by that legislation. Simply put there are different hourly rates for workers in the fast-food industry and those who receive tips.

This article will cover all of the information you need to know about taxes in detail, starting from different income types to types of taxes and the deduction percentage.

What Is A Paycheck

A paycheck is how businesses compensate employees for their work. The most common delivery schedules are bi-weekly and semi-monthly, though this varies based on employer preferences and applicable state laws and regulations. Business-specific requirements, such as collective bargaining agreements covering union employees, may also dictate paycheck frequency.

Also Check: How To Reduce Income Tax

Tax Brackets Vs Tax Rates

As with most things involving the federal government, the terminology around taxes tends to be more confusing than it needs to be. When you boil it all down, here are the definitions of tax bracket and tax rate:

- A tax bracket is a range of income taxed at a specific rate.

- A tax rate is the actual percentage youre taxed at based on your income.

Its actually simpler than it sounds.

How Qualified Do You Want Your Professional To Be

The average tax preparer will charge less than a high-quality advisor with loads of experience. But when it comes to the IRS and your money, the stakes can be high, depending on your specific situation.;

Now, dont get us wrong. We want you to save money just as much as you do. But when hiring expertslike tax pros, doctors and mechanicswere all for spending more cash to get the job done right. Paying an extra $100300 on the front end may be worth it in the long run if the expert is thorough, accurate and ends up saving you a ton. Remember, were talking about estimates here, so adjust your professional expectations accordingly.

Don’t Miss: How Much Does H&r Block Cost To File Taxes

Overview Of California Taxes

California has the highest top marginal income tax rate in the country. Its a high-tax state in general, which affects the paychecks Californians earn. The Golden States income tax system is progressive, which means wealthy filers pay a higher marginal tax rate on their income. Cities in California levy their own sales taxes, but do not charge their own local income taxes.

Work InfoDismiss

You can’t withhold more than your earnings. Please adjust your .

| Gross Paycheck | |

| FICA and State Insurance Taxes | –% |

| State Family Leave Insurance Tax | –% |

| State Workers Compensation Insurance Tax | –% |

- Our Tax Expert

Jennifer Mansfield, CPATax

Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. SmartAssets tax expert has a degree in Accounting and Business/Management from the University of Wyoming, as well as both a Masters in Tax Laws and a Juris Doctorate from Georgetown University Law Center. Jennifer has mostly worked in public accounting firms, including Ernst & Young and Deloitte. She is passionate about helping provide people and businesses with valuable accounting and tax advice to allow them to prosper financially. Jennifer lives in Arizona and was recently named to the Greater Tucson Leadership Program.

…read more

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

Resolving Human Resources Issues

When you hired your caregiver, you went over all the details to make sure they were the right person to care for your family. You probably didnt think the requirements concerning maternity leave, employment contracts, hiring and termination issues or paid time off would become your area of expertise. But, as a household employer, all those human resource issues fall squarely on your shoulders. Expect to spend a good chunk of time familiarizing yourself with these issues so you can make sure youre following the best employment practices and complying with the law.

With all these tasks, its easy to understand how it will take 50 to 55 hours of your time. If you need someone to do it for you or just want to talk through some concerns, check out how Care.com HomePay can help.

Next Steps:

You May Like: How To Find Out Your Tax Rate

What Are The Federal Income Tax Brackets For 2021 Filing

Which tax bracket you fall into in the United States also depends on your filing status. Here are the 2020 tax brackets according to the IRS for the four most common filing statuses: individual single filers, married individuals filing jointly, heads of households, and married individuals filing separately:

| Tax rate |

|---|

| $523,600+ |

What Does An Irs Treas 310 Transaction Mean

If you receive your tax refund by direct deposit, you may see;IRS TREAS 310;listed for the transaction. The 310 code simply;identifies the transaction;as a refund from a filed tax return in the form of an electronic payment . This would also apply to those receiving an automatic adjustment on their tax return or a refund due to March legislation on tax-free unemployment benefits. You may also see;TAX REF;in the description field for a refund.

If you received;IRS TREAS 310;combined with a;CHILD CTC;description, that means the money is for a monthly advance payment for the enhanced;child tax credit.;

If you see a;449;instead of;310, it means your refund has been offset for delinquent debt.

You May Like: Where Can I Find My Tax Return From Last Year

What Small Business Owners Need To Know For Payroll

All of the information above can apply to both business owners and employees. For example, as a small business owner, if youre asked how much federal tax is taken out of my paycheck by employees, youll have a better understanding to explain the process. Additionally, if youre asking this question for your personal paychecks youll also know. If youre one of the small business owners following a DIY approach to payroll, you really need to know the above information.

To handle payroll on your own, make sure that youre getting Form W-4 from employees during onboarding. Additionally, youll want employees to verify their personal information is correct at the end of the year as youre preparing Form W-2 for tax season. From there, payroll calculators will be your friend. Payroll calculators can help you calculate what payroll will be for salaried employees and contractors.

What Does A ‘math Error’ Notice From The Irs Mean

Millions of Americans have received confusing “math-error notices” from the IRS this year — letters saying they owe more taxes. Once they get the notice, they have a 60-day window to respond before it goes to the agency’s collection unit.;

From the start of the year to August, the IRS sent more than 11 million of these notices. According to the Taxpayer Advocate Service, “Many math error notices are vague and do not adequately explain the urgency the situation demands.” Additionally, sometimes the notices “don’t even specify the exact error that was corrected, but rather provide a series of possible errors that may have been addressed by the IRS.”;

The majority of the errors this year are related to stimulus payments, according to the Wall Street Journal. They could also be related to a tax adjustment for a variety of issues detected by the IRS during processing. They can result in tax due, or a change in the amount of the refund — either more or less. If you disagree with the amount, you can try contacting the IRS to review your account with a representative.

Also Check: How To Look Up Employer Tax Id Number

How Can You Use The Where’s My Refund Tool

To check the status of your 2020 income tax refund using the;IRS tracker tools, you’ll need to give some information: your Social Security number or Individual Taxpayer Identification Number, filing status — single, married or head of household — and your refund amount in whole dollars . Also, make sure it’s been at least 24 hours before you start tracking your refund.;

Using the IRS tool Where’s My Refund, go to the;Get Refund Status;page, enter your SSN or ITIN, filing status and exact refund amount, then press;Submit. If you entered your information correctly, you’ll be taken to a page that shows your refund status. If not, you may be asked to verify your personal tax data and try again. If all the information looks correct, you’ll need to enter the date you filed your taxes, along with whether you filed electronically or on paper.

The IRS also has a mobile app called;IRS2Go;that checks your tax refund status — it’s available in English and Spanish. You’ll be able to see if your return has been received, approved and sent. In order to log in, you’ll need some information — your Social Security number, filing status and expected refund amount. The IRS updates the data in this tool overnight, so if you don’t see a status change after 24 hours or more, check back the following day. Once your return and refund are approved, you’ll receive a personalized date by which to expect your money.;

Australian Income Tax Calculator

Employment income: Employment income frequency

Enter an income to view the result

The estimated tax on your taxable income is0

| Your income after tax & Medicare levy: |

|---|

| Your marginal tax rate: |

This means for an annual income of you pay:

| No tax on income between $1;-;$18,200 | $0 |

| 19c for every dollar between $18,201;-; | 0 |

| 32.5c for every dollar between ;-; | 0 |

| 37c for every dollar between ;-;$180,000 | 0 |

| c for every dollar over $180,000 | 0 |

- The rates are for Australian residents.

- Your marginal tax rate does not include the Medicare levy, which is calculated separately.

- The Medicare levy is calculated as 2% of taxable income for most taxpayers. The Medicare levy in this calculator is based on individual rates and does not take into account family income or dependent children.

- The calculations do not include the Medicare Levy Surcharge , an additional levy on individuals and families with higher incomes who do not have private health insurance.

- These calculations do not take into account any tax rebates or tax offsets you may be entitled to.

- For the 2016-17 financial year, the marginal tax rate for incomes over $180,000 includes the Temporary Budget Repair Levy of 2%.

- In most cases, your employer will deduct the income tax from your wages and pay it to the ATO.

- 2020-2021 pre-budget reflects the tax rates prior to those announced in the Budget in October 2020.

You May Like: How To Calculate Payroll Taxes In California

What Are The Benefits Of Taking A Lump Sum Payment Versus Annuity Payments

If you take a lump sum, you have more control over your money right now. You can choose to invest it into a retirement account or other stock option to generate a return. You could also use it to buy or expand a business.

Several financial advisors recommend taking the lump sum because you typically receive a better return on investing lottery winnings in higher-return assets, like stocks. If you elect annuity payments, however, you can take advantage of your tax deductions each year with the help of lottery tax calculator and a lower tax bracket to reduce your tax bill.

The decision for which option is better is complex. It all depends on the size of the lottery winnings, your current and projected income tax rates, where you reside, and the potential rate of return on any investments. If you win big, its in your best interest to work with a financial advisor to determine whats right for you. However, you can also determine the taxes using a federal tax calculator.

Do I Have To File Taxes If I Made Less Than $10000

If your gross income was less than $10,000, you may not have to file a federal income tax return. But you may still want to file if you worked during 2020 and your employer withheld tax from your paycheck. Filing a tax return even if youre not required to do so is the only way to get any tax youre owed refunded to you.

Also Check: How To Pay Llc Taxes

How Much Do People Pay In Taxes

Andrew Lundeen

Tax day is a day away and this time of year there are always questions about who pays how much in taxes.

A recent poll by Pew Research Center found that the feeling that some wealthy people dont pay their fair share, bothered 79 percent of respondents some or a lot. Recent analysis by the Joint Committee on Taxation shows that these respondents can rest easy.

When it comes to individual income taxation in the United States, the average tax rate paid increases as we move up the income scale . As a group, taxpayers who make over $1,000,000 pay an average tax rate of 27.4 percent. At the bottom of the income scale, taxpayers who earn less than $10,000 pay an average tax rate of -7.1 percent, which means they receive money back from the government, in the form of refundable tax credits. The next income group up has an even lower negative tax rate at 11 percent.

These results are as expected. The U.S. income tax system is progressive, with marginal tax rates increasing as incomes increase and a large number of tax credits that limit the tax burden for lower incomes.

Many would argue, however, that people pay more federal taxes that just individual income taxes. They are correct. People also pay social insurance taxes , business taxes, and excise taxes.

Whether this level of progressivity is the correct amount requires a larger discussion, but its important to note that progressive taxes come with an economic cost.

Was this page helpful to you?