What Is The Standard Deduction For Married Filing Jointly

The standard deduction is $25,900. Thats up $1,900 from last year. If you and your spouse are both 65 or older, or if youre blind, you get an additional $1,300 deduction. So, your total deduction would be $27,200

If you are a single filer, the standard deduction is $12,550. Thats up $550 from last year. If youre blind or 65 or older, you also get an additional $1,300 deduction. So your total deduction would be $13,850.

How To Calculate Your Tax Bracket

The TurboTax tax bracket calculator is a tool that can help you estimate your tax liability for the year. It takes into account your filing status, whether you are a married or single filer, income deductions, and to give you an idea of what your effective tax rate might be.

The calculator is easy to use and only takes a few minutes to complete. Simply enter your information and let the calculator do the rest.

In addition to giving you an estimated tax liability, the tax bracket calculator can help you determine if youre eligible for certain tax breaks.

If youre looking for a way to estimate your taxes for the year, the TurboTax tax bracket calculator is a helpful tool. Its quick, easy to use, and can give you an idea of what you can expect to owe come April 15th.

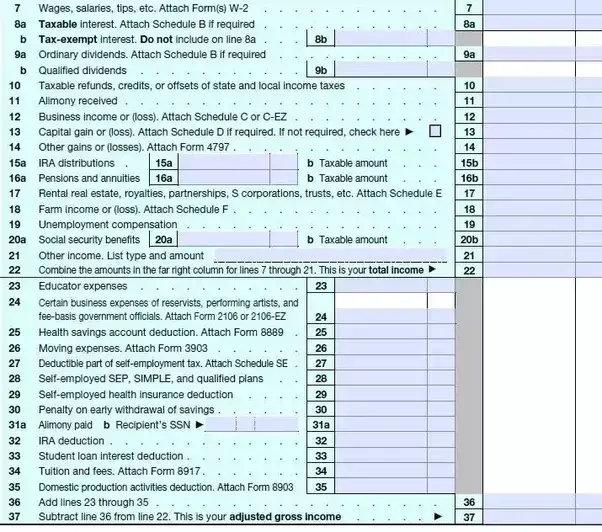

Estimating Federal Income Tax

The calculator results provided here are an estimate based on taxable income only. The IRS uses many factors to calculate the actual tax you may owe in any given year. Note that if you are self-employed this calculator does not include estimated self-employment tax. Please consultIRS.gov Form 1040-ES for specific information about estimated tax for the self-employed.

You May Like: Are Taxes Extended This Year

Need Assistance We’re Here To Help

Acknowledgement of Country

We acknowledge the Traditional Custodians of the land where we work and live. We pay our respects to Elders past and present. We celebrate the stories, cultures, and traditions of Aboriginal and Torres Strait Islander communities who also work and live on this land.

Conditions, fees & charges apply. Banking products issued by Police & Nurses Limited ABN 69 087 651 876 AFSL No. 240701 Australian Credit Licence No. 240701.

Any advice does not take into account your objectives, financial situation or needs. Read the relevant Product Terms and Conditions before making a decision and consider whether the product or service is right for you. The Target Market Determination for products is available on request. Approval criteria apply to credit products.

How Do I Affect Withholding Now

Since the 2020 W-4 is far simpler than it has been in the past, it might seem harder to change your total withholding. The loss of allowances on the form might seem especially irksome, but not to worry. There are still plenty of ways to affect your withholding.

First, its important to fill out the multiple jobs or working spouse section using the worksheet on the third page of the W-4 so that the IRS has a proper record of how much money total you bring in.

Second, the total number of dependents you claim also has a significant effect on your total withholding, so make sure you claim the correct number of dependents in Step 3.

Finally, Section 4 of the W-4 is a bit more indefinite. Here youll be able to state other income and list your deductions, which can help reduce your withholding. Use the worksheet on page 3 of the W-4 to figure out your deductions. Finally, you can also use the extra withholding section to make your total withholding as precise as possible.

If you have a complex tax situation, it may be wise to work with a financial advisor who specializes in tax issues.

Read Also: How To Get My Income Tax Return Copy Online

The Federal Income Tax: How Are You Taxed

The federal personal income tax that is administered by the Internal Revenue Service is the largest source of revenue for the U.S. federal government. Nearly all working Americans are required to file a tax return with the IRS each year. In addition to this, most people pay taxes throughout the year in the form of payroll taxes that are withheld from their paychecks.

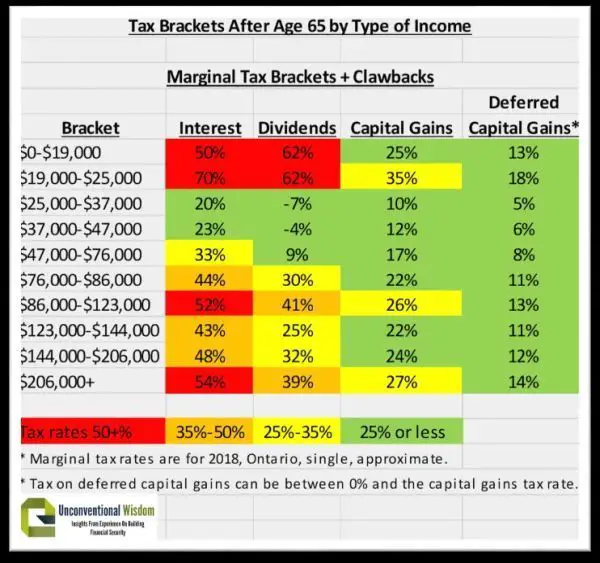

Income taxes in the U.S. are calculated based on tax rates that range from 10% to 37%. Taxpayers can lower their tax burden and the amount of taxes they owe by claiming deductions and credits.

What Is Better Total Payout Or Lump Sum In Cash

The total amount is paid in annual installments over 29 years, with each payment 5% larger than the preceding one. It’s guaranteed income, but the drawbacks are:

- Tax rates could rise over the next 30 years.

- If you die before all payments are made, your estate would be taxed at amounts more than $22 million.

- The entity making payments could go bankrupt.

Those who advocate taking the lump sum say the windfall grow with smart investments. Drawbacks include spending the money or giving too much of it away.

For those reasons, a 2018 USA TODAY analysis recommended taking the lump sum.

Don’t Miss: Where Do I Put Business Expenses On Tax Return

When Filing Married Jointly Who Is The Primary Taxpayer

If you and your spouse file your taxes jointly, the IRS will consider both of your incomes when determining your tax bracket.

However, the primary taxpayer is typically the spouse who earns the most income. This means that most of your joint tax bracket will be based on the primary taxpayers income.

The benefits are that you can take advantage of certain tax deductions and credits you would not be eligible for if you filed separately. You may also end up paying less in taxes overall by filing jointly.

States Participate In Mega Millions

Mega Millions can be played in 45 states, the District of Columbia and the Virgin Islands. The numbers are drawn Tuesday and Friday at 11 p.m. ET. Tickets cost $2 a play.

________

USA TODAY Network reporting and research Associated Press lotteryusa.com Internal Revenue Service Kiplinger megamillions.com

Don’t Miss: What Is New York City Tax

How Your Vermont Paycheck Works

It can be a challenge to predict the size of your paycheck because money is deducted for FICA, federal and state income taxes, as well as other withholdings.

When you start a new job, you’ll have to fill out a W-4 form. Your Vermont employer uses the information you provide on this form – with regard to your marital status, how many allowances you are claiming and any additional dollar withholding you take – to determine how much to deduct from your paychecks for federal and state taxes. You’ll need to submit a new form during the year if you want to make changes regarding your status or dependents.

Its also worth checking the information in your W-4 early in 2019. Because of President Trump’s new tax plan, withholding calculations changed in early 2018. Your employer will continue using the withholdings on your current form but it’s a good idea to check if you are happy with what you have currently designated.

Paying 50% of your FICA taxes is standard, but self-employed workers have to pay these taxes in their entirety since they do not have a separate employer to match their contributions. The good news is that theyre able to deduct the employer portion of their contribution.

What Types Of Income Arent Taxable

The good news is, several types of income arent taxable. You wont owe federal income taxes on:

- Child support payments

- Interest from municipal bonds

- Life insurance proceeds

- Disability benefits

- Capital gains from the sale of your primary residence

- Gifts and inheritances

Note that gifts arent taxable to the recipient, but they do have special tax rules. Gift givers may have to file a gift tax return if they give gifts worth more than the annual gift tax exclusion to any one person during the year.

However, generally gifts made to your spouse for any amount arent taxable. Also, inheritances arent taxable at the federal level, but some states levy inheritance taxes.

IRS Publication 525 has a more expansive list of the types of income that are and arent taxable.

Read Also: What Are The 2020 Income Tax Brackets

Gross Annual Income Calculator

Gross income is money before taxation. You can read more about it in the net to gross calculator.

The first four fields serve as a gross annual income calculator. To calculate gross annual income enter the gross hourly wage in the first field of this yearly salary calculator. The result in the fourth field will be your gross annual income.

If you’re wondering how to calculate gross annual income by yourself – use the formula mentioned earlier just remember to use your gross hourly wage.

Itemize Or Claim The Standard Deduction

You generally have a choice between itemizing deductions or claiming the standard deduction, whichever option is easiest or will result in the lowest tax bill.

The standard deduction is a flat amount determined by the IRS based on your filing status. To itemize deductions, you have to keep track of amounts you paid for things like out-of-pocket medical expenses, home mortgage interest, state and local taxes , and charitable contributions. You list each of these expenses on Schedule A and attach it to your return.

You May Like: What’s The Sales Tax In Texas

Financial Facts About The Us

The average monthly net salary in the United States is around 2 730 USD, with a minimum income of 1 120 USD per month. This places US on the 4th place out of 72 countries in the International Labour Organisation statistics for 2012.

The United States’ economy is the largest and one of the most open economies in the world, representing approximately 22% of the gross world product. The US leads the world by having a high productivity of manufactured goods, a well-developed infrastructure, and abundant natural resources. The United States financial market is also the largest and the most influential in the world. This makes the USD the most used currency in international transactions.

Over 128 of the world’s 500 largest companies are headquartered here, including: Walmart, ExxonMobil, Chevron, Apple, JP Morgan Chase, and many others. Thanks to its strong economy, the United States has always attracted a high number of immigrants from all over the world. The net migration rate is among the highest in the world.

The US is the 4th largest country by area in the world with over 50 states, covering a vast part of North America. Washington D.C. is the capital of the United States. Other major cities include: New York a global finance and culture center, Los Angeles famed for filmmaking and known as the “Creative Capital of the World”, Chicago renowned for its museums and bold architecture.

Net Income After Taxes

Net income after taxes is a similar concept to after-tax income, except it applies to corporations rather than individuals. Also referred to as the profit or the net earnings, the net income after taxes refers to the remaining earnings after deducting all expenses .

Aside from taxes, the net income after taxes also deducts operating expenses, interest, dividends, and depreciation. In the context of corporate finance, the net income after taxes is an important number because it represents the remaining profit for owners and shareholders. For publicly traded companies, a higher NIAT typically results in a higher share price.

You May Like: When Will Taxes Be Released 2021

Take Advantage Of Tax Credits To Potentially Get A Bigger Refund

Tax credits are a good way to reduce your tax burden, potentially all the way to zero and if they are refundable, could even put money in your pocket. Any portion of the refundable credit that is in excess of what you owe in taxes will be given to you as part of your tax refund.

This year the IRS is warning taxpayers that they may see smaller refunds than they may have become accustomed to over the past couple of years. The reason, in 2022 there was no Economic Impact Payments, better known as stimulus checks. As well, tax credits implemented during the pandemic have come to an end, such as the expanded Child Tax Credit, reverting to their previous amounts.

Financial News

Federal Top Income Tax Rate

| Year | |

|---|---|

| 2012 | 35.00% |

When it comes to tax withholdings, employees face a trade-off between bigger paychecks and a smaller tax bill. It’s important to note that while past versions of the W-4 allowed you to claim allowances, the current version doesn’t. Additionally, it removes the option to claim personal and/or dependency exemptions. Instead, filers are required to enter annual dollar amounts for things such as total annual taxable wages, non-wage income and itemized and other deductions. The new version also includes a five-step process for indicating additional income, entering dollar amounts, claiming dependents and entering personal information.

One way to manage your tax bill is by adjusting your withholdings. The downside to maximizing each paycheck is that you might end up with a bigger tax bill if, come April, you haven’t had enough withheld to cover your tax liability for the year. That would mean that instead of getting a tax refund, you would owe money.

If the idea of a big one-off bill from the IRS scares you, then you can err on the side of caution and adjust your withholding. Each of your paychecks may be smaller, but youre more likely to get a tax refund and less likely to have tax liability when you fill out your tax return.

Also Check: How To Do Taxes For Cryptocurrency

How To Use The Annual Income Calculator

This is how to calculate your annual income with our calculator:

Enter the hourly wage – how much money you earn per hour.

In the second field, input how many hours you work in a week. By default, we set the value to 40 hours . If you work half-time, change it to 20. Otherwise, you can set it to any number you want.

A year usually has 52 weeks . If you get paid for holidays and work all year round, leave the default number in the third field of the yearly income calculator. If you work less – enter the number of weeks in a year for which you get paid.

That’s it, the annual salary calculator has determined your yearly salary.

How To Use The Income Tax Calculator For Fy 2022

Following are the steps to use the tax calculator:

1. Choose the financial year for which you want your taxes to be calculated.

2. Select your age accordingly. Tax liability in India differs based on the age groups.

3. Click on ‘Go to Next Step’

4. Enter your taxable salary i.e. salary after deducting various exemptions such as HRA, LTA, standard deduction, and so on.

Or else, just enter your salary i.e salary without availing exemptions such as HRA, LTA, standard deduction, professional tax and so on.

5. Along with taxable salary, you must enter other details such as interest income, rental income, interest paid on home loan for rented, and interest paid on loan for self occupied property.

6. For Income from Digital Assets, enter the net income , such income is taxed at 30% Plus applicable surcharge and cess.

7. Click on ‘Go to Next Step’ again.

8. In case, you want to calculate your taxes under the old tax slabs,you will have to enter your tax saving investments under section 80C, 80D, 80G, 80E and 80TTA.

9. Click on ‘Calculate’ to get your tax liability. You will also be able to see a comparison of your pre-budget and post-budget tax liability .

Note: Whichever field is not applicable, you can enter “0”.

You can even get your tax computation on your mail.

Read Also: How Does Getting Married Affect Taxes

How To Calculate Your Taxable Income

Another piece of good news: Even if all your income falls into the taxable category, you wont owe tax on every dollar. Thats because the IRS allows you to claim certain deductions that reduce your gross income to arrive at taxable income.

You can calculate your taxable income in a few simple steps.

Should A Married Couple File Jointly

If youre married, you generally have the option of filing your taxes jointly with your spouse or separately. There are a few key things to consider when deciding how to file, including your tax bracket and whether you want to be jointly responsible for any taxes owed.

Generally speaking, married couples who file jointly tend to owe less in taxes than those who file separately. This is because they often fall into a lower tax bracket than they would if they filed as individuals.

Additionally, joint filers are only responsible for their own individual tax debt not their spouses.

There are some drawbacks when doing it jointly, however. For example, if one spouse has a lot of debt or is self-employed, it may be beneficial to do your tax returns separately so that the other spouse isnt liable for those debts.

Also Check: Do You Pay Taxes On Plasma Donations

How To Calculate Income Tax

Income tax calculation for the Salaried

Income from salary is the sum of Basic salary + HRA + Special Allowance + Transport Allowance + any other allowance. Some components of your salary are exempt from tax, such as telephone bills reimbursement, leave travel allowance. If you receive HRA and live on rent, you can claim exemption on HRA. Calculate exempt portion of HRA, by using this HRA Calculator.

On top of these exemptions, a standard deduction of Rs 40,000 was introduced in budget 2018. This has been increased to Rs 50,000 in budget 2019.

In case you opt for the new tax regime, these exemptions will not be available to you.

Let’s understand income tax calculation under the current tax slabs and new tax slabs by way of an example. Neha receives a Basic Salary of Rs 1,00,000 per month. HRA of Rs 50,000. Special Allowance of Rs 21,000 per month. LTA of Rs 20,000 annually. Neha pays a rent of Rs 40,000 and lives in Delhi.

| Nature |

|---|

To calculate Income tax, include income from all sources. Include:

- Income from Salary

- Income from house property

- Income from capital gains

- Income from business/profession

- Income from other sources

| Nature |

|---|

| Rs 12,500 + Rs 25,500+ Rs 37,500 + Rs 50,000 + Rs 62,500 + Rs 1,77,600 + Rs 14,604 | Rs 3,79,704 |

What are the exemptions/ deductions that are disallowed under the new tax regime?

Individual or HUF opting for taxation under the newly inserted section 115BAC of the Act shall not be entitled to the following exemptions/deductions: