Income That Is Assessed For Tax

Under the PAYE system, income tax is charged on all wages, fees, perks,profits or pensions and most types of interest. Tax is payable on earnings ofall kinds that result from your employment .

Money you get which is not liable to income tax may be liable to othertaxes. If you get gifts or inheritances, you may have to pay CapitalAcquisitions Tax. If you sell assets such as property or shares you mayhave to pay Capital GainsTax.

How Tax Brackets Work

There are seven brackets for 2021 and 2022, ranging from 10% to 37%. Yours will depend on your income level and filing status.

“Your tax bracket is evaluated by viewing all your income, including required minimum distributions from IRAs, Social Security and possibly even a pension if you are fortunate to have one,” says Peter J. Klein, founder and chief investment officer at ALINE Wealth. From this income, you can take certain allowances or deductions to reduce your taxable income, and thus lower your tax bracket.

You can choose to take the standard deduction for the year or use itemized deductions. The standard deduction in 2021 is $12,550 for single filers and married individuals filing separately. For heads of household it’s $18,800 and for married couples filing jointly the 2021 standard deduction is $25,100.

To determine what tax bracket you’re in, subtract allowable deductions from your adjusted gross income for the year . The resulting dollar amount will determine what marginal tax bracket you’re in.

Which Turbotax Is Best For You

Figuring out all these specifics can be stressful. But doing your income taxes doesnt need to be, when you use TurboTax Online.

However, if you do feel a bit overwhelmed, consider TurboTax Live Assist & Review and get unlimited help and advice from a real person as you do your taxes. Plus, theres a final review before you file. Or, choose TurboTax Live Full Service and have one of our tax experts do you return from start to finish.

With more than 20 years experience helping Canadians file their taxes confidently and get all the money they deserve, TurboTax products, including TurboTax Free, are available at www.turbotax.ca.

Read Also: File Amended Tax Return Online Free

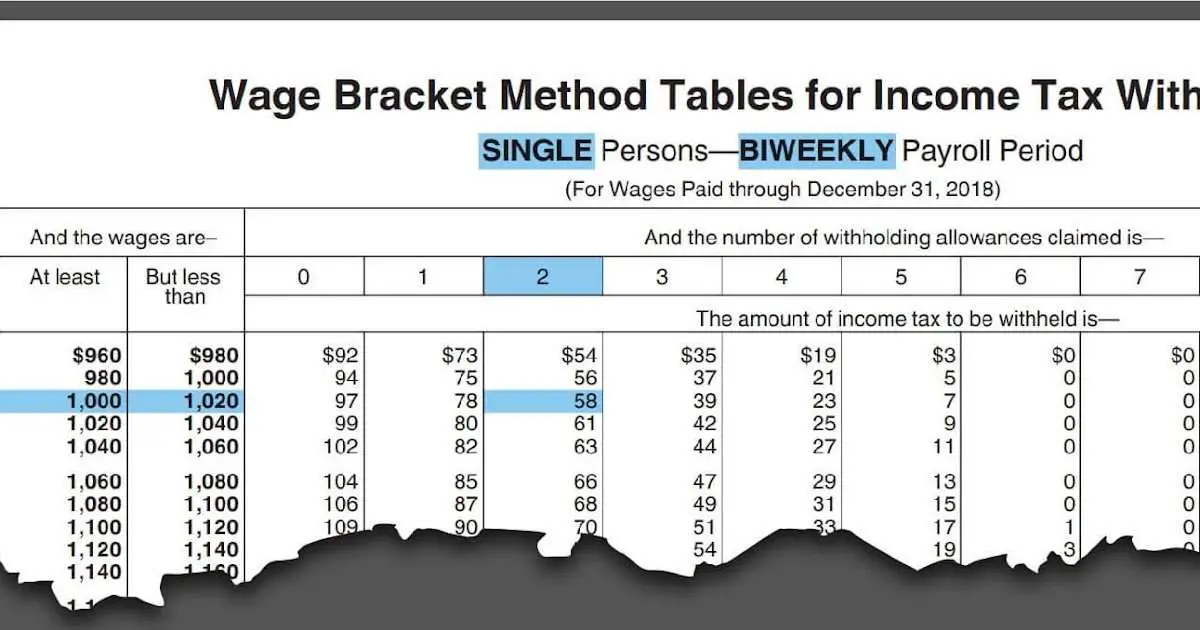

How To Determine Gross Pay

For salaried employees, start with the person’s annual amount divided by the number of pay periods. For hourly employees, it’s the number of hours worked times the rate .

If you are not sure how to pay employees, read this article on the difference between salaried and hourly employees.

Here are examples of how gross pay for one payroll period is calculated for both salaried and hourly employees if no overtime is included for that pay period:

A salaried employee is paid an annual salary. Let’s say the annual salary is $30,000. That annual salary is divided by the number of pay periods in the year to get the gross pay for one pay period. If you pay salaried employees twice a month, there are 24 pay periods in the year, and the gross pay for one pay period is $1,250 .

An hourly employeeis paid at an hourly rate for the pay period. If an employee’s hourly rate is $12 and they worked 38 hours in the pay period, the employee’s gross pay for that paycheck is $456.00 .

Then include any overtime pay. Next, you will need to calculate overtime for hourly workers and some salaried workers. Overtime pay must be added to regular pay to get gross pay.

When You’ll Get Paid

When you receive your paycheck depends on the timing of the company’s payroll. Employees typically receive a paycheck either weekly or every other week. Receiving a paycheck monthly is less common.

Compensation is typically paid via check or direct deposit directly into the employee’s checking account.

When you’re hired, you should be notified about payroll timing and options for getting paid. Starting a new jobor leaving your current position sometime soon? You might not receive your check at the regularly expected time.

Depending on the payroll cycle, company policy, and state law, your pay may lag. For example, when youre starting a new job, its not uncommon to receive your first paycheck a week or two after the usual time.

And, when you leave a job, you may receive your check on the last day youve worked or on the last regular pay date for the pay period. There are no federal laws mandating exactly when the last check must be issued, although some states specify that you must be paid immediately. In any case, you must be paid for the time youve worked.

Read Also: Www.1040paytax

A Traditional Second Job

If you have a traditional second job, you are working for a regular salary or hourly wage. In this case, you’ll receive a W-2 at tax time, and you’ll have to fill out a W-4 with your withholding information.

If you already have another job where taxes are withheld from your paycheck, one easy option might be to claim zero on your second paycheck if you’re working a job where your employer withholds taxes.

However, it can be a good idea to check a withholding calculator to see whether you need to make adjustments to accommodate this extra income. If it turns out that you owe more than you had withheld, the IRS will want the money all at once when you file your tax return.

Be sure to consider both your federal and state taxes when you determine how they will be affected by a second job.

How To Calculate Your Cpp Contributions

Personally, I just use this tax calculator to ensure Im saving enough for income taxes and my Canada Pension Plan contributions, but if youre curious how the math works, here goes!

For your CPP premiums, you are required to pay these if you are 18 or older and earn more than $3,500/year. Its also interesting to note that if you are an employee, you only pay half of your CPP premiums and your employer pays the other half. When youre self-employed, you arent so lucky and have to pay the full 10.9%. You are required to pay 10.9% on your gross income , minus the $3,500 basic exemption amount. Heres an example:

You earned $100,000 in business revenue

You spent $30,000 on business expenses and operating costs

Youre left with $70,000 in business earnings after expenses

Subtract the $3,500 basic exemption amount to equal $66,500

Multiply $66,500 by 10.9% to equal $7,248.50

$100,000 $30,000 = $70,000 $3,500 = $66,500 x 10.9% = $7,248.50

But thats not all! There is actually a ceiling for CPP premiums. The maximum amount a self-employed individual can contribute to CPP is $6,332.90/year as of 2021. Which means instead of paying $7,248.50 in CPP, you would actually only owe the maximum contribution amount which is $6,332.90.

Since CPP contribution amounts change every year, to keep up to date check out this CPP contribution rates, maximums and exemptions page on the governments website.

Read Also: Irs Employee Search

How To Calculate Federal Tax Credits

Unlike adjustments and deductions, which apply to your income, tax credits apply to your tax liability, which means the amount of tax that you owe.

For example, if you calculate that you have tax liability of $1,000 based on your taxable income and your tax bracket, and you are eligible for a tax credit of $200, that would reduce your liability to $800. In other words, you would only owe $800 to the federal government.

Tax credits are only awarded in certain circumstances, however. Some credits are refundable, which means you can receive payment for them even if you dont owe any income tax. By contrast, nonrefundable tax credits can reduce your liability no lower than zero. The list below describes the most common federal income tax credits.

- The Earned Income Tax Credit is a refundable credit for taxpayers with income below a certain level. The 2021 credit can be up to $6,728 for taxpayers with three or more children, or lower amounts for taxpayers with two, one or no children.

- The Child and Dependent Care Credit is a nonrefundable credit of up to $4,000 or $8,000 related to childcare expenses incurred while working or looking for work.

- The Adoption Credit is a nonrefundable credit equal to certain expenses related to the adoption of a child.

- The American Opportunity Tax Credit is a partially refundable credit of up to $2,500 per year for enrollment fees, tuition, course materials and other qualified expenses for your first four years of post-secondary education.

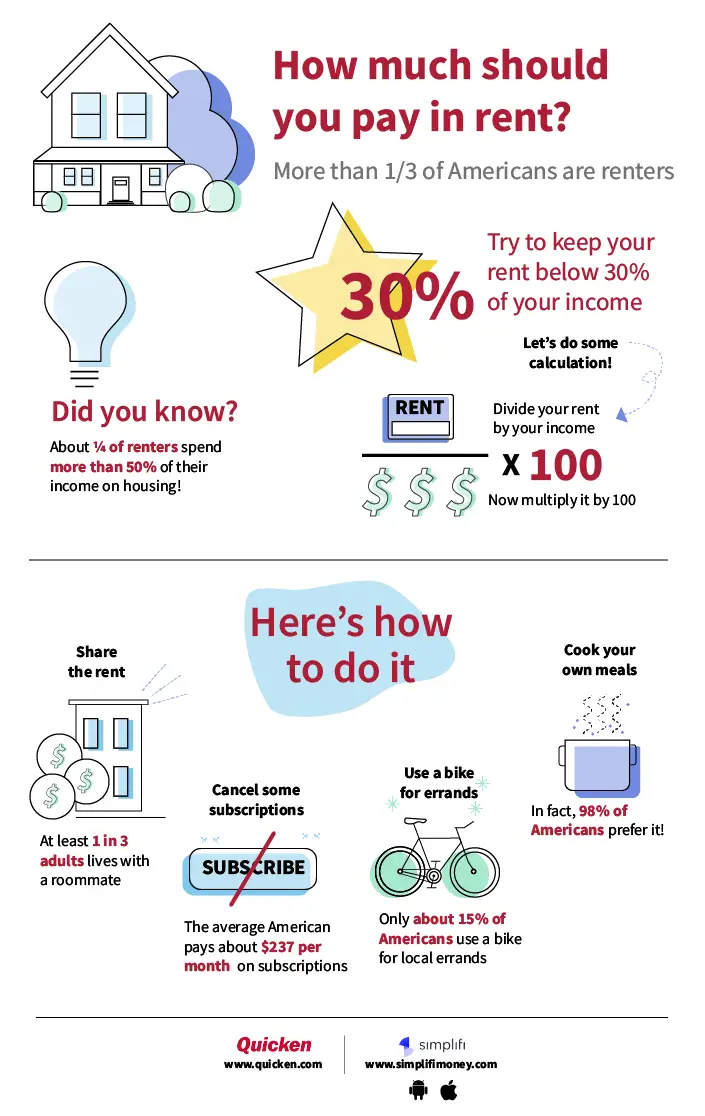

How Can I Reduce My Taxes

If you’re concerned that the income from a second job might push you into another tax bracket, you can look for ways to reduce your tax bill. If you pay a lot in mortgage interest, medical expenses, and charitable donations, you may be able to itemize your deductions. Additionally, you may be able to take various self-employment deductions or other deductions for job-related expenses.

The information contained in this article is not tax or legal advice and is not a substitute for such advice. State and federal laws change frequently, and the information in this article may not reflect your own states laws or the most recent changes to the law. For current tax or legal advice, please consult with an accountant or an attorney.

You May Like: Pastyeartax Com Review

Income Taxes And Your Social Security Benefit

Some of you have to pay federal income taxes on your Social Security benefits. This usually happens only if you have other substantial income in addition to your benefits .

You will pay tax on only 85 percent of your Social Security benefits, based on Internal Revenue Service rules. If you:

- file a federal tax return as an “individual” and your combined income* is

- between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits.

- more than $34,000, up to 85 percent of your benefits may be taxable.

How To Know If Youre Self

There are a ton of different terms for being self-employed, so I want to start with clearing some things up. If youre a freelancer, if youre a small business owner, or even if you have a side hustle, all of those would fall under the umbrella of self-employed. Self-employed simply means you are earning income by yourself, outside of an employer.

That being said, there are a few exceptions in which you arent self-employed but still need to set aside money for income taxes. For instance, if you earn cash tips from your job, that is considered taxable income. Not only do you need to claim that cash as income when filing your taxes, but you also need to pay tax on it. The same goes for if you do any cash gigs. For instance, if youre a musician and get paid for your performance in cash, that cash is considered taxable income that you need to claim and pay taxes on. If you do not claim any cash you earn as income on your taxes, that is considered tax evasion and is illegal.

Another example would be if you are a hired contract worker for a company. In some instances, the company will pay you regularly as if you are a normal employee, but they wont take any tax or CPP off your paycheque. In this case, you may not be self-employed in the traditional sense, but you would be in the sense that you have to save a percentage of your pay for tax time.

For more info, check out this article on the governments website about tax obligations for self-employed individuals.

Don’t Miss: Efstatus/taxact

How To Calculate Taxes Taken Out Of A Paycheck

Calculations, however, are just one piece of the larger paycheck picture.

When To Change How Much Tax Is Withheld From Your Pension

When you are working, you can change the amount of tax withheld from your paycheck each year. In retirement, you can do that, too. When your tax situation changes, you will want to adjust your tax withholding.

For example, your first year of retirement you may have a salary for part of the year, and you may have a spouse who is still working, so you may need to withhold a larger amount in taxes from your pension for that year. In subsequent years, your income may change, which means you should adjust your tax withholding.

The following events may trigger a need to change your tax withholding in retirement:

- Your spouse stops working.

- You or a spouse take on part-time work.

- You pay off a mortgage or take on a mortgage.

- You have a large amount of taxable capital gains from the sale of a property, mutual funds, or stock.

- You take withdrawals from an IRA or 401 account.

- You and/or a spouse start Social Security benefits.

- You reach age 72 , and required IRA distributions begin.

Don’t Miss: Cook County Appeal Property Tax

Keep An Eye On Your Income

You need to file a tax return if you meet or surpass certain levels of income during the year. If youre employed, look at your pay stub for the year to date incomeand if you have more than one job, be sure to add up your income from all your employers. Remember to include income from other sources, too, such as money you make on rental property, anything you sell, investments or interest.

Calculating Taxable Income Using Exemptions And Deductions

Of course, calculating how much you owe in taxes is not quite that simple. For starters, federal tax rates apply only to taxable income. This is different than your total income, otherwise known as gross income. Taxable income is always lower than gross income since the U.S. allows taxpayers to deduct certain income from their gross income to determine taxable income.

To calculate taxable income, you begin by making certain adjustments from gross income to arrive at adjusted gross income . Once you have calculated adjusted gross income, you can subtract any deductions for which you qualify to arrive at taxable income.

Note that there are no longer personal exemptions at the federal level. Prior to 2018, taxpayers could claim a personal exemption, which lowered taxable income. The tax plan signed in late 2017 eliminated the personal exemption, though.

Deductions are somewhat more complicated. Many taxpayers claim the standard deduction, which varies depending on filing status, as shown in the table below.

Don’t Miss: Doordash 1099-nec Schedule C

Rollover To A Traditional Ira

If you are simply withdrawing funds from a 401 and transferring them to another retirement account, you can opt for a direct rollover. A direct rollover moves retirement money directly from one retirement account to another, and it does not have a tax implication. You can also choose an indirect rollover, where the plan sponsor sends you a check with your 401 balance. You must then deposit the funds to a 401 or IRA within 60 days, failure to which the amount will be considered a distribution for tax purposes.

Types Of Investment Taxes

It’s a lesson you probably learned early in your working life: When you make money, you usually owe taxes.

This is also true of money you make on your investments. Some taxes are due only when you sell investments at a profit, while other taxes are due when your investments pay you a distribution.

One of the benefits of retirement and college accountslike IRAs and 529 accountsis that the tax treatment of the money you earn is a little different. In many cases, you won’t owe taxes on earnings until you take the money out of the accountor, depending on the type of account, ever.

See the tax treatment of:

Don’t Miss: Efstatus.taxactcom

How Long Does A 401 Distribution Take

There is no universal period of time in which you must wait to receive a 401 distribution. Generally, it takes between three and 10 business days to receive a check, depending on which institution administers your account and whether you are receiving a physical check or having it sent by electronic transfer to a bank account.

Is Unemployment Taxable

Generally, unemployment income is taxable as income at the federal level and may be at the state level, too, depending on where you live. But if you receive unemployment benefits from a private fund that you voluntarily contribute to, its only federally taxable if the benefits you receive exceed the amount you paid into the fund.

Read Also: Are Raffles Tax Deductible

Withholding And Tax Day

I mentioned that technically the tax bill is due the next year. As I write this, it’s 2020. Unless the government changes things around like they did this year, on April 15 next year your taxes for this year are due. .

You sit down, you figure out what you made. Then you sit down and figure out what your tax bill is. And then you pay the bill.

If you had to pay it all at once, that could become quite a shock. That’s part of why they take the money out early.

So now, essentially what’s happening when you figure out your taxes is this: You figure out your tax bill. You add up what you already paid for that bill, and add in whatever credits you might get to those payments.

If the total of payments and credits is less than the tax bill, you owe money. If the payments and credits end up being more than the tax bill. you get a refund.

We’ve gotten so used to that system that we’re often not even aware of our taxes. We don’t notice the money coming out of our pockets because it never got to our pockets in the first place.

And even on tax day, we usually don’t pay much attention to how much tax we are actually paying. All we care about is, how much was our refund or how much do we have to pay in?