Who Needs To File Form 1099

You should receive Form 1099-K by Feb. 1 if, in the prior calendar year, you received payments from payment card transactions and/or in settlement of third-party payment network transactions involving gross payments of more than $20,000 and more than 200 transactions. Typically, large-volume online sellers file taxes with a 1099-K.

You receive a 1099-K from each payment settlement entity from which you received income for reportable payment transactions in the previous year. That means a payment card transaction or a third-party network transaction:

- “Payment card transaction” means any transaction in which a payment card, or any account number or other identifying data associated with a payment card, is accepted as payment.

- “Third-party network transaction” means any transaction settled through a third-party payment networkbut only after the total exceeds the above thresholds.

The gross amount of a reportable payment doesnt include adjustments for credits, cash equivalents, discount amounts, fees, refunded amounts, or any other amounts.

Make sure the business income reported on your tax return correlates to the amounts on your 1099-Ks.

What Is The Difference Between Form 1099

Depending on the nature of your business, you may get both forms, so its important to know what sets the two apart.

The primary difference is that Form 1099-K is designed for business owners who deal with transactions through payment card and third-party payment networks. On the other hand, you may receive a Form 1099-MISC if you were paid at least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest, or more than $600 in

- Rents

- Medical and healthcare payments

- Crop insurance proceeds

- Cash payments for fish or other aquatic life you purchase from anyone engaged in the trade or business of catching fish

- Cash paid from a notional principal contract to an individual, partnership or estate

- Payments to an attorney

- Fishing boat proceeds

In other words, the criteria for Form 1099-MISC are based on the type of payment while Form 1099-K focuses on the payment method. As a result, it is possible to receive both forms reporting the same payments.

If So Consider The Following:

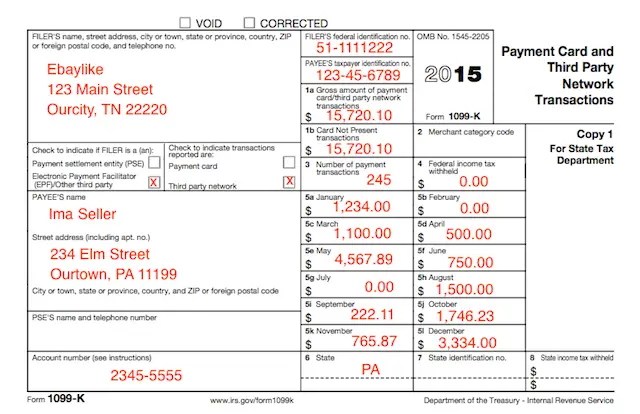

- If the Form 1099-K does not belong to you, contact the Payment Settlement Entity listed on the Form 1099-K to try determine why you received the document. The name and telephone number should be shown in the lower-left part on the form. If a PSE name and number are not shown, contact the Filer at the number shown in the upper-left corner on the form. Retain any correspondence with the PSE

- If there is an error on the form, request a corrected Form 1099-K from the PSE. Keep a copy of any corrected Form 1099-K you receive with your records as well as any correspondence with the PSE

Read Also: What Does H& r Block Charge

What Is A 1099

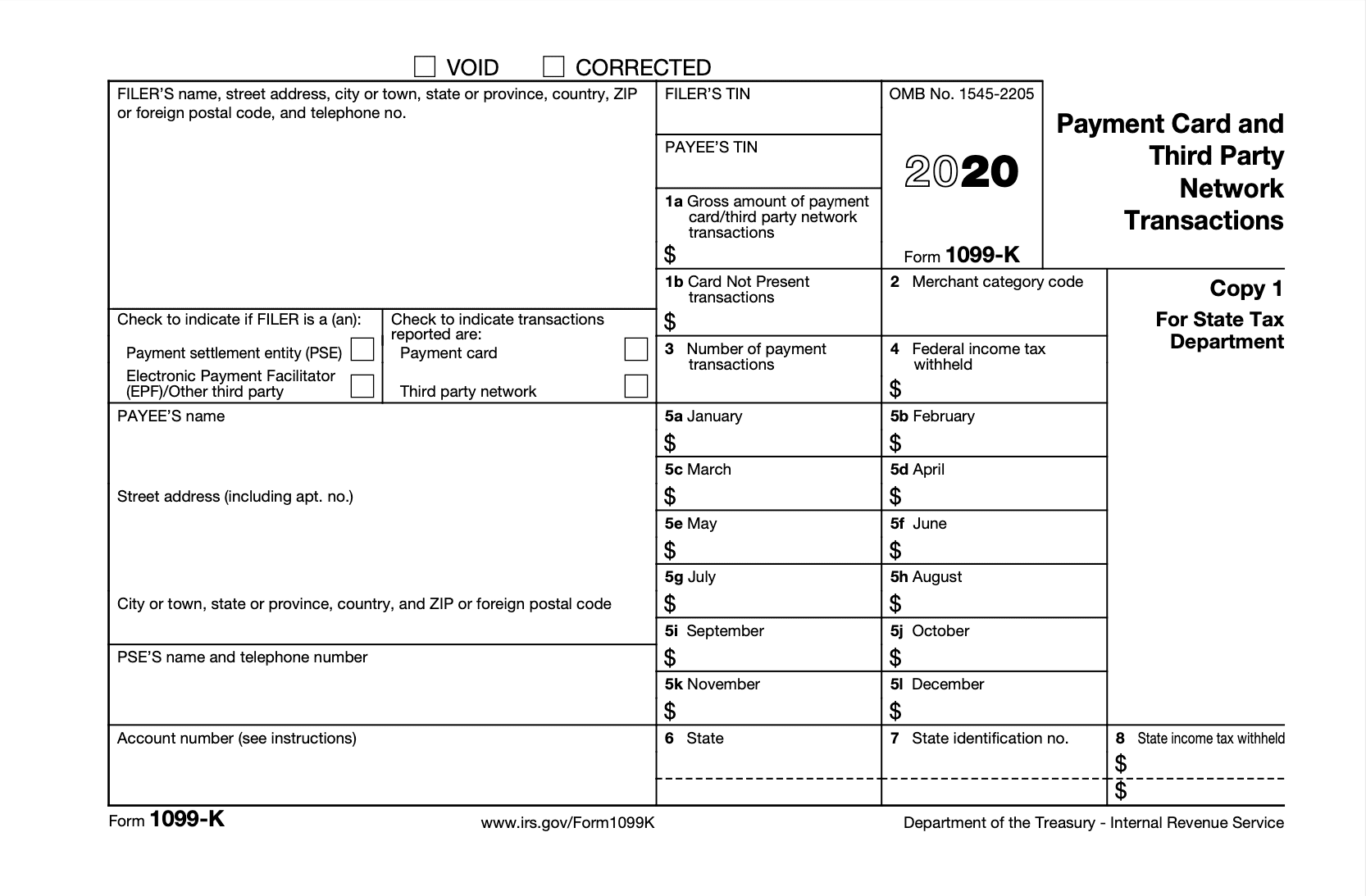

First, well explore the answer to what is a 1099-K used for? Form 1099-K, Payment Card and Third Party Network Transactions, is an IRS form. Your business uses the information on Form 1099-K when it files a tax return. Form 1099-K is issued to small business owners who had more than $20,000 and or more than 200 transactions through a payment card or third-party processor throughout a tax year until 2021.

In 2022, the tax rules for Form 1099-K will change. The payee must be issued a Form 1099-K if the service processed more than $600 worth of payments regardless of the number of individual payments or transactions. This is a significant decrease from previous tax law and will impact many small business owners who receive payments online.

What if you dont meet these requirements? Even if you dont receive a Form 1099-K because your business income from credit cards and third-party networks, you still need to report all business income you receive on your tax return.

What Does My Form 1099

A Form 1099-K includes the gross amount of all reportable payment transactions. You will receive a Form 1099-K from each payment settlement entity from which you received payments in settlement of reportable payment transactions. A reportable payment transaction is defined as a payment card transaction or a third party network transaction.

- Payment card transaction means any transaction in which a payment card, or any account number or other identifying data associated with a payment card, is accepted as payment.

- Third party network transaction means any transaction that is settled through a third party payment network, but only after the total amount of such transactions exceeds $20,000 and the aggregate number of such transactions exceeds 200.

The gross amount of a reportable payment does not include any adjustments for credits, cash equivalents, discount amounts, fees, refunded amounts or any other amounts. The dollar amount of each transaction is determined on the date of the transaction.

NOTE: The minimum reporting thresholds of greater than $20,000 and more than 200 transactions apply only to payments settled through a third-party network there is no threshold for payment card transactions.

Read Also: How To Get Pin To File Taxes

You May Notice Discrepancies With Form 1099

Form 1099-K shows the gross amount of income paid by your customers. Generally, you receive a smaller amount after bankcard processing fees are taken out.

Dont worry you dont pay tax on the gross amount. Be sure to report your fees and other expenses on your return to calculate your tax based on your net income. TaxAct can help make those calculations easy so you dont have to wonder if youre overpaying in taxes.

Tax Reporting With Cash For Business

Cash App for Business accounts that accept over $20,000 and more than 200 payments* per calendar year cumulatively with Square will receive a Form 1099-K.

*If you activated your Cash App account in Massachusetts or Vermont we are required to issue a Form 1099-K and report to your state when you accept $600 or more in credit card payments.

Log in to your Cash App Dashboard to update your EIN or SSN for your business accountso all your tax reporting will be associated with the correct information if you qualify.

Note: If you have both Cash for Business and Square Point of Sale accounts associated with your SSN, your payment volume for both will be totaled and reported on each Form 1099-K.

You May Like: Do You Have To Report Roth Ira On Taxes

How To Include A 1099

The Balance / Britney Wilson

You received a Form 1099-NEC from someone who paid you for the work you did as an independent contractor. Now what? Two big questions here:

You must report the income on your personal tax return and you must pay both income tax and self-employment tax on this income.

For 2020 taxes and beyond, Form 1099-NEC now must be used to report payments to non-employees, including independent contractors. Form 1099-MISC is now bused to report other types of payments.

Do I Need To Take Any Action

It depends on whether the payment was income that is subject to tax. Form 1099-K is an informational document and amounts included within are not necessarily subject to income tax in Virginia. You should use the information reported in conjunction with your other records to determine whether it is taxable income and to determine your correct tax. We recommend that you keep documentation of reportable transactions available if not all amounts included on Form 1099-K should be considered taxable income.

Read Also: How Much Does H& r Block Charge To Do Taxes

What Is A 1099 K Form

Form 1099 K an information return tax form that the IRS requires payment settlement entities to report credit card and third-party transactions. It was first introduced for tax years starting in 2011. The Form will include the gross amount of all the payments from a PSE. This Form reports the total gross volume of online payment transactions made through the business owner.

1099 K Form is an income reporting form used by the IRS. Payment processing services such as PayPal required to issue the Form to the IRS for reporting the sales of their customer. So, if your business gets income from several different sources like PayPal, checks, and cash, you need to report a 1099 K Form.

What To Do With The 1099

A 1099-NEC form is used to report amounts paid to non-employees . Non-employees receive a form each year at the same time as employees receive W-2 formsthat is, at the end of Januaryso the information can be included in the recipient’s income tax return.

Payers are required to give a 1099-NEC form to non-employees only when the total income during the year was $600 or more. If you had income under $600 from that payer, you won’t receive a 1099-NEC form, but you still must include the income amount on your tax return.

If you are doing your own tax return using a tax software program, you will be asked if you have any 1099 income. At this point, you can include the information from the form you received.

If you are having a tax preparer do your personal return, give the form to your preparer along with your other documents.

Read Also: Otter Tail County Tax Forfeited Land

How The Irs Uses Form 1099

Formalizing reporting with Form 1099-K places an emphasis on proper reporting of credit card income. By implementing Form 1099-K reporting, the IRS also sought to highlight proper reporting of non-Form 1099-K income. Since credit card transactions are processed by third parties, they inevitably include a paper trail, which, like other Form 1099 reporting, the government believes taxpayers will find compelling enough to ensure credit card receipts are fully reported.

Most taxpayers also have cash receipts. By collecting taxpayer data that isolates credit card income, the IRS can generate geographic and industry specific metrics based on ratios of credit card to total income and non-credit card to total income. Those metrics are then applied to taxpayers gross receipts, and when taxpayers report amounts that fall outside expected ratios, the IRS can take notice. Such notice may take the form of an actual IRS notice issued to the taxpayer, or even an IRS examination.

Understanding Irs Form 1099

Editor: Mindy Tyson Weber, CPA, M.Tax.

Practice& Procedures

Taxpayers that sell products or services online or accept payment cards for sales, as well as their advisers, need to be aware of IRS notice letters relating to Form 1099-K, Payment Card and Third Party Network Transactions, so they may quickly respond to the IRS when necessary.

Information reporting has become a prime avenue for the IRS to increase compliance while expending fewer resources. Compliance with tax laws increases when a taxpayer knows that a payer has reported to the tax authority the amount of payments made to the taxpayer. In addition, since information reporting allows the IRS to see what payments taxpayers receive, the IRS can better enforce compliance. Information reporting on the Form 1099 series has been used for many years to simultaneously report to the IRS and payment recipients the amount that payment recipients received in a given calendar year. Form 1099-K reports amounts that should be included in top-line business revenues and is simply another example of information reporting the IRS uses to reduce the tax gap .

Filing Requirements and Backup Withholding

Notice Letters

Specifically, Letters 5039 and 5043 require a taxpayer to “review all information used in preparing tax return to make sure fully reporting receipts from all sources, including payment card and non-card sources such as cash and checks.” Both of these letters instruct taxpayers to:

Insight

Recommendation

EditorNotes

You May Like: How Much Does H& r Block Charge To Do Taxes

Paying Social Security And Medicare Taxes On 1099 Income

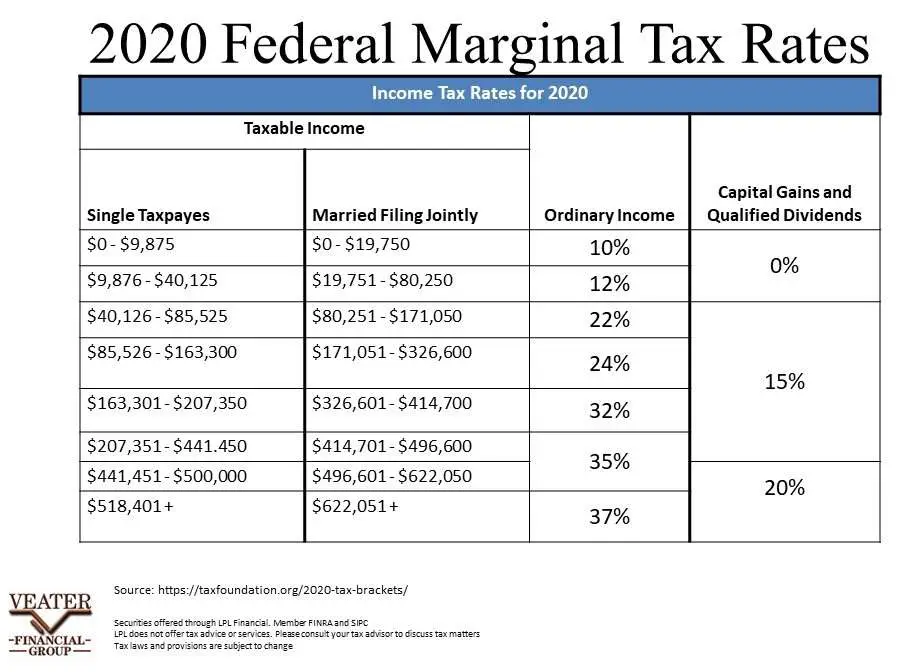

Every U.S. taxpayer must pay Social Security and Medicare taxes on his or her income. For self-employed individuals, these taxes are called self-employment taxes. Self-employment taxes are calculated on the individual’s federal income tax return based on the net income from the business, including 1099 income.

Do I Need To Report 1099

I sold a personal good on a website in 2018. I received payment for the sale through PayPal. I sold the personal good for less than what I paid for it.

I am not a merchant nor self-employed.

I’m of the opinion that I do not have to report/enter this 1099-k on my tax return.

Whats your advice?

Recommended Reading: How Can I Make Payments For My Taxes

What Is The Account Number On My 1099

The Account Number is the Merchant Number for your merchant account and is included to assist with your record keeping. The IRS is focused on the TIN from your tax return not your account number. If you have more than one merchant account with the same TIN, the 1099-K includes the merchant number with the highest sales volume.

How Are The Amounts On The Form Calculated

The amount and transaction count on each form are calculated based on your gross sales for the transaction date of those sales. This includes revenue from card payments that were refunded. Gross sales include taxes and tips collected on a sale if they were charged on a card.

Cash sales are not included in the total we report on the Form 1099-K so, the amount shown on the form may be different from the amount settled in your bank account. This is because you may have had refunds, chargebacks, or holds, and Squares fees were deducted before funds were transferred to your bank.

The transaction date is the date in our system that the transaction took place, which is based on a standardized time known as Coordinated Universal Time . Your online Square Dashboard shows your transactions in your local time, so there may be small differences if you have transactions that occur after either 4:00 p.m. or 5:00 p.m. or after midnight in your local time zone.

You May Like: How Can I Make Payments For My Taxes

What Is The 1099

Every year, the United States IRS requires that Stripe provide a form called a 1099-K for each Stripe account that meets all of the following criteria in the previous calendar year:

-

Account is based in the United States or the non-US account is for a US taxpayer AND

-

More than $20,000 USD in total gross volume AND

-

More than 200 charges

The 1099-K is a purely informational form that summarizes the sales activity of your account and is designed to assist you in reporting your taxes. It is provided to you and the IRS, as well as some US states.

For more help understanding your 1099-K, go to IRS.gov. You can also download a blank example of the 1099-K form here.

Who Sends An Irs Gov Form 1099

Theres not really an answer to: how to file a 1099-K? because technically, you dont need to file it as a small business owner. This is the responsibility of the third-party payment processors and credit card companies. They will report the transactions through filing Form 1099-K with the IRS. You will receive a copy of the form in the mail or electronically. No action is necessary for you, the small business owner.

But, heres an action for you: Make sure your tax statements match up with the IRS records.

Also Check: Have My Taxes Been Accepted

What Do I Do With The 1099

As with all tax matters, you should consult your tax advisor to determine the best approach to complete your income tax returns. Based on the latest available knowledge, the Form 1120 and Form 1040 Schedule C do not have any specific line items to report the amounts from your 1099-K. However, you may need to report sales from credit and debit card transactions as part of the gross sales on your tax return.

To make tax preparation easier, we provide an annual Activity Summary report that includes gross sales, credits, chargebacks and fees. The Activity Summary Report will be posted to Compass each February. We recommend that you provide both the 1099-K and Activity Summary report to your tax advisor or accountant to help them properly complete your tax return.

What Online Business Owners Should Know About Irs Form 1099

OVERVIEW

If you are an online retailer and accept credit card payments over the Internet, you may also have to deal with reporting any 1099-K forms that you receive from credit card or third party processors. Accounting for these forms accurately is important to ensure that you do not pay too much or too little tax.

As a business owner, you have many tax rules to follow to properly report your revenues and expenses. If you are an online retailer and accept credit card payments over the Internet, you may also have to deal with reporting any 1099-K forms that you receive from credit card or third party processors. Accounting for these forms accurately is important to ensure that you do not pay too much or too little tax.

Recommended Reading: Where Is My Federal Tax Refund Ga

What Amounts Included On Form 1099

Amounts included on Form 1099-K are generally includable as part of your gross income if received from activities such as:

- Working as an independent driver for hire

- Selling items as part of a hobby or business

- Renting or leasing personal or real property or

- Similar activities.

Amounts included on Form 1099-K are generally excluded from your gross income if they were received:

- From selling personal items at a loss

- As a reimbursement or

- As a gift.

Here are some examples:

If you have questions about the proper classification of amounts included on your Form 1099-K, we recommend that you contact a tax professional, as the treatment of certain forms of income may vary depending on your particular facts and circumstances.