How To Calculate Fica Payroll Tax

Social Security withholding

To calculate Social Security withholding, multiply your employeeâs gross pay for the current pay period by the current Social Security tax rate .

This is the amount you will deduct from your employeeâs paycheck and remit along with your payroll taxes.

Example Social Security withholding calculation:

$5,000 x .062 = $310

Medicare withholding

To calculate Medicare withholding, multiply your employeeâs gross pay by the current Medicare tax rate .

Example Medicare withholding calculation:

$5,000 x .0145 = $72.50 (Medicare tax to be deducted from employeeâs paycheck

Employer matching

As an employer, you are responsible for matching what your employees pay in FICA taxes. So in this case, you would also remit $310 for Social Security tax and $72.50 for Medicare tax.

Other Ways To Adjust The W

If it’s so early in the year that you haven’t received any paychecks yet, you can just divide your total tax liability for the year that just ended by the number of paychecks you receive in a year. Then, compare that amount to the amount that’s withheld from your first paycheck of the year once you get it and make any necessary adjustments from there.

If you adjust your W-4 to make up for any underpayment or overpayment partway through the year, you’ll want to fill out a new W-4 in January or your withholding will be off for the new year.

Of course, if your income fluctuates unpredictably, this is all a lot harder. But following the steps above should help you get close to a reasonable number.

And remember: You can redo your W-4 several times during the year if necessary.

Calculating Employee Payroll Taxes In 5 Steps

Once your employees are set up , youre ready to figure out the wages the employee has earned and the amount of taxes that need to be withheld. And, if necessary, making deductions for things like health insurance, retirement benefits, or garnishments, as well as adding back expense reimbursements.

- Our employee earns $50,000 a year, or $2,083.33 of gross pay per semi-monthly pay period.

- Our employees federal income tax withholding is $12.29 using the new W-4.

- Social Security tax is $129.17, and Medicare tax is $30.21. The total combined FICA tax is $159.38.

- Since our employee lives in Florida, there is no state income tax withholding.

- There were no deductions or expense reimbursements.

- Thus, our employees net pay is $1,911.66.

From time to time, there may be other things youll need to add or deduct from your employees paychecks. When these items are added and subtracted, the rest of the basic math outlined above stays the same.

Recommended Reading: How To Do Taxes Freelance

What Is Imputed Income

If you determine that domestic partners dont qualify as a dependent and they receive health benefits, the contribution you make toward any premium is counted as a type of employee income called imputed income. That can come as quite a shock to employees who might incorrectly believe that a legal domestic partners coverage is the same as a married couples.

Its important to highlight this detail in your open enrollment materials to eliminate any unwelcome surprises around domestic partner coverage when payday or year-end rolls around.

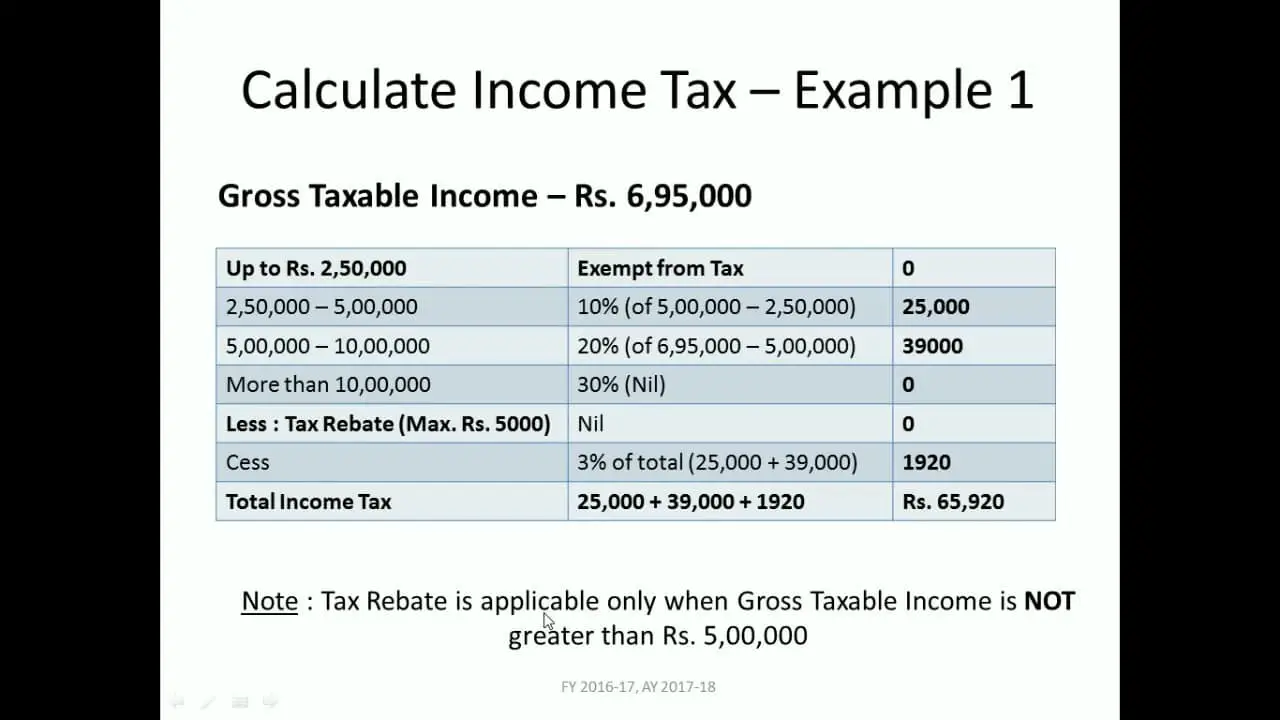

Does Everyone Have To File Their Income Tax Returns

Yes, it is mandatory for everyone to file income tax;return. However, a taxpayer whose net taxable income is less than the minimum tax slab, i.e., INR 2.5 lakh is exempted from mandatory tax filing.

It is mandatory for a taxpayer who wants to claim tax refunds of TDS deducted to file income tax returns. Even though tax filing isnt mandatory for some individuals, it has some benefits.

- Claim Tax refunds: For any TDS that has been deducted can be claimed only by tax filing.

- Applying for a loan: While applying for a loan, the eligibility and the loan amount sanction depends on the assessee income. The tax filing documents are processed for this.

- Carry forward of Losses: The taxpayer can always carry forward the losses to set them off against capital gains. However, this is only allowed if one is filing their taxes for the assessment year.

Don’t Miss: When Are Delaware State Taxes Due

Updating Your Personal Information

- To change your name: Contact your department’s payroll/HR administrator.

- To change your address:

- Go to the My Info tab in MyU.

- Note to Foreign Nationals: List your U.S. home address. Do not change it to your home country address until right before you leave to go back to your country. Your final check and tax documents will then be mailed to your home address in your home country.

The Tax Data section of your pay statement shows what you’ve claimed on your Form W-4:

- Your marital status

- Number of tax allowances

- Additional amounts you’ve chosen to have withheld from your paycheck

The state shown on the top line will be Minnesota, unless you’ve completed a MW-R reciprocity agreement form;for Michigan or North Dakota, or you live and work in another state where the University is registered to withhold taxCalifornia, Colorado, Illinois, Washington, or Wisconsin. Then that state will be indicated.

Summary Of Payroll Taxes

There are two types of payroll taxes: ones that come out of your own pocket, and ones that you just collect from employee paychecks and remit to the government.

Payroll taxes that come out of your pocket:

-

FICA tax: covers social security and Medicare. This cost is shared by employer and employee. The employer portion is 6.2% for social security and 1.45% for Medicare, and youâll collect and remit the same amount from your employees. Review a CPAâs summary in just a 4 minute read.

-

FUTA tax: covers unemployment insurance. The total amount is 6.0%. However, most states have a 5.4% credit, meaning most employers only pay 0.6%. Get everything you need to know in a 9 minute read.

Payroll taxes that you just collect and remit:

-

Federal income taxes

-

State and local taxes

Weâll cover each of these in detail, beginning with federal income tax withholding, since itâs the most commonly asked about.

You May Like: What Is Tax Liabilities On W2

How Are Taxes Determined

Taxes are determined by how much money you earn every year. It’s important to note that it doesn’t matter if this is done as an employee or as self-employed; all workers must be aware of what they owe the government at the end of the year.

Taxes are paid based on your annual income, which is calculated as your salary at the end of the year minus all deductions.

What Is The Income Tax Calculator

Paying tax is inevitable, be it an individual or a business. Income tax is levied on the income earned after considering few deductions. With too many tax exemptions and deductions, calculating tax can be complicated.

An income tax calculator is a tool that will help calculate taxes one is liable to pay under the old and new tax regimes. The calculator uses necessary basic information like annual salary, rent paid, tuition fees, interest on childs education loan, and any other savings to calculate the tax liability of an individual.

It gives the total tax payable under the old and new scheme. Also, it suggests investment opportunities for the individual based on the tax liability. The online income tax calculator is a convenient tool and is free to use. It is simple to understand and can be used by anyone to calculate their tax liability.

Read Also: What Can I Write Off On My Taxes For Instacart

Step : Figure The Tax Withholding Amount

To recap from the previous page, the adjusted annual wages are $69,400.;;

Lets look at the tax table found on page 6 of IRS Pub 15-T.

Note there are actually six different tables on this page. The one you use depends on the employees filing status, the version of the W-4 they are using, and whether they have checked the multiple jobs box in Step 2 of their new W-4 . Since our example is using the new W-4 and has the Step 2 box unchecked, were going to use the middle table in the left column.

- Looking in the Single or Married Filing Separately table, the employees taxable wages of $69,400 fall between the range of $44,475 to $90,325 .; See the highlighted row above.

- We can see in Column C, at least $4,664 in FIT needs withheld for the year. The $4,664 is a total of the following:

- 10% on wages between $3,950 and $13,900

- 12% on wages between $13,900 and $44,475

Here is what the worksheet would look like:

While The Appreciation In Value Of Property Is Taxed At The Time Of Sale As Capital Gains Concurring Rental Benefits Are Taxed On Yearly Basis In The Hands Of The Owner

An immovable property has always been considered as a secure mode of investment, especially for long-term investors. Such a property may be acquired for residing or for the sole purpose of enjoying rentals and appreciation benefits. While the appreciation in value of property is taxed at the time of sale as capital gains, concurring rental benefits are taxed on yearly basis in the hands of the owner.

Tax on rentalsWhile rentals received are taxable under the head house property, income from sub-letting of property is generally taxed under the head other sources. In case of jointly owned properties, tax incidence shall be divided proportionately on the basis of share of each co-owner of the property. A house property held for purposes of residing by self and family may not attract taxation up to a limit of two houses, however rentals from a commercial property shall always be charged to tax. Over and above two self-occupied houses, notional rent is taxable in the hands of an individual even though the property may not actually be rented.

While computing the income chargeable from such rentals, the Income-tax Act, 1961 allows certain deductions under this head of income. Apart from deduction of municipal taxes paid by the property owner during the year, a further standard deduction of 30% of the net annual value of rent is provided irrespective of the actual expenses incurred.

Don’t Miss: How Much Tax Do You Have To Pay On Stocks

How You Can Affect Your New York Paycheck

If you find yourself always paying a big tax bill in April, take a look at your W-4. One option that you have is to ask your employer to withhold an additional dollar amount from your paychecks. For example, you can have an extra $25 in taxes taken out of each paycheck by writing that amount on the corresponding line of your W-4. This paycheck calculator will help you determine how much your additional withholding should be.

Another way to manipulate the size of your paycheck – and save on taxes in the process – is to increase your contributions to employer-sponsored retirement accounts like a 401 or 403. The money you put into these accounts is taken out of your paycheck prior to its taxation. By putting money away for retirement, you are actually lowering your current taxable income, which can help you save in taxes right now. Another option is to put money in a spending account like a health savings account or a flexible spending account if your employer offers them. The money you put in these accounts is also taken from your paycheck before taxes, and you can use those pre-tax dollars to pay for medical-related expenses like copays or certain prescriptions. Just keep in mind that only $500 in an FSA will roll over from year to year. If you contribute more than that and then dont use it, you’re out of luck.

An Example Of An Employee Pay Stub

;In the case of the employee above, the weekly pay stub would look like this:;

| Employee Pay Stub |

|---|

;You must make deposits with the IRS of the taxes withheld from employee pay for federal income taxes and FICA taxes and the amounts you owe as an employer. Specifically, after each payroll, you must

- Pay the federal income tax withholding from all employees;

- Pay the FICA tax withholding from all employees, and;

- Pay your half of the FICA tax for all employees.;

Depending on the size of your payroll, you must make deposits monthly or semi-weekly.;

You must also file a quarterly report on Form 941 showing the amounts you owe and how much you have paid.;

If you have many employees or don’t have the staff to handle payroll processing, you might want to consider a payroll processing service;to handle paychecks, payments to the IRS, and year-end reports on Form W-2.

Recommended Reading: How Is Capital Gains Tax Calculated On Sale Of Property

Current Fica Tax Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

Combined, the FICA tax rate is 15.3% of the employees wages.

Do any of your employees make over $137,700? If so, the rules are a little different. Read more at the IRS website.

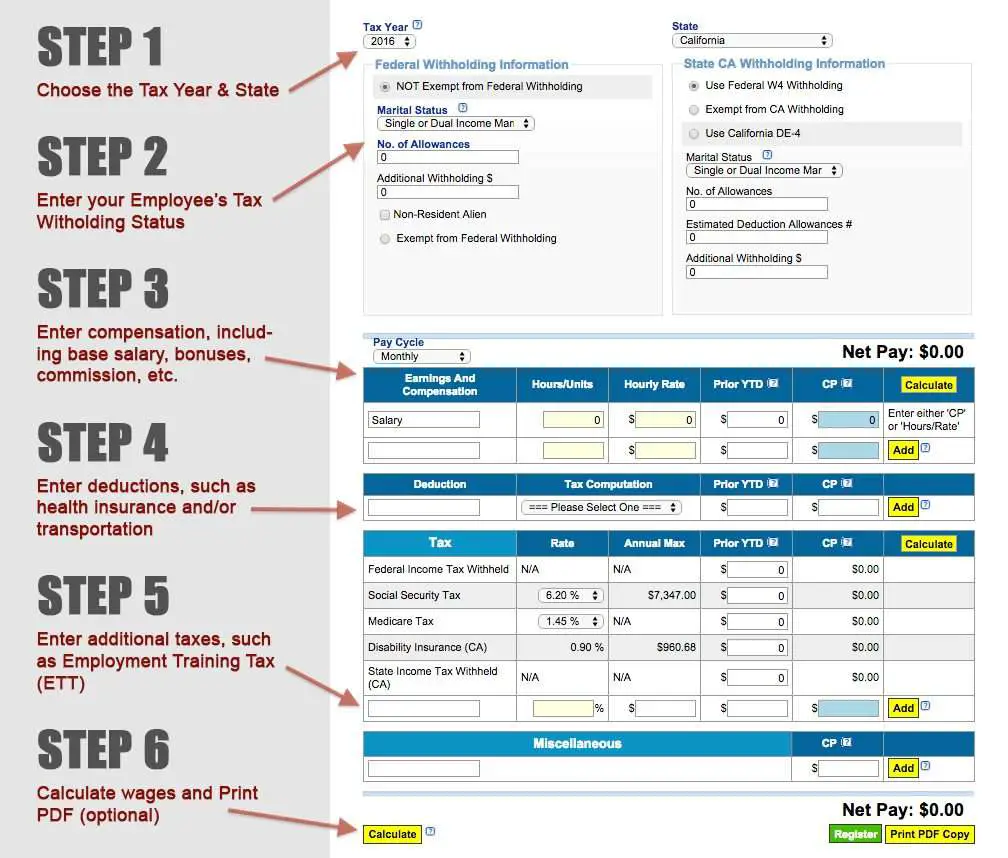

Input Any Additional Pay The Employee Receives

If the employee is salaried, you will only see two fields: bonus and commission. Fill in those amounts, if applicable.

If the employee is hourly, you should see four fields: overtime worked, bonus, commission, and salary. This is your opportunity to add in any additional pay they should receive this pay period. If the employee earned overtime, input in the number of overtime hours they worked. One thing to keep in mind for California employees is that this calculator does not account for double-time pay. The tool calculates overtime pay using time and a half.

You May Like: How Much Time To File Taxes

How State Taxes Work

States that levy an income tax may set a flat rate or rates based on the amount of income you earn, as do local governments that levy an income tax. For both local and state income taxes, you generally pay tax on your compensation income based on the state and locality where you work, rather than where you live.

To avoid double taxation, you are generally given a credit for the state and/or local government where you paid the tax so you do not have to pay extra taxes where you live in addition to those you paid in the locality and state where you work.

New York Median Household Income

| Year | |

|---|---|

| 2010 | $54,148 |

What your tax burden looks like in New York depends on where in the state you live. If you live in New York City, you’re going to face a heavier tax burden compared to taxpayers who live elsewhere. Thats because NYC imposes an additional local income tax.

New York States progressive income tax system is structured similarly to the federal income tax system. There are eight tax brackets that vary based on income level and filing status. Wealthier individuals pay higher tax rates than lower-income individuals. New Yorks income tax rates range from 4% to 8.82%. The top tax rate is one of the highest in the country, though only individual taxpayers whose taxable income exceeds $1,077,550 pay that rate. For heads of household, the threshold is $1,616,450, and for married people filing jointly, it is $2,155,350.

Taxpayers in New York City have to pay local income taxes in addition to state taxes. Like the states tax system, NYCs local tax rates are progressive and based on income level and filing status. There are four tax brackets starting at 3.078% on taxable income up to $12,000 for single filers and married people filing separately. The top rate for individual taxpayers is 3.876% on income over $50,000. The rates are the same for couples filing jointly and heads of households, but the income levels are different.

Yonkers also levies local income tax. Residents pay 16.75% of their net state tax, while non-residents pay 0.5% of wages.

Read Also: When Is Sales Tax Due

Calculating Taxable Income Using Exemptions And Deductions

Of course, calculating how much you owe in taxes is not quite that simple. For starters, federal tax rates apply only to taxable income. This is different than your total income, otherwise known as gross income. Taxable income is always lower than gross income since the U.S. allows taxpayers to deduct certain income from their gross income to determine taxable income.

To calculate taxable income, you begin by making certain adjustments from gross income to arrive at adjusted gross income . Once you have calculated adjusted gross income, you can subtract any deductions for which you qualify to arrive at taxable income.

Note that there are no longer personal exemptions at the federal level. Prior to 2018, taxpayers could claim a personal exemption, which lowered taxable income. The new tax plan signed by President Trump in late 2017 eliminated the personal exemption, though.

Deductions are somewhat more complicated. Many taxpayers claim the standard deduction, which varies depending on filing status, as shown in the table below.

How To File Payroll Taxes

According to the IRS, you have to make all federal tax deposits with an electronic funds transfer, or EFT. You can use the Electronic Federal Tax Payment System , a free service from the Department of the Treasury, to make these deposits, or your payroll software provider can make electronic deposits on your behalf.

Heres how to file payroll taxes broken down into steps:

Don’t Miss: What Is The Date To Pay Taxes